GM's Operating Profit Hurt by China Results, U.S. Production Cuts --Update

April 30 2019 - 10:03AM

Dow Jones News

By Mike Colias

General Motors Co.'s operating profit declined 11% in the first

quarter, dragged down by weaker results in China and a planned cut

in production of big sport-utility vehicles in the U.S.

GM said its operating profit for the January-through-March

period totaled $2.3 billion, down from $2.6 billion a year earlier.

Operating earnings per share were $1.41, surpassing Wall Street

analysts' average estimate of $1.10 per share.

Those results were lifted 31 cents by revaluations of GM's stake

in ride-hailing firm Lyft Inc., which it took in early 2016, and

French auto maker PSA Group. GM marked up the value of its stake in

Lyft, which had climbed higher than what was previously recorded on

GM's books following the ride-hailing firm's IPO last month.

Net income more than doubled, to $2.16 billion, from a year

earlier when GM recorded hefty restructuring charges in South

Korea. First-quarter revenue fell 3%, to $34.9 billion.

GM shares dropped about around 3% in premarket trading.

GM executives said in January that the first quarter would be

its weakest of the year, partly because of its plan to temporarily

stop building big, high-margin SUVs at the company's factory in

Arlington, Texas, to prepare the facility to make new versions.

Production at the plant, which makes the Chevrolet Suburban,

Cadillac Escalade and other SUVs, fell 27% during the quarter,

according to an estimate from WardsAuto.com

The results show that GM's bottom line is increasingly reliant

on its highly profitable pickup truck and large-SUV lines,

especially as profits from its sizable operation in China ebb amid

an industry wide slowdown in the Chinese auto market. GM's

first-quarter income from China fell 37% from a year earlier, to

$376 million.

Auto-industry sales in China dropped last year for the first

time in more than two decades and sank another 11% in the first

quarter, while GM's declined nearly 18%.

GM finance chief Dhivya Suryadevara said there are "green

shoots" in China that point to improved economic activity, though

that hasn't translated to a rebound in vehicle sales. She said GM

still believes the market could be "roughly flat" for the year --

which would require growth over the remaining three quarters -- but

said that would depend on whether Beijing provides consumer

incentives for auto purchases.

In January, GM said its 2019 profit forecast factored in flat

industry-wide sales in China, the company's largest market by

sales. Ms. Suryadevara reiterated GM's full-year profit forecast of

$6.50-$7 earnings per share, versus $6.54 last year.

GM is reaping stronger pricing in the U.S., especially on its

pickup trucks. This factor also helped propel rival Ford Motor

Co.'s profits higher last week when it reported first-quarter

earnings. Detroit auto makers dominate the market for big pickup

trucks and similar large SUVs, categories that contribute the vast

majority of global profits for both GM and Ford, analysts

estimate.

Buyers paid an average of around $48,000 for GM's large pickup

trucks -- the Chevrolet Silverado and GMC Sierra -- up about 20%

during the quarter following a redesign of those models. That

pricing power helped to offset the decline in production of its big

SUVs, Ms. Suryadevara said.

GM was the subject of criticism from President Trump in March

over its closure of a factory in Lordstown, Ohio.

On Tuesday, the company said the broader restructuring effort

that included the plant closure, along with thousands of layoffs

among salaried workers, boosted the first-quarter bottom line by

roughly $400 million, Ms. Suryadevara. The company has said it

expects the moves to help operating profit by $2 billion to $2.5

billion this year.

GM Chief Executive Mary Barra has described the effort as a

transformation of GM as it pushes into new areas like self-driving

cars that are rife with new competition from well-funded Silicon

Valley newcomers.

On Tuesday, Ms. Suryadevara reiterated GM's target of launching

a commercial ride-hailing service by the end of 2019 if it can be

deployed safely. GM spent about $200 million on its San

Francisco-based Cruise driverless-car division in the first quarter

and plans to spend about $1 billion total this year as it hires

hundreds more employees.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

April 30, 2019 09:48 ET (13:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

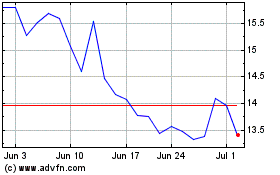

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Apr 2023 to Apr 2024