0001679268FALSE00016792682024-11-012024-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

| | |

| PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of Report (Date of earliest event reported): November 1, 2024

Mammoth Energy Services, Inc.

(Exact name of registrant as specified in its charter)

001-37917

(Commission File No.)

| | | | | | | | | | | | | | |

| Delaware | | | 32-0498321 |

| (State or other jurisdiction of incorporation or organization) | | | (I.R.S. Employer Identification No.) |

| | | | |

| 14201 Caliber Drive, | Suite 300 | | | |

| Oklahoma City, | Oklahoma | (405) | 608-6007 | 73134 |

| (Address of principal executive offices) | (Registrant’s telephone number, including area code) | (Zip Code) |

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of The Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | TUSK | The Nasdaq Stock Market LLC |

| | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§232.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(s) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition

On November 1, 2024, Mammoth Energy Services, Inc. (the “Company”) issued a press release announcing its operational and financial results for the third quarter ended September 30, 2024. A copy of that press release is furnished as Exhibit 99.1 to this report.

The information in this Item 2.02, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any registration statement filed under the Securities Act of 1933, as amended, unless specifically identified as being incorporated by reference in the registration statement.

Item 7.01 Regulation FD Disclosure

On November 1, 2024, the Company posted an investor presentation to the “investors” section of its website (www.mammothenergy.com), where the Company routinely posts announcements, updates, events, investor information and presentations and recent news releases. Information on the Company's website does not constitute part of this Current Report on Form 8-K.

The information in this Item 7.01 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any registration statement filed under the Securities Act of 1933, as amended, unless specifically identified as being incorporated by reference in the registration statement.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

| |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

|

| | | | | |

| | | | | MAMMOTH ENERGY SERVICES, INC. |

| Date: | November 1, 2024 | | By: | | /s/ Mark Layton |

| | | | | Mark Layton |

| | | | | Chief Financial Officer and Secretary |

| | | | | |

| | | | | |

Exhibit 99.1

Mammoth Energy Services, Inc. Announces

Third Quarter 2024 Operational and Financial Results

OKLAHOMA CITY - November 1, 2024 - Mammoth Energy Services, Inc. (NASDAQ: TUSK) (“Mammoth” or the “Company”) today reported financial and operational results for the third quarter ended September 30, 2024.

Arty Straehla, Chief Executive Officer of Mammoth commented, “Softness across our Well Completion Services markets appeared to have bottomed in the third quarter, and we expect a rebound in the fourth quarter. More importantly, we were pleased to have recently received a total of $168.4 million of the $188.4 million owed to our subsidiary through the Settlement Agreement with the Puerto Rico Electric Power Authority, or PREPA. We are now debt free and have plans to invest in both our Infrastructure Services and Well Completion Services divisions over the next year. In Infrastructure Services, we will be investing in additional crews and our engineering services capabilities to better serve our customers. In our Well Completion Services division, we will be upgrading pressure pumping equipment to more efficient dual fuel Tier 4 technology. We believe this investment positions us to capitalize on rising demand as markets are anticipated to improve later next year. Now that we are debt free and have significant capital to invest into our businesses, we believe we have an excellent platform to increase shareholder value.”

Financial Overview for the Third Quarter 2024:

Total revenue was $40.0 million for the third quarter compared to $65.0 million for the same quarter last year.

Net loss for the third quarter was $24.0 million, or $0.50 loss per diluted share, compared to net loss of $1.1 million, or $0.02 loss per diluted share, for the same quarter last year.

Adjusted EBITDA (as defined and reconciled below) was ($6.4) million for the third quarter of 2024, compared to $13.4 million for the same quarter last year.

Well Completion Services

Mammoth’s well completion services division contributed revenue (inclusive of inter-segment revenue) of $2.2 million for the third quarter, compared to $20.3 million for the same quarter of 2023. The Company had no pressure pumping fleets active during the third quarter of 2024 compared to an average utilization of 1.2 pressure pumping fleets during the same quarter of 2023. The third quarter 2024 revenue in the well completion services division was primarily attributable to one active pump-down crew.

Infrastructure Services

Mammoth’s infrastructure services division contributed revenue of $26.0 million for the third quarter compared to $26.7 million for the same quarter of 2023. Average crew count was 77 crews during the third quarter compared to 81 crews during the same quarter of 2023.

Natural Sand Proppant Services

Mammoth’s natural sand proppant services division contributed revenue (inclusive of inter-segment revenue) of $4.9 million for the third quarter compared to $10.6 million for the same quarter of 2023. In the third quarter, the Company sold approximately 163,000 tons of sand at an average sales price of $22.89 per ton compared to sales of approximately 352,000 tons of sand at an average sales price of $30.18 per ton during the same quarter of 2023.

Drilling Services

Mammoth’s drilling services division contributed revenue (inclusive of inter-segment revenue) of $1.6 million for the third quarter compared to $2.3 million for the same quarter of 2023.

Other Services

Mammoth’s other services, including aviation, equipment rentals, remote accommodations and equipment manufacturing, contributed revenue (inclusive of inter-segment revenue) of $7.0 million for the third quarter compared to $6.0 million for the same quarter of 2023.

Selling, General and Administrative Expenses

Selling, general and administrative (“SG&A”) expenses were $8.7 million for the third quarter compared to $10.4 million for the same quarter of 2023.

Following is a breakout of SG&A expense (in thousands): | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | | | September 30, |

| 2024 | | 2023 | | | | 2024 | | 2023 |

| Cash expenses: | | | | | | | | | |

| Compensation and benefits | $ | 3,173 | | | $ | 3,392 | | | | | $ | 10,394 | | | $ | 11,665 | |

| Professional services | 3,503 | | | 4,684 | | | | | 9,016 | | | 10,889 | |

Other(a) | 1,775 | | | 2,105 | | | | | 5,249 | | | 5,884 | |

| Total cash SG&A expense | 8,451 | | | 10,181 | | | | | 24,659 | | | 28,438 | |

| Non-cash expenses: | | | | | | | | | |

Change in provision for expected credit losses(b) | 32 | | | 11 | | | | | 89,645 | | | (414) | |

| | | | | | | | | |

| Stock based compensation | 219 | | | 219 | | | | | 657 | | | 1,127 | |

| Total non-cash SG&A expense | 251 | | | 230 | | | | | 90,302 | | | 713 | |

| Total SG&A expense | $ | 8,702 | | | $ | 10,411 | | | | | $ | 114,961 | | | $ | 29,151 | |

a. Includes travel-related costs, information technology expenses, rent, utilities and other general and administrative-related costs.

b. Included in the nine months ended September 30, 2024 amounts is a charge of $89.2 million related to Cobra's Settlement Agreement with PREPA.

SG&A expenses, as a percentage of total revenue, were 22% for the third quarter compared to 16% for the same quarter of 2023.

Interest Expense and Financing Charges, net

Interest expense and financing charges, net were $9.7 million for the third quarter compared to $2.9 million for the same quarter of 2023. The Company recognized a charge to interest expense totaling $7.1 million during the third quarter of 2024 related to its sale leaseback agreements.

Liquidity

As of September 30, 2024, Mammoth had unrestricted cash on hand of $4.2 million. As of September 30, 2024, the Company’s revolving credit facility was undrawn, the borrowing base was $20.4 million and there was $13.7 million of available borrowing capacity under the revolving credit facility, after giving effect to $6.7 million of outstanding letters of credit. As of September 30, 2024, Mammoth had total liquidity of $17.9 million.

As previously announced, Cobra has received the first two installment payments of $150.0 million and $18.4 million, respectively, in connection with the previously disclosed Settlement Agreement with PREPA in October 2024. Subsequent to the receipt of the first installment payment, the Company paid, in full, all amounts owed under the term credit facility with Wexford Capital LP, including the accrued and unpaid interest, in the aggregate amount of $50.9 million, and terminated the facility on October 2, 2024. In connection with the receipt of the second

installment payment from PREPA, as required under the terms of the Settlement Agreement, Cobra instructed Fifth Third Bank, National Association (“Fifth Third Bank”) to issue a letter of credit to PREPA in the amount of $18.4 million and transferred a total of $19.3 million to a restricted cash account maintained by Fifth Third Bank as collateral for the letter of credit.

As of October 30, 2024, Mammoth had cash on hand of $86.2 million, no outstanding borrowings under its revolving credit facility, and a borrowing base of $18.2 million. As of October 30, 2024, the Company had $11.5 million of available borrowing capacity under its revolving credit facility and total liquidity of $97.7 million.

Capital Expenditures

The following table summarizes Mammoth’s capital expenditures by operating division for the periods indicated (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | | | September 30, |

| 2024 | | 2023 | | | | 2024 | | 2023 |

Well completion services(a) | $ | 3,812 | | | $ | 4,651 | | | | | $ | 8,549 | | | $ | 14,762 | |

Infrastructure services(b) | 88 | | | 69 | | | | | 1,051 | | | 344 | |

| | | | | | | | | |

Drilling services(c) | 15 | | | 98 | | | | | 102 | | | 97 | |

Other(d) | 323 | | | 72 | | | | | 665 | | | 82 | |

Eliminations(a) | (2,341) | | | (165) | | | | | 600 | | | (20) | |

| Total capital expenditures | $ | 1,897 | | | $ | 4,725 | | | | | $ | 10,967 | | | $ | 15,265 | |

a. Capital expenditures primarily for upgrades and maintenance to our pressure pumping fleet for the periods presented.

b. Capital expenditures primarily for truck, tooling and equipment purchases for the periods presented.

c. Capital expenditures primarily for maintenance for the periods presented.

d. Capital expenditures primarily for equipment for the Company’s rental businesses for the periods presented.

Conference Call Information

Mammoth will host a conference call on Friday, November 1, 2024 at 9:00 a.m. Central time (10:00 a.m. Eastern time) to discuss its third quarter financial and operational results. The telephone number to access the conference call is 1-201-389-0872. The conference call will also be webcast live on https://ir.mammothenergy.com/events-presentations. Please submit any questions for management prior to the call via email to TUSK@dennardlascar.com.

About Mammoth Energy Services, Inc.

Mammoth is an integrated, growth-oriented energy services company focused on the providing products and services to enable the exploration and development of North American onshore unconventional oil and natural gas reserves as well as the construction and repair of the electric grid for private utilities, public investor-owned utilities and co-operative utilities through its infrastructure services businesses. Mammoth’s suite of services and products include: well completion services, infrastructure services, natural sand and proppant services, drilling services and other energy services. For more information, please visit www.mammothenergy.com.

Contacts:

Mark Layton, CFO

Mammoth Energy Services, Inc

investors@mammothenergy.com

Rick Black / Ken Dennard

Dennard Lascar Investor Relations

TUSK@dennardlascar.com

Forward-Looking Statements and Cautionary Statements

This news release (and any oral statements made regarding the subjects of this release, including on the conference call announced herein) contains certain statements and information that may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts that address activities, events or developments that Mammoth expects, believes or anticipates will or may occur in the future are forward-looking statements. The words “anticipate,” “believe,” “ensure,” “expect,” “if,” “intend,” “plan,” “estimate,” “project,” “forecasts,” “predict,” “outlook,” “aim,” “will,” “could,” “should,” “potential,” “would,” “may,” “probable,” “likely” and similar expressions, and the negative thereof, are intended to identify forward-looking statements. Without limiting the generality of the foregoing, forward-looking statements contained in this news release specifically include statements, estimates and projections regarding the Company’s business outlook and plans, future financial position, liquidity and capital resources, operations, performance, acquisitions, returns, capital expenditure budgets, plans for stock repurchases under its stock repurchase program, costs and other guidance regarding future developments. Forward-looking statements are not assurances of future performance. These forward-looking statements are based on management’s current expectations and beliefs, forecasts for the Company’s existing operations, experience and perception of historical trends, current conditions, anticipated future developments and their effect on Mammoth, and other factors believed to be appropriate. Although management believes that the expectations and assumptions reflected in these forward-looking statements are reasonable as and when made, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all). Moreover, the Company’s forward-looking statements are subject to significant risks and uncertainties, including those described in its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings it makes with the SEC, including those relating to the Company’s acquisitions and contracts, many of which are beyond the Company’s control, which may cause actual results to differ materially from historical experience and present expectations or projections which are implied or expressed by the forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: demand for our services; the volatility of oil and natural gas prices and actions by OPEC members and other exporting nations affecting commodities prices and production levels; the impact of the war in Ukraine and the Israel-Hamas war on the global energy and capital markets and global stability; performance of contracts and supply chain disruptions; inflationary pressures; higher interest rates and their impact on the cost of capital; instability in the banking and financial services sectors; the outcome of ongoing government investigations and other legal proceedings; the failure to receive or delays in receiving the remaining payments under the settlement agreement with PREPA; the Company’s inability to replace the prior levels of work in its business segments, including its infrastructure and well completion services segments; risks relating to economic conditions, including concerns over a potential economic slowdown or recession; impacts of the recent federal infrastructure bill on the infrastructure industry and our infrastructure services business; the loss of or interruption in operations of one or more of Mammoth’s significant suppliers or customers; the loss of management and/or crews; the outcome or settlement of our litigation matters and the effect on our financial condition and results of operations; the effects of government regulation, permitting and other legal requirements; operating risks; the adequacy of capital resources and liquidity; Mammoth's ability to comply with the applicable financial covenants and other terms and conditions under its revolving credit facility; weather; natural disasters; litigation; volatility in commodity markets; competition in the oil and natural gas and infrastructure industries; and costs and availability of resources.

Investors are cautioned not to place undue reliance on any forward-looking statement which speaks only as of the date on which such statement is made. We undertake no obligation to correct, revise or update any forward-looking statement after the date such statement is made, whether as a result of new information, future events or otherwise, except as required by applicable law.

MAMMOTH ENERGY SERVICES, INC.

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | | | | |

| ASSETS | | September 30, | | December 31, |

| | 2024 | | 2023 |

| CURRENT ASSETS | | (in thousands) |

| Cash and cash equivalents | | $ | 4,165 | | | $ | 16,556 | |

| Restricted cash | | 2,000 | | | 7,742 | |

| | | | |

| Accounts receivable, net | | 232,032 | | | 447,202 | |

| | | | |

| Inventories | | 13,498 | | | 12,653 | |

| Prepaid expenses | | 2,912 | | | 12,181 | |

| Other current assets | | 581 | | | 591 | |

| | | | |

| Total current assets | | 255,188 | | | 496,925 | |

| | | | |

| Property, plant and equipment, net | | 109,394 | | | 113,905 | |

| Sand reserves, net | | 57,497 | | | 58,528 | |

| Operating lease right-of-use assets | | 5,010 | | | 9,551 | |

| | | | |

| Goodwill | | 9,214 | | | 9,214 | |

| Deferred income tax asset | | — | | | 1,844 | |

| Other non-current assets | | 6,675 | | | 8,512 | |

| Total assets | | $ | 442,978 | | | $ | 698,479 | |

| LIABILITIES AND EQUITY | | | | |

| CURRENT LIABILITIES | | | | |

| Accounts payable | | $ | 30,065 | | | $ | 27,508 | |

| Accrued expenses and other current liabilities | | 35,433 | | | 86,713 | |

| Accrued expenses and other current liabilities - related parties | | — | | | 1,241 | |

| Current operating lease liability | | 3,428 | | | 5,771 | |

| | | | |

| Income taxes payable | | 44,512 | | | 61,320 | |

| Total current liabilities | | 113,438 | | | 182,553 | |

| | | | |

| | | | |

| Long-term debt from related parties | | 49,009 | | | 42,809 | |

| Deferred income tax liabilities | | 2,272 | | | 628 | |

| Long-term operating lease liability | | 1,556 | | | 3,534 | |

| Asset retirement obligation | | 4,244 | | | 4,140 | |

| Other long-term liabilities | | 3,781 | | | 4,715 | |

| Total liabilities | | 174,300 | | | 238,379 | |

| | | | |

| COMMITMENTS AND CONTINGENCIES | | | | |

| | | | |

| EQUITY | | | | |

| Equity: | | | | |

Common stock, $0.01 par value, 200,000,000 shares authorized, 48,127,369 and 47,941,652 issued and outstanding at September 30, 2024 and December 31, 2023 | | 481 | | | 479 | |

| Additional paid in capital | | 540,213 | | | 539,558 | |

| Accumulated deficit | | (268,163) | | | (76,317) | |

| Accumulated other comprehensive loss | | (3,853) | | | (3,620) | |

| Total equity | | 268,678 | | | 460,100 | |

| Total liabilities and equity | | $ | 442,978 | | | $ | 698,479 | |

MAMMOTH ENERGY SERVICES, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | | | September 30, |

| 2024 | | 2023 | | | | 2024 | | 2023 |

| (in thousands, except per share amounts) |

| REVENUE | |

| Services revenue | $ | 34,069 | | | $ | 54,025 | | | | | $ | 119,653 | | | $ | 221,140 | |

| Services revenue - related parties | 1,037 | | | 252 | | | | | 1,171 | | | 841 | |

| Product revenue | 4,909 | | | 10,682 | | | | | 13,908 | | | 34,729 | |

| | | | | | | | | |

| Total revenue | 40,015 | | | 64,959 | | | | | 134,732 | | | 256,710 | |

| | | | | | | | | |

| COST AND EXPENSES | | | | | | | | | |

Services cost of revenue (exclusive of depreciation, depletion, amortization and accretion of $4,495, $8,394, $15,149, $30,426, respectively, for the three months ended September 30, 2024 and 2023 and nine months ended September 30, 2024 and 2023) | 34,468 | | | 45,082 | | | | | 107,914 | | | 178,905 | |

| Services cost of revenue - related parties | 118 | | | 120 | | | | | 355 | | | 360 | |

Product cost of revenue (exclusive of depreciation, depletion, amortization and accretion of $1,688, $2,836, $4,105, $6,395, respectively, for the three months ended September 30, 2024 and 2023 and nine months ended September 30, 2024 and 2023) | 3,386 | | | 7,615 | | | | | 14,130 | | | 22,796 | |

| | | | | | | | | |

| Selling, general and administrative | 8,702 | | | 10,411 | | | | | 114,961 | | | 29,151 | |

| | | | | | | | | |

| Depreciation, depletion, amortization and accretion | 6,184 | | | 11,233 | | | | | 19,256 | | | 36,839 | |

| Gains on disposal of assets, net | (293) | | | (2,450) | | | | | (2,496) | | | (3,284) | |

| Impairment of goodwill | — | | | 1,810 | | | | | — | | | 1,810 | |

| | | | | | | | | |

| Total cost and expenses | 52,565 | | | 73,821 | | | | | 254,120 | | | 266,577 | |

| Operating loss | (12,550) | | | (8,862) | | | | | (119,388) | | | (9,867) | |

| | | | | | | | | |

| OTHER INCOME (EXPENSE) | | | | | | | | | |

| Interest expense and financing charges, net | (8,088) | | | (2,876) | | | | | (15,730) | | | (9,385) | |

| Interest expense and financing charges, net - related parties | (1,642) | | | — | | | | | (4,670) | | | — | |

| Other (expense) income, net | (1,122) | | | 14,088 | | | | | (64,658) | | | 31,051 | |

| | | | | | | | | |

| Total other (expense) income | (10,852) | | | 11,212 | | | | | (85,058) | | | 21,666 | |

| (Loss) income before income taxes | (23,402) | | | 2,350 | | | | | (204,446) | | | 11,799 | |

| Provision (benefit) for income taxes | 640 | | | 3,438 | | | | | (12,600) | | | 9,006 | |

| Net (loss) income | $ | (24,042) | | | $ | (1,088) | | | | | $ | (191,846) | | | $ | 2,793 | |

| | | | | | | | | |

| OTHER COMPREHENSIVE (LOSS) INCOME | | | | | | | | | |

| Foreign currency translation adjustment | 125 | | | (275) | | | | | (233) | | | (45) | |

| Comprehensive (loss) income | $ | (23,917) | | | $ | (1,363) | | | | | $ | (192,079) | | | $ | 2,748 | |

| | | | | | | | | |

| Net (loss) income per share (basic) | $ | (0.50) | | | $ | (0.02) | | | | | $ | (3.99) | | | $ | 0.06 | |

| Net (loss) income per share (diluted) | $ | (0.50) | | | $ | (0.02) | | | | | $ | (3.99) | | | $ | 0.06 | |

| Weighted average number of shares outstanding (basic) | 48,127 | | | 47,942 | | | | | 48,044 | | | 47,721 | |

| Weighted average number of shares outstanding (diluted) | 48,127 | | | 47,942 | | | | | 48,044 | | | 47,973 | |

| | | | | | | | | |

MAMMOTH ENERGY SERVICES, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | | | | | | |

| Nine Months Ended |

| September 30, |

| 2024 | | 2023 |

| (in thousands) |

| Cash flows from operating activities: | | | |

| Net (loss) income | $ | (191,846) | | | $ | 2,793 | |

| Adjustments to reconcile net (loss) income to cash provided by operating activities: | | | |

| | | |

| Stock based compensation | 657 | | | 1,127 | |

| Depreciation, depletion, accretion and amortization | 19,256 | | | 36,839 | |

| | | |

| Amortization of debt origination costs | 1,076 | | | 565 | |

| Change in provision for expected credit losses | 171,108 | | | (414) | |

| Gains on disposal of assets | (2,496) | | | (3,284) | |

| Gains from sales of equipment damaged or lost down-hole | (160) | | | (335) | |

| Impairment of goodwill | — | | | 1,810 | |

| | | |

| Gain on sale of business | — | | | (2,080) | |

| | | |

| Deferred income taxes | 3,488 | | | (70) | |

| Other | 724 | | | (273) | |

| Changes in assets and liabilities: | | | |

| Accounts receivable, net | 43,107 | | | 1,445 | |

| | | |

| Inventories | (845) | | | (2,896) | |

| Prepaid expenses and other assets | 9,252 | | | 8,990 | |

| | | |

| Accounts payable | 1,938 | | | (7,537) | |

| | | |

| Accrued expenses and other liabilities | (3,796) | | | (19,679) | |

| Accrued expenses and other liabilities - related parties | 4,647 | | | — | |

| Income taxes payable | (16,809) | | | 7,950 | |

| Net cash provided by operating activities | 39,301 | | | 24,951 | |

| | | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (10,967) | | | (15,265) | |

| | | |

| | | |

| Business divestitures, net of cash transferred | — | | | 3,276 | |

| | | |

| Proceeds from disposal of property and equipment | 5,047 | | | 4,304 | |

| | | |

| | | |

| Net cash used in investing activities | (5,920) | | | (7,685) | |

| | | |

| Cash flows from financing activities: | | | |

| Borrowings on long-term debt | — | | | 168,800 | |

| | | |

| Repayments of long-term debt | — | | | (183,291) | |

| | | |

| Payments on financing transaction | (46,837) | | | — | |

| | | |

| Payments on sale-leaseback transaction | (3,206) | | | (3,711) | |

| | | |

| Principal payments on financing leases and equipment financing notes | (1,403) | | | (4,872) | |

| Debt issuance costs | (37) | | | — | |

| Other | — | | | (919) | |

| Net cash used in financing activities | (51,483) | | | (23,993) | |

| Effect of foreign exchange rate on cash | (31) | | | (28) | |

| Net change in cash, cash equivalents and restricted cash | (18,133) | | | (6,755) | |

| Cash, cash equivalents and restricted cash at beginning of period | 24,298 | | | 17,282 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 6,165 | | | $ | 10,527 | |

| | | |

| Supplemental disclosure of cash flow information: | | | |

| Cash paid for interest | $ | 2,096 | | | $ | 8,951 | |

| Cash paid for income taxes, net of refunds received | $ | 716 | | | $ | 788 | |

| Supplemental disclosure of non-cash transactions: | | | |

| Interest paid in kind - related parties | $ | 5,888 | | | $ | — | |

| Purchases of property and equipment included in accounts payable | $ | 3,964 | | | $ | 4,197 | |

| Right-of-use assets obtained for financing lease liabilities | $ | 2,971 | | | $ | 507 | |

MAMMOTH ENERGY SERVICES, INC.

SEGMENT INCOME STATEMENTS

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 | Well Completion | Infrastructure | Sand | Drilling | All Other | Eliminations | Total |

| Revenue from external customers | $ | 2,124 | | $ | 26,043 | | $ | 4,909 | | $ | 1,557 | | $ | 5,382 | | $ | — | | $ | 40,015 | |

| Intersegment revenues | 108 | | — | | — | | — | | 1,641 | | (1,749) | | — | |

| Total revenue | 2,232 | | 26,043 | | 4,909 | | 1,557 | | 7,023 | | (1,749) | | 40,015 | |

| Cost of revenue, exclusive of depreciation, depletion, amortization and accretion | 7,099 | | 22,539 | | 3,110 | | 1,478 | | 3,746 | | — | | 37,972 | |

| Intersegment cost of revenues | 185 | | — | | — | | 1 | | 1,565 | | (1,751) | | — | |

| Total cost of revenue | 7,284 | | 22,539 | | 3,110 | | 1,479 | | 5,311 | | (1,751) | | 37,972 | |

| Selling, general and administrative | 887 | | 5,557 | | 1,211 | | 230 | | 817 | | — | | 8,702 | |

| Depreciation, depletion, amortization and accretion | 2,546 | | 626 | | 1,688 | | 587 | | 737 | | — | | 6,184 | |

| Gains on disposal of assets, net | (60) | | (41) | | — | | — | | (192) | | — | | (293) | |

| | | | | | | |

| | | | | | | |

| Operating (loss) income | (8,425) | | (2,638) | | (1,100) | | (739) | | 350 | | 2 | | (12,550) | |

| Interest expense and financing charges, net | 533 | | 8,742 | | 135 | | 127 | | 193 | | — | | 9,730 | |

| Other expense (income), net | 1 | | 1,491 | | 3 | | — | | (373) | | — | | 1,122 | |

| (Loss) income before income taxes | $ | (8,959) | | $ | (12,871) | | $ | (1,238) | | $ | (866) | | $ | 530 | | $ | 2 | | $ | (23,402) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 | Well Completion | Infrastructure | Sand | Drilling | All Other | Eliminations | Total |

| Revenue from external customers | $ | 20,166 | | $ | 26,712 | | $ | 10,633 | | $ | 2,337 | | $ | 5,111 | | $ | — | | $ | 64,959 | |

| Intersegment revenues | 161 | | — | | — | | — | | 909 | | (1,070) | | — | |

| Total revenue | 20,327 | | 26,712 | | 10,633 | | 2,337 | | 6,020 | | (1,070) | | 64,959 | |

| Cost of revenue, exclusive of depreciation, depletion, amortization and accretion | 17,528 | | 22,042 | | 6,977 | | 2,194 | | 4,076 | | — | | 52,817 | |

| Intersegment cost of revenues | 325 | | 10 | | — | | — | | 735 | | (1,070) | | — | |

| Total cost of revenue | 17,853 | | 22,052 | | 6,977 | | 2,194 | | 4,811 | | (1,070) | | 52,817 | |

| Selling, general and administrative | 1,579 | | 6,495 | | 1,224 | | 215 | | 898 | | — | | 10,411 | |

| Depreciation, depletion, amortization and accretion | 3,971 | | 1,557 | | 2,836 | | 1,114 | | 1,755 | | — | | 11,233 | |

| Gains on disposal of assets, net | (2,016) | | (311) | | — | | — | | (123) | | — | | (2,450) | |

| Impairment of goodwill | — | | — | | — | | — | | 1,810 | | — | | 1,810 | |

| | | | | | | |

| Operating loss | (1,060) | | (3,081) | | (404) | | (1,186) | | (3,131) | | — | | (8,862) | |

| Interest expense and financing charges, net | 774 | | 1,647 | | 117 | | 117 | | 221 | | — | | 2,876 | |

| Other income, net | — | | (11,348) | | (6) | | — | | (2,734) | | — | | (14,088) | |

| (Loss) income before income taxes | $ | (1,834) | | $ | 6,620 | | $ | (515) | | $ | (1,303) | | $ | (618) | | $ | — | | $ | 2,350 | |

MAMMOTH ENERGY SERVICES, INC.

SEGMENT INCOME STATEMENTS

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months ended September 30, 2024 | Well Completion | Infrastructure | Sand | Drilling | All Other | Eliminations | Total |

| Revenue from external customers | $ | 20,218 | | $ | 82,514 | | $ | 13,908 | | $ | 2,804 | | $ | 15,288 | | $ | — | | $ | 134,732 | |

| Intersegment revenues | 331 | | — | | 27 | | — | | 5,005 | | (5,363) | | $ | — | |

| Total revenue | 20,549 | | 82,514 | | 13,935 | | 2,804 | | 20,293 | | (5,363) | | 134,732 | |

| Cost of revenue, exclusive of depreciation, depletion, amortization and accretion | 25,533 | | 68,704 | | 13,540 | | 3,683 | | 10,939 | | — | | 122,399 | |

| Intersegment cost of revenues | 638 | | 26 | | — | | 4 | | 4,695 | | (5,363) | | $ | — | |

| Total cost of revenue | 26,171 | | 68,730 | | 13,540 | | 3,687 | | 15,634 | | (5,363) | | 122,399 | |

| Selling, general and administrative | 3,156 | | 105,625 | | 3,185 | | 618 | | 2,377 | | — | | 114,961 | |

| Depreciation, depletion, amortization and accretion | 8,501 | | 1,972 | | 4,105 | | 2,075 | | 2,603 | | — | | 19,256 | |

| Losses (gains) on disposal of assets, net | 85 | | (984) | | (110) | | — | | (1,487) | | — | | (2,496) | |

| | | | | | | |

| | | | | | | |

| Operating (loss) income | (17,364) | | (92,829) | | (6,785) | | (3,576) | | 1,166 | | — | | (119,388) | |

| Interest expense and financing charges, net | 1,624 | | 17,417 | | 408 | | 377 | | 574 | | — | | 20,400 | |

| Other expense, net | 2 | | 63,919 | | 2 | | — | | 735 | | — | | 64,658 | |

| Loss before income taxes | $ | (18,990) | | $ | (174,165) | | $ | (7,195) | | $ | (3,953) | | $ | (143) | | $ | — | | $ | (204,446) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months ended September 30, 2023 | Well Completion | Infrastructure | Sand | Drilling | All Other | Eliminations | Total |

| Revenue from external customers | $ | 114,810 | | $ | 83,308 | | $ | 34,643 | | $ | 6,501 | | $ | 17,448 | | $ | — | | $ | 256,710 | |

| Intersegment revenues | 400 | | — | | 25 | | — | | 1,743 | | (2,168) | | — | |

| Total revenue | 115,210 | | 83,308 | | 34,668 | | 6,501 | | 19,191 | | (2,168) | | 256,710 | |

| Cost of revenue, exclusive of depreciation, depletion, amortization and accretion | 93,158 | | 67,810 | | 21,905 | | 6,035 | | 13,153 | | — | | 202,061 | |

| Intersegment cost of revenues | 1,029 | | 29 | | — | | 26 | | 1,084 | | (2,168) | | — | |

| Total cost of revenue | 94,187 | | 67,839 | | 21,905 | | 6,061 | | 14,237 | | (2,168) | | 202,061 | |

| Selling, general and administrative | 5,847 | | 17,091 | | 2,682 | | 554 | | 2,977 | | — | | 29,151 | |

| Depreciation, depletion, amortization and accretion | 13,288 | | 7,366 | | 6,397 | | 3,497 | | 6,291 | | — | | 36,839 | |

| Gains on disposal of assets, net | (2,016) | | (439) | | (16) | | — | | (813) | | — | | (3,284) | |

| Impairment of goodwill | — | | — | | — | | — | | 1,810 | | — | | 1,810 | |

| | | | | | | |

| Operating income (loss) | 3,904 | | (8,549) | | 3,700 | | (3,611) | | (5,311) | | — | | (9,867) | |

| Interest expense and financing charges, net | 2,527 | | 5,361 | | 422 | | 376 | | 699 | | — | | 9,385 | |

| Other expense (income), net | 1 | | (28,713) | | (12) | | — | | (2,327) | | — | | (31,051) | |

| Income (loss) before income taxes | $ | 1,376 | | $ | 14,803 | | $ | 3,290 | | $ | (3,987) | | $ | (3,683) | | $ | — | | $ | 11,799 | |

MAMMOTH ENERGY SERVICES, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Adjusted EBITDA

Adjusted EBITDA is a supplemental non-GAAP financial measure that is used by management and external users of the Company’s financial statements, such as industry analysts, investors, lenders and rating agencies. Mammoth defines Adjusted EBITDA as net (loss) income before depreciation, depletion, amortization and accretion expense, gains on disposal of assets, net, impairment of goodwill, stock based compensation, interest expense and financing charges, net, other (income) expense, net (which is comprised of interest on trade accounts receivable and certain legal expenses) and provision (benefit) for income taxes, further adjusted to add back interest on trade accounts receivable. The Company excludes the items listed above from net (loss) income in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within the energy service industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be considered as an alternative to, or more meaningful than, net (loss) income or cash flows from operating activities as determined in accordance with GAAP or as an indicator of Mammoth’s operating performance or liquidity. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets. Mammoth’s computations of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. The Company believes that Adjusted EBITDA is a widely followed measure of operating performance and may also be used by investors to measure its ability to meet debt service requirements.

The following tables provide a reconciliation of Adjusted EBITDA to the GAAP financial measure of net (loss) income on a consolidated basis and for each of the Company’s segments (in thousands):

Consolidated

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended | | |

| September 30, | | | | September 30, | | |

| Reconciliation of net (loss) income to Adjusted EBITDA: | 2024 | | 2023 | | | | 2024 | | 2023 | | |

| Net (loss) income | $ | (24,042) | | | $ | (1,088) | | | | | $ | (191,846) | | | $ | 2,793 | | | |

| Depreciation, depletion, amortization and accretion expense | 6,184 | | | 11,233 | | | | | 19,256 | | | 36,839 | | | |

| Gains on disposal of assets, net | (293) | | | (2,450) | | | | | (2,496) | | | (3,284) | | | |

| Impairment of goodwill | — | | | 1,810 | | | | | — | | | 1,810 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Stock based compensation | 219 | | | 219 | | | | | 657 | | | 1,127 | | | |

| Interest expense and financing charges, net | 9,730 | | | 2,876 | | | | | 20,400 | | | 9,385 | | | |

| Other expense (income), net | 1,122 | | | (14,088) | | | | | 64,658 | | | (31,051) | | | |

| Provision (benefit) for income taxes | 640 | | | 3,438 | | | | | (12,600) | | | 9,006 | | | |

| Interest on trade accounts receivable | — | | | 11,443 | | | | | (60,686) | | | 33,897 | | | |

| Adjusted EBITDA | $ | (6,440) | | | $ | 13,393 | | | | | $ | (162,657) | | | $ | 60,522 | | | |

MAMMOTH ENERGY SERVICES, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Well Completion Services | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | | | September 30, |

| Reconciliation of net (loss) income to Adjusted EBITDA: | 2024 | | 2023 | | | | 2024 | | 2023 |

| Net (loss) income | $ | (8,959) | | | $ | (1,834) | | | | | $ | (18,990) | | | $ | 1,376 | |

| Depreciation and amortization expense | 2,546 | | | 3,971 | | | | | 8,501 | | | 13,288 | |

| (Gains) losses on disposal of assets, net | (60) | | | (2,016) | | | | | 85 | | | (2,016) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Stock based compensation | 33 | | | 64 | | | | | 122 | | | 451 | |

| Interest expense and financing charges, net | 533 | | | 774 | | | | | 1,624 | | | 2,527 | |

| Other expense, net | 1 | | | — | | | | | 2 | | | 1 | |

| | | | | | | | | |

| Adjusted EBITDA | $ | (5,906) | | | $ | 959 | | | | | $ | (8,656) | | | $ | 15,627 | |

Infrastructure Services | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | | | September 30, |

| Reconciliation of net (loss) income to Adjusted EBITDA: | 2024 | | 2023 | | | | 2024 | | 2023 |

| Net (loss) income | $ | (13,500) | | | $ | 3,239 | | | | | $ | (158,767) | | | $ | 6,392 | |

| Depreciation and amortization expense | 626 | | | 1,557 | | | | | 1,972 | | | 7,366 | |

| Gains on disposal of assets, net | (41) | | | (311) | | | | | (984) | | | (439) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Stock based compensation | 124 | | | 99 | | | | | 364 | | | 436 | |

| Interest expense and financing charges, net | 8,742 | | | 1,647 | | | | | 17,417 | | | 5,361 | |

| Other expense (income), net | 1,491 | | | (11,348) | | | | | 63,919 | | | (28,713) | |

| Provision (benefit) for income taxes | 629 | | | 3,381 | | | | | (15,398) | | | 8,411 | |

| Interest on trade accounts receivable | — | | | 11,443 | | | | | (60,686) | | | 33,897 | |

| Adjusted EBITDA | $ | (1,929) | | | $ | 9,707 | | | | | $ | (152,163) | | | $ | 32,711 | |

Natural Sand Proppant Services | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | | | September 30, |

| Reconciliation of net (loss) income to Adjusted EBITDA: | 2024 | | 2023 | | | | 2024 | | 2023 |

| Net (loss) income | $ | (1,238) | | | $ | (515) | | | | | $ | (7,195) | | | $ | 3,290 | |

| Depreciation, depletion, amortization and accretion expense | 1,688 | | | 2,836 | | | | | 4,105 | | | 6,397 | |

| Gains on disposal of assets, net | — | | | — | | | | | (110) | | | (16) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Stock based compensation | 39 | | | 37 | | | | | 109 | | | 149 | |

| Interest expense and financing charges, net | 135 | | | 117 | | | | | 408 | | | 422 | |

| Other expense (income), net | 3 | | | (6) | | | | | 2 | | | (12) | |

| | | | | | | | | |

| Adjusted EBITDA | $ | 627 | | | $ | 2,469 | | | | | $ | (2,681) | | | $ | 10,230 | |

MAMMOTH ENERGY SERVICES, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Drilling Services | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | | | September 30, |

| Reconciliation of net loss to Adjusted EBITDA: | 2024 | | 2023 | | | | 2024 | | 2023 |

| Net loss | $ | (866) | | | $ | (1,303) | | | | | $ | (3,953) | | | $ | (3,987) | |

| Depreciation expense | 587 | | | 1,114 | | | | | 2,075 | | | 3,497 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Stock based compensation | 5 | | | 5 | | | | | 15 | | | 18 | |

| Interest expense and financing charges, net | 127 | | | 117 | | | | | 377 | | | 376 | |

| | | | | | | | | |

| Adjusted EBITDA | $ | (147) | | | $ | (67) | | | | | $ | (1,486) | | | $ | (96) | |

Other Services(a) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | | | September 30, |

| Reconciliation of net income (loss) to Adjusted EBITDA: | 2024 | | 2023 | | | | 2024 | | 2023 |

| Net income (loss) | $ | 519 | | | $ | (675) | | | | | $ | (2,941) | | | $ | (4,278) | |

| Depreciation, amortization and accretion expense | 737 | | | 1,755 | | | | | 2,603 | | | 6,291 | |

| Gains on disposal of assets, net | (192) | | | (123) | | | | | (1,487) | | | (813) | |

| Impairment of goodwill | — | | | 1,810 | | | | | — | | | 1,810 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Stock based compensation | 18 | | | 14 | | | | | 47 | | | 73 | |

| Interest expense and financing charges, net | 193 | | | 221 | | | | | 574 | | | 699 | |

| Other (income) expense, net | (373) | | | (2,734) | | | | | 735 | | | (2,327) | |

| Provision for income taxes | 11 | | | 57 | | | | | 2,798 | | | 595 | |

| | | | | | | | | |

| Adjusted EBITDA | $ | 913 | | | $ | 325 | | | | | $ | 2,329 | | | $ | 2,050 | |

a. Includes results for Mammoth’s aviation, equipment rentals, remote accommodations and equipment manufacturing and corporate related activities. The Company’s corporate related activities do not generate revenue.

v3.24.3

Cover

|

Nov. 01, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 01, 2024

|

| Entity Registrant Name |

Mammoth Energy Services, Inc.

|

| Entity File Number |

001-37917

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

32-0498321

|

| Entity Address, Address Line One |

14201 Caliber Drive,

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Oklahoma City,

|

| Entity Address, State or Province |

OK

|

| City Area Code |

(405)

|

| Local Phone Number |

608-6007

|

| Entity Address, Postal Zip Code |

73134

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

TUSK

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001679268

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

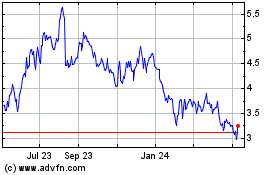

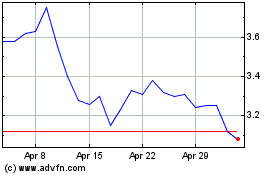

Mammoth Energy Services (NASDAQ:TUSK)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mammoth Energy Services (NASDAQ:TUSK)

Historical Stock Chart

From Nov 2023 to Nov 2024