Dow Jones and S&P 500 Slump Again as Russia-Ukraine War Intensifies

March 13 2022 - 12:18PM

Finscreener.org

Major indices such as the

S&P

500, Dow Jones

Industrial Average, and

the NASDAQ slumped

for the fifth straight week. While the S&P 500 fell 2.9%,

the NASDAQ and DJIA declined by 2% and 3.5%, respectively, in the

week ended on March 11 as investors remained cautious of the

ongoing war between Ukraine and Russia.

Alternatively, Russian President

Vladimir Putin

stated certain positive shifts occurred in talks

between the two countries. Right now, a ceasefire is not on the

cards, while Ukraine President Volodymyr Zelenskyy claimed the

country achieved a strategic turning point in the war. Meanwhile,

U.S. President Joe Biden rallied to call for an end to Russia’s

status as a preferred trade partner and the U.S. Congress passed a

bill to provide Ukraine with $14 billion in financial

aid.

According to Bank of America,

stock declines related to the war may have bottomed. In a CNBC

report, Bank of America analyst Savita Subramanian explains, “The

S&P 500′s -12% decline from its peak suggests much of the

froth has been taken out. Stocks are largely pricing in the

geopolitical shock, where the S&P 500 fell 9% from

peak-to-trough since Russia-Ukraine headlines in early Feb, similar

to a typical 7-8% fall in prior macro/geopolitical

events.”

Crude oil, copper, and nickel prices surge

higher

The geopolitical tensions

continue to drive prices of oil and other commodities higher. West

Texas Intermediate crude which is the U.S. benchmark gained 2.9% to

$109 per barrel while the international standard Brent crude also

rose 2.9% to $112.

While several metal prices fell

sharply, copper gained pace in the last week. Last Tuesday, nickel

prices spiked by an astonishing 250% to more than $100,000 per ton.

Russia produces 17% of the global nickel supply which has led to

fears of commodity shortages.

Around 75% of the nickel supply

is mixed with chromium to derive stainless steel which is used in a

variety of appliances. Its used in electric vehicle batteries as

well and the input costs for a single EV increased by $1,000 last

week.

Data expectations remain vulnerable

The University of Michigan’s

consumer sentiment index reduced to 59.7 in March, compared to 62.8

in February. It was the weakest print in the last 11 years. The

consumer confidence moved lower as households are now worried about

rising inflation rates as well as fears about an economic

slowdown.

Further, investors will be eyeing

an increase in interest rates by the Federal Reserve. According to

analysts, the Fed is on track to hike interest rates by 0.25% which

will be the first of multiple increases in 2022. The central bank

will reveal its outlook for interest rates and inflation for the

rest of 2022 as well.

In addition to interest rates,

the producer price index, retail sales data, and existing home

sales will be released in the next week.

Rivian stock falls by more than 7%

Shares of electric car

giant, Rivian (NASDAQ:

RIVN) nose-dived by 7.6%

on Friday after its missed Q4 estimates with respect to earnings

and revenue. The company shocked investors and analysts a few days

back after it increased prices by 20% for pre-orders. The backlash

on social media sent the stock lower which is now down 78% below

record highs.

DocuSign (NASDAQ: DOCU)

stock also fell by 20% after it issued weak guidance for Q1 and

fiscal 2023, ending in January. Company management forecast sales

to grow by 18% to $2.48 billion in fiscal 2023 which is lower than

Wall Street estimates of $2.61 billion.

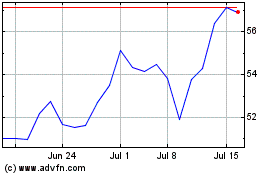

DocuSign (NASDAQ:DOCU)

Historical Stock Chart

From Mar 2024 to Apr 2024

DocuSign (NASDAQ:DOCU)

Historical Stock Chart

From Apr 2023 to Apr 2024