NON-EMPLOYEE DIRECTOR COMPENSATION

We compensate non-employee directors for their service on the Board with a combination of cash and equity awards that we believe

are commensurate with their role and involvement, and consistent with peer company practices. We intend to compensate our non-employee directors in a way that is competitive, attracts and retains a high

caliber of directors, and aligns their interests to our stakeholders. The NGC annually reviews and makes recommendations to the Board regarding the level and form of compensation paid to non-employee

directors, including our director compensation program’s underlying principles. As part of this analysis, the independent compensation consultant also provides guidance to the NGC with respect to director compensation trends and data from peer

companies. Pursuant to the review, and in consideration of the independent compensation consultant’s advice, the NGC recommended no changes to the non-employee director compensation program for 2021.

Mr. Rajagopalan, who is a director and is also our President and CEO, does not receive any additional compensation for his service on our Board.

Directors may

elect to defer up to one hundred percent of their cash compensation per year pursuant to our Voluntary Deferred Compensation Plan (the “VDC

Plan”). All directors are reimbursed for their out-of-pocket expenses incurred in connection with their duties as

directors.

Each non-employee director receives an annual equity award of either restricted stock units (“RSUs”) or shares of common stock with a value of approximately $115,000, awarded on the date of each annual meeting of stockholders. The RSUs remain

unvested until the director retires from the Board. Additionally, non-employee directors receive a cash retainer of $75,000 each per year, payable quarterly in arrears. In addition, the Board chairperson and

committee chairpersons and members receive compensation for their service as outlined below.

|

|

|

|

|

|

| |

|

|

Role |

|

Cash Retainer

|

| |

|

|

AFC Member |

|

|

$ |

10,000 |

|

| |

|

|

AFC Chair (in addition to the AFC member retainer) |

|

|

$ |

30,000 |

|

| |

|

|

HRCC Chair |

|

|

$ |

30,000 |

|

| |

|

|

NGC Chair |

|

|

$ |

10,000 |

|

| |

|

|

Chairman of the Board of Directors |

|

|

$ |

100,000 |

|

| GOVERNANCE

25

| GOVERNANCE

25

The compensation of our non-employee directors, including all RSUs or shares

of common stock, for the 2021 fiscal year is set forth in the table below and described in the accompanying footnotes.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Name |

|

Fees Earned or

Paid

in

Cash

($)1 |

|

Stock Award

($)2 |

|

All Other

Compensation ($) |

|

Total

($) |

| |

|

|

|

|

| Elizabeth L. Axelrod |

|

|

$ |

85,000 |

3 |

|

|

$ |

115,019 |

11 |

|

|

$ |

0 |

|

|

|

$ |

200,019 |

|

| |

|

|

|

|

| Mary E. G. Bear |

|

|

$ |

20,380 |

4 |

|

|

$ |

0 |

|

|

|

$ |

0 |

|

|

|

$ |

20,380 |

|

| |

|

|

|

|

| Laszlo Bock |

|

|

$ |

92,885 |

5 |

|

|

$ |

115,019 |

12 |

|

|

$ |

0 |

|

|

|

$ |

207,904 |

|

| |

|

|

|

|

| Clare M. Chapman |

|

|

$ |

42,693 |

6 |

|

|

$ |

0 |

|

|

|

$ |

0 |

|

|

|

$ |

42,693 |

|

| |

|

|

|

|

| Lyle Logan |

|

|

$ |

85,000 |

7 |

|

|

$ |

115,019 |

11 |

|

|

$ |

0 |

|

|

|

$ |

200,019 |

|

| |

|

|

|

|

| T. Willem Mesdag |

|

|

$ |

115,000 |

8 |

|

|

$ |

115,019 |

12 |

|

|

$ |

0 |

|

|

|

$ |

230,019 |

|

| |

|

|

|

|

| Stacey Rauch |

|

|

$ |

85,000 |

9 |

|

|

$ |

115,019 |

11 |

|

|

$ |

0 |

|

|

|

$ |

200,019 |

|

| |

|

|

|

|

| Adam Warby |

|

|

$ |

175,000 |

10 |

|

|

$ |

115,019 |

12 |

|

|

$ |

0 |

|

|

|

$ |

290,019 |

|

| 1 |

Reflects cash compensation earned by each director in 2021 and includes any amounts deferred at the director’s

election under our VDC Plan, described above. |

| 2 |

Reflects the grant date fair value for financial reporting purposes in accordance with Financial Accounting Standards

Board Accounting Standards Codification Topic 718, Compensation-Stock Compensation (“ASC Topic 718”) for shares of common stock or RSUs granted under the Third Amended and Restated Heidrick & Struggles 2012 GlobalShare Plan (the

“GlobalShare Plan”). |

| 3 |

Ms. Axelrod earned an additional cash retainer of $10,000 as Chair of the NGC. |

| 4 |

Ms. Bear was appointed to the Board on September 23, 2021. This amount reflects the prorated cash retainer

Ms. Bear earned as a member of the Board. |

| 5 |

Mr. Bock was appointed Chair of the HRCC, effective May 27, 2021. Mr. Bock earned an additional prorated

cash retainer of $17,885 as Chair of the HRCC. All of Mr. Bock’s fees were deferred pursuant to our VDC Plan. |

| 6 |

Ms. Chapman retired from the Board on May 27, 2021. This amount includes the prorated cash retainer

Ms. Chapman earned as a member of the Board. Ms. Chapman earned an additional prorated cash retainer of $12,198 as the Chair of the HRCC. |

| 7 |

Mr. Logan earned an additional cash retainer of $10,000 as a member of the AFC. |

| 8 |

Mr. Mesdag earned an additional cash retainer of $30,000 as Chair of the AFC and $10,000 as a member of the AFC. All

of Mr. Mesdag’s fees were deferred pursuant to our VDC Plan. |

| 9 |

Ms. Rauch earned an additional cash retainer of $10,000 for being a member of the AFC. |

| 10 |

Mr. Warby earned an additional cash retainer of $100,000 as Chairman of the Board. All of the $175,000 in fees earned

were paid to Warby Ltd., a company in which Mr. Warby is the controlling shareholder. |

| 11 |

The amount reflects the aggregate grant date fair value of shares of common stock granted on May 27, 2021 (the date

of the 2021 annual stockholders’ meeting). The award was equal to the annual equity retainer of $115,000 divided by the closing stock price on the date of grant of $43.85 rounded to nearest whole share, resulting in 2,623 shares of common

stock. |

| 12 |

The amount reflects an award of RSUs granted on May 27, 2021 (the date of the 2021 annual stockholder meeting) with

the same value as the award of common stock described in footnote 11 above. The amount reflects the aggregate grant date fair value of RSUs granted on May 27, 2021, calculated in accordance with ASC Topic 718. The value of the award was

$115,000 divided by the closing stock price on the date of grant of $43.85 rounded to nearest whole share, resulting in 2,623 RSUs. As of December 31, 2021, the aggregate RSUs granted and outstanding were as follows: 7,623 for Mr. Bock, 0 for

Ms. Bear, 25,343 for Mr. Mesdag, and 14,144 for Mr. Warby. |

The Company’s stock ownership guidelines for directors require each non-employee director to own three times their annual cash retainer in Company common stock within three years of joining the Board. As of March 31, 2022, each of the

non-employee directors has either satisfied the stock ownership guidelines or is on track to do so in compliance with the guidelines.

26 GOVERNANCE |

EXECUTIVE OFFICERS

All of the Executive Officers have been appointed by and serve at the pleasure of the Board of Directors. Below is the name, age, present title, principal occupation

and certain biographical information for each of the Company’s Executive Officers as of April 1, 2022.

|

|

|

|

Krishnan

Rajagopalan |

|

Mr. Rajagopalan, 62, has been our President and Chief Executive Officer since July 6, 2017. He served as acting President and CEO from April 3, 2017 until July 6, 2017. Prior to becoming President and CEO,

Mr. Rajagopalan served as Executive Vice President and Managing Partner – Executive Search since January 2016. Previously, he served as Head of Global Practices beginning in April 2014 and was appointed an Executive Vice President on

January 1, 2015. Mr. Rajagopalan has served in other leadership roles with Heidrick, including Global Practice Managing Partner, Technology & Services from 2010 to 2014 and Global Practice Managing Partner, Business/Professional

Services from 2007 to 2010. Mr. Rajagopalan joined the firm in 2001 in executive search. He has served on the Board of the Company since July 6, 2017. |

|

|

|

Michael Cullen |

|

Mr. Cullen, 56, was appointed Chief Operating Officer on January 1, 2019. Mr. Cullen joined Heidrick in April 2008 and served as the Managing Partner – Americas Technology & Services through April 2014.

Mr. Cullen then served as Global Practice Managing Partner – Technology and Services from April 2014 through December 2017. From January 2018 to January 2019 he was Group Chief Operating Officer. In his current role as Chief Operating

Officer, he is responsible for global field operations, client operations, and practice management, across all lines of business and all industry practices. His team has full P&L responsibility and all field resources under their management. He

also oversees information technology and shared services. Prior to joining Heidrick, Mr. Cullen was the Head of the Office of Executive Talent at EMC Corporation (now Dell EMC). |

|

|

|

Mark Harris |

|

Mr. Harris, 51, was appointed Chief Financial Officer of the Company on March 19, 2018. He had been serving as the Deputy Chief Financial Officer of the Company since February 2018. Before then, since 2015, Mr. Harris

had been CFO at Hercules Capital, Inc. a publicly traded business development company, where he was responsible for finance, accounting, operations, legal and investor relations, as well as a voting member of the Investment Committee. Prior to that,

Mr. Harris worked at Avenue Capital Group for over nine years, where he served as their Senior Managing Director/Head of Asia, in which he led the entire Asian investment strategy and before that, their Chief Financial Officer. Prior to working

at Avenue Capital Group, from 2004 to 2006 Mr. Harris served as Corporate Financial Controller and Chief Accounting Officer at Hutchinson Telecommunications, a publicly traded telecommunications company based in Hong Kong. Prior to Hutchinson

Telecommunications, Mr. Harris was a Manager at PricewaterhouseCoopers in their Global Capital Markets Group. |

| GOVERNANCE

27

| GOVERNANCE

27

|

|

|

|

|

|

Sarah Payne |

|

Ms. Payne, 51, was appointed Chief Human Resources Officer on January 1, 2019. She is responsible for working closely with leaders within the firm and in setting and executing a global talent strategy that supports the

near and long-term business objectives for Heidrick. Ms. Payne joined Heidrick in 2015, serving as Vice President – Global Compensation and Human Resources, America until 2017 when she led global total rewards strategy and design, in

addition to leading HR for the Americas Region. From 2017 until her appointment as CHRO in 2019, Ms. Payne served as Vice President – Human Resources, Global Executive Search where she served as a business partner to Heidrick’s global

Executive Search leaders. Prior to joining Heidrick, Sarah held human resources leadership positions within Executive Compensation, Total Rewards, Talent Acquisition and as a Human Resources Director within global agribusiness and satellite

communications firms. |

|

|

|

Tracey Heaton |

|

Ms. Heaton, 52, was appointed Chief Legal Officer and Corporate Secretary on November 15, 2021. Most recently, from February 2015 to July 2020 Tracey served as Senior Vice President and Chief Corporate Counsel for Visa

Inc. and was a key member of the company’s senior legal leadership team. She advised Visa’s board of directors and C-suite executives and managed a team of more than 20 lawyers and legal

professionals. Under her leadership, her team provided legal support for a wide variety of commercial and corporate areas, including: mergers, acquisitions and strategic venture investments; securities and public company reporting; ESG; treasury and

finance; marketing and sponsorships; trademark portfolio and global entity management; and employment and executive compensation. Previously, Tracey served as Executive Vice President and Deputy General Counsel at NYSE Euronext Inc. and as Associate

General Counsel at United Technologies Corporation. Tracey also held roles as an associate in the corporate group of Milbank, Tweed, Hadley & McCloy, LLP, while based in New York and Hong Kong, and in the corporate department of Dechert

LLP. |

Each of our Executive Officers has entered into an employment agreement with the Company, which contain customary restrictive covenants

in favor of the Company. Each Executive Officer also participates in the Company’s MIP, CIC Plan, Severance Plan, equity programs and vacation and benefit plans at the same level as other senior executives, as outlined below in further

detail.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Various Company policies and procedures and annual questionnaires completed by all Company directors and Executive Officers require disclosure of transactions or

relationships that may constitute conflict of interest or otherwise require disclosure under applicable SEC and Nasdaq Rules. Pursuant to the Related Party Transaction Policy and committee charters, the NGC—in consultation with the

AFC—reviews and approves related party transactions.

The process for reviewing certain relationships and related party transactions are outlined in the

Company’s Related Party Transaction Policy, Director Independence Standards and Policy on Resolution of Conflicts of Interest for Directors and Executive Officers. Depending on the particular transaction or relationship, the Company’s

review processes vary. When such a transaction or relationship is identified at the Chief Executive Officer or Board level, the NGC and/or its Chair, or in the instance of a potential conflict with the Chair of the NGC, the Board as whole, evaluates

the transaction or relationship and approves or ratifies it (without the vote of any interested person) only if it is judged to be fair and in the best interests of the Company.

The Company’s Related Party Transaction Policy, Director Independence Standards and Policy on Resolution of Conflicts of Interest for Directors and Executive

Officers can be found at: https://investors.heidrick.com/corporate-governance. In addition, it is the practice of the NGC, although not part of a written policy, to review each transaction specifically disclosed as a potential related party

transaction in connection with its review of the proxy statement for the annual meetings of stockholders, to the extent any such transaction has not previously been reviewed, applying the same standard.

Pursuant to our Related Party Transaction Policy, on a semi-annual basis, as requested by the NGC or the Company’s Chief Legal Office, each director and Executive

Officer is required to disclose in writing to the Company all pertinent information regarding their related parties and each charitable or non-profit organization for which such director or Executive Officer

(or any of his or her related parties) is actively involved in fundraising or otherwise serves as a director, trustee or in a similar capacity.

There were no

related party transactions since January 1, 2021 that required approval under the Company’s policies and procedures or the rules and regulations of the SEC.

28 GOVERNANCE |

ADDITIONAL GOVERNANCE MATTERS

COMMUNICATION WITH THE BOARD

Stockholders may

communicate directly with the Board. All communications should be directed to:

Corporate Secretary

Heidrick & Struggles International, Inc.

233 South Wacker Drive, Suite 4900

Chicago, Illinois

60606

Any such communication should prominently indicate on the outside of the envelope that it is intended for the Board or a particular committee, or director.

All appropriate communication intended for the Board or a particular committee or director and received by the Corporate Secretary will be forwarded to the specified party following its clearance through normal security procedures.

| GOVERNANCE

29

| GOVERNANCE

29

Executive Compensation

PROPOSAL 2

Advisory

Vote to Approve Named Executive Officer Compensation

|

|

|

|

|

|

The Board and HRCC value the views of our stockholders, and currently conduct an annual advisory vote

to approve the compensation of our Named Executive Officers. The Say-on-Pay vote is advisory, and therefore not binding on the Company, the HRCC or our

Board. |

|

|

|

Pursuant to

Section 14A of the Securities Exchange Act, the Company seeks your advisory vote on our executive compensation programs. The Company asks that you support the compensation of our Named Executive Officers as disclosed in the Compensation

Discussion & Analysis (“CD&A”) section and the accompanying executive compensation tables and narratives contained in this proxy statement.

The CD&A section of this proxy statement discusses

our executive compensation philosophy, policies and structure during the most recently completed fiscal year. The HRCC and the Board believe that these policies and procedures are effective in implementing our executive compensation philosophy and

in achieving its goals. As an advisory vote, your

vote will not be binding on the Company or the Board. However, our Board and our HRCC, which is responsible for designing and administering the Company’s executive compensation program, value the opinions of our stockholders and to the extent

there is any significant vote against the compensation paid to our Named Executive Officers, we will consider our stockholders’ concerns and the HRCC will evaluate whether any actions are necessary to address those concerns. |

The Board and the HRCC recommend that our stockholders vote “FOR” the approval, on an advisory

basis, the compensation paid to our Named Executive Officers, as disclosed in this proxy statement, including the following CD&A section, the executive compensation tables, and the related narrative discussion, and adopt the following resolution

at the Annual Meeting: “RESOLVED, that approval, on an advisory basis, of the compensation paid to our named executive officers as disclosed in this proxy statement is hereby RATIFIED.”.

30 EXECUTIVE COMPENSATION |

Compensation Discussion & Analysis

INTRODUCTION

Heidrick is a leadership advisory

firm, assisting a broad range of clients across the globe in achieving their long-term business objectives by helping them to improve the effectiveness of their leadership teams. More specifically, the Company provides executive search, leadership

consulting and on-demand talent services through the expertise of its experienced consultants located in major cities around the world. The Human Resources and Compensation Committee (“HRCC”) seeks to ensure that the Company’s executive compensation program attracts, retains and rewards the best talent, while at the same time

maintaining a strong link between pay and performance and aligning the interests of the Company’s executives and stockholders. Heidrick’s executive compensation philosophy emphasizes and rewards both Company and individual performance. The

Company believes this approach promotes sustained long-term performance by rewarding not only the achievement of financial and operational goals, but also the accomplishment of individual strategic objectives. Further, this approach enables

profitable growth and advances our high-performance organization by using culture as a strategic differentiator to attract, develop, and retain the highest-performing talent, and to build a more diverse and inclusive Company.

Through our HRCC, the Company has implemented strong governance practices for considering and making decisions with respect to the compensation of the Company’s

Named Executive Officers. Management, the HRCC and the full Board all play active roles in executive compensation decisions.

|

|

|

|

|

|

|

|

|

|

|

This Compensation Discussion & Analysis

describes and explains the Company’s

compensation philosophy and

executive

compensation program, as well as

compensation awarded to and earned by

the following persons who were our

Named Executive Officers1

(“Executive

Officers” or “NEOs”) for 2021: |

|

|

|

Name |

|

Title |

| |

|

|

Krishnan

Rajagopalan |

|

President & Chief Executive Officer |

| |

|

|

Michael

Cullen |

|

Chief Operating Officer |

| |

|

|

Mark Harris |

|

Chief Financial Officer |

| |

|

|

Sarah

Payne |

|

Chief Human Resources Officer |

| |

|

|

Tracey Heaton |

|

Chief Legal Officer & Corporate

Secretary2 |

| |

|

|

Kamau

Coar |

|

Former Chief Legal Officer & Chief Inclusion Officer3 |

THE CD&A IS ORGANIZED INTO FOUR SECTIONS:

|

|

|

| 2. |

|

Executive Compensation Philosophy

|

|

|

|

| 3. |

|

2021

Compensation Program

|

|

|

|

| 4. |

|

Other

Compensation

Policies

and

Information |

| 1 |

This term does not include Mr. Kamau Coar other than when referring to the named executive officers of the Company for

2021. |

| 2 |

Ms. Heaton was appointed as the Company’s Chief Legal Officer and Corporate Secretary on November 15, 2021.

|

| 3 |

Mr. Coar’s employment with the Company was terminated on June 18, 2021. |

| EXECUTIVE

COMPENSATION 31

| EXECUTIVE

COMPENSATION 31

The CD&A is followed by the Compensation Tables and Narrative Disclosures, which report and describe the

compensation and benefit amounts paid to the NEOs for 2021.

2021 YEAR IN REVIEW

2021 was a record year for revenues and profitability.

| |

• |

|

Consolidated net revenue was $1,003.0 million compared to $621.6 million in 2020, an increase of 61.4%

|

| |

• |

|

Operating income in 2021 was $98.3 million and operating margin was 9.8% |

| |

• |

|

Adjusted operating income in 2021 was $113.4 million and adjusted operating margin was 11.3% |

| |

• |

|

General and administrative expenses in 2021 declined to 13.0% of net revenues, from 18.8% in 2020 |

| |

• |

|

Diluted earnings per share were $3.58 compared to a loss per share of ($1.95) in 2020 |

| |

• |

|

Adjusted diluted earnings per share were $4.11 compared to $1.77 in 2020 |

32 EXECUTIVE COMPENSATION |

Adjusted Operating Income and Adjusted Diluted Earnings Per Share are Non-GAAP financial

measures and include adjustments to Operating Income and Earnings Per Diluted Share in 2017 to exclude expense associated with the settlement with Her Majesty’s Revenue and Customs related to the taxation of a legacy U.K. benefit trust

obligation in Q1 2017, impairment charges, and restructuring charges. 2016 and 2019 also included restructuring-related adjustments. The adjustments in 2020 excluded expense associated with goodwill impairment charges and restructuring charges. The

adjustments in 2021 exclude restructuring charges and one-time expenses for increases to earnout payouts related to the Business Talent Group (“BTG”) acquisition in April 2021. BTG is a market leader

in providing clients access to on-demand top independent talent for leadership roles and critical projects. Adjusted Operating Margin refers to Adjusted Operating Income as a percentage of Net Revenue.

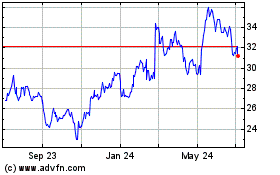

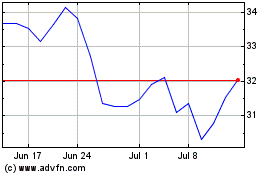

Total Shareholder Return is the value of $100 invested in shares of our common stock on December 31, 2016, assuming the reinvestment of dividends

during the following five-year period. The stock price performance depicted in the above graph is not necessarily indicative of future price performance. This graph will not be deemed to be filed as part of this proxy statement, and will not be

deemed to be incorporated by reference by any general statement incorporating this proxy statement into any filing by us under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we specifically incorporate this

information by reference. The annualized return represents the compounded annual growth rate of the Total Shareholder Return for the period beginning on December 31, 2016 and ending December 31, 2021.

A reconciliation of these Non-GAAP financial measures to the most directly comparable GAAP financial measures can be found on

Annexes A and B.

EXECUTIVE COMPENSATION PHILOSOPHY

The HRCC strives to design compensation programs for the Company’s executives that are competitive with firms in the executive search, leadership consulting and

management consulting space, both public and private, with which the Company competes for executive talent.

|

|

|

| |

|

This discussion explains: |

| |

|

| The objectives of

the Company’s compensation program for its NEOs. |

|

How the Company determines the amount to pay for each compensation element. |

| |

|

| What the

compensation program is designed to reward, each element of compensation within the program and why the Company chooses to pay each element. |

|

How each compensation element and the Company’s decisions regarding that element fit into the Company’s

overall compensation objectives and affect decisions regarding other elements. |

Pay-for-performance guides executive compensation for

Heidrick. The Company expects its NEOs to initiate and carry out sustainable growth strategies and to create long-term value for both the Company and its stockholders. Company performance,

| EXECUTIVE

COMPENSATION 33

| EXECUTIVE

COMPENSATION 33

incentives and retention are the primary factors in our executive incentive compensation program design. When measuring Company performance, the HRCC considers both qualitative and quantitative

factors relating to the Company’s business strategies and objectives. In assessing the individual performance of the NEOs, the HRCC considers, among other things, the NEO’s achievement of individual and shared performance objectives,

contributions to the Company’s strategic initiatives and demonstrated leadership qualities.

The HRCC regularly reviews the compensation program for the

Company’s executives to ensure that the program continues to meet the needs of the business, is competitive in the executive search and leadership consulting industry, and aligns the interests of the Company’s executives with those of the

Company’s stockholders. The Company’s executive compensation program may change from time to time based on the review and input of the HRCC.

Compensation Best Practices

|

| |

|

The Company’s compensation policies and practices include: |

| |

|

Independent HRCC. All of the members of the HRCC are independent. |

| |

|

Independent Compensation Consultant. The HRCC receives objective advice from an independent compensation

consultant. |

| |

|

Annual Assessment. The HRCC conducts an annual assessment of compensation policies to ensure that they

are aligned with the Company’s performance objectives, are competitive in the executive search and leadership consulting industry, and do not encourage undue risk. |

| |

|

Stock Ownership Guidelines. The CEO is required to own five times his or her annual base salary in

Company common stock, and all other NEOs are required to own two times their annual base salary. Effective February 2022, the HRCC approved revisions to the stock ownership guidelines which added share retention requirements, whereby the CEO or

other NEO must retain ownership of Company shares in an amount equal to 50% of the net after-tax value of any newly-vested RSUs, performance shares and/or PSUs until the applicable multiple requirement is met,

as further described on page 44. |

| |

|

Reward for Performance. A majority of each Executive Officer’s total direct compensation is tied to

the achievement of certain Company and individual performance goals. |

| |

|

Annual Payout Limits. The potential annual payout on incentive compensation elements is limited to 200%

of target, further described on page 38. |

| |

|

Long-Term Vesting. The Company encourages retention and long-term value creation by providing for equity

awards that vest over three years, commencing on the grant date anniversary. |

| |

|

No Excise Tax Gross-Ups. The Company does not provide excise tax

gross-ups to the Executive Officers. |

Strong Governance Practices Utilized in Determining Executive Compensation

Role of the HRCC. With respect to the Company’s NEOs, the HRCC

engages in a rigorous process in determining total compensation. This process involves setting Company performance and strategic and operational goals for the NEOs at the beginning of each year and evaluating the performance of the Company and NEOs

against those pre-established goals. The HRCC considers various additional factors in making its decisions regarding each NEO’s target total compensation opportunity. The specific factors include:

| |

• |

|

Company performance and relative stockholder return; |

| |

• |

|

Individual performance against pre-set goals and objectives for the year;

|

| |

• |

|

An individual’s experience and expertise; |

| |

• |

|

An individual’s position and scope of responsibilities; |

| |

• |

|

Retention considerations; |

34 EXECUTIVE COMPENSATION |

| |

• |

|

An individual’s compensation relative to other NEOs; |

| |

• |

|

The value of similar awards to NEOs at peer companies; |

| |

• |

|

An individual’s future potential with the Company; and |

| |

• |

|

The new total compensation that would result from any change and how the new total compensation compares to market data and

impacts the Company’s compensation expense. |

The HRCC determines and approves the compensation of the NEOs based on this evaluation. In

making its decisions, the HRCC does not apply formulaic weighting to any of the above factors.

To assist in evaluating the NEOs’ compensation, the HRCC has

retained the services of an independent compensation consultant, Pay Governance LLC, and considers recommendations from the CEO. The CEO does not provide such input as to his own compensation. The HRCC assesses the information it receives in

accordance with its business judgment. The HRCC is also guided by its independent compensation consultant with respect to compensation decisions.

Role of the Board. The HRCC, with input from the full Board, independently reviews the CEO’s performance and recommends the CEO’s compensation

to the Board. Based upon the recommendation of the HRCC, the full Board considers and determines the compensation of the CEO.

Role of the CEO. The CEO annually reviews the performance of each of the NEOs other than himself. Following these performance reviews, the CEO presents

compensation recommendations to the HRCC for consideration. The HRCC has full discretion to adopt, modify or reject any such recommendations.

Role of the Independent Consultant. The HRCC has retained an independent compensation consultant which reports directly to the HRCC and does no other work

for management. During 2021, the independent compensation consultant’s representatives participated in the HRCC meetings and provided guidance to the HRCC with respect to executive compensation, comparative peer group data, annual incentive

compensation and consultant pay programs. In supporting the HRCC, the independent compensation consultant provides the HRCC with an independent assessment of the CEO’s recommendations for compensation, reviews and confirms the peer group used

by the Company to prepare market compensation data, and provides ad hoc support to the HRCC, including discussing executive compensation and related corporate governance trends. In 2021, the HRCC determined that its compensation consulting

firm was independent and without conflicts of interest. This determination was reached after reviewing the independence factors set out in the Nasdaq Rules.

Use of a Peer Group. The HRCC evaluates the Company’s

executive compensation programs in comparison to those of a selected peer group, which in 2021 consisted of 12 similarly-sized public professional services companies. The HRCC reviews and approves peer group

composition each year. Navigant Consulting was removed from the 2021 peer group, as it was acquired by another company. TrueBlue, Inc. was added to the peer group in 2021, as a comparable company in the staffing and recruiting industry. The HRCC

uses the peer group to compare total direct compensation and each of the compensation elements for each NEO against those for positions at peer group companies with similar responsibilities. The HRCC also uses the peer group to review executive pay

programs and practices at those companies.

For 2021, the peer group consisted of the following companies:

|

|

|

| |

|

Peer Group |

| |

|

| Barrett Business

Services, Inc. |

|

ICF International, Inc. |

| |

|

| CBIZ, Inc. |

|

Kforce, Inc. |

| |

|

| CRA International,

Inc. |

|

Korn/Ferry International |

| |

|

| Cross Country

Healthcare, Inc. |

|

Resources Connection, Inc. |

| |

|

| FTI Consulting,

Inc. |

|

TrueBlue, Inc. |

| |

|

| Huron Consulting

Group, Inc. |

|

Volt Information Sciences, Inc. |

| EXECUTIVE

COMPENSATION 35

| EXECUTIVE

COMPENSATION 35

In determining compensation, the HRCC considers the peer group companies with which the Company directly competes for

executive talent. However, most of the Company’s executive search and leadership advisory competitors, from which executive talent is often recruited, are privately held and are not included in the above list of publicly traded companies. The

HRCC therefore also relies on its general knowledge of executive compensation levels and practices in the executive search and leadership consulting industry.

The

Company does not set a specific, relative percentile positioning for total direct compensation, or the elements of total direct compensation, as a target for NEO pay levels. Rather, the Company reviews the total direct compensation range for each

position and the mix of elements to ensure that compensation is adequate to attract and retain key executive talent. To ensure that compensation is linked to performance, the NEO compensation program is designed to deliver at least 65% of total

target compensation through variable pay. The NEO compensation program is also designed to ensure that a significant proportion of NEO compensation is delivered in the form of equity and thus aligns compensation with the interests of the

Company’s stockholders.

Stockholder Vote and Engagement on Executive Compensation

The Company held its annual non-binding stockholder advisory vote to approve executive compensation (“say-on-pay”) at the 2021 Annual Meeting of Stockholders. The stockholders

indicated their strong support for our 2020 executive compensation, with approximately 96.6% of voting stockholders casting their vote in favor of the say-on-pay

resolution.

The Company had regular and active discussions with its major stockholders on various topics throughout 2021 and, during those conversations,

stockholders did not raise any specific issues relating to the design of the Company’s executive compensation program. The Company did not make any changes to the executive compensation program as a result of the 2021 say-on-pay vote or its stockholder outreach efforts during 2021. The HRCC is dedicated to continuous improvement of the executive compensation program to reflect an

appropriate alignment of pay and performance, and will continue to seek and review stockholder perspectives when designing and implementing the Company’s executive compensation program.

2021 COMPENSATION PROGRAM

2021 Executive Total Target Direct Compensation Mix

The majority of total target direct compensation for the NEOs was variable compensation.

|

|

|

|

|

| 2021 Target Compensation Mix:

CEO |

|

2021 Target Compensation Mix: Other

NEOs |

36 EXECUTIVE COMPENSATION |

Consistent with the Company’s

pay-for-performance philosophy, the majority of direct compensation for the NEOs is variable. Our NEO compensation mix is generally split into three principal

components:

|

|

|

|

|

|

|

| |

|

|

|

|

Component |

|

Average

% Mix |

|

Objective |

|

What it Rewards |

| |

|

|

|

| Base Salary |

|

|

|

Pay competitive salaries to attract and retain executive talent necessary to develop, implement and execute Heidrick’s business strategy, and to reflect

responsibilities of the position, experience of the executive and the marketplace in which Heidrick competes for talent. |

|

Accomplishment of day-to-day job

responsibilities, taking into account individual performance and retention considerations. |

| |

|

|

|

| Annual Incentives (Cash Compensation) |

|

|

|

Motivate executives to generate outstanding performance and achieve or exceed the operating plan over a one-year

period and align annual compensation with annual performance and financial results. |

|

Achievement of specific pre-set performance thresholds related

to financial, operational and strategic objectives. |

| |

|

|

|

| Long-Term Incentive Equity Compensation |

|

|

|

Encourage achievement of long-term performance goals, align executive rewards with the interests of Heidrick’s stockholders through long-term stock price exposure, and

facilitate the accumulation of Heidrick shares by executives, thereby enhancing ownership and promoting retention. |

|

Share price growth and attainment of long-term financial goals, as well as retention. |

As discussed in greater detail below, total target direct compensation for each NEO in 2021 was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Name |

|

Base Salary ($) |

|

Annual Incentives

MIP Target

(% of Base Salary)

|

|

Long-Term

Incentives

Equity Target ($)

(for March 2021

Awards) |

| |

|

|

|

| Krishnan Rajagopalan |

|

|

$ |

850,000 |

|

|

|

|

150 |

% |

|

|

$ |

1,600,000 |

|

| |

|

|

|

| Michael Cullen |

|

|

$ |

650,000 |

|

|

|

|

100 |

% |

|

|

$ |

800,000 |

|

| |

|

|

|

| Mark Harris |

|

|

$ |

450,000 |

|

|

|

|

100 |

% |

|

|

$ |

750,000 |

|

| |

|

|

|

| Sarah Payne |

|

|

$ |

300,000 |

|

|

|

|

75 |

% |

|

|

$ |

300,000 |

|

| |

|

|

|

| Tracey Heaton |

|

|

$ |

400,000 |

|

|

|

|

(1 |

) |

|

|

|

(1 |

) |

| |

|

|

|

| Kamau Coar |

|

|

$ |

350,000 |

|

|

|

|

75 |

% |

|

|

$ |

300,000 |

|

| 1 |

Ms. Heaton was appointed as the Company’s Chief Legal Officer and Corporate Secretary on November 15, 2021

and was not eligible for a 2021 performance bonus or annual equity award. |

| EXECUTIVE

COMPENSATION 37

| EXECUTIVE

COMPENSATION 37

Base Salary

Base salaries are reviewed annually by the HRCC against levels for positions with similar responsibilities at peer companies, using the comparative data prepared by the

HRCC’s independent compensation consultant. The HRCC then considers individual performance, internal pay equity, functional expertise, experience and scope of responsibilities. In 2021, Ms. Payne’s base salary increased from $275,000

to $300,000 and Mr. Coar’s base salary increased from $275,000 to $350,000. Both were increased to reflect a better alignment to the external market for their respective roles.

Annual Incentives

The Management

Incentive Plan (“MIP”) is the vehicle through which NEOs are rewarded with an annual cash bonus for achieving specific short-term performance

goals over a one-year period. The MIP rewards our NEOs for achieving key annual non-GAAP financial metrics and personal objectives.

The HRCC sets Company and individual performance goals for the NEOs during each year. These goals consist of both quantitative and qualitative performance objectives.

The HRCC considers the reviews conducted by the CEO of the other NEOs and conducts its own review of the CEO’s performance against those pre-established performance objectives, as well as Company

performance milestones achieved during the year. With respect to the CFO, the HRCC also considers input from the AFC Chair.

Historically, 15% of the NEOs’

earned annual bonus amounts were deferred each year and paid out equally over the following three years. A review of competitive data for the Company and its peer group confirmed the deferral feature was not competitive market practice, nor was it

deemed to be retentive. As a result, the HRCC approved the removal of this element of the MIP effective in 2021 and on a go-forward basis, such that all of the NEOs’ earned annual bonus amounts are paid

after the end of the fiscal year in which they were earned.

2021 MIP Metrics

The MIP metrics and targets that the HRCC selected for 2021 tie directly to our operational and strategic goals. Under the MIP, determination of the payout level (if

any) for each NEO award is based upon the achievement of a combination of Company performance metrics (weighted at 70%) and non-financial, strategic performance factors (weighted at 30%). For the latter, there

is a combination of shared and individual objectives. The objectives and rationale for selecting the MIP performance metrics for the year ended December 31, 2021, and the relative weight of each metric were as follows:

|

|

|

|

|

|

|

|

| |

|

|

|

Performance Metric |

|

Rationale for Using Performance Metric |

|

Weight |

| |

|

|

| Adjusted

Operating Income |

|

Measures the ability of the Company to efficiently translate revenues

to profits, which allows the Company to invest for the future and enhance stockholder returns. |

|

|

|

30 |

% |

| |

|

|

| Search Net

Revenues |

|

Coupled with profitability (above), focuses the NEOs on growing the

top line revenues of the Company while managing profitability. |

|

|

|

30 |

% |

| |

|

|

| Non-Search Net Revenues |

|

Aligns the NEOs to critical strategic objectives of diversifying the

Company’s revenues. |

|

|

|

10 |

% |

| |

|

|

| Non-Financial Strategic Goals |

|

Measures achievement of critical strategic objectives, both shared

and individual. |

|

|

|

30 |

% |

| |

|

|

| TOTAL |

|

|

|

|

|

100 |

% |

In 2021, after a review of competitive data for the Company and its peer group, the HRCC increased the maximum payouts available under

the plan from 150% to 200% of target to better align with the external market. The performance required to achieve maximum payouts was increased to be commensurate with the payout.

Payout amounts under the MIP were set for each metric based on “Minimum,” “Target” and “Maximum” performance levels and corresponding

award levels based on the Company’s business plan and other operational and environmental factors, specifically: Adjusted Operating Income, Search Net Revenues, Non-Search Net Revenues, and non-financial strategic goals. “Target”

38 EXECUTIVE COMPENSATION |

performance is the level at which a participant will earn 100% of his or her target award. Depending upon the relationship of the Company’s actual financial performance and the

individual’s annual evaluation, final payouts under the MIP may be as little as zero (at or below “Minimum” performance) and as high as 200%

of Target (at “Maximum” performance). The HRCC has discretion to modify any payouts (upwards or downwards) under the MIP as appropriate to

ensure plan objectives are met, taking into consideration a variety of Company specific or environmental factors.

These financial metrics were set taking

into account the Company’s strategic initiatives, historical financial performance, internal budgeting for the relevant year, external guidance and expected market conditions. In 2021, multi-year investments were expected to adversely affect

operating income. Further, emergence from 2020 economic conditions and the Company’s restructuring announced in August 2020 presented additional reasons for conservative targets. Consequently, the Adjusted Operating Income target for 2021 was

lower than the 2020 actual and 2020 target Adjusted Operating Income. As discussed above, the maximum bonus opportunity was increased to 200% of target in 2021. The performance required to achieve maximum performance for Adjusted Operating Income,

Search Net Revenues and Non-Search Revenues was 180%, 110% and 116% of target, respectively. In 2020, the comparable maximum performance required was 115%, 105% and 110% of target for these measures.

As demonstrated on page 32, the Company’s actual 2021 financial results were very strong, with a record year in terms of profitability (Operating Income: $98.3M;

Net Income: $72.6M) and revenues ($1.0B).

Each NEO also had non-financial strategic goals that were reviewed and approved

by the HRCC in early 2021, and were aimed at focusing each NEO’s attention in areas where they have the most potential for impacting the Company’s performance. Minimum, Target and Maximum Performance Levels for 2021, as well as the actual

performance results for both Company performance metrics and non-financial strategic metrics, are set forth below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted

Operating

Income |

|

|

|

Search Net

Revenue |

|

|

|

Non-Search

Revenues |

|

|

|

Non-Financial

Strategic

Goals |

|

|

|

Total |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Performance

Minimum

Target

Maximum |

|

$17.2 million

$28.6 million $51.4 million |

|

|

|

$537.7 million

$566.0 million $622.6 million |

|

|

|

$56.0 million

$61.0 million $71.0 million |

|

|

|

|

|

|

|

|

|

|

| |

|

|

Target

Weighting:

% of Total

Bonus |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Actual

Performance |

|

$121.6 million1 425% of Target |

|

|

|

$867.7 million

153% of Target |

|

|

|

$67.6 million

111% of Target |

|

|

|

See below |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Bonus Result |

|

200% x 30% weight

60% |

|

|

|

200% x 30% weight

60% |

|

|

|

166% x 10% weight

16.6% |

|

|

|

200% x 30% weight

60% |

|

|

|

196.6% |

|

|

|

Results: All

NEOs |

|

|

| 1 |

For purposes of the MIP, Adjusted Operating Income includes adjustments of $23.3M to the Operating Income of $98.3M, which

the HRCC reviewed and approved. The adjustments are as follows: restructuring expenses of $3.8M, acquisition-related expenses of $8.8M, adjustments for mark-to-market

expenses on non-qualified deferred compensation plan and phantom stock of $5.1M, and adjustments of $5.6M related to the Company’s technology-driven offerings. |

| EXECUTIVE

COMPENSATION 39

| EXECUTIVE

COMPENSATION 39

NEO NON-FINANCIAL PERFORMANCE

As discussed above, for 2021, 30% of MIP performance was contingent on achieving non-financial strategic goals. These goals

include a combination of shared and individual objectives. Results for the objectives are quantified and reviewed with the HRCC. However, due to the nature of the objectives, all results are not publicly disclosed for competitive market reasons.

In 2022, the HRCC reviewed each NEO’s achievements relative to their non-financial strategic objectives and, in its

discretion, determined that such accomplishments exceeded expectations, resulting in a payout of 200% of target with respect to the non-financial portion of the bonus for each of the NEOs. Certain considerations of the HRCC when reviewing 2021 non-financial performance follows.

2021 was a unique year that presented new and unexpected challenges. The Company emerged from

2020 with expectations of a moderated market and slow recovery, but instead experienced a year of unprecedented growth in financial performance. Notably, the Company achieved 61% growth in revenues and record consultant productivity, with average

revenue per executive search consultant increasing from $1.5M in 2020 to $2.4M in 2021. The NEO team balanced year two of the global pandemic, which included another round of adjustments and adaptations to remote work and virtual delivery of its

services, as dictated by the COVID-19 pandemic. The team continued to lead with employee safety and well-being as the guiding principle. During this period of unexpected demand and growth, the team continued to drive the Company’s

transformation strategy and growth in all segments of the business, which included the acquisition of a new on-demand talent business and acquisitions within other geographies.

As a team, and in addition to the goals set in March 2021, the NEOs built on the foundations laid in 2020 with the following highlights:

| |

• |

|

Completed the acquisition of and many facets of integration with BTG, our newly acquired, on-demand talent business;

|

| |

• |

|

Built a new growth markets segment which included expanding and opening new markets in the Nordic region and Israel, and

pursuing growth through inorganic M&A opportunities; |

| |

• |

|

Re-envisioned office space which included reducing real estate footprint and

redesigning space in multiple offices to support the future of work; |

| |

• |

|

Extended and expanded credit facility from $175M to $200M in July 2021 for an extended term with a maturity in 2026;

|

| |

• |

|

Expanded key internal reporting and connectivity on key financial dashboards across multiple service lines;

|

| |

• |

|

Built new talent acquisition teams to support a record number of new hires in 2021, as a result of business demand and

growth; |

| |

• |

|

In a mainly remote environment, developed and deployed multiple learning and development frameworks to support skills and

action planning essential to support future business growth and development across multiple roles and functions; |

| |

• |

|

Advanced operational and policy-related decisions to support our new hybrid workplace model; |

| |

• |

|

Continued to keep safety of employees front and center when developing actions and policies around return to office,

actions to support employee well-being and psychological safety in year two of the global pandemic and in a year of record productivity within our Executive Search business; and |

| |

• |

|

Continued to advance internal and external philanthropic efforts and ESG internally and externally through client work.

|

|

| |

| 2021 Shared Objectives and

Accomplishments for all NEOs3 |

| |

| Strengthened a high performance, diverse and inclusive culture

measured through below-target attrition rates and through the number of diverse promotions and hires at Principal and Partner levels in 2021. |

| |

| Continued to build new digital products and

capabilities by launching strategy, hiring and aligning resources and go to market framework. |

| |

| Drove internal organizational understanding of the long-term

strategic plan through communication and development of quarterly and annual metrics. |

| 3 |

Ms. Heaton and Mr. Coar’s performance is excluded from the

NEO performance goals for 2021, because they were not respectively eligible for 2021 performance bonuses. Ms. Heaton was not eligible for a 2021 performance bonus pursuant to the terms of her joining the Company in November 2021.

Mr. Coar’s 2021 performance bonus was forfeited in connection with the termination of his employment in 2021. |

40 EXECUTIVE COMPENSATION |

KRISHNAN RAJAGOPALAN’S INDIVIDUAL PERFORMANCE

|

| |

| 2021

Accomplishments |

| |

| Created and implemented a new organizational structure to support

the long-term strategic plan. Further implemented metrics and a roadmap to achieve this plan. |

| |

| Enabled and refined Heidrick Consulting’s go-to-market strategy and revenue growth. |

| |

| Implemented broad organizational and leadership changes in support

of the strategic plan and go to market strategy. Continued to enhance the Company brand and build market presence and differentiation. |

MICHAEL CULLEN’S INDIVIDUAL PERFORMANCE

|

| |

| 2021

Accomplishments |

| |

| Achieved revenue growth and profitability in selected geographical

regions. Implemented a new leader of Growth Markets to expand markets in Poland, Israel, Russia and Ukraine (deals exited in 2022 due to current crisis and war); continued to build out our Nordics region with acquisitions in Finland and building in

Sweden. |

| |

| Continued growth and expansion of shared service

model. Expansion of shared services center across service lines and with key focus of on-boarding Project Administrators to support Principals, Partners and other leaders across Executive Search, Heidrick

Consulting, and Corporate segments. |

| |

| Improved margin within Europe and Heidrick Consulting. |

MARK HARRIS’ INDIVIDUAL PERFORMANCE

|

| |

| 2021

Accomplishments |

| |

| Completed inorganic expansion within Finland and new On-Demand business segment. |

| |

| Continued engagement and growth of stockholder

base. |

| |

| Created and implemented a real estate strategy to both reduce

operating costs and to support our hybrid workplace strategy with fluid office space and more spaces for teams to collaborate. |

| |

| Enhanced tools and efficiency within financial

reporting and operating processes. Built infrastructure to support new segments and growth. |

SARAH PAYNE’S INDIVIDUAL PERFORMANCE

|

| |

| 2021

Accomplishments |

| |

| Evolved talent acquisition strategies across regions and service

lines to support record hiring and growth in 2021 in alignment with our diversity, equity and inclusion aspirations. |

| |

| Advanced talent and internal development

capabilities by creating and implementing a new talent review process and by introducing a number of key new learning and development offerings to support account growth and development within multiple business segments and roles in support of

employee development, diversity, equity and inclusion goals, and overall employee engagement. |

| |

| Comprehensive review of, and changes to, key executive compensation

programs to implement market best practices in order to attract and retain top talent. |

| EXECUTIVE

COMPENSATION 41

| EXECUTIVE

COMPENSATION 41

The table below details the resulting payout under the MIP compared to target for each of our continuing NEOs other

than Ms. Heaton, who was not eligible for a 2021 performance bonus. Mr. Coar did not receive a 2021 bonus due to his departure from the Company in 2021:

Long-Term Incentives

Long-term incentives (“LTIs”) are the vehicle through which NEOs

are awarded the Company’s common stock for continued service and for achieving specific performance goals over a three-year period. These awards vest over a three-year period after the grant date. LTIs are designed to focus the NEOs on the

strategic goals necessary to increase stockholder value and further position the Company to succeed in a changing environment.

The LTI award targets are

based on the HRCC’s review of publicly disclosed data for the Company’s applicable peer group for each NEO position and internal pay equity considerations, as well as the CEO’s recommendations (other than with respect to himself) and

a review of individual performance and potential.

LTI awards issued to the NEOs in 2021 consist of:

|

|

|

| Performance Stock Units (“PSUs”) |

|

PSU awards are based on

performance over a three-year period, which provides greater focus on sustained long-term results. Each PSU represents a right to receive one share of the Company’s common stock upon vesting.

|

| Restricted Stock Units (“RSUs”) |

|

RSUs are service-based and vest in three equal

installments (specifically, on the first, second and third anniversaries of the date of grant). Each RSU represents a right to receive one share of the Company’s common stock upon vesting.

|

When issuing LTI awards, the Company calculates the number of RSUs and PSUs awarded to the NEOs by dividing the total dollar value of

the LTI award by the closing price of the Company’s common stock on the grant date (usually in March of the grant year). All outstanding RSUs and PSUs are credited with dividend equivalents that are payable in cash when and if the related units

vest. The primary purpose of crediting dividend equivalents on LTI awards is to align the participant with the value of being a stockholder over the course of the vesting period, but only to the extent the award vests.

In March 2021, LTI awards were issued to Messrs. Rajagopalan, Cullen, Harris and Coar and Ms. Payne, with 50% of the target value issued as PSUs and 50% of the

target value issued as RSUs. See the 2021 Grants of Plan-Based Awards Table on page 47 for more details on the equity grants that the HRCC approved.

42 EXECUTIVE COMPENSATION |

The following is a summary of the LTI awards issued in 2021:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

NEO |

|

PSUs (Target) |

|

RSUs |

|

Award

Value1 |

| |

|

|

|

| Award

Date |

|

|

|

3/30/2021 |

|

|

|

|

3/9/2021 |

|

|

|

|

|

|

| |

|

|

|

| Award

Price |

|

|

$ |

35.15 |

|

|

|

$ |

36.95 |

|

|

|

|

|

|

| |

|

|

|

|

Krishnan Rajagopalan |

|

|

|

26,316 |

|

|

|

|

25,034 |

|

|

|

$ |

1,850,014 |

|

| |

|

|

|

| Michael Cullen |

|

|

|

11,380 |

|

|

|

|

10,825 |

(2) |

|

|

$ |

799,991 |

|

| |

|

|

|

|

Mark Harris |

|

|

|

11,380 |

|

|

|

|

10,825 |

|

|

|

$ |

799,991 |

|

| |

|

|

|

| Sarah Payne |

|

|

|

4,979 |

|

|

|

|

4,736 |

|

|

|

$ |

350,007 |

|

| |

|

|

|

|

Kamau Coar |

|

|

|

4,979 |

|

|

|

|

4,736 |

|

|

|

$ |

350,007 |

|

| 1 |

Value based upon number of RSUs and PSUs (at target) awarded multiplied by the closing share price on the date of the

award. |

| 2 |

Mr. Cullen received an additional award of 27,064 RSUs as described below. |

2019, 2020 and 2021 PSU Awards. The 2019 PSU awards for the

performance period 2019 – 2021, the 2020 PSU awards for the performance period 2020 – 2022 and the 2021 PSU awards for the performance period 2021 – 2023 were issued to Messrs. Rajagopalan, Cullen, Harris, and Coar and Ms. Payne.

The awards are subject to target goals for the Company’s three-year Adjusted Operating Margin, as established by the HRCC at the beginning of the three-year PSU performance period, and three-year Relative Total Shareholder Return (“R-TSR”) for the 2019 – 2021, 2020– 2022 and 2021 – 2023 performance periods, respectively. Vesting

for the awards will be weighted equally based upon the outcome of Adjusted Operating Margin and R-TSR. The peer group for the R-TSR metric consists of the constituents

of the S&P Human Resources and Employment Services Index. The HRCC will review the performance for the 2020 and 2021 PSU awards, and the vesting of the awards will be determined in early 2023 and 2024, respectively. The 2019 PSU vesting outcome

is as follows.

2019 PSU Awards. The table below

illustrates the structure of the 2019 – 2021 PSU awards with an equal weighting placed on each of the performance targets. For the three-year performance period of 2019 – 2021, the Adjusted Operating Margin was 11.4% ($257.3M of Adjusted

Operating Income, $2,261.4M of Adjusted Revenues) and the three-year R-TSR performance placed the Company at the 46th percentile of the applicable peer

group. As a result of the performance achieved, the HRCC approved a vesting percentage of 139% of the target number of PSUs.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

Performance Target

3-year

Adjusted

Operating Margin |

|

Performance Target

Relative TSR

Ranking |

|

Percentage of Target PSUs Vesting |

| |

|

|

|

| Maximum |

|

>12.0% |

|

>75th %ile |

|

200% |

| |

|

|

|

|

Target |

|

8.0% |

|

50th %ile |

|

100% |

| |

|

|

|

| Threshold |

|

4.0% |

|

25th %ile |

|

50% |

| |

|

|

|

| |

|

<4.0% |

|

<25th %ile |

|

0% |

| EXECUTIVE

COMPENSATION 43

| EXECUTIVE

COMPENSATION 43

The PSUs issued to Messrs. Rajagopalan, Cullen and Harris and Ms. Payne in 2019 vested in 2022 at 139% of target

as follows. Mr. Coar’s employment terminated in 2021 and he accordingly forfeited his 2019 award of PSUs.

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Name |

|

Target PSUs

|

|

PSUs Vested

|

| |

|

|

|

Krishnan Rajagopalan |

|

23,455 |

|

32,602 |

| |

|

|

|

Michael Cullen |

|

9,964 |

|

13,850 |

| |

|

|

|

Mark Harris |

|

9,198 |

|

12,785 |

| |

|

|

|

Sarah Payne |

|

2,529 |

|

3,515 |

Special RSU Award to Mr. Cullen.

In March 2021, Mr. Cullen was awarded a special, one-time RSU award with a grant date value of $1,000,000. The award will vest ratably on an annual basis over a three-year period. The award was

provided to recognize Mr. Cullen’s contributions to continued improvements in the Company’s operating structure, commercial contributions within the market, and to further align Mr. Cullen with interests of the Company’s

stockholders.

Ms. Heaton’s Sign-On Awards. In connection with the commencement of her employment with the Company in November 2021, Ms. Heaton received a sign-on bonus of $125,000 and an RSU award with a grant date fair

value of $125,000, which vests in three equal installments on each of the first three anniversaries of the grant date for the RSUs. In the event that Ms. Heaton resigns from the Company for any reason or is terminated for cause (as defined in

her employment agreement), within two years of the sign-on award payment dates, Ms. Heaton will be required to reimburse the Company the amount of such payment, reduced on a

pro-rated basis by one twenty fourth (1/24th) per full month from the date of payment within 30 business days following the termination date.

Mr. Coar’s Separation Agreement. In connection with his

employment terminating in June 2021, Mr. Coar and the Company entered into a Separation Agreement and General Release (the “Coar Separation Agreement”), pursuant to which he received a cash payment in the amount of $87,500,

representing three months’ base salary, and three months of continued health coverage at active employee rates. These payments and benefits are included in the “All Other Compensation” column of the 2021 Summary Compensation Table

below.

OTHER COMPENSATION POLICIES AND INFORMATION

Stock Ownership Guidelines

To

enhance the alignment of NEOs’ interests with those of stockholders, the Company maintains stock ownership guidelines. The CEO is required to own five times his annual base salary in Company common stock, and all other NEOs are required to own

two times their annual base salary. Effective February 2022, the HRCC approved revisions to the stock ownership guidelines which added share retention requirements, and removed the previously required five-year timeframe for meeting the ownership

requirement. To the extent a covered employee becomes subject to these stock ownership guidelines and at that time does not own qualifying shares in an amount equal to or in excess of the relevant ownership multiple requirement, or falls below the

relevant ownership multiple requirement, the employee must retain ownership of Company common stock issued upon the vesting of Company RSUs or performance shares/PSUs, in an amount equal to 50% of the net

after-tax value of the newly vested RSUs, performance shares and/or PSUs until the applicable multiple requirement is met.

Equity interests that count toward the satisfaction of the ownership guidelines include HSII shares owned outright by the employee, HSII shares jointly owned, vested or

unvested restricted HSII shares, and unvested RSUs payable in HSII shares. Outstanding HSII stock options and performance shares/PSUs are not counted toward the guidelines. As of December 31, 2021, the NEOs all were on target to meet their

ownership guidelines within five years of appointment to their roles.

Hedging and Pledging Policy

Since 2013, the Company has had policies prohibiting hedging or pledging of Heidrick stock. Pursuant to our Insider Trading Policy, our officers, directors, and

employees shall not hold Heidrick securities in a margin account, pledge Heidrick securities as collateral

44 EXECUTIVE COMPENSATION |

for a loan, purchase financial instruments or otherwise engage in transactions that either hedge or offset any decrease in value of Heidrick securities. The full text of our Insider Trading

Policy, which includes details on our restrictions on hedging and pledging of Heidrick securities can be located on our website at: https://investors.heidrick.com/corporate-governance.

Clawback Policy

In December

2021 the Company amended its Clawback Policy whereby the HRCC on behalf of the Company may seek the recoupment of any incentive awards (cash or equity) given to: (1) any executive officer in the event of a financial restatement and/or

(2) any incentive plan participant in situations of fraud, bribery, or other intentional, illegal misconduct impacting the Company or which results in a breach of the Company’s Code of Ethics or knowing failure to report such acts of any

employee over whom such person had direct supervisory authority during the three-year period preceding the date the restatement is filed with the SEC or the date the HRCC determines a clawback is appropriate for misconduct. The full text of our

Clawback Policy can be found at: https://investors.heidrick.com/corporate-governance.

Tax Deductibility of

Executive Compensation

Section 162(m) of the Internal Revenue Code (“Section

162(m)”) limits the federal income tax deduction for annual individual compensation to $1 million for the current or former covered employees. In the past, Section 162(m)’s deduction

limit included an exception for “performance-based” compensation. This exception for “performance-based” compensation was eliminated in 2018. Although tax deductibility is one of many factors the Company considers when

determining executive compensation, the Company believes that the tax deduction limitation should not compromise its ability to design and maintain executive compensation arrangements that will attract and retain executive talent to compete

successfully.

Perquisites and Other Personal Benefits

Heidrick provides its NEOs with the same benefits that are provided to all employees generally, including medical, dental and vision benefits, group term life insurance

and participation in a 401(k) plan. The NEOs are also reimbursed for expenses incurred for an annual physical examination, financial planning services (maximum reimbursement for financial planning is $1,080 per year, or $3,150 if expenses are

incurred for the first time) and approved business club memberships.

Severance Arrangements

The Company has adopted other executive compensation arrangements, including a Change in Control Severance Plan (as described below) designed to retain executives in the

event of a change of ownership of the Company and a Management Severance Pay Plan designed to provide financial assistance to executives following termination of employment. The material terms and conditions of these plans are described in the

“Potential Payments Upon Termination or a Change in Control” section below.

Employment Agreements

Each of our continuing NEOs has entered into an employment agreement with the Company, which contains general employment

terms (including base salary and eligibility to participate in various incentive and benefit plans) and customary restrictive covenants in favor of the Company. These restrictive covenants contain

non-competition and non-solicitation restrictions for a period of 12 months after certain terminations of employment. Severance protection for our NEOs is generally

covered by our Management Severance Pay Plan and our Change in Control Severance Plan (described below) instead of by their employment agreements. However, our CEO’s employment agreement does provide for the following enhanced benefits:

(i) if he is entitled to receive severance payments under the Management Severance Pay Plan, he will also be entitled to a pro-rata bonus for the year of termination and (ii) he will receive the

benefits described in the Management Severance Pay Plan upon his resignation of employment for Good Reason (as defined in his employment agreement) instead of only upon a termination by the Company without Cause.

| EXECUTIVE

COMPENSATION 45

| EXECUTIVE

COMPENSATION 45

COMPENSATION TABLES AND NARRATIVE DISCLOSURES

2021 SUMMARY COMPENSATION TABLE

The table below

summarizes the total direct compensation paid or earned by each of the NEOs for the last three fiscal years, and only reflects information for those years in which the NEO was determined to be an NEO of the Company. The amounts in the Stock Awards

column indicate the fair value on the grant date associated with all grants awarded in the corresponding year and may not correspond with the amounts that the NEO will eventually realize with respect to these awards. The benefit, if any, actually

received from these awards will depend upon the future value of our common stock.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|