UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

__________________

Date of Report (Date of earliest event reported): May 18, 2020

___________________

DIFFUSION PHARMACEUTICALS INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-24477

|

30-0645032

|

|

(State or other jurisdiction of incorporation)

|

(Commission File

Number)

|

(I.R.S. Employer

Identification No.)

|

|

1317 Carlton Avenue, Suite 200

Charlottesville, Virginia

|

22902

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(434) 220-0718

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

DFFN

|

NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01.

Entry Into a Material Definitive Agreement.

On May 18, 2020, Diffusion Pharmaceuticals Inc., a Delaware corporation (the “Company”), entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain institutional and accredited investors (each, a “Purchaser” and together, the “Purchasers”) providing for the sale by the Company of 11,428,572 shares (the “Shares”) of its common stock, par value $0.001 per share (the “Common Stock”), for a purchase price of $1.05 per share. The offering closed on May 20, 2020. Prior to the issuance of the Shares pursuant to the offering and excluding any warrant exercises on May 20, 2020, the Company had 48,202,307 shares of Common Stock outstanding.

The Purchase Agreement contains customary representations and warranties of the Company, termination rights of the parties, and certain indemnification obligations of the Company and ongoing covenants of the Company.

The net proceeds of the offering are approximately $10.6 million, after deducting the placement agent fees and estimated offering expenses. The Company intends to use the net proceeds from this offering to fund research and development of its lead product candidate, trans sodium crocetinate, including clinical trial activities, and for general corporate purposes.

Pursuant to the Company’s engagement letter (the “Engagement Letter”) with H.C. Wainwright & Co., LLC (“Wainwright”), the Company has agreed to pay Wainwright an aggregate fee equal to 8.0% of the gross proceeds received by the Company from the offering as well as a management fee equal to 1.0% of the gross proceeds of the offering. Pursuant to the Engagement Letter, the Company also agreed to grant to Wainwright or its designees warrants to purchase up to 5.0% of the aggregate number of shares of Common Stock sold in any offering pursuant to the Engagement Letter. As a result, on May 20, 2020, the Company issued warrants to purchase up to 571,429 shares of common stock to designees of Wainwright (the “Warrants”). Subject to certain ownership limitations described in the Warrants, the Warrants are exercisable beginning on the date of their issuance until May 18, 2025 at an initial exercise price equal to $1.3125 per share. The exercise price of the Warrants will be subject to adjustment for stock splits, reverse splits, and similar capital transactions as described in the Warrants. The Warrants provide that holders will have the right to participate in any rights offering or distribution of assets, and will have the right to receive certain consideration in fundamental transactions, together with the holders of Common Stock on an as-exercised basis. In addition, upon a fundamental transaction, the holder shall have the right to receive payment in cash, or under certain circumstances in other consideration, from the Company at the Black Scholes value as described in the Warrants. The Warrants may be exercisable on a “cashless” basis while there is no effective registration statement or current prospectus available for the shares of Common Stock issuable upon exercise of the Warrants. A holder will not have the right to exercise any portion of the Warrant if the holder (together with its affiliates) would beneficially own in excess of 4.99% of the number of shares of Common Stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Warrants. However, any holder may increase or decrease such percentage to any other percentage not in excess of 9.99% upon notice to the Company, provided that any increase in such percentage shall not be effective until 61 days after such notice. The Company will also pay Wainwright non-accountable expenses of $80,000 and $12,900 for clearing fees.

The issuance of the Warrants was made in reliance on the exemption provided by Section 4(a)(2) of the Securities Act of 1933, as amended, for the offer and sale of securities not involving a public offering and Regulation D promulgated thereunder.

The foregoing is only a brief description of the Purchase Agreement, the Engagement Letter and the Warrant and does not purport to be a complete description thereof. Such descriptions are qualified in their entirety by reference to the forms of Purchase Agreement, Engagement Letter and Warrant, copies of which are filed as Exhibits 10.1, 10.2 and 4.1, respectively, to this Current Report on Form 8-K and are incorporated by reference herein.

A copy of the opinion of Dechert LLP relating to the validity of the Shares is filed herewith as Exhibit 5.1.

Item 3.02.

Unregistered Sales of Equity Securities.

The information set forth above under Item 1.01 in connection with the Warrants and the shares of Common Stock issuable thereunder is incorporated herein by reference.

Item 7.01.

Regulation FD Disclosure.

On May 18, 2020, the Company issued a press release announcing the offering. On May 20, 2020, the Company issued a press release announcing the closing of the offering. Copies of such releases are attached as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K and are incorporated by reference herein.

The information in this Current Report on Form 8-K furnished pursuant to Item 7.01, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that section, and they shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01.

Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: May 20, 2020

|

DIFFUSION PHARMACEUTICALS INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ David G. Kalergis

|

|

|

|

Name:

|

David G. Kalergis

|

|

|

|

Title:

|

Chief Executive Officer

|

|

Diffusion Pharmaceuticals (NASDAQ:DFFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

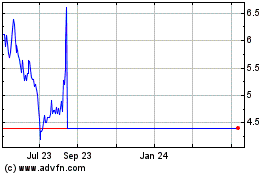

Diffusion Pharmaceuticals (NASDAQ:DFFN)

Historical Stock Chart

From Apr 2023 to Apr 2024