Galera Reports Third Quarter 2022 Financial Results and Recent Corporate Updates

November 09 2022 - 7:00AM

Galera Therapeutics, Inc. (Nasdaq: GRTX), a clinical-stage

biopharmaceutical company focused on developing and commercializing

a pipeline of novel, proprietary therapeutics that have the

potential to transform radiotherapy in cancer, today announced

financial results for the third quarter ended September 30, 2022

and provided recent corporate updates.

“During the quarter, we added to the package of data supporting

our planned avasopasem New Drug Application in radiotherapy-induced

severe oral mucositis, which we are on track to submit by the end

of the year,” said Mel Sorensen, M.D., Galera’s President and CEO.

“We presented long-term follow-up data from ROMAN at ASTRO, the

major annual radiation oncology conference, affirming what we saw

in GT-201, specifically that avasopasem reduced severe oral

mucositis while maintaining the clinical benefit of radiation

therapy. Moreover, patients were also evaluated for renal function

during the one-year follow-up period, and the data showed a 50%

reduction in chronic kidney disease, a known cisplatin-related

superoxide toxicity.”

Dr. Sorensen continued: “Our market research continues to

indicate that radiation and medical oncologists treating head and

neck cancer view the avasopasem profile favorably and that the

majority would prescribe avasopasem if approved by the FDA. The

research also indicates that physicians view SOM — the most

burdensome side effect of radiation therapy for head and neck

cancer — as something best characterized by several key measures.

These include not only whether a patient develops SOM, but also how

long they suffer from it, when it first develops and whether it

worsens into the most severe grade, Grade 4 OM. The meta-analysis

of the already positive results from both the ROMAN and GT-201

trials underscores that avasopasem improves SOM across these

measures.”

Recent Corporate Updates

Radiotherapy-Induced Toxicity Programs:

Severe Oral Mucositis (SOM)

- The Company remains on track to submit a New Drug Application

(NDA) for avasopasem manganese 90 mg for radiotherapy-induced SOM

to the U.S. Food and Drug Administration (FDA) by the end of

2022.

- Long-term follow-up data from the ROMAN trial was presented in

an oral presentation at the 2022 American Society for Radiation

Oncology (ASTRO) Annual Meeting. After one-year follow-up on ROMAN,

patients receiving avasopasem in combination with the

standard-of-care regimen demonstrated comparable tumor outcomes and

overall survival to patients in the placebo arm, showing that

avasopasem protected patients with head and neck cancer from SOM

without affecting the treatment benefit of standard-of-care

chemoradiotherapy.

- In a prospectively defined component of the ROMAN long-term

follow-up data, also presented at ASTRO, patients treated with

avasopasem in combination with radiotherapy and cisplatin had a 10%

incidence of chronic kidney disease (CKD) after one year of post

treatment follow-up, half the 20% rate in the placebo arm

(p=0.0043). This exploratory endpoint was based on mechanism-driven

non-clinical studies and a retrospective analysis of GT-201 and

suggests avasopasem may offer a further benefit for these

patients.

- Additionally, a meta-analysis of Galera’s two randomized

placebo-controlled trials (ROMAN and GT-201; n=551) was included in

the ASTRO presentation, and showed clinically meaningful reductions

in the incidence, duration, onset and severity of SOM compared to

placebo across both trials.

- A poster presentation during ASTRO highlighted the completed

Phase 2 EUSOM trial of avasopasem for radiotherapy-induced SOM in

Europe.

Esophagitis

- Final data from the open-label, single-arm Phase 2 AESOP trial

of avasopasem for severe acute radiotherapy-induced esophagitis in

patients with lung cancer receiving concurrent chemoradiotherapy

were presented at ASTRO. The Company previously reported positive

topline data from the trial demonstrating that avasopasem was well

tolerated and the incidence of Grade 3 esophagitis was

substantially reduced in comparison to expectations based on review

of historical data in the literature. No patients experienced Grade

4 or 5 esophagitis at any point during the AESOP trial.

Anti-Cancer Programs:

Locally Advanced Pancreatic Cancer (LAPC)

- Enrollment is ongoing in the randomized, placebo-controlled

Phase 2b GRECO-2 trial of rucosopasem in combination with

stereotactic body radiation therapy (SBRT) in patients with LAPC.

The primary endpoint of the trial is overall survival. Completion

of enrollment is expected in the second half of 2023.

Non-Small Cell Lung Cancer (NSCLC)

- A poster presentation at ASTRO highlighted the ongoing

randomized, placebo-controlled Phase 2 stage of the GRECO-1 trial

of rucosopasem in combination with SBRT in patients with NSCLC.

Completion of enrollment in the Phase 2 stage of this trial is

expected in the second half of 2023.

General Corporate Updates:

- The Company appointed Eugene P. Kennedy, M.D., F.A.C.S., as

Chief Medical Officer. Dr. Kennedy is a renowned Johns

Hopkins-trained surgical oncologist and former Chief of Pancreatic

and Hepatobiliary Surgery at Thomas Jefferson University with over

15 years’ experience in clinical development and biopharma

leadership. He will succeed Jon T. Holmlund, M.D., who plans to

retire at the end of this year following the planned submission of

the Company’s NDA for avasopasem to the FDA.

Third Quarter 2022 Financial Highlights

- Research and development expenses were $8.1 million in the

third quarter of 2022, compared to $14.8 million for the same

period in 2021. The decrease was primarily attributable to a

decrease in avasopasem development costs, partially offset by an

increase in rucosopasem development costs.

- General and administrative expenses were $4.9 million in the

third quarter of 2022, compared to $5.5 million for the same period

in 2021. The decrease was primarily attributable to the timing of

spend for avasopasem commercial preparations.

- Galera reported a net loss of ($16.0) million, or $(0.60) per

share, for the third quarter of 2022, compared to a net loss of

$(22.6) million, or $(0.86) per share, for the same period in

2021.

- As of September 30, 2022, Galera had cash, cash equivalents and

short-term investments of $42.8 million. Galera expects that its

existing cash, cash equivalents and short-term investments will

enable Galera to fund its operating expenses and capital

expenditure requirements into the second half of 2023.

About Galera TherapeuticsGalera Therapeutics,

Inc. is a clinical-stage biopharmaceutical company focused on

developing and commercializing a pipeline of novel, proprietary

therapeutic candidates that have the potential to transform

radiotherapy in cancer. Galera’s selective dismutase mimetic

product candidate avasopasem manganese (avasopasem, or GC4419) is

being evaluated for radiotherapy-induced toxicities. The Company’s

second product candidate, rucosopasem manganese (rucosopasem, or

GC4711), is in clinical-stage development to augment the

anti-cancer efficacy of stereotactic body radiation therapy in

patients with non-small cell lung cancer and locally advanced

pancreatic cancer. Galera is headquartered in Malvern, PA. For more

information, please

visit www.galeratx.com.

Forward-Looking Statements This press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. All statements

contained in this press release that do not relate to matters of

historical fact should be considered forward-looking statements,

including without limitation statements regarding: the expectations

surrounding the continued advancement of Galera’s product pipeline;

the potential safety and efficacy of Galera’s product candidates

and their regulatory and clinical development; the timing of the

submission of an NDA for avasopasem for radiotherapy-induced SOM in

patients with locally advanced head and neck cancer with the FDA;

the ability of avasopasem to reduce SOM while maintaining the

clinical benefit of radiation therapy; the ability of avasopasem to

reduce the incidence of CKD; the expectations surrounding the

progress of the Phase 2b trial of rucosopasem in patients with LAPC

and the timing of completion of enrollment of the trial; the

expectations surrounding the progress of the Phase 1/2 trial of

rucosopasem in patients with NSCLC and the timing of completion of

enrollment of the trial; the Company’s ability to achieve its goal

of transforming radiotherapy in cancer treatment with its selective

dismutase mimetics; the potential of GC4711 to augment the

anti-cancer efficacy of SBRT in patients with NSCLC and LAPC; and

the Company’s ability to fund its operating expenses and capital

expenditure into the second half of 2023. These forward-looking

statements are based on management’s current expectations. These

statements are neither promises nor guarantees, but involve known

and unknown risks, uncertainties and other important factors that

may cause Galera’s actual results, performance or achievements to

be materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements, including, but not limited to, the following: Galera’s

limited operating history; anticipating continued losses for the

foreseeable future; substantial doubt regarding our ability to

continue as a going concern; needing substantial funding and the

ability to raise capital; Galera’s dependence on avasopasem

manganese (GC4419); uncertainties inherent in the conduct of

clinical trials; difficulties or delays enrolling patients in

clinical trials; the FDA’s acceptance of data from clinical trials

outside the United States; undesirable side effects from Galera’s

product candidates; risks relating to the regulatory approval

process; failure to capitalize on more profitable product

candidates or indications; ability to receive or maintain

Breakthrough Therapy Designation or Fast Track Designation for

product candidates; failure to obtain regulatory approval of

product candidates in the United States or other jurisdictions;

ongoing regulatory obligations and continued regulatory review;

risks related to commercialization; risks related to competition;

ability to retain key employees and manage growth; risks related to

intellectual property; inability to maintain collaborations or the

failure of these collaborations; Galera’s reliance on third

parties; the possibility of system failures or security breaches;

liability related to the privacy of health information obtained

from clinical trials and product liability lawsuits; unfavorable

pricing regulations, third-party reimbursement practices or

healthcare reform initiatives; environmental, health and safety

laws and regulations; the impact of the COVID-19 pandemic on

Galera’s business and operations, including preclinical studies and

clinical trials, and general economic conditions; risks related to

ownership of Galera’s common stock; the possibility of Galera’s

common stock being delisted from The Nasdaq Global Market; and

significant costs as a result of operating as a public company.

These and other important factors discussed under the caption “Risk

Factors” in Galera’s Annual Report on Form 10-K for the year ended

December 31, 2021 and Quarterly Report on Form 10-Q for the quarter

ended September 30, 2022 filed with the U.S. Securities and

Exchange Commission (SEC) and Galera’s other filings with the SEC

could cause actual results to differ materially from those

indicated by the forward-looking statements made in this press

release. Any forward-looking statements speak only as of the date

of this press release and are based on information available to

Galera as of the date of this release, and Galera assumes no

obligation to, and does not intend to, update any forward-looking

statements, whether as a result of new information, future events

or otherwise.

| |

|

|

|

|

|

|

|

| Galera

Therapeutics, Inc. |

| Consolidated

Statements of Operations |

| (unaudited,

in thousands except share and per share data) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Research and development |

$ |

8,106 |

|

|

$ |

14,813 |

|

|

$ |

22,875 |

|

|

$ |

43,203 |

|

|

General and administrative |

|

4,853 |

|

|

|

5,487 |

|

|

|

15,193 |

|

|

|

15,667 |

|

| Loss from

operations |

|

(12,959 |

) |

|

|

(20,300 |

) |

|

|

(38,068 |

) |

|

|

(58,870 |

) |

|

Other income (expense), net |

|

(3,074 |

) |

|

|

(2,326 |

) |

|

|

(7,966 |

) |

|

|

(4,857 |

) |

| Net

loss |

$ |

(16,033 |

) |

|

$ |

(22,626 |

) |

|

$ |

(46,034 |

) |

|

$ |

(63,727 |

) |

| |

|

|

|

|

|

|

|

|

Net loss per share of common stock, basic and diluted |

$ |

(0.60 |

) |

|

$ |

(0.86 |

) |

|

$ |

(1.72 |

) |

|

$ |

(2.49 |

) |

|

Weighted average common shares outstanding, basic and diluted |

|

26,823,546 |

|

|

|

26,304,920 |

|

|

|

26,798,348 |

|

|

|

25,569,545 |

|

|

|

|

|

|

|

|

|

|

| Galera

Therapeutics, Inc. |

| Selected

Consolidated Balance Sheet Data |

| (unaudited,

in thousands) |

| |

|

|

|

| |

September

30, |

|

December

31, |

| |

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

| Cash, cash

equivalents, and short-term investments |

$ |

42,769 |

|

|

$ |

71,217 |

|

| Total

assets |

|

50,713 |

|

|

|

83,311 |

|

| Total

current liabilities |

|

11,632 |

|

|

|

12,935 |

|

| Total

liabilities |

|

148,215 |

|

|

|

141,315 |

|

| Total

stockholders' deficit |

|

(97,502 |

) |

|

|

(58,004 |

) |

| |

|

|

|

Investor Contacts:Christopher DegnanGalera

Therapeutics, Inc.610-725-1500cdegnan@galeratx.com

William WindhamSolebury Strategic

Communications646-378-2946wwindham@soleburystrat.com

Media Contact:Zara LockshinSolebury Strategic

Communications330-417-6250zlockshin@soleburystrat.com

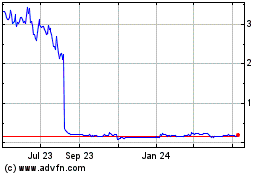

Galera Therapeutics (NASDAQ:GRTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

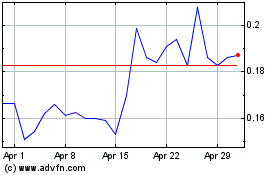

Galera Therapeutics (NASDAQ:GRTX)

Historical Stock Chart

From Apr 2023 to Apr 2024