As

filed with the Securities and Exchange Commission on August 26,

2022

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER THE SECURITIES ACT OF 1933

INDIE

SEMICONDUCTOR, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

08-7654321 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification Number) |

32

Journey

Aliso Viejo, California 92656

(949) 608-0854

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Thomas

Schiller

Chief

Financial Officer and EVP of Strategy

indie

Semiconductor, Inc.

32

Journey

Aliso

Viejo, California 92656

Telephone:

(949) 608-0854

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Jonathan H. Talcott

E. Peter Strand

Nelson Mullins Riley & Scarborough LLP

101 Constitution Avenue NW, Suite 900

Washington,

DC 20001

Telephone: (202) 689-2800

Approximate

date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or classes of additional securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

This

registration statement contains two prospectuses:

| ● | a

base prospectus which covers the offering, issuance and sale of such indeterminate number

of shares of common stock and preferred stock, such indeterminate principal amount of debt

securities, such indeterminate number of warrants to purchase common stock, preferred stock

and/or debt securities, such indeterminate number of rights to purchase common stock, preferred

stock and/or debt securities of one or more series, and such indeterminate number of units

representing an interest in one or more shares of common stock or preferred stock, debt securities,

warrants and/or rights in any combination by the Company of up to a maximum aggregate offering

price of $300,000,000; and |

| ● | a

sales agreement prospectus covering the offering, issuance and sale by the Company of up

to a maximum aggregate offering price of $150,000,000 of Class A common stock that may be

issued and sold under a sales agreement, dated August 26, 2022, with B. Riley Securities,

Inc., Craig-Hallum Capital Group LLC and Roth Capital Partners, LLC, as sales agents. |

The

base prospectus immediately follows this explanatory note. The prospectus relating to the sales agreement immediately follows the base

prospectus. The common stock that may be offered, issued and sold by the Company under the sales agreement prospectus is included in

the $300,000,000 of securities that may be offered, issued and sold by the Company under the base prospectus. Upon termination of the

sales agreement with B. Riley Securities, Inc., Craig-Hallum Capital Group LLC and Roth Capital Partners, LLC, any portion of the $150,000,000

included in the sales agreement prospectus that is not sold pursuant to the sales agreement will be available for sale in other offerings

pursuant to the base prospectus and a corresponding prospectus supplement, and if no shares are sold under the sales agreement, the full

$150,000,000 of securities may be sold in other offerings pursuant to the base prospectus and a corresponding prospectus supplement.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PROSPECTUS |

SUBJECT

TO COMPLETION, DATED AUGUST 26, 2022 |

$300,000,000

Common

Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

From

time to time, we may offer and sell our securities listed above in one or more offerings in amounts, at prices and on terms that we will

determine at the time of the offering. The aggregate initial offering price of all securities sold by us under this prospectus will not

exceed $300,000,000.

Each

time we offer our securities, we will provide you with specific terms of the securities offered in supplements to this prospectus. This

prospectus may not be used to offer and sell our securities unless accompanied by a prospectus supplement. Accompanying prospectus supplements

may add, update or change information contained in this prospectus. You should read this prospectus, the accompanying prospectus supplements,

the information incorporated by reference into this prospectus and the accompany prospectus supplements and the additional information

described below under the heading “Where You Can Find More Information” carefully before you invest in our securities.

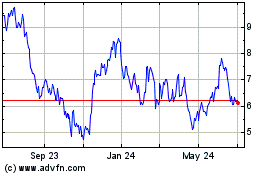

Our

Class A common stock and our public warrants are listed on the Nasdaq Capital Market (“Nasdaq”) under the symbols “INDI”

and “INDIW,” respectively. On August 24,

2022, the closing price of our Class A common stock was $7.67 and the closing price for our public warrants was $1.73.

Our

securities may be offered and sold to or through underwriters, brokers, dealers or agents as designated from time to time, or directly

to one or more other purchasers or through a combination of such methods. For additional information, you should refer to the section

captioned “Plan of Distribution” on page 34 of this prospectus. If any underwriters, dealers or agents are involved in the

sale of any of our securities, their names, and any applicable purchase price, fee, commission or discount arrangements between or among

them, will be set forth, or will be calculable from the information set forth, in the accompanying prospectus supplement. The price to

the public of our securities and the net proceeds that we expect to receive from such sale will also be set forth in the accompanying

prospectus supplement.

Investing

in our securities involves a high degree of risk. You should carefully read and consider the risk factors set forth under the caption

“Risk Factors” on page 3 of this prospectus, in any accompanying prospectus supplement and in the documents incorporated

or deemed incorporated by reference into this prospectus and the accompanying prospectus supplement before you invest in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus or any accompanying prospectus supplement is truthful or complete. Any representation to the contrary is a criminal

offense.

The

date of this prospectus is , 2022.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we have filed with the Securities and Exchange Commission (the “SEC”)

using a shelf registration process. Using this process, we may, from time to time, sell any combination of the securities described in

this prospectus in one or more offerings up to a total dollar amount of $300,000,000. This prospectus provides a general description

of the securities we may offer. Each time we sell any securities under this prospectus, we will provide a prospectus supplement that

will contain more specific information about the terms of the securities being offered and the specific manner in which they will be

offered. This prospectus may not be used to offer and sell our securities unless accompanied by a prospectus supplement. Accompanying

prospectus supplements may add, update or change information contained in this prospectus. To the extent that any statement we make in

an accompanying prospectus supplement is inconsistent with statements made in this prospectus or in any document incorporated by reference

herein, the statements made in this prospectus or in any document incorporated by reference herein will be deemed modified or superseded

by those made in the accompanying prospectus supplement.

You

should carefully read this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein and

therein as described below under the captions “Where You Can Find More Information” and “Incorporation of Certain Information

by Reference” before making a decision to invest in our securities.

You

should rely only on the information set forth in or incorporated by reference into this prospectus and any accompanying prospectus supplement.

We have not authorized anyone else to provide you with different information. If anyone provides you with different or inconsistent information,

you should not rely on it.

We

are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

You

should assume that the information in this prospectus, any prospectus supplement and the documents incorporated by reference herein and

therein are accurate only as of the dates of those documents. Our business, financial condition, results of operations and prospects

may have changed since those dates.

Unless

the context otherwise requires, throughout this prospectus and any accompanying prospectus supplement, the words “indie,”

“we,” “us,” “our,” “the registrant” or the “Company” refer to indie Semiconductor,

Inc., and the term “securities” refers collectively to our preferred stock, common stock, debt securities, warrants, units

and any combination of the foregoing securities.

This

prospectus contains summaries of certain provisions contained in documents described in this prospectus. All of the summaries are qualified

in their entirety by the actual documents, which you should review before making a decision to invest in our securities. Copies of the

documents referred to herein have been filed, or will be filed or incorporated by reference as exhibits to the registration statement

of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More

Information.”

THE

COMPANY

indie

Semiconductor, Inc. (“indie”) and its predecessor for accounting purposes, Ay Dee Kay, LLC, a California limited liability

company (“ADK LLC”), and its subsidiaries, are collectively referred to herein as the “Company.” The Company

offers highly innovative automotive semiconductors and software solutions for Advanced Driver Assistance Systems (“ADAS”),

connected car, user experience and electrification applications. The Company focuses on edge sensors across multiple modalities spanning

light detection and ranging (“LiDAR”), radar, ultrasound and vision. These functions represent the core safety systems for

next generation vehicles and set the stage for truly autonomous cars and trucks, while the advanced user interfaces are transforming

the in-cabin experience to mirror and seamlessly connect to the mobile platforms we rely on every day. indie is an approved vendor to

Tier 1 automotive suppliers and its platforms can be found in marquee automotive manufacturers around the world.

Through

innovative analog, digital and mixed signal integrated circuits (“ICs”) with software running on the embedded processors,

we are developing a differentiated, market-leading portfolio of automotive products. Our technological expertise, including cutting edge

design capabilities and packaging skillsets, together with our deep applications knowledge and strong customer relationships, have enabled

us to cumulatively ship over 140 million semiconductor devices since our inception.

Our

go-to-market strategy focuses on collaborating with key customers and partnering with roughly a dozen of Tier 1s via aligned product

development, in pursuit of solutions addressing the automotive industry’s highest growth applications. We leverage our core capabilities

in system-level hardware and software integration to develop highly integrated, ultra-compact and power efficient solutions. Further,

our products meet or exceed the quality standards set by the more than 20 global automotive manufacturers who utilize our devices today.

With

a global footprint, we support leading customers from our design and application centers located in North America, Asia and Europe, where

our local teams work closely on their unique design requirements.

indie

is a Delaware holding company that conducts its operations through its California subsidiary ADK LLC, which wholly-owns subsidiaries

indie Services Corporation, indie LLC and indie City LLC, all California entities, Ay Dee Kay Limited, a private limited company incorporated

under the laws of the United Kingdom, indie GmbH, a private limited liability company incorporated under the laws of Germany, indie Semiconductor

Hungary, a limited liability company incorporated under the laws of Hungary, TeraXion Inc., a wholly-owned subsidiary incorporated under

the laws of Canada, indie Semiconductor Japan, a wholly-owned subsidiary incorporated under the laws of Japan, indie Semiconductor Design

Israel Ltd., a private limited company incorporated under the laws of Israel, and has 64% voting power over subsidiary Wuxi indie Microelectronics

Technology Co., Ltd., an entity in China, and its wholly-owned subsidiaries, indie Semiconductor HK, Ltd and Shanghai Ziying Microelectronics

Co., Ltd, collectively as our “China Subsidiary.” Our China Subsidiary’s primary functions are product development,

sales, supply chain management and administrative support of its operations. indie Semiconductor is headquartered in Aliso Viejo, California

and a majority of our operations are based in the United States. A majority of our employees are located in the United States and Canada.

For

the year ended December 31, 2021, approximately 31% of our consolidated revenue was generated from product sales to Chinese-owned customers

with a final shipping destination of Greater China (including Hong Kong and Taiwan), 23% of our consolidated revenue was generated from

product sales to non-Chinese-owned customers with a final shipping destination of Greater China, and 46% of our consolidated revenue

was generated from product sales and services provided to non-Chinese-owned customers with a final shipping destination elsewhere. For

the same period, our China Subsidiary’s operations represented roughly 2% of our total assets and 3% of our total liabilities and

accounted for 18% of our consolidated revenue.

As

of the date of this prospectus, we have not paid, and do not anticipate paying in the foreseeable future, dividends or other distributions

to our stockholders. In order for us to pay dividends or other distributions to our stockholders, we will rely on payments from our domestic

operating subsidiary, ADK LLC. All revenue generated by shipments to China that is earned by ADK LLC is paid directly to ADK LLC, in

U.S. dollars. Additionally, there have not been any dividends or other distributions from our China subsidiary and our China subsidiary

has never paid any dividends or distributions outside of China. Any revenue generated by our China subsidiary is collected locally and

is held in Chinese bank accounts. We presently intend to retain all earnings to fund our operations and business expansions. See our

condensed consolidated financial statements and the related notes included elsewhere in the registration statement to which this prospectus

forms a part.

Background

On

June 10, 2021, Thunder Bridge Acquisition II, Ltd. (“Thunder Bridge II”) domesticated into a Delaware corporation and consummated

a series of transactions that resulted in the combination (the “Business Combination”) of Thunder Bridge II with ADK LLC

pursuant to a Master Transactions Agreement, dated December 14, 2020, as amended on May 3, 2021, by and among Thunder Bridge II, Thunder

Bridge II Surviving Pubco, Inc. (“Surviving Pubco”), ADK LLC, and the other parties named therein, following the approval

at the extraordinary general meeting of the stockholders of Thunder Bridge II held on June 9, 2021 (the “Special Meeting”).

On

December 14, 2020, Thunder Bridge II entered into subscription agreements with the investors named therein (the “PIPE Investors”),

including Mr. Kight and an affiliate of Thunder Bridge Acquisition II LLC (the “Sponsor”), pursuant to which Thunder Bridge

II agreed to issue and sell to the PIPE Investors an aggregate of 15,000,000 of Thunder Bridge II Class A ordinary shares, at a price

of $10.00 per Class A ordinary share, simultaneously with or immediately prior to the Closing (the “PIPE Financing”). Upon

the closing of the Business Combination, the shares issued pursuant to the PIPE Financing were automatically exchanged for 15,000,000

shares of our Class A common stock. Effective upon the closing of the Business Combination, Surviving Pubco changed its name to indie

Semiconductor, Inc.

The

rights of holders of our Class A common stock and warrants are governed by our amended and restated certificate of incorporation, our

bylaws and the Delaware General Corporation Law (the “DGCL”), and in the case of the warrants, the Warrant Agreement, dated

August 8, 2019, by and between Thunder Bridge II and Continental Stock Transfer & Trust Company, as amended by the Assignment, Assumption

and Amendment Agreement, dated as of June 10, 2021, by and among Thunder Bridge II, Surviving Pubco and Continental Stock Transfer &

Trust Company (as amended, the “Warrant Agreement”). See the section entitled “Description of Capital Stock.”

Corporate

Information

Our

principal executive offices are located at 32 Journey, Aliso Viejo, California 92656. Our telephone number is (949) 608-0854. Our website

address is www.indiesemi.com. The information located on, or accessible from, our website is not, and shall not be deemed to be,

a part of this prospectus or any accompanying prospectus supplement or incorporated into any other filings that we make with the SEC.

RISK

FACTORS

An

investment in our securities involves a high degree of risk. You should carefully read and review the risk factors discussed under the

caption “Risk Factors” in our most recent Annual Report on Form 10-K, the risk factors discussed under the caption

“Risk Factors” in any accompanying prospectus supplement, and any risk factors discussed in our other filings with

the SEC which are incorporated by reference into this prospectus and any accompanying prospectus supplement before investing in our securities.

These risks and uncertainties are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known

to us, or that we currently view as immaterial, may also materially and adversely affect us. If any of the risks or uncertainties described

in our most recent Annual Report on Form 10-K, any accompanying prospectus supplement or our other filings with the SEC or if any additional

risks and uncertainties actually occur, our business, financial condition, results of operations and prospects could be materially and

adversely affected. In that case, the trading price of our securities could decline, and you could lose all or part of your investment.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein and therein contain “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section

21E of the Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include, but are not limited

to, statements that express our strategies, intentions, financial projections, beliefs, expectations, strategies, predictions, or any

other statements relating to our future activities or other future events or conditions. Also, any statement that does not describe historical

or current facts is a forward-looking statement. These statements generally can be identified by the use of forward-looking terminology

such as “believes,” “expects,” “may,” “will,” “could,” “should,”

“projects,” “plans,” “goal,” “targets,” “potential,” “estimates,”

“pro forma,” “seeks,” “intends,” or “anticipates,” or similar expressions. These statements

are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These

statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict and/or

beyond our control. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted

in the forward-looking statements due to numerous factors discussed in this prospectus, any accompanying

prospectus supplement and the documents incorporated by reference herein. In addition, such statements could be affected by risks

and uncertainties related to:

| |

● |

the

expected benefits of the Business Combination and our acquisitions of TeraXion, Inc., Symeo GmbH and ON Design Israel; |

| |

● |

our

future financial performance; |

| |

● |

changes

in our strategy, future operations, financial position, estimated revenues and losses, projected costs, margins, cash flows, prospects

and plans; |

| |

● |

the

impact of health epidemics, including the COVID-19 pandemic, on our business and the actions we may take in response thereto; |

| |

● |

our

expansion plans and opportunities; |

| |

● |

the

outcome of any known and unknown regulatory proceedings; |

| |

● |

the

ability to recognize the anticipated benefits of recent acquisitions, which may be affected by, among other things, competition,

and our ability to successfully integrate and retain the acquired teams, and to grow and manage growth profitably; |

| |

● |

our

reliance on contract manufacturing and outsourced supply chain and the availability of semiconductors and manufacturing capacity; |

| |

● |

competitive

products and pricing pressures; |

| |

● |

our

future capital requirements and sources and uses of cash and our ability to obtain funding for our operations and future growth; |

| |

● |

changes

in the market for our products and services; |

| |

● |

expansion

plans and opportunities; |

| |

● |

the

cyclical nature of the semiconductor industry; |

| |

● |

our

ability to successfully introduce new technologies and products; |

| |

● |

the

demand for the goods into which our products are incorporated; |

| |

● |

our

ability to accurately estimate demand and obtain supplies from third-party producers; |

| |

● |

our

ability to win competitive bid selection processes and achieve additional design wins; |

| |

● |

conducting

business in China; |

| |

● |

the

inability to maintain the listing of our Class A common stock or the public warrants on Nasdaq; and |

| |

● |

other

risks described from time to time in periodic and current reports that we file with the SEC. |

This

list of risks and uncertainties, however, is only a summary of some of the most important factors and is not intended to be exhaustive.

You should carefully read and review the risks and information contained in, or incorporated by reference into, this prospectus and in

any accompanying prospectus supplement, including, without limitation, the section of this prospectus captioned “Risk Factors,”

the section captioned “Risk Factors” which is incorporated by reference herein from our most recent Annual Report on Form

10-K and any other risks and uncertainties we identify in other reports and information that we file with the SEC. New factors that are

not currently known to us or of which we are currently unaware may also emerge from time to time that could materially and adversely

affect us.

All

written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety

by the cautionary statements contained or referred to in this section. We caution investors not to rely too heavily on the forward-looking

statements we make or that are made on our behalf. Although we believe that the expectations reflected in the forward-looking statements

are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Any forward-looking statement made

by us in this prospectus speaks only as of the date of this prospectus. Except as required by applicable law, we undertake no obligation

and specifically decline any obligation to update any of these forward-looking statements after the date of such statements are made,

whether as a result of new information, future events or otherwise. You should, however, carefully read and review any further disclosures

we make related to forward-looking statements in any accompanying prospectus supplement and in the documents

incorporated by reference herein and therein.

USE

OF PROCEEDS

Unless

otherwise specified in an accompanying prospectus supplement, we currently intend to use the net proceeds from the sale of our securities

for general corporate and working capital purposes. Additional details regarding the use of the net proceeds from any particular sale

of our securities will be set forth in an accompanying prospectus supplement. Pending their use, we intend to invest the net proceeds

from the sale of our securities in high-quality, short-term, interest-bearing securities.

DESCRIPTION

OF CAPITAL STOCK

In

the discussion that follows, we have summarized certain material provisions of our Amended and Restated Certificate of Incorporation

(as amended, the “Certificate of Incorporation”), our Bylaws (the “Bylaws”) and the warrant-related documents

described herein that relate to our capital stock. This summary is not complete, is qualified in its entirety by reference to our Certificate

of Incorporation and our Bylaws and is subject to the relevant provisions of the DGCL. Copies of our Certificate of Incorporation and

Bylaws have been filed with the SEC and are incorporated by reference into this prospectus. You should carefully read our Certificate

of Incorporation and our Bylaws and the relevant provisions of the DGCL before you invest in our capital stock.

Authorized

and Outstanding Stock

The

Certificate of Incorporation authorizes the issuance of 300,000,000 shares of capital stock, consisting of:

| |

● |

10,000,000 shares

of preferred stock, par value $0.0001 per share (“Preferred Stock”); and |

| |

● |

250,000,000 shares

of Class A common stock, par value $0.0001 per share, and 40,000,000 shares of Class V common stock, par value $0.0001 per share. |

Class

A Common Stock

As of August 23, 2022, we had 121,444,910 shares of Class A common

stock issued and 119,717,910 shares issued and outstanding (which excludes 1,725,000 shares

of Class A common stock held by the Sponsor that remain held in escrow and subject to forfeiture if certain stock price performance thresholds

of the Company are not achieved by December 31, 2027).

Voting

rights. Each holder of Class A common stock is entitled to one vote for each share of Class A common stock held of record by

such holder on all matters on which stockholders generally are entitled to vote. The holders of Class A common stock do not have cumulative

voting rights in the election of directors. Generally, all matters to be voted on by stockholders must be approved by a majority vote

(or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all stockholders present in person or

represented by proxy and voting affirmatively or negatively on the matter, voting together as a single class. Notwithstanding the foregoing,

to the fullest extent permitted by law, holders of Class A common stock, as such, will have no voting power with respect to, and will

not be entitled to vote on, any amendment to the Certificate of Incorporation (including any certificate of designations relating to

any series of Preferred Stock) that relates solely to the terms of one or more outstanding series of Preferred Stock if the holders of

such affected series are entitled, either separately or together with the holders of one or more other such series, to vote thereon pursuant

to the Certificate of Incorporation (including any certificate of designations relating to any series of Preferred Stock) or pursuant

to the DGCL.

Dividend

rights. Subject to preferences that may be applicable to any outstanding Preferred Stock, the holders of shares of Class A common

stock are entitled to receive ratably such dividends, if any, as may be declared from time to time by our board of directors out of funds

legally available therefor.

Rights

upon liquidation. In the event of any voluntary or involuntary liquidation, dissolution or winding up of our affairs, the holders

of Class A common stock are entitled to share ratably in all assets remaining after payment of our debts and other liabilities, subject

to prior distribution rights of Preferred Stock or any class or series of stock having a preference over the Class A common stock, then

outstanding, if any.

Other

rights. The holders of Class A common stock have no preemptive or conversion rights or other subscription rights. There are no

redemption or sinking fund provisions applicable to the Class A common stock. The rights, preferences and privileges of holders of the

Class A common stock will be subject to those of the holders of any shares of the Preferred Stock the Company may issue in the future.

Class

V Common Stock

As

of August 23, 2022, we had 26,282,699 shares of Class V common stock outstanding. All outstanding

shares of Class V common stock are fully paid and non-assessable.

Voting

rights. The holders of the Class V common stock are entitled to one vote for each share of Class V common stock held of record

by such holders on all matters on which stockholders generally are entitled to vote. The holders of Class V common stock do not have

cumulative voting rights in the election of directors. Holders of shares of Class V common stock will vote together with holders of the

Class A common stock as a single class on all matters presented to the Company’s stockholders for their vote or approval. Generally,

all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality)

of the votes entitled to be cast by all stockholders present in person or represented by proxy, voting together as a single class. Notwithstanding

the foregoing, to the fullest extent permitted by law, holders of Class V common stock, as such, will have no voting power with respect

to, and will not be entitled to vote on, any amendment to the Certificate of Incorporation (including any certificate of designations

relating to any series of Preferred Stock) that relates solely to the terms of one or more outstanding series of Preferred Stock if the

holders of such affected series are entitled, either separately or together with the holders of one or more other such series, to vote

thereon pursuant to the Certificate of Incorporation (including any certificate of designations relating to any series of Preferred Stock)

or pursuant to the DGCL.

Dividend

rights. The holders of the Class V common stock will not participate in any dividends declared by the board of directors.

Rights

upon liquidation. In the event of any voluntary or involuntary liquidation, dissolution or winding up of our affairs, the holders

of Class V common stock are not entitled to receive any of our assets.

Other

rights. The holders of shares of Class V common stock do not have preemptive, subscription, redemption or conversion rights.

There are no redemption or sinking fund provisions applicable to the Class V common stock.

Issuance

and retirement of Class V common stock. In the event that any outstanding share of Class V common stock ceases to be held directly

or indirectly by a holder of a LLC Units following the merger of ADK Merger Sub LLC with and into ADK LLC (a “Post-Merger indie

Unit”), such share will automatically be transferred to us for no consideration and thereupon will be retired. We will not issue

additional shares of Class V common stock after the adoption of the Certificate of Incorporation other than in connection with the valid

issuance or transfer of Post-Merger indie Units in accordance with our governing documents and those of ADK LLC.

Preferred

Stock

As

of August 23, 2022, no shares of Preferred Stock were issued or outstanding. The Certificate

of Incorporation authorizes our board of directors to establish one or more series of Preferred Stock. Unless required by law or any

stock exchange, the authorized shares of Preferred Stock will be available for issuance without further action by the holders of our

common stock. Our board of directors has the discretion to determine the powers, preferences and relative, participating, optional and

other special rights, including voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences,

of each series of Preferred Stock.

The

issuance of Preferred Stock may have the effect of delaying, deferring or preventing a change in control of the Company without further

action by the stockholders. Additionally, the issuance of Preferred Stock may adversely affect the holders of our common stock by restricting

dividends on the Class A common stock, diluting the voting power of the Class A common stock and the Class V common stock or subordinating

the liquidation rights of the Class A common stock. As a result of these or other factors, the issuance of Preferred Stock could have

an adverse impact on the market price of our Class A common stock.

Warrants

As

of August 23, 2022, 27,400,000 warrants were

outstanding, including 17,250,000 public warrants, 8,650,000 private placement warrants and 1,500,000

sponsor warrants. Each whole public warrant entitles the registered holder to purchase one share of Class A common stock at a

price of $11.50 per share, subject to adjustment as discussed below, at any time. Pursuant to the warrant agreement, as amended by the

assignment, assumption and amendment agreement entered into in connection with the Business Combination, the Warrant Agreement, a public

warrant holder may exercise its warrants only for a whole number of shares. This means that only a whole number of warrants may be exercised

at any given time by a public warrant holder. However, except as set forth below, no public warrants will be exercisable for cash unless

we have an effective and current registration statement covering the shares of Class A common stock issuable upon exercise of the warrants

and a current prospectus relating to such shares of common stock. The public warrants will expire at 5:00 p.m., New York City time on

the earlier to occur of: (i) five years from the completion of the Business Combination or (ii) the redemption date as fixed by us pursuant

to the Warrant Agreement, if we elect to redeem all warrants.

The

private placement warrants and sponsor warrants are identical to the public warrants except that the private placement warrants and sponsor

warrants (including the shares of Class A common stock issuable upon exercise of the private placement warrants and sponsor warrants)

(i) are not transferable, assignable or salable until 30 days after the completion of the Business Combination, (ii) are exercisable

for cash (even if a registration statement covering the Class A common stock issuable upon exercise of such warrants is not effective)

or on a cashless basis, at the holder’s option, and (iii) are not be redeemable by us, in each case so long as they are still held

by the initial purchasers or their respective affiliates.

We

may call the warrants for redemption (excluding the private placement warrants and sponsor warrants), in whole and not in part, at a

price of $0.01 per warrant:

| |

● |

at

any time while the warrants are exercisable, |

| |

● |

upon

not less than 30 days’ prior written notice of redemption to each public warrant holder, |

| ● | if

and only if, the reported last sale price of the shares of our Class A common stock equals or exceeds $18.00 per share, for any 20 trading

days within a 30-day trading period ending on the third business day prior to the notice of redemption to public warrant holders, and |

| ● | if

and only if, there is a current registration statement in effect with respect to the shares of Class A common stock underlying such warrants

at the redemption date and for the entire 30-day trading period referred to above and continuing each day thereafter until the date of

redemption. |

The

right to exercise will be forfeited unless the warrants are exercised prior to the date specified in the notice of redemption. On and

after the redemption date, a record holder of a warrant will have no further rights except to receive the redemption price for such holder’s

warrant upon surrender of such warrant.

The

redemption criteria for the warrants have been established at a price which is intended to provide public warrant holders a reasonable

premium to the initial exercise price and provide a sufficient differential between the then-prevailing share price and the warrant exercise

price so that if the share price declines as a result of a redemption call, the redemption will not cause the share price to drop below

the exercise price of the warrants.

If

we call the warrants for redemption as described above, our management will have the option to require all holders that wish to exercise

warrants to do so on a “cashless basis.” In such event, each holder would pay the exercise price by surrendering the warrants

for that number of shares of Class A common stock equal to the quotient obtained by dividing (x) the product of the number of shares

underlying the warrants, multiplied by the difference between the exercise price of the warrants and the “fair market value”

(defined below) by (y) the fair market value. The “fair market value” will mean the average reported last sale price of the

Class A common stock for the 10 trading days ending on the third trading day prior to the date on which the notice of redemption is sent

to the holders of warrants. Whether we will exercise our option to require all holders to exercise their warrants on a “cashless

basis” will depend on a variety of factors including the price of the Class A common stock at the time the warrants are called

for redemption, our cash needs at such time and concerns regarding dilutive share issuances.

The

warrants are issued under a Warrant Agreement, as amended, between us and Continental Stock Transfer & Trust Company, as warrant

agent. The Warrant Agreement provides that the terms of the warrants may be amended without the consent of any holder to cure any ambiguity

or correct any defective provision, but requires the approval, by written consent or vote, of the holders of a majority of the then outstanding

public warrants in order to make any change that adversely affects the interests of the registered holders.

The

exercise price and number of shares of Class A common stock issuable on exercise of the warrants may be adjusted in certain circumstances

including in the event of a stock dividend, stock split or our recapitalization, reorganization, merger or consolidation. However, the

warrants will not be adjusted for issuances of shares of Class A common stock at a price below their respective exercise prices. We are

also permitted, in our sole discretion, to lower the exercise price (but not below the par value of a shares of Class A common stock)

at any time prior to the expiration date for a period of not less than 10 business days; provided, however, that we provide at least

10 business days’ prior written notice of such reduction to registered holders of the warrants and that any such reduction will

be applied consistently to all of the warrants. Any such reduction in the exercise price will comply with any applicable regulations

under the federal securities laws, including Rule 13e-4 under the Exchange Act generally and Rule 13e-4(f)(1)(i) specifically.

The

warrants may be exercised upon surrender of the warrant certificate on or prior to the expiration date at the offices of the warrant

agent, with the exercise form on the reverse side of the warrant certificate completed and executed as indicated, accompanied by full

payment of the exercise price, by certified or official bank check payable to us, for the number of warrants being exercised. The public

warrant holder will not have the rights or privileges of holders of shares of Class A common stock and any voting rights until they exercise

their warrants and receive shares of Class A common stock. After the issuance of Class A common stock upon exercise of the warrants,

each holder will be entitled to one vote for each share held of record on all matters to be voted on by stockholders.

Except

as described above, no public warrants will be exercisable and we will not be obligated to issue shares of Class A common stock unless

at the time a holder seeks to exercise such warrant, a prospectus relating to the Class A common stock issuable upon exercise of the

warrants is current and the Class A common stock has been registered or qualified or deemed to be exempt under the securities laws of

the state of residence of the holder of the warrants. Under the terms of the Warrant Agreement, we have agreed to use our best efforts

to meet these conditions and to maintain a current prospectus relating to the Class A common stock issuable upon exercise of the warrants

until the expiration of the warrants. However, we cannot assure you that we will be able to do so and, if we do not maintain a current

prospectus relating to the Class A common stock issuable upon exercise of the warrants, holders will be unable to exercise their warrants

and we will not be required to settle any such warrant. If the prospectus relating to the shares of Class A common stock issuable upon

the exercise of the warrants is not current or if the Class A common stock is not qualified or exempt from qualification in the jurisdictions

in which the holders of the warrants reside, we will not be required to net cash settle or cash settle the warrant exercise, the warrants

may have no value, the market for the warrants may be limited and the warrants may expire worthless.

Public

warrant holders may elect, at their sole option and discretion, to be subject to a restriction on the exercise of their warrants such

that an electing public warrant holder (and his, her or its affiliates) would not be able to exercise their warrants to the extent that,

after giving effect to such exercise, such holder (and his, her or its affiliates) would beneficially own in excess of 9.8% of the Class

A common stock outstanding. Notwithstanding the foregoing, any person who acquires a warrant with the purpose or effect of changing or

influencing the control of the Company, or in connection with or as a participant in any transaction having such purpose or effect, immediately

upon such acquisition will be deemed to be the beneficial owner of the underlying shares of Class A common stock and not be able to take

advantage of this provision.

No

fractional shares will be issued upon exercise of the warrants. If, upon exercise of the warrants, a holder would be entitled to receive

a fractional interest in a share (as a result of a subsequent stock dividend payable in shares of common stock, or by a split of the

Class A common stock or other similar event), we will, upon exercise, round up or down to the nearest whole number the number of shares

of Class A common stock to be issued to the public warrant holder.

Contractual

Arrangements with Respect to Certain Warrants

We

have agreed that so long as the private placement warrants and sponsor warrants are still held by the initial purchasers or their affiliates,

we will not redeem such warrants, we will allow the holders to exercise such warrants on a cashless basis and such warrants may be exercisable

for cash.

Dividends

It

is our present intention to retain any earnings for use in our business operations and, accordingly, we do not anticipate the board of

directors declaring any dividends on the shares of Class A common stock in the foreseeable future. The payment of cash dividends in the

future will be dependent upon our revenues and earnings, if any, capital requirements and general financial condition. The payment of

any cash dividends will be within the discretion of our board of directors.

We

are a holding company with no material assets other than our interest in ADK LLC. We intend to cause ADK LLC to make distributions to

holders of Post-Merger indie Units in amounts sufficient to cover applicable taxes and other obligations under the Tax Receivable Agreement

as well as any cash dividends declared by us.

The

Amended Operating Agreement provides that pro rata cash distributions be made to holders of Post-Merger indie Units (including us) at

certain assumed tax rates, which we refer to as “tax distributions.” We anticipate that amounts we will receive may, in certain

periods, exceed our actual tax liabilities and obligations to make payments under the Tax Receivable Agreement. Our board of directors,

in its sole discretion, will make any determination from time to time with respect to the use of any such excess cash so accumulated,

which may include, among other uses, to acquire additional newly issued Post-Merger indie Units from indie at a per unit price determined

by reference to the market value of the Class A common stock; to pay dividends, which may include special dividends, on our Class A common

stock; to fund repurchases of Class A common stock; or any combination of the foregoing. We also expect, if necessary, to undertake ameliorative

actions, which may include pro rata or non-pro rata reclassifications, combinations, subdivisions or adjustments of outstanding Post-Merger

indie Units, to maintain one-for-one parity between Post-Merger indie Units and shares of Class A common stock of the Company.

Anti-Takeover

Effects of the Certificate of Incorporation, the Bylaws and Certain Provisions of Delaware Law

The

Certificate of Incorporation, the Bylaws and the DGCL contain provisions, which are summarized in the following paragraphs, which are

intended to enhance the likelihood of continuity and stability in the composition of our board of directors and to discourage certain

types of transactions that may involve an actual or threatened acquisition of the Company. These provisions are intended to avoid costly

takeover battles, reduce our vulnerability to a hostile change of control or other unsolicited acquisition proposal, and enhance the

ability of the board of directors to maximize stockholder value in connection with any unsolicited offer to acquire us. However, these

provisions may have the effect of delaying, deterring or preventing a merger or acquisition of the Company by means of a tender offer,

a proxy contest or other takeover attempt that a stockholder might consider in its best interest, including attempts that might result

in a premium over the prevailing market price for the shares of Class A common stock. See also “Risk Factors - Risks Related

to Ownership of Our Class A Common Stock and Warrants - Delaware law and our Certificate of Incorporation and Bylaws contain certain

provisions, including anti-takeover provisions, that limit the ability of stockholders to take certain actions and could delay or discourage

takeover attempts that stockholders may consider favorable” incorporated by reference into this prospectus.

Authorized

but Unissued Capital Stock

Delaware

law does not require stockholder approval for any issuance of authorized shares. However, the listing requirements of Nasdaq, which apply

so long as the Class A common stock remains listed on Nasdaq, require stockholder approval of certain issuances equal to or exceeding

20% of the then outstanding voting power or then outstanding number of shares of Class A common stock. Additional shares that may be

issued in the future may be used for a variety of corporate purposes, including future public offerings, to raise additional capital

or to facilitate acquisitions.

One

of the effects of the existence of unissued and unreserved common stock may be to enable the board of directors to issue shares to persons

friendly to current management, which issuance could render more difficult or discourage an attempt to obtain control of the Company

by means of a merger, tender offer, proxy contest or otherwise and thereby protect the continuity of management and possibly deprive

stockholders of opportunities to sell their shares of Class A common stock at prices higher than prevailing market prices.

Election

of Directors and Vacancies

The

Certificate of Incorporation provides that the board of directors will determine the number of directors who will serve on the board.

The exact number of directors will be fixed from time to time by a majority of the board of directors. The board of directors is divided

into three classes designated as Class I, Class II and Class III. Class I directors will initially serve for a term expiring at the first

annual meeting of stockholders following the closing of the Business Combination. Class II and Class III directors will initially serve

for a term expiring at the second and third annual meeting of stockholders following the closing of the Business Combination, respectively.

At each succeeding annual meeting of stockholders, directors will be elected for a full term of three years to succeed the directors

of the class whose terms expire at such annual meeting of the stockholders. There will be no limit on the number of terms a director

may serve on the board of directors.

In

addition, the Certificate of Incorporation provides that any vacancy on the board of directors, including a vacancy that results from

an increase in the number of directors or a vacancy that results from the removal of a director with cause, may be filled only by a majority

of the directors then in office, subject to the provisions of any rights of the holders of Preferred Stock.

Notwithstanding

the foregoing provisions of this section, each director will serve until his or her successor is duly elected and qualified or until

his or her earlier death, resignation or removal. No decrease in the number of directors constituting the board of directors will shorten

the term of any incumbent director.

No

Cumulative Voting

Under

Delaware law, the right to vote cumulatively does not exist unless the certificate of incorporation expressly authorizes cumulative voting.

The Certificate of Incorporation does not authorize cumulative voting.

General

Stockholder Meetings

The

Certificate of Incorporation provides that special meetings of stockholders may be called only by or at the direction of the Chairman

of the Board, the Chief Executive Officer or a majority of the total number of directors that the Company would have if there were no

vacancies on the board of directors.

Requirements

for Advance Notification of Stockholder Meetings, Nominations and Proposals

The

Bylaws establish advance notice procedures with respect to stockholder proposals and the nomination of candidates for election as directors,

other than nominations made by or at the direction of the board of directors or a committee of the board of directors. For any matter

to be “properly brought” before a meeting, a stockholder will have to comply with advance notice requirements and provide

us with certain information. Generally, to be timely, a stockholder’s notice must be received at our principal executive offices

not less than 90 days nor more than 120 days prior to the first anniversary date of the immediately preceding annual meeting of stockholders.

The Bylaws also specify requirements as to the form and content of a stockholder’s notice. The Bylaws allow the presiding officer

at a meeting of the stockholders to adopt rules and regulations for the conduct of meetings which may have the effect of precluding the

conduct of certain business at a meeting if the rules and regulations are not followed. These provisions may also defer, delay or discourage

a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting

to influence or obtain control of the Company.

Supermajority

Provisions

The

DGCL provides generally that the affirmative vote of a majority of the outstanding shares entitled to vote thereon, voting together as

a single class, is required to amend a corporation’s certificate of incorporation, unless the certificate of incorporation requires

a greater percentage. The Certificate of Incorporation provides that the affirmative vote of the holders of at least 66⅔% of our

capital stock, voting together as a single class, will be required to amend provisions of the Certificate of Incorporation regarding

calling special meetings of stockholders and stockholder action by written consent.

The

Bylaws provide that, except as otherwise provided by law or the Certificate of Incorporation, the Bylaws may be amended in any respect

or repealed at any time, either (a) at any meeting of stockholders, provided that any amendment or supplement proposed to be acted upon

at any such meeting has been properly described or referred to in the notice of such meeting, or (b) by the board of directors, provided

that no amendment adopted by the board of directors may vary or conflict with any amendment adopted by the stockholders in accordance

with the Certificate of Incorporation and the Bylaws. The Bylaws provide that the following provisions therein may be amended, altered,

repealed or rescinded only by the affirmative vote of the holders of at least 66⅔% in voting power of all our outstanding voting

capital stock, voting together as a single class:

| |

● |

the

provisions regarding calling annual and special meetings of stockholders; |

| |

● |

the

provisions regarding the nominations of directors and the proposal of other business at an annual or special meeting of stockholders; |

| |

● |

the

provisions regarding the conduct of stockholder meetings; |

| |

● |

the

provisions providing for a classified board of directors (including the election and term of directors); |

| |

● |

the

provisions regarding filling vacancies on the board of directors and newly created directorships; |

| |

● |

the

provisions regarding removal of directors; and |

| |

● |

the

amendment provision requiring that the above provisions be amended only with an 66⅔% supermajority vote. |

These

provisions may have the effect of deterring hostile takeovers or delaying or preventing changes in control of the Company or its management,

such as a merger, reorganization or tender offer. These provisions are intended to enhance the likelihood of continued stability in the

composition of the board of directors and its policies and to discourage certain types of transactions that may involve an actual or

threatened acquisition of the Company. These provisions are designed to reduce our vulnerability to an unsolicited acquisition proposal.

The provisions are also intended to discourage certain tactics that may be used in proxy fights. However, such provisions could have

the effect of discouraging others from making tender offers for our shares and, as a consequence, may inhibit fluctuations in the market

price of our shares that could result from actual or rumored takeover attempts. Such provisions may also have the effect of preventing

changes in management.

Exclusive

Forum

The

Certificate of Incorporation provides that, unless we consent to the selection of an alternative forum, the Court of Chancery of the

State of Delaware (or, in the event that the Chancery Court does not have jurisdiction, the federal district court for the District of

Delaware) will, to the fullest extent permitted by law, be the sole and exclusive forum for (1) any derivative action, suit or proceeding

brought on behalf of the Company, (2) any action, suit or proceeding asserting a claim of breach of a fiduciary duty owed by any director,

officer, employee or stockholder of the Company to the Company or to the Company’s stockholders, (3) any action, suit or proceeding

arising pursuant to any provision of the DGCL or the Bylaws or the Certificate of Incorporation or as to which the DGCL confers jurisdiction

on the Chancery Court, or (4) any action, suit or proceeding asserting a claim against the Company governed by the internal affairs doctrine.

Our Certificate of Incorporation also provides that, unless we consent in writing to the selection of an alternative forum, the federal

district courts of the United States of America will be the exclusive forum for the resolution of any complaint asserting a cause of

action arising under the Securities Act. Notwithstanding the foregoing, the inclusion of such provision in our Certificate of Incorporation

will not be deemed to be a waiver by our stockholders of our obligation to comply with federal securities laws, rules and regulations,

and the provisions of this paragraph will not apply to suits brought to enforce any liability or duty created by the Exchange Act or

any other claim for which the federal district courts of the United States of America shall be the sole and exclusive forum. Although

we believe the exclusive forum provision benefits us by providing increased consistency in the application of Delaware law in the types

of lawsuits to which it applies, the provision may have the effect of discouraging lawsuits against our directors and officers. Furthermore,

the enforceability of choice of forum provisions in other companies’ certificates of incorporation has been challenged in legal

proceedings, and it is possible that a court could find these types of provisions to be inapplicable or unenforceable.

Limitations

on Liability and Indemnification of Officers and Directors

The

DGCL authorizes corporations to limit or eliminate the personal liability of directors to corporations and their stockholders for monetary

damages for breaches of directors’ fiduciary duties, subject to certain exceptions. The Certificate of Incorporation includes a

provision that eliminates the personal liability of directors for monetary damages for any breach of fiduciary duty or other act or omission

as a director of the Company, except to the extent such exemption from liability or limitation thereof is not permitted under the DGCL.

The effect of these provisions is to eliminate the rights of the Company and its stockholders, through stockholders’ derivative

suits on the Company’s behalf, to recover monetary damages from a director for breach of fiduciary duty as a director, including

breaches resulting from grossly negligent behavior. However, exculpation does not apply to any director if the director has breached

his or her duty of loyalty to the Company or its stockholder or for any act not in good faith or which involve intentional misconduct

or a knowing violation of law.

The

Certificate of Incorporation provides that we must indemnify and advance expenses to directors and officers to the fullest extent authorized

by the DGCL. We are also expressly authorized to carry directors’ and officers’ liability insurance providing indemnification

for directors, officers and certain employees for some liabilities. The limitation of liability, indemnification and advancement provisions

in the Certificate of Incorporation may discourage stockholders from bringing a lawsuit against directors for breach of their fiduciary

duty. These provisions also may have the effect of reducing the likelihood of derivative litigation against directors and officers, even

though such an action, if successful, might otherwise benefit us and our stockholders. In addition, your investment may be adversely

affected to the extent we pay the costs of settlement and damage awards against directors and officers pursuant to these indemnification

provisions. We believe that these provisions, liability insurance and the indemnity agreements are necessary to attract and retain talented

and experienced directors and officers.

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons

pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC such indemnification is against

public policy as expressed in the Securities Act and is, therefore, unenforceable.

There

is currently no pending material litigation or proceeding involving any of our respective directors, officers or employees for which

indemnification is sought.

Exchange

Agreement

Concurrently

with the completion of the Business Combination, Surviving Pubco entered into an Exchange Agreement with certain holders of Post-Merger

indie Units, including three of our founders, Messrs. Aoki, McClymont and Kee, which provides for the exchange of such holders’

Post-Merger indie Units into shares of our Class A common stock.

Exchange

Mechanics

Upon

the later of December 10, 2021 and the second anniversary of the grant of such holder’s Post-Merger indie Units may, from time

to time thereafter, exchange all or any portion of their Post-Merger indie Units for shares of our Class A common stock by delivering

a written notice to us; provided, that we may, in our sole and absolute discretion, in lieu of delivering shares of Class A common stock

for any Post-Merger indie Units surrendered for exchange, pay an amount in cash per Post-Merger indie Unit equal to the volume weighted

average price of the Class A common stock on the date of the receipt of the written notice of the exchange. Certain holders of Post-Merger

indie Units that hold Class B Units of ADK LLC will not be able to exchange their units under the Exchange Agreement until the later

of six months from the Closing or the second anniversary of the most recent Class B Unit award.

Exchange

Ratio

The

initial exchange ratio was one Post-Merger indie Unit for one share of Class A common stock. The exchange ratio will be adjusted for

any subdivision (split, unit distribution, reclassification, reorganization, recapitalization or otherwise) or combination (by reverse

unit split, reclassification, reorganization, recapitalization or otherwise) of the Post-Merger indie Units that is not accompanied by

an identical subdivision or combination of the Class A common stock or, by any such subdivision or combination of the Class A common

stock that is not accompanied by an identical subdivision or combination of the Post-Merger indie Units. If our Class A common stock

is converted or changed into another security, securities or other property, on any subsequent exchange an exchanging holder of Post-Merger

indie Units will be entitled to receive such security, securities or other property. The exchange ratio will also adjust in certain circumstances

when we acquire Post-Merger indie Units other than through an exchange for shares of Class A common stock.

Restrictions

on Exchange

We

may refuse to effect an exchange if we determine that an exchange would violate applicable law (including securities laws). We may also

limit the rights of holders of Post-Merger indie Units to exchange their Post-Merger indie Units under the Exchange Agreement if we determine

in good faith that such restrictions are necessary so that we will not be treated as a “publicly traded partnership” under

applicable tax laws and regulations. In addition, holders of Post-Merger indie Units that hold Class B Units of ADK LLC will not be able

to exchange their units under the Exchange Agreement until the later of six months from the Closing or the second anniversary of the

most recent Class B Unit award.

Expenses

The Company and each holder

of Post-Merger indie Units will bear its own expense regarding the exchange except that we will be responsible for transfer taxes, stamp

taxes and similar duties (unless the holder has requested the shares of Class A common stock to be issued in the name of another holder).

Registration Rights Agreements

On the closing date of the

Business Combination, Surviving Pubco entered into a registration rights agreement, dated as of the Closing Date, with Mr. McClymont,

Mr. Aoki, Mr. Schiller, Bison Capital Partners IV, L.P., and certain other members of ADK LLC prior to the closing of the Business Combination

(the “indie Equity Holders”), pursuant to which Surviving Pubco has agreed to register for resale under the Securities Act

shares of Class A common stock issued to such parties as consideration in connection with the Business Combination, and to provide such

parties with certain rights relating to the registration of the securities held by them.

In addition, pursuant to the

Purchase Agreement, dated August 27, 2021, among indie, indie’s acquisition subsidiary and the stockholders of TeraXion, Inc.,

indie agreed to file with the SEC a Registration Statement on Form S-1 to register for resale the shares of Class A common stock issued

to such stockholders in the TeraXion acquisition.

Rule 144

Rule 144 is not available

for the resale of securities initially issued by shell companies (other than business combination related shell companies) or issuers

that have been at any time previously a shell company, such as us. However, Rule 144 also includes an important exception to this prohibition

if the following conditions are met:

| |

● |

the issuer of the securities that was formerly a shell company has ceased to be a shell company; |

| |

● |

the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act; |

| |

● |

the issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Form 8-K reports; and |

| |

● |

at least one year has elapsed from the time that the issuer filed current Form 10 type information with the SEC reflecting its status as an entity that is not a shell company. |

Upon the closing of the Business

Combination, we ceased to be a shell company. As a result, a person who beneficially owns restricted shares of our Class A common stock

or warrants will be able to sell their shares of Class A common stock and private placement warrants and sponsor warrants, as applicable,

pursuant to Rule 144 without registration one year from the Closing so long as the other conditions set forth in the exceptions listed

above and the other conditions of Rule 144 described below are satisfied.

When and if Rule 144 becomes

available for the resale of our securities, a person who has beneficially owned restricted shares of our Class A common stock or warrants

for at least six months would be entitled to sell their securities, provided that (i) such person is not deemed to have been one of our

affiliates at the time of, or at any time during the three months preceding, a sale, and (ii) we are subject to the Exchange Act periodic

reporting requirements for at least three months before the sale and have filed all required reports under Section 13 or 15(d) of the

Exchange Act during the 12 months (or such shorter period as we were required to file reports) preceding the sale.

Persons who have beneficially

owned restricted shares of our Class A common stock or warrants for at least six months but who are our affiliates at the time of, or

at any time during the three months preceding, a sale, would be subject to additional restrictions, by which such person would be entitled

to sell within any three-month period only a number of securities that does not exceed the greater of:

| |

● |

one percent (1%) of the total number of shares of common stock then outstanding; or |

| |

● |

the average weekly reported trading volume of the Class A common stock during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale. |

Sales by our affiliates under

Rule 144 will also be limited by manner of sale provisions and notice requirements and to the availability of current public information

about us.

Our Transfer Agent and Warrant Agent

The transfer agent for our

Class A common stock and warrant agent for our warrants is Continental Stock Transfer & Trust Company. We have agreed to indemnify

Continental Stock Transfer & Trust Company in its roles as transfer agent and warrant agent, its agents and each of its stockholders,

directors, officers and employees against all liabilities, including judgments, costs and reasonable counsel fees that may arise out of

acts performed or omitted for its activities in that capacity, except for any liability due to any gross negligence, willful misconduct

or bad faith of the indemnified person or entity.

Listing of Securities

Our Class A common stock and

our public warrants are listed on Nasdaq under the symbols “INDI” and “INDIW,” respectively.

DESCRIPTION

OF DEBT SECURITIES

We

may issue debt securities either separately, or together with, or upon the conversion or exercise of or in exchange for, other securities

described in this prospectus. Debt securities may be our senior, senior subordinated or subordinated obligations and may be issued in

one or more series. Unless otherwise expressly stated in an accompanying prospectus supplement, the debt securities will represent our

general, unsecured obligations and will rank equally with all of our other unsecured indebtedness.

Any

debt securities that we issue will be issued under an indenture that will be entered into between us and a bank or trust company, or other

trustee that is qualified to act under the Trust Indenture Act of 1939 (the “TIA”), which we select to act as trustee. A copy

of the form of indenture (the “Indenture”) has been filed as an exhibit to the registration statement of which this prospectus

forms a part. The Indenture may be modified by one or more supplemental indentures, which we will incorporate by reference as an exhibit

to the registration statement of which this prospectus is a part. Any debt securities that we issue will include those stated in the Indenture

(including any supplemental indentures that specify the terms of a particular series of debt securities) as well as those made part of

the Indenture by reference to the TIA, as in effect on the date of the Indenture. The Indenture will be subject to and governed by the

terms of the TIA.

The

following description and any description in an accompanying prospectus supplement is a summary only and is subject to, and qualified

in its entirety by reference to the terms and provisions of the indentures and any supplemental indentures that we file with the SEC in

connection with an issuance of any series of debt securities. You should read all of the provisions of the indentures, including the definitions

of certain terms, as well as any supplemental indentures that we file with the SEC in connection with the issuance of any series of debt

securities. These summaries set forth certain general terms and provisions of the securities to which any accompanying prospectus supplement

may relate. The specific terms and provisions of a series of debt securities and the extent to which the general terms and provisions

may also apply to a particular series of debt securities will be described in the accompanying prospectus supplement. Copies of the Indenture