-- Omeros receives $125 million in gross

proceeds in sale of a portion of projected royalties receivable on

net sales of OMIDRIA –

Omeros Corporation (Nasdaq: OMER) today announced that Omeros

has sold to DRI Healthcare Acquisitions LP (“DRI”), a wholly owned

subsidiary of DRI Healthcare Trust, an interest in certain royalty

payments based on net sales of OMIDRIA (the “Purchased

Receivables”). The royalties payable to DRI comprise a portion of

the royalties projected to be paid under the terms of the Asset

Purchase Agreement (the “Asset Purchase Agreement”), among Omeros,

Rayner Surgical Inc. (“Rayner Surgical”) and Rayner Surgical Group

Limited, pursuant to which Omeros sold OMIDRIA and related business

assets to Rayner Surgical in December 2021.

Omeros received gross proceeds from DRI of $125 million upon

closing of the sale of the Purchased Receivables, which was

completed pursuant to a Royalty Purchase Agreement between Omeros

and DRI, dated September 30, 2022 (the “Royalty Purchase

Agreement”).

Under the Royalty Purchase Agreement, DRI is entitled to

royalties on net sales of OMIDRIA received between September 1,

2022 and December 31, 2030, subject to annual caps. Based on the

payment schedule and associated caps, not until July 2028 will DRI

have been paid an aggregate of $125 million, the amount that Omeros

has received from DRI. Specifically, the caps are set at $1.67

million for the remainder of 2022, $13 million for calendar year

2023, $20 million for calendar year 2024, $25 million for calendar

years 2025 through 2028, $26.25 million for calendar year 2029 and

$27.50 million for calendar year 2030. The total payments to DRI

throughout the term of the agreement are $188.4 million and

represent no more than one-third of future royalty payments

projected to be paid by Rayner to Omeros through 2030.

DRI is not entitled to carry-forward nor recoup any shortfall if

the royalties paid by Rayner for an annual period are less than the

cap amount applicable to such period. Omeros will retain all

royalties received during a given annual period in excess of the

respective cap. DRI has no recourse to Omeros’ assets other than

the Purchased Receivables and is entitled to payment for the

Purchased Receivables only to the extent of royalty payments

actually received, up to the previously described annual caps.

Given that this is a partial sale of OMIDRIA royalties, there are

no asset pledges or financial covenants.

Royalty payments, as received from Rayner, will be allocated

between Omeros and DRI each month based on the amount to which DRI

is entitled. Monthly caps are determined by dividing the annual cap

amount by 12 or, in the case of the partial calendar year 2022, by

four.

“We are pleased to have partnered with DRI to monetize a portion

of our OMIDRIA royalty stream,” said Gregory A. Demopulos, M.D.,

chairman and chief executive officer of Omeros. “The transaction

provides Omeros with a substantial capital infusion that is

repayable over the next eight and a half years solely from future

OMIDRIA royalties, retains the majority of our expected OMIDRIA

revenues, and does not dilute our stockholders.”

The Purchased Receivables do not include, and DRI is not

entitled to, any portion of the $200 million commercial milestone

payment payable to Omeros under the Asset Purchase Agreement if,

before January 1, 2025, separate payment for OMIDRIA under Medicare

Part B is secured for a continuous period of at least four

years.

OMIDRIA has been granted separate payment in ambulatory surgery

centers by the Centers for Medicare and Medicaid Services (CMS)

under CMS’ non-opioid alternative pain management exclusion from

packaged payment. The most recently reported quarterly net revenues

for OMIDRIA were $34.5 million for the quarter ended June 30, 2022,

on which Omeros earned a 50-percent royalty, or $17.2 million, from

Rayner.

About Omeros Corporation

Omeros is an innovative biopharmaceutical company committed to

discovering, developing and commercializing small-molecule and

protein therapeutics for large-market and orphan indications

targeting immunologic disorders including complement-mediated

diseases, cancers, and addictive and compulsive disorders. Omeros’

lead MASP-2 inhibitor narsoplimab targets the lectin pathway of

complement and is the subject of a biologics license application

(BLA) pending before FDA for the treatment of hematopoietic stem

cell transplant-associated thrombotic microangiopathy (HSCT-TMA).

Narsoplimab is also in multiple late-stage clinical development

programs focused on other complement-mediated disorders, including

IgA nephropathy, COVID-19, and atypical hemolytic uremic syndrome.

Omeros’ long-acting MASP-2 inhibitor OMS1029 is currently in a

Phase 1 clinical trial. OMS906, Omeros’ inhibitor of MASP-3, the

key activator of the alternative pathway of complement, is

advancing in clinical programs for paroxysmal nocturnal

hemoglobinuria (PNH), complement 3 (C3) glomerulopathy and one or

more related indications. For more information about Omeros and its

programs, visit www.omeros.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, which are

subject to the “safe harbor” created by those sections for such

statements. All statements other than statements of historical fact

are forward-looking statements, which are often indicated by terms

such as “anticipate,” “believe,” “could,” “estimate,” “expect,”

“goal,” “intend,” “likely,” “look forward to,” “may,” “objective,”

“plan,” “potential,” “predict,” “project,” “should,” “slate,”

“target,” “will,” “would” and similar expressions and variations

thereof. Forward-looking statements, including projections of

future royalties payable based on net sales of OMIDRIA, are based

on management’s beliefs and assumptions and on information

available to management only as of the date of this press release.

Omeros’ actual results could differ materially from those

anticipated in these forward-looking statements for many reasons,

including, without limitation, risks associated with product

commercialization and commercial operations, regulatory processes

and oversight, payment and reimbursement policies applicable to

OMIDRIA and the risks, uncertainties and other factors described

under the heading “Risk Factors” in the company’s Annual Report on

Form 10-K filed with the Securities and Exchange Commission (SEC)

on March 1, 2022. Given these risks, uncertainties and other

factors, you should not place undue reliance on these

forward-looking statements, and the company assumes no obligation

to update these forward-looking statements, whether as a result of

new information, future events or otherwise, except as required by

applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221003005401/en/

Jennifer Cook Williams Cook Williams Communications, Inc.

Investor and Media Relations IR@omeros.com

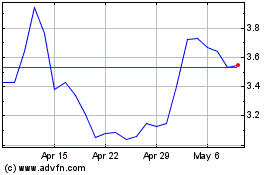

Omeros (NASDAQ:OMER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Omeros (NASDAQ:OMER)

Historical Stock Chart

From Apr 2023 to Apr 2024