Opera Limited (NASDAQ: OPRA), one of the world’s major browser

developers and a leading internet consumer brand, today announced

its unaudited consolidated financial results for the quarter ended

September 30, 2019.

| |

| Third quarter

2019 financial highlights |

| |

| |

|

Three Months Ended September 30, |

|

|

Year-over- |

|

|

Nine Months Ended September 30, |

|

|

Year-over- |

|

| [US$

thousands, except for margins and per ADS amounts] |

|

2018 |

|

|

2019 |

|

|

year %change |

|

|

2018 |

|

|

2019 |

|

|

year %change |

|

|

Revenue |

|

|

42,795 |

|

|

|

93,678 |

|

|

|

118.9 |

% |

|

|

122,069 |

|

|

|

205,245 |

|

|

|

68.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

|

9,717 |

|

|

|

28,120 |

|

|

|

189.4 |

% |

|

|

23,747 |

|

|

|

35,923 |

|

|

|

51.3 |

% |

| Margin |

|

|

22.7 |

% |

|

|

30.0 |

% |

|

|

|

|

|

|

19.5 |

% |

|

|

17.5 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA (1) |

|

|

16,495 |

|

|

|

12,647 |

|

|

|

-23.3 |

% |

|

|

48,283 |

|

|

|

25,305 |

|

|

|

-47.6 |

% |

| Margin |

|

|

38.5 |

% |

|

|

13.5 |

% |

|

|

|

|

|

|

39.6 |

% |

|

|

12.3 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income (1) |

|

|

12,494 |

|

|

|

30,578 |

|

|

|

144.7 |

% |

|

|

33,151 |

|

|

|

43,188 |

|

|

|

30.3 |

% |

| Margin |

|

|

29.2 |

% |

|

|

32.6 |

% |

|

|

|

|

|

|

27.2 |

% |

|

|

21.0 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net income per ADS,

US$ |

|

|

0.09 |

|

|

|

0.25 |

|

|

|

176.6 |

% |

|

|

0.23 |

|

|

|

0.32 |

|

|

|

36.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted adjusted net income

per ADS, US$ (1) |

|

|

0.11 |

|

|

|

0.27 |

|

|

|

146.1 |

% |

|

|

0.33 |

|

|

|

0.38 |

|

|

|

16.4 |

% |

(1) Please see the separate section "About non-IFRS financial

measures" for the definitions of adjusted EBITDA and adjusted net

income.

Frode Jacobsen, Opera’s CFO, said, “We are pleased with our

third quarter results delivering accelerated revenue growth

year-over-year and positive momentum throughout the business. We

are successfully leveraging our well-known brand and large user

base of more than 350 million monthly active users to drive growth

in new opportunities beyond the browser, including news and

content, fintech and classifieds. Our new initiatives, strategic

investments and the continued growth of our browser, led to an

accelerating growth trajectory with 119% year-over-year revenue

growth.

“Our third quarter revenue growth was driven by strong results

in both advertising and search revenues and more than a tripling of

microlending revenue versus the second quarter, driven by rapid

scaling in India and continued success in Kenya. Adjusted EBITDA

margins expanded meaningfully versus the prior quarter, while we

continued to invest aggressively in existing and future growth

initiatives.”

Third quarter 2019 user base and product

highlights(All comparisons are relative to the third

quarter of 2018 unless otherwise stated)

- Opera News average Monthly Active Users (“MAUs”) grew 39% to

169 million

- The Opera News app, launched in January 2018, reached 41

million average MAUs, up 136% on year-over-year basis

- Total smartphone average MAUs grew 18% to 232 million

- PC average MAUs grew 16% to 68 million

- Provided 4.9 million microloans in the quarter with a total

value of $250 million, up from 1.8 million microloans and $70

million value in the second quarter

Lin Song, Opera’s COO, said, “We are pleased with our strong

third quarter results across all of our key metrics. We maintain a

robust user growth trajectory while utilizing our scale to launch

new products and further expand our market opportunity.

“Opera News continues to scale, with MAUs of our news app

increasing 136% year-over-year to 41 million in the third quarter.

We remain focused on driving user growth and increasing engagement

through improved product quality and adding hyperlocal content on

the platform. This includes the launch of Opera News Hub, a

platform which allows content creators to publish and monetize

through Opera News, which has already signed on 500 key opinion

leaders. We continue to make progress monetizing our dedicated news

app, with revenue up 44% versus the prior quarter.

“Opera Ads, our direct selling platform is evolving and

expanding its capabilities. We are reaching an increasing number of

both large businesses and small to medium sized enterprises which

led to an increase in advertising revenue. Additionally, we

launched OLeads, a product aimed at helping the tens of millions of

small and medium enterprises in Nigeria grow and market their

businesses online.

“Olist, our classified offering in Nigeria is progressing well.

Listings have more than doubled to over 1 million from three months

ago. We are focusing on growing listings and driving consumer

awareness. We believe the potential in this area is very

interesting, both in terms of advertising, but also from taking

part in the underlying transactions through fee based models.

“On the browser side, our focus on product differentiation has

led to continued growth with PC users up 16% year-over-year as we

remain focused on privacy and security functionality, and supported

by the continued success of Opera GX, our web browser tailored for

gamers. Our smartphone user base also continued to grow during the

quarter, as we launched offline file sharing in our Opera Mini

browser that enables users to share content without using their

mobile data or being limited by a slow network connection. The

recent launch of our new tracker blocker is shown to speed up

mobile browser speed by almost 20%.”

Business outlook

Mr. Frode Jacobsen, Opera’s CFO, said, “In light of the success

we achieved during the third quarter of 2019, we are again raising

our full-year revenue expectations. We now expect 77% revenue

growth at the midpoint of our 2019 guidance. This view includes

further growth in our microlending business and continued scaling

of our advertising business. We expect our newest initiatives,

including OList and additional fintech efforts, to be more of a

factor in 2020. Further, we are increasing the lower end of our

2019 Adjusted EBITDA guidance. This reflects further margin

expansion in the fourth quarter, while continuing to make

aggressive investments in both existing and new initiatives aimed

at driving strong multi-year growth.”

As a result, Opera expects fourth quarter and full year 2019

revenue and adjusted EBITDA to be in the following ranges:

Fourth Quarter:

- Revenue of $95 - $105 million, or 89 - 109% growth versus the

fourth quarter of 2018, driven by fintech revenue and to a lesser

extent growth in advertising and search revenue. This growth will

be offset by an expected significant decline in technology

licensing revenue

- Adjusted EBITDA of $15 - $19 million, representing margin

expansion versus the third quarter

Full Year:

- Revenue of $300 - $310 million, or 74 - 80% growth

year-over-year, an increase from our previous guidance of $270 -

$290 million

- Adjusted EBITDA of $41 - $45 million

Third quarter 2019 consolidated financial

results

All comparisons in this section are relative to the third

quarter of 2018 unless otherwise stated.

Revenue increased 119% to $93.7 million.

- Search revenue increased 13% to $21.5 million, primarily due to

smartphone and PC browser growth.

- Advertising revenue increased 17% to $18.3 million, due to an

increase in both smartphone and PC users and continued monetization

improvements.

- Fintech revenue was $39.9 million. This revenue tripled versus

the prior quarter due to rapidly scaling India and continued growth

in Kenya.

- Retail revenue was $6.0 million versus $2.9 million in the

third quarter of 2018.

- Technology licensing and other revenue was $7.9 million. This

was higher than expected due to non-recurring incremental low

margin revenue relating to investee support.

Operating expenses increased 181% to $87.0

million.

- Cost of revenue was $15.0 million, compared to $10.1 million in

the second quarter of 2019. Within the total, $6.0 million related

to retail revenue, $8.8 million related to microlending and $0.2

million related to the browser and news business area.

- Personnel expenses including share-based remuneration were

$19.5 million, a 108% increase. This expense consists of cash-based

compensation expense of $18.0 million, and $1.5 million of

share-based remuneration expense. The increase included

approximately $4.0 million of short-term elevated compensation cost

relating to investee support, and some staff increases mainly

related to Opera News, Opera Ads, microlending and other growth

initiatives.

- Marketing and distribution expenses were $20.0 million, an

increase of 160% following our previously announced efforts to

further invest in accelerating our growth in 2019.

- Credit loss expense was $19.6 million, including $20.0 million

related to microlending which was partially offset by a $0.4

million reduction in credit loss provision within the browser and

news segment.

- Depreciation and amortization expenses were $4.5 million, a 48%

increase. The increase is largely the result of the adoption of

IFRS 16 on January 1, 2019.

- Other operating expenses were $8.3 million, a 19%

increase.

Operating profit was $6.7 million, representing

an operating margin of 7%, compared to $11.8 million and a 27%

margin in the year-ago quarter. The decline was largely due to the

increased investment in marketing and distribution activities and

increased headcount associated with our growth initiatives.

Share of net income of associates and joint

ventures amounted to $23.3 million, including a non-cash

gain from the increased OPay valuation in connection with the

company’s recent funding round.

Income tax expense was $1.7 million, compared

to an expense of $1.0 million in the year-ago quarter.

Net income was $28.1 million, compared to $9.7

million in the third quarter of 2018.

Net income per ADS was $0.25 in the quarter,

and $0.25 on a diluted basis.

Adjusted net income per ADS was $0.28 in the

quarter, and $0.27 on a diluted basis. Each ADS represents two

shares in Opera Limited. In the quarter, the average number of

shares outstanding was 221.6 million, corresponding to 110.8

million ADSs. Note that the third quarter only includes 1.0 million

impact of the 7.5 million new ADSs issued as part of the company’s

follow-on offering. An additional 1.1 million new ADSs were issued

in October related to the underwriters’ execution of the

over-allotment option.

Adjusted EBITDA was $12.6 million, representing

a 13% adjusted EBITDA margin, compared to $16.5 million in third

quarter 2018. Adjusted EBITDA excludes share-based

remuneration.

Adjusted Net Income was $30.6 million in the

quarter, representing a 33% adjusted net margin compared to $12.5

million in third quarter 2018. Adjusted net income excludes

share-based remuneration and amortization of intangible assets

related to acquisitions (all of which relates to the Opera

privatization in 2016). Adjusted net income further includes

partially offsetting reversals of the tax impacts of the foregoing

adjustments.

Other highlights included a follow-on public

offering of 8.6 million American Depositary Shares (ADS), raising a

total of $82.6 million net of underwriting discounts and

commissions. The initial offering of 7.5 ADSs was completed on

September 24th and the underwriters’ execution of the

over-allotment option of 1.1 million ADSs was completed on October

16th.

Conference call

Opera’s management team will host a conference call from Lagos,

Nigeria at 8:00 AM U.S. Eastern Time (2:00 PM Central European

Time, 9:00 PM Beijing/Hong Kong time) on Thursday, November 14,

2019.

The dial-in details for the live conference call are:United

States: +1 (877) 506-7703China: +86 400 682 8609Hong Kong: +852

5819 4851Norway: +47 239 64173United Kingdom: +44 (0)203 107

0289International: +1 (786) 815-8450Confirmation Code: 7235635

A live webcast of the conference call will be posted at

https://investor.opera.com.

About non-IFRS financial measures

To supplement our consolidated financial statements, which are

prepared and presented based on IFRS, we use adjusted EBITDA and

adjusted net income, both non-IFRS financial measures, to

understand and evaluate our core operating performance. These

non-IFRS financial measures, which may differ from similarly titled

measures used by other companies, are presented to enhance

investors’ overall understanding of our financial performance and

should not be considered a substitute for, or superior to, the

financial information prepared and presented in accordance with

IFRS.

We define adjusted EBITDA as net income (loss) excluding income

tax expense (benefit), net finance expense (income), share of net

loss (income) of associates and joint ventures, restructuring

costs, depreciation and amortization, share-based remuneration and

expensed costs related to our recent initial public offering, less

other income.

We define adjusted net income as net income excluding

share-based remuneration, amortization of acquired intangible

assets, and expensed costs related to our recent initial public

offering.

We believe that adjusted EBITDA and adjusted net income provides

useful information to investors and others in understanding and

evaluating our operating results. These non-IFRS financial measures

adjust for the impact of items that we do not consider indicative

of the operational performance of our business. While we believe

that these non-IFRS financial measures are useful in evaluating our

business, this information should be considered as supplemental in

nature and is not meant as a substitute for the related financial

information prepared and presented in accordance with IFRS. Please

refer to our financial statements at the end of this announcement

for a table reconciling our non-IFRS financial measures to net

income (loss), the most directly comparable IFRS financial

measure.

Safe harbor statement

This press release contains statements of a forward-looking

nature. These statements, including statements relating to the

Company’s future financial and operating results, are made under

the “safe harbor” provisions of the U.S. Private Securities

Litigation Reform Act of 1995. You can identify these

forward-looking statements by terminology such as “will,”

“expects,” “believes,” “anticipates,” “intends,” “estimates” and

similar statements. Among other things, management’s quotations and

the Business outlook section contain forward-looking statements.

These forward-looking statements involve known and unknown risks

and uncertainties and are based on current expectations,

assumptions, estimates and projections about Opera and the

industry. Potential risks and uncertainties include, but are not

limited to, those relating to its goals and strategies; its

expected development and launch, and market acceptance, of its

products and services; its expectations regarding demand for and

market acceptance of our brand, platforms and services; our

expectations regarding growth in our user base and level of

engagement; its ability to attract, retain and monetize users; its

ability to continue to develop new technologies and/or upgrade our

existing technologies and quarterly variations in its operating

results caused by factors beyond its control and global

macroeconomic conditions and its potential impact in the markets it

has businesses. All information provided in this press release is

as of the date hereof, and Opera undertakes no obligation to update

any forward-looking statements to reflect subsequent occurring

events or circumstances, or changes in its expectations, except as

may be required by law. Although Opera believes that the

expectations expressed in these forward-looking statements are

reasonable, it cannot assure you that its expectations will turn

out to be correct, and investors are cautioned that actual results

may differ materially from the anticipated results. Further

information regarding risks and uncertainties faced by Opera is

included in Opera’s filings with the U.S. Securities and Exchange

Commission, including its annual report on Form 20-F.

About Opera

Opera is a leading global internet brand with an engaged and

growing base of over 350 million average monthly active users.

Building on over 20 years of innovation, starting with our browser

products, we are increasingly leveraging our brand as well as our

massive and highly active user base in order to expand our

offerings and our business. Today, we offer users across Europe,

Africa and Asia a range of products and services that include our

PC and mobile browsers as well as our AI-powered news reader Opera

News and our app-based microfinance solutions.

| |

|

OPERA LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF

OPERATIONS |

|

|

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| [US$ thousands, except per

share and ADS amounts] |

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

Revenue |

|

|

42,795 |

|

|

|

93,678 |

|

|

|

122,069 |

|

|

|

205,245 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

|

(3,663 |

) |

|

|

(15,023 |

) |

|

|

(5,741 |

) |

|

|

(32,906 |

) |

| Personnel expenses including

share-based remuneration |

|

|

(9,378 |

) |

|

|

(19,495 |

) |

|

|

(29,844 |

) |

|

|

(46,180 |

) |

| Marketing and distribution

expenses |

|

|

(7,709 |

) |

|

|

(20,029 |

) |

|

|

(22,885 |

) |

|

|

(55,799 |

) |

| Credit loss expense |

|

|

(162 |

) |

|

|

(19,641 |

) |

|

|

167 |

|

|

|

(27,274 |

) |

| Depreciation and

amortization |

|

|

(3,051 |

) |

|

|

(4,511 |

) |

|

|

(9,817 |

) |

|

|

(12,934 |

) |

| Other expenses |

|

|

(6,992 |

) |

|

|

(8,326 |

) |

|

|

(21,862 |

) |

|

|

(22,236 |

) |

| Total operating

expenses |

|

|

(30,954 |

) |

|

|

(87,026 |

) |

|

|

(89,982 |

) |

|

|

(197,329 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit

(loss) |

|

|

11,841 |

|

|

|

6,652 |

|

|

|

32,086 |

|

|

|

7,917 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share of net income (loss) of

associates and joint ventures |

|

|

(1,757 |

) |

|

|

23,295 |

|

|

|

(3,381 |

) |

|

|

26,252 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net finance income

(expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Finance income |

|

|

629 |

|

|

|

611 |

|

|

|

827 |

|

|

|

3,970 |

|

| Finance expense |

|

|

(54 |

) |

|

|

(222 |

) |

|

|

(131 |

) |

|

|

(548 |

) |

| Net foreign exchange gain

(loss) |

|

|

28 |

|

|

|

(539 |

) |

|

|

140 |

|

|

|

(693 |

) |

| Net finance income

(expense) |

|

|

603 |

|

|

|

(151 |

) |

|

|

836 |

|

|

|

2,728 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss)

before income taxes |

|

|

10,687 |

|

|

|

29,797 |

|

|

|

29,541 |

|

|

|

36,897 |

|

| Income tax (expense)

benefit |

|

|

(970 |

) |

|

|

(1,677 |

) |

|

|

(5,794 |

) |

|

|

(974 |

) |

| Net income

(loss) |

|

|

9,717 |

|

|

|

28,120 |

|

|

|

23,747 |

|

|

|

35,923 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss)

attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity holders of the

parent |

|

|

9,717 |

|

|

|

28,120 |

|

|

|

23,747 |

|

|

|

35,923 |

|

| Non-controlling interests |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Total net income

(loss) attributed |

|

|

9,717 |

|

|

|

28,120 |

|

|

|

23,747 |

|

|

|

35,923 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of ordinary shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic, millions(1) |

|

|

209.99 |

|

|

|

221.55 |

|

|

|

196.83 |

|

|

|

220.31 |

|

| Diluted, millions(2) |

|

|

216.82 |

|

|

|

225.89 |

|

|

|

202.92 |

|

|

|

224.83 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per

ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic, US$ |

|

|

0.05 |

|

|

|

0.13 |

|

|

|

0.12 |

|

|

|

0.16 |

|

| Diluted, US$ |

|

|

0.05 |

|

|

|

0.12 |

|

|

|

0.12 |

|

|

|

0.16 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per

ADS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic, US$ |

|

|

0.09 |

|

|

|

0.25 |

|

|

|

0.24 |

|

|

|

0.33 |

|

| Diluted, US$ |

|

|

0.09 |

|

|

|

0.25 |

|

|

|

0.23 |

|

|

|

0.32 |

|

| (1) Assuming 200 million shares in Opera Limited were

outstanding for all periods presented prior to the Initial Public

Offering (IPO), less 9.75 million shares that were surrendered

by two shareholders upon completion of the IPO. As of September 30,

2019, the total number of shares outstanding for Opera Limited

was 235,576,326, equivalent to 117,788,163 ADSs. |

| |

| (2) Includes the net dilutive impact of employee equity awards,

all of which are dilutive. |

| |

|

OPERA LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME (LOSS) |

| |

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| [US$ thousands] |

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

Net income (loss) |

|

|

9,717 |

|

|

|

28,120 |

|

|

|

23,747 |

|

|

|

35,923 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive

income (loss) that may be reclassified to the Statement of

Operations in subsequent periods (net of tax) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exchange differences on

translation of foreign operations |

|

|

(177 |

) |

|

|

(1,982 |

) |

|

|

(1,273 |

) |

|

|

(2,092 |

) |

| Reclassification of exchange

differences on loss of control |

|

|

- |

|

|

|

- |

|

|

|

(138 |

) |

|

|

7 |

|

| Share of other comprehensive

income (loss) of associates and joint ventures |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(41 |

) |

| Net other

comprehensive income (loss) that may be reclassified to the

Statement of Operations in subsequent periods |

|

|

(177 |

) |

|

|

(1,982 |

) |

|

|

(1,411 |

) |

|

|

(2,126 |

) |

| Total comprehensive

income (loss) |

|

|

9,541 |

|

|

|

26,139 |

|

|

|

22,336 |

|

|

|

33,797 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive

income (loss) attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity holders of the

parent |

|

|

9,541 |

|

|

|

26,139 |

|

|

|

22,336 |

|

|

|

33,797 |

|

| Non-controlling interests |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Total comprehensive

income (loss) attributed |

|

|

9,541 |

|

|

|

26,139 |

|

|

|

22,336 |

|

|

|

33,797 |

|

|

OPERA LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL

POSITION |

| |

| |

|

As of December 31, |

|

|

As of September 30, |

|

| [US$ thousands] |

|

2018 |

|

|

2019 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Non-current

assets |

|

|

|

|

|

|

|

|

| Furniture, fixtures and

equipment |

|

|

12,162 |

|

|

|

27,689 |

|

| Intangible assets |

|

|

115,444 |

|

|

|

112,355 |

|

| Goodwill |

|

|

421,578 |

|

|

|

421,578 |

|

| Investments in associates and

joint ventures |

|

|

35,060 |

|

|

|

67,560 |

|

| Non-current financial

assets |

|

|

2,025 |

|

|

|

2,689 |

|

| Deferred tax assets |

|

|

944 |

|

|

|

- |

|

| Total non-current

assets |

|

|

587,213 |

|

|

|

631,870 |

|

| |

|

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

| Trade receivables |

|

|

37,468 |

|

|

|

47,983 |

|

| Loans to customers |

|

|

3,092 |

|

|

|

55,508 |

|

| Other receivables |

|

|

4,031 |

|

|

|

3,931 |

|

| Prepayments |

|

|

14,372 |

|

|

|

26,857 |

|

| Inventories |

|

|

- |

|

|

|

1,932 |

|

| Other current financial

assets |

|

|

89 |

|

|

|

- |

|

| Marketable securities |

|

|

1,165 |

|

|

|

45,253 |

|

| Cash and cash equivalents |

|

|

177,873 |

|

|

|

170,697 |

|

| Total cash, cash equivalents,

and marketable securities |

|

|

179,038 |

|

|

|

215,950 |

|

| Total current

assets |

|

|

238,090 |

|

|

|

352,161 |

|

| TOTAL

ASSETS |

|

|

825,303 |

|

|

|

984,031 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| EQUITY AND

LIABILITIES |

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

|

| Share capital |

|

|

22 |

|

|

|

24 |

|

| Other paid in capital |

|

|

738,690 |

|

|

|

803,896 |

|

| Retained earnings |

|

|

36,432 |

|

|

|

76,044 |

|

| Foreign currency translation

reserve |

|

|

316 |

|

|

|

(1,810 |

) |

| Equity attributed to

equity holders of the parent |

|

|

775,460 |

|

|

|

878,154 |

|

| Non-controlling interests |

|

|

- |

|

|

|

- |

|

| Total

equity |

|

|

775,460 |

|

|

|

878,154 |

|

| |

|

|

|

|

|

|

|

|

| Non-current

liabilities |

|

|

|

|

|

|

|

|

| Non-current lease liabilities

and other loans |

|

|

2,271 |

|

|

|

9,750 |

|

| Deferred tax liabilities |

|

|

13,358 |

|

|

|

13,654 |

|

| Other non-current

liabilities |

|

|

212 |

|

|

|

130 |

|

| Total non-current

liabilities |

|

|

15,841 |

|

|

|

23,534 |

|

| |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

| Trade and other payables |

|

|

17,957 |

|

|

|

41,542 |

|

| Current lease liabilities and

other loans |

|

|

2,490 |

|

|

|

26,471 |

|

| Income tax payable |

|

|

1,920 |

|

|

|

1,700 |

|

| Deferred revenue |

|

|

1,932 |

|

|

|

1,159 |

|

| Other current liabilities |

|

|

9,701 |

|

|

|

11,471 |

|

| Total current

liabilities |

|

|

34,002 |

|

|

|

82,343 |

|

| |

|

|

|

|

|

|

|

|

| Total

liabilities |

|

|

49,843 |

|

|

|

105,877 |

|

| TOTAL EQUITY AND

LIABILITIES |

|

|

825,303 |

|

|

|

984,031 |

|

| |

|

OPERA LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY |

| |

| [US$ thousands] |

|

Share capital (1) |

|

|

Other paid incapital

(1) |

|

|

Retainedearnings |

|

|

Foreigncurrencytranslationreserve |

|

|

Total equity |

|

|

As of December 31, 2017, as previously

reported |

|

|

19 |

|

|

|

576,512 |

|

|

|

5,366 |

|

|

|

1,605 |

|

|

|

583,503 |

|

| Impact of new accounting

standards |

|

|

- |

|

|

|

- |

|

|

|

(629 |

) |

|

|

- |

|

|

|

(629 |

) |

| As of January 1, 2018,

restated |

|

|

19 |

|

|

|

576,512 |

|

|

|

4,737 |

|

|

|

1,605 |

|

|

|

582,874 |

|

| Net income (loss) |

|

|

- |

|

|

|

- |

|

|

|

23,747 |

|

|

|

- |

|

|

|

23,747 |

|

| Other comprehensive income

(loss) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,411 |

) |

|

|

(1,411 |

) |

| Total comprehensive

income (loss) |

|

|

- |

|

|

|

- |

|

|

|

23,747 |

|

|

|

(1,411 |

) |

|

|

22,336 |

|

| Contribution of equity, net of

transaction costs |

|

|

3 |

|

|

|

167,153 |

|

|

|

- |

|

|

|

- |

|

|

|

167,156 |

|

| Share-based remuneration

expense |

|

|

- |

|

|

|

- |

|

|

|

4,638 |

|

|

|

- |

|

|

|

4,638 |

|

| As of September 30,

2018 |

|

|

22 |

|

|

|

743,665 |

|

|

|

33,122 |

|

|

|

194 |

|

|

|

777,003 |

|

| [US$ thousands] |

|

Share capital (1) |

|

|

Other paid incapital

(1) |

|

|

Retainedearnings |

|

|

Foreigncurrencytranslationreserve |

|

|

Total equity |

|

|

As of December 31, 2018 |

|

|

22 |

|

|

|

738,690 |

|

|

|

36,432 |

|

|

|

316 |

|

|

|

775,460 |

|

| Impact of implementing IFRS 16

Leases |

|

|

- |

|

|

|

- |

|

|

|

64 |

|

|

|

- |

|

|

|

64 |

|

| As of January 1, 2019,

restated |

|

|

22 |

|

|

|

738,690 |

|

|

|

36,496 |

|

|

|

316 |

|

|

|

775,524 |

|

| Net income (loss) |

|

|

- |

|

|

|

- |

|

|

|

35,923 |

|

|

|

- |

|

|

|

35,923 |

|

| Other comprehensive income

(loss) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(2,126 |

) |

|

|

(2,126 |

) |

| Total comprehensive

income (loss) |

|

|

- |

|

|

|

- |

|

|

|

35,923 |

|

|

|

(2,126 |

) |

|

|

33,797 |

|

| Contribution of equity, net of

transaction costs |

|

|

2 |

|

|

|

70,986 |

|

|

|

- |

|

|

|

- |

|

|

|

70,988 |

|

| Acquisition of treasury

shares |

|

|

- |

|

|

|

(5,780 |

) |

|

|

- |

|

|

|

- |

|

|

|

(5,780 |

) |

| Share-based remuneration

expense |

|

|

- |

|

|

|

- |

|

|

|

3,624 |

|

|

|

- |

|

|

|

3,624 |

|

| As of September 30,

2019 |

|

|

24 |

|

|

|

803,896 |

|

|

|

76,044 |

|

|

|

(1,810 |

) |

|

|

878,154 |

|

| (1) The amounts of share

capital and other paid in capital have been amended by

reclassifying amounts between the two equity components. |

| |

|

OPERA LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH

FLOWS |

| |

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| [US$ thousands] |

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash flow from (used in)

operating activities |

|

|

6,820 |

|

|

|

(17,539 |

) |

|

|

21,713 |

|

|

|

(24,460 |

) |

| Net cash flow from (used in)

investing activities |

|

|

(2,426 |

) |

|

|

(35,311 |

) |

|

|

(3,713 |

) |

|

|

(62,794 |

) |

| Net cash flow from (used in)

financing activities |

|

|

169,463 |

|

|

|

90,206 |

|

|

|

167,117 |

|

|

|

81,041 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net change in cash and

cash equivalents |

|

|

173,857 |

|

|

|

37,356 |

|

|

|

185,118 |

|

|

|

(6,213 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at

beginning of period |

|

|

43,993 |

|

|

|

134,155 |

|

|

|

33,207 |

|

|

|

177,873 |

|

| Net foreign exchange

difference |

|

|

(209 |

) |

|

|

(813 |

) |

|

|

(682 |

) |

|

|

(962 |

) |

| Cash and cash

equivalents at end of period |

|

|

217,642 |

|

|

|

170,697 |

|

|

|

217,642 |

|

|

|

170,697 |

|

| |

| Financial

details by business area |

| |

| The tables below

specify the contribution by each business area: |

| |

| [US$ thousands] |

|

Three months ended September 30, 2018 |

|

|

Business area |

|

Browser and News |

|

|

Fintech |

|

|

Retail |

|

|

Other |

|

|

Total |

|

|

Revenue categories |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Search |

|

|

19,130 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

19,130 |

|

| Advertising |

|

|

15,679 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

15,679 |

|

| Origination fees and

interest |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Airtime and handsets |

|

|

- |

|

|

|

- |

|

|

|

2,871 |

|

|

|

- |

|

|

|

2,871 |

|

| Technology licensing and other

revenue |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,116 |

|

|

|

5,116 |

|

| Total

revenue |

|

|

34,809 |

|

|

|

- |

|

|

|

2,871 |

|

|

|

5,116 |

|

|

|

42,795 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

|

(672 |

) |

|

|

- |

|

|

|

(2,991 |

) |

|

|

- |

|

|

|

(3,663 |

) |

| Marketing and distribution

expenses |

|

|

(7,709 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(7,709 |

) |

| Credit loss expense |

|

|

(162 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(162 |

) |

| Direct

expenses |

|

|

(8,543 |

) |

|

|

- |

|

|

|

(2,991 |

) |

|

|

- |

|

|

|

(11,534 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contribution by

business area |

|

|

26,266 |

|

|

|

- |

|

|

|

(120 |

) |

|

|

5,116 |

|

|

|

31,262 |

|

| [US$ thousands] |

|

Three months ended September 30, 2019 |

|

|

Business area |

|

Browser and News |

|

|

Fintech |

|

|

Retail |

|

|

Other |

|

|

Total |

|

|

Revenue categories |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Search |

|

|

21,527 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

21,527 |

|

| Advertising |

|

|

18,349 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

18,349 |

|

| Origination fees and

interest |

|

|

- |

|

|

|

39,858 |

|

|

|

- |

|

|

|

- |

|

|

|

39,858 |

|

| Airtime and handsets |

|

|

- |

|

|

|

- |

|

|

|

6,006 |

|

|

|

- |

|

|

|

6,006 |

|

| Technology licensing and other

revenue |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

7,937 |

|

|

|

7,937 |

|

| Total

revenue |

|

|

39,876 |

|

|

|

39,858 |

|

|

|

6,006 |

|

|

|

7,937 |

|

|

|

93,678 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

|

(207 |

) |

|

|

(8,797 |

) |

|

|

(6,019 |

) |

|

|

- |

|

|

|

(15,023 |

) |

| Marketing and distribution

expenses |

|

|

(16,831 |

) |

|

|

(3,198 |

) |

|

|

- |

|

|

|

- |

|

|

|

(20,029 |

) |

| Credit loss expense |

|

|

345 |

|

|

|

(19,986 |

) |

|

|

- |

|

|

|

- |

|

|

|

(19,641 |

) |

| Direct

expenses |

|

|

(16,693 |

) |

|

|

(31,981 |

) |

|

|

(6,019 |

) |

|

|

- |

|

|

|

(54,693 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contribution by

business area |

|

|

23,183 |

|

|

|

7,877 |

|

|

|

(13 |

) |

|

|

7,937 |

|

|

|

38,985 |

|

| [US$ thousands] |

|

Nine months ended September 30, 2018 |

|

|

Business area |

|

Browser and News |

|

|

Fintech |

|

|

Retail |

|

|

Other |

|

|

Total |

|

|

Revenue categories |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Search |

|

|

59,115 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

59,115 |

|

| Advertising |

|

|

42,312 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

42,312 |

|

| Origination fees and

interest |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Airtime and handsets |

|

|

- |

|

|

|

- |

|

|

|

2,871 |

|

|

|

- |

|

|

|

2,871 |

|

| Technology licensing and other

revenue |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

17,771 |

|

|

|

17,771 |

|

| Total

revenue |

|

|

101,427 |

|

|

|

- |

|

|

|

2,871 |

|

|

|

17,771 |

|

|

|

122,069 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

|

(2,750 |

) |

|

|

- |

|

|

|

(2,991 |

) |

|

|

- |

|

|

|

(5,741 |

) |

| Marketing and distribution

expenses |

|

|

(22,885 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(22,885 |

) |

| Credit loss expense |

|

|

167 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

167 |

|

| Direct

expenses |

|

|

(25,468 |

) |

|

|

- |

|

|

|

(2,991 |

) |

|

|

- |

|

|

|

(28,459 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contribution by

business area |

|

|

75,959 |

|

|

|

- |

|

|

|

(120 |

) |

|

|

17,771 |

|

|

|

93,610 |

|

| [US$ thousands] |

|

Nine months ended September 30, 2019 |

|

|

Business area |

|

Browser and News |

|

|

Fintech |

|

|

Retail |

|

|

Other |

|

|

Total |

|

|

Revenue categories |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Search |

|

|

63,514 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

63,514 |

|

| Advertising |

|

|

48,649 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

48,649 |

|

| Origination fees and

interest |

|

|

- |

|

|

|

56,466 |

|

|

|

- |

|

|

|

- |

|

|

|

56,466 |

|

| Airtime and handsets |

|

|

- |

|

|

|

- |

|

|

|

20,471 |

|

|

|

- |

|

|

|

20,471 |

|

| Technology licensing and other

revenue |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

16,145 |

|

|

|

16,145 |

|

| Total

revenue |

|

|

112,163 |

|

|

|

56,466 |

|

|

|

20,471 |

|

|

|

16,145 |

|

|

|

205,245 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

|

(1,420 |

) |

|

|

(11,058 |

) |

|

|

(20,428 |

) |

|

|

- |

|

|

|

(32,906 |

) |

| Marketing and distribution

expenses |

|

|

(51,730 |

) |

|

|

(4,069 |

) |

|

|

|

|

|

|

- |

|

|

|

(55,799 |

) |

| Credit loss expense |

|

|

(200 |

) |

|

|

(27,074 |

) |

|

|

- |

|

|

|

- |

|

|

|

(27,274 |

) |

| Direct

expenses |

|

|

(53,350 |

) |

|

|

(42,201 |

) |

|

|

(20,428 |

) |

|

|

- |

|

|

|

(115,979 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contribution by

business area |

|

|

58,813 |

|

|

|

14,265 |

|

|

|

43 |

|

|

|

16,145 |

|

|

|

89,266 |

|

| Personnel

expenses including share-based remuneration |

| The table below

specifies the amounts of personnel expenses including share-based

remuneration: |

| |

| [US$ thousands] |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

Personnel expenses including share-based

remuneration |

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

Personnel expenses excluding share-based remuneration |

|

|

8,617 |

|

|

|

18,012 |

|

|

|

26,416 |

|

|

|

41,726 |

|

| Share-based remuneration,

including related social security costs |

|

|

761 |

|

|

|

1,483 |

|

|

|

3,427 |

|

|

|

4,454 |

|

| Total |

|

|

9,378 |

|

|

|

19,495 |

|

|

|

29,844 |

|

|

|

46,180 |

|

| Other

expenses |

| |

| The table below

specifies the nature of other expenses: |

| |

| [US$ thousands] |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

Other expenses |

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

Hosting |

|

|

2,470 |

|

|

|

1,879 |

|

|

|

7,649 |

|

|

|

5,278 |

|

| Audit, legal and other

advisory services |

|

|

1,865 |

|

|

|

2,122 |

|

|

|

6,743 |

|

|

|

6,093 |

|

| Software license fees |

|

|

356 |

|

|

|

494 |

|

|

|

1,248 |

|

|

|

1,789 |

|

| Rent and other office

expense |

|

|

1,032 |

|

|

|

1,553 |

|

|

|

3,368 |

|

|

|

3,917 |

|

| Travel |

|

|

540 |

|

|

|

1,017 |

|

|

|

1,570 |

|

|

|

2,401 |

|

| Other |

|

|

729 |

|

|

|

1,262 |

|

|

|

1,284 |

|

|

|

2,757 |

|

| Total |

|

|

6,992 |

|

|

|

8,326 |

|

|

|

21,862 |

|

|

|

22,236 |

|

| |

| Non-IFRS

financial measures |

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| [US$ thousands, except per

share and ADS amounts] |

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

Reconciliation of net income (loss) to adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) |

|

|

9,717 |

|

|

|

28,120 |

|

|

|

23,747 |

|

|

|

35,923 |

|

| Add: Income tax expense

(benefit) |

|

|

970 |

|

|

|

1,677 |

|

|

|

5,794 |

|

|

|

974 |

|

| Add: Net finance expense

(income) |

|

|

(603 |

) |

|

|

151 |

|

|

|

(836 |

) |

|

|

(2,728 |

) |

| Add: Share of net loss

(income) of associates and joint ventures |

|

|

1,757 |

|

|

|

(23,295 |

) |

|

|

3,381 |

|

|

|

(26,252 |

) |

| Add: Depreciation and

amortization |

|

|

3,051 |

|

|

|

4,511 |

|

|

|

9,817 |

|

|

|

12,934 |

|

| Add: Share-based

remuneration |

|

|

761 |

|

|

|

1,483 |

|

|

|

3,427 |

|

|

|

4,454 |

|

| Add: Expensed IPO related

costs |

|

|

843 |

|

|

|

- |

|

|

|

2,952 |

|

|

|

- |

|

| Adjusted

EBITDA |

|

|

16,495 |

|

|

|

12,647 |

|

|

|

48,283 |

|

|

|

25,305 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of net income

(loss) to adjusted net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income

(loss) |

|

|

9,717 |

|

|

|

28,120 |

|

|

|

23,747 |

|

|

|

35,923 |

|

| Add: Share-based

remuneration |

|

|

761 |

|

|

|

1,483 |

|

|

|

3,427 |

|

|

|

4,454 |

|

| Add: Amortization of acquired

intangible assets |

|

|

1,280 |

|

|

|

1,280 |

|

|

|

3,840 |

|

|

|

3,840 |

|

| Add: Expensed IPO related

costs |

|

|

843 |

|

|

|

- |

|

|

|

2,952 |

|

|

|

- |

|

| Income tax adjustment (1) |

|

|

(106 |

) |

|

|

(305 |

) |

|

|

(816 |

) |

|

|

(1,029 |

) |

| Adjusted net

income |

|

|

12,494 |

|

|

|

30,578 |

|

|

|

33,151 |

|

|

|

43,188 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of ordinary shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic, millions |

|

|

209.99 |

|

|

|

221.55 |

|

|

|

196.83 |

|

|

|

220.31 |

|

| Diluted, millions |

|

|

216.82 |

|

|

|

225.89 |

|

|

|

202.92 |

|

|

|

224.83 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income

(loss) per ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic, US$ |

|

|

0.06 |

|

|

|

0.14 |

|

|

|

0.17 |

|

|

|

0.20 |

|

| Diluted, US$ |

|

|

0.06 |

|

|

|

0.14 |

|

|

|

0.16 |

|

|

|

0.19 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income

(loss) per ADS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic, US$ |

|

|

0.11 |

|

|

|

0.28 |

|

|

|

0.34 |

|

|

|

0.39 |

|

| Diluted, US$ |

|

|

0.11 |

|

|

|

0.27 |

|

|

|

0.33 |

|

|

|

0.38 |

|

| (1) Reversal of tax benefit

related to the social security cost component of share-based

remuneration, deferred taxes on the amortization of acquired

intangible assets, and expensed IPO-related costs. |

Investor Relations Contact:

Derrick Nueman

investor-relations@opera.com or (408) 596-3055

For media enquiries, please contact: press-team@opera.com

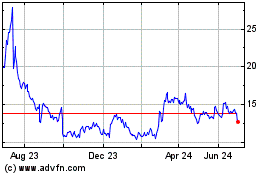

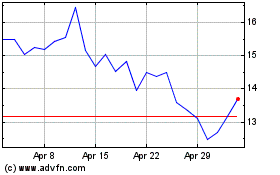

Opera (NASDAQ:OPRA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Opera (NASDAQ:OPRA)

Historical Stock Chart

From Apr 2023 to Apr 2024