UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities and

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to Section 240.14a-12

LCNB CORP.

..................................................................

(Name of Registrant as Specified In Its Charter)

N/A

..................................................................

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1) Title of each class of securities to which transaction applies:

N/A

...........................................................

2) Aggregate number of securities to which transaction applies:

N/A

...........................................................

3) Per unit price of other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 set forth the amount on which the filing fee is calculated and state how it was determined):

N/A

...........................................................

4) Proposed maximum aggregate value of transaction:

N/A

...........................................................

5) Total fee paid:

N/A

...........................................................

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

N/A

...........................................................

2) Form, Schedule or Registration Statement No.:

N/A

...........................................................

3) Filing Party:

N/A

...........................................................

4) Date Filed:

N/A

...........................................................

LCNB CORP.

P.O. Box 59

Lebanon, Ohio 45036

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

DATE: APRIL 26, 2022

TIME: 10:00AM EDT

ACCESS: The Annual Meeting of Shareholders can be accessed virtually at meetnow.global/M2LYYDT.

TO THE SHAREHOLDERS OF LCNB CORP.:

You are cordially invited to attend the annual meeting of the shareholders of LCNB Corp. to be held on April 26, 2022 at 10:00AM EDT. The meeting will be held virtually via the Internet for the safety of our shareholders, employees and directors in light of the ongoing COVID-19 pandemic. The meeting will be held for the purpose of considering and acting on the following:

1. Electing Class II directors to serve until the 2025 annual meeting.

2. Amending the Articles of Incorporation to eliminate cumulative voting for director elections.

3. Adopting an advisory, non-binding “say-on-pay” resolution to approve the compensation of our named executive officers.

4. Adopting an advisory, non-binding resolution regarding the frequency of our advisory votes on executive compensation.

5. Ratifying the appointment of BKD, LLP as the independent registered public accounting firm for LCNB Corp.

6. Transacting such other business as may properly come before the meeting or any adjournment thereof.

Shareholders of record at the close of business on March 1, 2022 will be entitled to vote at the meeting.

By Order of the Board of Directors

/s/ Eric J. Meilstrup

Eric J. Meilstrup

President & Chief Executive Officer

March 11, 2022

IMPORTANT

| | |

| A proxy statement and proxy are submitted herewith. As a shareholder, you are urged to complete and mail the proxy promptly whether or not you plan to attend this virtual annual meeting in person. Shareholders who attend the annual meeting by following the instructions to join the virtual meeting described on page 35 will be considered to be attending the annual meeting “in person.” Alternatively, refer to the instructions on the proxy card for details about transmitting your voting instructions electronically via the Internet or by telephone. The proxy is revocable at any time prior to the exercise thereof by written notice to the company, and shareholders who attend the annual meeting may withdraw their proxies and vote their shares via the Internet if they so desire. |

PROXY STATEMENT

LCNB CORP.

P.O. Box 59

Lebanon, Ohio 45036

ANNUAL MEETING OF SHAREHOLDERS

April 26, 2022

INTRODUCTION

The enclosed proxy is solicited by the Board of Directors of LCNB Corp. (also referred to as “LCNB” or the “Company”), in connection with the annual meeting of shareholders to be held on April 26, 2022 at 10:00AM EDT, or at any adjournments thereof. In light of the COVID-19 pandemic, for the safety of our directors, employees and shareholders, we have determined that the Annual Meeting will be held in a virtual meeting format only, via the Internet, with no physical in-person meeting. If you plan to attend the virtual meeting, please see “Information about the 2022 Virtual Annual Meeting” on page 43. Shareholders will be able to attend, vote and submit questions (both before, and for a portion of, the meeting) from any location via the Internet.

The meeting has been called for the following purposes:

| | | | | | | | |

| Proposal Number | Description | Board Recommendation |

| 1 | Election of Directors | FOR ALL the Company’s nominees |

| To elect four Class II directors to serve until the 2025 meeting of stockholders and until their successors are duly elected and qualified. | |

| 2 | Approval of the Elimination of Cumulative Voting for Future Director Elections | FOR |

| To approve removing the cumulative voting mechanism from future director elections in line with peers. | |

| 3 | Advisory Vote on the Compensation of our Named Executive Officers | FOR |

| To approve, on an advisory basis, a resolution regarding the compensation of our named executive officers. | |

| 4 | Advisory Vote on the Frequency of the Advisory Votes on the Compensation of our Named Executive Officers | ONE YEAR |

| To approve, on an advisory basis, a resolution regarding the frequency of our advisory votes on executive compensation. | |

| 5 | Ratification of Appointment of Independent Registered Public Accounting firm | FOR |

| To ratify the appointment of BKD, LLP as the independent registered public accounting firm for the Company. | |

In addition, the meeting will include transacting such other business as may properly come before the meeting or any adjournment thereof.

This Proxy Statement and the accompanying notice of meeting are being mailed to shareholders on or about March 11, 2022.

REVOCATION OF PROXIES, DISCRETIONARY

AUTHORITY AND CUMULATIVE VOTING

LCNB common shares can be voted at the annual meeting only if the shareholder is represented by proxy or is present in person at the virtual annual meeting. Shareholders who attend the annual meeting by following the instructions to join the virtual meeting described on page 43 will be considered to be attending the annual meeting “in person.” Shareholders who execute proxies retain the right to revoke them at any time. Unless so revoked, the shares represented by such proxies will be voted at the meeting and all adjournments thereof. Proxies may be revoked by: (i) written notice to the Secretary of LCNB (addressed to LCNB Corp., P.O. Box 59, Lebanon, Ohio 45036, Attention: Secretary); (ii) by the filing of a later dated proxy prior to a vote being taken on a particular proposal at the meeting; or (iii) during the virtual meeting at any time before it is voted.

Proxies solicited by the Board of Directors of LCNB (the “Board”) will be voted in accordance with the directions given therein. Where no instructions are indicated, properly executed proxies will be voted in line with the Board Recommendations explained in the Introduction on page 9. The proxy confers discretionary authority on the persons named therein to vote with respect to (i) the election of any person as a director where the nominee is unavailable or unable to serve, (ii) matters incident to the conduct of the meeting and (iii) any other business that may properly come before the meeting or any adjournments thereof. At this time, it is not known whether there will be cumulative voting for the election of directors at the meeting. If any shareholder demands cumulative voting for the election of directors at the meeting, your proxy will give the individuals named on the proxy full discretion and authority to vote cumulatively, and in their sole discretion, to allocate votes among any or all of the nominees, unless authority to vote for any or all of the nominees is withheld.

PERSONS MAKING THE SOLICITATION

The enclosed proxy is being solicited by LCNB. LCNB will bear the entire cost of the Board’s solicitation of proxies, including the preparation, assembly and mailing of this Proxy Statement, the Proxy Card, the Notice of Annual Meeting of Shareholders and any additional information furnished to shareholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries, and custodians holding shares of our Common Stock in their names that are beneficially owned by others to forward to those beneficial owners. We may reimburse persons representing beneficial owners for their costs of forwarding the solicitation materials to the beneficial owners. Original solicitation of proxies may be supplemented by telephone, facsimile, electronic mail or personal solicitation by our directors, officers or staff members. Other than the persons described in this Proxy Statement, no general class of employee of LCNB or the Bank will be employed to solicit shareholders in connection with this proxy solicitation. However, in the course of their regular duties, employees may be asked to perform clerical or ministerial tasks in furtherance of this solicitation. No additional compensation will be paid to our directors, officers or staff members for such services. We have retained Morrow Sodali to act as a proxy solicitor in conjunction with the 2022 Annual Meeting. We have agreed to pay Morrow Sodali a fee of $15,000, plus reasonable out-of-pocket expenses for proxy solicitation services.

VOTING SECURITIES

Each of the LCNB common shares (the “Common Shares”) outstanding on March 1, 2022, the record date of the meeting, is entitled to one vote on all matters coming before the meeting. As of March 1, 2022, LCNB had 11,364,403 Common Shares issued and outstanding. Only shareholders of record on the books of the Company on March 1, 2022 will be entitled to vote at the meeting either in person or by proxy. The presence at the meeting of at least a majority of the Common Shares, in person or by proxy, will be required to constitute a quorum at the meeting. Virtual attendance at the annual meeting constitutes presence “in person” for purposes of quorum at the meeting.

Shareholders of LCNB have cumulative voting rights in connection with the election of directors if notice is given to the President, a Vice-President or the Secretary of LCNB, not less than 48 hours before the time fixed for holding the meeting, that any shareholder desires that the voting be cumulative. Cumulative voting rights enable a shareholder to cumulate his or her voting power to give one candidate as many votes as the number of directors to be elected multiplied by the number of Common Shares owned by that person, or to distribute their votes on the same principal among two or more candidates as the shareholder sees fit. If any shareholder demands cumulative voting for the election of directors at the meeting, your proxy will give the individuals named on the proxy full discretion and authority to vote cumulatively, and in their sole discretion, to allocate votes among any or all of the nominees, unless authority to vote for any or all of the nominees is withheld.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of March 1, 2022, there are no beneficial owners of more than 5% of Common Shares known by LCNB.

The following table sets forth, as of March 1, 2022 (except as otherwise noted), the ownership of Common Shares by management of LCNB, including (i) the Common Shares beneficially owned by each director, nominee for director and executive officers of LCNB and (ii) the Common Shares beneficially owned by all executive officers and directors as a group.

| | | | | | | | | | | | | | | | | |

Name of Beneficial Owner | |

Number of Common Shares Beneficially Owned(1) | |

Percent of Common Shares Outstanding |

| | | |

Eric J. Meilstrup President, Chief Executive Officer and Director | | 22,816 | | 0. 20% | |

Spencer S. Cropper(2) Chairman of the Board | | 36,736 | | 0.32% | |

Steve P. Foster Director | | 40,262 | | 0.35% | |

Stephen P. Wilson Director | | 63,490 | | 0.56% | |

Mary E. Bradford Director | | 2,697 | | 0.02% | |

William G. Huddle(3) Director | | 171,482 | | 1.51% | |

Craig M. Johnson(4) Director | | 5,697 | | 0.05% | |

Michael J. Johrendt Director | | 150,698 | | 1.33% | |

William H. Kaufman(5) Director | | 77,757 | | 0.68% | |

Anne E. Krehbiel Director, Secretary | | 6,697 | | 0.06% | |

Takeitha W. Lawson Director | | 170 | | 0.00% | |

Robert C. Haines II Executive Vice President, Chief Financial Officer | | 13,147 | | 0.12% | |

-

| | | | | | | | | | | | | | | | | |

Matthew P. Layer(6) Executive Vice President | | 20,308 | | 0.18% | |

Michael R. Miller Executive Vice President, Trust Officer | | 11,167

| | 0.10% | |

Bradley A. Ruppert Executive Vice President, Trust Officer, Chief Investment Officer | | 9,203 | | 0.08% | |

Lawrence Mulligan Executive Vice President, Chief Operatingl Officer | | 8,874 | | 0.08% | |

All directors and officers as a group (16 persons) | | 641,201 | | 5.64% | |

| | |

(1)The Securities and Exchange Commission has defined “beneficial owner” of a security to include any person who has or shares voting power or investment power with respect to any such security or who has the right to acquire beneficial ownership of any such security within 60 days. The number of shares listed for each person includes shares held in the name of spouses, minor children, certain relatives, trusts or estates whose share ownership under the beneficial ownership rules of the Securities and Exchange Commission is to be aggregated with that of the director or officer whose share ownership is shown.

(2)Does not include 105,126 shares held in a Family Limited Partnership in which Mr. Cropper owns 50% interest. Includes 3,000 shares held by Mr. Cropper’s spouse. Includes 14,700 shares held by Mr. Cropper’s children.

(3)Includes 19,930 shares held by Mr. Huddle’s spouse.

(4)Includes 3,000 shares held by Mr. Johnson’s spouse.

(5)Includes 33,200 shares held in trust, 16,800 shares held jointly with Mr. Kaufman’s spouse, and 10,040 shares owned by Mr. Kaufman’s spouse.

(6)Includes 323 shares held by Mr. Layer’s spouse.

ITEMS OF BUSINESS TO BE VOTED ON BY SHAREHOLDERS

PROPOSAL 1. ELECTION OF DIRECTORS

LCNB’s Code of Regulations (i.e. bylaws) provide that its business shall be managed by a Board of Directors of not less than five nor more than fifteen persons. LCNB’s Amended Articles of Incorporation divide such directors into three classes as nearly equal in number as possible and set their terms at three years. The Board of Directors currently has eleven members, with Class I having three members, Class II having four members, and Class III having four members.

Assuming that at least a majority of the issued and outstanding Common Shares are present at the meeting so that a quorum exists, the nominees for Class II directors receiving the most votes will be elected as directors.

The Board of Directors has nominated:

Steve P. Foster

Michael J. Johrendt

Anne E. Krehbiel

Takeitha W. Lawson

The nominees have been nominated to serve as Class II directors until the 2025 annual meeting of shareholders and until their respective successors are elected and qualified. Each of the nominees are incumbent directors whose present terms will expire at the 2022 annual meeting.

Please see the narrative under the heading “Director and Nominee Qualifications” beginning on page 15 of this Proxy Statement for additional discussion of the qualifications of each director nominee and continuing director.

It is intended that Common Shares represented by the accompanying form of proxy will be voted FOR the election of the nominees, unless contrary instructions are indicated as provided on the proxy card. If you do not wish your shares to be voted for particular nominees, please so indicate on the proxy card. If one or more of the nominees should at the time of the meeting be unavailable or unable to serve as a director, the shares represented by the proxies will be voted to elect the remaining nominees and any substitute nominee or nominees designated by the Board of Directors. The Board of Directors knows of no reason why any of the nominees will be unavailable or unable to serve. At this time, it is not known whether there will be cumulative voting for the election of directors at the meeting. If any shareholder properly demands cumulative voting for the election of directors at the meeting, your proxy will give the individuals named on the proxy full discretion and authority to vote cumulatively and in their sole discretion to allocate votes among any or all of the nominees, unless authority to vote for any or all of the nominees is withheld.

The following table sets forth information concerning the nominees for the Class II directors of LCNB.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name |

Age |

Principal Occupation | Positions Held with LCNB | Director of LCNB or Bank Since | Term To Expire |

| Steve P. Foster | 69 | Former President and CEO of LCNB | Director | 2005 | 2022 |

| Michael J. Johrendt | 68 | Attorney at Law, Johrendt & Holford | Director | 2018 | 2022 |

| Anne E. Krebiel | 66 | Attorney at Law, Krehbiel Law Office | Director and Secretary | 2010 | 2022 |

| Takeitha W. Lawson | 42 | Operations Director, Cincinnati Bell | Director | 2021 | 2022 |

| | | | | |

The Board of Directors unanimously recommends that shareholders vote FOR the election of each of the director nominees.

PROPOSAL 2. APPROVAL OF AN AMENDMENT TO THE ARTICLES OF INCORPORATION TO ELIMINATE CUMULATIVE VOTING

We are asking our shareholders to vote to approve the elimination of the cumulative voting mechanism in future director elections through an amendment to the Fifth Article of the Amended and Restated Articles of Incorporation of LCNB Corp.

The Board carefully assessed and deliberated the decision to amend the Articles to eliminate cumulative voting, which had been included through a default provision under the Ohio Revised Code. The Board believes that each director is accountable to and should represent the interests of all of the Company's shareholders, and not just a minority shareholder or shareholder group that has cumulatively voted its shares and that may have special interests contrary to those of the majority of shareholders. Among other things, the election of directors who view themselves as representing a particular minority shareholder could result in partisanship and discord on the Board and may impair the ability of the directors to act in the best interests of LCNB and its shareholders. The Board believes that few public companies have cumulative voting in the election of directors, and that majority voting is viewed as a best governance practice. The Board, therefore, believes that each candidate in a director election should be elected only if he or she receives majority support, which cumulative voting could potentially preclude. Cumulative voting allows a shareholder owning far less than a majority of the outstanding shares to elect a director, even if that director was not supported by a majority of our shareholders.

This description of the proposed amendment to the Articles of Incorporation is only a summary and is qualified in its entirety by reference to the actual text of the proposed amendments to the Fifth Article. If adopted, the amendment to the Fifth Article of the Articles of Incorporation to eliminate cumulative voting in director elections will become effective upon filing with the Ohio Secretary of State, which is expected to occur promptly following the Annual Meeting.

Currently, the Fifth Article of LCNB’s Articles of Incorporation reads as follows:

“The number of Directors of the Corporation shall be fixed from time to time in accordance with the Corporation’s Regulations and may be increased or decreased as therein provided. The Board of Directors shall be divided into three classes, as nearly equal in number as the then total number of Directors constituting the whole Board permits, it not being required that each class have the same number of members if such is mathematically impossible with the term of office of one class expiring each year. At the organizational meeting of shareholders, Directors of the first class shall be elected to hold office for a term expiring at the next succeeding Annual Meeting; Directors of the second class shall be selected to hold office for a term expiring at the second succeeding Annual Meeting and Directors of the third class shall be selected to hold office for a term expiring at the third succeeding Annual Meeting. Thereafter, at each Annual Meeting of shareholders, the successors to the class of Directors whose term shall then expire shall be elected to hold office for a term expiring at the third succeeding Annual Meeting after such election. In the event of any increase in the number of Directors of the Corporation; the additional Directors shall be so classified that all classes of Directors shall be increased equally as nearly as may be possible. In the event of any decrease in the number of Directors of the Corporation, all classes of Directors shall be decreased equally as nearly as possible.”

If Proposal 2 is approved and the Amendment is implemented, the Fifth Article of LCNB’s Articles of Incorporation shall read as follows:

“The number of Directors of the Corporation shall be fixed from time to time in accordance with the Corporation’s Regulations and may be increased or decreased as therein provided. The Board of Directors shall be divided into three classes, as nearly equal in number as the then total number of Directors constituting the whole Board permits, it not being required that each class have the same number of members if such is mathematically impossible with the term of office of one class expiring each year. At the organizational meeting of shareholders, Directors of the first class shall be elected to hold office for a term expiring at the next succeeding Annual Meeting; Directors of the second class shall be selected to hold office for a term expiring at the second succeeding Annual Meeting and Directors of the third class shall be selected to hold office for a term expiring at the third succeeding Annual Meeting. Thereafter, at each Annual Meeting of shareholders, the successors to the class of Directors whose term shall then expire shall be elected to hold office for a term expiring at the third succeeding Annual Meeting after such election. No shareholder shall have any cumulative voting rights. In the event of any increase in the number of Directors of the Corporation; the additional Directors shall be so classified that all classes of Directors shall be increased

equally as nearly as may be possible. In the event of any decrease in the number of Directors of the Corporation, all classes of Directors shall be decreased equally as nearly as possible.”

The Board of Directors unanimously recommends that shareholders vote FOR the amendment to the Articles of Incorporation to eliminate the cumulative voting mechanism.

PROPOSAL 3. ADVISORY VOTE ON EXECUTIVE COMPENSATION (“SAY-ON-PAY”)

We are asking our shareholders to vote to approve, on a non-binding advisory basis, the compensation of our named executive officers (sometimes referred to as “NEOs”). This non-binding advisory vote, commonly referred to as “Say-on-Pay,” is not intended to address any specific item of compensation, but instead relates to the compensation of our “named executive officers” as disclosed in the Compensation Discussion and Analysis and the Summary Compensation Table and related narrative included in this proxy statement.

The Compensation Committee believes we have an effective compensation program that is designed to recruit and keep top quality executive leadership focused on attaining short-term and long-term corporate goals and increasing shareholder value. We believe that our executive compensation program is designed to reasonably and fairly recruit, motivate, retain and reward our executives for achieving our objectives and goals. Through equity grants, each of our executive officers is aligned with the long-term interests of shareholders in increasing the value of LCNB. Moreover, our performance-based compensation system links executive pay to LCNB’s short- and long-term performance.

As an advisory vote, the Say-on-Pay resolution is not binding. The approval or disapproval of this Proposal 3 by shareholders will not require the Board or the Compensation Committee to take any action regarding our executive compensation practices. The final decision on the compensation and benefits of our executive officers and on whether, and if so, how, to address any shareholder approval or disapproval remains with the Board and the Compensation Committee. However, the Board values the opinions of our shareholders as expressed through their votes and other communications. Accordingly, the Board and the Compensation Committee will review and consider the results of the “Say-on-Pay” vote, the opinions of our shareholders, and other relevant factors in making future decisions regarding our executive compensation program.

We encourage you to read the “Compensation Discussion and Analysis” and the related compensation tables and narrative that follow. These sections describe our executive compensation policies and practices and provide detailed information about the compensation of our named executive officers.

The Board of Directors recommends that shareholders vote FOR the approval, on a non-binding advisory basis, of the executive compensation paid by LCNB to its named executive officers and the following resolution:

“RESOLVED, that the compensation paid to LCNB’s named executive officers, as disclosed in this proxy statement pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables, footnotes and narrative discussion, is hereby APPROVED.”

PROPOSAL 4. ADVISORY VOTE ON THE FREQUENCY OF THE VOTE ON EXECUTIVE COMPENSATION

As required by Section 14A of the Securities Exchange Act of 1934, we are offering our shareholders an opportunity to cast an advisory vote on whether a non-binding shareholder advisory vote on the compensation of our named executive officers should occur every one, two or three years. Although the vote is non-binding, we value continuing and constructive feedback from our stockholders on compensation and other important matters. The Board and the Compensation Committee will take into consideration the voting results when determining how often a non-binding shareholder advisory vote on the compensation of our named executive officers should occur.

The Board has determined that an advisory vote on executive compensation every year is the best approach for the Company based on a number of considerations, including the vote frequency which the Board believes the majority of our investors prefer.

Shareholders are not voting to approve or disapprove of the Board’s recommendation. Instead, the proxy card provides shareholders with four choices with respect to this proposal: (1) every year, (2) every two years, (3) every three years or (4) abstaining from voting on the proposal. For the reason discussed above, we are asking our shareholders to indicate their support for the non-binding advisory vote on executive compensation to be held every year.

Generally, approval of any matter presented to shareholders requires the affirmative vote of the holders of a majority of the shares of common stock represented at the annual meeting and voting on the matter. However, because this vote is advisory and non-binding, if none of the frequency options receive the vote of a majority of common shares represented at the annual meeting and voting thereon, the option receiving the greatest number of votes will be considered the frequency recommended by the Company’s shareholders. Even though this vote will neither be binding on the Company or Board, the Board of Directors will take into account the result of the vote when determining the frequency of future say-on-pay votes.

The Board of Directors recommends that shareholders vote to recommend an advisory vote on executive compensation every ONE YEAR.

PROPOSAL 5. RATIFICATION OF THE APPOINTMENT OF BKD, LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE COMPANY

The Audit Committee of the Board of Directors of the Company has selected BKD, LLP (“BKD”), 312 Walnut Street, Suite 3000, Cincinnati, Ohio, as the Company’s independent registered public accounting firm to perform the audit of the Company’s financial statements and internal controls over financial reporting for the fiscal year ending December 31, 2022. BKD, LLP was the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2021 and has served the Company in that role since 2014.

Representatives from BKD are expected to attend the virtual annual meeting. They will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate shareholder questions.

We are asking our shareholders to ratify the selection of BKD as the Company’s independent registered public accounting firm. Although ratification of the appointment is not required by law, the Company’s Regulations, or otherwise, the Board is submitting the selection of BKD to our shareholders for ratification as a matter of good corporate practice. Even if the selection is ratified, the Audit Committee, in its discretion, may select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interest of the Company and our shareholders.

It is intended that the common shares represented by the accompanying form of proxy will be voted FOR the resolution ratifying the appointment of BKD as the Company’s independent registered public accounting firm, unless contrary instructions are indicated as provided on the proxy card. If you do not wish your shares to be voted for the resolution, please so indicate on the proxy card.

The Board of Directors recommends that shareholders vote FOR the ratification of BKD, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022.

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth information concerning the directors, nominees for director and executive officers of LCNB. Included in the table is information regarding each person’s principal occupation or employment during the past five years.

| | | | | | | | | | | | | | |

Name, Age |

Principal Occupation |

Positions Held with LCNB | Director of LCNB or Bank Since | Term to Expire |

| | | | |

Eric J. Meilstrup, 54 | Banker, President and Chief Executive Officer | Director and President | 2018 | 2024 |

| | | | |

Spencer S. Cropper, 49 |

Certified Public Accountant for Stolle Properties, Inc. |

Director, Chairman of the Board |

2006 |

2024 |

| | | | |

Steve P. Foster, 69 | Former President and CEO of LCNB | Director | 2005 | 2022 |

| | | | |

| Mary E. Bradford, 66 | Former IT Executive, GE Aviation | Director | 2018 | 2023 |

| | | | |

Stephen P. Wilson, 71 | Ohio State Senator, Former CEO of LCNB | Director | 1982 | 2024 |

| | | | |

| William (“Rhett”) G. Huddle, 66 | Former Banker | Director | 2018 | 2023 |

| | | | |

| Craig M. Johnson, 66 | Certified Public Accountant | Director | 2019 | 2023 |

| | | | |

| Michael J. Johrendt, 68 | Attorney at Law, Johrendt & Holford | Director | 2018 | 2022 |

| | | | |

William H. Kaufman, 78 | Attorney at Law, Kaufman & Florence | Director | 1982 | 2023 |

| | | | |

Anne E. Krehbiel, 66 | Attorney at Law, Krehbiel Law Office | Director, Secretary | 2010 | 2022 |

| | | | |

Takeitha W. Lawson 42 |

Operations Director, Cincinnati Bell |

Director |

2021 |

2022 |

| | | | |

Robert C. Haines II, 49 | Banker | Executive Vice President, Chief Financial Officer | N/A | N/A |

| | | | |

| | | | | | | | | | | | | | |

Matthew P. Layer, 59 | Banker | Executive Vice President, Chief Lending Officer | N/A | N/A |

| Lawrence P. Mulligan, Jr., 53 | Banker | Executive Vice President, Chief Operating Officer | N/A | N/A |

| | | | |

Michael R. Miller, 64 | Banker | Executive Vice President, Trust Officer | N/A | N/A |

| | | | |

Bradley A. Ruppert, 46 | Banker | Executive Vice President, Trust Officer, Chief Investment Officer | N/A | N/A |

.

Director and Nominee Qualifications

The Nominating and Governance Committee (“Nominating Committee”) of our Board of Directors considers candidates to fill new directorships created by expansion and vacancies that may occur and makes recommendations to the Board of Directors with respect to such candidates. There are currently no vacancies on the Board. The Board has not adopted a policy with respect to minimum qualifications for directors, rather the Nominating Committee evaluates each individual in the context of the board as a whole and with the objective of recommending a group of persons that can best implement our business plan, perpetuate our business and represent shareholder interests. The Nominating and Governance Committee, in making its nominations, considers all relevant qualifications of candidates for board membership, including, among other things, factors such as an individual’s business experience, industry knowledge and experience, financial background, breadth of knowledge about issues affecting the Company, public company experience, regulatory experience, diversity, current employment and other board memberships, and whether the candidate will be independent under the listing standards of the NASDAQ Stock Market (“NASDAQ”). In some cases, the Nominating and Governance Committee may require certain skills or attributes, such as financial or accounting experience, to meet specific Board needs that arise from time to time. In the case of incumbent directors whose terms of office are set to expire, the committee also reviews such director’s overall service to the Company during his or her term and any relationships and transactions that might impair such director’s independence.

The following table provides certain information, as of the date of this proxy statement, concerning each of this year’s nominees for election as a Class II director of LCNB. Unless otherwise indicated, each individual has had the same principal occupation for more than five years. Each individual also serves as a director of the Bank.

| | | | | | | | |

Steve P. Foster Age: 69 Director Since: 2005 Term Expires: 2022 | | A diverse career within the banking industry provides Steve P. Foster with the ability to provide insight in a breadth of areas to the Board of LCNB Corp.

Mr. Foster is the former Chief Executive Officer of both LCNB Corp. and LCNB National Bank, a position he held from 2015 until retirement in 2019.

He joined LCNB National Bank in 1977 and served as internal auditor, branch manager, and loan officer. He founded the Information Technology Department and served as Chief Financial Officer and President.

Mr. Foster is a former Chair of the Ohio Bankers League, one of the strongest financial trade associations in the country.

He serves on the Trust Committee, the Pension Committee, and the Loan Committee. |

| | |

Anne E. Krehbiel Age: 66 Director Since: 2010 Term Expires: 2022 | | Anne E. Krehbiel’s distinguished career as an attorney and firm principal provides a valuable perspective on legal matters and business management to the Board of LCNB Corp.

Earning a J.D. from the University of Cincinnati in 1980, Ms. Krehbiel worked at US Bank, and practiced law in several capacities, prior to founding Krehbiel Law Offices in 1998. She is OSBA Board Certified in Estate Planning and a Trust and Probate Law Specialist.

Ms. Krehbiel serves on the Warren County Bar Association (past President), the Warren County Foundation Board of Trustees, and Lebanon Rotary International.

Ms. Krehbiel is the Corporate Secretary for LCNB Corp., chairs the Compensation Committee, and serves on the Audit and Nominating & Corporate Governance Committees. |

| | |

Michael J. Johrendt Age: 68 Director Since: 2018 Term Expires: 2022 | | Expertise in law and commercial real estate are among Michael J. Johrendt’s significant contributions to the LCNB Corp. Board.

A graduate of The Ohio State University Moritz College of Law, Mr. Johrendt practices business and tax law as a principal in the law firm of Johrendt & Holford based in Columbus, Ohio. Mr. Johrendt previously owned and operated a commercial real estate investment company.

Mr. Johrendt previously served as a Director of Columbus First Bank from August 2007 until its merger with and into LCNB National Bank in May 2018. Mr. Johrendt has also served as Vice-Chair of the Ohio Board of Tax Appeals.

Mr. Johrendt chairs the Nominating & Corporate Governance Committee and serves on the Compensation Committee. |

| | | | | | | | |

| | |

Takeitha W. Lawson Age: 42 Director Since: 2021 Term Expires: 2022 | | Takeitha (Kei) Lawson brings corporate finance and investor relations expertise to her role on the Board of LCNB Corp.

Ms. Lawson has experience in working in finance and operations for some of the nation’s most well-known companies, including DuPont, Lockheed Martin, and Lexmark. Currently, she holds a director-level role at Cincinnati Bell, and previously guided Investor Relations strategy for the company. She holds a B.S. from Temple University and an MBA from Drexel University and has held Six Sigma Green Belt certifications. Extremely active in the Cincinnati community, Ms. Lawson currently serves on non-profit boards in the treasury capacity, including Women Helping Women and Jack & Jill of America, Inc. (Cincinnati).

Ms. Lawson serves the LCNB Board through her participation on the Audit Committee, Compensation Committee, and the Nominating & Corporate Governance Committee. |

The following table provides certain information, as of the date of this Proxy Statement, concerning the current Class I and Class III directors of LCNB who will continue to serve after the annual meeting. Unless otherwise indicated, each individual has had the same principal occupation for more than five years. Each individual also serves as a director of the Bank.

| | | | | | | | |

| Class I Directors |

| | |

Spencer S. Cropper Age: 49 Director Since: 2006 Term Expires: 2024 | | Spencer S. Cropper’s career in accounting and investment provides a wealth of insight to his role as Chair of the LCNB Corp. Board. The Chairman of LCNB Corp. and LCNB National Bank since 2019, Mr. Cropper is employed by Stolle Properties, Inc., and is a Board Director of the parent Ralph J. Stolle Company. He is an investor in and serves on the Finance Committee of a Private Investment Company that primarily focuses on providing mezzanine financing through investment funds. Mr. Cropper is a Certified Public Accountant, and a member of the Ohio Society of Certified Public Accountants and the AICPA. He serves on the Board of Directors and Board of Trustees for the Ralph J. Stolle Countryside YMCA and is a Trustee for both the Warren County Foundation and the Bethesda Foundation. Mr. Cropper serves on the Audit, Pension, Compensation. and the Nominating & Corporate Governance committees. |

Eric J. Meilstrup Age: 54 Director Since: 2018 Term Expires: 2024 | | Eric J. Meilstrup offers extensive bank management expertise and market-specific knowledge to his seat on the Board of LCNB Corp. Mr. Meilstrup is the President and Chief Executive Officer of LCNB Corp. and LCNB National Bank, and has been with the Bank for 33 years, the last 18 as a member of its Executive team. He has served in several roles over his LCNB career including oversight of Deposit Operations, Branch Operations, Human Resources, Training, and Customer Service functions. Mr. Meilstrup serves on the Countryside YMCA Board (past Chair) and is a Trustee for the same organization. He serves as a Trustee of the Warren County Foundation, the West Side Church of Christ, a member of the Warren County Career Center District Business Advisory Committee and a current and charter member of the Lebanon Optimist Club.

Mr. Meilstrup is a member of the Pension Committee. |

| | |

Stephen P. Wilson Age: 71 Director Since: 1982 Term Expires: 2024 | | As the former CEO and Chairman of LCNB National Bank, Stephen P. Wilson brings both banking industry expertise and institutional knowledge to the LCNB Corp. Board. Mr. Wilson joined the LCNB staff in 1975 and served as Chief Executive Officer of LCNB and the Bank from 1992 through 2015. He is a Past Chairman of the American Bankers Association and a former board member of the Federal Reserve Bank of Cleveland. Mr. Wilson has represented the Ohio 7th District in the Ohio State Senate since 2017. He is a board member and treasurer of AAA Club Alliance, a Trustee of the Ralph J. Stolle Countryside YMCA, a Trustee of the Warren County Foundation, and a member of the Area Progress Council. He is also former Vice Chair of Warren Co. Port Authority and a former trustee of Miami University. Mr. Wilson serves on the Trust and Pension committees. |

| | | | | | | | |

| Class III Directors |

| | |

William H. Kaufman Age: 78 Director Since: 1982 Term Expires: 2023 | | In addition to his perspectives gained as a long-tenured board member of LCNB Corp., William H. Kaufman oversees operational legal matters and real estate closings for LCNB National Bank from his seat on the Board.

Mr. Kaufman is former senior partner of Kaufman & Florence in Lebanon, Ohio, and is presently Of Counsel at the firm. A graduate of the Northern Kentucky University Salmon P. Chase College of Law, he began his career as an attorney with Young and Jones, a legacy firm to Kaufman & Florence. He has extensive litigation experience in insurance cases and commercial disputes.

He is a former Mayor of the City of Lebanon and was elected to two terms as Judge of Lebanon Municipal Court.

Mr. Kaufman is the Assistant Secretary for the Board.

|

Mary E. Bradford Age: 66 Director Since: 2018 Term Expires: 2023 | | Mary E. Bradford provides a unique contribution to the LCNB Corp. Board through her expertise in information technology.

A retired executive who spent 31 years with GE Aviation, Ms. Bradford built her career implementing information technology solutions for the Finance, Engineering, Supply Chain, and Sales teams at GE. She is a Phi Beta Kappa graduate of Miami University in Oxford, Ohio, and holds an MBA with a concentration in Information Systems from Xavier University.

Ms. Bradford co-led the GE Women's Network Cincinnati Hub for a two-year term and represented GE on the Miami University Department of Information Systems & Analytics Advisory Board for many years.

Ms. Bradford serves on the Audit, Compensation, and Nominating & Corporate Governance committees. In addition, she contributes her expertise to the Bank’s Technology Committee. |

| | | | | | | | |

William (“Rhett”) G. Huddle Age: 66 Director Since: 2018 Term Expires: 2023 | | William (“Rhett”) G. Huddle offers expertise in both legal and banking matters to LCNB Corp. as the result of a successful professional career.

Joining the LCNB Corp. board upon the acquisition of Columbus First Bank Corp, Inc., Mr. Huddle was the lead in the formation of Columbus First. He served as Chairman and CEO of the bank from 2007 until June 2018. Mr. Huddle previously served in both executive and governing roles of several banks in the Columbus market. He was also an associate with BakerHostetler law firm for five years.

Mr. Huddle is a graduate of Princeton University and The Ohio State University Moritz College of Law.

Mr. Huddle is a member of the Trust and Loan committees. |

Craig M. Johnson Age: 66 Director Since: 2019 Term Expires: 2023 | | Craig M. Johnson provides financial counsel to the LCNB Corp. Board through his extensive experience in public accounting and banking.

Mr. Johnson is a Certified Public Accountant with nearly 40 years’ experience in both public accounting and private industry. Mr. Johnson retired as Principal from the accounting firm of Clark Schaefer Hackett & Co. Prior, he served as Partner at J.D. Cloud & Co. LLP. He previously held a position at an international public accounting firm and was local market controller for a large regional bank.

Mr. Johnson is a member of the Ohio Society of Certified Public Accountants and the AICPA. He serves the community as Treasurer and Board Member of the Clifton Cultural Arts Center and sits on the Finance Committee of Clifton United Methodist Church and the Audit Committee of Easter Seals TriState.

Mr. Johnson is Chair of the Audit Committee of LCNB Corp., and also sits on the Compensation and Nominating & Corporate Governance Committees. |

Board of Directors Diversity

The Bank has a policy in place to promote a diverse pool of candidates in its hiring, recruiting, retention, and promotion, as well as the selection to its Board and leadership. The Board seeks directors who represent a mix of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions. The Board has directed the Nominating Committee to consider, among other factors and criteria, diversity with respect to viewpoint, skills, experience and community involvement in its evaluation of candidates for Board membership. Such diversity considerations are discussed by the Nominating Committee in connection with the general qualifications of each potential nominee.

The following table gives certain information, as of the date of this Proxy Statement, concerning the current directors of LCNB.

| | | | | | | | | | | | | | |

Board Diversity Matrix (as of February 28, 2022) |

| Total Number of Directors | 11 |

| Female | Male | Non-Binary | Did not Disclose Gender |

| Part I: Gender Identity | |

| Directors | 3 | 8 | -- | -- |

| Part II: Demographic Background | |

| African American or Black | 1 | -- | -- | -- |

| Alaskan Native or Native American | -- | -- | -- | -- |

| Asian | -- | -- | -- | -- |

| Hispanic or Latinx | -- | -- | -- | -- |

| Native Hawaiian or Pacific Islander | -- | -- | -- | -- |

| White | 2 | 8 | -- | -- |

| Two or More Races or Ethnicities | -- | -- | -- | -- |

| LGBTQ+ | -- |

| Did Not Disclose Demographic Background | -- |

Board of Directors Independence

Each year, the Board reviews the relationships that each director has with the Company and with other parties. Only those directors who do not have any of the categorical relationships that preclude them from being independent within the meaning of applicable NASDAQ Rules and who the Board affirmatively determines have no relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director are considered to be independent directors. The Board has reviewed a number of factors to evaluate the independence of each of its members. These factors include its members’ current and historic relationships with the Company and its competitors, suppliers and customers; their relationships with management and other directors; the relationships their current and former employers have with the Company; and the relationships between the Company and other companies of which the Company’s Board members are directors or executive officers. After evaluating these factors, the Board has determined that all of the directors, with the exception of Steve P. Foster, Eric J. Meilstrup and William H. Kaufman, are independent directors of the Company within the meaning of applicable NASDAQ Rules.

Board Leadership Structure and Role in Risk Oversight

The Board currently separates the position of Chairman of the Board from the position of Chief Executive Officer (“CEO”). Eric J. Meilstrup serves as our CEO and Spencer S. Cropper serves as Chairman of the Board. As the oversight responsibilities of the Board of Directors have expanded over the years, the Board has determined that it is beneficial to have an independent Chairman with the sole job of leading the Board, while allowing the CEO to focus his efforts on the day-to-day management of the Company. The Board believes that it is important to have the CEO as a director. The Company aims to foster an appropriate level of separation between these two distinct levels of leadership of the Company. In addition to the Chairman, leadership is also provided through the respective chairs of the Board’s various committees. However, no single leadership model is right for all companies and at all times. The Board recognizes that, depending on the circumstances, other leadership models, such as a combined CEO and Chairman of the Board position, might be appropriate. Accordingly, the Board periodically reviews its leadership structure.

The Board of Directors is responsible for consideration and oversight of risks facing the Company and is responsible for ensuring that material risks are identified and managed appropriately. Several oversight functions are delegated to committees of the Board with such committees regularly reporting to the full Board the results of their respective oversight activities. For example, the Audit Committee meets periodically with management in order to review the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures. As part of this process, the Audit Committee reviews management’s risk-assessment process and reports its findings to the full Board. Also, the Compensation Committee periodically reviews the most important enterprise risks to ensure that compensation programs do not encourage excessive risk-taking. Additional review or reporting on enterprise risks is conducted as needed or as requested by the Board or Board committees.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

LCNB has engaged and intends to continue to engage in the lending of money through the LCNB National Bank, its wholly-owned subsidiary, to various directors and officers of the Company. These loans to such persons were made in the ordinary course of business and in compliance with applicable banking laws and regulations, on substantially the same terms, including interest rates and collateral, as prevailing at the time for comparable transactions with other persons and do not involve more than a normal risk of collectability or other unfavorable features.

In addition to those banking transactions conducted in the ordinary course, the Bank was involved in the related transactions described below. Each of these transactions was made on terms similar to those that could have been negotiated with an unaffiliated third party.

The Bank again retained the law firm of Kaufman & Florence during 2021 for legal services in connection with various matters arising in the course of the Bank’s business. William H. Kaufman, a director of LCNB, is a former Partner (currently Of Counsel) of Kaufman & Florence. Additionally, customers of the Bank are charged for certain legal services provided by Mr. Kaufman’s firm in the preparation of various documents. The approximate amount billed by Kaufman & Florence for legal services during 2021 was $73,000. The Bank contemplates using Mr. Kaufman’s firm in the future on similar terms, as needed.

The Company does not have a written process of approval and ratification of related party transactions. However, the Company does adhere to an unwritten policy, whereby before the Company or the Bank enters into any transaction for which the value of the transaction is expected to be at least $120,000, and an interested party in the transaction is a director, executive officer, an immediate family member of a director or officer, or a shareholder owning 5% or greater of the Company’s outstanding stock, the disinterested Board of Directors must review and approve the transaction. In reviewing the potential transaction, the directors will consider the fairness of the transaction to the Company, whether the transaction would or could compromise the interested party’s independence and judgment, the best interests of the Company, and such other factors determined advisable by the Board of Directors. In 2021, the Board of Directors reviewed and approved of the related party transaction with Mr. Kaufman’s firm, as described above.

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Securities Exchange Act of 1934 requires LCNB’s officers and directors and persons who own more than 10% of a registered class of LCNB’s equity securities to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Officers, directors and greater than 10% shareholders are required to furnish LCNB with copies of all Section 16(a) forms they file. Based solely on LCNB’s review of the Section 16(a) forms received by it and by statements of officers and directors concerning their compliance with the applicable filing requirements, the officers, directors and greater than 10% beneficial owners of LCNB have complied with all applicable filing requirements.

BOARD OF DIRECTORS MEETINGS AND COMMITTEES

During the fiscal year ended December 31, 2021, the Board of Directors met on 6 occasions. No director attended less than 75% of the aggregate of the total number of meetings of the Board and the committees on which he or she served. The Company encourages its directors to attend the Annual Meeting of the Shareholders, and in 2021, all of the directors attended the meeting, virtually or in person. Directors do not receive any compensation from LCNB for their service on the Board of Directors of LCNB. However, each director of LCNB also serves as a director of LCNB National Bank, the banking subsidiary of LCNB, which meets once per month, for which each director is compensated with a $30,000 annual retainer with the exception of the Chair who is compensated with a $40,000 annual retainer. In addition to the annual retainer, non-employee directors who serve on committees of the Board of Directors receive $440 for each committee meeting attended. The Chair of each committee receives $880 for each committee meeting attended. In addition, in 2021 each director received an equity grant equal to 10 percent of their annual retainer.

The table below summarizes all compensation paid to the directors of LCNB for their services as directors during fiscal year 2021.

| | | | | | | | | | | |

| Director Compensation |

| Name | Fees Earned or Paid in Cash ($)(1) | Equity Grant ($)(2) | Total ($) |

| Eric J. Meilstrup | $30,000 | $3,000 | $33,000 |

| Spencer S. Cropper | $46,600 | $4,000 | $50,600 |

| Steve P. Foster | $35,280 | $3,000 | $38,280 |

| Stephen P. Wilson | $35,280 | $3,000 | $38,280 |

| Mary E. Bradford | $39,680 | $3,000 | $42,680 |

| William (“Rhett”) G. Huddle | $35,280 | $3,000 | $38,280 |

| Craig M. Johnson | $38,800 | $3,000 | $41,800 |

| Michael J. Johrendt | $36,600 | $3,000 | $39,600 |

| William H. Kaufman | $30,000 | $3,000 | $33,000 |

| Anne E. Krehbiel | $38,800 | $3,000 | $41,800 |

| Takeitha W. Lawson | $ 2,940 | $ 0 | $ 2,940 |

-

(1) The compensation paid to the directors of LCNB includes committee fees as follows: S. Cropper, $6,600; S. Foster, $5,280; S. Wilson, $5,280; M. Bradford, $9,680; W. Huddle, $5,280; C. Johnson, $8,800; M. Johrendt, $6,600; A. Krehbiel, $8,800; and T. Lawson, $440. Mr. Meilstrup and Mr. Kaufman are not independent directors and do not receive committee fees.

(2) The directors, in addition to their annual retainer and committee fees, receive an equity retainer grant valued at ten percent of their annual retainer.

The Company has an Audit Committee that serves in a dual capacity as the Audit Committee of the Bank. During 2021, the members of the Audit Committee were Craig M. Johnson (Chair), Spencer S. Cropper, Mary E. Bradford, Takeitha W. Lawson and Anne E. Krehbiel. The Audit Committee met a total of 5 times in 2021. All of the members of the Audit Committee meet the definition of independent director set forth in NASDAQ Listing Rule 5605(a)(2). Craig M. Johnson and Spencer Cropper served as the financial expert as defined by the Sarbanes-Oxley Act and NASDAQ Listing Rule 5605(a)(2). The Audit Committee is responsible for engaging independent auditors, reviewing with the independent auditors the plans and results of the audit, and reviewing the adequacy of the Bank’s internal accounting controls. The Board of Directors of the Company has adopted a written charter for the Audit Committee. The Audit Committee Charter is available online at https://www.lcnbcorp.com/corporate-profile/corporate-governance/default.aspx.

The Bank also has a Compensation Committee, Nominating and Corporate Governance Committee, Trust Committee, Pension Committee, and Loan Committee. Each of these committees meet as needed. The Trust Committee reviews the various trusts accepted by the Trust Department of the Bank, reviews trust investments and advises the trust officers in department operations. The members of the Trust Committee are Stephen P. Wilson, Steve P. Foster, Michael R. Miller, William G. Huddle, Bradley A. Ruppert, Josh Shapiro, Kasheen Swango, Traci Hammiel, and Jackie Manley. The Pension Committee reviews the Bank’s defined benefit pension plan. The members of the Pension Committee are Stephen P. Wilson, Spencer S. Cropper, Steve P. Foster, Eric J. Meilstrup and Robert C. Haines II. The Board Loan Committee reviews the lending procedures of the Bank and reviews and approves requests for loans in excess of the established lending authority of the officers of the Bank. The Board Loan Committee consists of Steve P. Foster and William G. Huddle.

During 2021, the Nominating and Corporate Governance Committee consisted of six of the Company’s independent directors (as defined in NASDAQ Listing Rule 5605(a)(2)): Michael J. Johrendt (Chair), Spencer S. Cropper, Mary E. Bradford, Craig M. Johnson, Takeitha W. Lawson, and Anne E. Krehbiel. The Nominating and Corporate Governance Committee met 5 times in 2021. Decisions concerning nominees for the Board of Directors will be made by the Nominating Committee and ratified by the entire Board. The Board has not adopted a policy with respect to minimum qualifications for Board members. However, in making its nominations, the committee considers, among other things, an individual’s business experience, industry experience, financial background, breadth of knowledge about issues affecting the Company, time available for meetings and consultation regarding Company matters and other particular skills and experience possessed by the individual. Please see the narrative under the heading “Director and Nominee Qualifications” beginning on page 14 of this Proxy Statement for additional discussion of the nomination process. The Board of Directors has adopted a written charter for the Nominating and Corporate Governance Committee and is available online at https://www.lcnbcorp.com/corporate-profile/corporate-governance/default.aspx.

Historically, the Company has not engaged third parties to assist in identifying and evaluating potential nominees, but would do so in those situations where particular qualifications are required to fill a vacancy and the Board’s contacts are not sufficient to identify an appropriate candidate.

The Company does not have a formal policy regarding consideration of director candidate recommendations from its shareholders. Any recommendations received from shareholders have been and will be evaluated in the same manner that potential nominees suggested by Board members are evaluated. The Company does not intend to treat shareholder recommendations in any manner different from other recommendations. Shareholders may send director nomination recommendations to Spencer S. Cropper at P.O. Box 59, Lebanon, Ohio 45036.

The Bank has a designated Compensation Committee, which met 6 times in 2021. The Board of Directors of the Company has adopted a written charter for the Compensation Committee and is available online at https://www.lcnbcorp.com/corporate-profile/corporate-governance/default.aspx. During 2021, the Compensation Committee consisted of six independent directors: Anne E. Krehbiel (Chair), Spencer S. Cropper, Michael J. Johrendt, Craig M. Johnson, Takeitha W. Lawson, and Mary E. Bradford. The committee makes compensation recommendations to the Board of Directors for consideration, as further described in the “Compensation of Executive Officers” section below.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The members of the Compensation Committee for fiscal year 2021 were Anne E. Krehbiel (Chair), Spencer S. Cropper, Mary E. Bradford, Michael J. Johrendt, Takeitha W. Lawson, and Craig M. Johnson. In 2021, no executive officer of the Company served on the Board of Directors or compensation committee of any entity that compensates any member of the Company’s Compensation Committee.

SHAREHOLDER COMMUNICATION WITH BOARD MEMBERS

The Company maintains contact information, both telephone and email, on its website (https://www.LCNB.com) under the heading “Resource Center” then “Contact.” By following the contact link, a shareholder will be given access to the Company’s toll-free telephone number and mailing address, as well as a form to populate that would then be sent to the Company in the form of an email. Communications sent to that Company email address and specifically marked as a communication for the Board will be forwarded to

the Board or specific members of the Board as directed in the shareholder communication. In addition, communications received via telephone for the Board of Directors are forwarded to the Board by an officer of the Company. In addition, shareholders may send communications to the Board or any of its members by sending such communications to the Company, c/o Secretary at P.O. Box 59, Lebanon, Ohio 45036.

CODE OF ETHICS

The Board of Directors has adopted a Code of Business Conduct and Ethics applicable to all directors, officers, and employees. The Code of Business Conduct and Ethics is included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and is available online at https://www.lcnbcorp.com/corporate-profile/corporate-governance/default.aspx.

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors of the Company is composed of five independent directors. The responsibilities of the Audit Committee are set forth in the charter of the Audit Committee which was adopted by the Board of Directors and is available at https://www.lcnbcorp.com/corporate-profile/corporate-governance/default.aspx. The Audit Committee reviews, and revises if necessary, the Audit Charter at least annually. Any changes are presented to the Board of Directors for approval. The Audit Committee, among other matters, is responsible for the annual appointment and supervision of the independent public accountants, and reviews the arrangements for and the results of the auditors’ examination of the Company’s books and records and auditors’ compensation. The Audit Committee reviews the Company’s accounting policies, internal control procedures and systems and compliance activities.

The Audit Committee has reviewed and discussed the audited consolidated financial statements with management. The committee has also reviewed and discussed with BKD, LLP their independence as auditors for the fiscal year ended December 31, 2021, as called for by the applicable requirements of the Public Company Accounting Oversight Board and (“PCAOB”). The Audit Committee also has received the written disclosures and the letter from the independent accountants as called for by the applicable requirements of the PCAOB.

Based on the foregoing discussions, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

This report has been submitted by the Audit Committee:

Craig M. Johnson (Chair)

Spencer S. Cropper

Anne E. Krehbiel

Mary E. Bradford

Takeitha W. Lawson

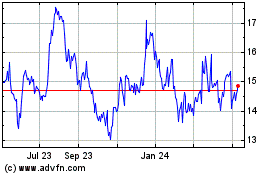

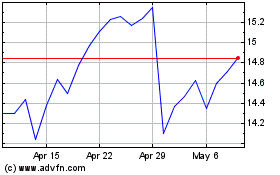

MARKET PRICE OF STOCK AND DIVIDEND DATA

Holders and Market Information

LCNB had approximately 928 registered holders of its Common Shares as of December 31, 2021. The number of shareholders includes banks and brokers who act as nominees, each of whom may represent more than one shareholder. LCNB’s Common Shares are currently traded on the NASDAQ Capital Market® under the symbol “LCNB”. Several market-makers facilitate the trading of the Common Shares. Trade prices for LCNB’s Common Shares, reported through registered securities dealers, are set forth below. Trades have occurred during the periods indicated without the knowledge of LCNB.

The trade prices shown below are interdealer without retail markups, markdowns or commissions.

| | | | | | | | | | | | | | |

| 2021 | | High | | Low |

| First Quarter | | $19.96 | | $14.07 |

| Second Quarter | | $18.34 | | $16.25 |

| Third Quarter | | $17.94 | | $16.01 |

| Fourth Quarter | | $20.43 | | $17.05 |

| | | | | | | | | | | | | | |

| 2020 | | High | | Low |

| First Quarter | | $19.43 | | $10.03 |

| Second Quarter | | $16.70 | | $10.53 |

| Third Quarter | | $15.87 | | $12.65 |

| Fourth Quarter | | $15.99 | | $12.51 |

Dividends

The following table presents cash dividends per share of common stock declared and paid in the periods shown.

| | | | | | | | | | | |

| 2021 | | 2020 |

| First Quarter | $0.19 | | $0.18 |

| Second Quarter | $0.19 | | $0.18 |

| Third Quarter | $0.19 | | $0.18 |

| Fourth Quarter | $0.20 | | $0.19 |

| Total | $0.77 | | $0.73 |

| | | |

It is expected that LCNB will continue to pay dividends on a similar schedule, to the extent permitted by business and other factors beyond management’s control. LCNB depends on dividends from its subsidiary for the majority of its liquid assets, including the cash needed to pay dividends to its shareholders. Federal banking laws and regulations limit the amount of dividends the Bank may pay to the sum of retained net income, as defined, for the current year plus retained net income for the previous two calendar years. Prior approval from the Office of the Comptroller of the Currency, the Bank’s primary regulator, would be necessary for the Bank to pay dividends in excess of this amount. In addition, dividend payments may not reduce capital levels below minimum regulatory guidelines. Management believes the Bank will be able to pay anticipated dividends to LCNB without needing to request approval.

Equity Compensation Plan Information

The Company’s 2015 Ownership Incentive Plan (the “2015 Plan”) was approved by shareholders at the 2015 annual meeting. The 2015 Plan provides for the grant of ownership incentives to key employees and directors in the form of stock options, appreciation rights, restricted shares and/or restricted share units. The 2015 Plan is administered by the Compensation Committee. For additional information on the 2015 Plan, please refer to the Company’s Definitive Proxy Statement, filed with the SEC on March 13, 2015. The Company’s previous equity incentive plan, the 2002 Ownership Incentive Plan (the “2002 Plan”), expired in accordance with its terms in 2012. The Board established the 2002 Plan to provide awards to certain executive officers after reaching specific earnings and asset growth goals set at the beginning of each year.

The following table summarizes share and exercise price information about LCNB’s equity compensation plans as of March 1, 2022.

| | | | | | | | | | | |

| Plan Category | Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities remaining available for future issuance |

Equity compensation plans approved by security holders | N/A | N/A | 328,508(1) |

Equity compensation plans not approved by security holders | N/A | N/A | N/A |

| Total | N/A | N/A | 328,508 |

(1) Includes restricted share awards granted under the 2015 Plan.

COMPENSATION OF EXECUTIVE OFFICERS

Compensation Discussion and Analysis

The Compensation Discussion and Analysis (“CD&A”) explains our executive compensation program for our named executive officers listed below (the “NEOs”), which include our Chief Executive Officer, Chief Financial Officer and our three other most highly-compensated executive officers who were serving as executive officers at the end of 2021. The NEOs for 2021 were:

•Eric J. Meilstrup, President and Chief Executive Officer

•Robert C. Haines II, Executive Vice President and Chief Financial Officer

•Matthew P. Layer, Executive Vice President and Chief Lending Officer

•Michael R. Miller, Executive Vice President, Trust Officer

•Bradley A. Ruppert, Executive Vice President, Trust Officer, Chief Investment Officer

The CD&A also describes the process followed by the Compensation Committee (the “Committee”) for making pay decisions, as well as its rationale for specific compensation related decisions related to 2021. LCNB has no direct employees. All officers and other employees performing services for LCNB are employees of the Bank. The Compensation Committee is a committee of the Board of Directors, composed solely of independent directors, and is responsible for developing the Bank’s executive compensation principles, policies and programs and approving the compensation to be paid to the NEOs. The Committee consults with Eric J. Meilstrup, President and Chief Executive Officer, concerning executive officer compensation; however, he does not participate in the deliberations regarding his own compensation.

2021 Executive Compensation Highlights

Our executive compensation programs are designed to align the interests of our NEOs with those of our shareholders. Based on our performance, findings from the 2020 Executive Total Compensation Review (discussed later in the CD&A), and our commitment to linking pay and performance, the Committee made the following executive compensation decisions for fiscal year 2021. For more detail, please refer to the “2021 Executive Compensation Components” later in the CD&A:

•Base Salaries: Base salaries were increased approximately 8.2% for each NEO, effective January 2021.

•2021 Short-Term Incentives/Cash Bonuses: Based on our 2021 financial performance and the NEOs’ individual performance, the NEOs earned short-term incentives equal to 12.5% of base salary. The target payout amount was set at 11.5% of base salary with the maximum opportunity set at 20% of base salary.

•2021 Long-Term Incentives: Equity grants were issued at 20 % of base salary for NEOs. The target amount was set at 10 % of base salary with the maximum opportunity set at 20 % of base salary.

Summary of Executive Compensation Practices

Our executive compensation program includes the following practices and policies, which we believe promote sound compensation governance and are in the best interests of our shareholders:

| | |

| What We Do |

•Periodically, compare our NEO compensation levels to the market and take these results into consideration when making compensation related decisions. |

•Provide our NEOs with a performance-based cash incentive plan on an annual basis. |

•Grant full-value equity to each of our NEOs with multi-year vesting provisions. |

•Provide each of our NEOs with deferred compensation programs to encourage retention and promote stability in our executive group. |

•Utilize the assistance of an outside independent compensation consultant to assist our Compensation Committee with gathering market data and best practices information. |

What Guides Our Compensation Programs

The primary objectives of LCNB’s executive officer compensation programs are to:

•Provide a direct link between executive officer compensation and the interests of LCNB and LCNB’s shareholders by making a portion of executive officer compensation dependent upon the financial performance of LCNB.

•Support LCNB’s annual and long-term goals and objectives as determined by the Board by linking these goals to the incentive compensation programs for the executive officers.

•Establish base salaries between the 25th and 75th percentiles of market for comparable positions within a comparison peer group of companies in the banking industry. If an executive officer is meeting performance expectations they’ll likely have a base salary level near market median. If an executive officer is experienced, high performing; performing significant additional duties, or brings a specific knowledge base to the organization, they may have a salary level near the 75th percentile of market. If an executive is new to a position or recently promoted they may have a salary level near the 25th percentile of the market.

•Provide executive officers with incentive (cash and equity) compensation opportunities designed to pay total compensation levels that are somewhere between the 25th and 75th percentiles of the market depending on the performance of LCNB and the individual executive officer.

•Provide long-term incentives/equity and deferred compensation plans and arrangements that encourage the retention of our proven team of executive officers.

The total compensation package for our NEOs includes: (i) base salary, (ii) annual cash bonuses and (iii) incentive opportunities, which may consist of equity incentives under the 2015 Ownership Incentive Plan. Some NEOs are also provided with a non-qualified deferred compensation program that strongly supports retention and provides for benefits after retirement. The NEOs also receive other employee benefits generally available to all employees.

The NEOs of the Bank are employed “at will” without severance agreements or employment contracts. Currently, the Company believes that its compensation levels and structure, as well as the Company’s culture and intangibles alleviate the need for the Company to utilize employment agreements with its NEOs.

Beginning in 2020, the Committee decided to propose a say-on-pay vote every year. Therefore, the next advisory shareholder vote on the compensation of LCNB’s NEOs will occur at the 2022 annual meeting and the advisory vote on the frequency of the say-on-pay vote will occur at the 2022 annual meeting.

The Committee and the Company’s Board of Directors believe that the Company’s executive compensation has been appropriately tailored to its business strategies, aligns pay with performance, and reflects best practices regarding executive compensation. The Committee will continue to consider shareholder sentiments about the Company’s core principles and objectives when determining executive compensation.

Engagement of Independent Compensation Consultant

The Compensation Committee has the sole authority to engage the services of any compensation consultant or advisor. Since 2013, the Committee has periodically engaged the services of Blanchard Consulting Group (“BCG”), an independent compensation consulting company focused on the banking industry. BCG was hired directly by the Compensation Committee and does not provide any other services to LCNB beyond independent compensation consulting services. The Committee considered all relevant factors, including those set forth in Rule 10C-1(b)(4)(i) through (vi) under the Securities Exchange Act of 1934 in determining that BCG’s work does not raise a conflict of interest. BCG reports directly to the Committee, and management has not retained its own consultant. BCG periodically attends meetings of the Committee, physically or by phone, and with or without management present. BCG assists the Committee in, among other things, analyzing current compensation conditions in the marketplace generally and among