Epsilon Reports Third Quarter 2023 Results

November 09 2023 - 4:05PM

Epsilon Energy Ltd. (“

Epsilon” or the

“

Company”) (NASDAQ: EPSN) today reported third

quarter 2023 financial and operating results.

Third Quarter Financial

Highlights:

- Reported net revenue interest (NRI)

production of 2.0 Bcfe (21.5 MMcfe per day) for the quarter ended

September 30, 2023, a decrease of 14% compared to the prior

quarter.

- As previously disclosed in our

August operational update, the quarter over quarter decrease was

caused in part by seven wells brought offline for 52 days during

the quarter in Pennsylvania to accommodate a workover operation

(cumulative NRI production rate for the wells before shut-in was

3.5 MMcf per day). These wells are now back online.

- Realized average price of $2.32 per

Mcfe including hedges ($1.64 per Mcfe excluding hedges) for the

quarter ended September 30, 2023, a decrease of 5% compared to the

prior quarter.

- Reported total revenues of $6.3

million for the quarter ended September 30, 2023, a decrease of 3%

compared to the prior quarter.

- $3.2 million from natural gas, oil,

and NGL sales, a decrease of 25% compared to the prior quarter

- $3.1 million from gathering and

compression fees through our ownership in the Auburn Gas Gathering

System, after eliminating revenue earned from Epsilon production

($0.3 million), an increase of 39% compared to the prior quarter.

This included $1.0 million of revenue received from a backward

looking fee adjustment as a result of an internal audit by the

system operator.

- Reported Adjusted EBITDA of $3.9

million for the quarter ended September 30, 2023.

- Cash, cash equivalents (including

restricted cash), and short term investments totaled $31.9 million

at September 30, 2023.

- Returned $4.0 million to

shareholders during the quarter ended September 30, 2023.

- $2.6 million through the repurchase

of 525,000 shares at $5.00 per share, over a 2% reduction of shares

outstanding

- $1.4 million through the quarterly

dividend

- 1.4 million shares remain under the

approved buyback program (expires in March 2024)

- Realized gains of $1.3 million on

Henry Hub (HH) and TGP Z4 basis swaps totaling 455,000 MMBTU.

- Placed Henry Hub (HHUB) and TGP Z4

basis swaps for November 2023 through March 2024 (at a net realized

price of $2.59 per MMBTU, for 380,000 MMBTU) and April 2024 through

October 2024 (at a net realized price of $2.05 per MMBTU, for

1,070,000 MMBTU).

- After quarter-end, we placed

additional Henry Hub (HHUB) and TGP Z4 basis swaps for November

2023 through March 2024 (at a net realized price of $2.65 per

MMBTU, for 380,000 MMBTU) and April 2024 through October 2024 (at a

net realized price of $2.09 per MMBTU, for 535,000 MMBTU).

Third Quarter Operating

Results:

Epsilon’s capital expenditures were $5.5 million

for the quarter ended September 30, 2023, including certain

pre-paid well costs. This capital was primarily related to the

drilling of one gross (0.25 net) well and the completion of two

gross (0.5 net) wells in Ector Co. Texas ($4.8 million).

During the quarter, we received well proposals

from our operating partner in Pennsylvania for the drilling and

completion of seven gross wells (0.74 net). The first three wells

have been drilled, and drilling is expected to commence on the

fourth this month. All seven wells are expected to be drilled by

year end with completions expected in the first half of 2024.

In addition, initial investment plans for 2024

on our position in Ector Co. Texas call for the drilling and

completion of up to four gross (1.0 net) wells, starting in the

first quarter. The two gross (0.5 net) wells drilled in 2023 are

now completed and on flowback. Initial results are encouraging and

in-line with our pre-drill projections.

Jason Stabell, Epsilon's Chief Executive

Officer, commented, "Our announced investments and ongoing

activities in Pennsylvania and Texas position the company for per

share volume and cash flow growth next year, and represent the next

step in our objective to deliver sustainable and attractive returns

across a more diversified portfolio. These investments will be

comfortably funded from cash flow and cash on hand while allowing

us to pursue additional opportunities on existing assets and in new

areas, to pay our annual dividend and to repurchase our shares

opportunistically.”

Earning’s Call:

The Company will host a conference call to

discuss its results on Friday, November 10, 2023 at 10:00 a.m.

Central Time (11:00 a.m. Eastern Time).

Interested parties in the United States and

Canada may participate toll-free by dialing (833) 816-1385.

International parties may participate by dialing (412) 317-0478.

Participants should ask to be joined to the “Epsilon Energy Third

Quarter 2023 Earnings Conference Call.”

A webcast can be viewed at:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=TKIiaI4y.

A webcast replay will be available on the Company’s website

(www.epsilonenergyltd.com) following the call.

About Epsilon

Epsilon Energy Ltd. is a North American onshore

natural gas and oil production and gathering company with assets in

Pennsylvania, Texas, New Mexico, and Oklahoma.

For more information, please visit

www.epsilonenergyltd.com, where we routinely post announcements,

updates, events, investor information, presentations and recent

news releases.

Forward-Looking Statements

Certain statements contained in this news

release constitute forward looking statements. The use of any of

the words “anticipate”, “continue”, “estimate”, “expect”, ‘may”,

“will”, “project”, “should”, ‘believe”, and similar expressions are

intended to identify forward-looking statements. These statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated. Forward-looking statements are based on

reasonable assumptions, but no assurance can be given that these

expectations will prove to be correct and the forward-looking

statements included in this news release should not be unduly

relied upon.

Contact Information:

281-670-0002

Jason StabellChief Executive

OfficerJason.Stabell@EpsilonEnergyLTD.com

Andrew Williamson Chief Financial Officer

Andrew.Williamson@EpsilonEnergyLTD.com

| EPSILON

ENERGY LTD. |

| Unaudited

Consolidated Statements of Operations |

| (All

amounts stated in US$) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

Nine months ended September 30, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Revenues from contracts with customers: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gas, oil, NGL, and condensate revenue |

|

$ |

3,241,531 |

|

|

$ |

19,171,121 |

|

|

$ |

14,509,184 |

|

|

$ |

48,566,282 |

|

|

Gas gathering and compression revenue |

|

|

3,068,996 |

|

|

|

2,072,806 |

|

|

|

7,657,755 |

|

|

|

6,180,747 |

|

|

Total revenue |

|

|

6,310,527 |

|

|

|

21,243,927 |

|

|

|

22,166,939 |

|

|

|

54,747,029 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease operating expenses |

|

|

1,559,957 |

|

|

|

2,024,229 |

|

|

|

4,404,757 |

|

|

|

5,681,736 |

|

|

Gathering system operating expenses |

|

|

631,725 |

|

|

|

600,672 |

|

|

|

1,854,000 |

|

|

|

1,666,275 |

|

|

Development geological and geophysical expenses |

|

|

- |

|

|

|

2,387 |

|

|

|

- |

|

|

|

7,159 |

|

|

Depletion, depreciation, amortization, and accretion |

|

|

1,392,032 |

|

|

|

1,706,030 |

|

|

|

4,780,766 |

|

|

|

4,898,988 |

|

|

Loss (gain) on sale of oil and gas properties |

|

|

- |

|

|

|

- |

|

|

|

1,449,871 |

|

|

|

(221,642 |

) |

|

General and administrative expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock based compensation expense |

|

|

439,653 |

|

|

|

500,597 |

|

|

|

799,149 |

|

|

|

836,949 |

|

|

Other general and administrative expenses |

|

|

1,540,358 |

|

|

|

2,015,272 |

|

|

|

5,160,757 |

|

|

|

4,651,547 |

|

|

Total operating costs and expenses |

|

|

5,563,725 |

|

|

|

6,849,187 |

|

|

|

18,449,300 |

|

|

|

17,521,012 |

|

|

Operating income |

|

|

746,802 |

|

|

|

14,394,740 |

|

|

|

3,717,639 |

|

|

|

37,226,017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

384,732 |

|

|

|

89,638 |

|

|

|

1,308,695 |

|

|

|

126,804 |

|

|

Interest expense |

|

|

(8,760 |

) |

|

|

(17,501 |

) |

|

|

(71,619 |

) |

|

|

(33,565 |

) |

|

(Loss) gain on derivative contracts |

|

|

(24,303 |

) |

|

|

(929,637 |

) |

|

|

1,672,535 |

|

|

|

(1,124,547 |

) |

|

Other income (expense), net |

|

|

468 |

|

|

|

(32,777 |

) |

|

|

5,169 |

|

|

|

(99,896 |

) |

|

Other income (expense), net |

|

|

352,137 |

|

|

|

(890,277 |

) |

|

|

2,914,780 |

|

|

|

(1,131,204 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income before income tax expense |

|

|

1,098,939 |

|

|

|

13,504,463 |

|

|

|

6,632,419 |

|

|

|

36,094,813 |

|

|

Income tax expense |

|

|

710,164 |

|

|

|

3,896,010 |

|

|

|

2,283,228 |

|

|

|

10,097,484 |

|

| NET

INCOME |

|

$ |

388,775 |

|

|

$ |

9,608,453 |

|

|

$ |

4,349,191 |

|

|

$ |

25,997,329 |

|

|

Currency translation adjustments |

|

|

(846 |

) |

|

|

(34,524 |

) |

|

|

(2,317 |

) |

|

|

(48,272 |

) |

|

Unrealized gain (loss) on securities |

|

|

24,641 |

|

|

|

- |

|

|

|

(22,365 |

) |

|

|

- |

|

| NET

COMPREHENSIVE INCOME |

|

$ |

412,570 |

|

|

$ |

9,573,929 |

|

|

$ |

4,324,509 |

|

|

$ |

25,949,057 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income per share, basic |

|

$ |

0.02 |

|

|

$ |

0.42 |

|

|

$ |

0.19 |

|

|

$ |

1.11 |

|

| Net

income per share, diluted |

|

$ |

0.02 |

|

|

$ |

0.41 |

|

|

$ |

0.19 |

|

|

$ |

1.11 |

|

|

Weighted average number of shares outstanding,

basic |

|

|

22,118,984 |

|

|

|

23,011,729 |

|

|

|

22,616,539 |

|

|

|

23,419,666 |

|

|

Weighted average number of shares outstanding,

diluted |

|

22,178,686 |

|

|

|

23,169,658 |

|

|

|

22,631,550 |

|

|

|

23,524,574 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

EPSILON ENERGY LTD. |

|

Unaudited Consolidated Balance Sheets |

| (All

amounts stated in US$) |

| |

|

|

|

|

|

|

| |

|

September

30, |

|

December

31, |

| |

|

2023 |

|

2022 |

|

ASSETS |

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

12,498,051 |

|

|

$ |

45,236,584 |

|

|

Accounts receivable |

|

|

4,006,278 |

|

|

|

7,201,386 |

|

|

Short term investments |

|

|

18,870,468 |

|

|

|

- |

|

|

Fair value of derivatives |

|

|

- |

|

|

|

1,222,090 |

|

|

Prepaid income taxes |

|

|

1,954,788 |

|

|

|

1,140,094 |

|

|

Other current assets |

|

|

920,224 |

|

|

|

632,154 |

|

|

Operating lease right-of-use assets |

|

|

- |

|

|

|

31,383 |

|

|

Total current assets |

|

|

38,249,809 |

|

|

|

55,463,691 |

|

|

Non-current assets |

|

|

|

|

|

|

|

Property and equipment: |

|

|

|

|

|

|

|

Oil and gas properties, successful efforts method |

|

|

|

|

|

|

|

Proved properties |

|

|

154,190,226 |

|

|

|

148,326,265 |

|

|

Unproved properties |

|

|

26,185,843 |

|

|

|

18,169,157 |

|

|

Accumulated depletion, depreciation, amortization and

impairment |

|

|

(111,142,288 |

) |

|

|

(107,729,293 |

) |

|

Total oil and gas properties, net |

|

|

69,233,781 |

|

|

|

58,766,129 |

|

|

Gathering system |

|

|

42,694,512 |

|

|

|

42,639,001 |

|

|

Accumulated depletion, depreciation, amortization and

impairment |

|

|

(35,241,595 |

) |

|

|

(34,500,740 |

) |

|

Total gathering system, net |

|

|

7,452,917 |

|

|

|

8,138,261 |

|

|

Land |

|

|

637,764 |

|

|

|

637,764 |

|

|

Buildings and other property and equipment, net |

|

|

303,211 |

|

|

|

286,035 |

|

|

Total property and equipment, net |

|

|

77,627,673 |

|

|

|

67,828,189 |

|

|

Other assets: |

|

|

|

|

|

|

|

Operating lease right-of-use assets, long term |

|

|

468,833 |

|

|

|

- |

|

|

Restricted cash |

|

|

495,000 |

|

|

|

570,363 |

|

|

Fair value of derivatives, long term |

|

|

42,005 |

|

|

|

- |

|

|

Prepaid drilling costs |

|

|

2,891,250 |

|

|

|

- |

|

|

Total non-current assets |

|

|

81,524,761 |

|

|

|

68,398,552 |

|

|

Total assets |

|

$ |

119,774,570 |

|

|

$ |

123,862,243 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

Accounts payable trade |

|

$ |

1,855,591 |

|

|

$ |

1,695,353 |

|

|

Gathering fees payable |

|

|

556,437 |

|

|

|

935,012 |

|

|

Royalties payable |

|

|

1,241,533 |

|

|

|

2,223,043 |

|

|

Accrued capital expenditures |

|

|

195,917 |

|

|

|

41,694 |

|

|

Accrued compensation |

|

|

631,646 |

|

|

|

598,351 |

|

|

Other accrued liabilities |

|

|

556,814 |

|

|

|

690,655 |

|

|

Fair value of derivatives |

|

|

126,508 |

|

|

|

- |

|

|

Operating lease liabilities |

|

|

55,656 |

|

|

|

35,299 |

|

|

Total current liabilities |

|

|

5,220,102 |

|

|

|

6,219,407 |

|

|

Non-current liabilities |

|

|

|

|

|

|

|

Asset retirement obligations |

|

|

2,794,743 |

|

|

|

2,780,237 |

|

|

Deferred income taxes |

|

|

11,805,453 |

|

|

|

10,617,394 |

|

|

Operating lease liabilities, long term |

|

|

498,155 |

|

|

|

- |

|

|

Total non-current liabilities |

|

|

15,098,351 |

|

|

|

13,397,631 |

|

|

Total liabilities |

|

|

20,318,453 |

|

|

|

19,617,038 |

|

|

Commitments and contingencies (Note 10) |

|

|

|

|

|

|

|

Shareholders' equity |

|

|

|

|

|

|

|

Preferred shares, no par value, unlimited shares authorized, none

issued or outstanding |

|

|

- |

|

|

|

- |

|

|

Common shares, no par value, unlimited shares authorized and

22,126,800 shares issued and outstanding at September 30, 2023 and

23,117,144 issued and outstanding at December 31, 2022 |

|

|

118,209,690 |

|

|

|

123,904,965 |

|

|

Additional paid-in capital |

|

|

10,655,378 |

|

|

|

9,856,229 |

|

|

Accumulated deficit |

|

|

(39,158,820 |

) |

|

|

(39,290,540 |

) |

|

Accumulated other comprehensive income |

|

|

9,749,869 |

|

|

|

9,774,551 |

|

|

Total shareholders' equity |

|

|

99,456,117 |

|

|

|

104,245,205 |

|

|

Total liabilities and shareholders' equity |

|

$ |

119,774,570 |

|

|

$ |

123,862,243 |

|

| |

|

|

|

|

|

|

|

EPSILON ENERGY LTD. |

|

Unaudited Consolidated Statements of Cash Flows |

|

(All amounts stated in US$) |

| |

|

|

|

|

|

|

| |

|

Nine months ended September 30, |

| |

|

2023 |

|

2022 |

| Cash

flows from operating activities: |

|

|

|

|

|

|

|

Net income |

|

$ |

4,349,191 |

|

|

$ |

25,997,329 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

Depletion, depreciation, amortization, and accretion |

|

|

4,780,766 |

|

|

|

4,898,988 |

|

|

Accretion of discount on available for sale securities |

|

|

(574,341 |

) |

|

|

- |

|

|

Gain on available for sale securities |

|

|

(60,494 |

) |

|

|

- |

|

|

Loss (gain) on sale of oil and gas properties |

|

|

1,449,871 |

|

|

|

(221,642 |

) |

|

(Gain) loss on derivative contracts |

|

|

(1,672,535 |

) |

|

|

1,124,547 |

|

|

Settlement received (paid) on derivative contracts |

|

|

2,979,128 |

|

|

|

(1,396,698 |

) |

|

Settlement of asset retirement obligation |

|

|

(3,482 |

) |

|

|

(118,259 |

) |

|

Stock-based compensation expense |

|

|

799,149 |

|

|

|

836,949 |

|

|

Deferred income tax expense (benefit) |

|

|

1,188,059 |

|

|

|

439,857 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

|

3,195,108 |

|

|

|

(5,472,585 |

) |

|

Prepaid income taxes |

|

|

(814,694 |

) |

|

|

- |

|

|

Other assets and liabilities |

|

|

(67,008 |

) |

|

|

(205,717 |

) |

|

Accounts payable, royalties payable and other accrued

liabilities |

|

|

(1,191,558 |

) |

|

|

1,511,652 |

|

|

Income taxes payable |

|

|

- |

|

|

|

2,021,246 |

|

| Net

cash provided by operating activities |

|

|

14,357,160 |

|

|

|

29,415,667 |

|

| Cash

flows from investing activities: |

|

|

|

|

|

|

|

Additions to unproved oil and gas properties |

|

|

(8,017,412 |

) |

|

|

(226,439 |

) |

|

Additions to proved oil and gas properties |

|

|

(7,860,073 |

) |

|

|

(5,528,037 |

) |

|

Additions to gathering system properties |

|

|

(52,069 |

) |

|

|

(129,985 |

) |

|

Additions to land, buildings and property and equipment |

|

|

(49,689 |

) |

|

|

(13,258 |

) |

|

Purchases of short term investments |

|

|

(32,812,974 |

) |

|

|

- |

|

|

Proceeds from short term investments |

|

|

14,554,976 |

|

|

|

- |

|

|

Proceeds from sale of oil and gas properties |

|

|

12,498 |

|

|

|

200,000 |

|

|

Prepaid drilling costs |

|

|

(2,891,250 |

) |

|

|

- |

|

| Net

cash used in investing activities |

|

|

(37,115,993 |

) |

|

|

(5,697,719 |

) |

| Cash

flows from financing activities: |

|

|

|

|

|

|

|

Buyback of common shares |

|

|

(5,695,275 |

) |

|

|

(6,234,879 |

) |

|

Exercise of stock options |

|

|

- |

|

|

|

747,112 |

|

|

Dividends paid |

|

|

(4,217,471 |

) |

|

|

(4,422,720 |

) |

|

Debt issuance costs |

|

|

(140,000 |

) |

|

|

- |

|

| Net

cash used in financing activities |

|

|

(10,052,746 |

) |

|

|

(9,910,487 |

) |

|

Effect of currency rates on cash, cash equivalents, and restricted

cash |

|

|

(2,317 |

) |

|

|

(48,272 |

) |

|

(Decrease) increase in cash, cash equivalents, and restricted

cash |

|

|

(32,813,896 |

) |

|

|

13,759,189 |

|

|

Cash, cash equivalents, and restricted cash, beginning of

period |

|

|

45,806,947 |

|

|

|

27,065,423 |

|

|

Cash, cash equivalents, and restricted cash, end of

period |

|

$ |

12,993,051 |

|

|

$ |

40,824,612 |

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow disclosures: |

|

|

|

|

|

|

|

Income taxes paid |

|

$ |

1,442,304 |

|

|

$ |

7,626 |

|

|

Interest paid |

|

$ |

88,835 |

|

|

$ |

50,872 |

|

|

|

|

|

|

|

|

|

|

Non-cash investing activities: |

|

|

|

|

|

|

| Change in

proved properties accrued in accounts payable and accrued

liabilities |

|

$ |

41,947 |

|

|

$ |

(194,391 |

) |

| Change in

gathering system accrued in accounts payable and accrued

liabilities |

|

$ |

3,441 |

|

|

$ |

12,882 |

|

| Asset

retirement obligation asset additions and adjustments |

|

$ |

4,640 |

|

|

$ |

10,821 |

|

| |

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

Nine months ended September 30, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Net income |

|

$ |

388,775 |

|

|

$ |

9,608,453 |

|

|

$ |

4,349,191 |

|

|

$ |

25,997,329 |

|

|

Add Back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest (income) expense, net |

|

|

(375,972 |

) |

|

|

(72,137 |

) |

|

|

(1,237,076 |

) |

|

|

(93,239 |

) |

|

Income tax expense |

|

|

710,164 |

|

|

|

3,896,010 |

|

|

|

2,283,228 |

|

|

|

10,097,484 |

|

|

Depreciation, depletion, amortization, and accretion |

|

1,392,032 |

|

|

|

1,706,030 |

|

|

|

4,780,766 |

|

|

|

4,898,988 |

|

|

Stock based compensation expense |

|

|

439,653 |

|

|

|

500,597 |

|

|

|

799,149 |

|

|

|

836,949 |

|

|

Loss (gain) on sale of assets |

|

|

- |

|

|

|

- |

|

|

|

1,449,871 |

|

|

|

(221,642 |

) |

|

Loss (gain) on derivative contracts net of cash received or paid on

settlement |

|

|

1,370,573 |

|

|

|

908,227 |

|

|

|

1,306,593 |

|

|

|

(272,151 |

) |

|

Foreign currency translation loss |

|

|

(98 |

) |

|

|

907 |

|

|

|

(1,086 |

) |

|

|

1,517 |

|

|

Adjusted EBITDA |

|

$ |

3,925,127 |

|

|

$ |

16,548,087 |

|

|

$ |

13,730,636 |

|

|

$ |

41,245,235 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Epsilon defines Adjusted EBITDA as earnings

before (1) net interest expense, (2) taxes, (3) depreciation,

depletion, amortization and accretion expense, (4) impairments of

natural gas and oil properties, (5) non-cash stock compensation

expense, (6) gain or loss on derivative contracts net of cash

received or paid on settlement, and (7) other income. Adjusted

EBITDA is not a measure of financial performance as determined

under U.S. GAAP and should not be considered in isolation from or

as a substitute for net income or cash flow measures prepared in

accordance with U.S. GAAP or as a measure of profitability or

liquidity.

Additionally, Adjusted EBITDA may not be

comparable to other similarly titled measures of other companies.

Epsilon has included Adjusted EBITDA as a supplemental disclosure

because its management believes that EBITDA provides useful

information regarding its ability to service debt and to fund

capital expenditures. It further provides investors a helpful

measure for comparing operating performance on a "normalized" or

recurring basis with the performance of other companies, without

giving effect to certain non-cash expenses and other items. This

provides management, investors and analysts with comparative

information for evaluating the Company in relation to other natural

gas and oil companies providing corresponding non-U.S. GAAP

financial measures or that have different financing and capital

structures or tax rates. These non-U.S. GAAP financial measures

should be considered in addition to, but not as a substitute for,

measures for financial performance prepared in accordance with U.S.

GAAP.

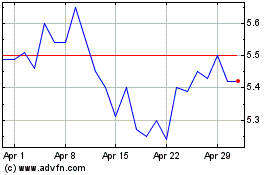

Epsilon Energy (NASDAQ:EPSN)

Historical Stock Chart

From Apr 2024 to May 2024

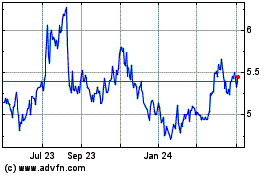

Epsilon Energy (NASDAQ:EPSN)

Historical Stock Chart

From May 2023 to May 2024