The Hackett Group, Inc. (NASDAQ:HCKT), a global strategic advisory

firm, today announced its financial results for the second quarter,

which ended June 27, 2008. Second quarter 2008 total revenue was

$49.1 million, an 8% increase from the second quarter of 2007,

driven by a 23% growth in The Hackett Group (excluding Technology

Solutions). Pro forma diluted earnings per share were $0.08 in the

second quarter of 2008, as compared to $0.04 in the second quarter

of 2007. Pro forma information is provided to enhance the

understanding of the Company�s financial performance and is

reconciled to the Company�s GAAP information in the accompanying

tables. GAAP diluted earnings per share were $0.10 in the second

quarter of 2008, as compared to $0.03 in the second quarter of

2007. At the end of the second quarter of 2008, the Company�s cash

balances were $20.3 million, including marketable investments and

restricted cash. During the second quarter, the Company repurchased

675 thousand shares of its common stock at an average price of

$4.39, for a total cost of approximately $3.0 million. Subsequent

to the end of the quarter, the Board of Directors authorized a $5.0

million increase to the share buyback program, which brings the

current remaining authorization in the share buyback program to

approximately $11.1 million. �We are pleased to see our operating

results continue to significantly improve, especially given the

weakening macro-economic backdrop,� stated Ted A. Fernandez,

Chairman & CEO of The Hackett Group, Inc. �Our unique ability

to help clients quickly address ever increasing organizational

effectiveness concerns is core to our success.� Based on the

current economic outlook, the Company estimates total revenue for

the third quarter of 2008 to be in the range of $49.0 million to

$51.0 million and estimates pro forma diluted earnings per share to

be in the range of $0.08 to $0.10. Other Highlights Hackett�s 18th

Annual Best Practices Conference � Nearly 500 senior-level

executives from the world�s largest companies attended Hackett�s

18th Annual Best Practices Conference, �20/20 Vision: Are You on

the Right Path to World-Class?� in Atlanta in May. At the

conference, Hackett previewed findings from its Book of NumbersTM

research series, which quantifies spending, staffing, economic

return, and other key efficiency and effectiveness metrics of

world-class performance in finance, IT, HR, procurement, and other

Selling, General, & Administrative (SG&A) areas. The event

also featured presentations by senior executives from more than 20

of the world�s most successful companies, including Alcoa,

Caterpillar, Corning, Dow Chemical, Hewlett-Packard, and Phillips.

Recession Survival Guide Research � According to The Hackett Group,

typical Global 1000 companies (with $23.4 billion in annual

revenue) can generate $200-$400 million per year in savings through

targeted General & Administrative (G&A) cuts, an amount

that represents up to 45% of the potential decline in pre-tax

profit due to a recession. As the recession looms, many companies

are reacting by mandating across the board cuts in key G&A

areas such as IT, finance, HR, and procurement. But new research

from The Hackett Group offers an alternative approach � targeted,

strategic reductions that can offset up to almost half of the

profitability impact of a potential recession while minimally

affecting service delivery and the ability to provide strategic

value. REL/CFO Europe Research Tracks Working Capital Performance �

REL, a division of The Hackett Group, Inc. and CFO Europe Magazine

released findings from their 10th annual joint study tracking

working capital performance of Europe�s largest public companies.

The research showed the impact of the global credit turmoil in

Europe, with DWC (Days of Working Capital) for the 1,000 largest

publicly-traded European companies deteriorating year-over-year to

47.3 days from 46.8 days. An overall improvement in DPO (Days

Payables Outstanding) was offset by a slight deterioration in DSO

(Days Sales Outstanding) and a significant increase in DIO (Days

Inventory On-Hand). Alcoa Recognized for World-Class Finance and IT

Performance � The Hackett Group recognized Alcoa, Inc. as a

world-class performer in finance and IT. Alcoa received its

World-Class Awards at Hackett�s 18th Annual Best Practices

Conference. The awards recognize Alcoa�s status as a company

demonstrating top quartile efficiency and effectiveness in these

two key SG&A functions, based on metrics captured during

Hackett benchmarks. Representative Client Engagements SG&A

Transformation for International Mining Group � This client

selected The Hackett Group to support the design and implementation

of a new service delivery model for finance, HR, procurement, and

select IT operations. The new global services business unit, which

Hackett is helping to create, will be designed to further improve

efficiency, will handle back-office functions using an integrated

mix of captive shared service centers, outsourcing, and some

limited decentralization of business functions. This new contract

comes on the heels of a long-time relationship with The Hackett

Group that has included benchmarking, advisory services, and

transformation support. Finance Transformation Engagement for

Engineered Rubber Products Manufacturer � This company engaged The

Hackett Group to assist in overall finance transformation and

design and implement a U.S. Finance Shared Services Center. The

Hackett Group has already completed a baseline of their finance

function and based on the performance gaps, the company decided to

move forward with a shared services strategy with the goals of

improving service levels and reducing cost. Customer-to-Cash

Transformation for Global Oil and Gas Development Equipment and

Services Provider � This client selected REL to assist in

transformation of customer-to-cash, order processing, and invoicing

functions. The company has grown by acquisition and seen dramatic

increases in revenue over the past few years. In addition, an

extensive array of product and service offerings has led to complex

invoicing, driving payment errors. As a result, DSO has increased.

REL will help the client standardize its practices in these areas

in an effort to reduce DSO. Supply Chain Optimization for Global

Marine Coatings Company � This long-standing REL client extended

its contract to complete a 9-month supply chain optimization

project, integrating both supply and distribution across three

manufacturing facilities and 160 owned distribution shops. With

REL�s help, the company has generated an initial 25% reduction of

inventory days coverage, accounting for a 17% reduction in

inventory value. Oracle Implementation for Not-For-Profit

Organization � This organization selected Hackett Technology

Solutions for a reimplementation of its Oracle financials platform.

The organization�s goal is to drive down business and technology

costs in the face of challenging economic factors. Hackett was

selected based on its Best Practice Implementation approach, which

will enable the implementation to integrate extensive process

transformation design to improve efficiency and effectiveness of

back-office operations. At 5:00 P.M. ET on Monday, August 4, 2008,

the senior management of The Hackett Group, Inc., formerly known as

Answerthink, Inc., will host a conference call to discuss second

quarter earnings results for the period ending June 27, 2008. The

number for the conference call is (800) 857-9601, [Passcode: Second

Quarter, Leader: Ted A. Fernandez]. For International callers,

please dial (210) 234-8000. Please dial in at least 5-10 minutes

prior to start time. If you are unable to participate on the

conference call, a rebroadcast will be available beginning at 8:00

P.M. ET on Monday, August 4, 2008 and will run through 5:00 P.M. ET

on Monday, August 18, 2008. To access the rebroadcast, please dial

(800) 839-1169. For International callers, please dial (203)

369-3036. In addition, The Hackett Group, Inc. will also be

webcasting this conference call live through the StreetEvents.com

service. To participate, simply visit

http://www.thehackettgroup.com approximately 10 minutes prior to

the start of the call and click on the conference call link

provided. An online replay of the call will be available after 8:00

P.M. ET on Monday, August 4, 2008 and will run through 5:00 P.M. ET

on Monday, August 18, 2008. To access the call, visit

http://www.thehackettgroup.com or http://www.streetevents.com.

About The Hackett Group, Inc. The Hackett Group, Inc. (NASDAQ:

HCKT), a global strategic advisory firm, is a leader in best

practice advisory, benchmarking, and transformation consulting

services, including shared services, offshoring, and outsourcing

advice. Utilizing best practices and implementation insights from

more than 4,000 benchmarking engagements, executives use The

Hackett Group's empirically-based approach to quickly define and

prioritize initiatives to enable world-class performance. Through

its REL brand, The Hackett Group offers working capital solutions

focused on delivering significant cash flow improvements. Through

its Hackett Technology Solutions group, The Hackett Group offers

business application consulting services that help maximize returns

on IT investments. The Hackett Group has worked with 2,700 major

corporations and government agencies, including 97% of the Dow

Jones Industrials, 73% of the Fortune 100, 73% of the DAX 30 and

50% of the FTSE 100. Founded in 1991, The Hackett Group was

acquired by Answerthink, Inc., which was renamed The Hackett Group,

Inc. in 2008. The Hackett Group has global offices in the United

States, Europe and India. More information on The Hackett Group is

available: by phone at (770) 225-7300; by e-mail at

info@thehackettgroup.com; or on the Web at www.thehackettgroup.com.

Book of Numbers is a trademark of The Hackett Group. This press

release contains �forward-looking statements� within the meaning of

the Private Securities Litigation Reform Act of 1995 and involve

known and unknown risks, uncertainties and other factors that may

cause The Hackett Group's actual results, performance or

achievements to be materially different from the results,

performance or achievements expressed or implied by the

forward-looking statements. Factors that impact such

forward-looking statements include, among others, the ability of

our products, services, or practices mentioned in this release to

deliver the desired effect, our ability to effectively integrate

acquisitions into our operations, our ability to retain existing

business, our ability to attract additional business, our ability

to effectively market and sell our product offerings and other

services, the timing of projects and the potential for contract

cancellations by our customers, changes in expectations regarding

the information technology industry, our ability to attract and

retain skilled employees, possible changes in collections of

accounts receivable, risks of competition, price and margin trends,

foreign currency fluctuations, changes in general economic

conditions and interest rates as well as other risks detailed in

our Company's Annual Report on Form 10-K for the most recent fiscal

year filed with the Securities and Exchange Commission. We

undertake no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law. The Hackett

Group, Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands,

except per share data) (unaudited) � Quarter Ended � Six Months

Ended � � June 27, June 29, June 27, June 29, 2008 2007 2008 2007

Revenue: Revenue before reimbursements $ 44,653 $ 40,505 $ 83,921 $

76,666 Reimbursements 4,447 5,007 9,017 8,723 Total revenue 49,100

45,512 92,938 85,389 � Costs and expenses: Cost of service:

Personnel costs before reimbursable expenses (includes $261 and

$360 and $658 and $771 of stock compensation expense in the

quarters and six months ended June 27, 2008 and June 29, 2007,

respectively) (2) 25,296 23,886 48,259 46,443 Reimbursable expenses

4,447 5,007 9,017 8,723 Total cost of service 29,743 28,893 57,276

55,166 � Selling, general and administrative costs (includes $839

and $701 and $1,387 and $1,298 of stock compensation expense in the

quarters and six months ended June 27, 2008 and June 29, 2007,

respectively) (2) 15,437 15,224 28,019 31,687 Collections from

misappropriation - - - (350) Total costs and operating expenses

45,180 44,117 85,295 86,503 Income (loss) from operations 3,920

1,395 7,643 (1,114) Other income (expense): Interest income 112 215

279 455 Interest expense - (91) - (93) Income (loss) before income

taxes 4,032 1,519 7,922 (752) Income tax expense 23 68 130 135 Net

income (loss) $ 4,009 $ 1,451 $ 7,792 $ (887) � Basic net income

(loss) per common share: Net income (loss) per common share $ 0.10

$ 0.03 $ 0.19 $ (0.02) Weighted average common shares outstanding

40,656 44,713 41,471 44,746 � Diluted net income (loss) per common

share (1): Net income (loss) per common share $ 0.10 $ 0.03 $ 0.18

$ (0.02) Weighted average common and common equivalent shares

outstanding 41,751 45,834 42,317 44,746 � Pro forma data (3):

Income (loss) before income taxes $ 4,032 $ 1,519 $ 7,922 $ (752)

Stock compensation expense 1,100 1,061 2,045 2,069 Amortization of

intangible assets 191 348 388 712 Professional fees related to the

misappropriation - 56 - 239 Collections from misappropriation - - -

(350) Pro forma income before income taxes 5,323 2,984 10,355 1,918

Pro forma income tax expense 2,129 1,194 4,142 767 Pro forma net

income $ 3,194 $ 1,790 $ 6,213 $ 1,151 � Pro forma basic net income

per common share $ 0.08 $ 0.04 $ 0.15 $ 0.03 Weighted average

common shares outstanding 40,656 44,713 41,471 44,746 � Pro forma

diluted net income per common share $ 0.08 $ 0.04 $ 0.15 $ 0.03

Weighted average common and common equivalent shares outstanding

41,751 45,834 42,317 45,776 � � (1) Potentially dilutive shares

were excluded from the diluted loss per share calculations for the

six months ended June 29, 2007 as their effects would have been

anti-dilutive to the loss incurred by the Company. (2) Certain

items in the quarter and six months ended June 29, 2007 have been

reclassified to conform with the June 27, 2008 presentation. As a

result, SGA for the second quarter, third quarter and fourth

quarters of 2007 have been recast to $15,224, $14,978 and $14,081,

respectively. In addition, personnel costs before reimbursable

expenses for the second quarter, third quarter and fourth quarters

of 2007 have been recast to $23,886, $23,363 and $22,047,

respectively. (3) The Company provides pro forma earnings results

(which exclude amortization of intangible assets, stock

compensation expense, collections and professional fees related to

the misappropriation and include a normalized tax rate) as a

complement to results provided in accordance with Generally

Accepted Accounting Principles ("GAAP"). These non-GAAP results are

provided to enhance the users' overall understanding of the

Company's current financial performance and its prospects for the

future. The Company believes the non-GAAP results provide useful

information to both management and investors by excluding certain

expenses that it believes are not indicative of its core operating

results. The non-GAAP measures are included to provide investors

and management with an alternative method for assessing operating

results in a manner that is focused on the performance of ongoing

operations and to provide a more consistent basis for comparison

between quarters. Further, these non-GAAP results are one of the

primary indicators management uses for planning and forecasting in

future periods. In addition, since the Company has historically

reported non-GAAP results to the investment community, it believes

the inclusion of non-GAAP numbers provides consistency in its

financial reporting. The presentation of this additional

information should not be considered in isolation or as a

substitute for results prepared in accordance with accounting

principles generally accepted in the United States of America. The

Hackett Group, Inc. CONDENSED CONSOLIDATED BALANCE SHEETS (in

thousands) (unaudited) � � June 27, � December 28, 2008 2007 �

ASSETS � Current assets: Cash and cash equivalents $ 16,194 $

20,061 Marketable investments 3,536 7,032 Accounts receivable and

unbilled revenue, net 35,047 29,735 Prepaid expenses and other

current assets 3,650 1,586 Total current assets 58,427 58,414 �

Restricted cash 600 600 Property and equipment, net 5,853 5,709

Other assets 2,043 2,434 Goodwill, net 68,199 68,302 Total assets $

135,122 $ 135,459 � LIABILITIES AND SHAREHOLDERS' EQUITY Current

liabilities: Accounts payable $ 4,141 $ 3,970 Accrued expenses and

other liabilities 29,300 29,047 Total current liabilities 33,441

33,017 Accrued expenses and other liabilities, non-current 3,059

3,623 Total liabilities 36,500 36,640 � Shareholders' equity 98,622

98,819 Total liabilities and shareholders' equity $ 135,122 $

135,459 The Hackett Group, Inc. Supplemental Financial Data

(unaudited) � Quarter Ended June 27, 2008 � March 28, 2008 � June

29, 2007 Revenue Breakdown by Group: (in thousands) � The Hackett

Group: Benchmarking and Business Transformation (5) $ 29,167 $

25,969 $ 23,292 Executive Advisory Programs (6) � 4,130 � 4,012 �

3,863 Total The Hackett Group 33,297 29,981 27,155 � Hackett

Technology Solutions (7) � 15,803 � 13,857 � 18,357 Total Revenue $

49,100 $ 43,838 $ 45,512 � � Revenue Concentration: (% of total

revenue) � Top customer 4% 7% 3% Top 5 customers 18% 20% 12% Top 10

customers 29% 29% 20% � � Key Metrics and Other Financial Data: The

Hackett Group annualized revenue per professional (in thousands) $

462 $ 415 $ 402 Executive Advisory Programs - Annualized Contract

Value (in thousands) (4) (8) $ 14,636 $ 15,148 $ 14,585 Hackett

Technology Solutions consultant utilization rate 73% 66% 65%

Hackett Technology Solutions gross billing rate per hour $ 169 $

160 $ 176 Consultant headcount 548 536 556 Total headcount 729 723

756 Days sales outstanding (DSO) 65 66 70 Cash (used in) provided

by operating activities (in thousands) $ (1,556) $ 4,733 $ (344)

Depreciation (in thousands) $ 508 $ 510 $ 525 Amortization (in

thousands) $ 191 $ 197 $ 348 � Share Repurchase Program: Shares

purchased in the quarter (in thousands) 675 1,783 509 Cost of

shares repurchased in the quarter (in thousands) $ 2,959 $ 6,793 $

1,749 Average price per share of shares purchased in the quarter $

4.39 $ 3.81 $ 3.44 Remaining authorization (in thousands) $ 6,307 $

4,266 $ 4,359 � � (4) � We define "Annualized Contract Value" as of

the beginning of the following quarter as the aggregate annualized

revenue attributed to all agreements in effect on such date,

without regard to the remaining duration of any such agreement. �

(5) Comparison of a client's demand drivers, costs and practices to

a peer group in order to empirically identify and define an

organization's ability to improve performance at a process level

and to identify and compare business practices utilized by

world-class performers. Additionally, strategic consulting support

that utilizes Hackett best practice implementation content and

tools to enable clients to accelerate transformation to world-class

performance. � (6) Annual or multi-year contract that provides

clients with on-demand access to world-class performance metrics,

best practice repository, best practice research forums and

conferences, and advice. � (7) Best Practice Implementation of ERP

Software, which is primarily Oracle and SAP, and business

performance management solutions, which is primarily Hyperion. �

(8) Certain items in the quarter ended June 29, 2007 have been

reclassified to conform with the June 27, 2008 presentation.

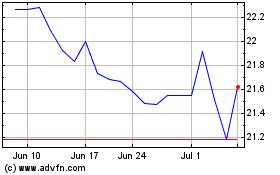

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Jun 2024 to Jul 2024

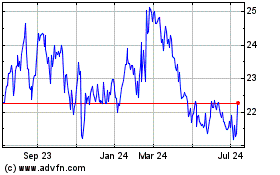

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Jul 2023 to Jul 2024