FVCBankcorp, Inc. (NASDAQ:FVCB) (the “Company”) today reported

second quarter 2019 net income of $4.1 million, or $0.28 diluted

earnings per share, compared to $3.1 million, or $0.26 diluted

earnings per share, for the quarterly period ended June 30, 2018.

Weighted-average common shares outstanding for the diluted earnings

per share calculations were 14.8 million and 12.1 million for the

three months ended June 30, 2019 and 2018, respectively, reflecting

the increase from shares issued in 2018 for the initial public

offering and acquisition of Colombo Bank (“Colombo”).

For the six month period ended June 30, 2019, net income was

$8.0 million, or $0.54 per diluted earnings per share, compared to

$6.1 million, or $0.50 diluted earnings per share, for the six

month period ended June 30, 2018. Before merger-related expenses

net of taxes, net income for the six months ended June 30, 2019 was

$8.1 million, or $0.55 per diluted share and for the prior year net

income for the six month period was $6.4 million, or $0.53 diluted

earnings per share.

Return on average assets was 1.13% and return on average equity

was 9.78% for the second quarter of 2019. For the comparable

quarterly June 30, 2018 period, return on average assets was 1.13%

and return on average equity was 12.00%. For the six months ended

June 30, 2019 and 2018, return on average assets was 1.14% and

1.13%, respectively. Return on average equity for the six months

ended June 30, 2019 and 2018 was 9.76% and 12.02%,

respectively.

Selected Highlights

- Record Earnings. Earnings increased $1.0 million, or

33%, to $4.1 million for the second quarter of 2019 as compared to

the same 2018 period. Net interest margin increased to 3.59% for

the quarter ended June 30, 2019 compared to 3.50% for the year ago

quarter ended June 30, 2018, and decreased from 3.65% for the

linked quarter ended March 31, 2019.

- Strong Loan Growth. Total loans, net of deferred fees,

totaled $1.23 billion at June 30, 2019, an increase of $55.4

million, or 19% annualized, from March 31, 2019. Year-over-year

loan growth was $278.7 million, or 29% from June 30, 2018 to June

30, 2019. Excluding the $110 million of loans associated with the

Colombo acquisition, organic growth was $168 million, or 18%.

- Sound Asset Quality. Asset quality remains strong, with

nonperforming loans and loans past due 90 days or more as a

percentage of total assets of 0.67% at June 30, 2019. Nonperforming

loans and loans past due 90 days or more totaled $10.0 million at

June 30, 2019, of which $2.9 million were acquired loans from

Colombo.

- Strong Core Deposit Growth. Total deposits increased

$56.7 million, to $1.27 billion at June 30, 2019, or 19%

annualized, from March 31, 2019. Noninterest-bearing deposits

increased $37.4 million, or 16% during 2019 and represent 21% of

the total deposit base at June 30, 2019.

- Improved Tangible Book Value. Tangible book value per

share at June 30, 2019 was $11.70, a 25% increase from $9.38 at

June 30, 2018.

“I continue to be pleased with how our Company performed during

the second quarter of 2019. FVCbank has consistently reported

record earnings which has been driven by strong loan and deposit

growth, a direct result of our expanded regional presence and the

strength of our business development teams,” stated David W. Pijor,

Chairman and CEO.

Balance Sheet

Total assets increased to $1.48 billion at June 30, 2019

compared to $1.14 billion at June 30, 2018, an increase of $345.2

million, or 30%. Loans receivable, net of deferred fees, totaled

$1.23 billion at June 30, 2019, compared to $955.6 million at June

30, 2018, an increase of $278.7 million, or 29%. Excluding the $110

million of loans associated with the Colombo acquisition, organic

growth was $168 million, or 18%. During the second quarter of 2019,

average loans grew $70.0 million, or 25% annualized. During the

quarter, loan originations totaled approximately $114 million, of

which $77 million funded during the quarter.

Investment securities increased $17.4 million to $136.2 million

at June 30, 2019, compared to $118.8 million at June 30, 2018.

Total deposits increased to $1.27 billion at June 30, 2019

compared to $1.01 billion at June 30, 2018, an increase of $260.5

million, or 26%. Core deposits, which represent total deposits less

wholesale deposits, increased $255.5 million or 27% to $1.19

billion at June 30, 2019 compared to $931.6 million at June 30,

2018. Wholesale deposits totaled $82.2 million, or 6% of total

deposits at June 30, 2019, a decrease of $33.2 million from March

31, 2019. Noninterest-bearing deposits increased $17.0 million to

$270.7 million at June 30, 2019 from $253.7 million at March 31,

2019, and represented 21% of total deposits at June 30, 2019.

Income Statement

Net interest income totaled $12.4 million, an increase of $3.0

million, or 32%, for the quarter ended June 30, 2019, compared to

the year ago quarter, and an increase of $607 thousand, or 5%

compared to the first quarter of 2019. The Company’s net interest

margin increased 9 basis points to 3.59% for the quarter ended June

30, 2019 compared to 3.50% for the quarter ended June 30, 2018. On

a linked quarter basis, net interest margin decreased 6 basis

points from 3.65% for the three months ended March 31, 2019,

primarily a result of a decrease in acquired loan accretion and an

increase in the cost of interest-bearing deposits. For the six

months ended June 30, 2019, net interest income was $24.1 million

compared to $18.1 million for the year to date period ended June

30, 2018, an increase of $6.0 million, or 33%.

Cost of deposits, which include noninterest-bearing deposits,

for the second quarter of 2019 was 1.36%, compared to 0.95% for the

second quarter of 2018, reflecting the increased rate environment

from a year ago. The Company has also been successful in adding

several new customer relationships at current market rates which

have contributed to the increase in deposit costs year-over-year.

The average yield for the loan portfolio for the second quarter of

2019 was 5.24% compared to 4.86% for the year ago quarter, and

5.23% for the quarter ended March 31, 2019. Included in net

interest income for the second quarter of 2019 is $222 thousand in

acquired loan accretion associated with the Company’s acquired loan

portfolio, which has contributed to the increase in margin.

Acquired loan accretion was $245 thousand for the first quarter of

2019.

Noninterest income totaled $539 thousand and $363 thousand for

the quarters ended June 30, 2019 and 2018, respectively. Fee income

from loans was $53 thousand, an increase of $49 thousand for the

quarter ended June 30, 2019 compared to 2018, primarily a result of

an increase in commercial loan fee income. Compared to the quarter

ended March 31, 2019, fees on loans decreased $294 thousand, all of

which was a result of a decrease in loan swap fee income during the

quarter ended June 30, 2019. Service charges on deposit accounts

and other fee income totaled $376 thousand for the second quarter

of 2019, an increase of 50% or $125 thousand from the year ago

quarter. This increase in deposit fee income resulted from the

increase in core deposit relationships, both organic and acquired,

year over year. Noninterest income for the year to date period

ended June 30, 2019 was $1.3 million, compared to $748 thousand for

the 2018 year to date period, an increase of $529 thousand, or 71%,

which was primarily driven by loan swap fee income and service

charges on deposit accounts.

Noninterest expense totaled $7.3 million for the quarter ended

June 30, 2019, compared to $5.8 million for the same three-month

period of 2018. Approximately $893 thousand of the increase in

noninterest expense from the year ago quarter is attributable to

expenses associated with Colombo’s former operations, in addition

to merger-related expenses of $16 thousand for the three months

ended June 30, 2019. Salary and compensation related expenses

increased $921 thousand, or 28%, for the quarter ended June 30,

2019, compared to the same three-month period of 2018, resulting

from the increase in staffing from the acquisition and increases in

back-office support staff. Occupancy and equipment expense

increased $293 thousand year-over-year primarily as a result of the

branch locations acquired from Colombo. Increases in data

processing and network administration, franchise taxes and other

operating expenses for the quarter ended June 30, 2019 compared to

the same three-month period of 2018 is primarily growth related. On

a linked quarter basis, noninterest expense increased $372 thousand

from the three months ended March 31, 2019, primarily a result of

salary increases related to the Company’s annual performance review

process and an increase in the variable component to employee

compensation. For the six months ended June 30, 2019 and 2018,

noninterest expense was $14.2 million and $11.1 million,

respectively, the increase of which relates directly to the

addition of Colombo to the Company’s expense structure.

The efficiency ratio for the quarter ended June 30, 2019 was

56.4%, a decrease from 59.9% from the year ago quarter. The

efficiency ratios for the six months ended June 30, 2019 and 2018,

excluding merger-related expenses were 55.5% and 56.6%,

respectively.

Asset Quality

The Company recorded provision for loan losses of $505 thousand

for the three months ended June 30, 2019, compared to $281 thousand

for the year ago quarter. Year to date provision expense for 2019

was $1.0 million compared to $639 thousand for the 2018 year to

date period. Asset quality remains strong as nonperforming loans

and loans ninety days or more past due totaled $10.2 million, or

0.68% of total assets, of which $2.7 million related to acquired

loans. All of the Company’s nonperforming loans are secured with

three loans having specific reserves totaling $325 thousand. There

were no performing troubled debt restructurings (“TDR”) at June 30,

2019, compared to $4.1 million at March 31, 2019, which is now

included as part of the nonperforming loan portfolio and represents

the decline in the allowance to nonperforming loans ratio.

Nonperforming assets (including TDRs and other real estate owned)

to total assets was 0.93% at June 30, 2019 compared to 0.83% for

March 31, 2019. The allowance for loan losses to total loans was

0.81% for each of the periods ended June 30, 2019 and December 31,

2018. The allowance for loan losses on the Company’s originated

portfolio was 0.89% of loans outstanding at June 30, 2019 versus

0.92% at December 31, 2018, a result of acquired loans maturing and

moving to the originated portfolio at renewal. One charge-off of

$20 thousand was recorded during the second quarter of 2019 which

was related to the Company’s purchased consumer installment loan

portfolio.

About FVCBankcorp Inc.

FVCBankcorp, Inc. is the holding company for FVCbank, a

wholly-owned subsidiary of FVCB which commenced operations in

November 2007. FVCbank is a $1.48 billion Virginia-chartered

community bank serving the banking needs of commercial businesses,

nonprofit organizations, professional service entities, their

owners and employees located in the greater Baltimore and

Washington D.C., metropolitan areas. Locally owned and managed,

FVCbank is based in Fairfax, Virginia, and has 11 full-service

offices in Arlington, Ashburn, Fairfax, Manassas, Reston and

Springfield, Virginia, Washington D.C., and Baltimore, Bethesda,

Rockville and Silver Spring, Maryland.

For more information on the Company’s selected financial

information, please visit the Investor Relations page of

FVCBankcorp Inc.’s website, www.fvcbank.com.

Caution about Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements include, but are not limited, statements of

goals, intentions, and expectations as to future trends, plans,

events or results of the Company’s operations and policies and

regarding general economic conditions. In some cases,

forward-looking statements can be identified by use of words such

as “may,” “will,” “anticipates,” “believes,” “expects,” “plans,”

“estimates,” “potential,” “continue,” “should,” and similar words

or phrases. These statements are based upon current and anticipated

economic conditions, nationally and in the Company’s market,

interest rates and interest rate policy, competitive factors, and

other conditions which by their nature, are not susceptible to

accurate forecast and are subject to significant uncertainty.

Because of these uncertainties and the assumptions on which this

discussion and the forward-looking statements are based, actual

future operations and results in the future may differ materially

from those indicated herein. These forward-looking statements are

based on current beliefs that involve significant risks,

uncertainties, and assumptions. Factors that could cause the

Company’s actual results to differ materially from those indicated

in these forward-looking statements, include, but are not limited

to, the risk factors and other cautionary language included in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2018 and in other periodic and current reports filed with the

Securities and Exchange Commission. Because of these uncertainties

and the assumptions on which the forward-looking statements are

based, actual operations and results in the future may differ

materially from those indicated herein. Readers are cautioned

against placing undue reliance on any such forward-looking

statements. The Company’s past results are not necessarily

indicative of future performance.

FVCBankcorp, Inc. Selected Financial Data (Dollars

in thousands, except share data and per share data)

(Unaudited)

For the Three Months Ended

June 30,

For the Six Months Ended June

30,

For the Three Months

Ended

2019

2018

2019

2018

3/31/2019

12/31/2018

Selected Balances Total assets

$

1,484,600

$

1,139,449

$

1,419,763

$

1,351,576

Total investment securities

141,611

122,644

144,865

130,597

Total loans, net of deferred fees

1,234,372

955,641

1,178,941

1,136,743

Allowance for loan losses

(9,996)

(8,298)

(9,512)

(9,159)

Total deposits

1,269,374

1,008,896

1,212,695

1,162,440

Subordinated debt

24,447

24,367

24,427

24,407

Total stockholders’ equity

170,163

103,966

163,993

158,336

Summary Results of Operations Interest income

$

16,990

$

12,070

$

32,950

$

23,411

$

15,960

$

15,640

Interest expense

4,619

2,714

8,815

5,292

4,196

3,823

Net interest income

12,371

9,356

24,135

18,119

11,764

11,817

Provision for loan losses

505

281

1,020

639

515

930

Net interest income after provision for loan losses

11,866

9,075

23,115

17,480

11,249

10,887

Noninterest income - loan fees, service charges and other

429

255

1,062

529

633

519

Noninterest income - bank owned life insurance

110

108

215

219

105

109

Noninterest income - gain (loss) on securities sold

-

-

-

-

-

(462)

Noninterest expense

7,276

5,822

14,180

11,082

6,904

9,419

Income before taxes

5,129

3,616

10,212

7,146

5,083

1,634

Income tax expense

1,044

539

2,201

1,072

1,157

224

Net income

4,085

3,077

8,011

6,074

3,926

1,410

Per Share Data Net income, basic

$

0.30

$

0.28

$

0.58

$

0.55

$

0.29

$

0.10

Net income, diluted

$

0.28

$

0.26

$

0.54

$

0.50

$

0.27

$

0.10

Book value

$

12.30

$

9.39

$

11.92

$

11.55

Tangible book value

$

11.70

$

9.38

$

11.32

$

10.90

Shares outstanding

13,839,772

11,076,266

13,755,249

13,712,615

Selected Ratios Net interest margin (2)

3.59

%

3.50

%

3.62

%

3.45

%

3.65

%

3.59

%

Return on average assets (2)

1.13

%

1.13

%

1.14

%

1.13

%

1.16

%

0.42

%

Return on average equity (2)

9.78

%

12.00

%

9.76

%

12.02

%

9.74

%

3.65

%

Efficiency (1)

56.36

%

59.90

%

55.80

%

58.74

%

55.22

%

75.69

%

Loans, net of deferred fees to total deposits

97.24

%

94.72

%

97.22

%

97.79

%

Noninterest-bearing deposits to total deposits

21.33

%

28.19

%

20.92

%

20.07

%

Reconciliation of Net Income (GAAP) to Operating Earnings

(Non-GAAP) (3) Net income (from above)

$

4,085

$

3,077

$

8,011

$

6,074

$

3,926

$

1,410

Add: Merger and acquisition expense

16

397

83

397

67

2,668

Add: Loss on sales of securities available-for-sale

-

-

-

-

-

462

Less: provision for income taxes associated with merger and

acquisition expense

(4)

(83)

(19)

(83)

(15)

(649)

Net income, as adjusted

$

4,097

$

3,391

$

8,075

$

6,388

$

3,978

$

3,891

Net income, diluted, on an operating basis

$

0.28

$

0.28

$

0.55

$

0.53

$

0.27

$

0.26

Return on average assets (non-GAAP operating earnings)

1.13

%

1.24

%

1.15

%

1.19

%

1.17

%

1.16

%

Return on average equity (non-GAAP operating earnings)

9.81

%

13.23

%

9.84

%

12.64

%

9.86

%

10.07

%

Efficiency ratio (non-GAAP operating earnings)

56.24

%

55.82

%

55.47

%

56.63

%

54.69

%

54.25

%

Capital Ratios - Bank Tangible common equity (to tangible

assets)

10.97

%

9.12

%

11.03

%

11.16

%

Total capital (to risk weighted assets)

13.21

%

12.79

%

13.21

%

14.02

%

Common equity tier 1 capital (to risk weighted assets)

12.49

%

12.00

%

12.50

%

13.27

%

Tier 1 capital (to risk weighted assets)

12.49

%

12.00

%

12.50

%

13.27

%

Tier 1 leverage (to average assets)

12.10

%

11.58

%

12.57

%

12.41

%

Asset Quality Nonperforming loans and loans 90+ past due

$

9,989

$

938

$

3,791

$

3,211

Performing troubled debt restructurings (TDRs)

-

1,600

4,092

203

Other real estate owned

3,866

3,866

3,866

4,224

Nonperforming loans and loans 90+ past due to total assets (excl.

TDRs)

0.67

%

0.08

%

0.27

%

0.24

%

Nonperforming assets to total assets

0.93

%

0.42

%

0.54

%

0.55

%

Nonperforming assets (including TDRs) to total assets

0.93

%

0.56

%

0.83

%

0.57

%

Allowance for loan losses to loans

0.81

%

0.87

%

0.81

%

0.81

%

Allowance for loan losses to nonperforming loans

100.07

%

884.65

%

250.91

%

285.24

%

Net charge-offs (recovery)

$

20

$

85

$

182

$

66

$

162

$

347

Net charge-offs (recovery) to average loans (2)

0.01

%

0.04

%

0.03

%

0.01

%

0.06

%

0.13

%

Selected Average Balances Total assets

$

1,444,588

$

1,092,950

$

1,399,949

$

1,074,807

$

1,354,814

$

1,341,991

Total earning assets

1,384,516

1,069,035

1,346,110

1,051,330

1,307,278

1,305,573

Total loans, net of deferred fees

1,207,933

930,133

1,173,134

912,025

1,137,948

1,101,539

Total deposits

1,228,595

958,304

1,188,841

940,066

1,148,646

1,141,500

Other Data Noninterest-bearing deposits

$

270,711

$

284,452

$

253,723

$

233,318

Interest-bearing checking, savings and money market

596,701

396,667

546,067

533,732

Time deposits

319,740

250,492

297,469

310,985

Wholesale deposits

82,222

77,285

115,436

84,405

(1) Efficiency ratio is calculated as noninterest expense divided

by the sum of net interest income and noninterest income, excluding

gains on sales of investment securities and other real estate

owned. (2) Annualized. (3) Some of the financial measures discussed

throughout the press release are "non-GAAP financial measures." In

accordance with SEC rules, the Company classifies a financial

measure as being a non-GAAP financial measure if that financial

measure excludes or includes amounts, or is subject to adjustments

that have the effect of excluding or including amounts, that are

included or excluded, as the case may be, in the most directly

comparable measure calculated and presented in accordance with GAAP

in our statements of income, balance sheets or statements of cash

flows.

FVCBankcorp, Inc. Summary Consolidated Statements

of Condition (Dollars in thousands) (Unaudited)

% Change % Change Current From

6/30/2019 3/31/2019 Quarter 12/31/2018

6/30/2018 Year Ago Cash and due from banks

$

15,201

$

13,404

13.4

%

$

9,435

$

6,309

140.9

%

Interest-bearing deposits at other financial institutions

29,149

30,359

-4.0

%

34,060

30,734

-5.2

%

Investment securities

136,232

139,474

-2.3

%

125,298

118,844

14.6

%

Restricted stock, at cost

5,379

5,391

-0.2

%

5,299

3,800

41.6

%

Loans, net of fees: Commercial real estate

733,354

693,439

5.8

%

682,203

572,039

28.2

%

Commercial and industrial

134,466

137,869

-2.5

%

137,080

110,359

21.8

%

Commercial construction

217,105

187,760

15.6

%

152,526

138,973

56.2

%

Consumer residential

124,933

132,638

-5.8

%

132,280

106,747

17.0

%

Consumer nonresidential

24,514

27,235

-10.0

%

32,654

27,523

-10.9

%

Total loans, net of fees

1,234,372

1,178,941

4.7

%

1,136,743

955,641

29.2

%

Allowance for loan losses

(9,996

)

(9,512

)

5.1

%

(9,159

)

(8,298

)

20.5

%

Loans, net

1,224,376

1,169,429

4.7

%

1,127,584

947,343

29.2

%

Premises and equipment, net

2,049

2,218

-7.6

%

2,271

1,401

46.3

%

Goodwill and intangibles, net

8,223

8,342

-1.4

%

8,443

88

9,244.3

%

Bank owned life insurance (BOLI)

26,621

16,511

61.2

%

16,406

16,187

64.5

%

Other real estate owned

3,866

3,866

0.0

%

4,224

3,866

0.0

%

Other assets

33,504

30,769

8.9

%

18,556

10,877

208.0

%

Total Assets

$

1,484,600

$

1,419,763

4.6

%

$

1,351,576

$

1,139,449

30.3

%

Deposits: Noninterest-bearing

$

270,711

$

253,723

6.7

%

$

233,318

$

284,452

-4.8

%

Interest-bearing checking

301,319

284,150

6.0

%

312,446

222,522

35.4

%

Savings and money market

295,382

261,917

12.8

%

221,286

174,145

69.6

%

Time deposits

319,740

297,469

7.5

%

310,985

250,492

27.6

%

Wholesale deposits

82,222

115,436

-28.8

%

84,405

77,285

6.4

%

Total deposits

1,269,374

1,212,695

4.7

%

1,162,440

1,008,896

25.8

%

Subordinated notes, net of issuance costs

24,447

24,427

0.1

%

24,407

24,367

0.3

%

Other liabilities

20,616

18,648

10.6

%

6,393

2,220

828.6

%

Stockholders’ equity

170,163

163,993

3.8

%

158,336

103,966

63.7

%

Total Liabilities & Stockholders' Equity

$

1,484,600

$

1,419,763

4.6

%

$

1,351,576

$

1,139,449

30.3

%

FVCBankcorp, Inc. Summary Consolidated Income

Statements (In thousands, except per share data)

(Unaudited) For the Three Months Ended

% Change % Change Current From

6/30/2019 3/31/2019 Quarter 6/30/2018

Year Ago

Net interest income

$

12,371

$

11,764

5.2

%

$

9,356

32.2

%

Provision for loan losses

505

515

-1.9

%

281

79.7

%

Net interest income after

provision for loan losses

11,866

11,249

5.5

%

9,075

30.8

%

Noninterest income:

Fees on Loans

53

347

-84.7

%

4

1,225.0

%

Service charges on deposit

accounts

229

182

25.8

%

152

50.7

%

BOLI income

110

105

4.8

%

108

1.9

%

Other fee income

147

104

41.3

%

99

48.5

%

Total noninterest income

539

738

-27.0

%

363

48.5

%

Noninterest expense:

Salaries and employee

benefits

4,245

3,938

7.8

%

3,324

27.7

%

Occupancy and equipment

expense

873

827

5.6

%

580

50.5

%

Data processing and network

administration

343

439

-21.9

%

272

26.1

%

State franchise taxes

426

422

0.9

%

296

43.9

%

Professional fees

274

130

110.8

%

132

107.6

%

Merger and acquisition

expense

16

67

-76.1

%

397

100.0

%

Other operating expense

1,099

1,081

1.7

%

821

33.9

%

Total noninterest expense

7,276

6,904

5.4

%

5,822

25.0

%

Net income before income

taxes

5,129

5,083

0.9

%

3,616

41.8

%

Income tax expense

1,044

1,157

-9.8

%

539

93.6

%

Net Income

$

4,085

$

3,926

4.0

%

$

3,077

32.8

%

Earnings per share - basic

$

0.30

$

0.29

3.5

%

$

0.28

6.0

%

Earnings per share - diluted

$

0.28

$

0.27

3.8

%

$

0.26

8.1

%

Weighted-average common shares

outstanding - basic

13,802,712

13,724,232

11,023,775

Weighted-average common shares

outstanding - diluted

14,817,462

14,779,955

12,063,423

Reconciliation of Net Income (GAAP) to Operating Earnings

(Non-GAAP):

GAAP net income reported

above

$

4,085

$

3,926

$

3,077

Add: Merger and acquisition

expense above

16

67

397

Subtract: provision for income

taxes associated with merger and acquisition expense

(4)

(15)

(83)

Net Income, excluding above

merger and acquisition charges

$

4,097

$

3,978

$

3,391

Earnings per share - basic

(excluding merger and acquisition charges)

$

0.30

$

0.29

$

0.31

Earnings per share - diluted

(excluding merger and acquisition charges)

$

0.28

$

0.27

$

0.28

Return on average assets

(non-GAAP operating earnings)

1.13%

1.17%

1.24%

Return on average equity

(non-GAAP operating earnings)

9.81%

9.86%

13.23%

Efficiency ratio (non-GAAP

operating earnings)

56.24%

54.69%

55.82%

FVCBankcorp, Inc. Summary Consolidated Income

Statements (In thousands, except per share data)

(Unaudited) For the Six Months Ended

% Change From 6/30/2019 6/30/2018

Year Ago Net interest income

$

24,135

$

18,119

33.2

%

Provision for loan losses

1,020

639

59.6

%

Net interest income after provision for loan losses

23,115

17,480

32.2

%

Noninterest income: Fees on Loans

400

62

545.2

%

Service charges on deposit accounts

411

293

40.3

%

BOLI income

215

219

-1.8

%

Other fee income

251

174

44.3

%

Total noninterest income

1,277

748

70.7

%

Noninterest expense: Salaries and employee benefits

8,183

6,509

25.7

%

Occupancy and equipment expense

1,700

1,152

47.6

%

Data processing and network administration

782

541

44.5

%

State franchise taxes

848

592

43.2

%

Professional fees

404

288

40.3

%

Merger and acquisition expense

83

397

100.0

%

Other operating expense

2,180

1,603

36.0

%

Total noninterest expense

14,180

11,082

28.0

%

Net income before income taxes

10,212

7,146

42.9

%

Income tax expense

2,201

1,072

105.4

%

Net Income

$

8,011

$

6,074

31.9

%

Earnings per share - basic

$

0.58

$

0.55

5.2

%

Earnings per share - diluted

$

0.54

$

0.50

7.8

%

Weighted-average common shares outstanding - basic

13,763,472

10,978,846

Weighted-average common shares outstanding - diluted

14,798,708

12,092,505

Reconciliation of Net Income (GAAP)

to Operating Earnings (Non-GAAP): GAAP net income

reported above

$

8,011

$

6,074

Add: Merger and acquisition expense above

83

397

Subtract: provision for income taxes associated with merger and

acquisition expense

(19)

(83)

Net Income, excluding above merger and acquisition charges

$

8,075

$

6,388

Earnings per share - basic (excluding merger and acquisition

charges)

$

0.59

$

0.58

Earnings per share - diluted (excluding merger and acquisition

charges)

$

0.55

$

0.53

Return on average assets (non-GAAP operating earnings)

1.15%

1.19%

Return on average equity (non-GAAP operating earnings)

9.84%

12.64%

Efficiency ratio (non-GAAP operating earnings)

55.47%

56.63%

FVCBankcorp, Inc. Average Statements of Condition and

Yields on Earning Assets and Interest-Bearing Liabilities

(Dollars in thousands) (Unaudited)

For the Three Months Ended 6/30/2019 3/31/2019

6/30/2018 Average Average Average

Average Average Average Balance

Yield Balance Yield Balance

Yield Interest-earning assets: Loans receivable, net

of fees (1) Commercial real estate

$

717,248

4.86

%

$

679,268

4.72

%

$

564,251

4.59

%

Commercial and industrial

135,335

6.07

%

134,803

6.63

%

105,175

5.65

%

Commercial construction

198,927

5.71

%

158,880

5.73

%

123,262

5.32

%

Consumer residential

129,605

5.25

%

133,939

5.26

%

108,451

4.51

%

Consumer nonresidential

26,818

7.70

%

31,058

7.58

%

28,994

6.40

%

Total loans

1,207,933

5.24

%

1,137,948

5.23

%

930,133

4.86

%

Investment securities (2)(3)

144,056

2.73

%

144,109

2.72

%

123,488

2.43

%

Interest-bearing deposits at other financial institutions

32,527

2.39

%

25,221

1.95

%

15,414

0.83

%

Total interest-earning assets

1,384,516

4.91

%

1,307,278

4.88

%

1,069,035

4.52

%

Non-interest earning assets: Cash and due from banks

7,597

5,807

2,348

Premises and equipment, net

2,152

2,294

1,394

Accrued interest and other assets

60,016

48,489

28,361

Allowance for loan losses

(9,693)

(9,054)

(8,188)

Total Assets

$

1,444,588

$

1,354,814

$

1,092,950

Interest-bearing liabilities: Interest checking

$

301,132

1.28

%

$

296,010

1.27

%

$

195,130

1.00

%

Savings and money market

275,129

1.54

%

235,926

1.46

%

194,327

1.03

%

Time deposits

299,551

2.17

%

307,780

1.93

%

249,664

1.47

%

Wholesale deposits

88,064

2.52

%

74,781

2.42

%

91,028

1.70

%

Total interest-bearing deposits

963,876

1.74

%

914,497

1.66

%

730,149

1.26

%

Other borrowed funds

4,754

2.65

%

9,302

2.68

%

6,627

2.00

%

Subordinated notes, net of issuance costs

24,434

6.48

%

24,414

6.56

%

24,354

6.51

%

Total interest-bearing liabilities

993,064

1.87

%

948,213

1.79

%

761,130

1.43

%

Noninterest-bearing liabilities: Noninterest-bearing

deposits

264,719

234,149

228,155

Other liabilities

19,776

11,170

1,132

Stockholders’ equity

167,029

161,282

102,533

Total Liabilities and Stockholders' Equity

$

1,444,588

$

1,354,814

$

1,092,950

Net Interest Margin (1)

3.59

%

3.65

%

3.50

%

(1)

Non-accrual loans are included in average balances.

(2)

The average yields for investment securities are reported on a

fully taxable-equivalent basis at a rate of 22.5%.

(3)

The average balances for investment securities includes restricted

stock.

FVCBankcorp, Inc. Average Statements of Condition

and Yields on Earning Assets and Interest-Bearing Liabilities

(Dollars in thousands) (Unaudited)

For the Six Months Ended 6/30/2019 6/30/2018

Average Average Average Average

Balance Yield Balance Yield

Interest-earning assets: Loans receivable, net of fees (1)

Commercial real estate

$

698,363

4.79

%

$

551,364

4.61

%

Commercial and industrial

135,070

6.35

%

99,915

5.42

%

Commercial construction

179,014

5.71

%

122,725

5.08

%

Consumer residential

131,760

5.25

%

108,632

4.41

%

Consumer nonresidential

28,927

7.64

%

29,389

6.31

%

Total loans

1,173,134

5.23

%

912,025

4.79

%

Investment securities (2)(3)

144,082

2.72

%

123,176

2.40

%

Interest-bearing deposits at other financial institutions

28,894

2.20

%

16,129

0.96

%

Total interest-earning assets

1,346,110

4.90

%

1,051,330

4.46

%

Non-interest earning assets: Cash and due from banks

6,707

2,440

Premises and equipment, net

2,223

1,312

Accrued interest and other assets

54,284

27,734

Allowance for loan losses

(9,375)

(8,009)

Total Assets

$

1,399,949

$

1,074,807

Interest-bearing liabilities: Interest checking

$

298,585

1.28

%

$

191,212

0.94

%

Savings and money market

255,636

1.51

%

191,634

0.99

%

Time deposits

303,643

2.07

%

256,661

1.43

%

Wholesale deposits

81,459

2.49

%

99,102

1.57

%

Total interest-bearing deposits

939,323

1.70

%

738,609

1.21

%

Other borrowed funds

7,015

2.67

%

7,472

1.84

%

Subordinated notes, net of issuance costs

24,424

6.52

%

24,344

6.54

%

Total interest-bearing liabilities

970,762

1.83

%

770,425

1.39

%

Noninterest-bearing liabilities: Noninterest-bearing

deposits

249,518

201,457

Other liabilities

15,498

1,821

Stockholders’ equity

164,171

101,104

Total Liabilities and Stockholders' Equity

$

1,399,949

$

1,074,807

Net Interest Margin (1)

3.62

%

3.45

%

(1)

Non-accrual loans are included in average balances.

(2)

The average yields for investment securities are reported on a

fully taxable-equivalent basis at a rate of 22.5%.

(3)

The average balances for investment securities includes restricted

stock.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190718005718/en/

David W. Pijor, Chairman and Chief Executive Officer Phone:

(703) 436-3802 Email: dpijor@fvcbank.com

Patricia A. Ferrick, President Phone: (703) 436-3822 Email:

pferrick@fvcbank.com

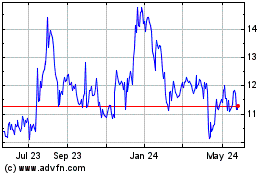

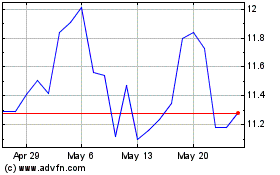

FVCBankcorp (NASDAQ:FVCB)

Historical Stock Chart

From Jun 2024 to Jul 2024

FVCBankcorp (NASDAQ:FVCB)

Historical Stock Chart

From Jul 2023 to Jul 2024