|

Prospectus

Supplement

|

SUBJECT

TO COMPLETION

|

Filed

Pursuant to Rule 424(b)(5)

|

|

(to

Prospectus February 5, 2021)

|

|

Registration

No. 333-252370

|

ESPORTS

ENTERTAINMENT GROUP, INC.

2,000,000

Shares of Common Stock

We

are offering 2,000,000 shares of our common stock, par value $0.0001 per share (the “Common Stock”), at a price of

$15.00 per share. We will receive gross proceeds of $30,000,000 from this offering.

We

have engaged Maxim Group LLC and Joseph Gunnar & Co. LLC, or the placement agents, as our exclusive placement agents in connection

with this offering. The placement agents have agreed to use reasonable best efforts to place the securities offered by this prospectus

supplement. The placement agents have no obligation to buy any of the securities from us or to arrange for the purchase or sale

of any specific number or dollar amount of securities. We have agreed to pay the placement agents the fees set forth in the table

below.

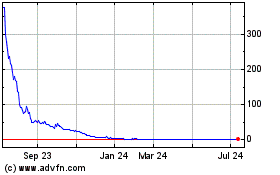

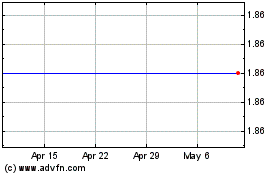

Our

common stock is traded on the NASDAQ Capital Market under the symbol “GMBL.” and our Unit A Warrants trade are traded

on the NASDAQ Capital Market under the symbol “GMBLW”. The last reported sale price of our common stock and our Unit

A Warrants on the Nasdaq Capital Market on February 12, 2021, was $15.00 per share and $10.85 per Unit A Warrant, respectively.

The

aggregate market value of our outstanding common stock held by non-affiliates is $209,734,396.80 based on 15,038,503 shares of

outstanding common stock, of which 3,577,607 are held by affiliates, and a per share price of $18.30 based on the closing sale

price of our common stock on February 10, 2021. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our

common stock in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period

so long as our public float remains below $75,000,000. We have not offered any securities pursuant to General Instruction I.B.6.

of Form S-3 during the prior 12 calendar month period that ends on and includes the date of this prospectus.

|

Public offering price

|

|

$

|

15.00

|

|

|

$

|

30,000,000

|

|

|

Placement Agents’ fees(1)

|

|

$

|

0.975

|

|

|

$

|

1,950,000

|

|

|

Proceeds, before expenses, to us

|

|

$

|

14.025

|

|

|

$

|

28,050,000

|

|

|

(1)

|

In

addition, we have agreed to reimburse the placement agents for certain out-of-pocket expenses. See “Plan of

Distribution” beginning on page S-38 of this prospectus supplement for additional information with respect to

the compensation we will pay the placement agents and other expenses that will be incurred.

|

Investing

in our securities involves a high degree of risk, including that the trading price of our common stock has been subject to

volatility. See “Risk Factors” beginning on page S-10 of this prospectus supplement, page 11 of the accompanying

base prospectus and under similar headings in the documents incorporated by reference into this prospectus supplement and the

accompanying base prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

Delivery

of the shares of Common Stock is expected to be made on or about February 16, 2021, subject to customary closing conditions.

|

Placement

Agent

|

|

Placement

Agent

|

|

|

|

|

|

Maxim

Group LLC

|

|

Joseph

Gunnar & Co. LLC

|

The

date of this prospectus supplement is February 16, 2021

Table

of Contents

Prospectus

Supplement

Prospectus

No

dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus

supplement or the accompanying prospectus. You must not rely on any unauthorized information or representations. This prospectus

supplement and the accompanying prospectus are an offer to sell only the securities offered hereby, but only under circumstances

and in jurisdictions where it is lawful to do so. The information contained in this prospectus supplement and the accompanying

prospectus is current only as of their respective dates.

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the U.S. Securities

and Exchange Commission, or SEC, utilizing a “shelf” registration process. This document is in two parts. The first

part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information

contained in the accompanying prospectus and the documents incorporated by reference herein. The second part, the accompanying

prospectus, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of

this document combined. To the extent there is a conflict between the information contained in this prospectus supplement and

the information contained in the accompanying prospectus or any document incorporated by reference therein filed prior to the

date of this prospectus supplement, you should rely on the information in this prospectus supplement; provided that if any statement

in one of these documents is inconsistent with a statement in another document having a later date-for example, a document incorporated

by reference in the accompanying prospectus-the statement in the document having the later date modifies or supersedes the earlier

statement.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any

document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made.

Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state

of our affairs.

You

should rely only on the information contained in this prospectus supplement or the accompanying prospectus, or incorporated by

reference herein. We have not authorized, and the placement agents have not authorized, anyone to provide you with information

that is different. The information contained in this prospectus supplement or the accompanying prospectus, or incorporated by

reference herein or therein is accurate only as of the respective dates thereof, regardless of the time of delivery of this prospectus

supplement and the accompanying prospectus or of any sale of our Common Stock. It is important for you to read and consider all

information contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference

herein and therein, in making your investment decision. You should also read and consider the information in the documents to

which we have referred you in the sections entitled “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference” in this prospectus supplement and in the accompanying prospectus, respectively.

We

are offering to sell, and seeking offers to buy, the securities offered by this prospectus supplement only in jurisdictions where

offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering

of the securities offered by this prospectus supplement in certain jurisdictions may be restricted by law. Persons outside the

United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about,

and observe any restrictions relating to, the offering of the Common Stock and the distribution of this prospectus supplement

and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute,

and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this

prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person

to make such an offer or solicitation.

When

used herein, “Esports”, “EEG”, “we”, “us” or “our” or the “Company”

refers to Esports Entertainment Group, Inc., a Nevada corporation, and our subsidiaries.

SPECIAL

NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements that involve risks and uncertainties, principally in the sections entitled “Risk

Factors.” All statements other than statements of historical fact contained in this prospectus, including statements regarding

future events, our future financial performance, business strategy and plans and objectives of management for future operations,

are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,”

“believes,” “can,” “continue,” “could,” “estimates,” “expects,”

“intends,” “may,” “plans,” “potential,” “predicts,” “should,”

or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking

statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are

only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk

Factors” or elsewhere in this prospectus, which may cause our or our industry’s actual results, levels of activity,

performance or achievements expressed or implied by these forward-looking statements.

Forward-looking

statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications

of the times at, or by which, that performance or those results will be achieved. Forward-looking statements are based on information

available at the time they are made and/or management’s good faith belief as of that time with respect to future events,

and are subject to risks and uncertainties that could cause actual performance or results to differ materially from what is expressed

in or suggested by the forward-looking statements.

Forward-looking

statements speak only as of the date they are made. You should not put undue reliance on any forward-looking statements. We assume

no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors

affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more

forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking

statements.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following information below is only a summary of more detailed information included elsewhere in, or incorporated by reference

in, this prospectus supplement and the accompanying base prospectus, and should be read together with the information contained

or incorporated by reference in other parts of this prospectus supplement and the accompanying base prospectus. This summary highlights

selected information about us and this offering. This summary may not contain all of the information that may be important to

you. Before making a decision to invest in our common stock, you should read carefully all of the information contained in or

incorporated by reference into this prospectus supplement and the accompanying base prospectus, including the information set

forth under the caption “Risk Factors” in this prospectus supplement and the accompanying base prospectus as well

as the documents incorporated herein by reference, which are described under “Where you can Find More Information”

and “Incorporation of Certain Documents by Reference” in this prospectus supplement.

Our

Business

Corporate

History

Esports

Entertainment Group, Inc. was formed in the State of Nevada on July 22, 2008 under our prior name Virtual Closet, Inc. Virtual

Closet, Inc. changed its name to DK Sinopharma, Inc. on June 6, 2010. DK Sinopharma, Inc. changed its name to VGambling, Inc.

on August 12, 2014. On or about April 24, 2017, VGambling, Inc. changed its name to Esports Entertainment Group, Inc. Our company

was engaged in a number of different enterprises up until May 20, 2013, when, pursuant to the terms of the Share Exchange Agreement,

we acquired all of the outstanding capital stock of H&H Arizona Corporation in exchange for 3,333,334 shares of our common

stock. From May 2013 until August 2018, our operations were limited to designing, developing and testing our wagering systems.

We launched our online esports wagering website (www.vie.gg) in August 2018.

Business

Overview

Esports

is the competitive playing of video games by amateur and professional teams for cash prizes. Esports typically takes the form

of organized, multiplayer video games that include real-time strategy, fighting, first-person shooter and multiplayer online battle

arena games. As of December 2020, the three largest selling esports games were Dota 2, League of Legends (each multiplayer

online battle arena games) and Counter Strike: Global Offensive (a first-person shooter game). Other popular games include

Smite, StarCraft II, Call of Duty¸ Heroes of the Storm, Hearthstone and Fortnite.

Esports also includes games which can be played, primarily by amateurs, in multiplayer competitions on the Sony PlayStation, Microsoft

Xbox and Nintendo Switch. Most major professional esports events and a wide range of amateur esports events are broadcast live

via streaming services including twitch.tv, azubu.tv, ustream.tv and youtube.com.

Esports

Entertainment Group is a diversified operator of esports, sports and igaming businesses with a global footprint. Our strategy

is to build and acquire betting and related platforms in the businesses of igaming and sports betting, and lever them into the

rapidly growing esports business. Our tag line is ‘‘Play, Watch, Bet’’. In esports, we are creating and

assembling best-in-class technologies to generate profit from the various elements of esports competition and betting. We are

primarily focused on three verticals, (i): esports entertainment, (ii) esports wagering, and (iii) iGaming and traditional sports

betting. We believe focusing on these verticals positions the Company to take advantage of a trending and expanding marketplace

in esports with the rise of competitive gaming as well as the legalization of online gambling in the United States.

Esports

Entertainment:

Our

esports entertainment vertical includes any activity that we pursue within esports that does not include real-money wagering.

Right now, the main component of this pillar is our skill-based tournament platform This allows us to engage and monetize players

across 41 states where skill-based gambling is legal as well as create relationships with players that can eventually migrate

into our real-money wagering platforms.

Esports

Wagering:

Our

goal is to be a leader in the large and rapidly growing sector of esports real-money wagering, offering fans the ability to wager

on professional esports events in a licensed and secure environment. From February 2021, under the terms of our Maltese Gaming

Authority (MGA) license, we are now able to accept wagers from residents of over 180 jurisdictions including Canada, Germany,

New Zealand and South Africa, on their ‘‘Vie.bet’’ platform

On

August 20, 2020, we announced our entry into a multi-year partnership with Twin River Worldwide Holdings, Inc (NYSE: TRWH), now

Bally’s Corporation (NYSE: BALY), to launch our proprietary mobile sports betting product, ‘‘Vie.gg’,

in the state of New Jersey. We intend to have our platform, which was previously licensed in Curacao, live in the state during

April 2021 or soon thereafter.

iGaming

and Traditional Sports Betting:

The

goal of our iGaming and traditional Sports Betting vertical is to provide profitable growth and access to strategic licenses in

jurisdictions that we can cross-sell into our Vie.bet platform. On July 7, 2020, we entered into a stock purchase agreement (the

“Argyll Purchase Agreement”), by and among the Company, LHE Enterprises Limited (“LHE”), and AHG Entertainment,

LLC (“AHG”) whereby, upon closing on July 31, 2020, the Company acquired all of the outstanding capital stock of LHE

and its subsidiaries, (i) Argyll Entertainment AG, (ii) Nevada Holdings Limited and (iii) Argyll Productions Limited (collectively

the “Acquired Companies” or “Argyle”). AHG is licensed and regulated by the UK Gambling Commission and

the Irish Revenue Commissioners to operate online sportsbook and casino sites in the UK and Ireland, respectively. Argyll has

a flagship brand, www.sportnation.bet, as well as two white label brands, www.redzone.bet and www.uk.fansbet.com (collectively

the “Argyll Brands”), with over 300,000 registered players at the end of calendar year 2020.

We

believe that as the size of the market and the number of esports enthusiasts continues to grow, so will the number of esports

enthusiasts who gamble on events, which would likely increase the demand for our platform.

Recent

Developments

Appointment

of Chief Compliance Officer

On

July 1, 2020, the Company entered into an employment agreement (the “Lefevre Employment Agreement”) with Mr. Adrien

Lefevre, whereby Mr. Lefevre was appointed to serve as Chief Risk & Compliance Officer of the Company (the “CCO Appointment”).

On February 10, 2021, the Company’s board of directors acknowledged the role of Chief Business Officer as constituting an

executive officer position.

Helix

Holdings, LLC Purchase Agreement

On

January 22, 2021, the Company entered into an equity purchase agreement (the “Helix Purchase Agreement”), by and among

the Company, Helix Holdings, LLC, a limited liability company incorporated under the laws of Delaware (“Helix”), and

the equity holders of Helix (the “Helix Equity Holders”), whereby the Company will acquire from the Helix Equity Holders

all of the issued and outstanding membership units of Helix (the “Helix Units”), making Helix a wholly owned subsidiary

of the Company.

As

consideration for the Helix Units, the Company agreed to pay the Helix Equity Holders $17,000,000 (the “Helix Purchase Price”),

to be paid fifty percent (50%) in shares of Common Stock (the “Helix Share Consideration”), and fifty percent (50%)

in cash (the “Helix Cash Consideration”). The per share price of the Common Stock issuable as Helix Share Consideration

shall be the Closing Base Price minus the Discount. “Closing Base Price” means the volume weighted average price (“VWAP”)

of the Common Stock during the thirty (30) trading days immediately preceding the date of the closing under the Helix Purchase

Agreement (the “Closing”). “Discount” equals the greater of (A) and (B) minus the lesser of (A) and (B)

multiplied by 0.25 where (A) is the VWAP of the common stock during the thirty (30) trading days immediately preceding October

26, 2020 (which was $4.54 per share) multiplied by 1.25(which is $5.675); and (B) is the Closing Base Price.

The

Closing under the Helix Purchase Agreement is subject to the simultaneous closing under an equity purchase agreement (the “GGC

Purchase Agreement”) among the Company, ggCircuit LLC, an Indiana limited liability company (“GGC”) and the

equity holders of GGC (the “GGC Equity Holders”), the principal terms of which are described below. The Closing is

also subject to (i) the completion of an opinion (the “Fairness Opinion”) respecting the fairness of the consideration

to be paid by the Company and received by the Helix Equity Holders and the GGC Equity Holders pursuant to the Helix Purchase Agreement

and the GGC Purchase Agreement from a financial point of view; (ii) an audit, as of and for the two years ending December 31,

2019, and a financial review, for the nine month periods ended September 30, 2019 and 2020, of Helix and affiliated entities;

and (iii) the approval of the Company’s shareholders to the issuance of the Helix Share Consideration and GGC Share Consideration(as

defined below) in satisfaction of NASDAQ Rule 5635(a).

The

parties to the Helix Purchase Agreement may terminate the Helix Purchase Agreement, among other reasons, if (i) the Fairness Opinion

does not support an aggregate purchase price for Helix and GGC of $43,000,000 and, based thereon, the Company is no longer willing

to pay the Helix Purchase Price, or (ii) the Closing has not occurred on or before May 14, 2021 or such later date as may be mutually

agreed to by the parties. The Company can also terminate the Helix Purchase Agreement if (i) upon completion of its legal, financial,

tax and commercial due diligence of Helix and affiliated entities, it is not satisfied, with the results thereof; (ii) the audit

and/or review of Helix and affiliated entities cannot be completed due to fraud, material accounting errors or otherwise or if

the results of the audit or the review are materially and adversely different from the financial information provided by Helix

and the Helix Equity Holders to the Company prior to the execution of the Helix Purchase Agreement.

In

connection with the negotiation of the Helix Purchase Agreement, the Company advanced an aggregate of $400,000 to Helix during

2020 in the form of loans (the “Helix Loans”). Upon execution of the Helix Purchase Agreement, the Company paid Helix

an additional $400,000 to be used for operating expenses pending the Closing (the “Operating Expense Payments”). If

the Closing takes place on or prior to May 14, 2021, the Company will receive a full credit against the Helix Purchase Price for

the Helix Loans and if the Closing takes place prior to April 30, 2021 the Company will receive a full credit against the Helix

Purchase Price for the Operating Expense Payments. If Closing takes place after April 30, 2021, but on or prior to May 14, 2021,

the Company shall receive a credit against the Helix Purchase Price for 60% of the Operating Expense Payments. If the transaction

does not close, depending on the reason, a portion of the Helix Loans and the Operating Expense Payments may be forgiven.

The

Helix Purchase Agreement contains customary representations, warranties, covenants, indemnification and other terms for transactions

of a similar nature.

ggCIRCUIT

LLC Purchase Agreement

On

January 22, 2021, the Company entered into the GGC Purchase Agreement whereby the Company will acquire from the GGC Equity Holders

all of the issued and outstanding membership units of GGC (the “GGC Units”), making GGC a wholly owned subsidiary

of the Company.

As

consideration for the GGC Units, the Company agreed to pay the GGC Equity Holders $26,000,000 (the “GGC Purchase Price”)

to be paid fifty percent (50%) in shares of Common Stock (the “GGC Share Consideration”), and fifty percent (50%)

in cash (the “GGC Cash Consideration”) The per share price of the Common Stock issuable as GGC Share Consideration

shall be the Closing Base Price minus the Discount. “Closing Base Price” means the volume weighted average price (“VWAP”)

of the Common Stock during the thirty (30) trading days immediately preceding the Closing. “Discount” equals the greater

of (A) and (B) minus the lesser of (A) and (B) multiplied by 0.25 where (A) is the VWAP of the common stock during the thirty

(30) trading days immediately preceding October 26, 2020 (which was $4.54 per share) multiplied by 1.25 (which is $5.675); and

(B) is the Closing Base Price.

The

Closing under the GGC Purchase Agreement is subject to the simultaneous closing under the Helix Purchase Agreement. The Closing

is also subject to (i) the completion of the Fairness Opinion; (ii) an audit, as of and for the two years ending December 31,

2019, and a financial review, for the nine month periods ended September 30, 2019 and 2020, of GGC and affiliated entities; and

(iii) the approval of the Company’s shareholders to the issuance of the GGC Share Consideration and Helix Share Consideration

in satisfaction of NASDAQ Rule 5635(a).

The

parties to the GGC Purchase Agreement may terminate the GGC Purchase Agreement, among other reasons, if (i) the Fairness Opinion

does not support an aggregate purchase price for Helix and GGC of $43,000,000 and, based thereon, the Company is no longer willing

to pay the GGC Purchase Price, or (ii) the Closing has not occurred on or before May 14, 2021 or such later date as may be mutually

agreed to by the parties. The Company can also terminate the GGC Purchase Agreement if (i) upon completion of its legal, financial,

tax and commercial due diligence of GGC and affiliated entities, it is not satisfied, with the results thereof; (ii) the audit

and/or review of GGC and affiliated entities cannot be completed due to fraud, material accounting errors or otherwise or if the

results of the audit or the review are materially and adversely different from the financial information provided by GGC and the

GGC Equity Holders to the Company prior to the execution of the GGC Purchase Agreement.

In

connection with the negotiation of the GGC Purchase Agreement, the Company advanced an aggregate of $600,000 to GGC during 2020

in the form of loans (the “GGC Loans”). Upon execution of the GGC Purchase Agreement, the Company paid GGC an additional

$600,000 to be used for operating expenses pending the Closing (the “Operating Expense Payments”). If the Closing

takes place on or prior to May 14, 2021, the Company will receive a full credit against the GGC Purchase Price for the GGC Loans

and if the Closing takes place prior to April 30, 2021, the Company will receive a full credit against the GGC Purchase Price

for the Operating Expense Payments. If Closing takes place after April 30, 2021, but on or prior to May 14, 2021, the Company

shall receive a credit against the GGC Purchase Price for 60% of the Operating Expense Payments. If the transaction does not close,

depending on the reason, a portion of the GGC Loans and the Operating Expense Payments may be forgiven.

The

GGC Purchase Agreement contains customary representations, warranties, covenants, indemnification and other terms for transactions

of a similar nature.

Phoenix

Purchase Agreement

On

December 21, 2020, the Company entered into a share purchase agreement (the “Phoenix Purchase Agreement”), by and

among the Company, Phoenix Games Network Limited, a company registered in England and Wales (“Phoenix”), and the shareholders

of Phoenix (the “Phoenix Shareholders” and, together with Phoenix, the “Sellers”), whereby the Company

acquired from the Sellers all of the issued and outstanding share capital of Phoenix (the “Phoenix Shares”). Pursuant

to the Phoenix Purchase Agreement, as consideration for the Phoenix Shares, the Company agreed to pay the Sellers: (i) GBP £1,000,000

(the “Original Cash Consideration”); and (ii) shares of Common Stock in the aggregate value of GBP£3,000,000

(the “Original Share Consideration” and, together with the Cash Consideration, the “Original Purchase Price”),

subject to adjustment based on certain revenue milestones as outlined therein.

On

January 21, 2021, the Company and Sellers, having met all conditions precedent, consummated the closing for the Phoenix Shares

pursuant to the terms of the Phoenix Purchase Agreement. The Original Purchase Price was adjusted at closing and as consideration

for the Phoenix Shares, the Company paid the Sellers: (i) GBP £350,000 (US $493,495.35) (the “Closing Cash Consideration”);

and (ii) 292,211 shares of common stock of the Company, par value $0.001 per share (aggregate value of $1,927,647.49) (the “Closing

Share Consideration” and, together with the Cash Closing Consideration, the “Closing Purchase Price”). The Closing

Cash Consideration was paid in US Dollars and was calculated in accordance with the applicable exchange rate on the Closing Date

(as such term is defined in the Phoenix Purchase Agreement). The Sellers shall remain eligible to receive the remainder of the

Original Purchase Price upon Phoenix meeting the aforementioned Revenue Targets by May 16, 2021.

Lucky

Dino Purchase Agreement

On

December 14, 2020, the Company, via its wholly owned subsidiary, Esports Entertainment (Malta) Limited (“EEL”), entered

into an asset purchase agreement (the “Lucky Dino Purchase Agreement”), by and among EEL, Lucky Dino Gaming Limited,

a company registered in Malta (“Lucky Dino”), and Hiidenkivi Estonia OU, a company registered in Estonia (“HEOU”

and, together with Lucky Dino, the “Lucky Dino Sellers”) whereby EEL will purchase from the Lucky Dino Sellers substantially

all the assets and will assume certain specified liabilities of the Sellers’ business of real money online casino gaming

(the “Acquired Business”).

As

consideration for the Acquired Business, the Company agreed to pay the Lucky Dino Sellers EUR €25,000,000 (the “Lucky

Dino Purchase Price”) subject to certain adjustments set forth in the Lucky Dino Purchase Agreement.

The

Lucky Dino Purchase Agreement contains customary representations, warranties, covenants, indemnification and other terms for transactions

of this nature. The closing of the transactions contemplated by the Lucky Dino Purchase Agreement is subject to certain conditions,

including, among other things, the completion of an audit of Lucky Dino and HEOU.

OFFERING

SUMMARY

This

summary highlights certain information about this offering and selected information contained elsewhere in or incorporated by

reference into this prospectus supplement. This summary is not complete and does not contain all of the information that you

should consider before deciding whether to invest in shares of our Common Stock. For a more complete understanding of our

company and this offering, we encourage you to read and consider carefully the more detailed information in this prospectus

supplement and the accompanying prospectus, including the information incorporated by reference into this prospectus

supplement and the accompanying prospectus, and the information referred to under the heading “RISK FACTORS” in

this prospectus supplement on page S-10 and on page 11 of the accompanying prospectus, and in the documents incorporated by

reference into this prospectus supplement and the accompanying prospectus.

|

Issuer

|

Esports Entertainment Group, Inc.

|

|

|

|

|

Common stock offered by us

|

2,000,000 shares at a purchase price of $15.00 per share.

|

|

|

|

|

Common stock outstanding prior to the offering

|

15,038,503 shares

|

|

|

|

|

Common stock to be outstanding after this offering

|

17,038,503 shares

|

|

|

|

|

Common Stock Trading symbol

|

Our Common Stock and Unit A Warrants are quoted for trading on Nasdaq under the symbols “GMBL”, and “GMBLW”, respectively.

|

|

|

|

|

Use of proceeds

|

We intend to use the net proceeds from the offering for general corporate purposes, including strategic acquisitions and working capital. See “Use of Proceeds.”

|

|

|

|

|

Risk factors

|

This investment involves a high degree of risk. See “Risk Factors” and other information included or incorporated by reference in this prospectus supplement beginning on page S-10 and the accompanying base prospectus beginning on page 11 for a discussion of certain factors you should carefully consider before deciding to invest in shares of our common stock.

|

The

number of shares of common stock to be outstanding after this offering excludes the following as of February 15, 2021:

● 457,009

shares of Common Stock issuable upon exercise of outstanding options with a weighted average exercise price of $5.42 per share;

● 3,502,930

shares of Common Stock issuable upon exercise of warrants outstanding as of February 15, 2021, having a weighted average

exercise price of $5.11 per share; and

● 683,854

shares reserved for future issuances under our equity compensation plans

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements. Forward-looking statements give our current expectations or forecasts of future

events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking

statements involve risks and uncertainties and include statements regarding, among other things, our projected revenue growth

and profitability, our growth strategies and opportunity, anticipated trends in our market and our anticipated needs for working

capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,”

“estimate,” “plans,” “potential,” “projects,” “continuing,” “ongoing,”

“expects,” “management believes,” “we believe,” “we intend” or the negative of

these words or other variations on these words or comparable terminology. These statements may be found under the sections entitled

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,”

as well as in this prospectus generally. In particular, these include statements relating to future actions, prospective products,

market acceptance, future performance or results of current and anticipated products, sales efforts, expenses, and the outcome

of contingencies such as legal proceedings and financial results.

Examples

of forward-looking statements in this prospectus include, but are not limited to, our expectations regarding our business strategy,

business prospects, operating results, operating expenses, working capital, liquidity and capital expenditure requirements. Important

assumptions relating to the forward-looking statements include, among others, assumptions regarding demand for our products, the

cost, terms and availability of components, pricing levels, the timing and cost of capital expenditures, competitive conditions

and general economic conditions. These statements are based on our management’s expectations, beliefs and assumptions concerning

future events affecting us, which in turn are based on currently available information. These assumptions could prove inaccurate.

Although we believe that the estimates and projections reflected in the forward-looking statements are reasonable, our expectations

may prove to be incorrect.

Important

factors that could cause actual results to differ materially from the results and events anticipated or implied by such forward-looking

statements include, but are not limited to:

|

|

●

|

changes

in the market acceptance of our products;

|

|

|

|

|

|

|

●

|

increased

levels of competition;

|

|

|

●

|

changes

in political, economic or regulatory conditions generally and in the markets in which we operate;

|

|

|

|

|

|

|

●

|

our

relationships with our key customers;

|

|

|

|

|

|

|

●

|

our

ability to retain and attract senior management and other key employees;

|

|

|

|

|

|

|

●

|

our

ability to quickly and effectively respond to new technological developments;

|

|

|

|

|

|

|

●

|

our

ability to protect our trade secrets or other proprietary rights, operate without infringing upon the proprietary rights of

others and prevent others from infringing on the proprietary rights of the Company; and

|

|

|

|

|

|

|

●

|

other

risks, including those described in the “Risk Factors” discussion of this prospectus.

|

We

operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for us

to predict all of those risks, nor can we assess the impact of all of those risks on our business or the extent to which any factor

may cause actual results to differ materially from those contained in any forward-looking statement. The forward-looking statements

in this prospectus are based on assumptions management believes are reasonable. However, due to the uncertainties associated with

forward-looking statements, you should not place undue reliance on any forward-looking statements. Further, forward-looking statements

speak only as of the date they are made, and unless required by law, we expressly disclaim any obligation or undertaking to publicly

update any of them in light of new information, future events, or otherwise.

RISK

FACTORS

Investing

in our Common Stock involves a high degree of risk. Before deciding whether to invest in our Common Stock, you should consider

carefully the risks and uncertainties and assumptions discussed under the heading “Risk Factors” included in our most

recent annual report on Form 10-K and most recent Form 10-Q which are on file with the SEC and are incorporated

herein by reference, and which may be amended, supplemented or superseded from time to time by other reports we file with the

SEC in the future. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that

could have material adverse effects on our future results. If any of these risks actually occurs, our business, business prospects,

financial condition or results of operations could be seriously harmed. This could cause the trading price of our Common Stock

to decline, resulting in a loss of all or part of your investment. Please also read carefully the section above entitled “Cautionary

Note Regarding Forward-Looking Statements.”

Risks

Related to Our Business

We

are a development stage company with a limited operating history.

While

we were incorporated under the laws of Nevada in July 2008, we did not begin to engage in our current business until May 2013

and our operations since that time have been mostly limited to designing, developing and testing our wagering systems. We have

had de minimis revenues to date. Consequently, we are subject to all the risks and uncertainties inherent in a new business and

in connection with the development and sale of new products and services. As a result, we still must establish many corporate

functions necessary to operate our business, including finalizing our administrative structure, continuing our product development,

assessing and expanding our marketing activities, implementing financial systems and controls and personnel recruitment. Accordingly,

you should consider the Company’s prospects in light of the costs, uncertainties, delays, and difficulties frequently encountered

by companies in this early stage of development. You should carefully consider the risks and uncertainties that a company, such

as ours, with a limited operating history will face. In particular, you should consider that we cannot provide assurance that

we will be able to:

|

|

●

|

successfully

implement or execute our current business plan;

|

|

|

●

|

maintain

our management team;

|

|

|

|

|

|

|

●

|

raise

sufficient funds in the capital markets to effectuate our business plan;

|

|

|

|

|

|

|

●

|

attract,

enter into or maintain contracts with, and retain customers; and/or

|

|

|

|

|

|

|

●

|

compete

effectively in the extremely competitive environment in which we operate.

|

If

we cannot successfully accomplish any of the foregoing objectives, our business may not succeed.

We

have a history of accumulated deficits, recurring losses and negative cash flows from operating activities. We may be unable to

achieve or sustain profitability

To

date, we have recorded de minimis revenues from the sale of our products. If we are unable to generate revenues, we will not be

able to achieve and maintain profitability. Beyond this, we may incur significant losses in the future for a number of reasons

including other risks described in this document, and we may encounter unforeseen expenses, difficulties, complications, delays

and other unknown events. Accordingly, we may not ever be able to achieve profitability. We incurred negative cash flows from

operating activities and recurring net losses in fiscal years 2020 and 2019. As of June 30, 2020, and 2019, our accumulated deficit

was $20,535,602 and $10,184,187, respectively. These factors, among others, raised substantial doubt about our ability to continue

as a going concern, which has been alleviated by the execution of management’s plans. On April 16, 2020, the Company raised

approximately $7,000,000 in net proceeds from its public offering. Additionally, the Company raised approximately $7,000,000 from

the exercise of warrants and over-allotments during the year ended June 30, 2020.

We

will require additional financing and cannot be certain that such additional financing will be available on reasonable terms when

required, or at all.

As

of September 30, 2020, we had cash of approximately $9,000,000, While this amount is sufficient to continue with operating activities

for at least the next 12 months, we anticipate that we will need to raise additional capital to fund our operations while we implement

and execute our business plan and acquisition strategy. We currently do not have any contracts or commitments for additional financing.

In addition, any additional equity financing may involve substantial dilution to the existing shareholders. There can be no assurance

that such additional capital will be available, on a timely basis, or on terms acceptable to the Company. Failure to obtain such

additional financing could result in delay or indefinite postponement of operations or the further development of its business

with the possible loss of such properties or assets. If adequate funds are not available or are not available on acceptable terms,

the Company may not be able to fund its business or the expansion thereof, take advantage of strategic acquisitions or investment

opportunities or respond to competitive pressures. Such inability to obtain additional financing when needed could have a material

adverse effect on the Company’s business, results of operations, cash flow, financial condition and prospects.

The

gaming and interactive entertainment industries are intensely competitive. Esports faces competition from a growing number of

companies and, if Esports is unable to compete effectively, its business could be negatively impacted.

There

is intense competition amongst gaming solution providers. There are a number of established, well financed companies producing

both land-based and online gaming and interactive entertainment products and systems that compete with the products of the Company.

As some of our competitors have financial resources that are greater than Esports’, they may spend more money and time on

developing and testing products, undertake more extensive marketing campaigns, adopt more aggressive pricing policies or otherwise

develop more commercially successful products than the Company, which could impact the Company’s ability to win new marketing

contracts and renew our existing ones. Furthermore, new competitors may enter the Company’s key market areas. If the Company

is unable to obtain significant market presence or if it loses market share to its competitors, the Company’s results of

operations and future prospects would be materially adversely affected. There are many companies with already established relationships

with third parties, including gaming operators that are able to introduce directly competitive products and have the potential

and resources to quickly develop competitive technologies. The Company’s success depends on its ability to develop new products

and enhance existing products at prices and on terms that are attractive to its customers.

There

has also been consolidation among the Company’s competitors in the esports and gaming industry. Such consolidation could

result in the formation of larger competitors with increased financial resources and altered cost structures, which may enable

them to offer more competitive pricing models, gain a larger market share of customers, expand product offerings and broaden their

geographic scope of operations.

Risks

that impact our customers may impact us.

Because

we generate website traffic through our affiliate marketing program, if participants in our affiliate marketing program see a

slowdown in business or website traffic it may lead to fewer visitors on our website, which could have an adverse effect on our

business.

Because

four of our directors and a substantial portion of our assets are located in jurisdictions other than the United States and Canada,

you may have no effective recourse against the directors not located in the United States and Canada for misconduct and may not

be able to enforce judgment and civil liabilities against these directors.

Four

of our directors and a substantial portion of our assets are or may be located in jurisdictions outside the U.S. As a result,

a person may not be able to affect service of process within the U.S. on our directors and officers. A person also may not be

able to recover against them on judgments of U.S. courts or to obtain original judgments against them in foreign courts, including

judgments predicated upon civil liability provisions of the U.S. federal securities laws.

We

operate in a very competitive business environment and if we do not adapt our approach and our products to meet this competitive

environment, our business, results of operations or financial condition could be adversely impacted.

There

is intense competition in the gaming management and gaming products industry which is characterized by dynamic customer demand

and rapid technological advances. Today, there are many systems providers in the U.S. and abroad offering casinos and gaming operators

“total solution” casino management and table games management systems. As a result, we must continually adapt our

approach and our products to meet this demand and match technological advances and if we cannot do so, our business results of

operations or financial condition may be adversely impacted. Conversely, the development of new competitive products or the enhancement

of existing competitive products in any market in which we operate could have an adverse impact on our business, results of operations

or financial condition. If we are unable to remain dynamic in the face of changes in the market, it could have a material adverse

effect on our business, results of operations or financial condition.

We

are vulnerable to additional or increased taxes and fees.

We

believe that the prospect of raising significant additional revenue through taxes and fees is one of the primary reasons that

certain jurisdictions permit legalized gaming. As a result, gaming companies are typically subject to significant taxes and fees

in addition to the normal federal, state, provincial and local income taxes and such taxes and fees may be increased at any time.

From time to time, legislators and officials have proposed changes in tax laws or in the administration of laws affecting the

gaming industry. Many states and municipalities, including ones in which we operate, are currently experiencing budgetary pressures

that may make it more likely they would seek to impose additional taxes and fees on our operations. It is not possible to determine

the likelihood or extent of any such future changes in tax laws or fees, or changes in the administration of such laws; however,

if enacted, such changes could have a material adverse impact on our business.

The

legalization of online real money gaming in the United States and our ability to predict and capitalize on any such legalization

may impact our business.

Nevada,

Delaware, New Jersey and Pennsylvania have enacted legislation to legalize online real money gaming. In recent years, California,

Mississippi, Hawaii, Massachusetts, Iowa, Illinois, New York, Washington D.C. and West Virginia have considered such legislation.

If a large number of additional states or the Federal government enact online real money gaming legislation and we are unable

to obtain the necessary licenses to operate online real money gaming websites in United States jurisdictions where such games

are legalized, our future growth in real money gaming could be materially impaired.

States

or the Federal government may legalize online real money gaming in a manner that is unfavorable to us. Several states and the

Federal government are considering draft laws that require online casinos to also have a license to operate a brick-and mortar

casino, either directly or indirectly through an affiliate. If, like Nevada and New Jersey, state jurisdictions enact legislation

legalizing online real money casino gaming subject to this brick-and-mortar requirement, we may be unable to offer online real

money gaming in such jurisdictions if we are unable to establish an affiliation with a brick-and-mortar casino in such jurisdiction

on acceptable terms.

In

the online real money gaming industry, a significant “first mover” advantage exists. Our ability to compete effectively

in respect of a particular style of online real money gaming in the United States may be premised on introducing a style of gaming

before our competitors. Failing to do so (“move first”) could materially impair our ability to grow in the online

real money gaming space. We may fail to accurately predict when online real money gaming will be legalized in significant jurisdictions.

The legislative process in each state and at the Federal level is unique and capable of rapid, often unpredictable change. If

we fail to accurately forecast when and how, if at all, online real money gaming will be legalized in additional state jurisdictions,

such failure could impair our readiness to introduce online real money gaming offerings in such jurisdictions which could have

a material adverse impact on our business.

Our

business is subject to online security risk, including security breaches, and loss or misuse of our stored information as a result

of such a breach, including customers’ personal information, could lead to government enforcement action or other litigation,

potential liability, or otherwise harm our business.

We

receive, process, store and use personal information and other customer data. There are numerous federal, state and local laws

regarding privacy and the storing, sharing, use, processing, disclosure and protection of personal information and other data.

Any failure or perceived failure by us to comply with our privacy policies, our privacy-related obligations to customers or other

third parties, or our privacy-related legal obligations, or any compromise of security that results in the unauthorized release

or transfer of personally identifiable information or other player data, may result in governmental enforcement actions, litigation

or public statements against us by consumer advocacy groups or others and could cause our customers to lose trust in us which

could have an adverse impact on our business. In the area of information security and data protection, many states have passed

laws requiring notification to customers when there is a security breach for personal data, such as the 2002 amendment to California’s

Information Practices Act, or requiring the adoption of minimum information security standards that are often vaguely defined

and difficult to practically implement. The costs of compliance with these types of laws may increase in the future as a result

of changes in interpretation or changes in law. Any failure on our part to comply with these types of laws may subject us to significant

liabilities.

Third

parties we work with, such as vendors, may violate applicable laws or our policies, and such violations may also put our customers’

information at risk and could in turn have an adverse impact on our business. We are also subject to payment card association

rules and obligations under each association’s contracts with payment card processors. Under these rules and obligations,

if information is compromised, we could be liable to payment card issuers for the associated expense and penalties. If we fail

to follow payment card industry security standards, even if no customer information is compromised, we could incur significant

fines or experience a significant increase in payment card transaction costs.

Security

breaches, computer malware and computer hacking attacks have become more prevalent in our industry. Many companies, including

ours, have been the targets of such attacks. Any security breach caused by hacking which involves efforts to gain unauthorized

access to information or systems, or to cause intentional malfunctions or loss or corruption of data, software, hardware or other

computer equipment, and the inadvertent transmission of computer viruses could harm our business. Though it is difficult to determine

what harm may directly result from any specific interruption or breach, any failure to maintain performance, reliability, security

and availability of our network infrastructure to the satisfaction of our players may harm our reputation and our ability to retain

existing players and attract new players.

If

unauthorized disclosure of the source code we currently license we could potentially lose future trade secret protection for that

source code. This could make it easier for third parties to compete with our products by copying functionality which could adversely

affect our revenue and operating margins. Unauthorized disclosure of source code also could increase security risks.

Because

the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems, change frequently and often

are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative

measures. We have developed systems and processes that are designed to protect customer information and prevent data loss and

other security breaches, including systems and processes designed to reduce the impact of a security breach at a third party vendor;

however, such measures cannot provide absolute security.

Risks

related to our reliance on third party technology, platforms and software (“third-party software”), and any failures,

errors, defects or disruptions in such third-party software could diminish our brand and reputation, subject us to liability,

disrupt our business and adversely affect our operating results and growth prospects.

We

rely on third party software that is critical to the performance of our platform and offerings and to user satisfaction, the principal

suppliers being Askott for our vie.gg website and SB Tech for our Argyll Brands.

If

there is any interruption to the third-party software provided by these suppliers or their products or services are not as scalable

as anticipated or at all, or if there are problems in upgrading such products or services, our business could be adversely affected,

and we may be unable to find adequate replacement services on a timely basis or at all and/or at a reasonable price. Additionally,

third-party software may contain errors, bugs, flaws or corrupted data, and these defects may only become apparent after their

launch. If a particular product offering is unavailable when end users attempt to access it or navigation through our platforms

is slower than they expect, users may be unable to place their bets and may be less likely to return to our platforms as often,

if at all. Furthermore, programming errors, defects and data corruption could disrupt our operations, adversely affect the experience

of our users, harm our reputation, cause our users to stop utilizing our platforms, divert our resources and delay market acceptance

of our offerings, any of which could result in legal liability to us or harm our business, financial condition, results of operations

and prospects. Moreover, end users are discriminating about the nature of the products offered and our suppliers do not provide

new and improved products on a regular basis, we may lose market share.

There

is a risk that if the contracts with such third parties are terminated and not renewed, or not renewed on favourable terms, or

if they do not get the level of support (in terms of updates and technical assistance) they require as we grow, this will materially

impact upon our financial condition and performance going forward. There may be circumstances in which we wish to terminate our

arrangements with such suppliers due to poor performance or other reasons but we are unable to do so. Any such circumstance may

have a material adverse effect on our reputation, business, financial condition and results of operations.

We

are dependent upon such software suppliers defending any challenges to their intellectual property; any litigation that arises

as a result of such change could materially impact upon us and, following even if legal actions were successfully defended, such

actions could disrupt our business in the interim, divert management time and result in significant cost and expense for us. Further,

any negative publicity related to any of our third-party partners, including any publicity related to regulatory concerns, could

adversely affect our reputation and brand, and could potentially lead to increased regulatory or litigation exposure.

As

a condition of an ongoing licence, permit or other authorisation required for their business, a key supplier to the Company may

determine that a condition of the ongoing use of their products and services, or the continuation of the licence, is that the

Company should block custom from certain territories, which may cause business disruption and loss should the Company either need

to switch suppliers at short notice or discontinue business in certain territories, either permanently (while such suppliers are

necessary) or pending the expiry of contract notice periods and/or the sourcing of alternative suppliers.

We

rely on other third-party data and live-streaming providers for real-time and accurate data and/or live streams for sporting events,

and if such third parties do not perform adequately or terminate their relationships with us, our costs may increase and our business,

financial condition and results of operations could be adversely affected.

We

rely on third-party sports data and live streaming providers to obtain accurate information regarding schedules, results, performance

and outcomes of sporting events and the live streaming of such events, such as horse racing. We rely on this data to determine

when and how bets are settled. We have experienced, and may continue to experience, errors in this data and/or streaming feed

which may result in us incorrectly settling bets. If we cannot adequately resolve the issue with our end users, our end users

may have a negative experience with our offerings, our brand or reputation may be negatively affected and our users may be less

inclined to continue or resume utilizing our products or recommend our platform to other potential users. As such, a failure or

significant interruption in our service would harm our reputation, business and operating results.

Furthermore,

if any of our data and/or live streaming partners terminates its relationship with us or refuses to renew its agreement with us

on commercially reasonable terms, we would need to find an alternate provider, and may not be able to secure similar terms or

replace such providers in an acceptable time frame. Any of these risks could increase our costs and adversely affect our business,

financial condition and results of operations. Further, any negative publicity related to any of our third-party partners, including

any publicity related to regulatory concerns, could adversely affect our reputation and brand, and could potentially lead to increased

regulatory or litigation exposure.

We

may be subject to the payment of contributions or fees to sporting bodies or rights holders for the use of their data.

Gambling

operators can be liable to make contributions to sporting bodies whether under regulations or agreement, such as The Horserace

Betting Levy Board in the UK, as a way of ensuring certain revenues generated from betting on sports are used to benefit those

sports or related interests. We may also be required to pay royalties or other types of levy to the organisers of sporting events,

or the rights holders in respect of such, to offer betting markets on such events. Any requirement to pay additional levies, fees

or royalties would have a material adverse effect on our business. In all such cases, the level of any such levy, fee or royalty

will be outside the control of the Company. The Company cannot predict with any certainty what future payments may be required

for the success of their business in the future and what other additional resources will need to be made available to address

the conditions which impose fees, royalties or other levies, as well as sports integrity issues.

The

success, including win or hold rates, of existing or future online betting and casino gaming products depends on a variety of

factors and is not completely controlled by us.

The

sports betting and casino gaming industries are characterized by an element of chance. Accordingly, our Argyll Brands employ theoretical

win rates to estimate what a certain type of sports bet or game, on average, will win or lose in the long run. Net win is impacted

by variations in the hold percentage (the ratio of net win to total amount wagered), or actual outcome, on our games and sports

betting we offer to our users. We use the hold percentage as an indicator of a casino game’s or sports bet’s performance

against its expected outcome. Although each game or sports bet generally performs within a defined statistical range of outcomes,

actual outcomes may vary for any given period. In addition to the element of chance, win rates (hold percentages) may also (depending

on the game involved) be affected by the spread of limits and factors that are beyond our control, such as an end user’s

skill, experience and behavior, the mix of games played, the financial resources of users, the volume of bets placed and the amount

of time spent gambling. As a result of the variability in these factors, the actual win rates on our online casino games and sports

bets may differ from the theoretical win rates we have estimated and could result in the winnings of our casino game’s or

sports bet’s users exceeding those anticipated. The variability of win rates (hold rates) also have the potential to negatively

impact our financial condition, results of operations, and cash flows.

Participation

in the sports betting industry exposes us to trading, liability management and pricing risk. We may experience lower than expected

profitability and potentially significant losses as a result of a failure to determine accurately the odds in relation to any

particular event and/or any failure of its sports risk management processes.

Our

fixed-odds betting products involve betting where winnings are paid on the basis of the stake placed and the odds quoted. Odds

are determined with the objective of providing an average return to the Company over a large number of events and therefore, over

the long term, gross win percentage is expected to remain fairly constant. However, there can be significant variation in gross

win percentage event-by-event and day-by-day. As a result, in the short term, there is less certainty of generating a positive

gross win, and we may experience significant losses with respect to individual events or betting outcomes, in particular if large

individual bets are placed on an event or betting outcome or series of events or betting outcomes. Odds compilers and risk managers

are capable of human error, thus even allowing for the fact that a number of betting products are subject to capped pay-outs,

significant volatility can occur. In addition, it is possible that there may be such a high volume of trading during any particular

period that even automated systems would be unable to address and eradicate all risks. Any significant losses on a gross-win basis

could have a material adverse effect on our business, financial condition and results of operations. In addition, if a jurisdiction

where we hold or wish to apply for a license imposes a high turnover tax for betting (as opposed to a gross-win tax), this too

would impact profitability, particularly with high value/low margin bets, and likewise have a material adverse effect on our business.

We

are required to comply with applicable anti-money laundering and countering the financing of terrorism legislation a breach of

which could lead to government enforcement action or other litigation, potential liability, or otherwise harm our business.

The

Company receive deposits and other payments from customers in the normal course of their business. The receipt of monies from

customers imposes anti-money laundering and other obligations and potential liabilities on the Company. Compliance with all such

laws and regulations creates complex regulatory obligations which involves a risk of large financial penalties (in not being fully

compliant) and additional potential burdens (in being fully compliant). While the Company has processes in place regarding customer

profiling and the identification of customers’ source of funds, such processes may fail or prove to be inadequate whether

in respect of the source of customers’ funds or otherwise. Any such failure or inadequacy could have a material adverse

effect on the Company’s financial position and impact upon its licensing obligations.

Handling,

or any form of facilitating the use of criminal property, is a crime in all jurisdictions in which the Company takes material

custom (and going forward will take material custom). In instances where no local licensing regime is in place and there is doubt

in connection with the legality of the remote supply of gambling services, there is a risk that the authorities will claim that

money movements in connection with gambling amounts to money laundering, irrespective of whether the intention is actually to

launder money (i.e. to disguise or conceal its provenance). This gives rise to a risk that when monies are held in (or moved into)

certain territories, authorities may wish to freeze their onward payment, seek to trace money movements into different jurisdictions

and recover the relevant sums. This would give rise to conflicts of law issues (not all the definitions of what comprises criminal

property are identical in all jurisdictions) and what may not amount to money laundering in one jurisdiction may satisfy the definition

in that other territory. There is a risk that should any such claim be brought and be successful, significant funds may have to

be repatriated to the jurisdiction bringing a claim, which would have a significant impact on the profitability of the Company.

We

are subject to payment-related risks, such as risk associated with the fraudulent use of credit or debit cards which could have

adverse effects on our business due to chargebacks from customers

We

allow funding and payments to accounts using a variety of methods, including electronic funds transfer (“EFT”), and

credit and debit cards. As we continue to introduce new funding or payment options to our players, we may be subject to additional

regulatory and compliance requirements. We also may be subject to the risk of fraudulent use of credit or debit cards, or other

funding and/or payment options. For certain funding or payment options, including credit and debit cards, we may pay interchange

and other fees which may increase over time and, therefore, raise operating costs and reduce profitability. We rely on third parties

to provide payment-processing services and it could disrupt our business if these companies become unwilling or unable to provide

these services to us. We are also subject to rules and requirements governing EFT which could change or be reinterpreted to make

it difficult or impossible for us to comply. If we fail to comply with these rules or requirements, we may be subject to fines

and higher transaction fees or possibly lose our ability to accept credit or debit cards, or other forms of payment from customers

which could have a material adverse impact on our business.

Chargebacks

occur when customers seek to void credit card or other payment transactions. Cardholders are intended to be able to reverse card

transactions only if there has been unauthorized use of the card or the services contracted for have not been provided. In our

business, customers occasionally seek to reverse online gaming losses through chargebacks. We place great emphasis on control

procedures to protect from chargebacks; however, these control procedures may not be sufficient to protect us from adverse effects

on our business or results of operations. Public health epidemics or outbreaks, such as COVID-19, could materially and adversely

impact our business.

In

December 2019, a novel strain of coronavirus (COVID-19) emerged in Wuhan, Hubei Province, China. While initially the outbreak

was largely concentrated in China and caused significant disruptions to its economy, it has now spread to several other countries

and infections have been reported globally. Due to the outbreak of Covid-19, almost all major sports events and leagues were postponed

or put-on hold, for the period of Apr 2020-June 2020. The cancelation of major sports events had a significant short-term negative

effect on betting activity globally. As a result, iGaming operators faced major short-term losses in betting volumes. To date

online casino operations have generally continued as normal without any noticeable disruption due to the Covid-19 outbreak. The

virus’s expected effect on online casino activity globally is expected to be overall positive or neutral. Travel restrictions

and border closures have not materially impacted our ability to manage and operate the day to day functions of our business. Management

has been able to operate in a virtual setting. However, if such restrictions become more severe, they could negatively impact

those activities in a way that would harm our business over the long term. Travel restrictions impacting people can restrain our

ability to operate, but at present we do not expect these restrictions on personal travel to be material to our business operations

or financial results.

The

ultimate impact of the COVID-19 pandemic on the Company’s operations is unknown and will depend on future developments,

which are highly uncertain and cannot be predicted with confidence, including the duration of the COVID-19 outbreak, new information

which may emerge concerning the severity of the COVID-19 pandemic, and any additional preventative and protective actions that

governments, or the Company, may direct, which may result in an extended period of continued business disruption and reduced operations.

Any resulting financial impact cannot be reasonably estimated at this time but may have a material adverse impact on our business,

financial condition and results of operations.

Our

profitability depends upon many factors for which no assurance can be given.

Profitability

depends upon many factors, including the ability to develop and maintain valuable products and services, our ability to identify

and obtain the rights to additional products to add to our existing product line, success and expansion of our sales programs,

expansion of our customer base, obtaining the right balance of expense levels and the overall success of our business activities.

Operating Income will be earned during the next 12 months, buoyed by the Argyll acquisition, but even if we do achieve profitability,

we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to become and remain profitable

would depress the value of our company and could impair our ability to raise capital, expand our business, diversify our product

offerings or even continue our operations. A decline in the value of our stock could also cause you to lose all or part of your

investment.

Future

cash flows fluctuations may affect our ability to fund our working capital requirements or achieve our business objectives in

a timely manner.

Our

working capital requirements and cash flows are expected to be subject to quarterly and yearly fluctuations, depending on such

factors as timing and size of capital expenditures, levels of sales and collection of receivables, customer payment terms and

supplier terms and conditions. We expect that a greater than expected slow-down in capital spending by our customers may require

us to adjust our current business model. As a result, our revenues and cash flows may be materially lower than we expect and we

may be required to reduce our capital expenditures and investments or take other measures in order to meet our cash requirements.

We may seek additional funds from liquidity-generating transactions and other conventional sources of external financing (which

may include a variety of debt, convertible debt and/or equity financings). We cannot provide any assurance that our net cash requirements

will be as we currently expect. Our inability to manage cash flow fluctuations resulting from the above factors could have a material

adverse effect on our ability to fund our working capital requirements from operating cash flows and other sources of liquidity

or to achieve our business objectives in a timely manner.

Our

business may be materially and adversely affected by increased levels of debt.

In

order to finance our business or to finance possible acquisitions we may incur significant levels of debt compared to historical

levels, and we may need to secure additional sources of funding, which may include debt or convertible debt financing, in the