As

filed with the Securities and Exchange Commission on August 20, 2021

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

GAN

Limited

(Exact

name of registrant as specified in its charter)

|

Bermuda

|

|

Not

applicable

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(I.R.S.

Employer

Identification

No.)

|

400

Spectrum Center Drive

Suite

1900

Irvine

CA 92618

(702)

964-5777

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Dermot

Smurfit

Chief

Executive Officer

GAN

Limited

400

Spectrum Center Drive

Suite

1900

Irvine,

CA 92618

(702)

964-5777

(Name,

address, including zip code, and telephone number,

including

area code, of agent for service)

With

a copy to:

James

A. Mercer III, Esq.

Sheppard,

Mullin, Richter & Hampton LLP

12275

El Camino Real, Suite 200

San

Diego, CA 92129

(858)

720-7469

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer ☐

|

|

Accelerated

filer ☐

|

|

Non-accelerated

filer ☒

|

|

Smaller

reporting company ☒

|

|

|

|

Emerging

growth company ☒

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION

OF REGISTRATION FEE

Title

of each class of

securities to be registered

|

|

Amount

to be registered (1)

|

|

|

Proposed

maximum offering price per unit (1)

|

|

|

Proposed

maximum aggregate offering price (1)

|

|

|

Amount

of registration fee (2)

|

|

|

Ordinary Shares, par value $0.01 per share

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Preferred Shares, par value $0.01 per share

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Depositary Shares

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Warrants

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Subscription Rights

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Purchase Contracts

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Units

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

(1)

|

An

indeterminate aggregate initial offering price and amount or number of securities is being registered as may from time to time be

offered at indeterminate prices.

|

|

|

|

|

(2)

|

In

accordance with Rules 456(b) and 457(r) under the Securities Act, the registrant is deferring payment of all of the registration

fees.

|

PROSPECTUS

GAN

Limited

Ordinary

Shares

Preferred

Shares

Depositary

Shares

Warrants

Subscription

Rights

Purchase

Contracts

Units

We

may from time to time offer and sell any of the securities described in this prospectus, either individually or in combination. In addition,

any selling shareholders identified in this prospectus, or any of their transferees, donees, pledgees or other successors, may offer

and sell from time to time ordinary shares.

This

prospectus provides a general description of the securities we may offer. Each time we or any selling shareholders sell securities under

this prospectus, we will provide specific terms related to such sales in one or more supplements to this prospectus. We may also authorize

one or more free writing prospectuses to be provided to you in connection with these offerings.

The

prospectus supplement, and any documents incorporated by reference, may also add, update or change information contained in this prospectus.

Before you invest, you should carefully read this prospectus, the applicable prospectus supplement, any documents incorporated by reference

and any related free writing prospectus before buying any of the securities being offered. This prospectus may not be used to consummate

a sale of securities unless accompanied by the applicable prospectus supplement.

We

or any selling shareholders may sell these securities directly, through underwriters, dealers or agents as designated from time to time,

or through a combination of these methods. If any underwriters, dealers or agents are involved in the sale of these securities, the applicable

prospectus supplement will set forth the names of the agents, dealers or underwriters and any applicable fees, commissions or discounts.

We will not receive any proceeds from the sale of ordinary shares by the selling shareholders.

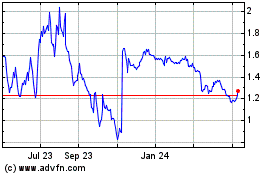

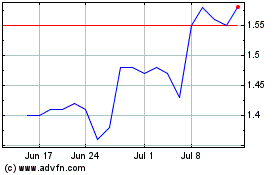

Our

ordinary shares are currently listed on the Nasdaq Capital Market under the symbol “GAN.” The applicable prospectus supplement

will contain information, where applicable, as to any other listing of the securities covered by the applicable prospectus supplement.

On August 19, 2021, the last reported sale price per ordinary share on the Nasdaq Capital Market was $14.47.

An

investment in our securities involves a high degree of risk. See the section entitled “Risk Factors” commencing on page 6

of this prospectus and the discussion of these risks in the sections entitled “Risk Factors” in our most recent Annual Report

on Form 10-K and in the Quarterly Reports on Form 10-Q, in each case, incorporated by reference in this prospectus, as well as in any

applicable prospectus supplement.

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required. We urge you to read the entire

prospectus, any amendments or supplements, any free writing prospectuses, and any documents incorporated by reference carefully before

you make your investment decision.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is August 20, 2021

TABLE

OF CONTENTS

You

should rely only on the information provided in this prospectus, as well as the information incorporated by reference into this prospectus

and any applicable prospectus supplement. Neither we nor the selling shareholders have authorized anyone to provide you with different

information. Neither we nor the selling shareholders are making an offer of these securities in any jurisdiction where the offer is not

permitted. You should not assume that the information in this prospectus, any applicable prospectus supplement or any documents incorporated

by reference is accurate as of any date other than the date of the applicable document. Since the respective dates of this prospectus

and the documents incorporated by reference into this prospectus, our business, financial condition, results of operations and prospects

may have changed.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, using

a “shelf” registration process. Under this shelf registration process, we may from time to time offer and sell, either individually

or in combination, in one or more offerings, any combination of the securities described in this prospectus. Each time we offer securities

under this prospectus, we will provide a prospectus supplement that will contain more specific information about the terms of that offering.

We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these

offerings. The prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add,

update or change any of the information contained in this prospectus or in the documents that we have incorporated by reference into

this prospectus.

In

addition, selling shareholders may use this shelf registration statement to sell ordinary shares from time to time. We will not receive

any proceeds from the sale of shares by any selling shareholders. The selling shareholders may deliver a supplement with this prospectus,

if required, to update the information contained in this prospectus. The selling shareholders may sell their ordinary shares through

any means described in the section entitled “Plan of Distribution” or described in any accompanying prospectus supplement.

As used herein, the term “selling shareholders” includes the selling shareholders and any of their transferees, donees, pledgees

or other successors.

You

should read this prospectus, any applicable prospectus supplement and any free writing prospectuses we have authorized for use in connection

with a specific offering together with additional information described under the headings “Cautionary Note Regarding Forward-Looking

Statements,” “Where You Can Find More Information,” and “Information Incorporated by Reference” below before

investing in any of the securities being offered. The information appearing in this prospectus, any applicable prospectus supplement

or any free writing prospectus is accurate only as of the date of such document and any information we have incorporated by reference

is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus, any

applicable prospectus supplement or any related free writing prospectus, or any sale of a security. Our business, financial condition,

results of operations and prospects may have changed since those dates. If there is any inconsistency between the information in this

prospectus and any prospectus supplement, you should rely on the information contained in that prospectus supplement. This prospectus

may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

You

should rely only on the information we have provided or incorporated by reference in this prospectus and any prospectus supplement. We

have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information,

you should not rely on it. We are not making an offer to sell securities in any jurisdiction where the offer or sale is not permitted.

This

prospectus contains summaries of certain provisions of documents. All of the summaries are qualified in their entirety by the actual

documents. Copies of some of these documents have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled

“Where You Can Find More Information.”

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in

some cases, for the purposes of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties and covenants should not be relied on as accurately representing

the current state of our affairs.

In

this prospectus, unless otherwise indicated, “our Company,” “we,” “us,” “GAN,” or “our”

refer to GAN Limited, a Bermuda exempted company limited by shares, and its subsidiaries.

PROSPECTUS

SUMMARY

This

prospectus summary highlights certain information about our Company and other information contained elsewhere in this prospectus or in

documents incorporated by reference. This summary does not contain all of the information that you should consider before making an investment

decision. You should carefully read the entire prospectus, any prospectus supplement, including the section entitled “Risk Factors,”

and the documents incorporated by reference into this prospectus, before making an investment decision.

Our

Business

GAN

Limited is a Bermuda exempted holding company which does not conduct any commercial operations. GAN Limited’s subsidiaries operate

as a business-to-business supplier of enterprise Software-as-a-Service solutions for online casino gaming, commonly referred to as iGaming,

and online sports betting applications. Our technology platform, which we market as the GameSTACK™ Internet gaming ecosystem platform,

has been deployed in both Europe and the United States. Our business has been primarily focused on enabling the U.S. casino industry’s

ongoing digital transformation, which is accelerating following the repeal of a federal ban on sports betting in May 2018. Our customers

rely on our software to run their online casinos and sportsbooks legally, profitably and with engaging content. Additionally, following

our acquisition of Coolbet in January 2021, an award-winning developer and operator of a legal online sports betting and casino platform,

we now offer customers a digital portal for engaging in sports betting, online casino games and peer-to-peer poker.

Corporate

Information

Our

executive offices are located at 400 Spectrum Center Drive, Suite 1900, Irvine, California 92618 and our telephone number at that address

is (702) 964-5777. Our corporate website is www.gan.com and we maintain an investor relations website at investors.gan.com.

Information contained on any of our websites or that can be accessed through our websites are not incorporated by reference in, and do

not constitute a part of, this prospectus.

The

Offering

We

may offer and sell, from time to time, ordinary shares, preferred shares, depositary shares, warrants, subscription rights, purchase

contracts or units, in one or more offerings and in any combination thereof. In addition, the selling shareholders may sell ordinary

shares. This prospectus provides you with a general description of the securities we may offer and the selling shareholders may offer.

Except in the case of certain offers and sales by the selling shareholders in circumstances described under “Plan of Distribution,”

this prospectus may not be used to offer or sell securities unless accompanied by a prospectus supplement. We will not receive any proceeds

from the sale of ordinary shares by the selling shareholders.

Listing

Our

ordinary shares are currently listed on the Nasdaq Capital Market, under the symbol “GAN.”

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before you make a decision to invest in our securities, you should consider

carefully the risks described in the section entitled “Risk Factors” contained in the applicable prospectus supplement and

in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the SEC, as well as any amendment or update

thereto reflected in subsequent filings with the SEC or in any current report on Form 8-K and in the other documents that we file with

the SEC from time to time. The risks and uncertainties described in this prospectus, any applicable prospectus supplement and the documents

incorporated by reference herein are not the only ones facing us. Additional risks and uncertainties that we do not presently know about

or that we currently believe are not material may also adversely affect our business. Our business, results of operations or financial

condition could be seriously harmed, and the trading price of our securities may decline, due to any of these or other risks.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference in this prospectus contain forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, which we refer to as the Securities Act, and Section 21E of the Securities Exchange Act

of 1934, as amended, which we refer to as the Exchange Act. Forward-looking statements reflect current views about future events and

are based on our currently available financial, economic and competitive data and on current business plans. Actual events or results

may differ materially depending on risks and uncertainties that may affect our operations, markets, services and other factors.

Statements

in this prospectus and the documents incorporated by reference in this prospectus concerning our anticipated financial performance, business

prospects and strategy; anticipated trends and prospects in the various industries in which our businesses operate; new products, services

and related strategies; and other similar matters are forward-looking statements. In some cases, you can identify forward-looking statements

by terminology such as “may,” “will,” “should,” “expect,” “intend,” “plan,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,”

“assumption” or the negative of these terms or other comparable terminology.

Forward-looking

statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements

to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Before deciding to purchase our securities, you should carefully consider such risks, including those factors listed in “Risk Factors”

set forth herein and elsewhere in this prospectus and the documents incorporated by reference in this prospectus and in other documents

that we file with the SEC from time to time.

We

do not undertake any responsibility to release publicly any revisions to these forward-looking statements to take into account events

or circumstances that occur after the date of this prospectus. Additionally, we do not undertake any responsibility to update you on

the occurrence of any unanticipated events which may cause actual results to differ from those expressed or implied by the forward-looking

statements contained in this prospectus unless required by applicable law.

USE

OF PROCEEDS

Except

as described in any applicable prospectus supplement, we currently intend to use the net proceeds from the sale of the securities offered

hereunder, if any, for general corporate purposes, which may include working capital, capital expenditures or acquisitions.

When

specific securities are offered, the prospectus supplement relating thereto will set forth our intended use of the net proceeds that

we receive from the sale of such securities. Pending the application of the net proceeds, we may invest the proceeds in marketable securities

and short-term investments.

We

will not receive any proceeds from the sale of ordinary shares by the selling shareholders pursuant to this prospectus.

DESCRIPTION

OF SHARE CAPITAL

The

description of our share capital is incorporated by reference to the description of the ordinary shares contained in the section entitled

“Description of Share Capital” in the prospectus included in our Registration Statement on Form F-1 (333-251153), initially

filed with the Securities and Exchange Commission on December 7, 2020, as amended from time to time, and to Exhibit 3.1, Exhibit 3.2,

Exhibit 4.1 and Exhibit 4.3 to our Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC on March 31, 2021.

DESCRIPTION

OF DEPOSITARY SHARES

General

We

may, at our option, elect to offer fractional shares of preferred shares, or depositary shares, rather than full shares of preferred

shares. If we do, we will issue to the public receipts, called depositary receipts, for depositary shares, each of which will represent

a fraction, to be described in the applicable prospectus supplement, of a share of a particular series of preferred shares. Unless otherwise

provided in the prospectus supplement, each owner of a depositary share will be entitled, in proportion to the applicable fractional

interest in preferred shares represented by the depositary share, to all the rights and preferences of the preferred shares represented

by the depositary share. Those rights include dividend, voting, redemption, conversion and liquidation rights.

The

preferred shares underlying the depositary shares will be deposited with a bank or trust company selected by us to act as depositary

under a deposit agreement between us, the depositary and the holders of the depositary receipts. The depositary will be the transfer

agent, registrar and dividend disbursing agent for the depositary shares.

The

depositary shares will be evidenced by depositary receipts issued pursuant to the depositary agreement. Holders of depositary receipts

agree to be bound by the deposit agreement, which requires holders to take certain actions such as filing proof of residence and paying

certain charges.

The

summary of terms of the depositary shares contained in this prospectus is not complete. You should refer to the form of the deposit agreement,

our Memorandum of Association and our Bye-Laws, as the same may be amended from time to time, that are, or will be, filed with the SEC.

Dividends

and Other Distributions

The

depositary will distribute all cash dividends or other cash distributions, if any, received in respect of the preferred shares underlying

the depositary shares to the record holders of depositary shares in proportion to the numbers of depositary shares owned by those holders

on the relevant record date. The relevant record date for depositary shares will be the same date as the record date for the underlying

preferred shares.

If

there is a distribution other than in cash, the depositary will distribute property (including securities) received by it to the record

holders of depositary shares, unless the depositary determines that it is not feasible to make the distribution. If this occurs, the

depositary may, with our approval, adopt another method for the distribution, including selling the property and distributing the net

proceeds from the sale to the holders.

Liquidation

Preference

If

a series of preferred shares underlying the depositary shares has a liquidation preference, in the event of the voluntary or involuntary

liquidation, dissolution or winding up of us, holders of depositary shares will be entitled to receive the fraction of the liquidation

preference accorded each share of the applicable series of preferred shares as prescribed in the certificate of designation relating

to the preferred shares or the Bye-laws, as set forth in the applicable prospectus supplement.

Withdrawal

of Shares

Unless

the related depositary shares have been previously called for redemption, upon surrender of the depositary receipts at the office of

the depositary, the holder of the depositary shares will be entitled to delivery, at the office of the depositary to or upon his or her

order, of the number of whole preferred shares and any money or other property represented by the depositary shares. If the depositary

receipts delivered by the holder evidence a number of depositary shares in excess of the number of depositary shares representing the

number of whole preferred shares to be withdrawn, the depositary will deliver to the holder at the same time a new depositary receipt

evidencing the excess number of depositary shares. Holders of preferred shares thus withdrawn may not thereafter deposit those shares

under the deposit agreement or receive depositary receipts evidencing depositary shares therefor.

Redemption

of Depositary Shares

Whenever

we redeem preferred shares held by the depositary, the depositary will redeem as of the same redemption date the number of depositary

shares representing the preferred shares so redeemed, so long as we have paid in full to the depositary the redemption price of the preferred

shares to be redeemed plus an amount equal to any accumulated and unpaid dividends on the preferred shares to the date fixed for redemption.

The redemption price per depositary share will be equal to the redemption price and any other amounts per share payable on the preferred

shares multiplied by the fraction of a preferred share represented by one depositary share. If less than all the depositary shares are

to be redeemed, the depositary shares to be redeemed will be selected by lot or pro rata or by any other equitable method as may be determined

by the depositary.

After

the date fixed for redemption, depositary shares called for redemption will no longer be deemed to be outstanding and all rights of the

holders of depositary shares will cease, except the right to receive the consideration payable upon redemption and any money or other

property to which the holders of the depositary shares were entitled upon redemption upon surrender to the depositary of the depositary

receipts evidencing the depositary shares.

Voting

the Preferred Shares

Upon

receipt of notice of any meeting at which the holders of the preferred shares are entitled to vote, the depositary will mail the information

contained in the notice of meeting to the record holders of the depositary receipts relating to those preferred shares. The record date

for the depositary receipts relating to the preferred shares will be the same date as the record date for the preferred shares. Each

record holder of the depositary shares on the record date will be entitled to instruct the depositary as to the exercise of the voting

rights pertaining to the number of preferred shares represented by that holder’s depositary shares. The depositary will endeavor,

insofar as practicable, to vote the number of preferred shares represented by the depositary shares in accordance with those instructions,

and we will agree to take all action that may be deemed necessary by the depositary in order to enable the depositary to do so. The depositary

will not vote any preferred shares except to the extent that it receives specific instructions from the holders of depositary shares

representing that number of preferred shares.

Charges

of the Depositary

We

will pay all transfer and other taxes and governmental charges arising solely from the existence of the depositary arrangements. We will

pay charges of the depositary in connection with the initial deposit of the preferred shares and any redemption of the preferred shares.

Holders of depositary receipts will pay transfer, income and other taxes and governmental charges and such other charges (including those

in connection with the receipt and distribution of dividends, the sale or exercise of rights, the withdrawal of the preferred shares

and the transferring, splitting or grouping of depositary receipts) as are expressly provided in the deposit agreement to be for their

accounts. If these charges have not been paid by the holders of depositary receipts, the depositary may refuse to transfer depositary

shares, withhold dividends and distributions and sell the depositary shares evidenced by the depositary receipt.

Amendment

and Termination of the Deposit Agreement

The

form of depositary receipt evidencing the depositary shares and any provision of the deposit agreement may be amended by agreement between

us and the depositary. However, any amendment that materially and adversely alters the rights of the holders of depositary shares, other

than fee changes, will not be effective unless the amendment has been approved by the holders of a majority of the outstanding depositary

shares. The deposit agreement may be terminated by the depositary or us only if:

|

|

●

|

all

outstanding depositary shares have been redeemed;

|

|

|

|

|

|

|

●

|

there

has been a final distribution of the preferred shares in connection with the consummation of a liquidation transaction in accordance

with our Bye-laws, and such distribution has been made to all the holders of depositary shares; or

|

|

|

●

|

such

arrangement is otherwise required, by change in applicable law, rule, regulation or contract, in order for us or the depositary to

comply with such applicable law, rule, regulation or contract.

|

Resignation

and Removal of Depositary

The

depositary may resign at any time by delivering to us notice of its election to do so, and we may remove the depositary at any time,

in each case. Any resignation or removal of the depositary will take effect upon our appointment of a successor depositary and its acceptance

of such appointment. The successor depositary must be appointed within 60 days after delivery of the notice of resignation or removal

and must be a bank or trust company having its principal office in the United States and having the requisite combined capital and surplus

as set forth in the applicable agreement.

Notices

The

depositary will forward to holders of depositary receipts all notices, reports and other communications, including proxy solicitation

materials received from us, that are delivered to the depositary and that we are required to furnish to the holders of the preferred

shares. In addition, the depositary will make available for inspection by holders of depositary receipts at the principal office of the

depositary, and at such other places as it may from time to time deem advisable, any reports and communications we deliver to the depositary

as the holder of preferred shares.

Limitation

of Liability

Neither

we nor the depositary will be liable if either is prevented or delayed by law or any circumstance beyond its control in performing its

obligations. Our obligations and those of the depositary will be limited to performance in good faith of our and its duties thereunder.

We and the depositary will not be obligated to prosecute or defend any legal proceeding in respect of any depositary shares or preferred

shares unless satisfactory indemnity is furnished to us and the depositary by the holder(s) of the preferred shares or depositary receipts

evidencing such depositary shares or preferred shares. We and the depositary may rely upon written advice of counsel or accountants,

on information provided by persons presenting preferred shares for deposit, holders of depositary receipts or other persons believed

to be competent to give such information and on documents believed to be genuine and to have been signed or presented by the proper party

or parties.

DESCRIPTION

OF WARRANTS

We

may issue warrants for the purchase of ordinary shares, preferred shares or depositary shares in one or more series. We may issue warrants

independently or together with ordinary shares or preferred shares, and the warrants may be attached to or separate from these

securities. While the terms summarized below will apply generally to any warrants that we may sell, we will describe the particular terms

of any series of warrants in more detail in the applicable prospectus supplement. The terms of any warrants offered under a prospectus

supplement may differ from the terms described below.

We

will file as exhibits to the registration statement of which this prospectus is a part, or will incorporate by reference from reports

that we file with the SEC, the form of warrant agreement, including a form of warrant certificate, that describes the terms of the particular

series of warrants we are offering before the issuance of the related series of warrants. The following summaries of material provisions

of the warrants and the warrant agreements are subject to, and qualified in their entirety by reference to, all the provisions of the

warrant agreement and warrant certificate applicable to the particular series of warrants that we may offer under this prospectus and

the accompanying prospectus supplement. We urge you to read the applicable prospectus supplements related to the particular series of

warrants that we may offer under this prospectus, as well as any related free writing prospectuses, and the complete warrant agreements

and warrant certificates that contain the terms of the warrants.

General

You

should review the applicable prospectus supplement for the specific terms of any warrants that may be offered, including the following:

|

|

●

|

the

title of the warrants;

|

|

|

|

|

|

|

●

|

the

aggregate number of the warrants;

|

|

|

|

|

|

|

●

|

the

price or prices at which the warrants will be issued;

|

|

|

|

|

|

|

●

|

in

the case of warrants to purchase ordinary shares or preferred shares, the number of ordinary shares or preferred shares, as the case

may be, purchasable upon the exercise of one warrant and the price at which these shares may be purchased upon such exercise;

|

|

|

|

|

|

|

●

|

if

applicable, the date on and after which the warrants and the related securities will be separately transferable;

|

|

|

|

|

|

|

●

|

the

effect of any merger, amalgamation, consolidation, sale or other disposition of our business on the warrant agreements and the warrants;

the terms of any rights to redeem or call the warrants;

|

|

|

|

|

|

|

●

|

any

provisions for changes to or adjustments in the exercise price or number of securities issuable upon exercise of the warrants;

|

|

|

|

|

|

|

●

|

the

date on which the right to exercise the warrants will commence and the date on which the right will expire;

|

|

|

|

|

|

|

●

|

if

applicable, the minimum or maximum number of warrants that may be exercised at any one time;

|

|

|

|

|

|

|

●

|

the

manner in which the warrant agreements and warrants may be modified; information relating to book-entry procedures, if any;

|

|

|

|

|

|

|

●

|

if

applicable, a discussion of material U.S. federal income tax considerations of holding or exercising the warrants; and

|

|

|

|

|

|

|

●

|

any

other terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of the warrants.

|

Before

exercising their warrants, holders of warrants will not have any of the rights of holders of the securities purchasable upon such exercise,

including in the case of warrants to purchase ordinary shares or preferred shares, the right to receive dividends, if any, or, payments

upon our liquidation, dissolution or winding up or to exercise voting rights, if any.

Exercise

of Warrants

Each

warrant will entitle the holder to purchase for cash such principal amount of securities or shares at such exercise price as shall in

each case be set forth in, or be determinable as set forth in, the prospectus supplement relating to the warrants offered thereby. Warrants

may be exercised at any time up to the close of business on the expiration date set forth in the prospectus supplement relating to the

warrants offered thereby. After the close of business on the expiration date, unexercised warrants will become void.

The

warrants may be exercised as set forth in the prospectus supplement relating to the warrants offered. Upon receipt of payment and the

warrant certificate properly completed and duly executed at the corporate trust office of the warrant agent or any other office indicated

in the prospectus supplement, we will, as soon as practicable, forward the securities purchasable upon such exercise. If less than all

of the warrants represented by such warrant certificate are exercised, a new warrant certificate will be issued for the remaining warrants.

Enforceability

of Rights By Holders of Warrants

Each

series of warrants will be issued under a separate warrant agreement to be entered into between a warrant agent and us. Each warrant

agent will act solely as our agent under the applicable warrant agreement and will not assume any obligation or relationship of agency

or trust with any holder of any warrant. A single bank or trust company may act as warrant agent for more than one issue of warrants.

A warrant agent will have no duty or responsibility in case of any default by us under the applicable warrant agreement or warrant, including

any duty or responsibility to initiate any proceedings at law or otherwise, or to make any demand upon us. Any holder of a warrant may,

without the consent of the related warrant agent or the holder of any other warrant, enforce by appropriate legal action its right to

exercise, and receive the securities purchasable upon exercise of, its warrants.

Amendments

and Supplements to the Warrant Agreements

We

may amend or supplement a warrant agreement without the consent of the holders of the applicable warrants to cure ambiguities in the

warrant agreement, to cure or correct a defective provision in the warrant agreement, or to provide for other matters under the warrant

agreement that we and the warrant agent deem necessary or desirable, so long as, in each case, such amendments or supplements do not

materially adversely affect the interests of the holders of the warrants.

Warrant

Adjustments

Unless

the applicable prospectus supplement states otherwise, the exercise price of, and the number of securities covered by, a warrant to purchase

ordinary shares or preferred shares will be adjusted proportionately if we subdivide or consolidate ordinary shares or preferred shares,

as applicable. In addition, unless the prospectus supplement states otherwise, if we, without payment:

|

|

●

|

issue

share capital or other securities convertible into or exchangeable for preferred shares or ordinary shares, or any rights to subscribe

for, purchase or otherwise acquire either class of shares, as a dividend or distribution to holders of our preferred shares or ordinary

shares;

|

|

|

|

|

|

|

●

|

pay

any cash to holders of our preferred shares or ordinary shares other than a cash dividend paid out of our current or retained earnings

or other than in accordance with the terms of the preferred shares;

|

|

|

|

|

|

|

●

|

issue

any evidence of our indebtedness or rights to subscribe for or purchase our indebtedness to holders of our preferred shares or ordinary

shares; or

|

|

|

●

|

issue

preferred shares or ordinary shares or additional shares or other securities or property to holders of our preferred shares or ordinary

shares by way of spinoff, split-up, reclassification, redesignation, consolidation, subdivision of shares or similar corporate rearrangement,

|

then

the holders of warrants will be entitled to receive upon exercise of the warrants, in addition to the securities otherwise receivable

upon exercise of the warrants and without paying any additional consideration, the amount of shares and other securities and property

those holders would have been entitled to receive had they held the preferred shares or ordinary shares, as applicable, issuable under

the warrants on the dates on which holders of those securities received or became entitled to receive the additional shares and other

securities and property.

Except

as stated above, the exercise price and number of securities covered by a preferred shares or ordinary share warrant, and the amounts

of other securities or property to be received, if any, upon exercise of those warrants, will not be adjusted or provided for if we issue

those securities or any securities convertible into or exchangeable for those securities, or securities carrying the right to purchase

those securities or securities convertible into or exchangeable for those securities.

Holders

of preferred shares or ordinary share warrants may have additional rights under the following circumstances:

|

|

●

|

certain

reclassifications, capital reorganizations or changes of the preferred shares or ordinary shares, as applicable;

|

|

|

|

|

|

|

●

|

certain

share exchanges, mergers, amalgamations, or similar transactions involving our company and which result in changes of preferred shares

or ordinary shares, as applicable; or

|

|

|

|

|

|

|

●

|

certain

sales or dispositions to another entity of all or substantially all of our property and assets.

|

If

one of the above transactions occurs and holders of our preferred shares or ordinary shares are entitled to receive shares, securities

or other property with respect to or in exchange for their securities, the holders of the preferred shares or ordinary share warrants

then outstanding, as applicable, will be entitled to receive upon exercise of their warrants the kind and amount of shares and other

securities or property that they would have received upon the applicable transaction if they had exercised their warrants immediately

before the transaction.

DESCRIPTION

OF SUBSCRIPTION RIGHTS

The

following is a general description of the terms of the subscription rights we may issue from time to time. Particular terms of any subscription

rights we offer will be described in the prospectus supplement or free writing prospectus relating to such subscription rights, and may

differ from the terms described herein.

We

may issue subscription rights to purchase our securities. These subscription rights may be issued independently or together with any

other security offered hereby and may or may not be transferable by the stockholder receiving the subscription rights in such offering.

In connection with any offering of subscription rights, we may enter into a standby arrangement with one or more underwriters or other

purchasers pursuant to which the underwriters or other purchasers may be required to purchase any securities remaining unsubscribed for

after such offering.

The

applicable prospectus supplement will describe the specific terms of any offering of subscription rights for which this prospectus is

being delivered, including the following:

|

|

●

|

whether

ordinary shares, preferred shares or warrants for those securities will be offered under the stockholder subscription rights;

|

|

|

●

|

the

price, if any, for the subscription rights;

|

|

|

|

|

|

|

●

|

the

exercise price payable for each security upon the exercise of the subscription rights;

|

|

|

|

|

|

|

●

|

the

number of subscription rights issued to each stockholder;

|

|

|

|

|

|

|

●

|

the

number and terms of the securities which may be purchased per each subscription right;

|

|

|

|

|

|

|

●

|

the

extent to which the subscription rights are transferable;

|

|

|

|

|

|

|

●

|

any

other terms of the subscription rights, including the terms, procedures and limitations relating to the exchange and exercise of

the subscription rights;

|

|

|

|

|

|

|

●

|

the

date on which the right to exercise the subscription rights shall commence, and the date on which the subscription rights shall expire;

|

|

|

|

|

|

|

●

|

the

extent to which the subscription rights may include an over-subscription privilege with respect to unsubscribed securities;

|

|

|

|

|

|

|

●

|

if

appropriate, a discussion of material U.S. federal income tax considerations; and

|

|

|

|

|

|

|

●

|

if

applicable, the material terms of any standby underwriting or purchase arrangement entered into by us in connection with the offering

of subscription rights

|

The

description in the applicable prospectus supplement of any subscription rights we offer will not necessarily be complete and will be

qualified in its entirety by reference to the applicable subscription rights certificate or subscription rights agreement, which will

be filed with the SEC if we offer subscription rights.

DESCRIPTION

OF PURCHASE CONTRACTS

The

following description summarizes the general features of the purchase contracts that we may offer under this prospectus. Although the

features we have summarized below will generally apply to any future purchase contracts we may offer under this prospectus, we will describe

the particular terms of any purchase contracts that we may offer in more detail in the applicable prospectus supplement. The specific

terms of any purchase contracts may differ from the description provided below as a result of negotiations with third parties in connection

with the issuance of those purchase contracts, as well as for other reasons. Because the terms of any purchase contracts we offer under

a prospectus supplement may differ from the terms we describe below, you should rely solely on information in the applicable prospectus

supplement if that summary is different from the summary in this prospectus.

We

will incorporate by reference into the registration statement of which this prospectus is a part the form of any purchase contract that

we may offer under this prospectus before the sale of the related purchase contract. The descriptions of the purchase contract terms

in this prospectus and in any prospectus supplement are summaries of the material provisions of the applicable purchase contracts. These

descriptions do not restate those purchase contracts in their entirety and may not contain all the information that you may find useful.

We urge you to read any applicable prospectus supplement related to specific purchase contracts being offered, as well as the complete

instruments that contain the terms of the securities that are subject to those purchase contracts. Certain of those instruments, or forms

of those instruments, have been filed as exhibits to the registration statement of which this prospectus is a part, and supplements to

those instruments or forms may be incorporated by reference into the registration statement of which this prospectus is a part from reports

we file with the SEC.

We

may issue purchase contracts, including contracts obligating holders to purchase from us, and for us to sell to holders, a specific or

variable number of our securities at a future date or dates. Alternatively, the purchase contracts may obligate us to purchase from holders,

and obligate holders to sell to us, a specific or varying number of our securities.

If

we offer any purchase contracts, certain terms of that series of purchase contracts will be described in the applicable prospectus supplement,

including, without limitation, the following:

|

|

●

|

the

price of the securities or other property subject to the purchase contracts (which may be determined by reference to a specific formula

described in the purchase contracts);

|

|

|

|

|

|

|

●

|

whether

the purchase contracts are issued separately, or as a part of units each consisting of a purchase contract and one or more of our

other securities, including U.S. Treasury securities, securing the holder’s obligations under the purchase contract; any requirement

for us to make periodic payments to holders or vice versa, and whether the payments are unsecured or pre-funded;

|

|

|

|

|

|

|

●

|

any

provisions relating to any security provided for the purchase contracts;

|

|

|

|

|

|

|

●

|

whether

the purchase contracts obligate the holder or us to purchase or sell, or both purchase and sell, the securities subject to purchase

under the purchase contract, and the nature and amount of each of those securities, or the method of determining those amounts;

|

|

|

|

|

|

|

●

|

whether

the purchase contracts are to be prepaid or not;

|

|

|

|

|

|

|

●

|

whether

the purchase contracts are to be settled by delivery, or by reference or linkage to the value, performance or level of the securities

subject to purchase under the purchase contract;

|

|

|

|

|

|

|

●

|

any

acceleration, cancellation, termination or other provisions relating to the settlement of the purchase contracts;

|

|

|

|

|

|

|

●

|

a

discussion of certain U.S. federal income tax considerations applicable to the purchase contracts;

|

|

|

|

|

|

|

●

|

whether

the purchase contracts will be issued in fully registered or global form; and

|

|

|

|

|

|

|

●

|

any

other terms of the purchase contracts and any securities subject to such purchase contracts.

|

For

more information, please review the forms of the relevant purchase contracts, which will be filed with the SEC promptly after the offering

of purchase contracts and will be available as described in the section of this prospectus captioned “Where You Can Find More Information.”

DESCRIPTION

OF UNITS

This

section outlines some of the provisions of the units and the unit agreements. This information may not be complete in all respects and

is qualified entirely by reference to the unit agreement with respect to the units of any particular series. The specific terms of any

series of units will be described in the applicable prospectus supplement or free writing prospectus. If so described in a particular

prospectus supplement or free writing prospectus, the specific terms of any series of units may differ from the general description of

terms presented below.

As

specified in the applicable prospectus supplement, we may issue units consisting of one or more shares of ordinary shares, preferred

shares, depositary shares, warrants, subscription rights, purchase contracts or units or any combination of such securities.

The

applicable prospectus supplement will specify the following terms of any units in respect of which this prospectus is being delivered:

|

|

●

|

the

terms of the units and of any of the ordinary shares, preferred shares, depositary shares, warrants, subscription rights or purchase

contracts comprising the units, including whether and under what circumstances the securities comprising the units may be traded

separately;

|

|

|

|

|

|

|

●

|

a

description of the terms of any unit agreement governing the units;

|

|

|

|

|

|

|

●

|

if

appropriate, a discussion of material U.S. federal income tax considerations; and

|

|

|

|

|

|

|

●

|

a

description of the provisions for the payment, settlement, transfer or exchange of the units.

|

LEGAL

OWNERSHIP OF SECURITIES

We

can issue securities in registered form or in the form of one or more global securities. We describe global securities in greater detail

below. We refer to those persons who have securities registered in their own names on the books that we or any applicable trustee, depositary

or warrant agent maintain for this purpose as the “holders” of those securities. These persons are the legal holders of the

securities. We refer to those persons who, indirectly through others, own beneficial interests in securities that are not registered

in their own names as “indirect holders” of those securities. As we discuss below, indirect holders are not legal holders

and investors in securities issued in book-entry form or in street name will be indirect holders.

Book-Entry

Holders

We

may issue securities in book-entry form only, as we will specify in the applicable prospectus supplement. This means securities may be

represented by one or more global securities registered in the name of a financial institution that holds them as depositary on behalf

of other financial institutions that participate in the depositary’s book-entry system. These participating institutions, which

are referred to as participants, in turn, hold beneficial interests in the securities on behalf of themselves or their customers.

Only

the person in whose name a security is registered is recognized as the holder of that security. Securities issued in global form will

be registered in the name of the depositary or its participants. Consequently, for securities issued in global form, we will recognize

only the depositary as the holder of the securities, and we will make all payments on the securities to the depositary. The depositary

passes along the payments it receives to its participants, which in turn pass the payments along to their customers who are the beneficial

owners. The depositary and its participants do so under agreements they have made with one another or with their customers; they are

not obligated to do so under the terms of the securities.

As

a result, investors in a book-entry security will not own securities directly. Instead, they will own beneficial interests in a global

security, through a bank, broker or other financial institution that participates in the depositary’s book-entry system or holds

an interest through a participant. As long as the securities are issued in global form, investors will be indirect holders, and not holders,

of the securities.

Street

Name Holders

We

may terminate a global security or issue securities in non-global form. In these cases, investors may choose to hold their securities

in their own names or in “street name.” Securities held by an investor in street name would be registered in the name of

a bank, broker or other financial institution that the investor chooses, and the investor would hold only a beneficial interest in those

securities through an account he or she maintains at that institution.

For

securities held in street name, we will recognize only the intermediary banks, brokers and other financial institutions in whose names

the securities are registered as the holders of those securities, and we will make all payments on those securities to them. These institutions

pass along the payments they receive to their customers who are the beneficial owners, but only because they agree to do so in their

customer agreements or because they are legally required to do so. Investors who hold securities in street name will be indirect holders,

not holders, of those securities.

Legal

Holders

Our

obligations, as well as the obligations of any third parties employed by us, run only to the legal holders of the securities. We do

not have obligations to investors who hold beneficial interests in global securities, in street name or by any other indirect means.

This will be the case whether an investor chooses to be an indirect holder of a security or has no choice because we are issuing the

securities only in global form.

For

example, once we make a payment or give a notice to the holder, we have no further responsibility for the payment or notice even if that

holder is required, under agreements with depositary participants or customers or by law, to pass it along to the indirect holders but

does not do so. Similarly, we may want to obtain the approval of the holders. In such an event, we would seek approval only from

the holders, and not the indirect holders, of the securities. Whether and how the holders contact the indirect holders is up to the holders.

Special

Considerations for Indirect Holders

If

you hold securities through a bank, broker or other financial institution, either in book-entry form or in street name, you should check

with your own institution to find out:

|

|

●

|

how

it handles securities payment and notices;

|

|

|

|

|

|

|

●

|

whether

it imposes fees or charges;

|

|

|

|

|

|

|

●

|

how

it would handle a request for the holders’ consents, if ever required;

|

|

|

|

|

|

|

●

|

whether

and how you can instruct it to send your securities registered in your own name so you can be a registered holder;

|

|

|

|

|

|

|

●

|

how

it would exercise rights under the securities if there were a default or other event triggering the need for holders to act to protect

their interests; and

|

|

|

|

|

|

|

●

|

if

the securities are in book-entry form, how the depositary’s rules and procedures will affect these matters.

|

Global

Securities

A

global security is a security that represents one or any other number of individual securities held by a depositary. Generally, all securities

represented by the same global securities will have the same terms.

Each

security issued in book-entry form will be represented by a global security that we deposit with and register in the name of a financial

institution or its nominee that we select. The financial institution that we select for this purpose is called the depositary. Unless

we specify otherwise in the applicable prospectus supplement, The Depository Trust Company, New York, New York, which we refer to as

DTC, will be the depositary for all securities issued in book-entry form.

A

global security may not be transferred to or registered in the name of anyone other than the depositary, its nominee or a successor depositary,

unless special termination situations arise. We describe those situations below under “Special Situations When a Global Security

Will Be Terminated.” As a result of these arrangements, the depositary, or its nominee, will be the sole registered owner and holder

of all securities represented by a global security, and investors will be permitted to own only beneficial interests in a global security.

Beneficial interests must be held by means of an account with a broker, bank or other financial institution that in turn has an account

with the depositary or with another institution that does. Thus, an investor whose security is represented by a global security will

not be a holder of the security, but only an indirect holder of a beneficial interest in the global security.

If

the prospectus supplement for a particular security indicates that the security will be issued in global form only, then the security

will be represented by a global security at all times unless and until the global security is terminated. If termination occurs, we may

issue the securities through another book-entry clearing system or decide that the securities may no longer be held through any book-entry

clearing system.

Special

Considerations for Global Securities

As

an indirect holder, an investor’s rights relating to a global security will be governed by the account rules of the investor’s

financial institution and of the depositary, as well as general laws relating to securities transfers. We do not recognize an indirect

holder as a holder of securities and instead deal only with the depositary that holds the global security.

If

securities are issued only in the form of a global security, an investor should be aware of the following:

|

|

●

|

an

investor cannot cause the securities to be registered in his or her name, and cannot obtain non-global certificates for his or her

interest in the securities, except in the special situations we describe below

|

|

|

|

|

|

|

●

|

an

investor will be an indirect holder and must look to his or her own bank or broker for payments on the securities and protection

of his or her legal rights relating to the securities, as we describe above;

|

|

|

|

|

|

|

●

|

an

investor may not be able to sell interests in the securities to some insurance companies and to other institutions that are required

by law to own their securities in non-book-entry form;

|

|

|

|

|

|

|

●

|

an

investor may not be able to pledge his or her interest in a global security in circumstances where certificates representing the

securities must be delivered to the lender or other beneficiary of the pledge in order for the pledge to be effective;

|

|

|

|

|

|

|

●

|

the

depositary’s policies, which may change from time to time, will govern payments, transfers, exchanges and other matters relating

to an investor’s interest in a global security. We and any applicable trustee have no responsibility for any aspect of the

depositary’s actions or for its records of ownership interests in a global security. We and the trustee also do not supervise

the depositary in any way;

|

|

|

|

|

|

|

●

|

the

depositary may, and we understand that DTC will, require that those who purchase and sell interests in a global security within its

book-entry system use immediately available funds, and your broker or bank may require you to do so as well; and

|

|

|

●

|

financial

institutions that participate in the depositary’s book-entry system, and through which an investor holds its interest in a

global security, may also have their own policies affecting payments, notices and other matters relating to the securities.

|

There

may be more than one financial intermediary in the chain of ownership for an investor. We do not monitor and are not responsible for

the actions of any of those intermediaries.

Special

Situations When a Global Security Will Be Terminated

In

a few special situations described below, the global security will terminate and interests in it will be exchanged for physical certificates

representing those interests. After that exchange, the choice of whether to hold securities directly or in street name will be up to

the investor. Investors must consult their own banks or brokers to find out how to have their interests in securities transferred to

their own name, so that they will be direct holders. We have described the rights of holders and street name investors above.

A

global security will terminate when the following special situations occur:

|

|

●

|

if

the depositary notifies us that it is unwilling, unable or no longer qualified to continue as depositary for that global security

and we do not appoint another institution to act as depositary within 90 days;

|

|

|

|

|

|

|

●

|

if

we notify any applicable trustee that we wish to terminate that global security; or

|

|

|

|

|

|

|

●

|

if

an event of default has occurred with regard to securities represented by that global security and has not been cured or waived.

|

The

applicable prospectus supplement may also list additional situations for terminating a global security that would apply only to the particular

series of securities covered by the prospectus supplement. When a global security terminates, the depositary, and not we or any applicable

trustee, is responsible for deciding the names of the institutions that will be the initial direct holders.

SELLING

SHAREHOLDERS

This

prospectus also relates to the possible sale from time to time of our ordinary shares by certain of our shareholders, who we refer to

in this prospectus as the “selling shareholders.”

Information

about the selling shareholders will be set forth in an applicable prospectus supplement. The selling shareholders may from time to time

offer and sell such securities pursuant to this prospectus and any applicable prospectus supplement.

The

selling shareholders shall not sell any of our ordinary shares pursuant to this prospectus until we have identified such selling shareholders

and the ordinary shares which may be offered for resale by such selling shareholders in a subsequent prospectus supplement. However,

the selling shareholders may sell or transfer all or a portion of their ordinary shares pursuant to any available exemption from the

registration requirements of the Securities Act.

PLAN

OF DISTRIBUTION

We

or any selling shareholders may sell our securities in any one or more of the following ways:

|

|

●

|

to

or through underwriters, brokers or dealers (acting as agent or principal);

|

|

|

|

|

|

|

●

|

directly

to one or more other purchasers;

|

|

|

|

|

|

|

●

|

upon

the exercise of rights distributed or issued to our security holders;

|

|

|

●

|

through

a block trade in which the broker or dealer engaged to handle the block trade will attempt to sell the securities as agent, but may

position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

|

|

|

|

●

|

in

“at the market” offerings within the meaning of Rule 415(a)(4) under the Securities Act or through a market maker or

into an existing market, on an exchange, or otherwise;

|

|

|

|

|

|

|

●

|

directly

to purchasers, through a specific bidding or auction process, on a negotiated basis or otherwise;

|

|

|

|

|

|

|

●

|

through

agents on a best-efforts basis;

|

|

|

|

|

|

|

●

|

through

any other method permitted pursuant to applicable law; or

|

|

|

|

|

|

|

●

|

otherwise

through a combination of any of the above methods of sale.

|

Sales

of securities may be effected from time to time in one or more transactions, including negotiated transactions:

|

|

●

|

at

a fixed price or prices, which may be changed;

|

|

|

|

|

|

|

●

|

at

market prices prevailing at the time of sale;

|

|

|

|

|

|

|

●

|

at

prices related to prevailing market prices;

|

|

|

|

|

|

|

●

|

at

varying prices determined at the time of sale; or

|

|

|

|

|

|

|

●

|

at

negotiated prices.

|

In

addition, we or any selling shareholders may enter into option, share lending or other types of transactions that require us or any such

selling shareholders, as applicable, to deliver ordinary shares to an underwriter, broker or dealer, who will then resell or transfer

the ordinary shares under this prospectus. We or any selling shareholders may also enter into hedging transactions with respect to our

securities or the securities of any such selling shareholders, as applicable. For example, we or the selling shareholders may enter into

option or other types of transactions that require us or any selling shareholders, as applicable, to deliver ordinary shares to an underwriter,

broker or dealer, who will then resell or transfer the ordinary shares under this prospectus; or loan or pledge the ordinary shares to

an underwriter, broker or dealer, who may sell the loaned shares or, in the event of default, sell the pledged shares.

Any

selling stockholder will act independently of us in making decisions with respect to the timing, manner and size of each sale of ordinary

shares covered by this prospectus.

We

or any selling shareholders may enter into derivative transactions with third parties, or sell securities not covered by this prospectus

to third parties in privately negotiated transactions. If the applicable prospectus supplement so indicates, in connection with those

derivatives, the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in

short sale transactions. If so, the third party may use securities pledged by us or any such selling shareholders, as applicable, or

borrowed from us, any such selling shareholders or others to settle those sales or to close out any related open borrowings of stock,

and may use securities received from us or any selling shareholders in settlement of those derivatives to close out any related open

borrowings of stock. The third party in such sale transactions will be an underwriter and, if not identified in this prospectus, will

be identified in the applicable prospectus supplement (or a post-effective amendment of the registration statement of which this prospectus

is a part). In addition, we or any selling shareholders may otherwise loan or pledge securities to a financial institution or other third

party that in turn may sell the securities short using this prospectus. Such financial institution or other third party may transfer

its economic short position to investors in our securities or the securities of any such selling shareholders, as applicable, or in connection

with a concurrent offering of other securities.

Ordinary

shares may also be exchanged for satisfaction of any selling shareholders’ obligations or other liabilities to their creditors.

Such transactions may or may not involve brokers or dealers.

If

we or any selling shareholders use any underwriter, the prospectus supplement will name any underwriter involved in the offer and sale

of the securities. If underwriters or dealers are used in the sale, the securities will be acquired by the underwriters or dealers for

their own account. The prospectus supplement will also set forth the terms of the offering, including:

|

|

●

|

the

purchase price of the securities and the proceeds we or any selling shareholders, as applicable, will receive from the sale of the

securities;

|

|

|

|

|

|

|

●

|

any

underwriting discounts and other items constituting underwriters’ compensation;

|

|

|

|

|

|

|

●

|

any

public offering or purchase price and any discounts or commissions allowed or re-allowed or paid to dealers;

|

|

|

|

|

|

|