Current Report Filing (8-k)

October 17 2019 - 9:13AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 16, 2019

Bionano Genomics, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

|

001-38613

|

|

26-1756290

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

9540 Towne Centre Drive, Suite 100

San Diego, California

|

|

92121

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (858)

888-7600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value per share

|

|

BNGO

|

|

The Nasdaq Stock Market LLC

|

|

Warrants to purchase Common Stock

|

|

BNGOW

|

|

The Nasdaq Stock Market LLC

|

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 17, 2019, Bionano Genomics, Inc. (the “Company”) filed with the U.S. Securities and Exchange Commission an

amendment to its Registration Statement on Form S-1 (No. 333-233828) in which the Company disclosed that it expects to report that total revenue for the three months ended September 30, 2019 was $3.3 million. This amount reflects the Company’s

estimates based solely upon information available to it as of the date of this Current Report on Form 8-K, is not a comprehensive statement of its financial results or position as of or for the quarter ended September 30, 2019, and has not been

audited, reviewed or compiled by the Company’s independent registered public accounting firm. The Company’s financial closing procedures for the quarter ended September 30, 2019 are not yet complete and, as a result, the Company’s final results

upon completion of its closing procedures may vary from this preliminary estimate, and any such differences may be material.

The information in Item 2.02 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and it shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or

under the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such filing to this item of this report.

Item 3.02 Unregistered Sales of Equity Securities.

On October 16, 2019, the Company obtained a waiver from Innovatus Life Sciences Lending Fund I, LP (“Innovatus”) with respect to certain financial covenants under its Loan and Security Agreement, dated March 14, 2019 (the “Loan Agreement”), by and among the Company, Innovatus, as collateral agent, and the lenders listed on

Schedule 1.1 to the Loan Agreement, including East West Bank.

Under the Loan Agreement, the Company is required to meet certain minimum revenue targets measured at the end of each calendar quarter. For the quarter

ended September 30, 2019, the Company did not achieve this revenue covenant. As partial consideration for the waiver of this revenue covenant, the Company agreed to amend, by no later than November 6, 2019, that certain Warrant to Purchase Stock,

issued to Innovatus on March 22, 2019 (the “Warrant”) to decrease the exercise price per share of the Company’s Common Stock subject to the Warrant from $4.63 per share to $0.48 per share. All other terms of the Warrant remain in full force and

effect.

In addition, under the Loan Agreement the Company is required to maintain a minimum cash balance in its collateral account. In the event that the

Company’s cash balance falls below the minimum required balance under the Loan Agreement, Innovatus agreed to waive non-compliance with the foregoing liquidity covenant through October 31, 2019 in exchange for a fee, payable on November 1, 2019, in

the form of (i) 572,917 shares of the Company’s Common Stock issued to Innovatus if the Company raises at least $10,000,000 from the sale and issuance of equity securities prior to October 31, 2019, or (ii) $250,000 in cash if such equity financing

is not completed before November 1, 2019.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

|

|

Bionano Genomics, Inc.

|

|

|

|

|

|

Date: October 17, 2019

|

By:

|

/s/ R. Erik Holmlin, Ph.D.

|

|

|

|

R. Erik Holmlin, Ph.D.

|

|

|

|

President and Chief Executive Officer

|

|

|

|

(Principal Executive Officer)

|

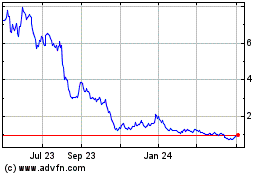

Bionano Genomics (NASDAQ:BNGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

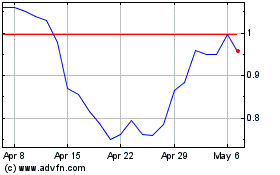

Bionano Genomics (NASDAQ:BNGO)

Historical Stock Chart

From Apr 2023 to Apr 2024