Current Report Filing (8-k)

November 23 2021 - 5:10PM

Edgar (US Regulatory)

0001651308false00016513082021-11-192021-11-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

Form 8-K

_________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported): November 19, 2021

BEIGENE, LTD.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

Cayman Islands

|

001-37686

|

98-1209416

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

|

|

|

|

|

|

c/o Mourant Governance Services (Cayman) Limited

94 Solaris Avenue, Camana Bay

Grand Cayman KY1-1108

Cayman Islands

(Address of Principal Executive Offices) (Zip Code)

+1 (345) 949-4123

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

American Depositary Shares, each representing 13 Ordinary Shares, par value $0.0001 per share

|

|

BGNE

|

|

The NASDAQ Global Select Market

|

|

Ordinary Shares, par value $0.0001 per share*

|

|

06160

|

|

The Stock Exchange of Hong Kong Limited

|

*Included in connection with the registration of the American Depositary Shares with the Securities and Exchange Commission. The ordinary shares are not registered or listed for trading in the United States but are listed for trading on The Stock Exchange of Hong Kong Limited.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Explanatory Note

As previously disclosed, on January 29, 2021, BeiGene, Ltd. (the “Company” or “BeiGene”) filed a listing application (as updated from time to time, the “Listing Application”) for a proposed public offering of the Company’s ordinary shares and initial listing of such shares on the Science and Technology Innovation Board (the “STAR Market”) of the Shanghai Stock Exchange (the “STAR Offering”). The STAR Offering will be conducted within the People’s Republic of China (the “PRC”) and such shares will be issued to and subscribed for by investors in Renminbi (“RMB”) in the PRC (the “RMB Shares”) and listed and traded on the STAR Market pursuant to the general mandate to issue shares, which was approved by the shareholders at the Company’s 2021 annual general meeting of shareholders on June 16, 2021 (the “Proposed Issue of RMB Shares”). The RMB Shares will not be fungible with the ordinary shares of the Company listed on the Hong Kong Stock Exchange or with the American Depositary Shares representing the Company’s ordinary shares listed on the NASDAQ Global Select Market. The number of RMB Shares (including the over-allotment option) to be issued will not exceed 132,313,549 ordinary shares, representing no more than 10% of the sum of the total number of issued ordinary shares of the Company as of January 7, 2021 (the day before the date of the board of directors’ approval of the STAR Offering) and the total number of RMB Shares to be issued in the STAR Offering. The Listing Application was prepared in accordance with the listing rules of the STAR Market and the applicable securities laws and regulations of the PRC (the “PRC Securities Laws”). On June 28, 2021, the Listing Committee of the STAR Market approved the Company’s Listing Application. On July 28, 2021, the Company filed a registration application for the STAR Offering (the “Registration Application”) with the China Securities Regulatory Commission (“CSRC”). On November 16, 2021, the Company’s Registration Application was granted by the CSRC. The consummation of the STAR Offering is subject to, among other things, market conditions and customary closing conditions related to the STAR Offering.

Item 8.01. Other Events.

On November 23, 2021, the Company issued a press release announcing the launch of the STAR Offering. A copy of this press release is attached hereto as Exhibit 99.1, and is incorporated herein by reference.

On November 23, 2021, the Company issued a press release announcing that the European Commission (EC) approved BRUKINSA® (zanubrutinib) for the treatment of adult patients with Waldenström’s macroglobulinemia (WM) who have received at least one prior therapy or for the first-line treatment of patients unsuitable for chemo-immunotherapy. The approval is applicable to all 27 European Union (EU) member states, plus Iceland and Norway. A copy of this press release is attached hereto as Exhibit 99.2, and is incorporated herein by reference.

On November 23, 2021, the Company announced that it has purchased a 42-acre site at the Princeton West Innovation Campus in Hopewell, N.J. to house a new state-of-the-art manufacturing campus and clinical R&D center. As a key part of BeiGene’s continued growth, the company is investing in U.S. manufacturing to further expand and diversify its global supply chain and build new manufacturing capabilities for its deep pipeline of biologic and drug candidates. A copy of this press release is attached hereto as Exhibit 99.3, and is incorporated herein by reference.

On November 22, 2021, the Company announced that the first patient has been dosed in a Phase 1 clinical trial of BGB-23339, a potent, allosteric investigational tyrosine kinase 2 (TYK2) inhibitor internally developed by BeiGene scientists. A copy of this press release is attached hereto as Exhibit 99.4, and is incorporated herein by reference.

On November 19, 2021, the China National Medical Products Administration approved POBEVCY® (a biosimilar to bevacizumab injection) for the treatment of patients with advanced, metastatic or recurrent non-small cell lung cancer (NSCLC) and metastatic colorectal cancer. BeiGene has rights to develop, manufacture, and commercialize POBEVCY® in China (including Hong Kong, Macao and Taiwan) under a collaboration agreement with Bio-Thera Solutions, Ltd. entered in August 2020.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws, including statements regarding the Proposed Issue of RMB Shares under the general mandate to be listed on the STAR Market. Actual results may differ materially from those indicated in the forward-looking statements as a result of various important factors, including the possibility that the conditions, including market conditions and customary closing conditions related to the STAR Offering, will not be met and that BeiGene will be unable to consummate the Proposed Issue of RMB Shares; the possibility that BeiGene will not realize the expected benefits of the transaction; the possibility that the final financial performance data will be different from the preliminary data; BeiGene's ability to demonstrate the efficacy and safety of its drug candidates; the clinical results for its drug candidates, which may not support further development or marketing approval; actions of regulatory agencies, which may affect the initiation, timing and progress of clinical trials and marketing approval; BeiGene's ability to achieve commercial success for its marketed medicines and drug candidates, if approved; BeiGene's ability to obtain and maintain protection of intellectual property for its medicines and technology; BeiGene's reliance on third parties to conduct drug development, manufacturing and other services; BeiGene’s limited experience in obtaining regulatory approvals and commercializing pharmaceutical products and its ability to obtain additional funding for operations and to complete the development and commercialization of its drug candidates and achieve and maintain profitability; the impact of the COVID-19 pandemic on the BeiGene’s clinical development, regulatory, commercial, and other operations, as well as those risks more fully discussed in the section entitled “Risk Factors” in BeiGene’s most recent quarterly report on Form 10-Q as well as discussions of potential risks, uncertainties, and other important factors in BeiGene's subsequent filings with the U.S. Securities and Exchange Commission. All information in this Current Report is as of the date of this Current Report, and BeiGene undertakes no duty to update such information unless required by law.

The Proposed Issue of RMB Shares under the general mandate is subject to, among other things, market conditions and customary closing conditions related to the STAR Offering, and thus may or may not proceed. Shareholders and potential investors of the Company should be aware that there is no assurance that the Proposed Issue of RMB Shares will complete or as to when it may complete. Shareholders and potential investors of the Company should exercise caution when dealing in the securities of the Company.

Further announcement(s) or filings will be made by the Company in accordance with the applicable laws and regulations on any material updates and progress in connection with the Proposed Issue of RMB Shares as and when appropriate. This announcement is for information purposes only and does not constitute any invitation or offer to acquire, purchase or subscribe for the securities of the Company.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press Release titled "BeiGene Launches Proposed Initial Public Offering on the STAR Market in China", issued by BeiGene, Ltd. on November 23, 2021.

|

|

|

|

|

|

99.2

|

|

Press Release titled "BeiGene Announces Approval of BRUKINSA® (zanubrutinib) in the European Union for Treatment of Adults with Waldenström’s Macroglobulinemia", issued by BeiGene, Ltd. on November 23, 2021.

|

|

|

|

|

|

99.3

|

|

Press Release titled "BeiGene Closes on Property for New U.S. Manufacturing and Clinical R&D Center", issued by BeiGene, Ltd. on November 23, 2021.

|

|

|

|

|

|

99.4

|

|

Press Release titled "BeiGene Initiates First-in-Human Phase 1 Clinical Trial of Investigational TYK2 Inhibitor BGB-23339", issued by BeiGene, Ltd. on November 22, 2021.

|

|

|

|

|

|

104

|

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL

|

Exhibit Index

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

|

|

|

|

|

|

99.2

|

|

|

|

|

|

|

|

99.3

|

|

|

|

|

|

|

|

99.4

|

|

|

|

|

|

|

|

104

|

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

BEIGENE, LTD.

|

|

|

|

|

|

|

|

|

|

Date: November 23, 2021

|

By:

|

/s/ Scott A. Samuels

|

|

|

Name:

|

Scott A. Samuels

|

|

|

Title:

|

Senior Vice President, General Counsel

|

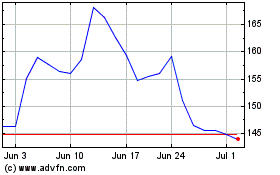

BeiGene (NASDAQ:BGNE)

Historical Stock Chart

From Mar 2024 to Apr 2024

BeiGene (NASDAQ:BGNE)

Historical Stock Chart

From Apr 2023 to Apr 2024