Continued ramp in enterprise FWA revenue; now

represents over 13% revenue

Next generation 5G hotspot launches with

Verizon and Telstra

Inseego Corp. (Nasdaq: INSG) (the “Company”), a leader in 5G

edge cloud solutions, today reported its results for the third

quarter ended September 30, 2022. The Company reported third

quarter net revenue of $69.2 million, GAAP operating loss of $11.9

million, GAAP net loss of $15.7 million, GAAP net loss of $0.15 per

share, adjusted EBITDA of negative $2.5 million, and non-GAAP net

loss of $0.11 per share. Unrestricted cash and cash equivalents at

quarter end was $18.1 million.

“We're pleased to report strong revenue results for the third

quarter,” said Ashish Sharma, CEO of Inseego. “The driver for

Inseego's future growth is the enterprise FWA business, which now

represents 13% of our revenue. This year, we signed up hundreds of

new customers for our 5G FWA solutions, and we’ve added a lot of

new enterprise customers to the list of ongoing pilots of both 5G

FWA and our new enterprise networking solution, 5G SD EDGE, which

was released earlier in the quarter. Thanks to the breadth of our

5G portfolio, we are seeing a trend of more and more customers

choosing Inseego over the competition.”

Business Highlights

– 5G revenue up 22% year-over-year on a

quarterly basis

– Software solutions represented 21% of total

revenue in the quarter

– Sold 5G products to over 600 enterprises by

quarter-end

– Enterprise base now exceeds 1,000

customers

– Introduced Inseego 5G SD EDGE™ cloud

enterprise WAN networking solution with zero trust networking

access (ZTNA)

– Provides corporate IT teams the ability to

extend IT policies to the edge

– Pilots with Fortune 500 companies

underway

– Launch of Inseego Wavemaker™ 5G indoor CPE

FG2000 with Drei Austria in September, the second member of the 3

Group to launch Inseego 5G fixed wireless access products

– Next generation 5G mobile hotspot launches

with Verizon and Telstra

“We exceeded our sales expectations for the quarter due in large

part to the successful launch of our next-generation 5G mobile

hotspot and continued ramp in 5G FWA enterprise deployments,” said

Bob Barbieri, CFO of Inseego. “This quarter’s gross margin was

impacted by the higher volume of carrier hotspot sales as well as

elevated supply chain costs. We expect gross margin to improve in

Q4 and with it our quarterly cash usage will trend lower. This will

allow us to achieve our goal of cash flow breakeven during Q1

2023.”

Conference Call Information

Inseego will host a conference call and live webcast for

analysts and investors today at 5:00 p.m. ET. A Q&A session

with analysts will be held live directly after the prepared

remarks. To access the conference call:

- Online, visit

https://investor.inseego.com/events-presentations

- Phone-only participants can pre-register by navigating to

https://dpregister.com/sreg/10163627/f141da2f15

- Those without internet access or unable to pre-register may

dial-in by calling:

- In the United States, call 1-844-282-4463

- International parties can access the call at

1-412-317-5613

An audio replay of the conference call will be available

beginning one hour after the call through November 16, 2022. To

hear the replay, parties in the United States may call

1-877-344-7529 and enter access code 5671868 followed by the # key.

International parties may call 1-412-317-0088. In addition, the

Inseego Corp. press release will be accessible from the Company's

website before the conference call begins.

About Inseego Corp.

Inseego Corp. is the industry leader in 5G Enterprise cloud WAN

solutions with millions of end customers and thousands of

enterprise and SMB customers on its 4G, 5G and cloud platforms.

Inseego’s 5G Edge Cloud combines industry’s best 5G technology,

rich cloud networking features and intelligent edge applications.

Inseego powers new business experiences by connecting distributed

sites and workforces, securing enterprise data and improving

business outcomes with intelligent operational visibility—all over

a 5G network. For more information on Inseego, visit

www.inseego.com #Putting5GtoWork

©2022. Inseego Corp. All rights reserved. The Inseego name and

logo, MiFi, Inseego Wavemaker, and Inseego 5G SD EDGE are

registered trademarks and trademarks of Inseego Corp. Other

Company, product or service names mentioned herein are the

trademarks of their respective owners.

Cautionary Note Regarding Forward-Looking Statements

Some of the information presented in this news release may

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. In this context,

forward-looking statements often address expected future business

and financial performance and often contain words such as “may,”

“estimate,” “anticipate,” “believe,” “expect,” “intend,” “plan,”

“project,” “will” and similar words and phrases indicating future

results. The information presented in this news release related to

our future business outlook, the future demand for our products, as

well as other statements that are not purely statements of

historical fact, are forward-looking in nature. These

forward-looking statements are made on the basis of management’s

current expectations, assumptions, estimates and projections and

are subject to significant risks and uncertainties that could cause

actual results to differ materially from those anticipated in such

forward-looking statements. We therefore cannot guarantee future

results, performance or achievements. Actual results could differ

materially from our expectations.

Factors that could cause actual results to differ materially

from the Company’s expectations include: (1) the future demand for

wireless broadband access to data and asset management software and

services; (2) the growth of wireless wide-area networking and asset

management software and services; (3) customer and end-user

acceptance of the Company’s current product and service offerings

and market demand for the Company’s anticipated new product and

service offerings; (4) increased competition and pricing pressure

from participants in the markets in which the Company is engaged;

(5) dependence on third-party manufacturers and key component

suppliers worldwide; (6) the impact that new or adjusted tariffs

may have on the cost of components or our products, and our ability

to sell products internationally; (7) the impact of fluctuations of

foreign currency exchange rates; (8) the impact of geopolitical

instability and supply chain challenges on our ability to source

components and manufacture our products; (9) unexpected liabilities

or expenses; (10) the Company’s ability to introduce new products

and services in a timely manner, including the ability to develop

and launch 5G products at the speed and functionality required by

our customers; (11) litigation, regulatory and IP developments

related to our products or components of our products; (12)

dependence on a small number of customers for a significant portion

of the Company’s revenues and accounts receivable; (13) the

Company’s ability to raise additional financing when the Company

requires capital for operations or to satisfy corporate

obligations; (14) the Company’s plans and expectations relating to

acquisitions, divestitures, strategic relationships, international

expansion, software and hardware developments, personnel matters,

and cost containment initiatives, including restructuring

activities and the timing of their implementations; (15) the global

semiconductor shortage and any related price increases or supply

chain disruptions, and (16) the potential impact of COVID-19 on the

business.

These factors, as well as other factors set forth as risk

factors or otherwise described in the reports filed by the Company

with the SEC (available at www.sec.gov), could cause actual results

to differ materially from those expressed in the Company’s

forward-looking statements. The Company assumes no obligation to

update publicly any forward-looking statements for any reason, even

if new information becomes available or other events occur in the

future, except as otherwise required pursuant to applicable law and

our on-going reporting obligations under the Securities Exchange

Act of 1934, as amended.

Non-GAAP Financial Measures

Inseego Corp. has provided financial information in this news

release that has not been prepared in accordance with GAAP.

Adjusted EBITDA, non-GAAP net loss, non-GAAP net loss per share and

non-GAAP operating costs and expenses exclude preferred stock

dividends, share-based compensation expense, amortization of

intangible assets purchased through acquisitions, amortization of

discount and issuance costs related to the Company’s 2025 Notes and

the revolving credit facility, fair value adjustments on derivative

instruments, a one-time prior period adjustment related to

unamortized debt discount and loss on debt extinguishment relating

to the Company’s 2022 Notes, and other non-recurring legal

expenses. Adjusted EBITDA also excludes interest, taxes,

depreciation and amortization, foreign exchange gains and losses,

and other.

Adjusted EBITDA, non-GAAP net loss, non-GAAP net loss per share

and non-GAAP operating costs and expenses are supplemental measures

of our performance that are not required by, or presented in

accordance with, GAAP. These non-GAAP financial measures have

limitations as an analytical tool and are not intended to be used

in isolation or as a substitute for operating expenses, net loss,

net loss per share or any other performance measure determined in

accordance with GAAP. We present these non-GAAP financial measures

because we consider each to be an important supplemental measure of

our performance.

Management uses these non-GAAP financial measures to make

operational decisions, evaluate the Company’s performance, prepare

forecasts and determine compensation. Further, management believes

that both management and investors benefit from referring to these

non-GAAP financial measures in assessing the Company’s performance

when planning, forecasting and analyzing future periods.

Share-based compensation expenses are expected to vary depending on

the number of new incentive award grants issued to both current and

new employees, the number of such grants forfeited by former

employees, and changes in the Company’s stock price, stock market

volatility, expected option term and risk-free interest rates, all

of which are difficult to estimate. In calculating non-GAAP

financial measures, management excludes certain non-cash and

one-time items in order to facilitate comparability of the

Company’s operating performance on a period-to-period basis because

such expenses are not, in management’s view, related to the

Company’s ongoing operating performance. Management uses this view

of the Company’s operating performance for purposes of comparison

with its business plan and individual operating budgets and in the

allocation of resources.

The Company further believes that these non-GAAP financial

measures are useful to investors in providing greater transparency

to the information used by management in its operational

decision-making. The Company believes that the use of these

non-GAAP financial measures also facilitates a comparison of our

underlying operating performance with that of other companies in

our industry, which use similar non-GAAP financial measures to

supplement their GAAP results.

In the future, the Company expects to continue to incur expenses

similar to the non-GAAP adjustments described above, and exclusion

of these items in the presentation of our non-GAAP financial

measures should not be construed as an inference that these costs

are unusual, infrequent or non-recurring. Investors and potential

investors are cautioned that there are material limitations

associated with the use of non-GAAP financial measures as an

analytical tool. The limitations of relying on non-GAAP financial

measures include, but are not limited to, the fact that other

companies, including other companies in our industry, may calculate

non-GAAP financial measures differently than we do, limiting their

usefulness as a comparative tool.

Investors and potential investors are encouraged to review the

reconciliation of our non-GAAP financial measures contained within

this news release with our GAAP financial results.

INSEEGO CORP.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except share and

per share data)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2022

2021

2022

2021

Net revenues:

IoT & Mobile Solutions

$

62,633

$

56,975

$

172,129

$

151,770

Enterprise SaaS Solutions

6,534

9,242

20,279

37,737

Total net revenues

69,167

66,217

192,408

189,507

Cost of net revenues:

IoT & Mobile Solutions

48,209

43,595

131,805

116,777

Enterprise SaaS Solutions

3,002

3,679

9,505

14,965

Total cost of net revenues

51,211

47,274

141,310

131,742

Gross profit

17,956

18,943

51,098

57,765

Operating costs and expenses:

Research and development

15,417

12,626

47,597

38,954

Sales and marketing

8,295

9,172

25,789

29,997

General and administrative

5,720

6,599

20,101

22,657

Amortization of purchased intangible

assets

433

519

1,319

1,649

Impairment of capitalized software

—

—

—

1,197

Total operating costs and expenses

29,865

28,916

94,806

94,454

Operating loss

(11,909

)

(9,973

)

(43,708

)

(36,689

)

Other (expense) income:

Gain on sale of Ctrack South Africa

—

5,262

—

5,262

Loss on debt conversion and

extinguishment, net

—

—

(450

)

(432

)

Interest expense, net

(2,034

)

(1,655

)

(6,621

)

(5,178

)

Other (expense) income, net

(1,758

)

(828

)

(3,145

)

291

Total other (expense) income

(3,792

)

2,779

(10,216

)

(57

)

Loss before income taxes

(15,701

)

(7,194

)

(53,924

)

(36,746

)

Income tax provision (benefit)

42

(4

)

(582

)

445

Net loss

(15,743

)

(7,190

)

(53,342

)

(37,191

)

Less: Net income attributable to

noncontrolling interests

—

—

—

(214

)

Net loss attributable to Inseego Corp.

(15,743

)

(7,190

)

(53,342

)

(37,405

)

Series E preferred stock dividends

(691

)

(1,843

)

(2,029

)

(3,596

)

Net loss attributable to common

stockholders

$

(16,434

)

$

(9,033

)

$

(55,371

)

$

(41,001

)

Per share data:

Net loss per common share:

Basic and diluted

$

(0.15

)

$

(0.09

)

$

(0.52

)

$

(0.40

)

Weighted-average shares used in

computation of net loss per common share:

Basic and diluted

107,747,468

103,430,083

106,977,201

102,586,121

INSEEGO CORP.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except par value

and share data)

September 30,

2022

December 31,

2021

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

18,063

$

46,474

Restricted cash

—

3,338

Accounts receivable, net of allowance for

doubtful accounts of $371 and $408, respectively

28,668

26,781

Inventories

42,406

37,402

Prepaid expenses and other

10,902

13,624

Total current assets

100,039

127,619

Property, plant and equipment, net of

accumulated depreciation of $25,240 and $26,692, respectively

6,157

8,102

Rental assets, net of accumulated

depreciation of $5,919 and $5,392, respectively

4,411

4,575

Intangible assets, net of accumulated

amortization of $63,425 and $48,404, respectively

44,406

46,995

Goodwill

21,922

20,336

Right-of-use assets, net

6,902

7,839

Other assets

563

377

Total assets

$

184,400

$

215,843

LIABILITIES AND STOCKHOLDERS’

DEFICIT

Current liabilities:

Accounts payable

$

39,537

$

48,577

Accrued expenses and other current

liabilities

31,476

26,253

Total current liabilities

71,013

74,830

Long-term liabilities:

2025 Notes, net

158,079

157,866

Revolving credit facility, net

3,451

—

Deferred tax liabilities, net

816

852

Other long-term liabilities

6,841

7,149

Total liabilities

240,200

240,697

Commitments and contingencies

Stockholders’ deficit:

Preferred stock, par value $0.001;

2,000,000 shares authorized:

Series E Preferred stock, par value

$0.001; 39,500 shares designated, 25,000 shares issued and

outstanding, liquidation preference of $1,000 per share (plus any

accrued but unpaid dividends)

—

—

Common stock, par value $0.001;

150,000,000 shares authorized, 107,846,082 and 105,380,533 shares

issued and outstanding, respectively

108

105

Additional paid-in capital

790,460

770,619

Accumulated other comprehensive loss

(3,950

)

(8,531

)

Accumulated deficit

(842,418

)

(787,047

)

Total stockholders’ deficit

(55,800

)

(24,854

)

Total liabilities and stockholders’

deficit

$

184,400

$

215,843

INSEEGO CORP.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

2022

2021

Cash flows from operating activities:

Net loss

$

(15,743

)

$

(7,190

)

$

(53,342

)

$

(37,191

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

6,981

6,080

20,936

19,131

Fair value adjustment on derivative

instrument

—

(1,612

)

(902

)

(3,435

)

Provision for bad debts

44

80

29

346

Impairment of capitalized software

—

—

—

1,197

Provision for excess and obsolete

inventory

434

91

1,330

587

Share-based compensation expense

2,406

3,062

15,892

14,467

Amortization of debt discount and debt

issuance costs

450

371

2,472

1,117

Loss on debt conversion and

extinguishment, net

—

—

450

432

Gain on sale of Ctrack South Africa

—

(5,262

)

—

(5,262

)

Deferred income taxes

(127

)

137

(223

)

175

Right-of-use assets

(13

)

481

1,057

1,364

Other

—

19

—

572

Changes in assets and liabilities, net of

effects of divestiture:

Accounts receivable

(5,800

)

(3,649

)

(561

)

2,834

Inventories

4,222

(7,055

)

(5,926

)

(7,889

)

Prepaid expenses and other assets

(377

)

271

2,723

1,429

Accounts payable

(7,341

)

8,809

(13,548

)

(7,206

)

Accrued expenses, income taxes, and

other

8,016

3,500

6,276

4,797

Operating lease liabilities

(257

)

(860

)

(1,366

)

(2,222

)

Net cash used in operating activities

(7,105

)

(2,727

)

(24,703

)

(14,757

)

Cash flows from investing activities:

Acquisition of noncontrolling interest

—

—

—

(116

)

Purchases of property, plant and

equipment

(144

)

(1,844

)

(1,203

)

(4,299

)

Proceeds from the sale of property, plant

and equipment

—

637

—

1,143

Proceeds from sale of Ctrack South Africa,

net of cash divested

—

31,526

—

31,526

Additions to capitalized software

development costs

(3,020

)

(5,220

)

(9,242

)

(20,589

)

Net cash (used in) provided by investing

activities

(3,164

)

25,099

(10,445

)

7,665

Cash flows from financing activities:

Net (repayment) borrowing of bank and

overdraft facilities

(317

)

20

(458

)

315

Principal payments under finance lease

obligations

—

(965

)

(62

)

(3,138

)

Proceeds from a public offering, net of

issuance costs

—

1

—

29,370

Principal payments on financed assets

(337

)

—

(1,567

)

—

Borrowings on revolving credit

facility

9,000

—

9,000

—

Repayments on revolving credit

facility

(4,500

)

—

(4,500

)

—

Payment of debt issuance costs on

revolving credit facility

(1,126

)

—

(1,126

)

—

Proceeds from stock option exercises and

employee stock purchase plan, net of taxes paid on vested

restricted stock units

80

412

196

2,432

Net cash provided by (used in) financing

activities

2,800

(532

)

1,483

28,979

Effect of exchange rates on cash

1,172

(614

)

1,916

(293

)

Net (decrease) increase in cash, cash

equivalents and restricted cash

(6,297

)

21,226

(31,749

)

21,594

Cash, cash equivalents and restricted

cash, beginning of period

24,360

40,383

49,812

40,015

Cash, cash equivalents and restricted

cash, end of period

$

18,063

$

61,609

$

18,063

$

61,609

INSEEGO CORP.

Reconciliation of GAAP Net

Loss Attributable to Common Shareholders to Non-GAAP Net

Loss

(In thousands, except per share

data)

(Unaudited)

Three Months Ended

September 30, 2022

Nine Months Ended

September 30, 2022

Net Loss

Net Loss Per Share

Net Loss

Net Loss Per Share

GAAP net loss attributable to common

shareholders

$

(16,434

)

$

(0.15

)

$

(55,371

)

$

(0.52

)

Adjustments:

Preferred stock dividends(a)

691

0.01

2,029

0.02

Share-based compensation expense

2,406

0.02

15,892

0.16

Purchased intangibles amortization

517

—

1,610

0.02

Debt discount and issuance costs

amortization(b)

450

—

2,472

0.02

Fair value adjustment on derivative

instrument(c)

—

—

(902

)

(0.01

)

Loss on debt conversion and

extinguishment, net (d)

—

—

450

—

Other

—

—

(109

)

—

Non-GAAP net loss

$

(12,370

)

$

(0.11

)

$

(33,929

)

$

(0.31

)

Note: Amounts may not foot due to

rounding.

(a) Includes accrued dividends on Series E Preferred Stock. (b)

Includes the debt discount and issuance costs amortization related

to the 2025 Notes, and the issuance costs related to the revolving

credit facility. (c) Includes the fair value adjustment related to

the Company’s interest make-whole derivative instrument. (d)

Includes the loss on debt conversion and extinguishment of the 2025

Notes.

See “Non-GAAP Financial Measures” for information regarding our

use of Non-GAAP financial measures.

INSEEGO CORP.

Reconciliation of GAAP

Operating Costs and Expenses to Non-GAAP Operating Costs and

Expenses

Three Months Ended September 30,

2022

(In thousands)

(Unaudited)

GAAP

Share-based compensation

expense

Purchased intangibles

amortization

Non-GAAP

Cost of net revenues

$

51,211

$

199

$

84

$

50,928

Operating costs and expenses:

Research and development

15,417

513

—

14,904

Sales and marketing

8,295

489

—

7,806

General and administrative

5,720

1,205

—

4,515

Amortization of purchased intangible

assets

433

—

433

—

Total operating costs and expenses

$

29,865

$

2,207

$

433

$

27,225

Total

$

2,406

$

517

See “Non-GAAP Financial Measures” for information regarding our

use of Non-GAAP financial measures.

INSEEGO CORP.

Reconciliation of GAAP

Operating Costs and Expenses to Non-GAAP Operating Costs and

Expenses

Nine Months Ended September 30,

2022

(In thousands)

(Unaudited)

GAAP

Share-based compensation

expense

Purchased intangibles

amortization

Non-GAAP

Cost of net revenues

$

141,310

$

1,873

$

290

$

139,147

Operating costs and expenses:

Research and development

47,597

5,011

—

42,586

Sales and marketing

25,789

3,087

—

22,702

General and administrative

20,101

5,921

—

14,180

Amortization of purchased intangible

assets

1,319

—

1,319

—

Total operating costs and expenses

$

94,806

$

14,019

$

1,319

$

79,468

Total

$

15,892

$

1,609

See “Non-GAAP Financial Measures” for information regarding our

use of Non-GAAP financial measures

INSEEGO CORP.

Reconciliation of GAAP Net

Loss Attributable to Common Shareholders to Adjusted EBITDA

(In thousands)

(Unaudited)

Three Months Ended

September 30, 2022

Nine Months Ended September

30, 2022

GAAP net loss attributable to common

shareholders

(16,434

)

$

(55,371

)

Preferred stock dividends(a)

691

2,029

Income tax provision (benefit)

42

(582

)

Depreciation and amortization

6,981

20,936

Share-based compensation expense

2,406

15,892

Fair value adjustment of derivative(b)

—

(902

)

Interest expense, net(c)

2,034

6,621

Loss on debt conversion and

extinguishment(d)

—

450

Other(e)

1,759

4,093

Adjusted EBITDA

$

(2,521

)

$

(6,834

)

(a) Includes accrued dividends on Series E Preferred Stock. (b)

Includes the fair value adjustment related to the Company’s

interest make-whole derivative instrument. (c) Includes the debt

discount and issuance costs amortization related to the 2025 Notes,

and the issuance costs related to the revolving credit facility.

(d) Includes the loss on debt conversion and extinguishment of the

2025 Notes. (e) Primarily includes a benefit recorded related to

non-recurring legal settlements and foreign exchange gains and

losses.

See “Non-GAAP Financial Measures” for information regarding our

use of Non-GAAP financial measures.

INSEEGO CORP.

Quarterly Net Revenues by

Product Grouping

(In thousands)

(Unaudited)

Three Months Ended

September 30, 2022

June 30, 2022

March 31, 2022

December 31, 2021

September 30, 2021

IoT & Mobile Solutions

$

62,633

$

54,990

$

54,505

$

66,214

$

56,975

Enterprise SaaS Solutions

6,534

6,866

6,879

6,678

9,242

Total net revenues

$

69,167

$

61,856

$

61,384

$

72,892

$

66,217

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221102005621/en/

Inseego Corp. Media Contact: Anette Gaven +1 (619)

993-3058 Anette.Gaven@inseego.com

Investor Relations Contact: Kevin Liu (626) 657-0013

Investor.Relations@inseego.com

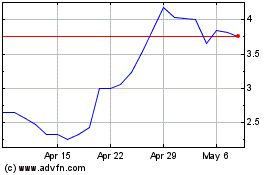

Inseego (NASDAQ:INSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Inseego (NASDAQ:INSG)

Historical Stock Chart

From Apr 2023 to Apr 2024