0001462056FALSE00014620562024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 205490

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

August 8, 2024

Date of Report (date of earliest event reported)

Backblaze, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-41026 | | 20-8893125 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

201 Baldwin Ave., San Mateo, California | | | | 94401 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

(650) 352-3738

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | BLZE | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2024, Backblaze, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

This information is intended to be furnished under Item 2.02 and Item 9.01 of Form 8-K, “Results of Operations and Financial Condition” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 5.02 Departure of Directors of Principal Officers; Election of Directors; Appointment of Principal officers.

5.02(b) Departure of Certain Officers.

As previously announced, Frank Patchel will be retiring from his position as Chief Financial Officer (and Principal Financial and Accounting Officer) of the Company, effective August 16, 2024. Mr. Patchel is expected to remain with the Company for approximately 4-6 weeks in an advisory capacity to help ensure a smooth transition. Mr. Patchel is not resigning due to any disagreement with the Company.

5.02(c) Appointment of Certain Officers.

The Company announced today that Marc Suidan will be joining the Company as Chief Financial Officer (and Principal Financial and Accounting Officer), effective August 16, 2024. Mr. Suidan previously served as Chief Financial Officer of The Beachbody Company (NYSE: BODI), a consumer digital subscription health technology company, from May 2022 to August 2024, and as a partner at PricewaterhouseCoopers, an accounting and professional services firm, from 2011 to April 2022. Mr. Suidan obtained a Bachelor of Management from McGill University, and an MBA from the Kellogg School of Management at Northwestern University.

5.02(e) Compensatory Arrangements of Certain Officers.

In connection with Mr. Patchel's retirement, the Company has amended the outstanding stock options dated April 21, 2020 held by Mr. Patchel to extend the option exercise expiration date until September 1, 2029.

The Company has entered into an employment agreement with Mr. Suidan. The terms of the employment agreement include the following:

•An annual base salary of $440,000;

•A target bonus of 50% of his prorated base salary for 2024 pursuant to the Company’s 2024 Bonus Plan;

•A grant of 300,000 restricted stock units for the Company's common stock; and

•Certain severance benefits in the event of termination of employment without cause or resignation for good reason.

The foregoing description of the employment agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the employment agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exhibit No. | | Description | |

| 10.1 | | | |

| 99.1 | | | |

| 104 | | | | Cover Page Interactive Data File (formatted as Inline XBRL) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | August 8, 2024 | Backblaze, Inc. |

| | | |

| | By: | /s/ Frank Patchel |

| | | Frank Patchel, Chief Financial Officer |

Backblaze, Inc.

201 Baldwin Avenue

San Mateo, CA 94401

July 9, 2024

Marc Suidan,

San Jose, CA

Dear Marc,

Backblaze, Inc. (the “Company”) is pleased to offer you employment on the following terms:

1.Position. Your initial title will be Chief Financial Officer, and you will initially report to Gleb Budman, the Company’s Chief Executive Officer. This is a Full-Time position at the Company Headquarters. While you render services to the Company, you will not engage in any other employment, consulting, or other business activity (whether full-time or part-time) that would create a conflict of interest with the Company. By signing this letter agreement, you confirm to the Company that you have no contractual commitments or other legal obligations that would prohibit you from performing your duties for the Company.

2.Cash Compensation (Salary and Bonus). The Company will pay you a starting salary at the rate of $440,000 per year, payable in accordance with the Company’s standard payroll schedule. You will also be entitled to participate in the Company’s 2024 Bonus Plan with an annual target bonus equal to 50% of your pro-rata base salary for 2024 and subject to the terms and conditions of the Company’s 2024 Bonus Plan. This salary and bonus is subject to adjustment pursuant to the Company’s employee compensation policies in effect from time to time.

3.Employee Benefits. As a regular employee of the Company, you will be eligible to participate in the Company’s benefits that it makes available to its employees from time to time, subject to applicable plan terms.

4.Restricted Stock Units. Subject to the approval of the Company’s Compensation Committee, you will be granted 300,000 Restricted Stock Units (RSUs). The RSUs will vest 25% on the 1-year anniversary of the vesting commencement date and the remainder of the RSUs will vest on a quarterly basis over the remaining 3 years, subject to continued service. The grant will be on terms and conditions substantially similar to the Company’s 2021 Equity Incentive Plan and the applicable RSU Agreement.

5.Proprietary Information and Inventions Agreement. Like all Company employees, you will be required, as a condition of your employment with the Company, to sign the Company’s standard Proprietary Information and Inventions Agreement, a copy of which is attached hereto as Exhibit A.

6.Employment Relationship.

(a) At Will Employment. Employment with the Company is for no specific period of time. Your employment with the Company will be “at will,” meaning that either you or the Company may terminate your employment at any time and for any reason, with or without cause. As a condition of your employment, you will be required to abide by the Company’s policies and procedures, as may be in effect from time to time, including, without limitation, the policies and procedures set forth in the Company’s handbook. Although your job duties, title, compensation and benefits, as well as the Company’s personnel policies and procedures, may change from time to time, the “at will” nature of your employment may only be changed in an express written agreement signed by you and a duly authorized officer of the Company (other than you).

(b) Severance and Change in Control Agreement. In accordance with your executive position, you will be eligible for certain severance benefits, including severance in connection with a change of control and outside of a change of control, commencing on your hire date. The terms and conditions governing your severance benefits are detailed in the agreement, the form of which is attached hereto as Exhibit B.

7. Tax Matters.

(a) Withholding. All forms of compensation referred to in this letter agreement are subject to reduction to reflect applicable withholding and payroll taxes and other deductions required by law.

(b) Tax Advice. You are encouraged to obtain your own tax advice regarding your compensation from the Company. You agree that the Company does not have a duty to design its compensation policies in a manner that minimizes your tax liabilities, and you will not make any claim against the Company or its Board of Directors related to tax liabilities arising from your compensation.

8.Interpretation, Amendment and Enforcement. This letter agreement and Exhibit A supersede and replace any prior agreements, representations or understandings (whether written, oral, implied or otherwise) between you and the Company and constitute the complete agreement between you and the Company regarding the subject matter set forth herein. This letter agreement may not be amended or modified, except by an express written agreement signed by both you and a duly authorized officer of the Company. The terms of this letter agreement and the resolution of any disputes as to the meaning, effect, performance or validity of this letter agreement or arising out of, related to, or in any way connected with, this letter agreement, your employment with the Company or any other relationship between you and the Company (the “Disputes”) will be governed by California law, excluding laws relating to conflicts or choice of law. You and the Company submit to the exclusive personal jurisdiction of the federal and state courts located in California in connection with any Dispute or any claim related to any Dispute.

* * * * *

We hope that you will accept our offer to join the Company. You may indicate your agreement with these terms and accept this offer by signing and dating both the enclosed duplicate original of this letter agreement, the enclosed Proprietary Information and Inventions Agreement, and the enclosed Severance and Change of Control Agreement and returning them to me. This offer, if not accepted, will expire at the close of business on Friday, July 12, 2024. In addition to the expiry date, your employment with the Company is contingent upon successful completion of your references and background check. As required by law, your employment with the Company is contingent upon your providing legal proof of your identity and authorization to work in the United States.

Very truly yours,

Backblaze, Inc.

/s/ Gleb Budman

By: Gleb Budman

Title: Chief Executive Officer

I have read and accept this employment offer:

/s/ Marc Suidan

Signature of Employee

Dated: 7/12/2024

Attachment

Exhibit A: Proprietary Information and Inventions Agreement [not attached]

Exhibit B: Severance and Change Control Agreement

Exhibit C: Job Description for Chief Financial Officer [not attached]

Exhibit D: Employee Benefits 2024 [not attached]

EXHIBIT B

SEVERANCE AND CHANGE IN CONTROL AGREEMENT

[ATTACHED]

BACKBLAZE, INC.

SEVERANCE AND CHANGE IN CONTROL AGREEMENT

This Severance and Change in Control Agreement (the “Agreement”) is made and entered into by and between _______________ (“Executive”) and Backblaze, Inc., a Delaware corporation (the “Company”), as of _______________ (the “Effective Date”).

This Agreement provides severance and acceleration benefits in connection with certain qualifying terminations of Executive’s employment with the Company. Certain capitalized terms are defined in Section 8. The Company and Executive agree as follows:

1. Term. This Agreement shall become effective on the Effective Date.

2. Certain Involuntary Termination Benefits.

(a) Involuntary Termination Outside of a Change in Control Period. If Executive is subject to an Involuntary Termination that occurs outside of a Change in Control Period and Executive satisfies the conditions described in Section 2(c) below, then:

(i) The Company shall pay Executive a lump-sum cash amount equal to the greater of (A) six (6) months of Executive’s Base Salary, or (B) the number of months of Executive’s Base Salary equal to one month for each year (full years or at least 6 months of any remaining partial year) Executive has been continuously employed by the Company; provided, however, that the number of months shall not exceed 18 months in any event, which will be paid in accordance with the Company’s standard payroll procedures;

(ii) The Company shall pay the Executive a lump-sum cash amount equal to Executive’s annual target bonus established by the Company for the fiscal year in which Executive’s Separation occurs, prorated based on the number of days that Executive was employed by the Company during such fiscal year; and

(iii) The Company shall pay the Executive a lump-sum cash amount equal to the monthly premium under COBRA applicable to such Executive and his or her eligible dependents in effect prior to such termination, multiplied by six (6), subject to any applicable tax withholding, which payment shall be made regardless of whether Executive elects COBRA continuation coverage.

(b) Involuntary Termination Within a Change in Control Period. If Executive is subject to an Involuntary Termination that occurs within a Change in Control Period and Executive satisfies the conditions described in Section 2(c) below, then:

(i) The Company shall pay Executive a lump-sum cash amount equal to the greater of (A) twelve (12) months of Executive’s Base Salary, or (B) the number of months of Executive’s Base Salary equal to one month for each year (full years or at least 6 months of any remaining partial year) Executive has been

continuously employed by the Company; provided, however, that the maximum number of months shall not exceed 18 months in any event, which will be paid on the first payroll following the effective date of the release agreement;

(ii) The Company shall pay the Executive a lump-sum cash amount equal to Executive’s annual target bonus established by the Company for the fiscal year in which Executive’s Separation occurs, prorated based on the number of days that Executive was employed by the Company during such fiscal year;

(iii) The Company shall pay the Executive a lump-sum cash amount equal to the monthly premium under COBRA applicable to such Executive and his or her eligible dependents in effect prior to such termination, multiplied by twelve (12), subject to any applicable tax withholding, which payment shall be made regardless of whether Executive elects COBRA continuation coverage; and

(iv) One hundred percent (100%) of the shares subject to each of Executive’s then-outstanding equity awards subject to time-based vesting shall become fully vested. In the case of equity awards with performance-based vesting, the level of achievement of the applicable performance goals will be deemed to equal the greater of (a) the target level of achievement of the performance goals or (ii) the actual level of achievement of the performance goals (to the extent then reasonably determinable). For the avoidance of doubt, if Executive’s Involuntary Termination occurs prior to a Change in Control, then any unvested portion of Executive’s then-outstanding equity awards will remain outstanding until the earlier of (a) three (3) months after the Involuntary Termination or (b) the occurrence of a Change in Control so that any additional benefits due on an Involuntary Termination Within a Change in Control Period can be provided if a Change in Control occurs within 3 months following such Involuntary Termination (provided that in no event will Executive’s stock options or similar equity awards remain outstanding beyond the equity award’s maximum term to expiration). In such case, if no Change in Control occurs within 3 months following an Involuntary Termination, any then-unvested portion of Executive’s equity awards will automatically be forfeited on the 3-month anniversary of the Involuntary Termination.

(c) Preconditions to Severance and Vesting Acceleration Benefits / Timing of Benefits. As a condition to Executive’s receipt of any benefits described in Section 2(a) or 2(b) (except due to Involuntary Termination as a result of Executive’s death or Disability), Executive shall execute, and allow to become effective, a general release of claims provided by the Company consistent with past practice and promptly after such Involuntary Termination and, if requested by the Company’s Board of Directors, must immediately resign as an officer and member of the Company’s Board of Directors and as an officer and member of the board of directors of any subsidiaries of the Company. Executive must execute and return the release on or before the date specified by the Company in the release, which will in no event be later than 50 days after Executive’s employment terminates. If Executive fails to return the release by the deadline (after additional written notice by the Company to Executive) or if Executive revokes the release, then Executive will not be entitled to the benefits described in this Section 2.

Subject to the foregoing, all such benefits will be provided, paid or commence in all events within 60 days after Executive’s Involuntary Termination (and, where applicable, will include at such time any amounts accrued from the date of Executive’s Separation). If such 60-day period spans two calendar years, then such benefit will in any event be provided, paid or commence in the second calendar year; provided, that where such 60-day period does not span two calendar years, then the benefits will be provided, paid or commence within 30 days after execution of such general release of claims (without revocation).

(d) Death of the Executive. If the Executive dies before all payments or benefits the Executive is entitled to receive under the Agreement have been paid, such unpaid amounts will be paid to the Executive’s designated beneficiary, if living, or otherwise to the Executive’s personal representative in a lump-sum payment as soon as possible following the Executive’s death.

3. Section 409A. The Company intends that all payments and benefits provided under this Agreement or otherwise are exempt from, or comply with, with the requirements of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”) so that none of the payments or benefits will be subject to the additional tax imposed under Code Section 409A, and any ambiguities herein will be interpreted in accordance with such intent. For purposes of Code Section 409A, each payment, installment or benefit payable under this Agreement is hereby designated as a separate payment. In addition, if the Company determines that Executive is a “specified employee” under Code Section 409A(a)(2)(B)(i) at the time of Executive’s Separation, then (i) any severance payments or benefits, to the extent that they are subject to Code Section 409A, will not be paid or otherwise provided until the first business day following the earlier of (A) expiration of the six-month period measured from Executive’s Separation or (B) the date of Executive’s death and (ii) any installments that otherwise would have been paid or provided prior to such date will be paid or provided in a lump sum when the severance payments or benefits commence.

4. Section 280G.

(a) Notwithstanding anything contained in this Agreement to the contrary, in the event that the payments and benefits provided pursuant to this Agreement, together with all other payments and benefits received or to be received by Executive (“Payments”), constitute “parachute payments” within the meaning of Code Section 280G, and, but for this Section 4, would be subject to the excise tax imposed by Code Section 4999 (the “Excise Tax”), then the Payments shall be made to Executive either (i) in full or (ii) as to such lesser amount as would result in no portion of the Payments being subject to the Excise Tax (a “Reduced Payment”), whichever of the foregoing amounts, taking into account applicable federal, state and local income taxes and the Excise Tax, results in Executive’s receipt on an after-tax basis, of the greatest amount of benefits, notwithstanding that all or some portion of the Payments may be subject to the Excise Tax. For the avoidance of doubt, the Payments shall include acceleration of vesting of equity awards granted by the Company that vest based on service to the Company and that accelerate in connection with a Change in Control of the Company, but only to the extent such acceleration of vesting is deemed a parachute payment with respect to a Change in Control of the Company.

(b) For purposes of determining whether to make a Reduced Payment, if applicable, the Company shall cause to be taken into account all federal, state and local income and employment taxes and excise taxes applicable to the Executive (including the Excise Tax). If a Reduced Payment is made, the Company shall reduce or eliminate the Payments in the following order, unless (to the extent permitted by Section 409A of the Code) Executive elects to have the reduction in payments applied in a different order: (1) cancellation of accelerated vesting of options with no intrinsic value, (2) reduction of cash payments, (3) cancellation of accelerated vesting of equity awards other than options, (4) cancellation of accelerated vesting of options with intrinsic value and (5) reduction of other benefits paid to the Executive. In the event that acceleration of vesting is reduced, such acceleration of vesting shall be cancelled in the reverse order of the date of grant of the Executive’s equity awards. In the event that cash payments or other benefits are reduced, such reduction shall occur in reverse order beginning with payments or benefits which are to be paid farthest in time from the date of the determination. For avoidance of doubt, an option will be considered to have no intrinsic value if the exercise price of the shares subject to the option exceeds the fair market value of such shares.

(c) All determinations required to be made under this Section 4 (including whether any of the Payments are parachute payments and whether to make a Reduced Payment) will be made by a nationally recognized independent accounting firm selected by the Company. For purposes of making the calculations required by this section, the accounting firm may make reasonable assumptions and approximations concerning applicable taxes and may rely on reasonably, good faith interpretations concerning the application of Code Sections 280G and 4999. The Company will bear the costs that the accounting firm may reasonably incur in connection with the calculations contemplated by this Section 4. The accounting firm’s determination will be binding on both Executive and the Company absent manifest error.

(d) As a result of uncertainty in the application of Sections 4999 and 280G of the Code at the time of the initial determination by the accounting firm hereunder, it is possible that payments will have been made by the Company which should not have been made (an “Overpayment”) or that additional payments which will not have been made by the Company could have been made (an “Underpayment”), consistent in each case with the calculation of whether and to what extent a Reduced Payment shall be made hereunder. In either event, the accounting firm shall determine the amount of the Underpayment or Overpayment that has occurred. In the event that the accounting firm determines that an Overpayment has occurred, the Executive shall promptly repay, or transfer, to the Company the amount of any such Overpayment; provided, however, that no amount shall be payable, or transferable, by the Executive to the Company if and to the extent that such payment or transfer would not reduce the amount that is subject to taxation under Section 4999 of the Code. In the event that the accounting firm determines that an Underpayment has occurred, such Underpayment shall promptly be paid or transferred by the Company to or for the benefit of the Executive, together with interest at the applicable federal rate provided in Section 7872(f)(2) of the Code.

(e) If this Section 4 is applicable with respect to an Executive’s receipt of a Reduced Payment, it shall supersede any contrary provision of any plan, arrangement or agreement governing the Executive’s rights to the Payments.

5. Company’s Successors. Any successor to the Company or to all or substantially all of the Company’s business and/or assets shall assume the Company’s obligations under this Agreement and agree expressly to perform the Company’s obligations under this Agreement in the same manner and to the same extent as the Company would be required to perform such obligations in the absence of a succession.

6. Miscellaneous Provisions.

(a) Modification or Waiver. No provision of this Agreement may be modified, waived or discharged unless the modification, waiver or discharge is agreed to in writing and signed by Executive and by an authorized officer of the Company (other than Executive). No waiver by either party of any breach of, or of compliance with, any condition or provision of this Agreement by the other party shall be considered a waiver of any other condition or provision or of the same condition or provision at another time.

(b) Integration. This Agreement represents the entire agreement and understanding between the parties as to the subject matter herein and supersedes all prior or contemporaneous agreements, whether written or oral, with respect to the subject matter of this Agreement.

(c) Choice of Law. The validity, interpretation, construction and performance of this Agreement shall be governed by the internal substantive laws, but not the conflicts of law rules, of the State of California.

(d) Tax Withholding. Any payments provided for hereunder are subject to reduction to reflect applicable withholding and payroll taxes and other reductions required under federal, state or local law.

(e) Notices. Any notice required by the terms of this Agreement shall be given in writing. It shall be deemed effective upon (i) personal delivery, (ii) deposit with the United States Postal Service, by registered or certified mail, with postage and fees prepaid or (iii) deposit with nationally recognized overnight courier, with shipping charges prepaid. Notice shall be addressed to the Company at its principal executive office (attention: General Counsel) and to Executive at the address that he or she most recently provided to the Company in accordance with this Subsection (e).

(f) Severability. The invalidity or unenforceability of any provision or provisions of this Agreement shall not affect the validity or enforceability of any other provision hereof, which shall remain in full force and effect.

(g) Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together will constitute one and the same instrument.

7. At-Will Employment. Nothing contained in this Agreement shall (a) confer upon Executive any right to continue in the employ of the Company, (b) constitute any contract or agreement of employment, or (c) interfere in any way with the at-will nature of Executive’s employment with the Company.

8. Definitions. The following terms referred to in this Agreement shall have the

following meanings:

(a) “Base Salary” means Executive’s base salary as in effect immediately prior to an Involuntary Termination; provided, however, that in the event of a Resignation for Good Reason due to a material reduction in Executive’s base salary, “Base Salary” means Executive’s base salary as in effect immediately prior to such reduction.

(b) “Cause” means Executive’s (i) unauthorized use or disclosure of the Company’s confidential information or trade secrets, which use or disclosure causes material harm to the Company, (ii) material breach of any agreement with the Company, (iii) material failure to comply with the Company’s written policies or rules, (iv) conviction of, or plea of “guilty” or “no contest” to, a felony under the laws of the United States or any State involving fraud, embezzlement or any other act of moral turpitude, (v) gross negligence or willful misconduct related to the Company’s business, (vi) willful and repeated failure to perform reasonably assigned and essential duties, or (vii) failure to cooperate in good faith with a governmental or internal investigation of the Company or its directors, officers or employees, if the Company has requested such cooperation. For purposes of this definition, Cause shall not exist unless the Company delivers written notice to Executive specifically identifying the conduct, events or circumstances that may provide grounds for Cause, in reasonable detail. To the extent curable, Executive shall have ten (10) business days following receipt of the notice to cure or remedy such conduct, events or circumstances before any Termination for Cause is finalized.

(c) “Change in Control” means (i) a sale, conveyance or other disposition of all or substantially all of the assets, property or business of the Company, except where such sale, conveyance or other disposition is to a wholly owned subsidiary of the Company, (ii) a merger or consolidation of the Company with or into another corporation, entity or person, other than any such transaction in which the holders of voting capital stock of the Company outstanding immediately prior to the transaction continue to hold a majority of the voting capital stock of the Company (or the surviving or acquiring entity) outstanding immediately after the transaction (taking into account only stock of the Company held by such stockholders immediately prior to the transaction and stock issued on account of such stock in the transaction), or (iii) the direct or indirect acquisition (including by way of a tender or exchange offer) by any person, or persons acting as a group, of beneficial ownership or a right to acquire beneficial ownership of shares representing a majority of the voting power of the then outstanding shares of capital stock of the Company; provided, however, that a Change in Control shall not include any transaction or series of related transactions (1) principally for bona fide equity financing purposes or (2) effected exclusively for the purpose of changing the domicile of the Company. A series of related transactions shall be deemed to constitute a single transaction for purposes of determining whether a Change in Control has occurred. In addition, if a Change in Control constitutes a payment event with respect to any amount that is subject to Code Section 409A, then the transaction must also constitute a “change in control event” as defined in Treasury Regulation Section 1.409A-3(i)(5) to the extent required by Code Section 409A.

(d) “Change in Control Period” means the period commencing on the date that is three (3) months prior to the date on which the Change in Control occurs and ending on the date that is twelve (12) months after the date of such Change in Control.

(e) “COBRA” means the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended.

(f) “Disability” means the Executive is, by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a period of not less than 12 months, unable to engage in any substantial gainful activity.

(g) “Involuntary Termination” means either Executive’s (i) Termination Without Cause, (ii) Resignation for Good Reason, or (iii) Disability or death.

(h) “Resignation for Good Reason” means a Separation as a result of Executive’s resignation from employment within 12 months after one of the following conditions has come into existence without Executive’s express written consent: (i) a reduction in Executive’s total target annual cash compensation by more than 10%, other than a general reduction that is part of a cost-reduction program that affects all similarly situated employees in substantially the same proportions, (ii) a relocation of Executive’s principal workplace by more than 25 miles, or (iii) a material reduction of Executive’s responsibilities, authority or duties. A Resignation for Good Reason will not be deemed to have occurred unless Executive gives the Company written notice of the condition within 90 days after the condition comes into existence and the Company fails to remedy the condition within 30 days after receiving such written notice; provided, however, that the Company will be deemed to have waived such cure period if the Company has communicated after such notice that it does not intend to cure such condition.

(i) “Separation” means a “separation from service” as defined in the regulations under Code Section 409A.

(j) “Termination Without Cause” means a Separation as a result of the termination of Executive’s employment by the Company without Cause, provided the individual is willing and able to continue performing services within the meaning of Treasury Regulation 1.409A-1(n)(1).

IN WITNESS WHEREOF, each of the parties has executed this Agreement, in the case

of the Company by its duly authorized officer, as of the Effective Date.

BACKBLAZE, INC.

Signature:

Print Name:

Title:

EXECUTIVE

Signature:

Print Name:

Backblaze Announces Second Quarter 2024 Financial Results

43% Revenue Growth in B2 Cloud Storage, 27% Revenue Growth Overall in Q2 2024

San Mateo, CA (August 8, 2024)—Backblaze, Inc. (Nasdaq: BLZE), the cloud storage innovator delivering a modern alternative to traditional cloud providers, today announced results for its second quarter ended June 30, 2024.

“Q2 marked another strong growth quarter for Backblaze, along with efficient execution driving continued margin expansion and momentum moving up-market,” said Gleb Budman, CEO of Backblaze. “We continued our recent string of innovations with the launch of Backblaze B2 Live Read in June. This transformative, patent-pending feature enables customers to use their data during the upload process, which has unique value for live broadcast workflows.

“Additionally, we are excited to introduce our new Chief Revenue Officer Jason Wakeam and Chief Financial Officer Marc Suidan, both accomplished leaders who will help drive our growth strategy.”

Second Quarter 2024 Financial Highlights:

•Revenue of $31.3 million, an increase of 27% year-over-year (YoY).

•B2 Cloud Storage revenue was $15.4 million, an increase of 43% YoY.

•Computer Backup revenue was $15.9 million, an increase of 15% YoY.

◦Gross profit of $17.2 million, or 55% of revenue, compared to $12.1 million or 49% of revenue, in Q2 2023.

•Adjusted gross profit of $24.5 million, or 78% of revenue, compared to $18.4 million or 75% of revenue in Q2 2023.

•Net loss was $10.3 million compared to a net loss of $14.3 million in Q2 2023.

•Net loss per share was $0.25 compared to a net loss per share of $0.41 in Q2 2023.

•Adjusted EBITDA was $2.7 million, or 9% of revenue, compared to $(1.8) million or (7%) of revenue in Q2 2023.

•Non-GAAP net loss of $4.8 million compared to non-GAAP net loss of $8.3 million in Q2 2023.

•Non-GAAP net loss per share of $0.11 compared to a non-GAAP net loss per share of $0.24 in Q2 2023.

•Cash, short-term investments and restricted cash, non-current totaled $28.3 million as of June 30, 2024.

Second Quarter 2024 Operational Highlights:

•Annual recurring revenue (ARR) was $126.3 million, an increase of 30% YoY.

◦B2 Cloud Storage ARR was $62.8 million, an increase of 44% YoY.

◦Computer Backup ARR was $63.5 million, an increase of 18% YoY.

•Net revenue retention (NRR) rate was 114% compared to 110% in Q2 2023.

◦B2 Cloud Storage NRR was 126% compared to 121% in Q2 2023.

◦Computer Backup NRR was 105% compared to 103% in Q2 2023.

•Gross customer retention rate was 90% in Q2 2024 compared to 91% in Q2 2023.

◦B2 Cloud Storage gross customer retention rate was 89% in Q2 2024 compared to 90% in Q2 2023.

◦Computer Backup gross customer retention rate was 90% in Q2 2024 compared to 91% in Q2 2023.

Recent Business Highlights:

•Launched Backblaze B2 Live Read: This patent-pending cloud solution enables customers to access and edit files during the upload process. The initial focus will be on media and entertainment use cases, which will help production teams accelerate their speed to market.

•Continued Up-Market Momentum: Customers contributing over $50,000 in ARR grew more than 55% year over year.

•Introduced Internet2 Peering: The integration of Internet2’s network provides the world's largest research and educational institutions fast access to and easier adoption of B2 Cloud Storage.

•Announced Marc Suidan to join as Chief Financial Officer: Marc brings over 20 years of experience as a public company CFO, strategic advisor and management consultant. As a senior partner at PricewaterhouseCoopers, Marc advised the largest global technology companies. Marc is expected to join Backblaze as CFO on August 16, 2024.

•Hired Jason Wakeam as Chief Revenue Officer: Jason adds decades of experience in building high impact sales, channel, and partner teams and driving competitive market share growth at Hewlett-Packard, Microsoft, Cloudera and SnapLogic.

•Selected for the Russell 2000 Index: The widely used benchmark brings added investor awareness to Backblaze.

Financial Outlook:

Based on information available as of the date of this press release,

For the third quarter of 2024 we expect:

•Revenue between $32.4 million to $32.8 million

•Adjusted EBITDA margin between 9% to 11%

•Basic shares outstanding of 43.0 million to 43.5 million shares

For full-year 2024 we expect:

•Revenue between $126.5 million to $128.5 million

•Adjusted EBITDA margin between 9% to 11%

Conference Call Information:

Backblaze will host a conference call today, August 8, 2024 at 1:30 p.m. PT (4:30 p.m. ET) to review its financial results.

Attend the webcast here: https://edge.media-server.com/mmc/p/47dcvumd

Register to listen by phone here: https://dpregister.com/sreg/10190613/fcff4b25e9

Phone registrants will receive dial-in information via email.

An archive of the webcast will be available shortly after its completion on the Investor Relations section of the Backblaze website at https://ir.backblaze.com.

About Backblaze

Backblaze is the cloud storage innovator delivering a modern alternative to traditional cloud providers. We offer high-performance, secure cloud object storage that customers use to develop applications, manage media, secure backups, build AI workflows, protect from ransomware, and more. Backblaze helps businesses break free from the walled gardens that traditional providers lock customers into, enabling customers to use their data in open cloud workflows with the providers they prefer at a fraction of the cost. Headquartered in San Mateo, CA, Backblaze (Nasdaq: BLZE) was founded in 2007 and serves over 500,000 customers in 175 countries around the world. For more information, please go to www.backblaze.com.

Cautionary Note Regarding Forward-looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which involve risks and uncertainties. These forward-looking statements are frequently identified by the use of forward-looking terminology, including the terms “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “may,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” or other similar terms or expressions that relate to our future performance, expectations, strategy, plans or intentions, and include statements in the section titled “Financial Outlook” and statements regarding the use and impact of our IPO proceeds.

Our actual results could differ materially from those stated in or implied by the forward-looking statements in this press release due to a number of factors, including but not limited to: market competition, including competitors that may have greater size, offerings and resources; effectively managing growth; ability to offer new features and other offerings on a timely basis and achieve desired market adoption; disruption in our service or loss of availability of customers’ data; cyberattacks; ability to attract and retain customers, including increasingly larger customers and the continued growth of data stored by our customers; continued growth consistent with historical levels; the impact of pricing and other product offering changes; material defects or errors in our software; supply chain disruption; ability to maintain existing relationships with partners and to enter into new partnerships; ability to remediate and prevent material weaknesses in our internal controls over financial reporting; hiring and retention of key employees; the impact of a pandemic, war or hostilities, including the Israel-Hamas conflict, and other significant world or regional events on our business and the business of our customers, vendors, supply chain and partners; litigation and other disputes; and general market, political, economic, and business conditions. Further information on these and additional risks, uncertainties, assumptions, and other factors that could cause actual results or outcomes to differ materially from those included in or implied by the forward-looking statements contained in this release are included under the caption “Risk Factors” and elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2023 and other filings and reports we make with the SEC from time to time.

The forward-looking statements made in this release reflect our views as of the date of this press release. We undertake no obligation to update any forward-looking statements in this press release, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Measures

To supplement the financial measures prepared in accordance with generally accepted accounting principles (GAAP), we use non-GAAP adjusted gross margin and adjusted EBITDA margin. These non-GAAP financial measures exclude certain items and are not prepared in accordance with GAAP; therefore, the information is not necessarily comparable to other companies and should be considered as a supplement to, not a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. We present these non-GAAP measures because management believes they are a useful measure of the company’s performance and provide an additional basis for assessing our operating results. Please see the appendix attached to this press release for a reconciliation of non-GAAP adjusted gross margin and adjusted EBITDA margin to the most directly comparable GAAP financial measures.

A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses and other factors in the future. For example, stock-based compensation expense-related charges are impacted by the timing of employee stock transactions, the future fair market value of our common stock, and our future hiring and retention needs, all of which are difficult to predict with reasonable accuracy and subject to constant change.

Adjusted Gross Profit (and Margin)

We believe adjusted gross profit (and margin), when taken together with our GAAP financial results, provides a meaningful assessment of our performance and is useful to us for evaluating our ongoing operations and for internal planning and forecasting purposes.

We define adjusted gross margin as gross profit, exclusive of stock-based compensation expense, depreciation expense of our property and equipment, and amortization expense of capitalized internal-use software included within cost of revenue, as a percentage of adjusted gross profit to revenue. We exclude stock-based compensation, which is a non-cash item, because we do not consider it indicative of our core operating performance. We exclude depreciation expense of our property and equipment and amortization expense of capitalized internal-use software, because these may not reflect current or future cash spending levels to support our business. We believe adjusted gross margin provides consistency and comparability with our past financial performance and facilitates period-to-period comparisons of operations, as this metric eliminates the effects of depreciation and amortization.

Adjusted EBITDA

We define adjusted EBITDA as net loss adjusted to exclude depreciation and amortization, stock-based compensation, interest expense, investment income, income tax provision, workforce reduction and related severance charges, and other non-recurring charges. We use adjusted EBITDA to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that adjusted EBITDA, when taken together with our GAAP financial results, provides meaningful supplemental information regarding our operating performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. We consider adjusted EBITDA to be an important measure because it helps illustrate underlying trends in our business and our historical operating performance on a more consistent basis.

Non-GAAP Net Income (Loss)

We define non-GAAP net income (loss) as net income adjusted to exclude stock-based compensation and other items we deem non-recurring. We believe that non-GAAP net income (loss), when taken together with our GAAP financial results, provides meaningful supplemental information regarding our operating performance by excluding certain items that may not be indicative of our business, results of operations, or outlook.

Key Business Metrics:

Annual Recurring Revenue (ARR)

We define annual recurring revenue (ARR) as the annualized value of all Backblaze B2 and Computer Backup arrangements as of the end of a period. Given the renewable nature of our business, we view ARR as an important indicator of our financial performance and operating results, and we believe it is a useful metric for internal planning and analysis. ARR is calculated based on multiplying the monthly revenue from all Backblaze B2 and Computer Backup arrangements, which represent greater than 98% of our revenue for the periods presented (and excludes Physical Media revenue), for the last month of a period by 12. Our annual recurring revenue for Computer Backup and B2 Cloud Storage is calculated in the same manner as our overall annual recurring revenue based on the revenue from our Computer Backup and B2 Cloud Storage solutions, respectively.

Net Revenue Retention Rate (NRR)

Our overall net revenue retention rate (NRR) is a trailing four-quarter average of the recurring revenue from a cohort of customers in a quarter as compared to the same quarter in the prior year. We calculate our overall net revenue retention rate for a quarter by dividing (i) recurring revenue in the current quarter from any accounts that were active at the end of the same quarter of the prior year by (ii) recurring revenue in the current corresponding quarter from those same accounts. Our overall net revenue retention rate includes any expansion of revenue from existing customers and is net of revenue contraction and customer attrition, and excludes revenue from new customers in the current period. Our net revenue retention rate for Computer Backup and B2 Cloud Storage is calculated in the same manner as our overall net revenue retention rate based on the revenue from our Computer Backup and B2 Cloud Storage solutions, respectively.

Gross Customer Retention Rate

We use gross customer retention rate to measure our ability to retain our customers. Our gross customer retention rate reflects only customer losses and does not reflect the expansion or contraction of revenue we earn from our existing customers. We believe our high gross customer retention rates demonstrate that we serve a vital service to our customers, as the vast majority of our customers tend to continue to use our platform from one period to the next. To calculate our gross customer retention rate, we take the trailing four-quarter average of the percentage of cohort of customers who were active at the end of the quarter in the prior year that are still active at the end of the current quarter. We calculate our gross customer retention rate for a quarter by dividing (i) the number of accounts that generated revenue in the last month of the current quarter that also generated recurring revenue during the last month of the corresponding quarter in the prior year, by (ii) the number of accounts that generated recurring revenue during the last month of the corresponding quarter in the prior year.

Investors Contact

Mimi Kong

Senior Director, Investor Relations and Corporate Development

ir@backblaze.com

Press Contact

Jeanette Foster

Communications Manager

press@backblaze.com

BACKBLAZE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

| | | | | | | | | | | |

| June 30, | | December 31, |

| 2024 | | 2023 |

| (unaudited) |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 9,273 | | | $ | 12,502 | |

| Short-term investments, net | 14,373 | | | 16,799 | |

| Accounts receivable, net | 1,814 | | | 800 | |

| | | |

| Prepaid expenses and other current assets | 8,252 | | | 8,413 | |

| Total current assets | 33,712 | | | 38,514 | |

| Restricted cash, non-current | 4,682 | | | 4,128 | |

| Property and equipment, net | 41,037 | | | 45,600 | |

| Operating lease right-of-use assets, net | 8,962 | | | 9,980 | |

| Capitalized internal-use software, net | 38,335 | | | 32,521 | |

| Other assets | 1,048 | | | 944 | |

| Total assets | $ | 127,776 | | | $ | 131,687 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 1,147 | | | $ | 1,973 | |

Accrued expenses and other current liabilities(1) | 5,854 | | | 8,768 | |

| | | |

| Finance lease liabilities and lease financing obligations, current | 16,951 | | | 18,492 | |

| Operating lease liabilities, current | 1,668 | | | 1,878 | |

| Deferred revenue, current | 29,438 | | | 25,976 | |

| | | |

| Total current liabilities | 55,058 | | | 57,087 | |

| Debt facility, non-current | 4,682 | | | 4,128 | |

| Deferred revenue, non-current | 4,605 | | | 4,073 | |

| Finance lease liabilities and lease financing obligations, non-current | 10,763 | | | 13,310 | |

| Operating lease liabilities, non-current | 7,570 | | | 8,151 | |

| | | |

| | | |

| | | |

| Total liabilities | $ | 82,678 | | | $ | 86,749 | |

| Commitments and contingencies | | | |

| | | |

| | | |

| Stockholders’ Equity | | | |

| Class A common stock, $0.0001 par value; 113,000,000 shares authorized as of June 30, 2024 and December 31, 2023; 42,886,281 and 39,150,610 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively. | 4 | | | 4 | |

| | | |

| Additional paid-in capital | 213,949 | | | 192,388 | |

| Accumulated deficit | (168,855) | | | (147,454) | |

| Total stockholders’ equity | 45,098 | | | 44,938 | |

| Total liabilities and stockholders’ equity | $ | 127,776 | | | $ | 131,687 | |

(1) As of June 30, 2024, the company reclassified certain current liabilities from accounts payable to accrued expenses and other current liabilities. The prior period amount of $0.3 million as of December 31, 2023 has been reclassified to conform with current presentation.

BACKBLAZE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| (unaudited) | | | | |

| Revenue | $ | 31,285 | | | $ | 24,589 | | | $ | 61,253 | | | $ | 47,983 | | | | | |

| Cost of revenue | 14,056 | | | 12,538 | | | 28,213 | | | 24,963 | | | | | |

| Gross profit | 17,229 | | | 12,051 | | | 33,040 | | | 23,020 | | | | | |

| Operating expenses: | | | | | | | | | | | |

| Research and development | 9,589 | | | 9,925 | | | 19,335 | | | 20,458 | | | | | |

| Sales and marketing | 10,991 | | | 9,875 | | | 21,013 | | | 20,434 | | | | | |

| General and administrative | 6,458 | | | 6,165 | | | 13,011 | | | 12,842 | | | | | |

| Total operating expenses | 27,038 | | | 25,965 | | | 53,359 | | | 53,734 | | | | | |

| Loss from operations | (9,809) | | | (13,914) | | | (20,319) | | | (30,714) | | | | | |

| Investment income | 362 | | | 519 | | | 746 | | | 1,129 | | | | | |

| Interest expense | (901) | | | (942) | | | (1,822) | | | (1,865) | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Loss before provision for income taxes | (10,348) | | | (14,337) | | | (21,395) | | | (31,450) | | | | | |

| Income tax provision | — | | | — | | | 6 | | | — | | | | | |

| Net loss | $ | (10,348) | | | $ | (14,337) | | | $ | (21,401) | | | $ | (31,450) | | | | | |

| Net loss per share, basic and diluted | $ | (0.25) | | | $ | (0.41) | | | $ | (0.52) | | | $ | (0.91) | | | | | |

Weighted average shares used in computing net loss per share attributable to Class A and Class B common stockholders, basic and diluted(1) | 42,151,850 | | | 35,149,000 | | | 41,188,544 | | | 34,539,229 | | | | | |

(1) On July 6, 2023, all shares of the Company’s then outstanding Class B common stock were automatically converted into the same number of Class A common stock, pursuant to the terms of the Company’s Amended and Restated Certificate of Incorporation. No additional shares of Class B common stock will be issued following such conversion.

BACKBLAZE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands) | | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| (unaudited) |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net loss | $ | (21,401) | | | $ | (31,450) | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | |

| | | |

| Net accretion of discount on investment securities and net realized investment gains | 31 | | | (966) | |

| | | |

| | | |

| Noncash lease expense on operating leases | 1,018 | | | 1,293 | |

| Depreciation and amortization | 13,937 | | | 11,864 | |

| Stock-based compensation | 11,057 | | | 10,712 | |

| | | |

| Gain on disposal of assets and other | (6) | | | (1) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (1,014) | | | 30 | |

| Prepaid expenses and other current assets | (59) | | | 941 | |

| Other assets | (104) | | | 134 | |

| | | |

| Accounts payable | (745) | | | (245) | |

| Accrued expenses and other current liabilities | (274) | | | (1,600) | |

| | | |

| Deferred revenue | 3,994 | | | 259 | |

| Operating lease liabilities | (791) | | | (1,399) | |

| | | |

| Net cash provided by (used in) operating activities | 5,643 | | | (10,428) | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Purchases of marketable securities | (24,127) | | | (9,734) | |

| Maturities of marketable securities | 26,523 | | | 38,500 | |

| Proceeds from disposal of property and equipment | 184 | | | 78 | |

| Purchases of property and equipment | (694) | | | (4,719) | |

| Capitalized internal-use software costs | (6,828) | | | (7,098) | |

| Net cash (used in) provided by investing activities | (4,942) | | | 17,027 | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| Principal payments on finance leases and lease financing obligations | (9,711) | | | (9,734) | |

| | | |

| | | |

| | | |

| Proceeds from debt facility | 554 | | | 3,529 | |

| | | |

| Principal payments on insurance premium financing | (590) | | | (1,024) | |

| | | |

| | | |

| Proceeds from exercises of stock options | 5,012 | | | 2,182 | |

| Proceeds from ESPP | 1,359 | | | 1,171 | |

| Net cash used in financing activities | (3,376) | | | (3,876) | |

| Net (decrease) increase in cash and restricted cash, non-current | (2,675) | | | 2,723 | |

| Cash, cash equivalents, restricted cash, current and restricted cash, non-current at beginning of period | 16,630 | | | 11,165 | |

| Cash, restricted cash, current and restricted cash, non-current at end of period | $ | 13,955 | | | $ | 13,888 | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | |

| Cash paid for interest | $ | 1,817 | | | $ | 1,816 | |

| Cash paid for income taxes | $ | 42 | | | $ | 58 | |

| Cash paid for operating lease liabilities | $ | 1,328 | | | $ | 1,458 | |

| SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITIES | | | |

| Stock-based compensation included in capitalized internal-use software | $ | 1,965 | | | $ | 2,030 | |

| Accrued bonus settled in restricted stock units | $ | 3,507 | | | $ | 1,848 | |

| 2023 Bonus Plan expense classified as stock-based compensation | $ | 473 | | | $ | 929 | |

| 2024 Bonus Plan accrual classified as stock-based compensation | $ | 853 | | | $ | — | |

| | | |

| Equipment acquired through finance lease and lease financing obligations | $ | 5,989 | | | $ | 8,705 | |

| Accruals related to purchases of property and equipment | $ | 18 | | | $ | 224 | |

| | | |

| Assets obtained in exchange for operating lease obligations | $ | — | | | $ | 268 | |

| Receivable recorded due to stock option exercises pending settlement | $ | 5 | | | $ | 29 | |

| RECONCILIATION OF CASH AND RESTRICTED CASH | | | |

| Cash and cash equivalents | $ | 9,273 | | | $ | 5,886 | |

| Restricted cash - included in prepaid expenses and other current assets | $ | — | | | $ | 169 | |

| | | |

| Restricted cash, non-current | $ | 4,682 | | | $ | 7,833 | |

| Total cash and restricted cash | $ | 13,955 | | | $ | 13,888 | |

BACKBLAZE, INC.

RECONCILIATION OF GAAP TO NON-GAAP DATA

(unaudited)

Adjusted Gross Profit and Adjusted Gross Margin

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands, except percentages) |

| Gross profit | $ | 17,229 | | | $ | 12,051 | | | $ | 33,040 | | | $ | 23,020 | |

| Adjustments: | | | | | | | |

| Stock-based compensation | 354 | | | 387 | | | 740 | | | 803 | |

| Depreciation and amortization | 6,879 | | | 5,985 | | | 13,653 | | | 11,555 | |

| Adjusted gross profit | $ | 24,462 | | | $ | 18,423 | | | $ | 47,433 | | | $ | 35,378 | |

| Gross margin | 55 | % | | 49 | % | | 54 | % | | 48 | % |

| Adjusted gross margin | 78 | % | | 75 | % | | 77 | % | | 74 | % |

Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands, except percentages) |

| Net loss | $ | (10,348) | | | $ | (14,337) | | | $ | (21,401) | | | $ | (31,450) | |

| Adjustments: | | | | | | | |

| Depreciation and amortization | 7,025 | | | 6,131 | | | 13,937 | | | 11,864 | |

Stock-based compensation(1) | 5,528 | | | 4,884 | | | 11,057 | | | 10,587 | |

| Interest expense and investment income | 539 | | | 423 | | | 1,076 | | | 736 | |

| Income tax provision | — | | | — | | | 6 | | | — | |

| | | | | | | |

| Workforce reduction and related severance charges | — | | | 1,147 | | | — | | | 3,604 | |

| | | | | | | |

| Adjusted EBITDA | $ | 2,744 | | | $ | (1,752) | | | $ | 4,675 | | | $ | (4,659) | |

| Adjusted EBITDA margin | 9 | % | | (7) | % | | 8 | % | | (10) | % |

(1) During the six months ended June 30, 2023, $125 thousand of stock-based compensation expense is classified as workforce reduction and related severance charges in the table above as it was incurred as part of our restructuring program.

Non-GAAP Net Loss

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands, except share and per share data) |

| Net loss | $ | (10,348) | | | $ | (14,337) | | | $ | (21,401) | | | $ | (31,450) | |

| Adjustments: | | | | | | | |

Stock-based compensation(1) | 5,528 | | | 4,884 | | | 11,057 | | | 10,587 | |

| | | | | | | |

| Workforce reduction and related severance charges | — | | | 1,147 | | | — | | | 3,604 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Non-GAAP net loss | $ | (4,820) | | | $ | (8,306) | | | $ | (10,344) | | | $ | (17,259) | |

| Non-GAAP net loss per share, basic and diluted | $ | (0.11) | | | $ | (0.24) | | | $ | (0.25) | | | $ | (0.50) | |

Weighted average shares used in computing net loss per share attributable to Class A and Class B common stockholders, basic and diluted(2) | 42,151,850 | | | 35,149,000 | | | 41,188,544 | | | 34,539,229 | |

(1) During the six months ended June 30, 2023, $125 thousand of stock-based compensation expense is classified as workforce reduction and related severance charges in the table above as it was incurred as part of our restructuring program.

(2) On July 6, 2023, all shares of the Company’s then outstanding Class B common stock were automatically converted into the same number of Class A common stock, pursuant to the terms of the Company’s Amended and Restated Certificate of Incorporation. No additional shares of Class B common stock will be issued following such conversion.

BACKBLAZE, INC.

SUPPLEMENTAL FINANCIAL INFORMATION

(unaudited)

Stock-based Compensation

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In thousands, unaudited) |

| Cost of revenue | $ | 354 | | | $ | 387 | | | $ | 740 | | | $ | 803 | |

| Research and development | 2,250 | | 1,788 | | 4,358 | | 3,921 |

| Sales and marketing | 1,762 | | 1,717 | | 3,584 | | 3,869 |

| General and administrative | 1,162 | | 992 | | 2,375 | | 2,119 |

| Total stock-based compensation expense | $ | 5,528 | | | $ | 4,884 | | | $ | 11,057 | | | $ | 10,712 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

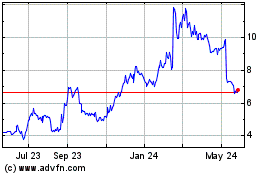

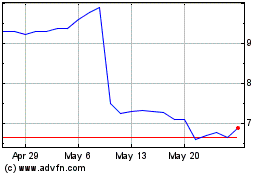

Backblaze (NASDAQ:BLZE)

Historical Stock Chart

From Jul 2024 to Aug 2024

Backblaze (NASDAQ:BLZE)

Historical Stock Chart

From Aug 2023 to Aug 2024