The Hackett Group, Inc. (NASDAQ:HCKT), a global strategic advisory

firm, today announced its financial results for the first quarter,

which ended March 28, 2008. In January of 2008, Answerthink, Inc.

was renamed The Hackett Group, Inc. and the Answerthink technology

practices were placed into a newly named group, Hackett Technology

Solutions. First quarter 2008 revenue was $43.8 million, a 10%

increase from the first quarter of 2007 driven by a 31% growth in

The Hackett Group (excluding Technology Solutions). Pro forma

diluted earnings per share were $0.07 in the first quarter of 2008,

as compared to a $0.01 loss per share in the first quarter of 2007.

Pro forma information is provided to enhance the understanding of

the Company�s financial performance and is reconciled to the

Company�s GAAP information in the accompanying tables. GAAP diluted

earnings per share were $0.09 in the first quarter of 2008, as

compared to a $0.05 loss per share in the first quarter of 2007. At

the end of the first quarter of 2008, the Company�s cash balances

were $25.3 million, including marketable investments and restricted

cash. During the first quarter, the Company repurchased

approximately 1.8 million shares of its common stock at an average

price of $3.81, for a total cost of approximately $6.8 million. On

May 2, 2008, the Board of Directors authorized an additional $5.0

million increase to the share buyback program, which brings the

current remaining authorization to approximately $8.1 million. �We

have now reported a significant improvement in our operating

results in the last four quarters and we expect to carry this

momentum into our next quarter,� stated Ted A. Fernandez, Chairman

& CEO of The Hackett Group, Inc. �A slowing economy has

heightened the management challenge for organizations globally and

I am pleased to see them turn to us for assistance during this

period.� Based on the current economic outlook, the Company

estimates total revenues for the second quarter of 2008 to be in

the range of $46.0 million to $48.0 million and estimates pro forma

diluted earnings per share to be in the range of $0.06 to $0.08.

The Hackett Group and Hackett Technology Solutions are expected to

grow sequentially, on a quarter over quarter basis with The Hackett

Group�s revenues growing approximately 20% on a year over year

basis. Other Highlights IT Business Value Management Research � New

Book of Numberstm research from The Hackett Group found that IT

excellence can drive real improvements to a company�s bottom line.

The Hackett Group found that companies that are top performers in

IT Business Value Management (IT BVM) also outperform their peers

across a wide range of financial and profitability metrics,

including net profitability, return on assets, and return on

equity. Forecasting Research � New Book of Numberstm research from

The Hackett Group found that despite a market environment where

missed earnings projections can lead to sharp stock declines, CFO

firings, or worse, most companies fail to accurately forecast

earnings and sales. According to The Hackett Group, two out of

every three companies are unable to accurately forecast earnings

for the next quarter, missing the mark by anywhere from 6% to over

30%. Learning & Development Study Launch � The Hackett Group

launched a new open performance study designed to help companies

better understand how their Learning & Development initiatives

compare with those of their peers and how they can improve the

efficiency and effectiveness of efforts in this key Talent

Management area. Representative Client Engagements Finance and HR

Transformation Effort for Leading Technology Company � This client

contracted with The Hackett Group for a global transformational

finance benchmark, HR rapid assessment, and other related services.

The company is seeking to restructure its cost basis while at the

same time driving higher effectiveness in back office support

functions. The work will include an analysis to assist the company

in leveraging global sourcing opportunities in finance and other

areas. Procure-to-Pay Working Capital Reengineering for Leading

Global Aerospace Manufacturer � This client selected REL to assist

in the reengineering of procure-to-pay processes for multiple

global entities. The project, which is supported by the company�s

finance and procurement organizations, is designed to streamline

and more effectively manage the working capital impacts of

distributed global sourcing efforts. Enterprise Performance

Management Implementation for Global Specialty Pharmaceutical

Company � This client selected the Hackett Technology Solutions

group for the next stage of a comprehensive enterprise performance

management data warehousing design and implementation project.

Under the contract, Hackett Technology Solutions will implement the

financial data warehouse system, which will drive enhanced business

value, improved information access, and streamlined reporting. The

project will result in a single source of financial information

company-wide and target and implement best practices broadly across

performance reporting, planning, forecasting, and business analyst

partnering. Hyperion Implementation for Leading Media &

Entertainment Company � This client selected the Hackett Technology

Solutions group to implement a new consolidation and�SEC reporting

tool using Hyperion Financial Management and Hyperion Financial

Data Quality Management. The implementation leverages our 12-step

rapid deployment methodology to achieve go-live in approximately 4

months. The new system will eliminate manual production of Form

10-Q and 10-K reports, improve audit trails, and enhance

transparency of reporting across multiple business segments. At

5:00 P.M. ET on Tuesday, May 6, 2008, the senior management of The

Hackett Group, Inc. will host a conference call to discuss first

quarter earnings results for the period ending March 28, 2008. The

number for the conference call is 800-857-9601 (Passcode: First

Quarter, Leader: Ted A. Fernandez). For International callers,

please dial 210-234-8000. Please dial in at least 5-10 minutes

prior to start time. If you are unable to participate on the

conference call, a rebroadcast will be available beginning at 8:00

P.M. ET on Tuesday, May 6, 2008 and will run through 5:00 P.M. ET

on Tuesday, May 20, 2008. To access the rebroadcast, please dial

800-944-6957. For International callers, please dial 402-220-3502.

In addition, The Hackett Group, Inc. will be webcasting this

conference call live through the StreetEvents.com service. To

participate, simply visit http://www.thehackettgroup.com

approximately 10 minutes prior to the start of the call and click

on the conference call link provided. An online replay of the call

will be available after 8:00 P.M. ET on Tuesday, May 6, 2008 and

will run through 5:00 P.M. ET on Tuesday, May 20, 2008. To access

the call, visit http://www.thehackettgroup.com or

http://www.streetevents.com. About The Hackett Group, Inc. The

Hackett Group Inc. (NASDAQ: HCKT), a global strategic advisory

firm, is a leader in best practice advisory, benchmarking, and

transformation consulting services, including shared services,

offshoring and outsourcing advice. Utilizing best practices and

implementation insights from more than 4,000 benchmarking

engagements, executives use The Hackett Group's empirically-based

approach to quickly define and prioritize initiatives to enable

world-class performance. Through its REL brand, The Hackett Group

offers working capital solutions focused on delivering significant

cash flow improvements. Through its Hackett Technology Solutions

group, The Hackett Group offers business application consulting

services that help maximize returns on IT investments. The Hackett

Group has worked with 2,700 major corporations and government

agencies, including 97% of the Dow Jones Industrials, 73% of the

Fortune 100, 73% of the DAX 30 and 50% of the FTSE 100. Founded in

1991, The Hackett Group was acquired by Answerthink, Inc., which

was renamed The Hackett Group in 2008. The Hackett Group has global

offices in the United States, Europe and India. More information on

The Hackett Group is available: by phone at 770-225-7300; by e-mail

at info@thehackettgroup.com; or on the Web at

www.thehackettgroup.com. Book of Numbers is a trademark of The

Hackett Group. This press release contains �forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995 and involve known and unknown risks,

uncertainties and other factors that may cause The Hackett Group's

actual results, performance or achievements to be materially

different from the results, performance or achievements expressed

or implied by the forward-looking statements. Factors that impact

such forward-looking statements include, among others, the ability

of our products, services, or practices mentioned in this release

to deliver the desired effect, our ability to effectively integrate

acquisitions into our operations, our ability to attract additional

business, our ability to effectively market and sell our product

offerings and other services, the timing of projects and the

potential for contract cancellations by our customers, changes in

expectations regarding the information technology industry, our

ability to attract and retain skilled employees, possible changes

in collections of accounts receivable, risks of competition, price

and margin trends, foreign currency fluctuations, changes in

general economic conditions and interest rates as well as other

risks detailed in our Company's Annual Report on Form 10-K for the

most recent fiscal year filed with the Securities and Exchange

Commission. We undertake no obligation to update or revise publicly

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by law.

The Hackett Group, Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (in

thousands, except per share data) (unaudited) � � � Quarter Ended �

March 28, � March 30, 2008 � 2007 Revenues: Revenues before

reimbursements $ 39,268 � $ 36,161 Reimbursements � 4,570 � 3,716 �

Total revenues 43,838 39,877 � Costs and expenses: Cost of service:

Personnel costs before reimbursable expenses (includes $397 and

$411 of stock compensation expense in the quarters ended March 28,

2008 and March 30, 2007, respectively) (2) 22,963 22,558

Reimbursable expenses � 4,570 � 3,716 � Total cost of service

27,533 26,274 � Selling, general and administrative costs (includes

$548 and $597 of stock compensation expense in the quarters ended

March 28, 2008 and March 30, 2007, respectively) (2) 12,582 16,462

Collections from misappropriation � - � (350 ) Total costs and

operating expenses � 40,115 � 42,386 � Income (loss) from

operations 3,723 (2,509 ) Other income (expense): Interest income

167 240 Interest expense � - � (2 ) Income (loss) before income

taxes 3,890 (2,271 ) Income tax expense � 107 � 67 � Net income

(loss) $ 3,783 � $ (2,338 ) � Basic net income (loss) per common

share: Net income (loss) per common share $ 0.09 � $ (0.05 )

Weighted average common shares outstanding 42,755 44,778 � Diluted

net income (loss) per common share (1): Net income (loss) per

common share $ 0.09 � $ (0.05 ) Weighted average common and common

equivalent shares outstanding 43,353 44,778 � Pro forma data (3):

Income (loss) before income taxes $ 3,890 � $ (2,271 ) Stock

compensation expense 945 1,008 Amortization of intangible assets

197 364 Professional fees related to the misappropriation - 183

Collections from misappropriation � - � (350 ) Pro forma income

(loss) before income taxes 5,032 (1,066 ) Pro forma income tax

expense (benefit) � 2,013 � (427 ) Pro forma net income (loss) $

3,019 � $ (639 ) � Pro forma basic net income (loss) per common

share $ 0.07 � $ (0.01 ) Weighted average common shares outstanding

42,755 44,778 � Pro forma diluted net income (loss) per common

share $ 0.07 � $ (0.01 ) Weighted average common and common

equivalent shares outstanding 43,353 44,778 � (1) Potentially

diluted shares were excluded from the diluted loss per share

calculations for the quarter ended March 30, 2007 as their effects

would have been anti-dilutive to the loss incurred by the Company.

(2) Certain items in the quarter ended March 30, 2007 have been

reclassified to conform with the March 28, 2008 presentation. As a

result, SGA for the second quarter, third quarter and fourth

quarter of 2007 have been recast to $15,224, $14,978 and $14,081,

respectively. In addition, personnel costs before reimbursable

expenses for the second quarter, third quarter and fourth quarter

of 2007 have been recast to $23,886, $23,363 and $22,047,

respectively. (3) The Company provides pro forma earnings results

(which exclude amortization of intangible assets, stock

compensation expense, collections and professional fees related to

the misappropriation and include a normalized tax rate) as a

complement to results provided in accordance with Generally

Accepted Accounting Principles. These non-GAAP results are provided

to enhance the users' overall understanding of the Company's

current financial performance and its prospects for the future. The

Company believes the non-GAAP results provide useful information to

both management and investors by excluding certain expenses that it

believes are not indicative of its core operating results. The

non-GAAP measures are included to provide investors and management

with an alternative method for assessing operating results in a

manner that is focused on the performance of ongoing operations and

to provide a more consistent basis for comparison between quarters.

Further, these non-GAAP results are one of the primary indicators

management uses for planning and forecasting in future periods. In

addition, since the Company has historically reported non-GAAP

results to the investment community, it believes the inclusion of

non-GAAP numbers provides consistency in its financial reporting.

The presentation of this additional information should not be

considered in isolation or as a substitute for results prepared in

accordance with accounting principles generally accepted in the

United States of America. The Hackett Group, Inc. CONDENSED

CONSOLIDATED BALANCE SHEETS (in thousands) (unaudited) � March 28,

� December 28, � 2008 2007 � ASSETS � Current assets: Cash and cash

equivalents $ 20,188 $ 20,061 Marketable investments 4,546 7,032

Accounts receivable and unbilled revenue, net 31,265 29,735 Prepaid

expenses and other current assets � 3,988 � 1,586 Total current

assets 59,987 58,414 � Restricted cash 600 600 Property and

equipment, net 5,677 5,709 Other assets 2,248 2,434 Goodwill, net �

68,474 � 68,302 Total assets $ 136,986 $ 135,459 � LIABILITIES AND

SHAREHOLDERS' EQUITY Current liabilities: Accounts payable $ 5,704

$ 3,970 Accrued expenses and other liabilities � 30,988 � 29,047

Total current liabilities 36,692 33,017 Accrued expenses and other

liabilities, non-current � 3,339 � 3,623 Total liabilities 40,031

36,640 � Shareholders' equity � 96,955 � 98,819 Total liabilities

and shareholders' equity $ 136,986 $ 135,459 The Hackett Group,

Inc. Supplemental Financial Data (unaudited) � � � Quarter Ended

March 28, 2008 December 28, 2007 March 30, 2007 Revenue Breakdown

by Group: (in thousands) � The Hackett Group: Benchmarking and

Business Transformation (5) $ 25,969 $ 26,022 $ 19,303 Executive

Advisory Programs (6) � 4,012 � � 3,893 � � 3,613 � Total The

Hackett Group 29,981 29,915 22,916 � Hackett Technology Solutions

(7) � 13,857 � � 14,975 � � 16,961 � Total Revenues $ 43,838 � $

44,890 � $ 39,877 � � � Revenue Concentration: (% of total

revenues) � Top customer 7 % 5 % 3 % Top 5 customers 20 % 17 % 13 %

Top 10 customers 29 % 28 % 23 % � � Key Metrics and Other Financial

Data: The Hackett Group annualized revenue per professional (in

thousands) $ 415 $ 411 $ 345 Executive Advisory Programs -

Annualized Contract Value (in thousands) (4) (8) $ 15,148 $ 16,031

$ 14,310 Hackett Technology Solutions consultant utilization rate

66 % 62 % 63 % Hackett Technology Solutions gross billing rate per

hour $ 160 $ 161 $ 171 Consultant headcount 536 552 563 Total

headcount 723 739 770 Days sales outstanding (DSO) 66 60 71 Cash

provided by operating activities (in thousands) $ 4,733 $ 8,320 $

4,209 Depreciation (in thousands) $ 510 $ 508 $ 536 Amortization

(in thousands) $ 197 $ 296 $ 364 � Share Repurchase Program: Shares

purchased in the quarter (in thousands) 1,783 1,029 - Cost of

shares repurchased in the quarter (in thousands) $ 6,793 $ 4,208 $

- Average price per share of shares purchased in the quarter $ 3.81

$ 4.09 $ - Remaining authorization (in thousands) $ 4,266 $ 6,060 $

6,133 � (4) We define "Annualized Contract Value" as of the

beginning of the following quarter as the aggregate annualized

revenue attributed to all agreements in effect on such date,

without regard to the remaining duration of any such agreement. (5)

Comparison of a client's demand drivers, costs and practices to a

peer group in order to empirically identify and define an

organization's ability to improve performance at a process level

and to identify and compare business practices utilized by

world-class performers. Additionally, strategic consulting support

that utilizes Hackett best practice implementation content and

tools to enable clients to accelerate transformation to world-class

performance. (6) Annual or multi-year contract that provides

clients with on-demand access to world-class performance metrics,

best practice repository, best practice research forums and

conferences, and advice. (7) Best Practice Implementation of ERP

Software, which is primarily Oracle and SAP, and business

performance management solutions, which is primarily Hyperion. (8)

Certain items in the quarter ended March 30, 2007 have been

reclassified to conform with the March 28, 2008 presentation.

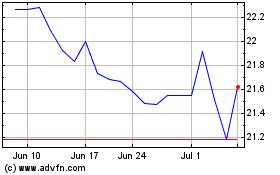

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Jun 2024 to Jul 2024

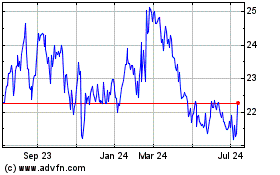

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Jul 2023 to Jul 2024