Lakeland Bancorp, Inc. (NASDAQ:

LBAI) (the

“Company”), the parent company of Lakeland Bank (“Lakeland”),

reported net income of $19.8 million and earnings per diluted share

(“EPS”) of $0.30 for the three months ended March 31, 2023 compared

to net income of $15.9 million and diluted EPS of $0.25 for the

three months ended March 31, 2022.

For the first quarter of 2023, annualized return

on average assets was 0.75%, annualized return on average common

equity was 7.17% and annualized return on average tangible common

equity was 9.57%.

Thomas Shara, Lakeland Bancorp’s President and

CEO, commented, “Lakeland’s operating performance for the quarter

was solid in light of the current economic conditions and the

liquidity concerns in the banking industry. Despite the continued

increase in market interest rates during the quarter and concern

over bank failures in March, our loan portfolio was up 1%, our

deposit portfolio remained flat compared to year-end balances, our

stellar asset quality improved further in the quarter with

non-performing assets to total assets decreasing to 16 basis points

and our capital and liquidity levels remain strong. Lakeland’s

franchise value is based upon our focus on full customer

relationships including long-term core deposits and lending

solutions that solve our customers’ needs. Finally, we are

incredibly proud of our associates and appreciate their efforts in

serving our customers during a challenging time for the

industry.”

Regarding the Company’s pending merger with

Provident Financial Service, Inc., Mr. Shara added, “The

preparation for the merger is well underway and teams from both

banks have participated in numerous planning and integration

meetings to ensure the smooth transition to a combined company once

the regulatory approvals are received.” The shareholders of both

companies approved the merger at special shareholder meetings in

February.

First Quarter 2023

Highlights

- First quarter

2023 results were negatively impacted by a provision for credit

losses on investment securities of $6.5 million resulting

exclusively from a $6.6 million provision and subsequent charge-off

of an investment in subordinated debt of Signature Bank, which

failed in March. First quarter 2022 results were negatively

impacted by a provision for credit losses of $6.3 million, of which

$4.6 million was related to the acquired 1st Constitution Bank non

purchased credit deteriorated loans and $1.2 million related to

investment securities.

- In response to

the volatility in the banking industry during first quarter 2023

caused by high-profile bank failures, the Company instituted

measures to maintain its liquidity including proactively reaching

out to clients and maximizing our funding sources. These measures

included increasing our usage of our insured cash sweep (“ICS”)

product, as a method to increase the level of customers’ deposit

insurance. The Company's ICS deposits increased from $349.1 million

on December 31, 2022 to $417.9 million at March 31, 2023.

Currently, the Company’s estimated uninsured and uncollateralized

deposits are $2.1 billion and we have borrowing capacity of $2.0

billion.

- Net interest

margin for the first quarter of 2023 increased to 3.07% compared to

3.02% in the first quarter of 2022 and decreased from 3.28% in the

linked quarter.

- Nonperforming

assets decreased 14% to $16.9 million for the first quarter of

2023 compared to $19.7 million in the first quarter of 2022

and $17.4 million in the linked quarter.

- Loan growth for

the first quarter of $86.5 million, or 1.1%, compared to the

linked fourth quarter of 2022 was attributable to expansion

primarily in the residential mortgage portfolio.

Net Interest Margin and Net Interest

Income

Net interest margin for the first quarter of

2023 of 3.07% increased five basis points compared to the first

quarter of 2022 and decreased 21 basis points compared to the

fourth quarter of 2022. The increase in net interest margin

compared to the first quarter of 2022 was due primarily to an

increase in yields on loans and securities partially offset by an

increase in cost of interest-bearing liabilities. The decrease in

net interest margin compared to the fourth quarter of 2022 was due

primarily to an increase in rates on interest-bearing liabilities

as well as an increase in higher costing average time deposits and

short-term borrowings during the first quarter of 2023.

The yield on interest-earning assets for the

first quarter of 2023 was 4.56% as compared to 3.25% for the first

quarter of 2022 and 4.31% for the fourth quarter of 2022. The

increase in the yield on interest-earning assets compared to prior

periods was due primarily to an increase in the yield on loans and

investment securities driven primarily by increases in market

interest rates.

The cost of interest-bearing liabilities for the

first quarter of 2023 was 2.11% compared to 0.34% for the first

quarter of 2022 and 1.50% for the fourth quarter of 2022. The

increase in the cost of interest-bearing liabilities compared to

prior periods was largely driven by increases in market interest

rates as well as an increase in balances of higher costing average

time deposits and borrowings.

Net interest income for the first quarter of

2023 of $75.9 million increased $5.5 million compared to the first

quarter of 2022. The increase in net interest income compared to

the first quarter of 2022 was due primarily to an increase in the

yield on loans and investment securities as well as an increase in

average loan balances, partially offset by increased interest paid

on interest-bearing liabilities related to increases in market

interest rates.

Noninterest Income

For the first quarter of 2023, noninterest

income totaled $6.3 million, a decrease of $515,000 as

compared to the first quarter of 2022. Gains on sales of loans

decreased $996,000 compared to the first quarter of 2022 due

primarily to lower sale volume. Commissions and fees decreased

$181,000 driven primarily by a decrease in loan fees. Partially

offsetting these unfavorable variances was gains on equity

securities which totaled $148,000 in the first quarter of 2023

compared to losses of $485,000 in the first quarter of 2022.

Additionally, service charges on deposit accounts increased

$163,000.

Noninterest Expense

Noninterest expense for the first quarter of

2023 of $48.6 million decreased $1.4 million compared to

the first quarter of 2022. The decrease in noninterest expense was

primarily due to merger-related expenses which totaled $295,000 in

the first quarter of 2023 compared to $4.6 million during the

first quarter of 2022. Merger-related expense during the current

quarter was a result of the anticipated merger with Provident

Financial, while merger-related expense for the first quarter of

2022 was due to the acquisition of 1st Constitution Bancorp.

Compensation and employee benefits increased $2.3 million resulting

primarily from increased commissions, bonus expense, share based

compensation expense and normal merit increases. FDIC insurance

expense increased $291,000 due to an estimated increase in 2023

assessment rates related to Lakeland's asset size exceeding $10

billion. Other operating expenses in the first quarter of 2023

increased $131,000 compared to the same period in 2022 due

primarily to increased marketing expense.

Income Tax Expense

The effective tax rate for the first quarter of

2023 was 22.9% compared to 23.9% for the first quarter of 2022. The

decreased effective tax rate for the first quarter of 2023 was

primarily a result of tax advantaged items increasing as a

percentage of pretax income.

Financial Condition

At March 31, 2023, total assets were $10.84

billion, an increase of $53.4 million, compared to

December 31, 2022. As of March 31, 2023, total loans

increased $86.5 million, to $7.95 billion while investment

securities decreased $42.5 million, to $1.99 billion from

December 31, 2022. On the funding side, total deposits

decreased $30.5 million from December 31, 2022, to $8.54

billion at March 31, 2023, including an increase in brokered

deposits of $141.9 million. At March 31, 2023, total loans as

a percent of total deposits was 93.15%. Uninsured and

uncollateralized deposits as a percent of total deposits were

25.26% at March 31, 2023 compared to 26.81% at December 31,

2022.

Asset Quality

At March 31, 2023, non-performing assets

totaled $16.9 million or 0.16% of total assets compared to

$19.7 million, or 0.19% of total assets at March 31,

2022. Non-accrual loans as a percent of total loans was 0.21% at

March 31, 2023, compared to 0.28% at March 31, 2022. The

decrease in non-accrual loans resulted primarily from an

improvement in asset quality. The allowance for credit losses on

loans totaled $71.4 million, 0.90% of total loans, at

March 31, 2023, compared to $67.1 million, 0.94% of total

loans, at March 31, 2022. In the first quarter of 2023, the

Company had net charge-offs of $74,000 compared to

$7.6 million or 0.44% of average loans on an annualized basis

for the same period in 2022.

The provision for credit losses for the first

quarter of 2023 was $7.9 million compared to $6.3 million in the

first quarter of 2022. The provision in the 2023 period is

comprised of a provision for credit losses on loans of $1.2

million, a provision for credit losses on investment securities of

$6.5 million and a provision for off-balance-sheet exposures of

$140,000. The provision for credit losses on investment securities

was exclusively related to the $6.6 million provision and

subsequent charge-off of an investment in subordinated debt of

Signature Bank.

Capital

At March 31, 2023, stockholders' equity was

$1.13 billion compared to $1.11 billion at December 31, 2022,

a 2% increase, resulting primarily from net income and a decrease

in other comprehensive loss, partially offset by the payment of

dividends. Lakeland Bank remains above FDIC “well capitalized”

standards, with a Tier 1 leverage ratio of 9.13% at March 31,

2023. The book value per common share increased 3% to $17.33 at

March 31, 2023 compared to $16.82 at March 31, 2022.

Tangible book value per common share was $13.01 and $12.45 at

March 31, 2023 and 2022, respectively (see "Supplemental

Information - Non-GAAP Financial Measures" for a reconciliation of

non-GAAP financial measures, including tangible book value). At

March 31, 2023, the Company’s common equity to assets ratio

and tangible common equity to tangible assets ratio were 10.40% and

8.02%, respectively, compared to 10.60% and 8.07% at March 31,

2022. On April 25, 2023, the Company declared a quarterly cash

dividend of $0.145 per share to be paid on May 17, 2023, to

shareholders of record as of May 8, 2023.

Forward-Looking Statements

The information disclosed in this document

includes various forward-looking statements that are made in

reliance upon the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. The words “anticipates,” “projects,”

“intends,” “estimates,” “expects,” “believes,” “plans,” “may,”

“will,” “should,” “could,” and other similar expressions are

intended to identify such forward-looking statements. The Company

cautions that these forward-looking statements are necessarily

speculative and speak only as of the date made, and are subject to

numerous assumptions, risks and uncertainties, all of which may

change over time. Actual results could differ materially from such

forward-looking statements. Accordingly, you should not place undue

reliance on forward-looking statements. In addition to the specific

risk factors disclosed in the Company's Annual Report on Form 10-K

for the year ended December 31, 2022, as updated by our subsequent

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, the

following factors, among others, could cause actual results to

differ materially and adversely from such forward-looking

statements: changes in levels of market interest rates, which may

affect demand for our products and the value of our financial

instruments; pricing pressures on loan and deposit products;

changes in the financial services industry and the U.S. and global

capital markets; inflation and other changes in economic conditions

nationally, regionally and in the Company’s markets; the nature and

timing of actions of the Federal Reserve Board and other

regulators; the nature and timing of legislation and regulation

affecting the financial services industry; government intervention

in the U.S. financial system; changes in federal and state tax

laws; credit risks of the Company’s lending and leasing activities;

the effects of the recent turmoil in the banking industry

(including the failures of two financial institutions); successful

implementation, deployment and upgrades of new and existing

technology, systems, services and products; customers’ acceptance

of the Company’s products and services; competition; failure to

realize anticipated efficiencies and synergies from the merger of

1st Constitution Bancorp into Lakeland Bancorp and the merger of

1st Constitution Bank into Lakeland Bank; and expenses related to

our proposed merger with Provident Financial, unexpected delays

related to the merger, inability to obtain regulatory approvals or

satisfy other closing conditions required to complete the merger,

and failure to realize anticipated efficiencies and synergies from

the merger. Further, given its ongoing and dynamic nature, it is

difficult to predict the continuing effects that the COVID-19

pandemic will have on our business and results of operations. Any

statements made by the Company that are not historical facts should

be considered to be forward-looking statements. The Company is not

obligated to update and does not undertake to update any of its

forward-looking statements made herein.

Explanation of Non-GAAP Financial Measures

Reported amounts are presented in accordance

with U.S. generally accepted accounting principles ("GAAP"). This

press release also contains certain supplemental non-GAAP

information that the Company’s management uses in its analysis of

the Company’s financial results.

The Company also provides measurements and

ratios based on tangible equity and tangible assets. These measures

are utilized by regulators and market analysts to evaluate a

company’s financial condition and, therefore, the Company’s

management believes that such information is useful to

investors.

Specifically, the Company also uses an

efficiency ratio that is a non-GAAP financial measure. The ratio

that the Company uses excludes amortization of core deposit

intangibles, and, where applicable, long-term debt prepayment fees

and merger-related expenses. Income for the non-GAAP ratio is

increased by the favorable effect of tax-exempt income and excludes

gains and losses from the sale of investment securities, which can

vary from period to period. The Company uses this ratio because it

believes the ratio provides a relevant measure to compare the

operating performance period to period.

These disclosures should not be viewed as a

substitute for financial results determined in accordance with

GAAP, nor are they necessarily comparable to non-GAAP performance

measures which may be presented by other companies. See

accompanying "Supplemental Information - Non-GAAP Financial

Measures" and "Supplemental Information – Reconciliation of Net

Income" for a reconciliation of non-GAAP financial measures.

About Lakeland

Lakeland Bank is the wholly-owned subsidiary of

Lakeland Bancorp, Inc. (NASDAQ:LBAI), which had $10.84 billion in

total assets at March 31, 2023. With an extensive branch

network and commercial lending centers throughout New Jersey and

Highland Mills, New York, the Bank offers business and retail

banking products and services. Business services include commercial

loans and lines of credit, commercial real estate loans, loans for

healthcare services, asset-based lending, equipment financing,

small business loans and lines and cash management services.

Consumer services include online and mobile banking, home equity

loans and lines, mortgage options and wealth management solutions.

Lakeland is proud to be recognized as New Jersey's Best-In-State

Bank by Forbes and Statista for the fourth consecutive year, Best

Banks to Work For by American Banker, rated a 5-Star Bank by Bauer

Financial and named one of New Jersey's 50 Fastest Growing

Companies by NJBIZ. Visit LakelandBank.com or 973-697-6140 for more

information.

| Thomas J.

Shara |

|

Thomas F.

Splaine |

| President & CEO |

|

EVP & CFO |

|

Lakeland Bancorp, Inc. and Subsidiaries |

|

Consolidated Statements of Income (Unaudited) |

| |

| |

|

For the Three Months Ended March 31, |

|

(in thousands, except per share data) |

|

|

2023 |

|

|

|

2022 |

|

| Interest

Income |

|

|

|

|

| Loans and fees |

|

$ |

100,481 |

|

|

$ |

67,809 |

|

| Federal funds sold and

interest-bearing deposits with banks |

|

|

728 |

|

|

|

182 |

|

| Taxable investment securities

and other |

|

|

11,554 |

|

|

|

6,709 |

|

| Tax-exempt investment

securities |

|

|

1,642 |

|

|

|

1,302 |

|

|

Total Interest Income |

|

|

114,405 |

|

|

|

76,002 |

|

| Interest

Expense |

|

|

|

|

| Deposits |

|

|

29,158 |

|

|

|

4,039 |

|

| Federal funds purchased and

securities sold under agreements to repurchase |

|

|

7,222 |

|

|

|

20 |

|

| Other borrowings |

|

|

2,100 |

|

|

|

1,555 |

|

|

Total Interest Expense |

|

|

38,480 |

|

|

|

5,614 |

|

|

Net Interest Income |

|

|

75,925 |

|

|

|

70,388 |

|

| Provision for credit

losses |

|

|

7,893 |

|

|

|

6,272 |

|

|

Net Interest Income after Provision for Credit

Losses |

|

|

68,032 |

|

|

|

64,116 |

|

| Noninterest

Income |

|

|

|

|

| Service charges on deposit

accounts |

|

|

2,789 |

|

|

|

2,626 |

|

| Commissions and fees |

|

|

1,925 |

|

|

|

2,106 |

|

| Income on bank owned life

insurance |

|

|

776 |

|

|

|

830 |

|

| Gain (loss) on equity

securities |

|

|

148 |

|

|

|

(485 |

) |

| Gains on sales of loans |

|

|

430 |

|

|

|

1,426 |

|

| Swap income |

|

|

56 |

|

|

|

— |

|

| Other income |

|

|

141 |

|

|

|

277 |

|

|

Total Noninterest Income |

|

|

6,265 |

|

|

|

6,780 |

|

| Noninterest

Expense |

|

|

|

|

| Compensation and employee

benefits |

|

|

29,996 |

|

|

|

27,679 |

|

| Premises and equipment |

|

|

7,977 |

|

|

|

7,972 |

|

| FDIC insurance |

|

|

963 |

|

|

|

672 |

|

| Data processing |

|

|

1,862 |

|

|

|

1,670 |

|

| Merger-related expenses |

|

|

295 |

|

|

|

4,585 |

|

| Other operating expenses |

|

|

7,512 |

|

|

|

7,381 |

|

|

Total Noninterest Expense |

|

|

48,605 |

|

|

|

49,959 |

|

|

Income before provision for income taxes |

|

|

25,692 |

|

|

|

20,937 |

|

| Provision for income

taxes |

|

|

5,887 |

|

|

|

5,008 |

|

|

Net Income |

|

$ |

19,805 |

|

|

$ |

15,929 |

|

| Per Share

of Common Stock |

|

|

|

|

Basic earnings |

|

$ |

0.30 |

|

|

$ |

0.25 |

|

|

Diluted earnings |

|

$ |

0.30 |

|

|

$ |

0.25 |

|

|

Dividends |

|

$ |

0.145 |

|

|

$ |

0.135 |

|

|

Lakeland Bancorp, Inc. and Subsidiaries |

|

Consolidated Balance Sheets |

| |

| (dollars in thousands) |

March 31, 2023 |

|

December 31, 2022 |

| |

(Unaudited) |

|

|

| Assets |

|

|

|

|

Cash |

$ |

261,261 |

|

|

$ |

223,299 |

|

| Interest-bearing deposits due

from banks |

|

13,681 |

|

|

|

12,651 |

|

|

Total cash and cash equivalents |

|

274,942 |

|

|

|

235,950 |

|

| Investment securities

available for sale, at estimated fair value (allowance for credit

losses of $160 at March 31, 2023 and $310 at December 31,

2022) |

|

1,029,127 |

|

|

|

1,054,312 |

|

| Investment securities held to

maturity (estimated fair value of $762,720 at March 31, 2023

and $760,455 at December 31, 2022, allowance for credit losses of

$156 at March 31, 2023 and $107 at December 31, 2022) |

|

902,498 |

|

|

|

923,308 |

|

| Equity securities, at fair

value |

|

17,496 |

|

|

|

17,283 |

|

| Federal Home Loan Bank and

other membership stocks, at cost |

|

45,806 |

|

|

|

42,483 |

|

| Loans held for sale |

|

— |

|

|

|

536 |

|

| Loans, net of deferred

fees |

|

7,952,553 |

|

|

|

7,866,050 |

|

|

Less: Allowance for credit losses |

|

71,403 |

|

|

|

70,264 |

|

|

Net loans |

|

7,881,150 |

|

|

|

7,795,786 |

|

| Premises and equipment,

net |

|

55,556 |

|

|

|

55,429 |

|

| Operating lease right-of-use

assets |

|

19,329 |

|

|

|

20,052 |

|

| Accrued interest

receivable |

|

34,220 |

|

|

|

33,374 |

|

| Goodwill |

|

271,829 |

|

|

|

271,829 |

|

| Other identifiable intangible

assets |

|

8,572 |

|

|

|

9,088 |

|

| Bank owned life insurance |

|

157,761 |

|

|

|

156,985 |

|

| Other assets |

|

138,955 |

|

|

|

167,425 |

|

|

Total Assets |

$ |

10,837,241 |

|

|

$ |

10,783,840 |

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Liabilities |

|

|

|

| Deposits: |

|

|

|

| Noninterest-bearing |

$ |

1,998,590 |

|

|

$ |

2,113,289 |

|

| Savings and interest-bearing

transaction accounts |

|

4,918,041 |

|

|

|

5,246,005 |

|

| Time deposits $250 thousand

and under |

|

1,233,856 |

|

|

|

901,505 |

|

| Time deposits over $250

thousand |

|

386,456 |

|

|

|

306,672 |

|

|

Total deposits |

|

8,536,943 |

|

|

|

8,567,471 |

|

| Federal funds purchased and

securities sold under agreements to repurchase |

|

813,328 |

|

|

|

728,797 |

|

| Other borrowings |

|

25,000 |

|

|

|

25,000 |

|

| Subordinated debentures |

|

194,376 |

|

|

|

194,264 |

|

| Operating lease

liabilities |

|

20,644 |

|

|

|

21,449 |

|

| Other liabilities |

|

120,370 |

|

|

|

138,272 |

|

|

Total Liabilities |

|

9,710,661 |

|

|

|

9,675,253 |

|

| Stockholders' Equity |

|

|

|

| Common stock, no par value;

authorized 100,000,000 shares; issued 65,148,180 shares and

outstanding 65,017,145 shares at March 31, 2023 and

issued 65,002,738 shares and outstanding 64,871,703 shares at

December 31, 2022 |

|

855,657 |

|

|

|

855,425 |

|

| Retained earnings |

|

339,680 |

|

|

|

329,375 |

|

| Treasury shares, at cost,

131,035 shares at March 31, 2023 and December 31, 2022 |

|

(1,452 |

) |

|

|

(1,452 |

) |

| Accumulated other

comprehensive loss |

|

(67,305 |

) |

|

|

(74,761 |

) |

|

Total Stockholders' Equity |

|

1,126,580 |

|

|

|

1,108,587 |

|

|

Total Liabilities and Stockholders' Equity |

$ |

10,837,241 |

|

|

$ |

10,783,840 |

|

|

Lakeland Bancorp, Inc. |

|

Financial Highlights |

|

(Unaudited) |

| |

| |

|

For the Quarter Ended |

| (dollars in thousands, except

per share data) |

|

March 31,2023 |

|

December 31,2022 |

|

September 30,2022 |

|

June 30,2022 |

|

March 31,2022 |

| Income

Statement |

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

$ |

75,925 |

|

|

$ |

81,640 |

|

|

$ |

80,285 |

|

|

$ |

80,302 |

|

|

$ |

70,388 |

|

| (Provision) benefit for credit

losses |

|

|

(7,893 |

) |

|

|

2,760 |

|

|

|

(1,358 |

) |

|

|

(3,644 |

) |

|

|

(6,272 |

) |

| Gains on sales of loans |

|

|

430 |

|

|

|

269 |

|

|

|

355 |

|

|

|

715 |

|

|

|

1,426 |

|

| Gains (loss) on equity

securities |

|

|

148 |

|

|

|

11 |

|

|

|

(464 |

) |

|

|

(364 |

) |

|

|

(485 |

) |

| Other noninterest income |

|

|

5,687 |

|

|

|

6,743 |

|

|

|

7,342 |

|

|

|

6,712 |

|

|

|

5,839 |

|

| Merger-related expenses |

|

|

(295 |

) |

|

|

(533 |

) |

|

|

(3,488 |

) |

|

|

— |

|

|

|

(4,585 |

) |

| Other noninterest expense |

|

|

(48,310 |

) |

|

|

(44,837 |

) |

|

|

(44,323 |

) |

|

|

(45,068 |

) |

|

|

(45,374 |

) |

|

Pretax income |

|

|

25,692 |

|

|

|

46,053 |

|

|

|

38,349 |

|

|

|

38,653 |

|

|

|

20,937 |

|

| Provision for income

taxes |

|

|

(5,887 |

) |

|

|

(12,476 |

) |

|

|

(9,603 |

) |

|

|

(9,536 |

) |

|

|

(5,008 |

) |

|

Net income |

|

$ |

19,805 |

|

|

$ |

33,577 |

|

|

$ |

28,746 |

|

|

$ |

29,117 |

|

|

$ |

15,929 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Basic earnings per common

share |

|

$ |

0.30 |

|

|

$ |

0.51 |

|

|

$ |

0.44 |

|

|

$ |

0.44 |

|

|

$ |

0.25 |

|

| Diluted earnings per common

share |

|

$ |

0.30 |

|

|

$ |

0.51 |

|

|

$ |

0.44 |

|

|

$ |

0.44 |

|

|

$ |

0.25 |

|

| Dividends paid per common

share |

|

$ |

0.145 |

|

|

$ |

0.145 |

|

|

$ |

0.145 |

|

|

$ |

0.145 |

|

|

$ |

0.135 |

|

| Dividends paid |

|

$ |

9,500 |

|

|

$ |

9,505 |

|

|

$ |

9,506 |

|

|

$ |

9,507 |

|

|

$ |

8,809 |

|

| Weighted average shares -

basic |

|

|

64,966 |

|

|

|

64,854 |

|

|

|

64,842 |

|

|

|

64,828 |

|

|

|

63,961 |

|

| Weighted average shares -

diluted |

|

|

65,228 |

|

|

|

65,222 |

|

|

|

65,061 |

|

|

|

64,989 |

|

|

|

64,238 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Selected Operating

Ratios |

|

|

|

|

|

|

|

|

|

|

| Annualized return on average

assets |

|

|

0.75 |

% |

|

|

1.26 |

% |

|

|

1.10 |

% |

|

|

1.15 |

% |

|

|

0.64 |

% |

| Annualized return on average

common equity |

|

|

7.17 |

% |

|

|

12.19 |

% |

|

|

10.33 |

% |

|

|

10.71 |

% |

|

|

5.89 |

% |

| Annualized return on average

tangible common equity (1) |

|

|

9.57 |

% |

|

|

16.42 |

% |

|

|

13.87 |

% |

|

|

14.45 |

% |

|

|

7.88 |

% |

| Annualized net interest

margin |

|

|

3.07 |

% |

|

|

3.28 |

% |

|

|

3.28 |

% |

|

|

3.38 |

% |

|

|

3.02 |

% |

| Efficiency ratio (1) |

|

|

57.84 |

% |

|

|

49.67 |

% |

|

|

49.76 |

% |

|

|

50.69 |

% |

|

|

57.77 |

% |

| Common stockholders' equity to

total assets |

|

|

10.40 |

% |

|

|

10.28 |

% |

|

|

10.29 |

% |

|

|

10.51 |

% |

|

|

10.60 |

% |

| Tangible common equity to

tangible assets (1) |

|

|

8.02 |

% |

|

|

7.88 |

% |

|

|

7.83 |

% |

|

|

8.01 |

% |

|

|

8.07 |

% |

| Tier 1 risk-based ratio |

|

|

11.33 |

% |

|

|

11.24 |

% |

|

|

11.16 |

% |

|

|

11.12 |

% |

|

|

11.34 |

% |

| Total risk-based ratio |

|

|

13.93 |

% |

|

|

13.83 |

% |

|

|

13.78 |

% |

|

|

13.74 |

% |

|

|

14.03 |

% |

| Tier 1 leverage ratio |

|

|

9.13 |

% |

|

|

9.16 |

% |

|

|

9.10 |

% |

|

|

9.05 |

% |

|

|

8.97 |

% |

| Common equity tier 1 capital

ratio |

|

|

10.81 |

% |

|

|

10.71 |

% |

|

|

10.62 |

% |

|

|

10.57 |

% |

|

|

10.72 |

% |

| Book value per common

share |

|

$ |

17.33 |

|

|

$ |

17.09 |

|

|

$ |

16.70 |

|

|

$ |

16.82 |

|

|

$ |

16.82 |

|

| Tangible book value per common

share (1) |

|

$ |

13.01 |

|

|

$ |

12.76 |

|

|

$ |

12.36 |

|

|

$ |

12.47 |

|

|

$ |

12.45 |

|

(1) See Supplemental Information - Non-GAAP Financial

Measures

|

Lakeland Bancorp, Inc. |

|

Financial Highlights |

|

(Unaudited) |

| |

| |

|

For the Quarter Ended |

| (dollars in thousands) |

|

March 31,2023 |

|

December 31,2022 |

|

September 30,2022 |

|

June 30,2022 |

|

March 31,2022 |

| Selected

Balance Sheet Data at Period End |

|

|

|

|

|

|

|

|

|

Loans |

|

$ |

7,952,553 |

|

|

$ |

7,866,050 |

|

|

$ |

7,568,826 |

|

|

$ |

7,408,540 |

|

|

$ |

7,137,793 |

|

| Allowance for credit losses on

loans |

|

|

71,403 |

|

|

|

70,264 |

|

|

|

68,879 |

|

|

|

68,836 |

|

|

|

67,112 |

|

| Investment securities |

|

|

1,994,927 |

|

|

|

2,037,386 |

|

|

|

2,047,186 |

|

|

|

2,124,213 |

|

|

|

2,139,054 |

|

| Total assets |

|

|

10,837,241 |

|

|

|

10,783,840 |

|

|

|

10,515,599 |

|

|

|

10,374,178 |

|

|

|

10,275,233 |

|

| Total deposits |

|

|

8,536,943 |

|

|

|

8,567,471 |

|

|

|

8,677,799 |

|

|

|

8,501,804 |

|

|

|

8,748,909 |

|

| Short-term borrowings |

|

|

813,328 |

|

|

|

728,797 |

|

|

|

357,787 |

|

|

|

432,206 |

|

|

|

102,911 |

|

| Other borrowings |

|

|

219,376 |

|

|

|

219,264 |

|

|

|

219,148 |

|

|

|

219,027 |

|

|

|

218,904 |

|

| Stockholders' equity |

|

|

1,126,580 |

|

|

|

1,108,587 |

|

|

|

1,082,406 |

|

|

|

1,090,145 |

|

|

|

1,089,282 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Loans |

|

|

|

|

|

|

|

|

|

|

| Non-owner occupied

commercial |

|

$ |

2,943,897 |

|

|

$ |

2,906,014 |

|

|

$ |

2,873,824 |

|

|

$ |

2,777,003 |

|

|

$ |

2,639,784 |

|

| Owner occupied commercial |

|

|

1,205,635 |

|

|

|

1,246,189 |

|

|

|

1,141,290 |

|

|

|

1,179,527 |

|

|

|

1,122,754 |

|

| Multifamily |

|

|

1,275,771 |

|

|

|

1,260,814 |

|

|

|

1,186,036 |

|

|

|

1,134,938 |

|

|

|

1,104,206 |

|

| Non-owner occupied

residential |

|

|

210,203 |

|

|

|

218,026 |

|

|

|

222,597 |

|

|

|

221,339 |

|

|

|

225,795 |

|

| Commercial, industrial and

other |

|

|

562,287 |

|

|

|

606,276 |

|

|

|

612,494 |

|

|

|

647,531 |

|

|

|

620,611 |

|

| Paycheck Protection

Program |

|

|

390 |

|

|

|

435 |

|

|

|

734 |

|

|

|

10,404 |

|

|

|

36,785 |

|

| Construction |

|

|

404,994 |

|

|

|

380,100 |

|

|

|

381,109 |

|

|

|

370,777 |

|

|

|

404,186 |

|

| Equipment financing |

|

|

161,889 |

|

|

|

151,575 |

|

|

|

137,999 |

|

|

|

134,136 |

|

|

|

123,943 |

|

| Residential mortgages |

|

|

857,427 |

|

|

|

765,552 |

|

|

|

690,453 |

|

|

|

622,417 |

|

|

|

564,042 |

|

| Consumer and home equity |

|

|

330,060 |

|

|

|

331,069 |

|

|

|

322,290 |

|

|

|

310,468 |

|

|

|

295,687 |

|

|

Total loans |

|

$ |

7,952,553 |

|

|

$ |

7,866,050 |

|

|

$ |

7,568,826 |

|

|

$ |

7,408,540 |

|

|

$ |

7,137,793 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing |

|

$ |

1,998,590 |

|

|

$ |

2,113,289 |

|

|

$ |

2,288,902 |

|

|

$ |

2,330,550 |

|

|

$ |

2,300,030 |

|

| Savings and interest-bearing

transaction accounts |

|

|

4,918,041 |

|

|

|

5,246,005 |

|

|

|

5,354,716 |

|

|

|

5,407,212 |

|

|

|

5,602,674 |

|

| Time deposits |

|

|

1,620,312 |

|

|

|

1,208,177 |

|

|

|

1,034,181 |

|

|

|

764,042 |

|

|

|

846,205 |

|

|

Total deposits |

|

$ |

8,536,943 |

|

|

$ |

8,567,471 |

|

|

$ |

8,677,799 |

|

|

$ |

8,501,804 |

|

|

$ |

8,748,909 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Total loans to total deposits

ratio |

|

|

93.2 |

% |

|

|

91.8 |

% |

|

|

87.2 |

% |

|

|

87.1 |

% |

|

|

81.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Selected Average

Balance Sheet Data |

|

|

|

|

|

|

|

|

|

|

| Loans |

|

$ |

7,900,426 |

|

|

$ |

7,729,510 |

|

|

$ |

7,517,878 |

|

|

$ |

7,229,175 |

|

|

$ |

7,021,462 |

|

| Investment securities |

|

|

2,117,076 |

|

|

|

2,145,252 |

|

|

|

2,160,719 |

|

|

|

2,188,199 |

|

|

|

2,019,578 |

|

| Interest-earning assets |

|

|

10,091,341 |

|

|

|

9,923,173 |

|

|

|

9,755,797 |

|

|

|

9,588,396 |

|

|

|

9,504,287 |

|

| Total assets |

|

|

10,698,807 |

|

|

|

10,534,884 |

|

|

|

10,358,600 |

|

|

|

10,192,140 |

|

|

|

10,138,437 |

|

| Noninterest-bearing demand

deposits |

|

|

2,040,070 |

|

|

|

2,240,197 |

|

|

|

2,325,391 |

|

|

|

2,310,702 |

|

|

|

2,194,038 |

|

| Savings deposits |

|

|

928,796 |

|

|

|

1,001,870 |

|

|

|

1,092,222 |

|

|

|

1,153,591 |

|

|

|

1,131,359 |

|

| Interest-bearing transaction

accounts |

|

|

4,224,024 |

|

|

|

4,389,672 |

|

|

|

4,337,559 |

|

|

|

4,369,067 |

|

|

|

4,399,531 |

|

| Time deposits |

|

|

1,385,661 |

|

|

|

1,100,911 |

|

|

|

905,735 |

|

|

|

803,421 |

|

|

|

879,427 |

|

| Total deposits |

|

|

8,578,551 |

|

|

|

8,732,650 |

|

|

|

8,660,907 |

|

|

|

8,636,781 |

|

|

|

8,604,355 |

|

| Short-term borrowings |

|

|

617,611 |

|

|

|

311,875 |

|

|

|

240,728 |

|

|

|

130,242 |

|

|

|

104,633 |

|

| Other borrowings |

|

|

219,308 |

|

|

|

219,202 |

|

|

|

219,082 |

|

|

|

218,958 |

|

|

|

217,983 |

|

| Total interest-bearing

liabilities |

|

|

7,375,400 |

|

|

|

7,023,530 |

|

|

|

6,795,326 |

|

|

|

6,675,279 |

|

|

|

6,732,933 |

|

| Stockholders' equity |

|

|

1,120,356 |

|

|

|

1,092,720 |

|

|

|

1,104,145 |

|

|

|

1,090,613 |

|

|

|

1,095,913 |

|

|

Lakeland Bancorp, Inc. |

|

Financial Highlights |

|

(Unaudited) |

| |

| |

|

For the Quarter Ended |

| (dollars in thousands) |

|

March 31,2023 |

|

December 31,2022 |

|

September 30,2022 |

|

June 30,2022 |

|

March 31,2022 |

| Average

Annualized Yields (Taxable Equivalent Basis) and

Costs |

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

Loans |

|

|

5.10 |

% |

|

|

4.84 |

% |

|

|

4.43 |

% |

|

|

4.22 |

% |

|

|

3.92 |

% |

| Taxable investment securities

and other |

|

|

2.61 |

% |

|

|

2.41 |

% |

|

|

2.12 |

% |

|

|

1.81 |

% |

|

|

1.60 |

% |

| Tax-exempt securities |

|

|

2.41 |

% |

|

|

2.36 |

% |

|

|

2.12 |

% |

|

|

2.02 |

% |

|

|

1.91 |

% |

| Federal funds sold and

interest-bearing cash accounts |

|

|

4.00 |

% |

|

|

3.68 |

% |

|

|

2.21 |

% |

|

|

0.55 |

% |

|

|

0.16 |

% |

|

Total interest-earning assets |

|

|

4.56 |

% |

|

|

4.31 |

% |

|

|

3.90 |

% |

|

|

3.61 |

% |

|

|

3.25 |

% |

| Liabilities |

|

|

|

|

|

|

|

|

|

|

| Savings accounts |

|

|

0.28 |

% |

|

|

0.29 |

% |

|

|

0.25 |

% |

|

|

0.18 |

% |

|

|

0.17 |

% |

| Interest-bearing transaction

accounts |

|

|

1.85 |

% |

|

|

1.46 |

% |

|

|

0.97 |

% |

|

|

0.33 |

% |

|

|

0.25 |

% |

| Time deposits |

|

|

2.71 |

% |

|

|

1.77 |

% |

|

|

1.00 |

% |

|

|

0.39 |

% |

|

|

0.40 |

% |

| Borrowings |

|

|

4.46 |

% |

|

|

3.52 |

% |

|

|

2.15 |

% |

|

|

2.04 |

% |

|

|

1.95 |

% |

|

Total interest-bearing liabilities |

|

|

2.11 |

% |

|

|

1.50 |

% |

|

|

0.94 |

% |

|

|

0.40 |

% |

|

|

0.34 |

% |

| Net interest spread (taxable

equivalent basis) |

|

|

2.45 |

% |

|

|

2.81 |

% |

|

|

2.96 |

% |

|

|

3.22 |

% |

|

|

2.92 |

% |

| Annualized net interest margin

(taxable equivalent basis) |

|

|

3.07 |

% |

|

|

3.28 |

% |

|

|

3.28 |

% |

|

|

3.38 |

% |

|

|

3.02 |

% |

| Annualized cost of

deposits |

|

|

1.38 |

% |

|

|

0.99 |

% |

|

|

0.62 |

% |

|

|

0.22 |

% |

|

|

0.19 |

% |

| Loan Quality

Data |

|

|

|

|

|

|

|

|

|

|

| Allowance for Credit Losses on

Loans |

|

|

|

|

|

|

|

|

|

|

| Balance at beginning of

period |

|

$ |

70,264 |

|

|

$ |

68,879 |

|

|

$ |

68,836 |

|

|

$ |

67,112 |

|

|

$ |

58,047 |

|

| Initial allowance for credit

losses on purchased credit deteriorated loans |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

12,077 |

|

| Charge-offs on purchased

credit deteriorated loans |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(7,634 |

) |

| Provision for credit losses on

loans |

|

|

1,213 |

|

|

|

1,464 |

|

|

|

11 |

|

|

|

1,583 |

|

|

|

4,630 |

|

| Charge-offs |

|

|

(139 |

) |

|

|

(138 |

) |

|

|

(56 |

) |

|

|

(365 |

) |

|

|

(170 |

) |

| Recoveries |

|

|

65 |

|

|

|

59 |

|

|

|

88 |

|

|

|

506 |

|

|

|

162 |

|

| Balance at end of period |

|

$ |

71,403 |

|

|

$ |

70,264 |

|

|

$ |

68,879 |

|

|

$ |

68,836 |

|

|

$ |

67,112 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Net Loan Charge-Offs

(Recoveries) |

|

|

|

|

|

|

|

|

|

|

| Non owner occupied

commercial |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

(4 |

) |

|

$ |

4 |

|

| Owner occupied commercial |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(337 |

) |

|

|

24 |

|

| Non owner occupied

residential |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(14 |

) |

| Commercial, industrial and

other |

|

|

(35 |

) |

|

|

(24 |

) |

|

|

(49 |

) |

|

|

272 |

|

|

|

778 |

|

| Construction |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,804 |

|

| Equipment finance |

|

|

46 |

|

|

|

51 |

|

|

|

(23 |

) |

|

|

(40 |

) |

|

|

82 |

|

| Residential mortgages |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(48 |

) |

| Consumer and home equity |

|

|

63 |

|

|

|

52 |

|

|

|

40 |

|

|

|

(32 |

) |

|

|

12 |

|

|

Net charge-offs (recoveries) |

|

$ |

74 |

|

|

$ |

79 |

|

|

$ |

(32 |

) |

|

$ |

(141 |

) |

|

$ |

7,642 |

|

|

Lakeland Bancorp, Inc. |

|

Financial Highlights |

|

(Unaudited) |

| |

| |

|

For the Quarter Ended |

| (dollars in thousands) |

|

March 31,2023 |

|

December 31,2022 |

|

September 30,2022 |

|

June 30,2022 |

|

March 31,2022 |

| Non-Performing Assets

(1) |

|

|

|

|

|

|

|

|

|

|

|

Non owner occupied commercial |

|

$ |

908 |

|

|

$ |

618 |

|

|

$ |

307 |

|

|

$ |

324 |

|

|

$ |

5,482 |

|

| Owner occupied commercial |

|

|

8,757 |

|

|

|

9,439 |

|

|

|

10,322 |

|

|

|

12,587 |

|

|

|

2,626 |

|

| Multifamily |

|

|

584 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Non owner occupied

residential |

|

|

— |

|

|

|

441 |

|

|

|

868 |

|

|

|

839 |

|

|

|

2,430 |

|

| Commercial, industrial and

other |

|

|

2,221 |

|

|

|

2,978 |

|

|

|

3,623 |

|

|

|

4,882 |

|

|

|

6,098 |

|

| Construction |

|

|

980 |

|

|

|

980 |

|

|

|

— |

|

|

|

— |

|

|

|

220 |

|

| Equipment finance |

|

|

379 |

|

|

|

114 |

|

|

|

226 |

|

|

|

112 |

|

|

|

51 |

|

| Residential mortgages |

|

|

1,918 |

|

|

|

2,011 |

|

|

|

2,226 |

|

|

|

2,249 |

|

|

|

1,935 |

|

| Consumer and home equity |

|

|

1,131 |

|

|

|

781 |

|

|

|

798 |

|

|

|

1,168 |

|

|

|

898 |

|

|

Total non-accrual loans |

|

|

16,878 |

|

|

|

17,362 |

|

|

|

18,370 |

|

|

|

22,161 |

|

|

|

19,740 |

|

|

Total non-performing assets |

|

$ |

16,878 |

|

|

$ |

17,362 |

|

|

$ |

18,370 |

|

|

$ |

22,161 |

|

|

$ |

19,740 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Loans past due 90 days or more

and still accruing |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

31 |

|

|

$ |

— |

|

|

$ |

— |

|

| Loans restructured and still

accruing |

|

$ |

— |

|

|

$ |

2,640 |

|

|

$ |

3,113 |

|

|

$ |

3,189 |

|

|

$ |

3,290 |

|

| Ratio of allowance for loan

losses to total loans |

|

|

0.90 |

% |

|

|

0.89 |

% |

|

|

0.91 |

% |

|

|

0.93 |

% |

|

|

0.94 |

% |

| Total non-accrual loans to

total loans |

|

|

0.21 |

% |

|

|

0.22 |

% |

|

|

0.24 |

% |

|

|

0.30 |

% |

|

|

0.28 |

% |

| Total non-performing assets to

total assets |

|

|

0.16 |

% |

|

|

0.16 |

% |

|

|

0.17 |

% |

|

|

0.21 |

% |

|

|

0.19 |

% |

| Annualized net (recoveries)

charge-offs to average loans |

|

|

— |

% |

|

|

— |

% |

|

|

— |

% |

|

(0.01 |

)% |

|

|

0.44 |

% |

(1) Includes non-accrual purchased credit

deteriorated loans.

|

Lakeland Bancorp, Inc. |

|

Supplemental Information - Non-GAAP Financial

Measures |

|

(Unaudited) |

| |

| |

|

At or for the Quarter Ended |

| (dollars in thousands, except

per share amounts) |

|

March 31,2023 |

|

December 31,2022 |

|

September 30,2022 |

|

June 30,2022 |

|

March 31,2022 |

|

Calculation of Tangible Book Value Per Common

Share |

|

|

|

|

|

|

|

|

| Total common stockholders'

equity at end of period - GAAP |

|

$ |

1,126,580 |

|

|

$ |

1,108,587 |

|

|

$ |

1,082,406 |

|

|

$ |

1,090,145 |

|

|

$ |

1,089,282 |

|

| Less: Goodwill |

|

|

271,829 |

|

|

|

271,829 |

|

|

|

271,829 |

|

|

|

271,829 |

|

|

|

271,829 |

|

| Less: Other identifiable

intangible assets |

|

|

8,572 |

|

|

|

9,088 |

|

|

|

9,669 |

|

|

|

10,250 |

|

|

|

10,842 |

|

| Total tangible common

stockholders' equity at end of period - Non-GAAP |

|

$ |

846,179 |

|

|

$ |

827,670 |

|

|

$ |

800,908 |

|

|

$ |

808,066 |

|

|

$ |

806,611 |

|

| Shares outstanding at end of

period |

|

|

65,017 |

|

|

|

64,872 |

|

|

|

64,804 |

|

|

|

64,794 |

|

|

|

64,780 |

|

| Book value per share -

GAAP |

|

$ |

17.33 |

|

|

$ |

17.09 |

|

|

$ |

16.70 |

|

|

$ |

16.82 |

|

|

$ |

16.82 |

|

| Tangible book value per share

- Non-GAAP |

|

$ |

13.01 |

|

|

$ |

12.76 |

|

|

$ |

12.36 |

|

|

$ |

12.47 |

|

|

$ |

12.45 |

|

|

Calculation of Tangible Common Equity to Tangible

Assets |

|

|

|

|

|

|

| Total tangible common

stockholders' equity at end of period - Non-GAAP |

|

$ |

846,179 |

|

|

$ |

827,670 |

|

|

$ |

800,908 |

|

|

$ |

808,066 |

|

|

$ |

806,611 |

|

| Total assets at end of period

- GAAP |

|

$ |

10,837,241 |

|

|

$ |

10,783,840 |

|

|

$ |

10,515,599 |

|

|

$ |

10,374,178 |

|

|

$ |

10,275,233 |

|

| Less: Goodwill |

|

|

271,829 |

|

|

|

271,829 |

|

|

|

271,829 |

|

|

|

271,829 |

|

|

|

271,829 |

|

| Less: Other identifiable

intangible assets |

|

|

8,572 |

|

|

|

9,088 |

|

|

|

9,669 |

|

|

|

10,250 |

|

|

|

10,842 |

|

|

Total tangible assets at end of period - Non-GAAP |

|

$ |

10,556,840 |

|

|

$ |

10,502,923 |

|

|

$ |

10,234,101 |

|

|

$ |

10,092,099 |

|

|

$ |

9,992,562 |

|

| Common equity to assets -

GAAP |

|

|

10.40 |

% |

|

|

10.28 |

% |

|

|

10.29 |

% |

|

|

10.51 |

% |

|

|

10.60 |

% |

| Tangible common equity to

tangible assets - Non-GAAP |

|

|

8.02 |

% |

|

|

7.88 |

% |

|

|

7.83 |

% |

|

|

8.01 |

% |

|

|

8.07 |

% |

|

Calculation of Return on Average Tangible Common

Equity |

|

|

|

|

|

|

| Net income - GAAP |

|

$ |

19,805 |

|

|

$ |

33,577 |

|

|

$ |

28,746 |

|

|

$ |

29,117 |

|

|

$ |

15,929 |

|

| Total average common

stockholders' equity - GAAP |

|

$ |

1,120,356 |

|

|

$ |

1,092,720 |

|

|

$ |

1,104,145 |

|

|

$ |

1,090,613 |

|

|

$ |

1,095,913 |

|

| Less: Average goodwill |

|

|

271,829 |

|

|

|

271,829 |

|

|

|

271,829 |

|

|

|

271,829 |

|

|

|

265,409 |

|

| Less: Average other

identifiable intangible assets |

|

|

8,904 |

|

|

|

9,386 |

|

|

|

9,982 |

|

|

|

10,569 |

|

|

|

10,851 |

|

| Total average tangible common

stockholders' equity - Non-GAAP |

|

$ |

839,623 |

|

|

$ |

811,505 |

|

|

$ |

822,334 |

|

|

$ |

808,215 |

|

|

$ |

819,653 |

|

| Return on average common

stockholders' equity - GAAP |

|

|

7.17 |

% |

|

|

12.19 |

% |

|

|

10.33 |

% |

|

|

10.71 |

% |

|

|

5.89 |

% |

| Return on average tangible

common stockholders' equity - Non-GAAP |

|

|

9.57 |

% |

|

|

16.42 |

% |

|

|

13.87 |

% |

|

|

14.45 |

% |

|

|

7.88 |

% |

| Calculation of

Efficiency Ratio |

|

|

|

|

|

|

|

|

|

|

| Total noninterest expense |

|

$ |

48,605 |

|

|

$ |

45,370 |

|

|

$ |

47,811 |

|

|

$ |

45,068 |

|

|

$ |

49,959 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

Amortization of core deposit intangibles |

|

|

516 |

|

|

|

581 |

|

|

|

581 |

|

|

|

593 |

|

|

|

596 |

|

|

Merger-related expenses |

|

|

295 |

|

|

|

533 |

|

|

|

3,488 |

|

|

|

— |

|

|

|

4,585 |

|

| Noninterest expense, as

adjusted |

|

$ |

47,794 |

|

|

$ |

44,256 |

|

|

$ |

43,742 |

|

|

$ |

44,475 |

|

|

$ |

44,778 |

|

| Net interest income |

|

$ |

75,925 |

|

|

$ |

81,640 |

|

|

$ |

80,285 |

|

|

$ |

80,302 |

|

|

$ |

70,388 |

|

| Total noninterest income |

|

|

6,265 |

|

|

|

7,023 |

|

|

|

7,233 |

|

|

|

7,063 |

|

|

|

6,780 |

|

| Total revenue |

|

|

82,190 |

|

|

|

88,663 |

|

|

|

87,518 |

|

|

|

87,365 |

|

|

|

77,168 |

|

| Tax-equivalent adjustment on

municipal securities |

|

|

436 |

|

|

|

443 |

|

|

|

395 |

|

|

|

382 |

|

|

|

346 |

|

| Total revenue, as

adjusted |

|

$ |

82,626 |

|

|

$ |

89,106 |

|

|

$ |

87,913 |

|

|

$ |

87,747 |

|

|

$ |

77,514 |

|

| Efficiency ratio -

Non-GAAP |

|

|

57.84 |

% |

|

|

49.67 |

% |

|

|

49.76 |

% |

|

|

50.69 |

% |

|

|

57.77 |

% |

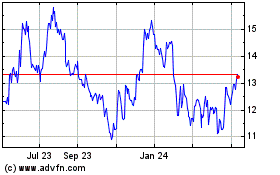

Lakeland Bancorp (NASDAQ:LBAI)

Historical Stock Chart

From Apr 2024 to May 2024

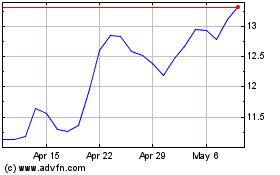

Lakeland Bancorp (NASDAQ:LBAI)

Historical Stock Chart

From May 2023 to May 2024