true

0000836147

0000836147

2023-01-01

2023-12-31

0000836147

2023-06-30

0000836147

2024-03-28

iso4217:USD

xbrli:shares

--12-31FY2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

| |

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

|

For the fiscal year ended December 31, 2023

|

or

| |

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

|

For the transition period from ___________ to ___________ .

|

Commission file number 001-36613

|

Middlefield Banc Corp.

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

Ohio

|

|

34-1585111

|

|

State or Other Jurisdiction of

|

|

I.R.S. Employer Identification No.

|

|

Incorporation or Organization

|

|

|

| |

|

|

|

15985 East High Street, Middlefield, Ohio

|

|

44062-0035

|

|

Address of Principal Executive Offices

|

|

Zip Code

|

| |

440-632-1666

|

|

|

Registrant’s Telephone Number, Including Area Code

|

Securities Registered Pursuant To Section 12(b) Of The Act:

|

Title of Each Class

|

|

MBCN

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, Without Par Value

|

|

Trading Symbol

|

|

The NASDAQ Stock Market, LLC

(NASDAQ Capital Market)

|

|

Securities registered pursuant to Section 12(g) of the Act: None

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ☐

|

Accelerated filer ☐

|

| |

Non-accelerated filer ☒

|

Smaller reporting company ☒

|

| |

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value on June 30, 2023 of common stock held by non-affiliates of the registrant was approximately $215.2 million, based on the closing price of $27.51 per share of common stock as reported on the NASDAQ Capital Market.

As of March 28, 2024, there were 8,069,144 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

EXPLANATORY NOTE

Middlefield Banc Corp (“Company”) is filing this Amendment No. 1 to its Annual Report on Form 10-K (“Form 10-K/A") for the fiscal year ended December 31, 2023, originally filed with the Securities and Exchange Commission (“SEC") on March 28, 2024 (“Original Filing”).

This Form 10-K/A is being filed to correct the Report of Independent Registered Public Accounting Firm of S. R. Snodgrass, P.C. included in the Original Filing due to an inadvertent administrative error. This Amendment does not alter in any way S. R. Snodgrass, P.C.’s opinion on the Company’s financial statements. This Form 10-K/A is also being filed to reflect correct dates in Management’s Annual Report on Internal Control Over Financial Reporting and amend wording in Item 9A(b).

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended, certifications by the Company’s principal executive officer and principal financial officer are filed as exhibits to this Form 10-K/A under Item 15 of Part IV. Additionally, this Form 10-K/A does not include the certifications under Section 906 of the Sarbanes-Oxley Act of 2002, as no financial statements are being filed with this Form 10-K/A.

Except as described above, this Form 10-K/A does not amend, modify, or otherwise update any other information in the Original Filing. We have not updated or amended the disclosures contained in the Original Filing to reflect events that have occurred since the Original Filing. Accordingly, this Form 10-K/A should be read in conjunction with our Original Filing.

PART II

Item 8. Financial Statements and Supplementary Data

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders and the Board of Directors of Middlefield Banc Corp.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Middlefield Banc Corp. and subsidiaries (the “Company”) as of December 31, 2023 and 2022; the related consolidated statements of income, comprehensive income (loss), changes in stockholders’ equity, and cash flows for the years then ended; and the related notes to the consolidated financial statements (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2023 and 2022, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Change in Accounting Principle

As discussed in Note 1 to the financial statements, the Company changed its method of accounting for credit losses effective January 1, 2023, due to the adoption of Accounting Standards Codification (ASC) Topic 326, Financial Instruments – Credit Losses.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent, with respect to the Company, in accordance with U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the Audit Committee and that: (1) relate to accounts or disclosures that are material to the financial statements; and (2) involve our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter, in any way, our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

Allowance for Credit Losses on Loans (ACL)

Description of the Matter

The Company’s loan portfolio totaled $1.5 billion as of December 31, 2023, and the associated allowance for credit losses on loans was $21.7 million. As discussed in Notes 1 and 6 to the consolidated financial statements, the allowance for credit losses (ACL) related to loans is a contra-asset valuation account, calculated in accordance with ASC 326, that is deducted from the amortized cost basis of loans to present the net amount expected to be collected. The amount of the ACL represents management’s best estimate of current expected credit losses on these financial instruments considering all relevant available information, from internal and external sources, relevant to assessing exposure to credit loss over the contractual term of the instruments.

The Company’s methodology for estimating the allowance for credit losses on loans includes quantitative and qualitative components of the calculation. For pooled loans, the Company utilizes a discounted cash flow (“DCF”) methodology to estimate credit losses over the expected life of loan. The DCF methodology combines probability of default, the loss given default, and prepayment speed assumptions to estimate a reserve for each loan. The quantitative loss rates are adjusted by current and forecasted macroeconomic assumptions and return to the mean after the forecasted periods. The sum of all the loan level reserves are aggregated for each portfolio segment and a loss factor is derived. These quantitative loss factors are also supplemented by certain qualitative risk factors reflecting management’s view of how losses may vary from those represented by quantitative loss rates. Qualitative loss factors are applied to each portfolio segment with the amounts determined by correlation of credit stress to the maximum loss factor. Changes in these assumptions could have a material effect on the Company’s financial results.

We identified auditing ACL on pooled loans as a critical audit matter because the methodology to determine the estimate of credit losses significantly changed upon adoption of ASC 326, including the application of new accounting policies, the use of subjective judgments for both the quantitative and qualitative calculations and overall changes made to the loss estimation models. Performing audit procedures to evaluate the implementation and subsequent application of ASC 326 for loans involved a high degree of auditor judgment and required significant effort.

How We Addressed the Matter in Our Audit

The primary procedures we performed related to this critical audit matter (CAM) included:

● Testing the design, implementation, and operating effectiveness of internal controls over the adoption and calculation of the allowance for credit losses, including the qualitative factor adjustments.

● Evaluated the reasonableness of selected loss drivers utilized and loss driver forecasts for loan pools

● Testing the completeness and accuracy of the significant data points that management uses in their evaluation of the qualitative adjustments.

● Testing the anchoring calculation that management completes to properly align the magnitude of the adjustments with the Company’s historical loss data.

● Evaluating the directional consistency and reasonableness of management’s conclusions regarding basis points applied (whether positive or negative) based on the trends identified in the underlying data.

● Testing the mathematical accuracy of the application of the qualitative adjustments to the loan segments within the ACL calculation.

Measurement Period Adjustment – Loan Valuation

Description of the Matter

During 2022, the Company completed the acquisition of Liberty Bancshares, Inc, as disclosed in Note 21 to the consolidated financial statements. The transaction was accounted for by applying the acquisition method. Subsequent to December 31, 2022, the Company utilized the measurement period to post an adjustment of $4.6 million to goodwill for updated information regarding the fair value of loans acquired.

Auditing the Company’s accounting for the acquisition of Liberty Bancshares, Inc. was complex due to the significant estimation required by management to determine the fair value of the loans acquired of $307 million. The Company determined the fair value of the acquired loans by estimating the principal and interest cash flows expected to be collected on the loans and discounting those cash flows at a market rate of interest. The significant estimation was primarily due to the judgment involved in determining the discount rate used to discount the expected cash flows for acquired loans to establish the acquisition-date fair value of the loans.

How We Addressed the Matter in Our Audit

We obtained an understanding, evaluated the design, and tested the operating effectiveness of controls over the Company’s accounting for the measurement period adjustment. Our tests included testing controls over the completeness and accuracy of the data and the estimation process supporting the fair value of loans acquired. We also tested management’s discount rate used in the valuation model.

To test the estimated fair value of the loans acquired, we performed audit procedures that included, among others, evaluating the Company’s valuation methodology, evaluating the discount rate used by the Company’s valuation specialist, and evaluating the completeness and accuracy of the underlying data.

We have served as the Company’s auditor since 1986.

/s/S. R. Snodgrass, P.C

Cranberry Township, Pennsylvania

PCAOB: 00074

March 28, 2024

MANAGEMENT’S ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act. The Company’s internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

A material weakness is a significant deficiency (as defined in Public Company Accounting Oversight Board Auditing Standard No. 5), or a combination of significant deficiencies, that results in there being more than a remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis by management or employees in the normal course by management or employees in the normal course of performing their assigned functions.

Management assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2023. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control-Integrated Framework (2013). Based on this assessment, management believes that, as of December 31, 2023, the Company’s internal control over financial reporting was effective.

This annual report does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm because section 989G of the Dodd Frank Act exempts smaller reporting companies from the requirement of an attestation by registered public accountants concerning internal controls over financial reporting.

/s/ Ronald L. Zimmerly

By: Ronald L. Zimmerly

Chief Executive Officer

(Principal Executive Officer)

Date: March 28, 2024

/s/ Michael C. Ranttila

By: Michael C. Ranttila

Executive Vice President, Chief Financial Officer

(Principal Financial & Accounting Officer)

Date: March 28, 2024

Item 9A – Controls and Procedures

| |

(a) |

Disclosure Controls and Procedures

|

| |

|

The Company’s management, including the Company’s principal executive officer and principal financial officer, has evaluated the effectiveness of the Company’s “disclosure controls and procedures,” as such term is defined in Rule 13a-15(e) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Based upon their evaluation, the principal executive officer and principal financial officer concluded that, as of the end of the period covered by this report, the Company’s disclosure controls and procedures were effective in ensuring that the information required to be disclosed in the reports that the Company files or submits under the Exchange Act with the SEC (1) is recorded, processed, summarized and reported within the periods specified in the SEC’s rules and forms, and (2) is accumulated and communicated to the Company’s management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure.

|

| |

(b) |

Internal Controls Over Financial Reporting

|

| |

|

Management’s annual report on internal control over financial reporting is incorporated herein by reference to Item 8 - the Company’s audited Consolidated Financial Statements in this Annual Report on Form 10-K.

|

| |

(c)

|

Changes to Internal Control Over Financial Reporting

|

| |

|

There were no changes in the Company’s internal control over financial reporting during the period ended December 31, 2023, that have materially affected or are reasonably likely to materially affect the Company’s internal control over financial reporting.

|

PART IV

Item 15. Exhibits, Financial Statement Schedules

The following is a list of exhibits filed as part of this Form 10-K/A.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

MIDDEFIELD BANC CORP

By: /s/ Ronald L. Zimmerly, Jr.

Ronald L. Zimmerly, Jr.

Chief Executive Officer

Date: December 23, 2024

Exhibit 23

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in Registration Statements File No. 333-213607 and 333-219313 on Form S-3; File No. 333-218859 on Form S-8; and File No. 333-183497 on Form S-3D and Form S-3DPOS, effective September 13, 2012, of Middlefield Banc Corp. of our report dated March 28, 2024, relating to our audit of the consolidated financial statements, which appears in the Annual Report to Stockholders, which is incorporated in this Annual Report on Form 10-K of Middlefield Banc Corp. for the year ended December 31, 2023.

/s/S. R. Snodgrass, P.C.

Cranberry Township, Pennsylvania

December 23, 2024

Exhibit 31.1

Certification of Principal Executive Officer

I, Ronald L. Zimmerly, certify that:

|

1.

|

I have reviewed this annual report on Form 10-K/A of Middlefield Banc Corp.;

|

|

2.

|

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

|

|

3.

|

[Paragraph intentionally omitted];

|

|

4.

|

The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

|

|

|

(a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

|

|

|

(b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

|

|

|

(c) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

|

|

|

(d) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

|

|

5.

|

The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s Board of Directors (or persons performing the equivalent functions):

|

|

|

(a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

|

|

|

(b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

|

|

Date: December 23, 2024

|

/s/ Ronald L. Zimmerly

|

| |

|

| |

Ronald L. Zimmerly |

| |

Chief Executive Officer

|

Exhibit 31.2

Certification of Principal Financial and Accounting Officer

I, Michael C. Ranttila, certify that:

|

1.

|

I have reviewed this annual report on Form 10-K/A of Middlefield Banc Corp.;

|

|

2.

|

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

|

|

3.

|

[Paragraph intentionally omitted];

|

|

4.

|

The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

|

|

|

(a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

|

|

|

(b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

|

|

|

(c) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

|

|

|

(d) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

|

|

5.

|

The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s Board of Directors (or persons performing the equivalent functions):

|

|

|

(a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

|

|

|

(b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

|

|

Date: December 23, 2024

|

/s/ Michael C. Ranttila

|

| |

|

| |

Michael C. Ranttila |

| |

Principal Financial and Accounting Officer

|

v3.24.4

Document And Entity Information - USD ($)

$ in Millions |

12 Months Ended |

|

|

Dec. 31, 2023 |

Mar. 28, 2024 |

Jun. 30, 2023 |

| Document Information [Line Items] |

|

|

|

| Entity, Registrant Name |

Middlefield Banc Corp.

|

|

|

| Current Fiscal Year End Date |

--12-31

|

|

|

| Document, Fiscal Period Focus |

FY

|

|

|

| Document, Fiscal Year Focus |

2023

|

|

|

| Document, Type |

10-K/A

|

|

|

| Document, Annual Report |

true

|

|

|

| Document, Period End Date |

Dec. 31, 2023

|

|

|

| Document, Transition Report |

false

|

|

|

| Entity, File Number |

001-36613

|

|

|

| Entity, Incorporation, State or Country Code |

OH

|

|

|

| Entity, Tax Identification Number |

34-1585111

|

|

|

| Entity, Address, Address Line One |

15985 East High Street

|

|

|

| Entity, Address, City or Town |

Middlefield

|

|

|

| Entity, Address, State or Province |

OH

|

|

|

| Entity, Address, Postal Zip Code |

44062-0035

|

|

|

| City Area Code |

440

|

|

|

| Local Phone Number |

632-1666

|

|

|

| Trading Symbol |

MBCN

|

|

|

| Title of 12(b) Security |

Common Stock, Without Par Value

|

|

|

| Security Exchange Name |

NASDAQ

|

|

|

| Entity, Well-known Seasoned Issuer |

No

|

|

|

| Entity, Voluntary Filers |

No

|

|

|

| Entity, Current Reporting Status |

Yes

|

|

|

| Entity, Interactive Data, Current |

Yes

|

|

|

| Entity, Filer Category |

Non-accelerated Filer

|

|

|

| Entity, Small Business |

true

|

|

|

| Entity, Emerging Growth Company |

false

|

|

|

| ICFR Auditor Attestation Flag |

false

|

|

|

| Document, Financial Statement Error Correction Flag |

false

|

|

|

| Entity, Shell Company |

false

|

|

|

| Entity, Public Float |

|

|

$ 215.2

|

| Entity, Common Stock Shares, Outstanding |

|

8,069,144

|

|

| Amendment Description |

Middlefield Banc Corp (“Company”) is filing this Amendment No. 1 to its Annual Report on Form 10-K (“Form 10-K/A") for the fiscal year ended December 31, 2023, originally filed with the Securities and Exchange Commission (“SEC") on March 28, 2024 (“Original Filing”).

This Form 10-K/A is being filed to correct the Report of Independent Registered Public Accounting Firm of S. R. Snodgrass, P.C. included in the Original Filing due to an inadvertent administrative error. This Amendment does not alter in any way S. R. Snodgrass, P.C.’s opinion on the Company’s financial statements. This Form 10-K/A is also being filed to reflect correct dates in Management’s Annual Report on Internal Control Over Financial Reporting and amend wording in Item 9A(b).

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended, certifications by the Company’s principal executive officer and principal financial officer are filed as exhibits to this Form 10-K/A under Item 15 of Part IV. Additionally, this Form 10-K/A does not include the certifications under Section 906 of the Sarbanes-Oxley Act of 2002, as no financial statements are being filed with this Form 10-K/A.

Except as described above, this Form 10-K/A does not amend, modify, or otherwise update any other information in the Original Filing. We have not updated or amended the disclosures contained in the Original Filing to reflect events that have occurred since the Original Filing. Accordingly, this Form 10-K/A should be read in conjunction with our Original Filing.

|

|

|

| Auditor Name |

S. R. Snodgrass, P.C

|

|

|

| Auditor Location |

Cranberry Township, Pennsylvania

|

|

|

| Auditor Firm ID |

74

|

|

|

| Amendment Flag |

true

|

|

|

| Entity, Central Index Key |

0000836147

|

|

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates whether any of the financial statement period in the filing include a restatement due to error correction. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 402

-Subsection w

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentFinStmtErrorCorrectionFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

| Name: |

dei_EntityPublicFloat |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Name: |

dei_EntityVoluntaryFilers |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_IcfrAuditorAttestationFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

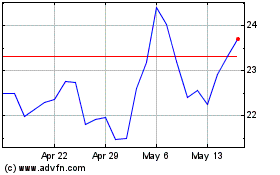

Middlefield Banc (NASDAQ:MBCN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Middlefield Banc (NASDAQ:MBCN)

Historical Stock Chart

From Jan 2024 to Jan 2025