As filed with the Securities and Exchange Commission on June 22, 2022

Registration No. 333-239661

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT No. 3

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PANBELA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

2834

(Primary Standard Industrial

Classification Code Number)

|

|

88-2805017

(I.R.S. Employer

Identification No.)

|

712 Vista Blvd, Suite 305

Waconia, Minnesota 55387

(952) 479-1196

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Susan Horvath

Chief Financial Officer

712 Vista Blvd, Suite 305

Waconia, Minnesota 55387

(952) 479-1196

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

W. Morgan Burns & Joshua L. Colburn

Faegre Drinker Biddle & Reath LLP

90 South Seventh Street

2200 Wells Fargo Center

Minneapolis, Minnesota 55402-3901

Telephone: (612) 766-7000

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. ☑

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☑

|

Smaller reporting company ☑

|

| |

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Explanatory Note

On July 2, 2020, Panbela Research, Inc. (formerly known as Panbela Therapeutics, Inc., the “Predecessor”) filed a registration statement with the Securities and Exchange Commission (the “SEC”) on Form S-1 (Registration No. 333-239661) (as amended, the “Registration Statement”). The Registration Statement was initially declared effective by the SEC on August 27, 2020, was amended by post-effective amendments filed with, and declared effective by, the SEC on March 26, 2021 and March 28, 2022.

Effective June 15, 2022, Panbela Research completed a corporate reorganization (the “Holding Company Reorganization”) pursuant to which the Predecessor became a direct, wholly-owned subsidiary of a new public holding company, Panbela Therapeutics, Inc. (formerly known as Canary Merger Holdings, Inc., “Panbela”). The Holding Company Reorganization was effected by a merger conducted pursuant to 251(g) without a vote of the stockholders of the constituent corporations. The merger resulting in the Holding Company Reorganization was completed pursuant to the terms of an agreement and plan of merger, dated as of February 21, 2022 (the “Merger Agreement”), by and among Panbela, Cancer Prevention Pharmaceuticals, Inc. (“Cancer Prevention”) and the Predecessor, among others. Panbela became a successor issuer to the Predecessor by operation of Rule 12g-3(a) promulgated under the Securities Exchange Act of 1934, as amended.

Panbela is filing this Post-Effective Amendment No. 3 (this “Amendment”) to the Registration Statement pursuant to Rule 414 promulgated under the Securities Act of 1933, as amended (the “Securities Act”), to update the Registration Statement as a result of the Holding Company Reorganization. In accordance with Rule 414(d) under the Securities Act, except as modified by this Amendment, Panbela, as successor issuer to the Predecessor pursuant to Rule 12g-3, hereby expressly adopts the Registration Statement as its own registration statement for all purposes of the Securities Act and the Exchange Act, as updated by subsequent amendment and other filings under the Exchange Act.

The Registration Statement, as amended by this Post-Effective Amendment No. 3 (this “Amendment”), pertains solely to the issuance by Panbela of the remaining 2,306,516 shares of common stock, $0.001 par value per share, underlying warrants (collectively, the “Investor Warrants”) previously issued by Panbela Research to investors in a public offering and 127,273 shares of common stock underlying warrants previously issued to the underwriters (the “Underwriter Warrants” and, together with the Investor Warrants, the “Warrants”). The shares of common stock issuable upon exercise of the Warrants were initially registered on the Registration Statement.

For the convenience of the reader, this Amendment sets forth the Registration Statement in its entirety, as amended. Panbela is filing this Amendment to update the financial statements and other information, including pursuant to the undertakings in Item 17 of the Registration Statement, and to update and supplement the information contained in the Registration Statement and the Prospectus contained therein.

No additional securities are being registered under this Amendment. All applicable registration fees were paid at the time of the original filing of the Registration Statement.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities, and we are not soliciting offers to buy these securities, in any state where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION

|

DATED JUNE 22, 2022

|

2,433,789 Shares of Common Stock Underlying Previously Issued Warrants

This prospectus relates to the offer and sale by Panbela Therapeutics, Inc. of up to (i) 2,306,516 shares of our common stock underlying warrants previously issued by us to investors that are issuable at a price of $4.54 per share and (ii) 127,345 shares of our common stock underlying warrants previously issued by us to the underwriter in a public offering that are issuable at a price of $4.357 per share, in each case from time to time upon exercise of such warrants. We are not selling any shares of our common stock in this offering other than pursuant to the exercise of outstanding warrants. Upon exercise of the warrants we will receive proceeds from the exercise of such warrants if exercised for cash and not on a cashless basis.

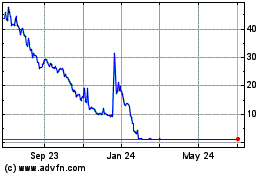

Our common stock is listed on the Nasdaq Capital Market under the symbol “PBLA.” On June 16, 2022, the last reported sale price of our common stock on the Nasdaq Capital Market was $1.33 per share. None of the warrants are listed on a national securities exchange.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 9 of this prospectus, and under similar headings in any amendments or supplements to this prospectus.

See “Plan of Distribution” beginning on page 40, for more information regarding the offering. No underwriter or person has been engaged to facilitate the sale of Shares in this offering. All costs associated with the registration were borne by us.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022

TABLE OF CONTENTS

Page

|

Prospectus Summary

|

1

|

|

The Offering

|

7

|

|

THE INITIAL CLOSING

|

8

|

|

Risk Factors

|

9

|

|

CAUTIONARY Note Regarding Forward-Looking Statements

|

20

|

|

Use of Proceeds

|

21

|

|

MARKET INFORMATION

|

22

|

|

DILUTION

|

26

|

|

Dividend Policy

|

27

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

28

|

|

FINANCIAL STATEMENTS

|

28

|

|

Business

|

29

|

|

Management

|

52

|

|

Security Ownership of Certain Beneficial Owners AND Management

|

62

|

|

DESCRIPTION OF Securities

|

63

|

|

SHARES ELIGIBLE FOR FUTURE SALE

|

67

|

|

PLAN OF DISTRIBUTION

|

68

|

|

Legal Matters

|

68

|

|

Experts

|

68

|

|

Where You Can Find More Information

|

68

|

|

INCORPORATION OF DOCUMENTS BY REFERENCE

|

69

|

|

FINANCIAL STATEMENTS

|

|

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with any information other than that contained in this prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our securities. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of these securities in any jurisdiction where the offer is not permitted.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States must inform themselves about, and observe any restrictions relating to, the offering of securities and the distribution of this prospectus outside the United States.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We believe that the data obtained from these industry publications and third-party research, surveys and studies are reliable. We are ultimately responsible for all disclosure included in this prospectus.

You should rely only on the information contained in this prospectus, as supplemented and amended. We have not authorized anyone to provide you with information that is different. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus may only be accurate on the date of this prospectus.

We urge you to read carefully this prospectus, as supplemented and amended, before deciding whether to invest in any of the securities being offered.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus. Unless otherwise stated or the context requires otherwise, references in this prospectus to “Panbela”, the “Company”, “we”, “us”, “our” and similar references refer to Panbela Therapeutics, Inc. and its subsidiaries.

Business Overview

Panbela is a clinical stage biopharmaceutical company developing disruptive therapeutics for the treatment of patients with urgent unmet medical needs. The company’s lead assets are SBP-101 and Flynpovi. SBP-101, is a proprietary polyamine analogue designed to induce polyamine metabolic inhibition (“PMI”), a metabolic pathway of critical importance in multiple tumor types. Many tumors require greatly elevated levels of polyamines to support their growth and survival. SBP-101 has demonstrated encouraging activity against metastatic disease in a clinical trial of patients with pancreatic cancer. The efficacy and safety results demonstrated in our completed phase I clinical trial of SBP-101 in combination with gemcitabine and nab-paclitaxel in the first line treatment of metastatic pancreatic cancer provides support for the current randomized, double-blind, placebo controlled phase II/III study of SBP-101 in combination with gemcitabine and nab-paclitaxel in patients previously untreated for metastatic pancreatic cancer. We believe that SBP-101, if successfully developed, may represent a novel approach that effectively treats patients with pancreatic cancer and could become a dominant product in that market. Only three first-line treatment combinations, a single maintenance treatment for a subset (3-7%) of patients, and one second-line drug have been approved by the FDA for pancreatic cancer in the last 25 years.

On June 15, 2022 Panbela acquired Cancer Prevention Pharmaceuticals, Inc. (CPP), which added the company’s second lead asset, an investigational new drug product, Flynpovi which is a combination of the polyamine synthesis inhibitor eflornithine and the non-steroidal anti-inflammatory drug sulindac. Eflornithine is an enzyme-activated, irreversible inhibitor of the enzyme ornithine decarboxylase, the first and rate-limiting enzyme in the biosynthesis of polyamines. Sulindac facilitates the export and catabolism of polyamines. We believe the investigational drug is unique in that it is designed to treat the risk factors (e.g., polyps) that are hypothesized to lead to Familial Adenomatous Polyposis (FAP) surgeries and colon cancer and therefore may have the ability to prevent various types of colon cancer. Flynpovi has received orphan drug designation status for FAP in the United States and Europe. There are no currently approved pharmaceutical therapies for FAP.

Both of the principal active ingredients in our investigational drug candidate Flynpovi (eflornithine and sulindac) have been previously approved individually but not in combination for other uses by the U.S. Food and Drug Administration (“FDA”) and have shown limited side effects at the dosages utilized in FAP studies. Eflornithine has never been approved in an oral form, is not on the market in any systemic dosage form, and is not available in any generic form. The combination of eflornithine and sulindac is delivered in an oral form, to which we have exclusive license rights to commercialize from the Arizona Board of Regents of the University of Arizona (the “University of Arizona”). This combination showed promising results in a National Cancer Institute (“NCI”) supported randomized, placebo-controlled Phase II/III clinical trial to prevent recurrent colon adenomas, particularly high-risk pre-cancerous polyps. These results led to a Phase III program in FAP, and a Phase III program to study colon cancer risk reduction in partnership with the Southwest Oncology Group (SWOG) and the NCI.

Additional programs are evaluating eflornithine as a single agent tablet (CPP-1X) or high dose powder sachet (CPP-1X-S) for several indications including prevention of gastric cancer, treatment of neuroblastoma and recent onset Type 1 diabetes. Preclinical studies as well as Phase 1 or Phase 2 investigator-initiated trials suggest that eflornithine treatment is well tolerated and has potential activity.

Holding Company Reorganization

Effective June 15, 2022, Panbela became a successor issuer to Panbela Research, Inc. (formerly known as Panbela Therapeutics, Inc., the “Predecessor”) pursuant to a holding company reorganization pursuant to which the Predecessor became a direct, wholly-owned subsidiary of Panbela. Panbela became a successor issuer to the Predecessor by operation of Rule 12g-3(a) promulgated under the Securities Exchange Act of 1934, as amended the (“Exchange Act”).

Cancer Prevention Acquisition

On June 15, 2022, Panbela acquired Cancer Prevention Pharmaceuticals, Inc. (“Cancer Prevention”), a private clinical stage company developing therapeutics to reduce the risk and recurrence of cancer and rare diseases,, via merger for consideration consisting of (a) 6,587,576 shares of common stock, (b) 731,957 shares of common stock that remained subject to a holdback escrow (as defined in the Merger Agreement), (c) replacement options to purchase up to 1,596,754 shares of common stock at a weighted average purchase price of $0.35 per share, and (d) replacement warrants to purchase up to 338,060 shares of common stock at a weighted average purchase price of $4.145 per share, and post-closing contingent payments up to a maximum of $60 million, subject to satisfaction of milestones.

Clinical Trials

SBP-101

In August 2015, the FDA accepted our Investigational New Drug (“IND”) application for our SBP-101 product candidate. We have completed an initial clinical trial of SBP-101 in patients with previously treated locally advanced or metastatic pancreatic cancer. This was a Phase I, first-in-human, dose-escalation, safety study. Between January 2016 and September 2017, we enrolled twenty-nine patients into six cohorts, or groups, in the dose-escalation phase of our Phase I trial. Twenty-four of the patients received at least two prior chemotherapy regimens. No drug-related serious adverse events occurred during the first four cohorts. In cohort five, serious adverse events (klebsiella sepsis with metabolic acidosis in one patient, renal and hepatic toxicity in one patient, and mesenteric vein thrombosis with metabolic acidosis in one patient) were observed in three of the ten patients, two of whom exhibited progressive disease at the end of their first cycle of treatment and were determined by the Data Safety Monitoring Board (“DSMB”) to be Disease Limiting Toxicities (“DLTs”). Consistent with the study protocol, the DSMB recommended continuation of the study by expansion of cohort 4, one level below that at which DLTs were observed. Four patients were enrolled in this expansion cohort.

In addition to being evaluated for safety, 23 of the 29 patients were evaluable for preliminary signals of efficacy prior to or at the eight-week conclusion of their first cycle of treatment using the RECIST, the current standard for evaluating changes in the size of tumors. Eight of the 23 patients (35%) had Stable Disease (“SD”) and 15 of 24 (65%) had Progressive Disease (“PD”). It should be noted that of the 15 patients with PD, six came from cohorts one and two and are considered to have received less than potentially therapeutic doses of SBP-101.

By cohort, stable disease occurred in two patients in cohort 3, two patients in cohort 4 and four patients in cohort 5. The best response outcomes and best median survival were observed in the group of patients who received total cumulative doses of approximately 6 mg/kg (cohort three). Two of four patients (50%) showed SD at week eight. Median survival in this group was 5.9 months, with two patients surviving 8 and 10 months, respectively. By total cumulative dose received, five of twelve patients (42%) who received total cumulative doses between 2.5 mg/kg and 8.0 mg/kg had reductions in the CA19-9 levels, as measured at least once after the baseline assessment. Nine of these patients (67%) exceeded three months of Overall Survival (“OS”), three patients (25%) exceeded nine months of OS and two patients (17%) exceeded one year of OS and were still alive at the end of the study.

We completed enrollment of patients in our second clinical trial in December 2020. This second clinical trial was a Phase Ia/Ib study of the safety, efficacy and pharmacokinetics of SBP-101 administered in combination with two standard-of-care chemotherapy agents, gemcitabine and nab-paclitaxel. The trial included six study sites; four in Australia and two in the United States. In the Phase Ia portion of this trial, we completed enrollment during the first quarter of 2020 consisting of four cohorts with increased dosage levels of SBP-101 administered in the second and third cohorts; the fourth cohort evaluated an alternate dosing schedule. A total of 25 subjects were enrolled in four cohorts of Phase Ia. The demonstration of adequate safety in Phase Ia allowed us to immediately begin enrollment in February 2020 in the Phase Ib exploration of efficacy. By December 2020 an additional 25 subjects in Phase Ib, using the recommended dosage level and schedule determined in Phase Ia, were enrolled.

After Phase Ib enrollment was completed, some patients in the trial were noted to have complaints of serious visual adverse effects. Visual changes were not seen in the SBP-101 monotherapy study. We consulted with our DSMB and withheld the administration of SBP-101 while all other trial activities continued. In February of 2021, we also conferred with the FDA regarding our plan to withhold dosing of SBP-101. This constituted a “partial clinical hold.” In April of 2021, the FDA lifted the partial clinical hold. The Company agreed with the FDA to include in the design of all future studies the exclusion of patients with a history of retinopathy or risk of retinal detachment and scheduled ophthalmologic monitoring for all patients.

Updated, but still not final results, were presented in a poster at the American Society of Clinical Oncology - GI conference (“ASCO-GI”) in January 2022. Best response in evaluable subjects (cohorts 4 and Ib N=29) was a Complete Response (“CR”) in 1 (3%), Partial Response (“PR”) in 13 (45%), SD in 10 (34%) and PD in 5 (17%). One subject did not have post baseline scans with RECIST tumor assessments. Median Progression Free Survival (“PFS”) , now final at 6.5 months may have been negatively impacted by drug dosing interruptions to evaluate potential toxicity. Median overall survival in Cohort 4 + Phase Ib was 12.0 months when data was presented in January 2022 and is now final at 14.6 months. Two patients from cohort 2 have demonstrated long term survival. One at 30.3 months (final data) and one at 33.0 months and still alive. Seven subjects are still alive at this time, one from cohort 2 and six from cohort 4 plus Ib.

The Company announced that the ASPIRE trial, a randomized, double-blind, placebo-controlled study of SBP-101 with Gemcitabine and Nab-Paclitaxel versus Gemcitabine, Nab-Paclitaxel and placebo, was initiated in January of 2022. The trial is in patients with first-line metastatic pancreatic ductal adenocarcinoma. The trial is designed as a Phase II/III randomized trial, with a primary endpoint of overall survival. The design includes a phase II portion for which a futility analysis after 104 progression free survival events will occur. If the futility analysis is favorable, the trial will be expanded to the phase III portion, and may serve for registration. We are intending to conduct the ASPIRE trial at leading cancer centers in the United States, Europe and the Asia-Pacific Region. It is expected that there will be approximately 60 sites and we anticipate enrollment for the phase II portion to be completed in approximately 12 months after the first subject is enrolled.

If we can successfully complete all FDA recommended clinical studies, we intend to seek marketing authorization from the FDA, the European Medicines Agency (“EMA”) (European Union), Ministry of Health and Welfare (Japan) and TGA (Australia). The submission fees may be waived when SBP-101 has been designated an orphan drug in each geographic region.

Data presented at the American Association for Cancer Research (AACR) in April 2022, demonstrated in an in vitro study evaluating cancer cell lines, SBP-101 was toxic in ovarian cancer cell lines with an average IC50 of ~1.5 μM. Efficacy of SBP-101 was further assessed in the VDID8+murine ovarian cancer model (ID8+C57Bl/6 ovarian cells overexpressing both VEGF and Defensin). Mice were treated with SBP-101 at either 24 mg/kg or 6 mg/kg alternating MWF. Both doses of SBP-101 produced a statistically significant prolongation of survival (24mg/kg p=.0049, 6 mg/kg p=.0042). There was no significant difference in response between the two SBP-101 doses. The prolonged survival was correlated with a delay in the production of ascites, the indication of tumor burden in this model. Given this data, the Company intends to proceed with a clinical development program in ovarian cancer by year-end.

FLYNPOVI

In a phase III study, the efficacy and safety of the combination of eflornithine and sulindac, as compared with either drug alone, in adults with familial adenomatous polyposis was conducted. The patients were randomly assigned in a 1:1:1 ratio to receive eflornithine, sulindac, or both once daily for up to 48 months. The primary end point, assessed in a time-to-event analysis, was disease progression, defined as a composite of major surgery, endoscopic excision of advanced adenomas, diagnosis of high-grade dysplasia in the rectum or pouch, or progression of duodenal disease. A total of 171 patients underwent randomization. Disease progression occurred in 18 of 56 patients (32%) in the eflornithine–sulindac group, 22 of 58 (38%) in the sulindac group, and 23 of 57 (40%) in the eflornithine group, with a hazard ratio of 0.71 (95% confidence interval [CI], 0.39 to 1.32) for eflornithine–sulindac as compared with sulindac (P = 0.29) and 0.66 (95% CI, 0.36 to 1.23) for eflornithine–sulindac as compared with eflornithine. Adverse and serious adverse events were similar across the treatment groups. In a post-hoc analysis, none of the patients in the combination arm progressed to a need for lower gastrointestinal (LGI) surgery for up to 48 months compared with 7 (13.2%) and 8 (15.7%) patients in the sulindac and eflornithine arms. These data corresponded to risk reductions for the need for LGI surgery approaching 100% between combination and either monotherapy with HR = 0.00 (95% CI, 0.00–0.48; p = 0.005) for combination versus sulindac and HR = 0.00 (95% CI, 0.00–0.44; p = 0.003) for combination versus eflornithine. Given the statistical significance of the LGI group, a new drug application (NDA) was filed with the FDA. As the study failed to meet the primary endpoint, and the NDA was based on the results of an exploratory analysis, a complete response letter was issued. To address this deficiency concern, the Company must submit the results of one or more adequate and well-controlled clinical trials which demonstrate an effect on a clinical endpoint. As the result of an existing North American license agreement, the FAP registration trial is fully funded and is scheduled to begin in the first-half of 2023.

CPP-1X-S/CPP-1X

Additionally, there are trials evaluating CPP-1X-S in relapsed refractory neuroblastoma supported by the childrens’ oncology group (COG) and NCI (ongoing) and STK11 mutation patients with non-small cell lung cancer scheduled to begin this year. For CPP-1X-T, a phase II trial in Type I onset diabetes is scheduled to begin this year in collaboration with Indiana University and the Juvenile Diabetes Research Foundation (JDRF).

Recent Developments

As previously announced, Panbela and certain of its subsidiaries successfully completed a merger and reorganization of Cancer Prevention Pharmaceuticals, Inc. (“CPP”), a private clinical stage company developing therapeutics to reduce the risk and recurrence of cancer and rare diseases, for a combination of stock and future milestone payments. The combined entity will have an expanded pipeline; areas of initial focus include familial adenomatous polyposis (FAP), first-line metastatic pancreatic cancer, neoadjuvant pancreatic cancer, colorectal cancer prevention and ovarian cancer. The combined development programs will have a steady cadence of catalysts with programs ranging from pre-clinical to registration studies.

Through December 31, 2021, we had:

| |

●

|

secured an orphan drug designation from the FDA;

|

| |

●

|

submitted and received acceptance from the FDA for an IND application;

|

| |

●

|

received acceptance of a Clinical Trial Notification from the Australian Therapeutic Goods Administration;

|

| |

●

|

completed a Phase Ia monotherapy safety study of SBP-101in the treatment of patients with metastatic pancreatic ductal adenocarcinoma;

|

| |

●

|

received “Fast Track” designation from the FDA for SBP-101 for metastatic pancreatic cancer;

|

| |

●

|

completed enrollment and released interim results in our second trial a Phase Ia /Ib clinical study of SBP-101, a first-line study with SBP-101 given in combination with a current standard of care in patients with pancreatic ductal adenocarcinoma who were previously untreated for metastatic disease; a total of 50 subjects were enrolled in this study, 25 in the Phase Ia and 25 in the Phase Ib or expansion phase;

|

| |

●

|

secured a two year research agreement with Johns Hopkins School of Medicine led by Professor Robert Casero an internationally recognized researcher in polyamine biology;

|

| |

●

|

completed process improvement measures expected to be scalable for commercial use and received issue notification for a patent covering this new shorter synthesis of SBP-101;

|

| |

●

|

initiated a randomized, double-blind, placebo controlled study with SBP-101 given in combination with gemcitabine and nab-paclitaxel in patients with pancreatic ductal adenocarcinoma who are previously untreated for metastatic disease;

|

| |

●

|

Completed preclinical evaluation of SBP-101 for use as neoadjuvant therapy in resectable pancreatic cancer prior to surgery; and

|

| |

●

|

Obtained early, preclinical, indication of tumor growth inhibition activity in ovarian cancer.

|

Risks Associated with Our Business

Our business is subject to many significant risks, as more fully described in the section titled “Risk Factors” immediately following this prospectus summary. You should read and carefully consider these risks, together with the risks set forth under the section titled “Risk Factors” and all of the other information in this prospectus, including the financial statements and the related notes included elsewhere in this prospectus, before deciding whether to invest in our securities. If any of the risks discussed in this prospectus actually occur, our business, financial condition or operating results could be materially and adversely affected. In particular, our risks include, but are not limited to, the following:

| |

●

|

our lack of diversification and the corresponding risk of an investment in our Company;

|

| |

●

|

potential deterioration of our financial condition and results due to failure to diversify;

|

| |

●

|

our ability to successfully complete acquisitions and integrate operations for new product candidates;

|

| |

●

|

our ability to obtain additional capital, on acceptable terms or at all, required to implement our business plan;

|

| |

●

|

final results of our Phase I clinical trial;

|

| |

●

|

progress and success of our randomized Phase II/III clinical trial;

|

| |

●

|

our ability to demonstrate safety and effectiveness of our product candidates;

|

| |

●

|

our ability to obtain regulatory approvals for our product candidate in the United States, the European Union, or other international markets;

|

| |

●

|

the market acceptance and future sales of our product candidates;

|

| |

●

|

the cost and delays in product development that may result from changes in regulatory oversight applicable to our product candidates;

|

| |

●

|

the rate of progress in establishing reimbursement arrangements with third-party payors;

|

| |

●

|

the effect of competing technological and market developments;

|

| |

●

|

the costs involved in filing and prosecuting patent applications and enforcing or defending patent claims; and

|

| |

●

|

other risk factors included under the caption “Risk Factors” starting on page 9 of this prospectus.

|

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and have elected to take advantage of certain of the scaled disclosure available to smaller reporting companies.

Corporate History

Panbela Therapeutics, Inc., formerly known as Sun BioPharma, Inc., was originally incorporated under the laws of the State of Delaware in September 2011. In 2015, we became a public company by completing a reverse merger transaction (the “Merger”) with a wholly owned subsidiary of Cimarron Medical, Inc., a public company organized under the laws of the State of Utah. Upon completion of the Merger and other separate but contemporaneous transactions by certain of our stockholders, our stockholders collectively owned approximately 99.0% of the post-Merger public company, which was renamed “Sun BioPharma, Inc.” In 2016, we reincorporated under the laws of the State of Delaware via a merger with our operating subsidiary, resulting in our current corporate form. The Company changed its name to Panbela Therapeutics, Inc. on December 2, 2020. On June 15, 2022, Panbela became a successor issuer pursuant to a holding company reorganization via merger by operation of Rule 12g-3(a) promulgated under the Exchange Act.

Corporate Information

Our corporate mailing address is 712 Vista Blvd, #305, Waconia, MN 55387. Our telephone number is (952) 479-1196, and our website is www.sunbiopharma.com. The information on our website is not part of this prospectus. We have included our website address as a factual reference and do not intend it to be an active link to our website. The information contained in or connected to our website is not incorporated by reference into, and should not be considered part of, this prospectus.

Trade names, trademarks, and service marks of other companies appearing in this prospectus are the property of the respective holders.

THE OFFERING

|

Common stock offered by us

|

Up to 2,433,789 shares of our common stock, consisting of (i) 2,306,516 shares issuable upon exercise of outstanding warrants with an exercise price of $4.54 per share and (ii) 127,273 shares issuable upon exercise of outstanding warrants with an exercise price of $4.537 per share. Each such warrant is exercisable at any time for the purchase of one share of our common stock and is scheduled to expire on September 1, 2025.

|

| |

|

|

Common stock outstanding as of the date of this prospectus

|

20,774,045 shares

|

| |

|

|

Common stock to be outstanding immediately after completion of this offering

|

23,207,834 shares (assuming full exercise of the warrants)

|

| |

|

|

Use of proceeds

|

We will receive approximately $10.9 million in proceeds if all of the currently outstanding warrants issued in the public offering are exercised for cash. We intend to use the net proceeds from this offering for the continued clinical development of our initial product candidate SBP-101, and for working capital and other general corporate purposes. See “Use of Proceeds” on page 20.

|

| |

|

|

Risk Factors

|

You should read the “Risk Factors” section of this prospectus beginning on page 9 for a discussion of factors to consider carefully before deciding to invest in our securities.

|

| |

|

|

Nasdaq Capital Market trading symbol

|

“PBLA”

|

| |

|

The number of shares of our common stock outstanding before and after this offering is based on 20,774,045 shares of our common stock outstanding as of June 16, 2022, and excludes:

| |

●

|

4,040,890 shares of common stock issuable upon the exercise of outstanding stock options at a weighted average exercise price of $3.62 per share;

|

| |

●

|

2,019,776 additional shares of common stock reserved and available for future issuances under our equity plans; and

|

| |

●

|

3,013,772 shares of common stock issuable upon exercise of stock purchase warrants not related to this offering at a weighted average exercise price of $4.58 per share.

|

Unless otherwise indicated, all information in this prospectus assumes no exercise of the outstanding options or warrants not relating to this offering.

THE INITIAL CLOSING

On September 1, 2020, we completed an initial closing (the “Initial Closing”) of the offering whereby we issued and sold in an underwritten public offering 2,545,454 shares of our common stock and 2,545,454 five-year warrants to purchase one share of common stock for an exercise price of $4.54 per share (collectively, the “Investor Warrants”). The securities were issued to the public at a combined price of $4.125 per share and warrant and were offered by our Company pursuant to the registration statement of which this prospectus forms a part (File No. 333-239661), which was declared effective on August 28, 2020. The aggregate net proceeds received by us from the Initial Closing were approximately $9.31 million and were used for the continued clinical development of our initial product candidate SBP-101, the repayment of approximately $0.9 million of outstanding indebtedness, and for working capital and other general corporate purposes. We also issued to the underwriter in the public offering five-year warrants to purchase 127,345 shares of common stock for an exercise price of $4.537 per share (the “Underwriter Warrant” and, together with the Investor Warrants, the “Warrants”).

As of June 16, 2022, 2,433,789 shares of our common stock remained issuable upon exercise of the Warrants.

RISK FACTORS

Any investment in our securities involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our securities. Our business, financial condition or results of operations could be materially adversely affected by these risks if any of them actually occur. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus.

Risks Related to Our Business and Financial Position

We are a pre-revenue company with a history of negative operating cash flow.

We have experienced negative cash flows for our operating activities since inception, primarily due to the investments required to commercialize our primary drug candidates, SBP-101 and eflornithine. Our financing cash flows historically have been positive due to proceeds from the sale of equity securities and promissory notes issuances. Our net cash used in operating activities was $6.7 million and $3.9 million for the years ended December 31, 2021 and 2020, respectively, and we had working capital of $9.6 million and $8.4 million as of the same dates, respectively. Working capital is defined as current assets less current liabilities.

Our operations are subject to all the risks, difficulties, complications and delays frequently encountered in connection with the development of new products, as well as those risks that are specific to the pharmaceutical and biotechnology industries in which we compete. Investors should evaluate us considering the delays, expenses, problems and uncertainties frequently encountered by companies developing markets for new products, services and technologies. We may never overcome these obstacles.

As a result of our current limited financial liquidity, we and our auditors have expressed substantial doubt regarding our ability to continue as a “going concern.”

As a result of our current limited financial liquidity, our auditors’ report for our 2021 financial statements, which is included as part of this report, contains a statement concerning our ability to continue as a “going concern.” Our limited liquidity could make it more difficult for us to secure additional financing or enter into strategic relationships on terms acceptable to us, if at all, and may materially and adversely affect the terms of any financing that we may obtain and our public stock price generally.

Our continuation as a “going concern” is dependent upon, among other things, achieving positive cash flow from operations and, if necessary, augmenting such cash flow using external resources to satisfy our cash needs. Our plans to achieve positive cash flow primarily include engaging in offerings of securities. Additional potential sources of funds include negotiating up-front and milestone payments on our current and potential future product candidates or royalties from sales of our products that secure regulatory approval and any milestone payments associated with such approved products. These cash sources could, potentially, be supplemented by financing or other strategic agreements. However, we may be unable to achieve these goals or obtain required funding on commercially reasonable terms, or at all, and therefore may be unable to continue as a going concern.

We may be unable to obtain the additional capital that is required to execute our business plan, which could restrict our ability to grow.

Our current capital and our other existing resources will be sufficient only to provide a limited amount of working capital and will not be sufficient to fund our expected continuing opportunities. While we project that our current capital resources are to fund our operations, including increased clinical trial costs, into the fourth quarter of 2022, we will require additional capital to continue to operate our business and complete our clinical development plans.

Future research and development, including clinical trial cost, capital expenditures and possible acquisitions, and our administrative requirements, such as salaries, insurance expenses and general overhead expenses, as well as legal compliance costs and accounting expenses, will require a substantial amount of additional capital and cash flow. There is no guarantee that we will be able to raise additional capital required to fund our ongoing business on commercially reasonable terms or at all.

We intend to pursue sources of additional capital through various financing transactions or arrangements, including collaboration arrangements, debt financing, equity financing or other means. We may not be successful in locating suitable financing transactions on commercially reasonable terms, in the time period required or at all, and we may not obtain the capital we require by other means. If we do not succeed in raising additional capital, our resources will not be sufficient to fund our operations going forward.

Any additional capital raised through the sale of equity may dilute the ownership percentage of our stockholders. This could also result in a decrease in the fair market value of our equity securities because our assets would be owned by a larger pool of outstanding equity. The terms of securities we issue in future capital transactions may be more favorable to our new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities which may have a further dilutive effect.

Our ability to obtain needed financing may be impaired by such factors as the capital markets, both generally and in the pharmaceutical and other drug development industries in particular, the limited diversity of our activities and/or the loss of key personnel. If the amount of capital we are able to raise from financing activities is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations, we may be required to cease our operations.

We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs, which may adversely impact our financial condition.

Our business is subject to risks arising from epidemic diseases, such as the 2020 outbreak of the COVID-19 illness.

March of 2022 marked two years since the outbreak of COVID-19, was declared by the World Health Organization to be a pandemic. A pandemic, including COVID-19, or other public health epidemics pose the risk that we or our employees, contractors, suppliers, and other vendors may be prevented from conducting business activities for an indefinite period of time, including due to the spread of the disease within these groups or due to shutdowns that may be requested or mandated by governmental authorities. Early in the pandemic we paused enrollment in our Phase Ia/Ib clinical trial for 6 weeks to allow the health care systems involved in the trial time to focus resources on responding to the pandemic. Once enrollment was restarted in May 2020, we experienced no further delays. This delay did not have a material effect on the completion of enrollment or costs of the clinical trial. During the course of the pandemic, health care facilities have limited our ability to conduct on site patient data monitoring for our clinical trial, these visits are now successfully conducted remotely as necessary. We also experienced a delay, a short delay, early in the pandemic, in the manufacturing of our active ingredient and another minor delay in 2021 in the preparation of drug product We believe our supply of drug is adequate and these delays have not caused any disruption in the start of the new Phase II/III clinical trial which we initiated in January of 2022. This new trial has been designed to mitigate any potential effects of Covid-19 on site activations or subject enrollment.

While we have not, to date experienced any significant disruptions as a result of the pandemic, we are unable to estimate the future impact that COVID-19 could have on our operations. The recent trends in reduced infections and deaths, and increased levels of vaccination should help reduce the risk that the pandemic may slow potential enrollment of clinical trials and reduce the number of eligible patients for our clinical trials. While the pandemic could still disrupt the supply chain and the manufacture or shipment of both drug substance and finished drug product for our product candidates for preclinical testing and clinical trials, we believe that product secured in 2021 will be sufficient to complete the conduct of our new clinical trial. We often attend and present clinical updates at various medical and investor conferences throughout the year. The COVID-19 outbreak has caused, and may to continue to cause, cancellations or reduced attendance of these conferences and we may need to seek alternate methods to present clinical updates and to engage with the medical and investment communities. The COVID-19 outbreak, including new variants of the virus, and future mitigation measures may also have an adverse impact on global economic conditions which could have an adverse effect on our business and financial condition and our potential to conduct financings on terms acceptable to us, if at all. The extent to which the COVID-19 outbreak impacts our results will depend on future developments that remain uncertain and cannot be predicted, including new information that may emerge concerning the severity of the virus and the actions to contain its impact.

The markets for our product candidates are highly competitive and are subject to rapid scientific change, which could have a material adverse effect on our business, results of operations and financial condition.

The pharmaceutical and biotechnology industries in which we compete are highly competitive and characterized by rapid and significant technological change. We face intense competition from organizations such as pharmaceutical and biotechnology companies, as well as academic and research institutions and government agencies. Some of these organizations are pursuing products based on technologies similar to our technology. Other of these organizations have developed and are marketing products or are pursuing other technological approaches designed to produce products that are competitive with our product candidates in the therapeutic effect these competitive products have on the diseases targeted by our product candidates. Our competitors may discover, develop or commercialize products or other novel technologies that are more effective, safer or less costly than any that we may develop. Our competitors may also obtain FDA or other regulatory approval for their products more rapidly than we may obtain approval for our product candidates.

Many of our competitors are substantially larger than we are and have greater capital resources, research and development staffs and facilities than we have. In addition, many of our competitors are more experienced in drug discovery, development and commercialization, obtaining regulatory approvals and drug manufacturing and marketing.

We anticipate that the competition with our product candidates and technology will be based on a number of factors including product efficacy, safety, availability and price. The timing of market introduction of our planned future product candidates and competitive products will also affect competition among products. We expect the relative speed with which we can develop our product candidates, complete the required clinical trials, establish strategic partners and supply appropriate quantities of the product candidate for late stage trials, if required, to be important competitive factors. Our competitive position will also depend upon our ability to attract and retain qualified personnel, to obtain patent protection in non-U.S. markets, which we currently do not have, or otherwise develop proprietary products or processes and to secure sufficient capital resources for the period between technological conception and commercial sales or out-license to pharmaceutical partners. If we fail to develop and deploy a proposed product candidate in a successful and timely manner, we will in all likelihood not be competitive.

Our lack of diversification increases the risk of an investment in our Company and our financial condition and results of operations may deteriorate if we fail to diversify.

Our Board of Directors has centered our attention on our drug development activities, which are currently focused a limited number of product candidates. Our ability to diversify our investments will depend on our access to additional capital and financing sources and the availability and identification of suitable opportunities.

Larger companies have the ability to manage their risk by diversification. However, we lack and expect to continue to lack diversification, in terms of both the nature and geographic scope of our business. As a result, we will likely be impacted more acutely by factors affecting pharmaceutical and biotechnology industries in which we compete than we would if our business were more diversified, enhancing our risk profile. If we cannot diversify our operations, our financial condition and results of operations could deteriorate.

Our business may suffer if we do not attract and retain talented personnel.

Our success will depend in large measure on the abilities, expertise, judgment, discretion, integrity and good faith of our management and other personnel in conducting our business. We have a small management team, and the loss of a key individual or inability to attract suitably qualified staff could materially adversely impact our business.

Our success depends on the ability of our management, employees, consultants and strategic partners, if any, to interpret market data correctly and to interpret and respond to economic market and other conditions in order to locate and adopt appropriate investment opportunities, monitor such investments, and ultimately, if required, to successfully divest such investments. Further, no assurance can be given that our key personnel will continue their association or employment with us or that replacement personnel with comparable skills can be found. We will seek to ensure that management and any key employees are appropriately compensated; however, their services cannot be guaranteed. If we are unable to attract and retain key personnel, our business may be adversely affected.

We may be required to defend lawsuits or pay damages for product liability claims.

Product liability is a major risk in testing and marketing biotechnology and pharmaceutical products. We may face substantial product liability exposure in human clinical trials and in the sale of products after regulatory approval. Product liability claims, regardless of their merits, could exceed policy limits, divert management’s attention and adversely affect our reputation and the demand for our product. In any such event, your investment in our securities could be materially and adversely affected.

Risks Related to Acquisitions and Integrations

We have and expect to incur substantial costs related to the Mergers and subsequent integration efforts.

We have incurred and expect to incur a number of non-recurring costs associated with the Mergers and related transactions. These costs include legal, financial advisory, accounting, consulting and other advisory fees, retention, severance and employee benefit-related costs, regulatory fees, closing, integration and other related costs. Some of these costs are payable regardless of whether or not the Mergers are completed.

Although the Mergers have been completed, integration may be more difficult, costly, or time-consuming than expected, and we may not realize the anticipated benefits of the underlying acquisition.

The anticipated benefits of the combined company, including product candidate diversification and growth, may not be realized fully or at all or may take longer to commercialize than expected and integration may result in additional and unforeseen expenses. An inability to realize the full extent of the anticipated benefits, as well as any delays encountered in the integration process, could have an adverse effect upon our operating results.

In addition, we and CPP operated independently prior to the completion of the Mergers. It is possible that the now-active integration process could result in the loss of one or more key employees, including employees of CPP, the disruption of each company’s ongoing businesses or inconsistencies in standards, controls, procedures, and policies that adversely affect each company’s ability to maintain relationships with clients, customers, depositors, and employees or to achieve the anticipated benefits of the Mergers. Integration efforts between the companies may also divert management attention and resources. These integration matters could have an adverse effect on the Company during this transition period and for an undetermined period.

We may not have discovered certain liabilities or other matters related to CPP, which may adversely affect the future financial performance of the combined company.

In the course of the due diligence review that we conducted prior to the execution of the merger agreement, we may not have discovered, or may have been unable to properly quantify, certain liabilities of CPP or other factors that may have an adverse effect on the business, results of operations, financial condition, and cash flows of the combined company.

Our estimates and judgments related to the acquisition accounting methods used to record the purchase price allocation related to the merger may be inaccurate.

Our management will make significant accounting judgments and estimates related to the application of acquisition accounting of the Mergers under GAAP, as well as the underlying valuation models. Our business, operating results, and financial condition could be materially adversely impacted in future periods if the accounting judgments and estimates prove to be inaccurate.

Risks Related to the Development and Approval of New Drugs

Clinical trials required for our product candidate are expensive and time-consuming, and their outcome is highly uncertain. If any of our drug trials are delayed or yield unfavorable results, we will have to delay or may be unable to obtain regulatory approval for our product candidate.

We must conduct extensive testing of our product candidate before we can obtain regulatory approval to market and sell it. We need to conduct both preclinical animal testing and human clinical trials. Conducting these trials is a lengthy, time-consuming and expensive process. These tests and trials may not achieve favorable results for many reasons, including, among others, failure of the product candidate to demonstrate safety or efficacy, the development of serious or life-threatening adverse events, or side effects, caused by or connected with exposure to the product candidate, difficulty in enrolling and maintaining subjects in the clinical trial, lack of sufficient supplies of the product candidate or comparator drug, and the failure of clinical investigators, trial monitors, contractors, consultants, or trial subjects to comply with the trial protocol. A clinical trial may fail because it did not include a sufficient number of patients to detect the endpoint being measured or reach statistical significance. A clinical trial may also fail because the dose(s) of the investigational drug included in the trial were either too low or too high to determine the optimal effect of the investigational drug in the disease setting. Many clinical trials are conducted under the oversight of Independent Data Monitoring Committees (“IDMCs”) also known as DSMB’s. These independent oversight bodies are made up of external experts who review the progress of ongoing clinical trials, including available safety and efficacy data, and make recommendations concerning a trial’s continuation, modification, or termination based on interim, unblinded data. Any of our ongoing clinical trials may be discontinued or amended in response to recommendations made by responsible IDMCs based on their review of such interim trial results.

We will need to reevaluate our product candidate if it does not test favorably and either conduct new trials, which are expensive and time consuming, or abandon our drug development program. Even if we obtain positive results from preclinical or clinical trials, we may not achieve the same success in future trials. Many companies in the biopharmaceutical industry have suffered significant setbacks in clinical trials, even after promising results have been obtained in earlier trials. The failure of clinical trials to demonstrate safety and effectiveness for the desired indication could harm the development of our product candidate and our business, financial condition and results of operations may be materially harmed.

We face significant risks in our product candidate development efforts.

Our business depends on the successful development and commercialization of our product candidates. We are currently focused on developing our product candidates, SBP-101 and eflornithine, and are not permitted to market it in the United States until we receive approval of an NDA from the FDA, or in any foreign jurisdiction until we receive the requisite approvals from such jurisdiction. The process of developing new drugs and/or therapeutic products is inherently complex, unpredictable, time-consuming, expensive and uncertain. We must make long-term investments and commit significant resources before knowing whether our development programs will result in drugs that will receive regulatory approval and achieve market acceptance. A product candidate that appears to be promising at all stages of development may not reach the market for a number of reasons that may not be predictable based on results and data from the clinical program. A product candidate may be found ineffective or may cause harmful side effects during clinical trials, may take longer to progress through clinical trials than had been anticipated, may not be able to achieve the pre-defined clinical endpoints even though clinical benefit may have been achieved, may fail to receive necessary regulatory approvals, may prove impracticable to manufacture in commercial quantities at reasonable cost and with acceptable quality, or may fail to achieve market acceptance.

We cannot predict whether or when we will obtain regulatory approval to commercialize our initial product candidate and we cannot, therefore, predict the timing of any future revenues from this or other product candidates, if any. The FDA has substantial discretion in the drug approval process, including the ability to delay, limit or deny approval of a product candidate for many reasons. For example, the FDA:

| |

●

|

could determine that the information provided by us was inadequate, contained clinical deficiencies or otherwise failed to demonstrate the safety and effectiveness of any of our product candidates for any indication;

|

| |

●

|

may not find the data from clinical trials sufficient to support the submission of an NDA or to obtain marketing approval in the United States, including any findings that the clinical and other benefits of our product candidates outweigh their safety risks;

|

| |

●

|

may disagree with our trial design or our interpretation of data from preclinical studies or clinical trials or may change the requirements for approval even after it has reviewed and commented on the design for our trials;

|

| |

●

|

may identify deficiencies in the manufacturing processes or facilities of third-party manufacturers with which we enter into agreements for the manufacturing of our product candidates;

|

| |

●

|

may approve our product candidates for fewer or more limited indications than we request or may grant approval contingent on the performance of costly post-approval clinical trials;

|

| |

●

|

may change its approval policies or adopt new regulations; or

|

| |

●

|

may not approve the labeling claims that we believe are necessary or desirable for the successful commercialization of our product candidates.

|

Any failure to obtain regulatory approval of our initial product candidate or future product candidates we develop, if any, would significantly limit our ability to generate revenues, and any failure to obtain such approval for all of the indications and labeling claims we deem desirable could reduce our potential revenues.

Our product candidate is based on new formulation of an existing technology which has never been approved for the treatment of any cancer and, consequently, is inherently risky. Concerns about the safety and efficacy of our product candidate could limit our future success.

We are subject to the risks of failure inherent in the development of product candidates based on new technologies. These risks include the possibility that any product candidates we create will not be effective, that our current product candidate will be unsafe, ineffective or otherwise fail to receive the necessary regulatory approvals or that our product candidate will be hard to manufacture on a large scale or will be uneconomical to market.

Many pharmaceutical products cause multiple potential complications and side effects, not all of which can be predicted with accuracy and many of which may vary from patient to patient. Long term follow-up data may reveal additional complications associated with our product candidate. The responses of potential physicians and others to information about complications could materially affect the market acceptance of our product candidate, which in turn would materially harm our business.

Our ability to commence and complete the planned FAP registration trial depends substantially on a third-party and its resources.

In July 2021, Cancer Prevention licensed the U.S. and Canadian rights to Flynpovi to One-Two Therapeutics Assets Limited (“One-Two”), a private commercial-stage specialty pharma company focused on GI and orphan disease. Under the terms of the license, One-Two is responsible for all costs of development and approval of Flynpovi in North America. Accordingly, our ability to potentially obtain FDA approval of Flynpovi is dependent on One-Two’s ability to fund and complete the registration trial. Any failure to obtain regulatory approval of Flynpovi in this context, could significantly limit our ability to obtain milestone payments or generate revenues from Flynpovi.

Due to our reliance on third parties to conduct our clinical trials, we are unable to directly control the timing, conduct, expense and quality of our clinical trials, which could adversely affect our clinical data and results and related regulatory approvals.

We extensively outsource our clinical trial activities and expect to directly perform only a small portion of the preparatory stages for planned trials. We rely on independent third-party CROs to perform most of our clinical trials, including document preparation, site identification, screening and preparation, pre-study visits, training, program management and bio-analytical analysis. Many important aspects of the services performed for us by the CROs are out of our direct control. If there is any dispute or disruption in our relationship with our CROs, our clinical trials may be delayed. Moreover, in our regulatory submissions, we rely on the quality and validity of the clinical work performed by third-party CROs. If a CRO’s processes, methodologies or results are determined to be invalid or inadequate, our own clinical data and results and related regulatory approvals could be adversely affected or invalidated.

We rely on third-party suppliers and other third parties for production of our product candidate and our dependence on these third parties may impair the advancement of our research and development programs and the development of our product candidates.

We rely on, and expect to continue to rely on, third parties for the supply of raw materials and manufacture of drug supplies necessary to conduct our preclinical studies and clinical trials. During 2021 the Company, in collaboration with our manufacturing partner confirmed a new shorter and less expensive synthesis of the active drug substance. However, delays in production by third parties could delay our clinical trials or have an adverse impact on any commercial activities. In addition, the fact that we are dependent on third parties for the manufacture of and formulation of our product candidates means that we are subject to the risk that the products may have manufacturing defects that we have limited ability to prevent or control. Although we oversee these activities to ensure compliance with our quality standards, budgets and timelines, we have had and will continue to have less control over the manufacturing of our product candidates than potentially would be the case if we were to manufacture our product candidates. Further, the third parties we deal with could have staffing difficulties, might undergo changes in priorities or may become financially distressed, which would adversely affect the manufacturing and production of our product candidates.

The results of pre-clinical studies and completed clinical trials are not necessarily predictive of future results, and our current product candidates may not have favorable results in later studies or trials.

Pre-clinical studies and Phase I clinical trials are not primarily designed to test the efficacy of a product candidate in the general population, but rather to test initial safety, to study pharmacokinetics and pharmacodynamics, to study limited efficacy in a small number of study patients in a selected disease population, and to identify and attempt to understand the product candidate’s side effects at various doses and dosing schedules. Success in pre-clinical studies or completed clinical trials does not ensure that later studies or trials, including continuing pre-clinical studies and large-scale clinical trials, will be successful nor does it necessarily predict future results. Favorable results in early studies or trials may not be repeated in later studies or trials, and product candidates in later stage trials may fail to show acceptable safety and efficacy despite having progressed through earlier trials.

Risks Related to the Regulation of our Business

Federal and state pharmaceutical marketing compliance and reporting requirements may expose us to regulatory and legal action by state governments or other government authorities.

The Food and Drug Administration Modernization Act (the “FDMA”) established a public registry of open clinical trials involving drugs intended to treat serious or life-threatening diseases or conditions in order to promote public awareness of and access to these clinical trials. Under the FDMA, pharmaceutical manufacturers and other trial sponsors are required to post the general purpose of these trials, as well as the eligibility criteria, location and contact information of the trials. Failure to comply with any clinical trial posting requirements could expose us to negative publicity, fines and other penalties, all of which could materially harm our business.

In recent years, several states, including California, Vermont, Maine, Minnesota, New Mexico and West Virginia have enacted legislation requiring pharmaceutical companies to establish marketing compliance programs and file periodic reports on sales, marketing, pricing and other activities. Similar legislation is being considered in other states. Many of these requirements are new and uncertain, and available guidance is limited. Unless we are in full compliance with these laws, we could face enforcement actions and fines and other penalties and could receive adverse publicity, all of which could harm our business.

If the product candidate we develop becomes subject to unfavorable pricing regulations, third party reimbursement practices or healthcare reform initiatives, our ability to successfully commercialize our product candidate may be impaired.

Our future revenues, profitability and access to capital will be affected by the continuing efforts of governmental and private third-party payors to contain or reduce the costs of health care through various means. We expect several federal, state and foreign proposals to control the cost of drugs through government regulation. We are unsure of the impact recent health care reform legislation may have on our business or what actions federal, state, foreign and private payors may take in response to the recent reforms. Therefore, it is difficult to predict the effect of any implemented reform on our business. Our ability to commercialize our product candidate successfully will depend, in part, on the extent to which reimbursement for the cost of such product candidate and related treatments will be available from government health administration authorities, such as Medicare and Medicaid in the United States, private health insurers and other organizations. Significant uncertainty exists as to the reimbursement status of newly approved health care products, particularly for indications for which there is no current effective treatment or for which medical care typically is not sought. Adequate third-party coverage may not be available to enable us to maintain price levels sufficient to realize an appropriate return on our investment in product research and development. If adequate coverage and reimbursement levels are not provided by government and third-party payors for use of our product candidates, our product candidates may fail to achieve market acceptance and our results of operations will be harmed.

Healthcare legislative reform measures may have a material adverse effect on our business and results of operations.

Legislative and regulatory actions affecting government prescription drug procurement and reimbursement programs occur relatively frequently. In the United States, the ACA was enacted in 2010 to expand healthcare coverage. Since then, numerous efforts have been made to repeal, amend or administratively limit the ACA in whole or in part. For example, the Tax Cuts and Jobs Act, signed into law by President Trump in 2017, repealed the individual health insurance mandate, which is considered a key component of the ACA. In December 2018, a Texas federal district court struck down the ACA on the grounds that the individual health insurance mandate is unconstitutional, although this ruling has been stayed pending appeal. The ongoing challenges to the ACA and new legislative proposals have resulted in uncertainty regarding the ACA's future viability and destabilization of the health insurance market. The resulting impact on our business is uncertain and could be material.

Efforts to control prescription drug prices could also have a material adverse effect on our business. For example, in 2018, President Trump and the Secretary of the U.S. Department of Health and Human Services (“HHS”) released the “American Patients First Blueprint” and have begun implementing certain portions. The initiative includes proposals to increase generic drug and biosimilar competition, enable the Medicare program to negotiate drug prices more directly and improve transparency regarding drug prices and ways to lower consumers’ out-of-pocket costs. The Trump administration also proposed to establish an “international pricing index” that would be used as a benchmark to determine the costs and potentially limit the reimbursement of drugs under Medicare Part B. Among other pharmaceutical manufacturer industry-related proposals, Congress has proposed bills to change the Medicare Part D benefit to impose an inflation-based rebate in Medicare Part D and to alter the benefit structure to increase manufacturer contributions in the catastrophic phase. The volume of drug pricing-related bills has dramatically increased under the current Congress, and the resulting impact on our business is uncertain and could be material.

In addition, many states have proposed or enacted legislation that seeks to regulate pharmaceutical drug pricing indirectly or directly, such as by requiring biopharmaceutical manufacturers to publicly report proprietary pricing information or to place a maximum price ceiling on pharmaceutical products purchased by state agencies. For example, in 2017, California’s governor signed a prescription drug price transparency state bill into law, requiring prescription drug manufacturers to provide advance notice and explanation for price increases of certain drugs that exceed a specified threshold. Both Congress and state legislatures are considering various bills that would reform drug purchasing and price negotiations, allow greater use of utilization management tools to limit Medicare Part D coverage, facilitate the import of lower-priced drugs from outside the United States and encourage the use of generic drugs. Such initiatives and legislation may cause added pricing pressures on our products.