Keros Therapeutics Reports Second Quarter 2024 Financial Results

August 07 2024 - 4:01PM

Keros Therapeutics, Inc. (“Keros” or the “Company”) (Nasdaq: KROS),

a clinical-stage biopharmaceutical company focused on developing

and commercializing novel therapeutics to treat a wide range of

patients with disorders that are linked to dysfunctional signaling

of the transforming growth factor-beta (“TGF-ß”) family of

proteins, today reported financial results for the quarter ended

June 30, 2024.

“Keros continued to build upon the progress of all programs

across our pipeline in the second quarter of 2024, as evidenced by

our recent positive regulatory and data updates from the

elritercept (KER-050) program,” said Jasbir S. Seehra, Ph.D., Chair

and Chief Executive Officer. “We continue to be excited by the

strong enrollment activity we have seen to date in our Phase 2

clinical trial of cibotercept (KER-012) in patients with pulmonary

arterial hypertension and look forward to completing enrollment of

that trial in the fourth quarter of this year.”

Second Quarter 2024 Financial

Results

Keros reported a net loss of $45.3 million in the second quarter

of 2024 as compared to a net loss of $37.5 million in the second

quarter of 2023. The increase of $7.8 million for the second

quarter was largely due to increased research and development

efforts as well as additional investments to support the

achievement of Keros’ clinical and corporate goals.

Research and development expenses were $40.5 million for the

second quarter of 2024 as compared to $32.5 million for the same

period in 2023. The increase of $8.0 million was primarily due to

additional research and development efforts, manufacturing

activities and personnel expenses to support the advancement of

Keros’ pipeline.

General and administrative expenses were $10.0 million for the

second quarter of 2024 as compared to $8.8 million for the same

period in 2023. The increase of $1.2 million was primarily due to

increase in personnel expenses and other external expenses to

support Keros’ organizational growth.

Keros’ cash and cash equivalents as of June 30, 2024 was

$405.9 million compared to $331.1 million as of December 31, 2023.

Keros expects that the cash and cash equivalents it had on hand at

June 30, 2024 will enable Keros to fund its operating expenses

and capital expenditure requirements into 2027.

About Keros Therapeutics, Inc.

Keros is a clinical-stage biopharmaceutical company focused on

developing and commercializing novel therapeutics to treat a wide

range of patients with disorders that are linked to dysfunctional

signaling of the TGF-ß family of proteins. We are a leader in

understanding the role of the TGF-ß family of proteins, which are

master regulators of the growth, repair and maintenance of a number

of tissues, including blood, bone, skeletal muscle, adipose and

heart tissue. By leveraging this understanding, we have discovered

and are developing protein therapeutics that have the potential to

provide meaningful and potentially disease-modifying benefit to

patients. Keros’ lead product candidate, elritercept (KER-050), is

being developed for the treatment of low blood cell counts, or

cytopenias, including anemia and thrombocytopenia, in patients with

myelodysplastic syndromes and in patients with myelofibrosis.

Keros’ second product candidate, cibotercept (KER-012), is being

developed for the treatment of pulmonary arterial hypertension and

for the treatment of cardiovascular disorders. Keros’ third product

candidate, KER-065, is being developed for the treatment of obesity

and for the treatment of neuromuscular diseases.

Cautionary Note Regarding Forward-Looking

Statements

Statements contained in this press release regarding matters

that are not historical facts are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995, as amended. Words such as “enable,” “expects,” “look

forward,” “progress” and “will” or similar expressions are intended

to identify forward-looking statements. Examples of these

forward-looking statements include statements concerning: Keros’

expectations regarding its growth, strategy, progress and the

design, objectives and timing of its clinical trials for

elritercept and cibotercept, including its regulatory plans; and

Keros’ expected cash runway. Because such statements are subject to

risks and uncertainties, actual results may differ materially from

those expressed or implied by such forward-looking statements.

These risks and uncertainties include, among others: Keros’ limited

operating history and historical losses; Keros’ ability to raise

additional funding to complete the development and any

commercialization of its product candidates; Keros’ dependence on

the success of its product candidates, elritercept, cibotercept and

KER-065; that Keros may be delayed in initiating, enrolling or

completing any clinical trials; competition from third parties that

are developing products for similar uses; Keros’ ability to obtain,

maintain and protect its intellectual property; and Keros’

dependence on third parties in connection with manufacturing,

clinical trials and preclinical studies.

These and other risks are described more fully in Keros’ filings

with the Securities and Exchange Commission (“SEC”), including the

“Risk Factors” section of the Company’s Quarterly Report on Form

10-Q, filed with the SEC on May 8, 2024, and its other documents

subsequently filed with or furnished to the SEC. All

forward-looking statements contained in this press release speak

only as of the date on which they were made. Except to the extent

required by law, Keros undertakes no obligation to update such

statements to reflect events that occur or circumstances that exist

after the date on which they were made.

Investor Contact:

Justin Frantzjfrantz@kerostx.com 617-221-6042

|

KEROS THERAPEUTICS, INC.Condensed Consolidated

Statements of Operations(In thousands, except share and per share

data)(Unaudited) |

| |

THREE MONTHS ENDED JUNE 30, |

|

SIX MONTHS ENDED JUNE 30, |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

REVENUE: |

|

|

|

|

|

|

|

|

Service and other revenue |

|

37 |

|

|

|

— |

|

|

|

120 |

|

|

|

— |

|

|

Total revenue |

|

37 |

|

|

|

— |

|

|

|

120 |

|

|

|

— |

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

Research and development |

|

(40,515 |

) |

|

|

(32,534 |

) |

|

|

(78,773 |

) |

|

|

(63,625 |

) |

|

General and administrative |

|

(9,961 |

) |

|

|

(8,803 |

) |

|

|

(20,269 |

) |

|

|

(16,581 |

) |

|

Total operating expenses |

|

(50,476 |

) |

|

|

(41,337 |

) |

|

|

(99,042 |

) |

|

|

(80,206 |

) |

| LOSS

FROM OPERATIONS |

|

(50,439 |

) |

|

|

(41,337 |

) |

|

|

(98,922 |

) |

|

|

(80,206 |

) |

| OTHER

INCOME (EXPENSE), NET |

|

|

|

|

|

|

|

|

Dividend income |

|

5,378 |

|

|

|

3,987 |

|

|

|

11,184 |

|

|

|

7,093 |

|

|

Other expense, net |

|

(196 |

) |

|

|

(155 |

) |

|

|

(633 |

) |

|

|

(196 |

) |

|

Total other income, net |

|

5,182 |

|

|

|

3,832 |

|

|

|

10,551 |

|

|

|

6,897 |

|

| Net

loss |

$ |

(45,257 |

) |

|

$ |

(37,505 |

) |

|

$ |

(88,371 |

) |

|

$ |

(73,309 |

) |

| Net loss attributable to

common stockholders—basic and diluted |

$ |

(45,257 |

) |

|

$ |

(37,505 |

) |

|

$ |

(88,371 |

) |

|

$ |

(73,309 |

) |

| Net loss per share

attributable to common stockholders—basic and diluted |

$ |

(1.25 |

) |

|

$ |

(1.27 |

) |

|

$ |

(2.46 |

) |

|

$ |

(2.53 |

) |

| Weighted-average common stock

outstanding—basic and diluted |

|

36,103,187 |

|

|

|

29,602,458 |

|

|

|

35,894,305 |

|

|

|

28,989,361 |

|

|

KEROS THERAPEUTICS, INC.Condensed Consolidated

Balance Sheets(In thousands, except share and per share

data)(Unaudited) |

| |

JUNE 30,2024 |

|

DECEMBER 31,2023 |

| ASSETS |

|

|

|

| CURRENT ASSETS: |

|

|

|

|

Cash and cash equivalents |

405,863 |

|

|

331,147 |

|

|

Accounts receivable |

4 |

|

|

143 |

|

|

Prepaid expenses and other current assets |

26,847 |

|

|

16,003 |

|

|

Total current assets |

432,714 |

|

|

347,293 |

|

| Operating lease right-of-use

assets |

14,649 |

|

|

15,334 |

|

| Property and equipment,

net |

4,292 |

|

|

4,134 |

|

| Restricted cash |

1,212 |

|

|

1,212 |

|

| Other long-term assets |

2,155 |

|

|

2,052 |

|

|

TOTAL ASSETS |

455,022 |

|

|

370,025 |

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

| CURRENT LIABILITIES: |

|

|

|

| Accounts payable |

6,535 |

|

|

5,450 |

|

| Current portion of operating

lease liabilities |

1,096 |

|

|

1,005 |

|

| Accrued expenses and other

current liabilities |

13,614 |

|

|

17,918 |

|

|

Total current liabilities |

21,245 |

|

|

24,373 |

|

| Operating lease liabilities,

net of current portion |

12,861 |

|

|

13,439 |

|

|

Total liabilities |

34,106 |

|

|

37,812 |

|

| STOCKHOLDERS' EQUITY: |

|

|

|

| Preferred stock, par value of

$0.0001 per share; 10,000,000 shares authorized as of June 30, 2024

and December 31, 2023; no shares issued and outstanding |

— |

|

|

— |

|

| Common stock, par value of

$0.0001 per share; 200,000,000 shares authorized as of June 30,

2024 and December 31, 2023; 36,169,558 and 31,841,084 shares issued

and outstanding as of June 30, 2024 and December 31, 2023,

respectively |

3 |

|

|

3 |

|

|

Additional paid-in capital |

890,710 |

|

|

713,636 |

|

|

Accumulated deficit |

(469,797 |

) |

|

(381,426 |

) |

|

Total stockholders' equity |

420,916 |

|

|

332,213 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

455,022 |

|

|

370,025 |

|

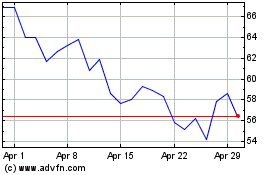

Keros Therapeutics (NASDAQ:KROS)

Historical Stock Chart

From Jul 2024 to Aug 2024

Keros Therapeutics (NASDAQ:KROS)

Historical Stock Chart

From Aug 2023 to Aug 2024