UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 13, 2023 (March 9, 2023)

REPUBLIC FIRST BANCORP, INC.

(Exact name of registrant as specified in its charter)

|

Pennsylvania

|

000-17007

|

23-2486815

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

50 South 16th Street, Suite 2400

Philadelphia, Pennsylvania 19102

(215) 735-4422

(Address, including zip code, and telephone number, including area code, of

the registrant's principal executive offices)

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

FRBK

|

Nasdaq Global Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions.

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☒

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.01 – ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

Securities Purchase Agreement

On March 9, 2023, Republic First Bancorp, Inc. (the “Company”) entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with Castle Creek Capital Partners VII, L.P. and Castle Creek Capital Partners VIII, L.P. (together, “Castle Creek”), certain co-investment funds managed by affiliates of Castle Creek (the “Castle Creek Co-Investors”) and CPV Republic Investment, LLC (“CPV” and collectively with Castle Creek, the Castle Creek Co-Investors and the other purchasers under the Securities Purchase Agreement, the “Purchasers”), pursuant to which the Company agreed to (i) sell shares of the Company’s common stock, par value $0.01 per share, at a purchase price of $2.25 per share (the “Common Stock”), and shares of a new series of Series B convertible preferred stock, par value $0.01 per share, at a purchase price of $22.50 per share (the “Series B Preferred Stock”), and (ii) issue to Castle Creek, as anchor and lead investor, a warrant to purchase 1,300,000 shares of Series B Preferred Stock or Non-Voting Common Stock (as defined below) at an exercise price of $2.25 per equivalent share of Common Stock (the “Warrant”), in a private placement (collectively, the “Private Placement”). Castle Creek, the Castle Creek Co-Investors and CPV have agreed to purchase $90.725 million of Securities (as defined below) in the aggregate, while certain other accredited investors from a pool identified by the Company and its advisors are expected to commit to purchase $34.275 million of Securities in the aggregate on the same terms as the other Purchasers. The Private Placement was negotiated by the Strategic Review Committee of the Company’s board of directors, which was comprised of directors not affiliated with CPV or current or former members of management.

Each share of Series B Preferred Stock will be convertible on a one for ten basis into either (i) non-voting common stock, par value $0.01 per share (which will be convertible into Common Stock), subject to approval of an increase in the number of authorized shares of Common Stock and approval of the creation of such class of non-voting common stock by the Company’s shareholders (the “Non-Voting Common Stock,” and together with the Common Stock, Series B Preferred Stock and the Warrant, the “Securities”) or (ii) Common Stock.

The obligations of the Company and the Purchasers to consummate the Private Placement pursuant to the Securities Purchase Agreement are subject to the satisfaction or waiver of certain closing conditions, including, among others: (i) receipt of approval or non-objection from the Pennsylvania Department of Banking and Securities for each of Castle Creek and CPV to hold in excess of 9.9% of the outstanding shares of the Company and (ii) the Company raising aggregate gross proceeds of at least $125 million in the Private Placement. The Private Placement is expected to close in May 2023.

In addition, each of Castle Creek and CPV will need the approval or non-objection of the Board of Governors of the Federal Reserve System (together with the Pennsylvania Department of Banking and Securities, the “Bank Regulatory Authorities”) if it seeks to increase its ownership of shares of Common Stock in excess of 9.9% of the outstanding shares of Common Stock. Following the closing of the Private Placement (the “Closing”), Castle Creek (including the Castle Creek Co-Investors) and CPV will each own approximately 9.9% of the Company’s outstanding shares of Common Stock.

The Company intends to use the net proceeds of the Private Placement to strengthen the Company’s current balance sheet, improve the regulatory capital of the Company’s wholly-owned subsidiary, Republic First Bank, support organic growth opportunities and for general corporate purposes. The Securities Purchase Agreement contains representations, warranties, and covenants of the Company and the Purchasers that are customary in private placement transactions.

Pursuant to the terms of the Securities Purchase Agreement, following the Closing, each of Castle Creek and CPV will be entitled to have one representative appointed to the Company’s board of directors and the board of directors of any subsidiary bank for so long as such Purchaser, together with its respective affiliates, owns, in the aggregate, 4.9% or more of the outstanding shares of the Company’s Common Stock and, solely with respect to CPV, if Andrew B. Cohen is no longer a director on the Company’s board of directors. If Castle Creek, together with its affiliates, owns, in the aggregate, 4.9% or more of the outstanding shares of the Company’s Common Stock and does not have a board representative on the Company’s board of directors or the board of directors of any subsidiary bank, the Company will invite a person designated by Castle Creek to attend meetings of the Company’s board of directors or the board of directors of any subsidiary bank as an observer.

The Securities Purchase Agreement provides that, for so long as each of Castle Creek or CPV, together with its respective affiliates, owns, in the aggregate, 4.9% or more of the outstanding shares of the Company’s Common Stock, if the Company makes any public or non-public offering or sale of any securities (including, without limitation, Common Stock, Series B Preferred Stock or Non-Voting Common Stock), or any options or debt instruments that are convertible or exchangeable into such securities or that include an equity component, then such Purchaser may acquire from the Company for the same price (net of any underwriting discounts or sales commissions) and on the same terms as such securities are proposed to be offered to others, up to the amount of new securities in the aggregate required to enable it to maintain its proportionate Common Stock equivalent interest in the Company immediately prior to any such issuance of new securities. These preemptive rights will not apply to (i) any Common Stock, Non-Voting Common Stock or other securities issuable upon the exercise or conversion of any securities of the Company issued or agreed or contemplated to be issued as of the Closing, (ii) the exercise of employee stock options, restricted stock or other stock incentives pursuant to the Company’s stock incentive plans, which do not exceed in the aggregate 5% of the outstanding shares of Common Stock or (iii) the issuances of capital stock as full or partial consideration for a merger, acquisition, joint venture, strategic alliance, license agreement or other similar non-financing transaction.

Prior to the Closing, the Company may not solicit or enter into another transaction involving the issuance of 20% or more of the outstanding shares of Common Stock. However, if prior to the Closing, the Company receives an unsolicited proposal from a third party involving the acquisition of 50% or more of the outstanding shares of Common Stock, the Company may terminate the Securities Purchase Agreement if the Company’s board of directors determines that such unsolicited proposal is more favorable to the Company’s shareholders from a financial point of view and failure to terminate the Securities Purchase Agreement in favor of such proposal would be inconsistent with the fiduciary duties of the Company’s board of directors, subject to payment of a termination fee to the Purchasers equal to three percent (3%) of the purchase price committed to be paid by such Purchasers pursuant to the Securities Purchase Agreement.

Each Purchaser has agreed that from the Closing and until the conclusion of the next annual shareholder meeting of the Company, it will not acquire or solicit any direct or indirect interests in the Company or its assets, or seek to influence the voting of the Company’s shareholders, and that it will vote in favor of an amendment to the Articles of Incorporation of the Company to facilitate the transactions contemplated by the Securities Purchase Agreement, and in favor of each director candidate nominated by the Company’s board of directors and against any director nominee not recommended by the Company’s board of directors.

The foregoing description of the Securities Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Securities Purchase Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

The issuance of the Securities pursuant to the Securities Purchase Agreement and the other documents discussed below is exempt from registration pursuant to the exemption provided under Rule 506 of Regulation D promulgated under the Securities Act of 1933, as amended (the “Act”). The offering was made only to accredited investors as that term is defined in Rule 501(a) of Regulation D under the Act.

Series B Preferred Stock

In connection with the Private Placement, at the Closing, the Company will file the Statement with Respect to Shares for Perpetual Convertible Preferred Stock, Series B (the “Series B Statement”) with the Department of State of the Commonwealth of Pennsylvania to authorize and issue the shares of Series B Preferred Stock to the Purchasers. The preferences, limitations, powers and relative rights of the Series B Preferred Stock are set forth in the Series B Statement and are described below.

Holders of the Series B Preferred Stock will be entitled to receive dividends if declared by the Company’s board of directors, in the same per share amount as paid on the Common Stock on an as-converted basis. No dividends will be payable on the Common Stock unless a dividend identical to that paid on the Common Stock on an as-converted basis is payable at the same time on the Series B Preferred Stock.

Each share of Series B Preferred Stock will automatically convert into ten shares of Non-Voting Common Stock, subject to adjustment, effective as of the close of business on the date that the Company obtains shareholder approval for and files an amendment to the Articles of Incorporation of the Company to authorize the class of Non-Voting Common Stock. The Securities Purchase Agreement provides that no later than 120 days following the filing of the Company’s annual report with respect to the year ending December 31, 2022, the Company shall use commercially reasonable efforts to duly call, give notice of, establish a record date for, convene and hold a special meeting of its shareholders to approve (i) the amendment to the Articles of Incorporation of the Company to authorize the class of Non-Voting Common Stock, (ii) the amendment to the Articles of Incorporation of the Company to increase the number of authorized shares of Common Stock to 200 million and (iii) the issuance of the Common Stock contemplated by this Agreement to the extent required by NASDAQ Listing Rule 5635. Unless the shares of Series B Preferred Stock have previously been converted into shares of Non-Voting Common Stock as described above, each share of Series B Preferred Stock will automatically convert into ten shares of Common Stock upon a “Permissible Transfer” of such shares of Series B Preferred Stock to a non-affiliate of such holder or may be converted into ten shares of Common Stock at any time, provided that, upon such conversion, the holder and its affiliates will not own more than 9.9% of the Company’s voting securities, or such greater amount approved by the applicable bank regulatory authorities. A “Permissible Transfer” is a transfer by a holder of Series B Preferred Stock (i) to the Company; (ii) in a widely distributed public offering of Common Stock or Series B Preferred Stock; (iii) that is part of an offering that is not a widely distributed public offering of Common Stock or Series B Preferred Stock but is one in which no one transferee acquires the rights to receive 2% or more of any class of voting securities; or (iv) to a transferee that controls more than 50% of the voting securities of the Company without giving effect to such transfer.

The Series B Preferred Stock will rank, as to payments of dividends and distribution of assets upon dissolution, liquidation or winding up of the Company, pari passu with the Common Stock on an as-converted basis. Holders of Series B Preferred Stock will have no voting rights, except as to amendments or changes that would adversely affect the rights, preferences or privileges of the Series B Preferred Stock, or that would increase or decrease the number of authorized shares of Series B Preferred Stock, or as may be required by law. The Series B Preferred Stock will not be redeemable by either the Company or by the holder.

The Non-Voting Common Stock, once authorized, shall be substantially similar to the Series B Preferred Stock with respect to the rights, preferences and privileges thereof, except that the Non-Voting Common Stock shall be convertible on a one-for-one basis into Common Stock.

The foregoing description of the Series B Statement and the Non-Voting Common Stock does not purport to be complete and is qualified in its entirety by the full text of the form of Series B Statement and terms of the Non-Voting Common Stock, a copy of which is filed as Exhibit G to Exhibit 10.1 hereto and is incorporated herein by reference.

Warrant

Pursuant to the Securities Purchase Agreement, at the Closing, the Company shall issue the Warrant to Castle Creek. The Warrant is exercisable at any time after its issuance, and from time to time, in whole or in part, until the seventh anniversary of the date of issuance of the Warrant. However, the exercise of such Warrant remains subject to regulatory approval if Castle Creek’s ownership of the outstanding shares of Common Stock would exceed 9.9%.

The exercise price and the number of shares of Non-Voting Common Stock or Series B Preferred Stock for which the Warrant is exercisable are subject to adjustment from time to time upon the occurrence of certain events including: (1) the Company declaring a dividend or making a distribution on its Common Stock in shares of Common Stock, or (2) splitting, subdividing or reclassifying the outstanding shares of Common Stock into a greater number of shares. If an adjustment to the exercise price shall result in a requirement to obtain shareholder approval pursuant to NASDAQ Listing Rule 5635, the Company will pay cash dividends on the Warrant in lieu of any such adjustment. If the Company declares a cash dividend, the holder of the Warrant shall receive its pro rata portion of such dividend as if the Warrant had been exercised in full prior to the record date of such dividend in lieu of any such adjustment.

The foregoing description of the Warrant does not purport to be complete and is qualified in its entirety by reference to the full text of the form of Warrant, a copy of which is filed as Exhibit H to Exhibit 10.1 hereto and is incorporated herein by reference.

Registration Rights Agreement

At the Closing, the Company has agreed to enter into a registration rights agreement with Castle Creek and CPV (the “Registration Rights Agreement”). Pursuant to the terms of the Registration Rights Agreement, the Company has agreed to file a resale registration statement by no later than thirty months following the date of the Closing to register the resale of the Securities.

Pursuant to the Registration Rights Agreement, if the Company intends to file a registration statement covering a primary or secondary offering of any of its Common Stock, Series B Preferred Stock, Non-Voting Common Stock or other securities, which is not a registration solely to implement an employee benefit plan pursuant to a registration statement on Form S-8 or a registration statement on Form S-4, the Company will promptly give written notice to the holders of the Securities of its intention to effect such a registration and the Company will effect the registration under the Securities Act of all registrable securities that the holders request be included in such registration.

The foregoing description of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by the full text of the form of Registration Rights Agreement, a copy of which is filed as Exhibit A to Exhibit 10.1 hereto and is incorporated herein by reference.

ITEM 3.02 – UNREGISTERED SALES OF EQUITY SECURITIES

The information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02.

FORWARD-LOOKING STATEMENTS

Certain statements and information contained in this current report on Form 8-K may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements contained herein are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected in the forward-looking statements. For example, risks and uncertainties can arise with changes in: general economic conditions, including turmoil in the financial markets and related efforts of government agencies to stabilize the financial system; the impact of the COVID-19 pandemic on our business and results of operation; geopolitical conflict and inflationary pressures including Federal Reserve interest rate hikes; the adequacy of our allowance for credit losses and our methodology for determining such allowance; adverse changes in our loan portfolio and credit risk-related losses and expenses; concentrations within our loan portfolio, including our exposure to commercial real estate loans; inflation; changes to our primary service area; changes in interest rates; our ability to identify, negotiate, secure and develop new branch locations and renew, modify, or terminate leases or dispose of properties for existing branch locations effectively; business conditions in the financial services industry, including competitive pressure among financial services companies, new service and product offerings by competitors, price pressures and similar items; deposit flows; loan demand; the regulatory environment, including evolving banking industry standards, changes in legislation or regulation; our securities portfolio and the valuation of our securities; accounting principles, policies and guidelines as well as estimates and assumptions used in the preparation of our financial statements; rapidly changing technology; our ability to regain compliance with Nasdaq Listing Rules 5250(c)(1) and 5620(a); the failure to consummate the transactions contemplated by the Securities Purchase Agreement; the failure to maintain current technologies; failure to attract or retain key employees; our ability to access cost-effective funding; fluctuations in real estate values; litigation liabilities, including costs, expenses, settlements and judgments; and other economic, competitive, governmental, regulatory and technological factors affecting our operations, pricing, products and services. You should carefully review the risk factors described in the Annual Report on Form 10-K for the year ended December 31, 2021, and other documents the Company files from time to time with the Securities and Exchange Commission. The words "would be," "could be," "should be," "probability," "risk," "target," "objective," "may," "will," "estimate," "project," "believe," "intend," "anticipate," "plan," "seek," "expect" and similar expressions or variations on such expressions are intended to identify forward-looking statements. All such statements are made in good faith by the Company pursuant to the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. We do not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company, except as may be required by applicable law or regulations.

For additional information regarding known material factors that could cause our actual results to differ from our projected results, please see our filings with the SEC, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events, or otherwise.

The Securities will be offered and sold only to accredited investors pursuant to an exemption from registration under the Securities Act of 1933. The Securities have not been registered under the Securities Act of 1933 or any state securities laws and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act of 1933 and applicable state laws.

This news release shall not constitute an offer to sell or a solicitation of an offer to purchase the Securities or any other securities, and shall not constitute an offer, solicitation or sale in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful.

The Company intends to file a definitive proxy statement and may file a WHITE proxy card with the SEC in connection with the Company’s 2022 annual meeting of shareholders (the “2022 Annual Meeting”) and, in connection therewith, the Company, certain of its directors and executive officers will be participants in the solicitation of proxies from the Company’s shareholders in connection with such meeting. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE 2022 ANNUAL MEETING. The Company’s definitive proxy statement for the 2021 annual meeting of shareholders contains information regarding the direct and indirect interests, by security holdings or otherwise, of the Company’s directors and executive officers in the Company’s securities. Information regarding subsequent changes to their holdings of the Company’s securities can be found in the SEC filings on Forms 3, 4, and 5, which are available on the Company’s website at http://investors.myrepublicbank.com/ or through the SEC’s website at www.sec.gov. Information can also be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 on file with the SEC. Updated information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the definitive proxy statement and other materials to be filed with the SEC in connection with the 2022 Annual Meeting. Shareholders will be able to obtain the definitive proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at the Company’s website at http://investors.myrepublicbank.com.

ITEM 9.01 – FINANCIAL STATEMENTS AND EXHIBITS

|

#

|

Schedules have been omitted pursuant to Regulation S-K Item 601(b)(2). The Company agrees to furnish to the SEC a copy of any omitted schedule upon request.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

REPUBLIC FIRST BANCORP, INC.

|

|

|

|

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Date:

|

March 13, 2023

|

|

/s/ Michael W. Harrington

|

|

|

Michael W. Harrington

|

|

|

Chief Financial Officer

|

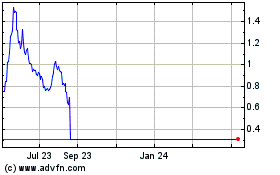

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Oct 2024 to Nov 2024

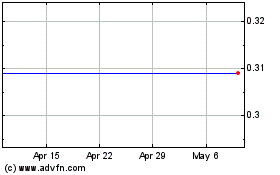

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Nov 2023 to Nov 2024