0000850460false00008504602023-10-242023-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 24, 2023

| | |

|

| ENCORE WIRE CORPORATION |

| (Exact name of registrant as specified in its charter) |

|

| | | | | | | | | | | | | | | | | |

Delaware | 000-20278 | 75-2274963 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| 1329 Millwood Road | | | | |

| McKinney, | Texas | | | | 75069 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code: (972) 562-9473

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $.01 per share | WIRE | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 24, 2023, Encore Wire Corporation, a Delaware corporation (the “Company”), issued an earnings release describing selected financial results of the Company for the quarter ended September 30, 2023 (the “Earnings Release”). A copy of the Earnings Release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Limitation on Incorporation by Reference:

In accordance with general instruction B.2 of Form 8-K, the information in this report, including exhibits, is furnished pursuant to Item 2.02 and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section.

Item 7.01 Regulation FD Disclosure.

On October 24, 2023, the Company issued the Earnings Release. A copy of the Earnings Release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Limitation on Incorporation by Reference:

In accordance with general instruction B.2 of Form 8-K, the information in this report, including exhibits, is furnished pursuant to Item 7.01 and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section.

Item 9.01 Financial Statements and Exhibits.

(i)Exhibits. | | | | | | | | |

| Exhibit Number | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| ENCORE WIRE CORPORATION |

| (Registrant) |

| | |

| October 24, 2023 | By: | | /s/ BRET J. ECKERT |

| | | Bret J. Eckert

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

| | | | | | | | | | | | | | |

| PRESS RELEASE | | Contact: | Bret J. Eckert |

| 972-562-9473 | October 24, 2023 | | | Executive Vice President & Chief Financial Officer |

ENCORE WIRE REPORTS STRONG THIRD QUARTER RESULTS; HIGHLIGHTS INCREASED VOLUMES; CONTINUED SHARE REPURCHASES DURING QUARTER

McKinney, TX - Encore Wire Corporation (NASDAQ Global Select: WIRE) (“Encore Wire” or the “Company”) today announced results for the third quarter of 2023.

Third Quarter and YTD 2023 Highlights

•Third Quarter Earnings per diluted share of $4.82; YTD Earnings per diluted share of $17.40

•Third Quarter Net Income of $82.1 million; YTD Net Income of $306.3 million

•Gross Profit of 23.3% in the third quarter of 2023; 26.9% YTD in 2023

•Cash on hand of $581.8 million as of September 30, 2023; $730.6 million as of December 31, 2022

•Capital expenditures of $118.6 million YTD in 2023

•Company repurchased 710,083 shares during the quarter and 2,185,492 YTD in 2023

•Total cash outlay for share repurchases of $121.2 million during the quarter and $375.0 million YTD in 2023

•Company repurchased 5,157,769 shares since the first quarter of 2020, approximately 25% of outstanding shares

•Remaining share repurchase authorization of 1,289,917 shares of our common stock through March 31, 2024

Net sales for the third quarter ended September 30, 2023 were $637.0 million compared to $762.4 million in the third quarter ended September 30, 2022. Copper unit volume, measured in pounds of copper contained in the wire sold, increased 6.4% in the third quarter of 2023 versus the third quarter of 2022. Aluminum wire represented 12.5% of net sales in the third quarter of 2023 compared to 17.4% in the third quarter of 2022. The decrease in net sales dollars was driven by an anticipated decrease in the average selling prices in the third quarter of 2023 compared to the third quarter of 2022.

Gross profit percentage for the third quarter of 2023 was 23.3% compared to 39.3% in the third quarter of 2022. The average selling price of wire per copper pound sold decreased 16.8% in the third quarter of 2023 versus the third quarter of 2022, while the average cost of copper per pound purchased increased 4.6%. This resulted in the continued gradual, albeit slowing, abatement of copper spreads during the quarter, primarily driven by the decrease in the average selling price of copper pounds sold noted above, which resulted in the decreased gross profit margin in the third quarter of 2023 compared to the third quarter of 2022.

Net income for the third quarter of 2023 was $82.1 million versus $191.8 million in the third quarter of 2022. Fully diluted earnings per common share were $4.82 in the third quarter of 2023 versus $9.97 in the third quarter of 2022.

On a sequential quarter basis, net sales for the third quarter ended September 30, 2023 were $637.0 million compared to $636.5 million in the second quarter ended June 30, 2023. Copper unit volume, measured in pounds of copper contained in the wire sold, increased 6.8% in the third quarter of 2023 versus the second quarter of 2023. Aluminum wire represented 12.5% of net sales in the third quarter of 2023 compared to 14.4% in the second quarter of 2023. The slight increase in net sales dollars was driven by an increase in copper unit volume sold in the third quarter of 2023 compared to the second quarter of 2023, partially offset by decreased average selling prices in the third quarter of 2023.

Gross profit percentage for the third quarter of 2023 was 23.3% compared to 26.1% in the second quarter of 2023. The average selling price of wire per copper pound sold decreased 4.3% in the third quarter of 2023 versus the second quarter of 2023, while the average cost of copper per pound purchased decreased 2.0%. This resulted in the continued gradual, albeit slowing, abatement of copper spreads during the quarter, primarily driven by the decrease in the average selling price noted above,

partially offset by a decrease in the average cost per pound of copper purchased, which resulted in the decreased gross profit margin in the third quarter of 2023 compared to the second quarter of 2023.

Net income for the third quarter of 2023 was $82.1 million versus $104.7 million in the second quarter of 2023. Fully diluted earnings per common share were $4.82 in the third quarter of 2023 versus $6.01 in the second quarter of 2023.

Net sales for the nine months ended September 30, 2023 were $1.934 billion compared to $2.324 billion for the nine months ended September 30, 2022. Copper unit volume, measured in pounds of copper contained in the wire sold, increased 2.7% in the first nine months of 2023 versus the first nine months of 2022. Aluminum wire represented 13.8% of net sales in the first nine months of 2023 compared to 14.7% in the first nine months of 2022. The decrease in net sales dollars was driven by an anticipated decrease in the average selling prices in the first nine months of 2023 compared to the first nine months of 2022.

Gross profit percentage for the first nine months of 2023 was 26.9% compared to 37.2% in the first nine months of 2022. The average selling price of wire per copper pound sold decreased 18.1% in the first nine months of 2023 versus the first nine months of 2022, while the average cost of copper per pound purchased decreased 5.3%. This resulted in the continued gradual abatement of copper spreads during the first nine months of 2023 versus the first nine months of 2022.

The increase in SG&A in the first nine months of 2023 was primarily due to an increase in Stock Appreciation Rights (“SARs”) expense charges driven by the increase in our stock price at September 30, 2023 versus December 31, 2022. We recorded $16.9 million in SARs expense in the first nine months of 2023 compared to a breakeven SARs benefit recorded in the first nine months of 2022, resulting in a $16.9 million increase in SARs expense. No SARs were granted subsequent to January of 2020. The increased SARs expense was partially offset by a decrease in selling expenses period-over-period.

Net income for the first nine months of 2023 was $306.3 million versus $563.8 million in the first nine months of 2022. Fully diluted earnings per common share were $17.40 in the first nine months of 2023 versus $28.57 in the first nine months of 2022.

Commenting on the results, Daniel L. Jones, Chairman, President and Chief Executive Officer of Encore Wire Corporation, said, “Demand for our products has remained strong, and our build-to-ship model, combined with the increased throughput of our modern service center, allowed us to reach a quarterly record of copper and aluminum pounds shipped. Despite continued tightness in raw copper availability, our key suppliers continue to perform at a high level which positioned us favorably to meet customer demand in a timely manner. By continuing to execute on our core values of providing unbeatable customer service and high order fill rates, ongoing margin abatement remained gradual in the third quarter of 2023.

Our balance sheet remains very strong, and we remain committed to returning capital to shareholders, as evidenced by our ongoing share repurchases. We have no long-term debt, and our revolving line of credit remains untapped. We had $581.8 million in cash as of September 30, 2023. During the third quarter we repurchased 710,083 shares of our common stock for a total cash outlay of $121.2 million. Since the first quarter of 2020 we have repurchased 5,157,769 shares of our common stock, approximately 25% of outstanding shares, at an average price of $133.12, for a total cash outlay of $686.6 million. We also declared a $0.02 cash dividend during the quarter.

We remain committed to reinvesting in our business with current and planned projects focused on increasing capacity, efficiency and vertical integration across our campus, which will continue to improve our service model. These types of organic investments have fueled our consistent growth since inception and position us well to continue to profitably capture market share for years to come.

In 2022 we began construction on a new, state of the art, cross-link polyethylene (XLPE) compounding facility to deepen vertical integration related to wire and cable insulation. XLPE insulation is used in many applications including Data Centers, Oil and Gas, Transit, Waste-Water Treatment facilities, Utilities, and Wind and Solar applications. The new facility is substantially complete. Capital spending in 2023 through 2025 will further expand vertical integration in our manufacturing processes to reduce costs as well as modernize select wire manufacturing facilities to increase capacity and efficiency and improve our position as a sustainable and environmentally responsible company. Total capital expenditures were $148.4 million in 2022 and $118.6 million in the first nine months of 2023. We expect total capital expenditures to range from $160 - $170 million in 2023, $150 - $170 million in 2024, and $80 - $100 million in 2025. We expect to continue to fund these investments with existing cash reserves and operating cash flows.

We continue to believe that our operational agility, speed to market, and deep supplier relationships remain competitive advantages in serving our customers’ evolving needs and capturing market share in the current economic environment. As we continue to address near-term challenges, we remain focused on the long-term opportunities for our business. We thank our employees and associates for their outstanding effort and our shareholders for their continued support.”

The Company will host a conference call to discuss the third quarter results on Wednesday, October 25 2023, at 10:00 am Central time. Hosting the call will be Daniel L. Jones, Chairman, President and Chief Executive Officer, and Bret J. Eckert, Executive Vice President and Chief Financial Officer. Attendants may register at https://registrations.events/direct/ENC60443 to participate in the call. A confirmation email will be sent to all registrants containing a dial-in number and a unique passcode. Each passcode allows one user on the call. Please plan to join this call at least five minutes prior to the scheduled start time. After entering your dial-in number, you will be prompted to enter your unique passcode, followed by the # key. A replay of this conference call will be accessible in the Investors section of our website, www.encorewire.com, for a limited time.

Encore Wire Corporation is a leading manufacturer of a broad range of copper and aluminum electrical wire and cables, supplying power generation and distribution solutions to meet our customers’ needs today and in the future. The Company focuses on maintaining a low-cost of production while providing exceptional customer service, quickly shipping complete orders coast-to-coast. Our products are proudly made in America at our vertically-integrated, single-site, Texas campus.

The matters discussed in this news release may include forward-looking statements. Forward-looking statements can be identified by words such as: “anticipate”, “intend”, “plan”, “goal”, “seek”, “believe”, “project”, “estimate”, “expect”, “strategy”, “future”, “likely”, “may”, “should”, “will” and similar references to future periods. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, such statements are subject to certain risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. Therefore, you should not rely on any of these forward-looking statements. Examples of such uncertainties and risks include, but are not limited to, statements about the pricing environment of copper, aluminum and other raw materials, the duration, magnitude and impact of the ongoing COVID-19 global pandemic, our order fill rates, profitability and stockholder value, payment of future dividends, future purchases of stock, the impact of competitive pricing and other risks detailed from time to time in the Company’s reports filed with the Securities and Exchange Commission. Actual results may vary materially from those anticipated. Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Additional Disclosures:

The term “EBITDA” is used by the Company in presentations, quarterly conference calls and other instances as appropriate. EBITDA is defined as net income before interest, income taxes, depreciation and amortization. The Company presents EBITDA because it is a required component of financial ratios reported by the Company to the Company’s banks, and is also frequently used by securities analysts, investors and other interested parties, in addition to and not in lieu of measures of financial performance calculated and presented in accordance with Generally Accepted Accounting Principles (“GAAP”), to compare to the performance of other companies who also publicize this information. EBITDA is not a measurement of financial performance calculated and presented in accordance with GAAP and should not be considered an alternative to net income as an indicator of the Company’s operating performance or any other measure of financial performance calculated and presented in accordance with GAAP.

The Company has reconciled EBITDA with net income for fiscal years 1996 to 2022 on previous reports on Form 8-K filed with the Securities and Exchange Commission. EBITDA for each period pertinent to this press release is calculated and reconciled to net income as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter Ended September 30, | | Nine Months Ended September 30, |

| In Thousands | | 2023 | | 2022 | | 2023 | | 2022 |

| Net Income | | $ | 82,052 | | | $ | 191,773 | | | $ | 306,276 | | | $ | 563,843 | |

| Income Tax Expense | | 24,512 | | | 55,470 | | | 91,387 | | | 162,065 | |

| Interest Expense | | 103 | | | 103 | | | 305 | | | 305 | |

| Depreciation and Amortization | | 8,110 | | | 6,514 | | | 23,891 | | | 19,035 | |

| EBITDA | | $ | 114,777 | | | $ | 253,860 | | | $ | 421,859 | | | $ | 745,248 | |

Encore Wire Corporation

Condensed Balance Sheets

(In Thousands)

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| | (Unaudited) | | (Audited) |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 581,753 | | | $ | 730,557 | |

| Accounts receivable, net | 495,179 | | | 498,762 | |

| Inventories, net | 158,991 | | | 153,187 | |

| Income tax receivable | 19,867 | | | 15,143 | |

| Prepaid expenses and other | 8,766 | | | 3,992 | |

| Total current assets | 1,264,556 | | | 1,401,641 | |

| Property, plant and equipment, net | 713,937 | | | 616,601 | |

| Other assets | 496 | | | 490 | |

| Total assets | $ | 1,978,989 | | | $ | 2,018,732 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Trade accounts payable | $ | 80,914 | | | $ | 62,780 | |

| Accrued liabilities | 80,502 | | | 81,381 | |

| | | |

| Total current liabilities | 161,416 | | | 144,161 | |

| Long-term liabilities: | | | |

| Deferred income taxes and other | 55,881 | | | 55,905 | |

| Total long-term liabilities | 55,881 | | | 55,905 | |

| Total liabilities | 217,297 | | | 200,066 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

| Common stock | 273 | | | 271 | |

| Additional paid-in capital | 99,984 | | | 83,622 | |

| Treasury stock | (781,244) | | | (402,639) | |

| Retained earnings | 2,442,679 | | | 2,137,412 | |

| Total stockholders’ equity | 1,761,692 | | | 1,818,666 | |

| Total liabilities and stockholders’ equity | $ | 1,978,989 | | | $ | 2,018,732 | |

Encore Wire Corporation

Statements of Income

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| (Unaudited) | | (Unaudited) |

| | | | | | | | | | | | | | | |

| Net sales | $ | 636,991 | | | 100.0 | % | | $ | 762,363 | | | 100.0 | % | | $ | 1,933,944 | | | 100.0 | % | | $ | 2,323,670 | | | 100.0 | % |

| Cost of goods sold | 488,749 | | | 76.7 | % | | 462,916 | | | 60.7 | % | | 1,414,469 | | | 73.1 | % | | 1,459,704 | | | 62.8 | % |

| Gross profit | 148,242 | | | 23.3 | % | | 299,447 | | | 39.3 | % | | 519,475 | | | 26.9 | % | | 863,966 | | | 37.2 | % |

| | | | | | | | | | | | | | | |

| Selling, general, and administrative expenses | 50,279 | | | 7.9 | % | | 55,291 | | | 7.3 | % | | 147,654 | | | 7.7 | % | | 141,908 | | | 6.1 | % |

| Operating income | 97,963 | | | 15.4 | % | | 244,156 | | | 32.0 | % | | 371,821 | | | 19.2 | % | | 722,058 | | | 31.1 | % |

| | | | | | | | | | | | | | | |

| Net interest and other income | 8,601 | | | 1.4 | % | | 3,087 | | | 0.4 | % | | 25,842 | | | 1.3 | % | | 3,850 | | | 0.2 | % |

| Income before income taxes | 106,564 | | | 16.8 | % | | 247,243 | | | 32.4 | % | | 397,663 | | | 20.5 | % | | 725,908 | | | 31.3 | % |

| | | | | | | | | | | | | | | |

| Provision for income taxes | 24,512 | | | 3.9 | % | | 55,470 | | | 7.3 | % | | 91,387 | | | 4.7 | % | | 162,065 | | | 7.0 | % |

| Net income | $ | 82,052 | | | 12.9 | % | | $ | 191,773 | | | 25.1 | % | | $ | 306,276 | | | 15.8 | % | | $ | 563,843 | | | 24.3 | % |

| Earnings per common and common equivalent share – basic | $ | 4.93 | | | | | $ | 10.11 | | | | | $ | 17.73 | | | | | $ | 28.98 | | | |

| Earnings per common and common equivalent share – diluted | $ | 4.82 | | | | | $ | 9.97 | | | | | $ | 17.40 | | | | | $ | 28.57 | | | |

| Weighted average common and common equivalent shares outstanding – basic | 16,638 | | | | | 18,968 | | | | | 17,271 | | | | | 19,459 | | | |

| Weighted average common and common equivalent shares outstanding – diluted | 17,007 | | | | | 19,243 | | | | | 17,597 | | | | | 19,733 | | | |

| Cash Dividends Declared per Share | $ | 0.02 | | | | | $ | 0.02 | | | | | $ | 0.06 | | | | | $ | 0.06 | | | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

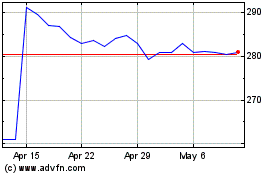

Encore Wire (NASDAQ:WIRE)

Historical Stock Chart

From Apr 2024 to May 2024

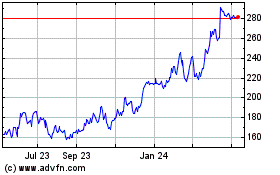

Encore Wire (NASDAQ:WIRE)

Historical Stock Chart

From May 2023 to May 2024