0001805651FalseAugust 14, 202400018056512024-08-142024-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 14, 2024

MarketWise, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | 001-39405 | 87-1767914 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

| 1125 N. Charles St. |

| Baltimore, | Maryland | | 21201 |

| (Address of principal executive offices, including zip code) |

(888) 261-2693

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.0001 par value per share | | MKTW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 14, 2024, MarketWise, Inc.(the “Company”) issued a letter to its shareholders announcing its financial results for the second quarter ended June 30, 2024. A copy of the letter is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is herein incorporated by reference.

The foregoing information (including Exhibit 99.1) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| MarketWise, Inc. |

| | |

Date: August 14, 2024 | By: | /s/ Erik Mickels |

| Name: | Erik Mickels |

| Title: | Chief Financial Officer |

MarketWise Inc.

August 14, 2024

Dear Investors:

MarketWise Inc. is in the midst of a difficult turnaround, and I have been asked to guide us through that effort.

Before I get to the challenges ahead of us, let me first introduce myself…

Folks around the office call me “Doc” because I went to medical school in my 40s. Before that, with an MBA from Kellogg, I worked for more than a decade on Wall Street with several banks, notably Goldman Sachs.

But over the past 15 years, I have been an editor, analyst, and now senior partner and board member of MarketWise. My affiliation with this company stretches back to 2004, when our founder and outgoing CEO, Porter Stansberry, convinced me to consult with Stansberry Research. Soon after my residency in Ophthalmology, in 2008, I joined him and the company full-time.

Today, my team and I produce the investment advisories Retirement Millionaire, Retirement Trader, Income Intelligence, and Prosperity Investor, as well as the daily letter called The Health and Wealth Bulletin.

As you may know, Porter announced his decision to step away from the CEO and Chairman positions on Friday. Now, the MarketWise board has asked me to step into the role of interim CEO.

As I mentioned, MarketWise currently faces a number of challenges that I’m confident we can overcome by continuing some of the initiatives Porter was working on and tackling a few other forward-looking items. I want you to understand where I will be focusing my attention and the energies of our company.

While we are making lots of fundamental progress, these efforts have not yet materialized in our financial results. Worse, in February, we uncovered serious mismanagement inside our Legacy Research business. We opted to dissolve that business, which has resulted in a big decline in revenue and operational changes that have demanded the attention of our top executives. Fortunately, the wind-down of Legacy Research is now largely complete. It’s time to again focus on our mission to reassert MarketWise as the leading platform for high-quality, independent investment research.

Here’s where we are now.

For the second quarter of 2024, MarketWise generated net income of $21.2 million on Generally Accepted Accounting Principles (GAAP) net revenue of $105.0 million. This compares with last year’s second-quarter net income of $9.7 million on GAAP net revenue of $103.6 million. Our Paid Subscriber file size was 645,259 as of June 30, 2024, compared with 750,287 as of June 30, 2023.

In prior letters, we have described our ongoing efforts to review our products, people, and processes to ensure we are delivering high-quality and valuable research and products. Underpinning everything is trust and credibility, and our commitment to being good stewards of your trust.

Where we go from here: a return to our original strategy

In his first letter to shareholders in November 2023 after returning as CEO, Porter laid out the principles upon which he built our business. At our core is the fundamental idea that:

“Our culture of putting the subscribers first – even if doing so harms our revenues (in the short term) or even when doing so may put us in jeopardy of offending powerful corporate and political interests – has allowed us to attract dedicated customers and talented financial analysts.”

Nothing about that vision will change. We remain dedicated to a few simple principles that might seem naive to “professional” money managers.

We want to give investors the information we’d most want to know, if our roles were reversed. We believe that doing so, consistently, is the key to earning our customers’ trust. This well-earned trust is the real secret to our business. As Porter once wrote:

Sticking with our founding principles allowed us to create what Charlie Munger would have described as a “virtuous circle.” Producing consistently valuable research and having a totally transparent business model (no conflicts of interest), allowed us to attract and retain both valuable customers and the most talented analysts. More affluent and sophisticated customers led to bigger editorial budgets and higher and higher quality research, which attracted still more customers. And at the root of this success was the earned trust of our customers.

This isn’t hypothetical. Over 25 years in business, we’ve achieved fantastic results following this formula.

By the end of 2017, Stansberry Research - one of MarketWise's subsidiaries - was producing Billings in excess of $100 million with extremely strong margins. It did so with very little capital, because it was a business based on earned trust. Most of our profits came from renewal income, not new sales. We produced a return on invested capital that year that was tremendous.

By 2020, we were producing Billings in excess of $548 million, but our return on invested capital declined by nearly half. In 2021, the “COVID bubble” year, Billings reached an incredible $730 million, but despite this massive increase, our return on invested capital declined further.

Across virtually all of our brands, we lowered our prices, increased our marketing spending, and chased one hot investment fad after another – no matter how risky or ridiculous. We also adopted a host of marketing tactics (endless upsell funnels, huge quantities of email promotions, dozens of co-registrations) that drove near-term revenue at the expense of lifetime value. Driving your best customers away with aggressive marketing only works for a short period of time.

These changes produced huge amounts of churn in our subscriber files and brought to our business exactly the wrong kind of customers. When you do what’s best for the customer, you attract high-quality customers and employees; when you do the opposite, the opposite occurs.

Making progress

What we are doing today is trying to produce higher per-share intrinsic value.

We believe the best way for us to do that is by creating high-quality investment research brands, like Stansberry Research. We’ve changed the compensation structure across the company to reward executives who can produce high margin renewal income. We’re going to reward people for earning the trust of our customers and building sustainable brands, not for driving revenue churn.

But it will take time because we’ve done a lot of damage to some of our brands, and we’ve undermined some of the trust that took us decades to build. It will also take time because we are not going to be driven purely by marketing decisions, but instead by the hard rule that we only do what we genuinely believe is in the best interest of our customers. So, for example, rather than piling into the mania for Nvidia this summer, we published a timely warning that the market for tech stocks was

about to crash. (See July 12 Stansberry Digest [1] and my Income Intelligence issue from July 18, titled “I Can’t Bite My Tongue Any Longer” [2])

Part of our strategy includes acquiring other outstanding financial brands, when we can get them at a fair price. We want to make MarketWise the holding company of choice for excellent independent financial writers.

We have also completed the relaunch of Wide Moat Research. The business is led by Brad Thomas, who has long been among the widely read real estate investors in the world. Brad is also famously well-connected to Donald Trump, having written a book about the former president’s real estate empire. We believe that working closely with Brad, we’ll be able to build an extremely high-quality and high-margin research group that’s focused on real estate and other blue-chip investments.

Likewise, Porter successfully recruited Jeff Brown back to Brownstone Research and promoted him to become a partner in the business. Jeff’s resume in technology is unmatched by any other financial newsletter writer, having been a senior executive at Qualcomm, NXP Semiconductor, and Juniper Networks. We’re confident that no one has written to more technology investors over the last decade with more skill than Jeff Brown. We intend to rebuild Brownstone Research into the highest-quality source of tech investment research in the world.

Finally, at the end of the second quarter we also launched a new “ultra-premium" global travel and financial research club called The MarketWise Fellowship (marketwisefellowship.com). We’d encourage all shareholders to check out this group.

We believe that these efforts will begin to yield new Billings and profitability beginning in the fourth quarter of this year and growing substantially next year.

Our plan is to focus our efforts on providing high-quality investment research across our customers’ investment lifetimes. By focusing on the customer’s experience and providing a long-term customer journey in our brands, we can maximize the utility of our products for our customers and maximize their lifetime value to our business.

Capital Allocation

After fixing the focus toward better customers, implementing a matching incentive structure, and building (and rebuilding) our brands, my most important goal is making sure that we re-invest our earnings wisely, or distribute them if no such opportunities present themselves.

We are also exploring a range of ways we might repurchase a large number of our shares. Whether or not this happens, you should know that I have more than 6 million reasons to do everything I can to improve the intrinsic value per share of our company.

The next best investment we can make is acquiring similar high-quality brands in our industry, where we can use our marketing know-how, technology, and distribution network to rapidly grow the acquired business. The relaunch of Wide Moat, and re-signing of Jeff Brown at Brownstone Research are just our first two examples. While these moves include small amounts of shares (for bonuses and incentives) they were essentially all-cash deals that we believe will be extremely accretive on a per share basis.

[1] https://members.stansberryresearch.com/articles/stansberry-digest/a-warning-from-porter-stansberry

[2] https://members.stansberryresearch.com/articles/income-intelligence/i-cant-bite-my-tongue-any-longer

When we execute well our company can produce hundreds of millions of dollars in float, which is capital we will eventually have to pay in taxes but can be invested profitably in the interim. Currently, we remain invested 100% in only short-term fixed-income assets, but we look forward to the day when we find more attractive opportunities in other long-term investments. Of course, we also need to return to growth to increase the size of this float, which we expect will begin to decrease this year as various taxes come due.

I thank you for your interest in our company and the trust you’ve placed in me as the company’s CEO. I look forward to updating you on our progress in November.

Sincerely,

David “Doc” Eifrig

P.S. I would be remiss in not thanking our outgoing Chairman and CEO Porter Stansberry for his leadership, vision, and assistance in this past year. I’m excited to have him on the board, in a place where we can continue our business fellowship and our nearly 20-year friendship: thank you Porter.

v3.24.2.u1

Document and Entity Information Document

|

Aug. 14, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 14, 2024

|

| Entity Registrant Name |

MarketWise, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39405

|

| Entity Tax Identification Number |

87-1767914

|

| Entity Address, Address Line One |

1125 N. Charles St.

|

| Entity Address, City or Town |

Baltimore,

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

21201

|

| City Area Code |

(888)

|

| Local Phone Number |

261-2693

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.0001 par value per share

|

| Trading Symbol |

MKTW

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001805651

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

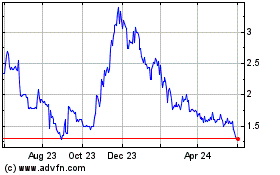

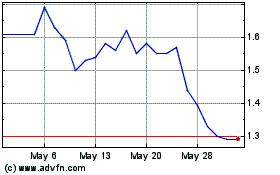

MarketWise (NASDAQ:MKTW)

Historical Stock Chart

From Oct 2024 to Nov 2024

MarketWise (NASDAQ:MKTW)

Historical Stock Chart

From Nov 2023 to Nov 2024