0001534120false00015341202023-07-202023-07-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 20, 2023

AVALO THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| | | | | | | | |

| 001-37590 | | 45-0705648 |

| (Commission File Number) | | (IRS Employer Identification No.) |

540 Gaither Road, Suite 400, Rockville, Maryland 20850

(Address of principal executive offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (410) 522-8707

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 Par Value | AVTX | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry Into a Material Definitive Agreement.

As previously disclosed on Current Report on Form 8-K filed on June 8, 2021, Avalo Therapeutics, Inc. (the “Company”), entered into a Venture Loan and Security Agreement (as amended, from time to time, the “Note”), issued on June 4, 2021, to certain institutional investor (the “Holders”). As of July 20, 2023, the Holders asserted that a default and event of default has occurred due to a material adverse change in the Company’s business (the “Existing Default”).

On July 20, 2023, the Company entered into a forbearance agreement (the “Forbearance Agreement”) with the Holders, pursuant to which the Holders agreed to forbear from enforcing its full remedies related to the Existing Default until the earliest of (i) August 15, 2023, (ii) the occurrence of any default or event of default (other than the Existing Default) under the Note, or (iii) the occurrence of a breach by the Company of any provision in the Forbearance Agreement. In exchange for the Holders agreeing to enter the Forbearance Agreement, the Company agreed to maintain cash on deposit in deposit accounts subject to an Account Control Agreement (as defined in the Note) in favor of the Collateral Agent (as defined in the Forbearance Agreement) in an amount not less than the sum of (a) three million dollars ($3,000,000) plus (b) one-hundred percent (100%) of the aggregate cash proceeds received by Company as a result of the any future sale of the Company’s equity securities while the Forbearance Agreement is in effect.

Except as set forth above, all other terms, conditions and rights of the Note remain in full force and effect.

The foregoing description of the Forbearance Agreement does not purport to be complete and is subject to, and qualified by, the full text of such document, a copy of which is filed as Exhibit 10.1 and is incorporated by reference herein.

Item 2.04. Triggering Events that Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

To the extent applicable, the information related to the Forbearance Agreement set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 8.01. Other Events.

On July 21, 2023, the Company posted on its website an updated investor presentation (the “Investor Presentation”). The Investor Presentation will be used from time to time in meetings with investors. A copy of the Investor Presentation is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

On July 20, 2023, the Company entered into a non-binding letter of intent (the “LOI”) for the potential sale of AVTX-801 (D-galactose), AVTX-802 (D-mannose) and AVTX-803 (L-fucose) (collectively, the “800 Series”). Pursuant to the LOI, the Company would sell the 800 Series in exchange for an upfront payment of $150,000, and contingent milestone payments of up to an aggregate of $45,000,000 upon certain FDA approvals, plus up to 20% of certain payments, if any, granted to the buyer upon any sale of any priority review voucher granted to the buyer by the FDA. Given that the LOI is non-binding, there can be no assurance the Company will be able to negotiate definitive agreements and close the transaction on these or any terms.

Based upon preliminary estimates and information available to the Company, the Company had approximately $4.5 million in cash and cash equivalents as of July 20, 2023. This estimate of the Company’s cash and cash equivalents as of July 20, 2023 is preliminary, unaudited and is subject to change upon completion of the Company’s financial statement closing procedures and the audit of the Company’s consolidated financial statements.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 10.1 | | |

| | |

| 99.1 | | |

| | |

| 104 | | The cover pages of this Current Report on Form 8-K, formatted in Inline XBRL. |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | | AVALO THERAPEUTICS, INC. |

| | | |

| Date: July 21, 2023 | | By: | /s/ Christopher Sullivan |

| | | Christopher Sullivan |

| | | Chief Financial Officer |

FORBEARANCE AGREEMENT

This FORBEARANCE AGREEMENT (this “Agreement”) is made as of July 20, 2023, by and among (i) Avalo Therapeutics, Inc. (f/k/a Cerecor Inc.), a Delaware corporation (the “Borrower”), (ii) Horizon Credit II LLC, Horizon Funding Trust 2019-1, Horizon Funding I, LLC, and Powerscourt Investments XXV Trust, as lenders (collectively, the “Lenders”), and (iii) Horizon Technology Finance Corporation, as collateral agent for the Lenders (in such capacity, the “Collateral Agent” and collectively with the Lenders, the “Secured Parties”). Capitalized terms used but not otherwise defined herein shall have the meanings ascribed to such terms in the Loan Agreement (as defined below).

WHEREAS, on June 4, 2021, the Borrower, the Lenders, and the Collateral Agent entered into a Venture Loan and Security Agreement (as the same may be amended, restated, supplemented or modified from time to time, the “Loan Agreement”);

WHEREAS, pursuant to the Loan Agreement, the Lenders provided Loans to the Borrower in the aggregate original principal amount of $35,000,000, as evidenced by a (i) Secured Promissory Note (Loan A) in the original principal amount of $5,000,000, executed by the Borrower and other parties thereto in favor of Horizon Credit II LLC, dated as of June 4, 2021, (ii) Secured Promissory Note (Loan B) in the original principal amount of $5,000,000, executed by the Borrower in favor of Horizon Funding Trust 2019-1, dated as of June 4, 2021, (iii) Secured Promissory Note (Loan C) in the original principal amount of $2,500,000, executed by the Borrower in favor of Horizon Funding I, LLC, dated as of June 4, 2021, (iv) Secured Promissory Note (Loan D) in the original principal amount of $7,500,000, executed by the Borrower in favor of Powerscourt Investments XXV Trust, dated as of June 4, 2021, (v) Secured Promissory Note (Loan E) in the original principal amount of $5,000,000, executed by the Borrower in favor of Horizon Funding I LLC, dated as of July 30, 2021, (vi) Secured Promissory Note (Loan F) in the original principal amount of $5,000,000, executed by the Borrower in favor of Horizon Credit II LLC, dated as of July 30, 2021, (vii) Secured Promissory Note (Loan G) in the original principal amount of $2,500,000, executed by the Borrower in favor of Horizon Credit II LLC, dated as of September 29, 2021, and (viii) Secured Promissory Note (Loan H) in the original principal amount of $2,500,000, executed by the Borrower in favor of Horizon Credit II LLC, dated as of September 29, 2021;

WHEREAS, the Lenders have asserted that as of the date hereof a Default and Event of Default has occurred under Section 8.4 of the Loan Agreement, due to the occurrence of events prior to the date of this Agreement that constitute a material adverse change in the Borrower’s business (the “MAC Default”);

WHEREAS, the Secured Parties would be entitled to exercise their rights and remedies under the Loan Agreement as a result of the MAC Default, and the Borrower has requested that the Secured Parties forbear until August 15, 2023 (the “Forbearance Termination Date”) from exercising such rights and remedies in respect of the MAC Default; and

WHEREAS, subject to the terms and conditions of this agreement, and the covenants of the Borrower set forth herein, the Secured Parties have agreed to forbear as provided herein.

NOW, THEREFORE, in consideration of the promises herein contained and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto agree as follows:

1. Event of Default. The Borrower agrees that the MAC Default constitutes an Event of Default under the Loan Agreement. The Borrower represents and warrants that, except for the MAC Default, no Default or Event of Default has occurred under the Loan Agreement that has

not been waived by the Secured Parties. The Borrower acknowledges and agrees that, as a result of the occurrence of the MAC Default, each Secured Party has the immediate and unrestricted right to accelerate the maturity of the Obligations and to exercise any and all rights and remedies available to it under the Loan Documents and/or at law or in equity.

2. Agreement to Forbear. Each Secured Party hereby agrees to forbear from exercising remedies in respect of the MAC Default through and until the earliest to occur of (a) the Forbearance Termination Date, (b) the occurrence of any Default or Event of Default other than the MAC Default or (c) a breach of any provision of this Agreement (such period the “Forbearance Period”). At the end of the Forbearance Period, all agreements hereunder to forbear shall terminate automatically and without further notice or action, and be of no force and effect, and the effect of such termination shall be to permit each Secured Party to immediately exercise any and all rights and remedies available to it under the Loan Agreement or any other Loan Document.

3. Extension of Forbearance Period. In the sole discretion of the Secured Parties and without obligation, at the request of the Borrower, after the Forbearance Termination Date the Secured Parties may renew or extend the Forbearance Period, or grant additional forbearance periods.

4. Representations and Warranties of Borrower. The Borrower hereby represents and warrants to the Secured Parties as of the date of this Agreement:

a. The Borrower is a corporation duly organized and validly existing under the laws of its state of incorporation and qualified and licensed to do business in, and is in good standing in, any state or country in which the conduct of its business or its ownership of properties requires that it be so qualified, except where the failure to do so could not reasonably be expected to have a material adverse effect on the Borrower’s business.

b. The Borrower has all necessary corporate power and authority to execute, deliver, and perform in accordance with the terms thereof, this Agreement. The Borrower has all requisite corporate power and authority to own and operate its properties and to carry on its business as now conducted.

c. The execution and delivery of this Agreement, and the consummation of the transactions contemplated herein have each been duly authorized and delivered by all necessary action on the part of the Borrower and constitute legal, valid and binding obligations of the Borrower, enforceable in accordance with its terms, except as the enforceability thereof may be limited by bankruptcy, insolvency or other similar laws of general application relating to or affecting the enforcement of creditors’ rights or by general principles of equity.

d. The Borrower represents and warrants that, except for the MAC Default, no Default or Event of Default has occurred and is continuing under the Loan Documents.

5. Borrower’s Covenant. The Borrower covenants and agrees, for the benefit of the Collateral Agent and the Lenders, that commencing as of the date of this Agreement, and continuing through the Forbearance Period, the Borrower shall maintain, at all times, cash on deposit in deposit accounts subject to an Account Control Agreement in favor of the Collateral Agent in an amount not less than the sum of (a) Three Million Dollars ($3,000,000) plus (b) one-hundred percent (100%) of the aggregate cash proceeds received by Borrower as a result of the sale of Borrower’s Equity Securities.

6. Acknowledgments and Agreements.

a. The Borrower acknowledges, agrees, and represents and warrants that, immediately prior to the effective date of this Agreement, pursuant to the Loan Documents, the Borrower is legally and validly indebted to the Lenders in respect of the Loans in the outstanding principal amount of Fourteen Million One Hundred Ninety-Three Nine Hundred Seventy-Four and 94/100 Dollars ($14,193,974.94), plus interest, fees, and other amounts accrued and accruing thereon or related thereto, including, without limitation, Lenders’ Expenses related to the MAC Default and this Agreement, the Loan A Final Payment, the Loan B Final Payment, the Loan C Final Payment, the Loan D Final Payment, the Loan E Final Payment, the Loan F Final Payment, the Loan G Final Payment, and the Loan H Final Payment.

b. The Borrower acknowledges, affirms and agrees that the Secured Parties hold valid, perfected, enforceable, first priority security interests (except for Permitted Liens) in the Collateral as security for all Obligations under the Loan Documents (including, for the avoidance of doubt, all Obligations arising from or related to this Agreement).

c. The Borrower acknowledges and agrees that it has no defense, claim, offset, abatement, or deduction to any Obligations and no cause of action, claim, defense, or counter-claim against any Secured Party in any way relating to the Loan Documents, any transactions contemplated thereby, or any Secured Party’s actions thereunder.

d. The Borrower acknowledges and agrees that (i) any failure of the Borrower to perform any of the covenants set forth in Section 5 of this Agreement shall constitute an immediate “Event of Default” under the Loan Agreement and (ii) upon the occurrence of any such Event of Default, the Secured Parties shall have the immediate and unrestricted right to exercise any and all rights and remedies available under the Loan Documents and/or at law and in equity.

e. The Borrower acknowledges, agrees, and affirms that (i) this Agreement shall constitute a “Loan Document” for all purposes, including, without limitation, the definitions of “Obligations” and “Lenders’ Expenses;” (ii) the definition of “Obligations” shall include all amounts, obligations, covenants, and duties owing by the Borrower to the Secured Parties, of any kind and description, under this Agreement; and (iii) the definition of “Lenders’ Expenses” shall include the costs and expenses set forth in Section 8 hereof.

f. The Borrower hereby ratifies and confirms all terms and provisions of this Agreement, the Loan Agreement, and the other Loan Documents and all other documents, instruments, or agreements executed in connection therewith and except as expressly set forth herein, agrees that all of such terms and provisions remain in full force and effect and have not been modified or amended in any respect.

7. Release. In consideration of each Secured Party’s willingness to enter into this Agreement, the Borrower does hereby release, remise and forever discharge each Secured Party and its current and former officers, directors, managers, partners, members, employees, agents, attorneys, affiliates, advisors, consultants, shareholders and representatives (collectively, the “Released Parties”) of and from (and covenants not to sue the Released Parties for) any and all debts, demands, actions, causes of action, suits, accounts, covenants, contracts, agreements, claims, rights, damages, losses or liabilities of any nature whatsoever, whether at law or in equity, anticipated or unanticipated, fixed or contingent, known or unknown, which arose at any time prior to the date hereof, or which hereafter could arise based on any act, fact, transaction, cause, matter, or thing which occurred prior to the date hereof related to the Borrower, the Loans, the Loan Documents, or any documents or instruments delivered pursuant thereto or the transactions governed thereby or the dealings of the Borrower with the Released Parties with

respect thereto. The Borrower hereby expressly waives any and all rights it may have against the Released Parties under Section 1542 of the California Civil Code (“Section 1542”) or any similar law, and the Borrower acknowledges that it may not invoke in any manner any claims released in this Agreement. The Borrower is aware that Section 1542 provides as follows: “[a] general release does not extend to claims which the creditor or releasing party does not know or suspect to exist in his or her favor at the time of executing the release, which if known by him or her must have materially affected his or her settlement with the debtor or released party.”

8. Fees and Expenses. The Borrower agrees to pay (a) concurrently with the execution of this Agreement a forbearance fee to the Secured Parties in an amount equal to Five Thousand Dollars ($5,000) and (b) on demand, all reasonable, documented costs and expenses of the Secured Parties (including, without limitation, reasonable, documented attorneys’ fees and expenses) incurred in connection with (i) the preparation, negotiation, execution, delivery, and administration of this Agreement, and (ii) the MAC Default.

9. Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Connecticut, other than legal principles related to conflicts of laws.

10. No Waiver. No course of dealing heretofore or hereafter between the Borrower and any Secured Party, and no failure or delay on the part of any Secured Party in exercising any rights or remedies under the Loan Documents or existing at law or in equity, shall operate as a waiver of any rights or remedies of any Secured Party with respect to the Obligations, and no single or partial exercise of any rights or remedies hereunder shall operate as a waiver or preclusion to the exercise of any other rights or remedies that any Secured Party may have in regard to the Obligations.

11. Modification. This Agreement may not be modified in any manner, except by written agreement signed by the Borrower and the Secured Parties.

12. Execution in Counterparts. This Agreement may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed shall be deemed to be an original and all of which taken together shall constitute one and the same agreement.

13. Severability. Wherever possible, each provision of this Agreement shall be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Agreement shall be prohibited by or invalid under such law, such provision shall be ineffective to the extent of such prohibition or invalidity without invalidating the remainder of such provision or the remaining provisions of this Agreement.

14. Good Faith Negotiations. The Borrower acknowledges that this Agreement is the result of good faith negotiations, that it has carefully considered all of its alternatives and that it has entered into this Agreement without duress or coercion of any kind.

15. Entire Agreement. This Agreement constitutes the entire understanding and agreement among the parties hereto and supersedes any prior or contemporaneous written or oral understanding with respect to the subject matter hereof.

[the remainder of this page intentionally left blank]

IN WITNESS WHEREOF, this Agreement has been duly executed by each of the undersigned as of the day and year first set forth above.

| | | | | | | | |

| BORROWER |

| | |

| AVALO THERAPEUTICS, INC. |

| | |

| By: | /s/ Garry Neil |

| Name: | Garry Neil |

| Title: | Chief Executive Officer |

[Signature Page to Forbearance Agreement - Avalo]

| | | | | | | | |

| COLLATERAL AGENT: |

| | |

| HORIZON TECHNOLOGY FINANCE CORPORATION |

| | |

| By: | /s/ Daniel S. Devorsetz |

| Name: | Daniel S. Devorsetz |

| Title: | Executive Vice President, Chief Operating Officer and Chief Investment Officer |

[Signature Page to Forbearance Agreement - Avalo]

| | | | | | | | |

| LENDERS: |

| |

| HORIZON CREDIT II LLC, as a Lender |

| |

| By: | /s/ Daniel S. Devorsetz |

| Name: | Daniel S. Devorsetz |

| Title: | Executive Vice President, Chief Operating Officer and Chief Investment Officer |

| |

| | HORIZON FUNDING TRUST 2019-1, as a Lender |

| | |

| | By: | /s/ Daniel S. Devorsetz |

| | Name: | Daniel S. Devorsetz |

| | Title: | Executive Vice President, Chief Operating Officer and Chief Investment Officer |

| | |

| | HORIZON FUNDING I, LLC, as a Lender |

| | |

| | By: | /s/ Daniel S. Devorsetz |

| | Name: | Daniel S. Devorsetz |

| | Title: | Executive Vice President, Chief Operating Officer and Chief Investment Officer |

| |

| POWERSCOURT INVESTMENTS XXV, TRUST, as a Lender |

| By: 1485 Management, LLC, as Trust's Agent |

| | |

| /s/ Glenn Guszkowski |

| Name: | Glenn Guszkowski |

| Title: | Authorized Signatory |

[Signature Page to Forbearance Agreement - Avalo]

1 © Copyright 2023. Avalo Therapeutics. All rights reserved. FOR DISCUSSION PURPOSES ONLY Avalo Therapeutics, Inc. July 2023 Corporate Presentation (AVTX) EX-99.1

2 © Copyright 2023. Avalo Therapeutics. All rights reserved. This presentation may include forward-looking statements made pursuant to the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are subject to significant risks and uncertainties that are subject to change based on various factors (many of which are beyond the control of Avalo Therapeutics, Inc. (“Avalo” or the “Company”)), which could cause actual results to differ from the forward-looking statements. Such statements may include, without limitation, statements with respect to Avalo’s plans, objectives, projections, expectations and intentions and other statements identified by words such as “projects,” “may,” “might,” “will,” “could,” “would,” “should,” “continue,” “seeks,” “aims,” “predicts,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “potential,” or similar expressions (including their use in the negative), or by discussions of future matters such as: the future financial and operational outlook of the Company; the development of product candidates or products; timing and success of trial results and regulatory review; potential attributes and benefits of product candidates; and other statements that are not historical. These statements are based upon the current beliefs and expectations of Avalo’s management but are subject to significant risks and uncertainties, including: Avalo’s debt and cash position and the potential need for it to raise additional capital; drug development costs, timing of trial results and other risks, including reliance on investigators and enrollment of patients in clinical trials, which might be slowed by the COVID-19 pandemic; reliance on key personnel; regulatory risks; general economic and market risks and uncertainties, including those caused by the COVID-19 pandemic and the war in Ukraine; and those other risks detailed in Avalo’s filings with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements. Except as required by applicable law, Avalo expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Avalo’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based. Forward-Looking Statements

3 © Copyright 2023. Avalo Therapeutics. All rights reserved. Exclusive consulting arrangement with Carl Ware, PhD, Sanford Burnham Prebys (discoverer of the LIGHT-signaling network) LIGHT, Lymphotoxin-like, exhibits Inducible expression, and competes with HSV Glycoprotein D for HVEM, a receptor expressed by T lymphocytes; mAb, monoclonal antibody; CD, Crohn’s Disease; NEA, non-eosinophilic asthma; POC, Proof of concept studies; COVID-19 ARDS, SARS-COV2 associated acute respiratory distress syndrome (ARDS); IBD, Inflammatory bowel disease; PEAK trial, A Phase 2, Randomized, Double-Blind, Placebo- Controlled, Parallel Group Study to Evaluate the Safety and Efficacy of AVTX-002 for the Treatment of Poorly Controlled Non-Eosinophilic Asthma K; BTLA, B and T Lymphocyte Attenuator, Ig superfamily checkpoint AVTX-002, quisovalimab (anti-LIGHT mAb) – Positive proof of concept in COVID-19 ARDS. Positive trends in Crohn’s Disease and NEA sub-population. Strong target engagement and favorable safety profile in both acute and chronic dosing Portfolio emphasizing potential high value, first-in-class biologics focused on dysregulated inflammation via the LIGHT-signaling network AVTX-008 (BTLA agonist fusion protein) – IND enabling stage Avalo Therapeutics (AVTX)

4 © Copyright 2023. Avalo Therapeutics. All rights reserved. Avalo continues to evaluate the topline data results of the Phase 2 PEAK trial in NEA, while also pursuing funding for its programs, including financings and out-licensing, strategic alliances/collaborations or sale of its core and non-core programs. Development plans and corresponding milestone timing will be updated upon completion of the topline data analyses and completion of funding, if any. 1On July 20, 2023, the Company entered into a non-binding letter of intent (LOI) for the potential sale of AVTX-801 (D-galactose), AVTX-802 (D-mannose) and AVTX-803 (L-fucose) (collectively, the 800 Series). Pursuant to the LOI, the Company would sell the 800 Series in exchange for an upfront payment of $150,000, and contingent milestone payments of up to an aggregate of $45,000,000 upon certain FDA approvals, plus up to 20% of certain payments, if any, received by the buyer upon any sale of any priority review voucher granted to the buyer by the FDA. Given that the LOI is non-binding, there can be no assurance the Company will be able to negotiate definitive agreements and close the transaction on these or any terms. Program Mechanism of Action Indication Designation Development Stage Preclinical Phase 1 Phase 2 Phase 3/Pivotal Core Programs: Immune Dysregulation Disorders AVTX-002 Anti-LIGHT mAb NEA – Crohn’s Disease – COVID-19 ARDS Fast Track AVTX-008 BTLA agonist fusion protein Immunoregulatory disorders – Other AVTX-8031 Fucose replacement LAD II (SLC35C1-CDG) ODD RPDD Fast Track Pipeline

5 © Copyright 2023. Avalo Therapeutics. All rights reserved. AVTX-002 (quisovalimab) Anti-LIGHT mAb

6 © Copyright 2023. Avalo Therapeutics. All rights reserved. Ware, C., Croft, M., and Neil, G. J.Exp Med. 2022 Jul 4;219(7):e20220236. 10.1084/jem.20220236. CD4Tem, CD4 effector-memory T cells; DC, dendritic cell; HVEM, herpes virus entry mediator; LTβR, Lymphotoxin beta receptor; MAC, macrophage; NK, natural killer cell; Tfh, T follicular helper cells; TNF, tumor necrosis factor LIGHT is a Key Driver of Acute & Chronic Inflammation • Proinflammatory cytokine in the TNF superfamily • Key component of a larger immunoregulatory network, including BTLA • Critical for neutrophil, NK, T & B cell function • Two primary receptors: LTβR, HVEM • Pivotal role in body “barriers”: lung, gut, skin • We believe modulating LIGHT can moderate immune dysregulation in many acute and chronic inflammatory disorders

7 © Copyright 2023. Avalo Therapeutics. All rights reserved. • Fully human monoclonal antibody to LIGHT • CMC at 2,000 L scale; 6-month toxicology study near completion • Positive proof of concept in COVID-19 ARDS • Positive Phase 2 trends: – Crohn’s Disease – NEA in sub-population of patients with elevated baseline LIGHT levels • Additional indications in immune dysregulation under consideration AVTX-002: First-in-Class Neutralizing Anti-LIGHT mAb CMC, Chemistry, manufacturing and control

8 © Copyright 2023. Avalo Therapeutics. All rights reserved. TNF SuperFamily of Ligands (TNFSF) and Receptors (TNFRSF) C. F. Ware, Ruddle, N.H. TNF Superfamily of Cytokines and Receptors. M. F. Flajnik ed. Paul's Fundamental Immunology. Publisher: Wolters Kluwer Health 2022 8th ed. Vol. Ch 10, 308-343. Cardinale CJ, et al.,Targeted resequencing identifies defective variants of decoy receptor 3 in pediatric-onset inflammatory bowel disease. Genes Immun. 2013 Oct;14(7):447-52. doi: 10.1038/gene.2013.43. Epub 2013 Aug 22. • LIGHT is a member of a select group of key immunomodulator cytokines (TL1A, FasL) that are “regulated” by Decoy Receptor 3 (DcR3) • DcR3 loss of function has been associated with autoimmune diseases including Crohn’s disease Inflammation, Immunoregulation and Homeostasis Ligands Receptors

9 © Copyright 2023. Avalo Therapeutics. All rights reserved. Perlin, D. S. et al., Randomized, double-blind, controlled trial of human anti-LIGHT monoclonal antibody in COVID-19 acute respiratory distress syndrome. J Clin Invest. 2022; 132(3):e153173 LIGHT Levels (pg/mL) Over Treatment Period Percentage of Patients with Respiratory Failure and/or Death by Day 28 AVTX-002 (n=36) Placebo (n=34) LI G HT L ev el s ( pg /m L) 400 300 200 100 0 Day 5Day 1 (Baseline) Day 2 AVTX-002 Significant Reduction in COVID-19 Induced Respiratory Failure and Mortality • Well-tolerated; no increase in serious adverse events vs. placebo • Granted Fast Track Designation by FDA

10 © Copyright 2023. Avalo Therapeutics. All rights reserved. FOR DISCUSSION PURPOSES ONLY AVTX-002 (quisovalimab) Non-Eosinophilic Asthma

11 © Copyright 2023. Avalo Therapeutics. All rights reserved. Non-Eosinophilic Asthma 1. Asthma and Allergy Foundation of America. Asthma facts and figures. https://www.aafa.org/asthma-facts/. Accessed January 3, 2022; 2. McGrath KW et al., Am J Resp Crit Care Med. 2012;185(6):612-619; 3. Jiang Y et al., Allergy Asthma Clin Immunol. 2021;17(1):45; 4. Centers for Disease Control and Prevention. AsthmaStats: Uncontrolled asthma among adults, 2016. https://www.cdc.gov/asthma/asthma_stats/uncontrolled-asthma-adults.htm. Accessed January 3, 2022; 5. Carr, T. F., Zeki, A. A. & Kraft, M. Eosinophilic and Noneosinophilic Asthma. Am J Resp Crit Care 197, 22–37 (2017); 6. Esteban-Gorgojo I et al., J Asthma Allergy. 2018;11:267-281; 7. ClearView Healthcare Partners Analysis, June 2021; 8. Hastie AT et al., J Allergy Clin Immunol. 2010;125(5):1028-1036; 9. Romeo J et al., J Allergy Clin Immunol. 2013;131(2 Suppl):AB203. Abstract 725; 10. Rørvig et al., J Leukocyte Biol 94, 711–721 (2013). FEV, forced expiratory volume in 1 second; FVC, forced vital capacity Treatment Approach4 • Asthma symptoms often more severe/resistant to treatment5 • Associated with smoking, pollution, infections, obesity5 • Sputum LIGHT levels negatively associated with lung function (FEV and FVC) in asthma8,9 • Higher LIGHT levels in sputum in asthma patients with neutrophilia8 • Neutrophils have high, pre-formed LIGHT levels10 Patient Population • US prevalence of asthma ⋍ 25M1 • NEA accounts for ⋍ 47% of asthma2,3 • Majority of patients with asthma remain uncontrolled4 • Higher need in underserved populations1 • Standard therapies for asthma; many NEA patients remain uncontrolled6,7 • Currently limited targeted therapies for NEA Signs and Symptoms4 Rationale for AVTX-002

12 © Copyright 2023. Avalo Therapeutics. All rights reserved. Phase 2, Randomized, Double-Blind, Placebo-Controlled, Parallel Group Trial that Enrolled a Total of 91 Patients to Evaluate the Safety and Efficacy of AVTX-002 for the Treatment of Poorly Controlled NEA • The trial did not meet its primary endpoint, measured by the proportion of patients who experienced an asthma-related event (ARE), nor its secondary endpoints. However, the following positive observations were observed: – AVTX-002 demonstrated a significant and sustained reduction in LIGHT levels – AVTX-002 demonstrated a favorable safety and tolerability profile – Preliminary post-hoc analyses for sub-population of patients with baseline LIGHT levels > 125 pg/mL*: • Sub-population represented over 50% of patients • Positive trend showed ~50% reduction in AREs for patients treated with AVTX-002 compared to placebo • Positive trends were not identified in the secondary endpoints NEA PEAK Trial Topline Data Executive Summary *Post-hoc analyses are ongoing and therefore preliminary in nature.

13 © Copyright 2023. Avalo Therapeutics. All rights reserved. NEA PEAK Trial: Significant and Sustained Reduction in LIGHT Levels in Patients Treated with AVTX-002 LIGHT Levels (pg/mL) Over Treatment Period AVTX-002 Placebo

14 © Copyright 2023. Avalo Therapeutics. All rights reserved. LIGHT (TNFSF14) in Asthma and Pulmonary Fibrosis Persistent insults: antigens toxins viruses Human Patients* • LIGHT expression in lung inflammatory cells (T and NK cells), alveolar epithelial, fibroblasts, goblet cells • LIGHT expression in lungs of patients with persistent airflow limitation • IL-8, IL-19, MMP2, osteopontin associated with high LIGHT immunoreactivity • LIGHT-positive cells correlate with increased PMN, macrophages in sputum • Intense immunoreactivity of LIGHT is negatively associated with decreased forced expiratory volume Asthma Models** • Signaling receptors LTβR and HVEM expressed in lung fibroblasts, goblet and epithelial cells • Pharmacological inhibition or gene deletion of LIGHT: • Reduces Lung fibrosis, smooth muscle hyperplasia, airway hyperresponsiveness • LIGHT inhibition limits lung expression of IL13, TGFb, TSLP • LTβR controls airway smooth muscle deregulation and asthmatic lung dysfunction • LIGHT induces inflammatory activation of lung fibroblasts • LIGHT promotes differentiation of proinflammatory lung fibroblasts through LTβR Conclusion: LIGHT is a profibrogenic cytokine in asthma acting through the LTβR *Gaddis, LungMAP Portal Ecosystem: Am J Respir Cell Mol Biol doi: 10.1165/rcmb.2022-0165OC; Hirano, Respir Investig 2021 doi: 10.1016/j.resinv.2021.05.011 **Mouse models of asthma induced by antigen, bleomycin or Rhinovirus Miki J Allergy Clin Immunol 2022 DOI: 10.1016/j.jaci.2022.11.016; Mehta, Allergy 2018 DOI: 10.1111/all.13390; Da Silva Antunes Front Immunol 2018 DOI: 10.3389/fimmu.2018.00576; Herro, J Allergy Clin Immunol 2015 DOI: 10.1016/j.jaci.2014.12.1936; Doherty, Nat Med 2011 DOI: 10.1038/nm.2356 MMP2, matrix metalloproteinase-2; PMN, polymorphonuclear neutrophils

15 © Copyright 2023. Avalo Therapeutics. All rights reserved. LIGHT-Signaling Network & AVTX-008 BTLA agonist fusion protein

16 © Copyright 2023. Avalo Therapeutics. All rights reserved. • BTLA - B and T lymphocyte attenuator (Ig superfamily checkpoint) – Co-expressed with HVEM in T and B cells – “Dampens” the immune response • LIGHT activates HVEM – Inhibits BTLA signaling, allowing immune stimulation • LIGHT activates LTβR – Activates dendritic cells, macrophages, stromal cells – Recruits lymphocytes – Stimulates antigen presentation & lymphoid organization • DcR3 inhibits/regulates LIGHT • CD160 competes with BTLA for HVEM – Stimulated immune activation by restricting inhibitory signaling in NK, CTL, Tfh • BTLA and CD160 can activate HVEM (bidirectional signaling) Arrow heads refer to mono and bidirectional signaling Ward-Kavanagh et al., Immunity 2016. Šedý et al., Cold Spring Harb Perspect Biol 2014; Mintz & Cyster Immunol Rev 2020; Ware, C., Croft, M., and Neil, G. J.Exp Med. 2022 Jul 4;219(7):e20220236. 10.1084. DcR3, decoy receptor 3 The LIGHT-Signaling Network: A Key Immunoregulatory System

17 © Copyright 2023. Avalo Therapeutics. All rights reserved. Activation of the BTLA inhibitory receptor by its ligand HVEM turns on SHP phosphatases* limiting lymphocyte activation and inflammatory cytokine signaling AVTX-008 MOA: Distinct from Other Autoimmune Therapeutics Ward-Kavanagh, et al., Immunity 2016; Ware, C., Croft, M., and Neil, G., J.Exp Med. 2022 Jul 4;219(7):e20220236. 10.1084; Xiaozheng Xu, et al., PD-1 and BTLA regulate T cell signaling differentially and only partially through SHP1 and SHP2. J Cell Biol 1 June 2020; 219 (6): e201905085. doi: https://doi.org/10.1083/jcb.201905085/jcb.201905085 *Includes SHP-1 and SHP-2: SHP-1, sarcoma (SRC) homology 2 domain-containing protein tyrosine phosphatase 1; SHP-2, SRC homology 2 domain-containing protein tyrosine phosphatase 2

18 © Copyright 2023. Avalo Therapeutics. All rights reserved. Fully human, bioengineered HVEM, specific and high-affinity agonist for BTLA Stage • Immunoregulatory disorders: potentially SLE, GVHD and non-responders to TNF inhibitors • Inhibition of inflammatory cytokine production predicts efficacy in patients not responsive to anti-TNF therapy • Efficacy in murine lupus model excels compared to Abatacept • Reduced risk of anti-drug response • Proven modality of Fc fusion proteins: Orencia, Enbrel MOA • Novel mechanism of action • Inhibits lymphocyte activation and effector cells through BTLA • IND enabling stage Executive Summary Unmet Need AVTX-008: BTLA Agonist Fusion Protein Business Advantages • Unique BTLA agonist fusion protein • Exclusive license to portfolio of issue patents and patent applications Clinical Advantages SLE, Systemic lupus erythematosus; GVHD, graft-versus-host disease

19 © Copyright 2023. Avalo Therapeutics. All rights reserved. • Carl Ware, PhD, Head of Avalo Scientific Advisory Board – Director, Sanford Burnham Prebys (SBP) Infectious and Inflammatory Diseases Center – Professor, SBP Immunity and Pathogenesis Program – Director, SBP Laboratory of Molecular Immunology • Discoverer of LIGHT-signaling network World Class Scientific Advisor

20 © Copyright 2023. Avalo Therapeutics. All rights reserved. Finance Update

21 © Copyright 2023. Avalo Therapeutics. All rights reserved. NASDAQ: AVTX Financial & Investor Information The following data is as of June 30, 20231 • Cash and cash equivalents – $6.3M2 • Outstanding common shares – 14M • Fully diluted shares – 21.4M3 Financial Highlights 1 Preliminary, has not been audited and subject to change. 2 Reflects $6M prepayment of principal on the Company’s outstanding debt. As of June 30, 2023, the outstanding principal debt balance was $15.2M, inclusive of the final payment fee. 3 Based on shares of common stock outstanding and common stock underlying outstanding warrants and outstanding options, including approximately 1.3M pre-funded warrants.

22 © Copyright 2023. Avalo Therapeutics. All rights reserved. Decades of successful leadership, product development, and commercialization in pharma and biotech Garry A. Neil, MD Chief Executive Officer Chairman of the Board Lisa Hegg, PhD SVP, Program Management, Corporate Infrastructure Colleen Matkowski SVP, Global Regulatory Affairs, Quality Assurance Dino C. Miano, PhD SVP, CMC, Technical Operations Chris Sullivan Chief Financial Officer Experienced Management Team

23 © Copyright 2023. Avalo Therapeutics. All rights reserved. Exclusive consulting arrangement with Carl Ware, PhD, Sanford Burnham Prebys (discoverer of the LIGHT-signaling network) AVTX-002, quisovalimab (anti-LIGHT mAb) – Positive proof of concept in COVID-19 ARDS. Positive trends in Crohn’s Disease and NEA sub-population. Strong target engagement and favorable safety profile in both acute and chronic dosing Portfolio emphasizing potential high value, first-in-class biologics focused on dysregulated inflammation via the LIGHT-signaling network AVTX-008 (BTLA agonist fusion protein) – IND enabling stage Avalo Therapeutics (AVTX)

24 © Copyright 2023. Avalo Therapeutics. All rights reserved. Appendix

25 © Copyright 2023. Avalo Therapeutics. All rights reserved. FOR DISCUSSION PURPOSES ONLY AVTX-002 (quisovalimab)

26 © Copyright 2023. Avalo Therapeutics. All rights reserved. Key Secondary/Exploratory EndpointsPrimary Endpoint Final Enrollment (n=91) • Proportion of patients who experience an asthma related event defined as: ≥6 additional reliever puffs of SABAʈ (compared to baseline) in a 24-hour period on 2 consecutive days, or Increase in ICS† dose ≥4 times than the dose at baseline, or A decrease in peak flow of 30% or more (compared to baseline) on 2 consecutive days of treatment, or An asthma exacerbation requiring the use of systemic corticosteroids (tablets, suspension, or injection) for at least 3 days, or A hospitalization or emergency room visit because of an asthma exacerbation. • Poorly controlled asthma on LABA* and ICS † • Exacerbation in the last 24 months • Blood eosinophil count <300 cells/µL Phase 2, Randomized, Double-Blind, Placebo-Controlled, Parallel Group Trial of AVTX-002 in patients with NEA PEAK Trial Key Inclusion Criteria Screening AVTX-002 600 mg SC (n=40) Placebo (n=40) Baseline Visit Randomization Discontinue LABA* (W2) 30 Day Run-In Salmeterol/Fluticasone Reduce ICS † 50% (W4) Discontinue ICS† (W6) Treatment – Days 0, 28, 56 *LABA, long-acting beta-agonist; †ICS, inhaled corticosteroid; ʈSABA, short-acting beta agonist; ‡FEV1, forced expiratory volume in 1 second; #FeNO, fractional exhaled nitric oxide; §ACQ, asthma control questionnaire. • Change in FEV1 ‡ from baseline • Time to asthma related event • Change in FeNO# from baseline • Change in ACQ§ from baseline AVTX-002 for Treatment of NEA: Phase 2 Trial Design Final Visit

27 © Copyright 2023. Avalo Therapeutics. All rights reserved. Phase 1b Escalating Dose, Open-Label, Signal-Finding Trial to Evaluate the Safety, Tolerability, and Short-Term Efficacy of the Anti-Light Monoclonal Antibody AVTX-002 in Adults with Moderate to Severe Active Crohn’s Disease (CD) who have Failed Prior Treatment with an Anti-TNFα Agent • Rapid reduction in serum free LIGHT levels • Well-tolerated: no drug-related serious adverse events observed • Clinically meaningful mucosal healing signal observed – 3 out of 7 patients demonstrated evidence of mucosal healing as determined by colonoscopy and adjudicated by a central reader – One patient (1/7) achieved remission (SES-CD = 0) Efficacy Signal Observed in Crohn’s Disease Phase 1b Proof of Concept Trial 1TNFα, tumor necrosis factor alpha; †SES-CD, Simple Endoscopic Score for Crohn’s Disease

28 © Copyright 2023. Avalo Therapeutics. All rights reserved. AVTX-002 Crohn’s Disease Phase 1b, Proof of Concept Trial Design * SES-CD, Simple Endoscopic Score for Crohn’s Disease; † CDAI, Crohn’s Disease Activity Index; ‡ IBDQ, Inflammatory Bowel Disease Questionnaire; Screening (Visit 1) Open-Label Treatment Period (Visits 2-10) (8 weeks) Safety Follow-Up (Visit 11) AVTX-002, SQ injections every 14 days (N=8, 4 patients in each cohort; Cohort 1: 1mg/kg; Cohort 2: 3mg/kg) Telephone Visit Eligibility & Washout Week: -14 0 1 2 3 4 5 6-8 127 8 Visit #: 1 2 3 4 5 6 7 108 9 11 • Safety • Tolerability • Pharmacokinetics • Short-term efficacy – as measured by SES-CD*, CDAI †, and IBDQ ‡ scores Open-Label, Phase 1b POC Clinical Trial of AVTX-002 in adults with moderate-to-severe, active Crohn’s disease who have previously failed anti-tumor necrosis factor alpha (anti-TNFα) treatment Phase 1b Proof of Concept Trial Design Primary Objectives/Endpoints Key Secondary/Exploratory Objectives/Endpoints • Moderate-to- severe disease • Anti-TNFα failure • Heavily pre-treated patients • Dose escalation starting at 1mg/kg every 2 weeks • Short duration (8 weeks) • SES-CD* score ≥7 Inclusion Criteria

29 © Copyright 2023. Avalo Therapeutics. All rights reserved. TNF SuperFamily: Proven Target-rich Opportunities TNF inhibitors (Autoimmune) Humira Cimzia Remicade Simponi ENBREL LIGHT inhibitor AVTX-002 TL1A inhibitors PRA023 PF-06480605 HVEM mimetics - BTLA agonists: AVTX-008, LY3361237, MB272, ANB032 41BB signaling CAR-T Cancer GITR antagonist Treg modulation OX40 agonists Cancer BAFF inhibitor Benlysta TRAILR agonists Cancer RANKL inhibitor Prolia osteoporosis C. F. Ware, Ruddle, N.H. TNF Superfamily of Cytokines and Receptors. M. F. Flajnik ed. Paul's Fundamental Immunology. Publisher: Wolters Kluwer Health 2022 8th ed. Vol. Ch 10, 308-343.

v3.23.2

Cover Page Document

|

Jul. 20, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 20, 2023

|

| Entity Registrant Name |

AVALO THERAPEUTICS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37590

|

| Entity Tax Identification Number |

45-0705648

|

| Entity Address, Address Line One |

540 Gaither Road, Suite 400

|

| Entity Address, City or Town |

Rockville

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20850

|

| City Area Code |

410

|

| Local Phone Number |

522-8707

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 Par Value

|

| Trading Symbol |

AVTX

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001534120

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

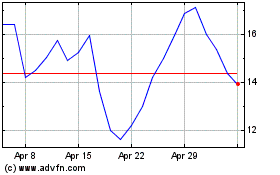

Avalo Therapeutics (NASDAQ:AVTX)

Historical Stock Chart

From Apr 2024 to May 2024

Avalo Therapeutics (NASDAQ:AVTX)

Historical Stock Chart

From May 2023 to May 2024