UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Regi

strant

þ

Filed by a Party other than the Registrant

o

Check the appropriate box:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o

|

|

Preliminary Proxy Statement

|

|

|

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

þ

|

|

Definitive Proxy Statement

|

|

|

|

o

|

|

Definitive Additional Materials

|

|

|

|

o

|

|

Soliciting Material Pursuant to §240.14a-12

|

|

|

|

|

|

|

|

|

|

HEALTHCARE SERVICES GROUP, INC.

|

|

|

|

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

þ

|

|

No fee required.

|

|

|

|

o

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

o

|

|

Fee paid previously with preliminary materials.

|

|

|

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

HEALTHCARE SERVICES GROUP, INC.

3220 Tillman Drive

Suite 300

Bensalem, Pennsylvania 19020

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 28, 2019

To the Shareholders of

HEALTHCARE SERVICES GROUP, INC.

NOTICE IS HEREBY GIVEN that the Annual Meeting (the “Annual Meeting”) of Shareholders of Healthcare Services Group, Inc. (the “Company”) will be held at the Courtyard Philadelphia Bensalem, 3280 Tillman Drive, Bensalem, Pennsylvania 19020, on

May 28, 2019

, at 10:00 A.M.

(E

DT)

, for the following purposes:

|

|

|

|

|

|

|

|

1

|

To elect ten directors;

|

|

|

|

|

2

|

To approve and ratify the selection of Grant Thornton LLP as the independent registered public accounting firm of the Company for its current fiscal year ending December 31, 2019;

|

|

|

|

|

3

|

To consider an advisory vote on a non-binding resolution to approve the compensation of certain of our executive officers disclosed in this Proxy Statement; and

|

|

|

|

|

4

|

To consider and act upon such other business as may properly come before the Annual Meeting and any adjournment or postponement.

|

|

|

|

Only shareholders of record at the close of business on

April 1, 2019

will be entitled to notice of and to vote at the Annual Meeting.

Important Notice Regarding the Availability of

Proxy Materials for the Shareholders

meeting to be held on

May 28, 2019

The proxy statement and annual report to shareholders are available under “

2019

Investor Materials

” at

www.proxydocs.com/hcsg

.

While we encourage shareholders to

attend the Annual Meeting

, shareholders can sign and promptly mail the enclosed proxy, whether or not you expect to attend the Annual Meeting, in order that your shares may be voted for you. A return envelope is provided for your convenience.

|

|

|

|

|

By Order of the Board of Directors,

|

|

|

|

J

UDE

V

ISCONTO

Chairman

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

|

|

April 19, 2019

|

|

|

|

Bensalem, Pennsylvania

|

Table of Contents

HEALTHCARE SERVICES GROUP, INC.

3220 Tillman Drive

Suite 300

Bensalem, Pennsylvania 19020

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

May 28, 2019

SUMMARY OF THIS PROXY STATEMENT

This

P

roxy

S

tatement contains information related to the annual meeting of shareholders (the “Annual Meeting”) of Healthcare Services Group, Inc. (the “Company,” “we,” “us” or “our”), to be held on

Tuesday, May 28, 2019

, beginning at 10:00 a.m. (EDT), at the Courtyard Philadelphia Bensalem, 3280 Tillman Drive, Bensalem, Pennsylvania 19020, and at any postponements or adjournments thereof.

QUESTIONS AND ANSWERS ABOUT OUR ANNUAL MEETING

What is the Purpose of the Annual Meeting

At the Annual Meeting, shareholders will hear an update on the Company’s operations, have a chance to meet some of our directors and executives and will act on the following matters:

|

|

|

|

|

|

|

|

1

|

To elect ten directors;

|

|

|

|

|

2

|

To approve and ratify the selection of Grant Thornton LLP as the independent registered public accounting firm of the Company for its current fiscal year ending December 31, 2019;

|

|

|

|

|

3

|

To consider an advisory vote on a non-binding resolution to approve the compensation of certain of our executive officers disclosed in this Proxy Statement; and

|

|

|

|

|

4

|

To consider and act upon such other business as may properly come before the Annual Meeting and any adjournment or postponement.

|

|

|

|

Who May Vote; Date of Mailing

Only holders of record of our Common Stock, $.01 par value (the “Common Stock”) at the close of business on

April 1, 2019

(the “Record Date”), are entitled to notice of and to vote at the Annual Meeting. On the Record Date, there were issued and outstanding approximately

74,058,000

shares of our Common Stock.

Each share of Common Stock entitles the holder thereof to one vote. This Proxy Statement is being mailed to shareholders on or about

April 26, 2019

.

What constitutes a quorum?

In order to carry on the business of the Annual Meeting, we must have a quorum. The presence, in person or by proxy, of the holders of a majority of the outstanding shares of our Common Stock is required to constitute a quorum at the Annual Meeting.

How many votes are required to approve each proposal?

Election of Directors

The affirmative vote of a plurality of the shares of Common Stock entitled to vote and present in person or by proxy at the Annual Meeting is required for the el

ection to our Board of Directors

(the "Board")

of each of the nominees for director. Shareholders do not have the right to cumulate their votes in the election of directors.

Ratification of Independent Registered Public Accounting Firm and Approval of Executive Compensation

The affirmative vote of the holders of a majority of the votes cast at the Annual Meeting in person or by proxy and entitled to vote is required for approval of Proposal No. 2 and Proposal No. 3.

How are votes counted?

You may either vote ‘FOR’ or ‘WITHHOLD’ authority to vote for each nominee for election to the Board

. You may vote ‘FOR,’ ‘AGAINST’ or ‘ABSTAIN’ on Proposal No. 2 and Proposal No. 3. Abstentions will be counted as present for purposes of determining the existence of a quorum, but will have no effect on the vote of the particular proposal. If you sign and submit a proxy card without voting instructions, your shares will be voted ‘FOR’ each director nominee, ‘FOR’ Proposal No. 2 and Proposal No. 3 and ‘FOR’ or ‘AGAINST’ any other proposal as recommended by the Board

.

What is a broker non-vote?

If shareholders do not give their brokers instructions as to how to vote shares held in street name, the brokers have discretionary authority to vote those shares on ‘routine’ matters, such as the ratification of the independent registered public accounting firm, but not on ‘non-routine’ proposals, such as the election of directors and the advisory vote regarding executive compensation. As a result, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote. Shares held by brokers who do not have discretionary authority to vote on a particular matter and who have not received voting instructions from their customers will be counted as present for the purpose of determining whether there is a quorum at the Annual Meeting, but will not be counted or deemed to be present in person or by proxy for the purpose of determining whether our shareholders have approved that matter.

How to Vote

You may vote in person at the Annual Meeting or by proxy. We recommend that you vote by proxy even if you plan to attend the Annual Meeting. You can always change your vote at the Annual Meeting.

How Proxies Work

Our Board

is

asking for your proxy. Giving us your proxy means you authorize us to vote your shares at the Annual Meeting in the manner you direct.

Proxies submitted will be voted by the individuals named on the proxy card in the manner you indicate. If you give us your proxy but do not specify how you want your shares voted, they will be voted in accordance with the Board

's

recommendations.

You may receive more than one proxy or voting card depending on how you hold your shares. If you hold shares through someone else, such as a stockbroker, you may get materials from them asking how you want to vote. The latest proxy card we receive from you will determine how we will vote your shares.

Revoking a Proxy

A proxy may be revoked by delivery of a written statement to the Secretary of the Company stating that the proxy is revoked, by a subsequent proxy executed by the person executing the prior proxy and presented to the Annual Meeting, or by voting in person at the Annual Meeting.

Attending in Person

Only shareholders, their proxy holders, and our invited guests may attend the Annual Meeting. For security purposes, all persons attending the Annual Meeting must bring identification with photo. If you wish to attend the Annual Meeting in person but you hold your shares through someone else, such as a stockbroker, you must bring proof of your ownership to the Annual Meeting. For example, you could bring an account statement showing that you owned shares of the Company’s Common Stock as of the Record Date as acceptable proof of ownership.

Expenses; Proxy Solicitation

All expenses in connection with this solicitation will be borne by the Company. It is expected that solicitation will be made primarily by mail, but regular employees or representatives of the Company may also solicit proxies by telephone, facsimile, email or in person, without additional compensation, except for reimbursement of out-of-pocket expenses.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

At the Annual Meeting, ten directors of the Company are to be elected, each to hold office for a term of one year. All nominees currently serve as Directors

. Unless authority is specifically withheld, management proxies will be voted FOR the election of the nominees named below to serve as directors until the next annual meeting of shareholders and until their successors have been chosen and qualified. Should any nominee not be a candidate at the time of the Annual Meeting (a situation which is not now anticipated), proxies will be voted in favor of the remaining nominees and may also be voted for substitute nominees. If a quorum is present, the candidate or candidates receiving the highest number of votes will be elected. Brokers that do not receive shareholder instructions are not entitled to vote for the election of directors because an uncontested election is considered a “non-routine” matter. Hence, shareholders who hold their shares through brokerage accounts and who would like to vote in favor of the director nominees will need to instruct their brokerage firm to vote for the Company’s nominees.

The Board of Directors recommend a vote “FOR” all nominees.

The nominees are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name, Age and Principal Occupations and Public Directorships for the past five years

|

|

Director

Since

|

|

|

1

|

Robert L. Frome, Esq., 81, Robert L. Frome, Esq., 81, is Counsel to the law firm of Olshan Frome Wolosky LLP and prior thereto was a partner at such Firm for more than five years.

|

|

1983

|

|

|

2

|

Robert J. Moss, Esq., 81, is the retired President and CEO of Moss Associates, a law firm. Previously, Mr. Moss served as a Court Officer of the First Judicial District of Pennsylvania from 2006 to 2007.

|

|

1992

|

1

|

|

3

|

John M. Briggs, CPA, 68, serves as the Company’s lead independent director. Mr. Briggs was the Treasurer of the Philadelphia Affiliate of Susan G. Komen for the Cure from 2005 through 2011. Additionally, he is the founder and formerly a Partner of Briggs, Bunting & Dougherty, LLP, a registered public accounting firm. Mr. Briggs is currently a board member of Crossmark Global Investments of Regulated Investment Funds.

|

|

1993

|

1

,

2

|

|

4

|

Dino D. Ottaviano, 71, is the retired Principal of D2O Marketing, Inc., a provider of internet productivity tools founded in 2006. Previously, Mr. Ottaviano was employed for 23 years with Transcontinental Direct (successor to Communication Concepts, Inc.), a publicly held outsourcing printer, retiring in 2002 as Vice President of Business Development.

|

|

2007

|

1

|

|

5

|

Theodore Wahl, 45,

has been

the

President and Chief Executive Officer, since May 2015. Mr. Wahl joined the Company in 2004. Prior to his appointment to President and Chief Executive Officer,

Mr. Wahl

served as President and Chief Operating Officer, Executive Vice President & Chief Operating Officer, Vice President of Finance, Regional Manager, Regional Sales Director, District Manager and Facility Manager. Prior to joining the Company, Mr. Wahl was a Senior Manager with Ernst & Young’s Transaction Advisory Group

.

|

|

2011

|

|

|

6

|

Michael E. McBryan, 54, has been the Executive Vice President and Chief Revenue Officer since April 2012. Mr. McBryan joined the Company in 1988. Prior to becoming Executive Vice President and Chief Revenue Officer, Mr. McBryan served as Senior Vice President, Divisional Vice President, Regional Sales Director, District Manager and Facility Manager.

|

|

2011

|

|

|

7

|

Diane S. Casey, RN, 65, has been a Clinical Nursing Coordinator (CNC) of Endoscopy at Huntingdon Valley Surgery Center, an AAAHC accredited healthcare facility, where she has worked for more than the past five years. Previously, Ms. Casey was employed at Holy Redeemer Health Systems in various surgical nursing and management positions.

|

|

2011

|

3

|

|

8

|

John J. McFadden, 57, has been the Principal of Global Circulation Services, a provider of marketing and advertising services to Media and Publishing companies founded since 2008. Mr. McFadden previously worked at The McGraw-Hill Companies (parent company of Standard and Poor’s) where he held management positions within their global circulation, sales and outsourcing services departments for approximately 15 years.

|

|

2012

|

3

|

|

9

|

Jude Visconto, 45, has been a Principal of American Property Holdings, a real estate investment firm focused on the acquisition, development and management of multi-family/senior housing and commercial assets, for more than the past five years. Mr. Visconto is an active member of the real estate community and participates in a variety of industry-related associations including The American Senior Housing Association, The Association of the National Investment Center for Senior Housing and Care, and The National Association of Realtors.

|

|

2015

|

4

|

|

10

|

Daniela Castagnino, 44,

is

a

n

Information Specialist at United Spinal Association, a national 501(c)(3) non-profit

membership organization dedicated to enhancing the quality of life of all people living with spinal cord injuries

and disorders (SCI/D),

for more than

the past

five years.

P

reviously

,

Ms. Castagnino

was

an international consultant for Lazos Profesionales Asociación Civil and

t

he Inter-American Development Bank

.

|

|

2018

|

|

|

|

|

|

|

|

1.

Member of Audit Committee.

2.

Lead Independent Director.

3.

Member of Nominating, Compensation and Stock Option Committee.

4.

C

hairman of the Board of the Company.

If Messrs. Briggs, Moss and Ottaviano are re-elected as Directors of the Company, it is anticipated that such individuals will continue to comprise the Audit Committee following the Annual Meeting with Mr. Briggs serving as the chairman of such committee.

If Ms. Casey and Mr. McFadden are re-elected as Directors of the Company, it is anticipated that such individuals will continue to

comprise

the Nominating, Compensation and Stock Option Committee following the Annual Meeting with Ms. Casey serving as the chair

woman

of such committee.

PROPOSAL NO. 2

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The

accounting firm of

Grant Thornton LLP

was

selected by the Audit Committee of the Board as the Independent Auditors of the Company

for the fiscal year ending

December 31, 2019

. Said firm has no other relationship to the Company. The Board recommends the ratification of the selection of the firm of Grant Thornton LLP to serve as the Independent Auditors of the Company for the year ending

December 31, 2019

. A representative of Grant Thornton LLP, which has served as the Company’s Independent Auditors since December 1992, will be present at the forthcoming shareholders’ meeting with the opportunity to make a statement if so desired and such representative will be available to respond to appropriate questions. The approval of the proposal to ratify the appointment of Grant Thornton LLP requires the affirmative vote of a majority of the votes cast by all shareholders represented and entitled to vote thereon. An abstention, therefore, will not have the same legal effect as an “against” vote and will not be counted in determining whether the proposal has received the required shareholder vote. However, brokers that do not receive instructions on this proposal are entitled to vote for the selection of the independent registered public accounting firm.

The Board of Directors recommend a vote “FOR” the approval and ratification of the selection of Grant Thornton LLP as the independent registered public accounting firm of the Company for its current fiscal year ending

December 31, 2019

.

PROPOSAL NO. 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Board of Directors recognizes the significant interest of shareholders in executive compensation matters. Pursuant to amendments to Section 14A of the Securities Exchange Act, as amended (the “Exchange Act”)

and the shareholder vote on the frequency of the advisory vote on executive compensation at our 2017 Annual Meeting of Shareholders, we are providing our shareholders with an annual opportunity to cast an advisory vote (commonly referred to as “say-on-pay”) to approve the compensation of our Named Executive Officers.

We are asking our shareholders to provide advisory approval of the compensation of our Named Executive Officers (which consist of our President and Chief Executive Officer, Chief Financial Officer, and our other three highest paid executive

officers

), as such compensation is disclosed in the Compensation Discussion and Analysis, compensation tables and narrative discussion set forth in this Proxy Statement. Our executive compensation programs are designed to enable us to attract, motivate and retain executive talent, who are critical to our success. Our compensation philosophy and framework have resulted in compensation for our Named Executive Officers that is tied to the Company’s financial results and the other performance factors described in the section of this Proxy Statement entitled Compensation Discussion and Analysis. These programs focus on rewarding the types of performance that increase shareholder value, link executive compensation to the Company’s long-term strategic objectives and align executive officers’ interests with those of our shareholders. The Company believes that its executive compensation programs, which emphasize long-term equity awards and variable compensation, satisfy these goals. A substantial portion of each executive’s total compensation is intended to be variable and delivered on a pay-for-performance basis.

Our Board of Directors believes that the information provided above and within the “Executive Compensation” section of this Proxy Statement demonstrates that our executive compensation program was designed appropriately and is working to ensure that management’s interests are aligned with our shareholders’ interests and support long-term value creation.

The Board of Directors recommend a vote “FOR” the adoption of the following non-binding resolution:

RESOLVED, that the shareholders of the Company approve, on an advisory basis, the compensation of the Company’s Named Executive Officers, as disclosed in the Compensation Discussion and Analysis, compensation tables and narrative discussion set forth in this Proxy Statement.

This say-on-pay vote is advisory, and therefore not binding on the Company, the Nominating, Compensation and Stock Option Committee or our Board of Directors.

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The Company operates within a comprehensive plan of corporate governance for the purpose of defining responsibilities, setting high standards of professional and personal conduct and assuring compliance with such responsibilities and standards. The Company regularly monitors developments in the area of corporate governance. These include corporate governance standards and disclosure requirements resulting from the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”). In addition, the NASDAQ Stock Market, LLC (“NASDAQ”) also has corporate governance and listing requirements. Our corporate governance policies are available on our website at

http://investor.hcsgcorp.com/corporate-governance

.

BOARD OF DIRECTORS. The business of the Company is managed under the direction of the Board. The Board meets on a regularly scheduled basis during the Company’s fiscal year to review significant developments affecting the Company and to act on matters requiring Board approval. It also holds special meetings when an important matter requires Board action between scheduled meetings and also acts by unanimous written consent when necessary and appropriate. The Board met

four

times during the fiscal year ended December 31,

2018

. During

2018

,

each member of the Board attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board held during 2018, and (ii) the total number of meetings held by each committee of the Board on which such member served during 2018.

Board Qualifications

We believe that the collective skills, experiences and qualifications of our directors provide

our Board with the expertise and experience necessary to advance the interests of our shareholders. While the Nominating, Compensation and Stock Option Committee of our Board has not established any specific, minimum qualifications that must be met by each of our directors, it uses a variety of criteria to evaluate the qualifications and skills necessary for each member of the Board. In addition

to the individual attributes of each of our current directors described below, we believe that our directors should have the highest professional and personal ethics and values, consistent with our longstanding values and standards. They should have broad experience in the industry the Company serves at the policy-making level in business, exhibit commitment to enhancing shareholder value and have sufficient time to carry out their duties and to provide insight and practical wisdom based on their past experience.

Messrs. Wahl and McBryan, and Mmes. Casey and Castagnino have extensive experience in the health

care services industry. Each of the aforementioned persons’ operational experience, in addition to Mr. Wahl’s financial expertise, enables them to provide guidance with respect to our operations. Also, we believe since Mmes. Casey and Castagnino have not been employees of the Company and have served their careers in patient care and advocacy, respectively, they bring a patient care perspective to the Company. For instance, Mmes. Casey and Castagnino may become aware of new developments related to the healthcare services industry before the Company’s management learns of such developments and their impact on patient-related issues. Additionally, Ms.

Castagnino

's experience with non-governmental and not-for profit institutions provides valuable insight into a customer segment that supports the Company's growth strategy.

Mr. Visconto has real estate experience as a Principal of American Property Holdings, with a specific focus on the acquisition, development and management of multi-family, senior housing and commercial assets. Mr. Visconto also has extensive experience with licensed operators, management companies and property owners, all of which align with our customer base.

Messrs. Frome and Moss have extensive legal experience. In addition, Mr. Frome has also served as a member of the board of directors of other public companies and has extensive corporate finance, Securities and Exchange Commission (“SEC”) compliance and mergers and acquisitions experience, which experience aids his service to the Board. Both Mr. Frome and Mr. Moss also have extensive executive experience as they both served as managing partners of their respective firms.

Mr. Briggs’ years of experience as a certified public accountant provide him with extensive financial and accounting expertise obtained from over thirty years in public accounting. Mr. Briggs qualifies as an audit committee financial expert under SEC guidelines. Mr. Briggs also brings executive experience to the Board as he served as a partner at his accounting firm.

Mr. Ottaviano, through his experience as a top-level marketing and operations executive for many years for two different companies, one of which was a public company, has a comprehensive understanding of business operations, including business development, as well as the compliance obligations of public companies.

Mr. McFadden has sales and marketing experience both as a Principal of his consulting company and through his experience at The McGraw Hill Companies that provide him with an understanding of a large public company’s operations, as well as the compliance obligations of a public company.

8

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors, Executive Officers and Corporate Governance

|

Board Leadership

Jude Visconto was appointed Chairman of the Board of Directors

in

May

, 2017 and has served as an independent director since May 2015. The Board believes that Mr. Visconto’s financial background and management experience are qualifications for the role of Chairman of the Board. In addition, Mr. Visconto’s more recent business experience is expected to bring additional perspective to the Board as the Company continues its growth and evolution.

If Mr. Visconto is re-elected to the Board, it is the intention of the Board that he continue to serve as Chairman of the Board. As Chairman of the Board, Mr. Visconto’s duties

include: (i) approving agendas, schedules and supporting information provided to the Board; (ii) ensuring the Board has full, timely and relevant information to support its decision-making requirements; (iii) performing the duties of the Chairman at Board meetings; (iv) consulting on the effectiveness of Board committees; (v) at his sole discretion, when necessary and appropriate, calling meetings of the Board’s non-employee directors; (vi) consulting as to the timeliness of the flow of information from the Company that is necessary for the directors to effectively perform their duties; (vii) serving as principal liaison between the non-employee, independent directors and the President and Chief Executive Officer; (viii) if requested by shareholders, being available for consultation and direct communication; and (ix) other duties requested by the Board. In addition, Mr. Visconto presides at executive sessions of the Board without the presence of management. We believe that including an independent chairman in our Board structure enhances the effectiveness of our Board. This structure strengthens our corporate governance by promoting active engagement, objectivity, independence and oversight of management.

The independent directors of the Board have also unanimously re-appointed John M. Briggs as the lead independent director. In the absence of the Chairman, the lead independent director will assume the responsibilities of the Chairman.

Our Board conducts an annual evaluation in order to determine whether it and its committees are functioning effectively. As part of this annual self-evaluation, the Board evaluates whether the current leadership structure continues to be optimal for the Company and our shareholders.

Board Committees

The Board has established an Audit Committee and a Nominating, Compensation and Stock Option Committee to devote attention to specific subjects and to assist in the discharge of its responsibilities. The functions of those committees, their current members and the number of meetings held during

2018

with respect to the Audit Committee and the Nominating, Compensation and Stock Option Committee are described below:

AUDIT COMMITTEE.

The Audit Committee’s primary responsibilities, as described in the Amended and Restated Audit Committee Charter (a copy of which is available on the Company’s website, www.hcsg.com) include:

a.

appointment, compensation and oversight of the Company’s Independent

Registered Public Accounting Firm

, who report directly to the Audit Committee, including (i) prior review of the

Independent Registered Public Accounting Firm

’ plan for the annual audit, (ii) pre-approval of both audit and non-audit services to be provided by the

Independent Registered Public Accounting Firm

and (iii) annual assessment of the qualifications, performance and independence of the

Independent Registered Public Accounting Firm

;

b.

overseeing and monitoring the Company’s accounting and financial reporting processes and internal control system, audits of the Company’s financial statements and the quality and integrity of the financial reports and other financial information issued by the Company;

c.

providing an open avenue of communication among the

Independent Registered Public Accounting Firm

and financial and other senior management and the Board;

d.

reviewing with management and, where applicable, the

Independent Registered Public Accounting Firm

, prior to release, required annual, quarterly and interim filings by the Company with the SEC and the type and presentation of information to be included in earnings press releases;

9

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors, Executive Officers and Corporate Governance

|

e.

reviewing material issues, and any analysis by management or the

Independent Registered Public Accounting Firm

, concerning accounting principles, financial statement presentation, certain risk management issues, such as the adequacy of the Company’s internal controls and significant financial reporting issues and judgments and the effect of regulatory and accounting initiatives on the Company’s financial statements;

f.

reviewing with the Company’s legal counsel any legal matters that could have a significant effect on the Company’s financial statements, compliance with applicable laws and regulations and inquiries from regulators or other governmental agencies;

g.

reviewing and approving all related party transactions between the Company and any director, executive officer, other employee or family member;

h.

reviewing and overseeing compliance with the Company’s Code of Ethics and Business Conduct;

i.

establishing procedures regarding the receipt, retention and treatment of, and the anonymous submission by employees of the Company of, complaints regarding the Company’s accounting, internal controls or auditing matters; and

j.

reporting Audit Committee activities to the full Board and issuing annual reports to be included in the Company’s

P

roxy

S

tatement.

Each of Messrs. Moss, Ottaviano and Briggs is an independent director as such term is defined by Rule 5605(a)(2) of the NASDAQ listing standards and Rule 10A-3 of the Exchange Act.

Mr. Briggs has been designated

an

“audit committee financial expert” and he satisfies the attributes required of audit committee financial experts pursuant to Section 407 of Sarbanes-Oxley.

The Audit Committee me

t

five

times during fiscal year

2018

. The report of the Audit Committee for the fiscal year ended December 31,

2018

is included herein under “Audit Committee Report” below.

NOMINATING, COMPENSATION AND STOCK OPTION COMMITTEE.

The Nominating, Compensation and Stock Option Committee (currently composed of Ms. Casey and Mr. McFadden) assists the Board by:

a.

developing and recommending to the Board a set of effective corporate governance policies and procedures applicable to the Company;

b.

identifying, reviewing and evaluating individuals qualified to become Board members and recommending that the Board select director nominees for each annual meeting of the Company’s shareholders;

c.

discharging the Board’s responsibilities relating to the compensation of Company executives; and

d.

administering the Company’s stock option plan and other equity-based compensation plans.

Each of Ms. Casey and Mr. McFadden are independent directors as such term is defined by Rule 5605(a)(2) of the NASDAQ listing standards. The Nominating, Compensation and Stock Option Committee met once during fiscal year

2018

and also acts by unanimous written consent when necessary and appropriate.

The Nominating, Compensation and Stock Option Committee has not adopted a policy or process by which shareholders may make recommendations to the Nominating, Compensation and Stock Option Committee of candidates to be considered by this Nominating, Compensation and Stock Option Committee for nomination for election as Directors. The Nominating, Compensation and Stock Option Committee has determined that it is not appropriate to have such a policy because such recommendations may be informally submitted to and considered by the Nominating, Compensation and Stock Option Committee under its Charter. Shareholders may make such recommendations by giving written notice to Healthcare Services Group, Inc., 3220 Tillman Drive, Suite 300, Bensalem, PA 19020, Attention: Corporate Secretary either by personal delivery or by United States mail, postage prepaid. The Charter of the Nominating, Compensation and Stock Option Committee is provided on the Company’s website, www.hcsg.com. The Nominating, Compensation and Stock Option Committee has not established a formal process for identifying and evaluating nominees for Director, although generally the Nominating, Compensation and Stock Option Committee may use multiple sources for identifying and evaluating nominees for Director, including referrals from current Directors and shareholders. The Nominating, Compensation and Stock Option Committee has identified certain qualifications it believes an individual should possess before it recommends such person as a nominee for election to the Board of Directors.

10

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors, Executive Officers and Corporate Governance

|

The Nominating, Compensation and Stock Option Committee believes that nominees for Director should possess the highest personal and professional ethics, integrity, values and judgment and be committed to representing the long-term interests of the Company’s shareholders. The Nominating, Compensation and Stock Option Committee does not have a formal policy with respect to considering diversity in identifying nominees for directors. The Nominating, Compensation and Stock Option Committee believes that racial and gender diversity are important factors in assessing potential board members, but not at the expense of particular qualifications and experience required to meet the needs of the Board. Furthermore, as part of the Nominating, Compensation and Stock Option Committee’s review of board composition, the board considers diversity of experience and background in an effort to ensure that the composition of directors ensures a strong and effective board. The Nominating, Compensation and Stock Option Committee seeks to ensure that the composition of the Board at all times adheres to the independence requirements of the NASDAQ

listing standards

and reflects a range of talents, skills, and expertise, particularly in the areas of management, leadership, and experience in the Company’s and related industries, sufficient to provide sound and prudent guidance with respect to the operations and interests of the Company.

The report of the

Nominating, Compensation and Stock Option Committee

regarding executive com

pensation

for the fiscal year ended December 31,

2018

is included herein und

er “

Nominating, Compensation and Stock Option Committee Report

” below.

Code of Ethics and Business Conduct

We have also adopted a Code of Ethics and Business Conduct for directors, officers and employees of the Company. It is intended to promote honest and ethical conduct, full and accurate reporting and compliance with laws as well as other matters. A copy of the Code of Ethics and Business Conduct is posted on our website at www.hcsg.com.

Board Role in Risk Oversight

Our Board is responsible for overseeing the Company’s risk management process. The Board focuses on the Company’s general risk management strategy, including the most significant risks facing the Company, and ensures that appropriate risk mitigation strategies are implemented by management. The Board is also apprised of particular risk management matters in connection with its general oversight and approval of corporate matters.

The Board has delegated to the Audit Committee oversight of certain aspects of the Company’s risk management process. Among its duties, the Audit C

ommittee oversees the Company’s compliance with legal and regulatory requirements and the Company’s system of disclosure controls and system of internal financial, accounting and legal compliance controls. The Board receives a quarterly update from the Audit Committee, which includes a review of items addressed during prior quarters. Our other Board committee

also consider

s

and address

es

risk as

it

perform

s

its

committee responsibilities. All committees report to the full Board as appropriate, including when a matter rises to the level of a material risk.

The Company’s management is responsible for day-to-day risk management under the direction of Jason J. Bundick, the Company’s

Executive Vice P

resident

,

Chief Compliance Officer, General Counsel and Secretary

. Our internal audit department serves as the primary monitoring and testing function for Company-wide policies and procedures, and manages the day-to-day oversight of the risk management strategy for the ongoing business of the Company. This oversight includes identifying, evaluating, and addressing potential risks that may exist at the enterprise, strategic, financial, operational,

compliance and reporting levels. The Company conducts an annual review of the Company’s disclosure controls and procedures, code of ethics and billing and sales compliance. To the extent deemed necessary, the Company revises such procedures and policies.

The Company also assesses environmental, social and governance risks and opportunities.

We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing the Company and that our Board leadership structure supports this approach.

11

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors, Executive Officers and Corporate Governance

|

Directors’ Compensation

Directors who are also our employees are not separately compensated for their service as directors. Our non-employee directors received the following aggregate amounts of compensation for the year ended

December 31, 2018

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Fees Earned or Paid in Cash

|

|

Option Awards

1

,

2

|

|

Total

|

|

John

M.

Briggs

3

|

|

$

|

50,000

|

|

$

|

52,410

|

|

$

|

102,410

|

|

Robert L. Frome

4

|

|

$

|

4,000

|

|

$

|

52,410

|

|

$

|

56,410

|

|

Robert J. Moss

5

|

|

$

|

9,000

|

|

$

|

52,410

|

|

$

|

61,410

|

|

Dino D. Ottaviano

6

|

|

$

|

9,000

|

|

$

|

52,410

|

|

$

|

61,410

|

|

Diane S. Casey

7

|

|

$

|

5,000

|

|

$

|

52,410

|

|

$

|

57,410

|

|

John J. McFadden

8

|

|

$

|

5,000

|

|

$

|

52,410

|

|

$

|

57,410

|

|

Jude Visconto

9

|

|

$

|

44,000

|

|

$

|

52,410

|

|

$

|

96,410

|

|

Daniel

a Castagnin

o

10

|

|

$

|

2,000

|

|

—

|

|

2,000

|

1.

The amounts in this column do not reflect compensation actually received by the Director, nor do they reflect the actual value that will be recognized by the Director. Instead, the amounts represent the expense to be recognized for financial statement reporting purposes with respect to the grant date fair value of the

2018

option awards made to each Director. In accordance with FASB ASC Topic 718, the fair value of the options was estimated using the Black-Scholes option valuation model.

2.

All option awards granted in

2018

become vested and exercisable ratably over a five year period on each yearly anniversary date of the grant.

3.

Mr. Briggs had vested options to purchase

23,782

shares of Common Stock outstanding as of

December 31, 2018

.

4.

Mr. Frome had vested options to purchase

32,510

shares of Common Stock outstanding as of

December 31, 2018

.

5.

Mr. Moss had vested options to purchase

8,004

shares of Common Stock outstanding as of

December 31, 2018

.

6.

Mr. Ottaviano had vested options to purchase

15,957

shares of Common Stock as of

December 31, 2018

.

7.

Ms. Casey

had

vested options to purchase

5,001

shares of Common Stock as of

December 31, 2018

.

8.

Mr. McFadden had vested options to purchase

15,006

shares of Common Stock as of

December 31, 2018

.

9.

Mr. Visconto had vested options to purchase

3,002

shares of Common Stock as of

December 31, 2018

.

10.

Ms. Castagnino

had no

vested options as of

December 31, 2018

.

Directors’ Fees

The Company pays each

non-employee director

$1,000 for each regular or committee meeting of the Board

attended. In addition, Messrs. Visconto and Briggs receive a quarterly retainer of $10,000 with respect to Mr. Visconto’s services as Chairman of the Board of Directors and Mr. Briggs’s services as Chairman of the Audit Committee and as

a

n

a

udit

c

ommittee

f

inancial

e

xpert. In addition, as indicated above under Directors’ Compensation, Directors also receive option awards.

Procedures for Contacting Directors

The Board has established a process for shareholders to send communications to the Board. Shareholders may communicate with the Board generally or

to

a specific director at any time by writing to: Healthcare Services Group, Inc., 3220 Tillman Drive, Suite 300, Bensalem, PA 19020, Attention: Corporate Secretary. The Company reviews all messages received, and forwards any message that reasonably appears to be a communication from a shareholder about a matter of shareholder interest that is intended for communication to the Board

. Communications are sent as soon as practicable to the director to whom they are addressed, or if addressed to the Board generally, to the chairman of the Nominating, Compensation and Stock Option Committee. Because other appropriate avenues of communication exist for matters that are not of shareholder interest, such as general business complaints or employee grievances, communications that do not relate to matters of shareholder interest are not forwarded to the Board.

12

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors, Executive Officers and Corporate Governance

|

Non Director Executive Officers

Our non-director

executive officers for the

2018

fiscal year are listed below. For biographical information relating to Messrs. Wahl and McBryan, please refer to the Company’s Board nominees under Proposal 1 and the Board Qualifications section of this Proxy Statement.

|

|

|

|

|

Name, Age and Principal Occupations

|

|

John C. Shea, MBA, CPA, 47, Executive Vice President and Chief Financial Officer since April 2012. Mr. Shea had previously served as Secretary, Vice President of Finance & Chief Accounting Officer. Mr. Shea joined the Company in 2009 as the Director of Regulatory Reporting. Prior to joining the Company, Mr. Shea was a Senior Manager with Ernst & Young’s Transaction Advisory Services.

|

|

Jason J. Bundick, Esq., 42, Executive Vice President, Chief Compliance Officer, General Counsel & Secretary since December 2013. Mr. Bundick joined the Company in 2012 as Corporate Counsel. Prior to joining the Company, Mr. Bundick was an attorney with the law firm of Drinker Biddle & Reath LLP for more than five years.

|

|

David Hurlock, 44, Executive Vice President and Chief Operating Officer since July 2017. Mr. Hurlock had previously served as Senior Vice President of Operations since January 2013. Mr. Hurlock joined the Company in 1997.

|

|

Andrew W. Kush, 41, Executive Vice President and Chief Administrative Officer since June 2017. Mr. Kush had previously served as Senior Vice President of Human Resources & Risk Management since January 2013. Mr. Kush joined the Company in 2010 as the Vice President of Human Resources. Prior to joining the Company, Mr. Kush was a Vice President of Risk Management with PNC Financial Services Group, Inc.

|

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s Directors, executive officers and 10% shareholders to file with the SEC and NASDAQ initial reports of ownership and reports of changes in ownership of the Company’s Common Stock. Directors and executive officers are required to furnish the Company with copies of all Section 16(a) reports which they file.

To the Company’s knowledge, based solely on review of the copies of these reports furnished to the Company and written representations that no other reports were required, during

2018

all Section 16(a) filing requirements applicable to its directors and executive officers were complied with, other than a filing by

Mr. Wahl

which was

two

day

s

late.

Sarbanes-Oxley Act Compliance

Sarbanes-Oxley sets forth various requirements for public companies and directs the SEC to adopt additional rules and regulations.

Currently, the Company believes it is in compliance with all applicable laws, rules and regulations arising from Sarbanes-Oxley. The Company intends to comply with any additional rules and regulations adopted by the SEC pursuant to Sarbanes-Oxley no later than the time they become applicable to the Company.

13

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors, Executive Officers and Corporate Governance

|

Audit Committee Report

The members of the Audit Committee from January 1,

2018

to December 31,

2018

were Messrs.

Briggs,

Moss and

Ottaviano. The Audit Committee met

five

times during the fiscal year ended December 31,

2018

. The Audit Committee is responsible for the appointment of the Independent Auditors for each fiscal year, recommending the discharge of the Independent Auditors to the Board and confirming the independence of the Independent Auditors. It is also responsible for: reviewing and approving the scope of the planned audit, the results of the audit and the Independent Auditors’ compensation for performing such audit; reviewing the Company’s audited financial statements; and reviewing and approving the Company’s internal accounting controls and disclosure procedures, and discussing such controls and procedures with the Independent Auditors.

A copy of the Company's

Amended and Restated Audit Committee Charter

is available on the Company’s website at www.hcsg.com.

The Company’s

Independent Registered Public Accounting Firm

are responsible for auditing the financial statements, as well as auditing the Company’s internal controls over financial reporting. The activities of the Audit Committee are in no way designed to supersede or alter those traditional responsibilities. The Audit Committee’s role does not provide any special assurances with regard to the Company’s financial statements, nor does it involve a professional evaluation of the quality of the audits performed by the Independent Auditors.

In connection with the audit of the Company’s financial statements for the year ended December 31,

2018

, the Audit Committee met with representatives from Grant Thornton LLP, the Company’s Independent Auditors, and the Company’s internal auditor. The Audit Committee reviewed and discussed with Grant Thornton LLP and the Company’s internal auditor, the Company’s financial management and financial structure, as well as the matters relating to the audit required by the Public Company Accounting Oversight Board Auditing Standard.

The Audit Committee and Grant Thornton LLP also discussed Grant Thornton LLP’s independence. In November

2018

, the Audit Committee received from Grant Thornton LLP the written disclosures and the letter regarding Grant Thornton LLP’s independence required by Public Company Accounting Oversight Board Rule 3526.

In addition, the Audit Committee reviewed and discussed with management the Company’s audited financial statements for the fiscal year ended December 31,

2018

, as well as management’s assessment of internal controls over financial reporting.

Based upon the review and discussions described above, the Audit Committee recommended to the Board of Directors, and the Board of Directors approved, that the Company’s financial statements audited by Grant Thornton LLP, as well as the audit of the Company’s internal controls over financial reporting be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31,

2018

.

AUDIT COMMITTEE

John M. Briggs, Chairman

Robert J. Moss

Dino D. Ottaviano

Nominating, Compensation and Stock Option Committee Report

The compensation of the President and Chief Executive Officer of the Company is determined by the Nominating, Compensation and Stock Option Committee. Such Committee’s determinations regarding such compensation are based on a number of factors including, in order of importance:

•

Consideration of the operating and financial performance of the Company, primarily its income before income taxes

.

;

•

Attainment of a level of compensation designed to retain a superior executive in a highly competitive environment; and

•

Consideration of the individual’s overall contribution to the Company.

In consultation with the President and Chief Executive Officer of the Company, the Nominating, Compensation and Stock Option Committee develops guidelines and reviews the compensation and performance of the other executive officers of the Company

, and sets the compensation of the executive officers of the Company

and/or any management fees

paid by the Company

for executives services

when needed

. In addition, the Nominating, Compensation and Stock Option Committee makes recommendations to the Board

with respect to incentive-compensation plans and equity-based plans, and establishes criteria for the granting of options in accordance with such criteria; and administers such plans. The Nominating, Compensation and Stock Option Committee reviews major organizational and staffing matters. In consultation with the President and Chief Executive Officer of the Company, the Nominating, Compensation and Stock Option Committee oversees the development and growth of executive management personnel. With respect to director compensation, the Nominating, Compensation and Stock Option Committee designs a director compensation package of a reasonable total value based on comparisons with similar firms and aligned with long-term shareholder interests. Finally, the Nominating, Compensation and Stock Option Committee reviews director compensation levels and practices, and may recommend, from time to time, changes in such compensation levels and practices to the Board

, with equity ownership in the Company encouraged. The Nominating, Compensation and Stock Option Committee’s charter provides that the Nominating, Compensation and Stock Option Committee shall have the authority to obtain advice and seek assistance from internal and external legal, accounting and other advisors.

The Nominating, Compensation and Stock Option Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this

P

roxy

S

tatement.

NOMINATING, COMPENSATION AND STOCK OPTION COMMITTEE

Diane S. Casey, Chair

w

o

man

John J. McFadden

15

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominating, Compensation and Stock Option Committee Report

|

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

We refer to our President and Chief Exec

utive Officer, the Chief Financial Officer and each of our other three most highly compensated executive officers as our Named Executive Officers (“NEOs”)

.

In 2018 our NEOs were as follows:

|

|

|

|

|

|

|

|

|

|

|

Named Executive Officer

|

|

Role

|

|

Theodore Wahl

|

|

President & Chief Executive Officer & Director

|

|

John C. Shea

|

|

Executive Vice President & Chief Financial Officer

|

|

Michael E. McBryan

|

|

Executive Vice President & Chief Revenue Officer & Director

|

|

David Hurlock

|

|

Executive Vice President & Chief Operating Officer

|

|

Andrew W. Kush

|

|

Executive Vice President & Chief Administrative Officer

|

Compensation Objectives

NEO

compensation

is

based on

a combination of company and individual contributions to our

performance

, alo

ng with each NEO

's

level

and scope

of responsibility. Our Nominating, Compensation and Stock Option Committee (“NCSO Committee”) believes that the compensation paid is consistent with

our

overarching

principle that compensation plans of senior operational officers should be closely aligned with our performance on both a short-term and long-term basis to create value for shareholders, and that such compensation should assist us in attracting and retaining key executives critical to our long-term success.

In establishing compensation for executive officers, the following are the objectives of the Company and the NCSO Committee:

•

Attract and retain individuals of superior ability and managerial talent;

•

Aim to

e

nsure officer compensation is aligned with our corporate strategies, business objectives and the long-term interests of our shareholders; and

•

Enhance the officers’ incentive to maximize shareholder value, as well as promote retention of key personnel, by providing a portion of total compensation for management in the form of direct ownership in the Company through stock options and other stock-based compensation plans.

To support these objectives, the Company’s executive compensation program

ha

s

the following characteristics:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

What we do:

|

|

|

What we don’t do:

|

|

|

þ

|

Significant share ownership requirements for senior executives

|

|

o

|

No employment agreements containing special severance payments such as golden parachutes

|

|

þ

|

Double-trigger requirements for vesting of time-based awards on a change in control

|

|

o

|

No hedging or engaging in derivative transactions related to Company shares

|

|

þ

|

A cap on the annual incentive payout for the Chief Executive Officer

|

|

o

|

No gross-up payments to cover income taxes related to executive compensation

|

|

þ

|

Majority of NEO compensation is “at-risk”

|

|

o

|

No repricing or backdating of stock options

|

|

þ

|

Operate a clawback policy that applies to “at-risk” variable compensation (new for 2019)

|

|

o

|

No retirement programs that are specific to executive officers

|

|

þ

|

Balance "at risk" compensation across short-term and long-term time horizons

|

|

|

|

|

þ

|

Company engages an independent compensation consultant

|

|

|

|

Compensation

Oversight

Among its d

uties, the NCSO is accountable for discharging the Board’s responsibilities relating to the compensation of Company executives. Accordingly,

t

he NCSO Committee conducts an annual review of the aggregate level of our executive compensation, as well as the mix of elements used to compensate our executive officers.

To achieve these objectives, our overall compensation program aims to pay our NEOs competitively, consistent with our success and their contribution to that success. To accomplish this we rely on programs that provide compensation in the form of

both cash and equity. Although our NCSO Committee has not adopted any formal guidelines for allocating total compensation between cash and equity, the NCSO Committee considers the balance between providing short-term and long-term incentives which are designed to help align the interests of management with the interests of shareholders.

Determination of Compensation Awards

The compensation of the President and Chief Executive Officer of the Company is determined by the NCSO Committee. Such determinations regarding compensation are based on a number of factors including, in order of importance:

•

Consideration of the operating and financial performance of the Company, primarily its income before income taxes

;

•

Attainment of a level of compensation designed to retain a superior executive in a highly competitive environment; and

•

Consideration of the individual’s overall contribution to the Company.

The NCSO Com

mittee has

also

historically

taken into account input from other independent members of our Board

in

determining the compensation of the President and Chief Executive Officer

.

Compensation for the

other

NEOs

is

recommended

by the President and Chief Executive Officer

and reviewed by

the NCSO Committee, taking into account the same factors

described above.

The Company engages an independent compensation consultant who provides advice as requested in areas such as peer group composition, market benchmarking and executive compensation policy design.

Beyond the NEOs

t

he Company applies a consistent approach to compensation for all employees, including senior management. This approach is based on the belief that the achievements of the Company result from the coordinated efforts of all employees working toward common objectives.

Review of Compensation

In conducting the annual review of compensation, publicly available data relating to the compensation practices and policies of other companies within and outside our industry is collected to the extent it is available. The NCSO Committee believes that gathering information about the compensation practices of other companies is an important part of our compensation-related decision-making process.

Given the challenge that there are no other U.S. publicly-traded companies specifically engaged in the Company’s business, which provides housekeeping and food services solely to the healthcare industry and primarily to the long-term care segment of the industry, our comparator group has been developed looking at a broader cross-section of service industry companies.

T

he

following companies have been

selected

as reasonable comparators for talent as they

operate

in similar industries

, are of

similar size and scope, and/or have similar employee bases. That

group consists of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

l

|

ABM Industries Incorporated

|

l

|

J&J Snack Foods Corp.

|

|

l

|

Amedisys, Inc.

|

l

|

ServiceMaster Global Holdings, Inc.

|

|

l

|

AMN Healthcare Services, Inc.

|

l

|

Snyder’s-Lance, Inc.

|

|

l

|

Chemed Corporation

|

l

|

The Brink’s Company

|

|

l

|

Clean Harbors, Inc.

|

l

|

The Providence Service Corporation

|

|

l

|

CoreCivic, Inc.

|

l

|

UniFirst Corporation

|

Based on t

he Company’s size relative to the peer group

(

58

th

percentile

for both

revenue

and

market cap)

,

the NCSO Committee referenced a range around the peer group 50

th

percentile when reviewing total compensation levels for the

President and

Chief Executive Officer.

Given the challenges noted above in identifying directly comp

arable

c

ompanies

, if and when collected, market data is just one factor that the NCSO Committee considers in reachin

g decisions.

Such other factors considered include

individual performance, the trends in Company performance relative to broader market indices, the industry in which we operate, tax implications, and achievements in the Company’s social and sustainability efforts

.

Shareholder Views

During the course of 2017

,

2018

and 2019,

the NCSO Committee made a number of changes to the Company’s executive compensation programs in response to feedback. These conclusions, and where applicable resulting changes, of the review, are summarized below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation Program Review

|

Highlights

|

|

Rationale

|

|

|

Formalization of annual incentive program

(

Effective FY 2017

)

|

s

|

Primary performance metric of income before income taxes for President and CEO, and the other NEOs

|

s

|

Desire to increase transparency and demonstrate objectivity in determining annual incentive payments

|

|

|

|

|

|

|

|

|

s

|

Additional quantifiable operational performance metrics used to validate outcomes for other NEOs

|

s

|

Feedback suggested consideration of annual incentive arrangements that were not wholly discretionary

|

|

|

|

|

|

|

|

|

s

|

Individual opportunities defined as percentage of the Company’s income before income taxes

|

s

|

Income before income taxes is an important financial metric to the Company and our shareholders

|

|

|

|

|

|

|

|

|

s

|

Maximum payment for the President and CEO of two-times salary

|

|

|

|

|

|

|

s

|

The ability for the

President and

CEO to take bonus in the form of stock, reinforces our ownership culture as we transition away from a founder

President and

CEO

|

|

|

s

|

President and CEO can elect to receive part of the annual incentive in stock

|

|

|

|

|

|

|

|

|

|

Assessment of Long-Term Equity Award Approach

(

Under ongoing review and discussion

)

|

s

|

The NCSO Committee believes that the use of stock options continues to provide direct alignment to sustainable shareholder value creation, aligning our NEOs’ interests with those of our shareholders, reinforced by the use of restricted stock units which also helps retain our successful leadership team

|

s

|

In light of feedback, the NCSO Committee has reviewed the current practice of awarding long-term equity as a mix of stock options and restricted stock units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

s

|

Given the Company currently does not provide guidance or set targets externally, the NCSO Committee determined the current approach remains optimal

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

s

|

Furthermore, the NCSO Committee believes a five-year vesting period for all awards further enhances the focus on long-term sustainable performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Ownership Guidelines

(

Effective FY2018

)

|

s

|

Adopted share ownership guidelines and a retention requirement for executive officers with effect from January 1, 2018

|

s

|

Due to a pre-existing ‘ownership culture’, which meant there were significant levels of stock ownership among the leadership team, the NCSO Committee had not historically seen the need to adopt formal guidelines

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

s

|

President and

CEO required to hold stock worth six-times base salary

|

|

|

|

|

|

|

|

|

|

|

|

|

s

|

However, to be responsive to shareholder feedback the NCSO has formalized a guideline from 2018

|

|

|

s

|

Other NEOs required to hold stock worth two-times base salary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

s

|

Retention requirements apply if guideline not achieved within five years

|

s

|

All NEOs already exceed their respective stock ownership guideline

|

|

|

|

|

|

|

|

Adoption of double trigger requirements on a change in control

(Effective FY2018)

|

s

|

On a change in control, stock awards will now be subject to double trigger requirements

|

s

|

Review of market practices, investor guidelines and shareholder feedback indicated a shift to double-trigger would be appropriate

|

|

Adoption of a clawback policy

(Effective FY2019)

|

s

|

“At-risk” compensation (performance-based compensation and equity awards) will now be subject to clawback at the discretion of the NCSO Committee

|

s

|

Review of market practices, investor guidelines and shareholder feedback indicated the adoption of a clawback policy would be appropriate

|

|

|

|

|

|

|

|

|

s

|

A clawback could be affected in the event of a restatement of Company financial statements

|

s

|

Desire to provide greater risk mitigation power to the Board of Directors

|

|

|

|

|

|

|

The NCSO Committee was pleased to see that the overwhelming majority of votes cast at the 2018 Annual Meeting of Shareholders approved, on an advisory basis, the compensation of the Company’s NEOs (“say-on-pay”). The NCSO Committee considered that support in its efforts to align the Company’s executive compensation policies with long-term shareholder interests.

Since the Annual Meeting of Shareholders the Committee has continued to keep under review our ability to set meaningful long-term performance targets, and accordingly our ability to use long-term performance-based equity.

T

he Committee remains of the view that stock options and restricted stock

units

best achieve our compensation objectives and successfully align pay with performance.

This is evidenced through the fact that over the last three years (the tenure of our cur

rent CEO) the outcome under the annual incentive plan and value of equity awarded has generally trended in line with performance.

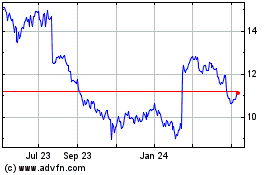

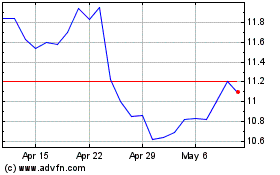

The chart below shows the value of equity granted to the CEO in each of 2016, 2017, and 2018 versus the change in Total Shareholder Return and Operating Income (indexed to 100%) over the period. When the value of equity is calculated as of the vesting date or as of April 1, 2019, there is a stronger correlation with performance than when Summary Compensation (grant date fair value) totals are used.

This demonstrates the alignment of pay and performance as the value of long-term awards decreases as the stock price does.

Note:

Equity data collected from applicable proxy filings. Financial data are sourced from the S&P Capital IQ financial database. “SCT” values represent the grant-date fair value of the awards as disclosed in the applicable proxy filing. “Value at vesting” reflects the intrinsic value

for award tranches that have vested as of 12/31/2018 using the close price for the estimated day of vesting; for award tranches that are unvested as of 12/31/2018, the closing stock price as of

04/01/2019

is used.

“Value (4/1/2019)” reflects the intrinsic value of the entire award using the closing stock price as of

04/01/

2019.

This analysis reinforces the Committee’s view that pay and performance remain suitably aligned despite the absence of a long-term plan with formal performance requirements beyond share price appreciation which is an implicit requirement under the stock option plan. The Committee will continue to keep this position and the alignment of pay and performance under review.

Elements of Compensation

Base Salary

.