false000160397800016039782020-05-052020-05-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

Date of Report (Date of earliest event reported)

|

July 31, 2020

|

|

|

|

|

|

AquaBounty Technologies, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-36426

|

04-3156167

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

2 Mill & Main Place, Suite 395, Maynard, Massachusetts

(Address of principal executive offices)

978-648-6000

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

|

(Former name or former address, if changed since last report.)

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

AQB

|

The NASDAQ Stock Market LLC

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On July 31, 2020 (the “Closing Date”), AquaBounty Farms Indiana LLC (“ABFI”), a subsidiary of AquaBounty Farms, Inc. (the “Parent”), which is a subsidiary of AquaBounty Technologies, Inc. (the “Registrant”), entered into a credit facility (the

“Credit Facility”) with First Farmers Bank and Trust (“First Farmers”) to partially finance the purchase of equipment for, and making improvements to, ABFI’s farm in Albany, Indiana (the “Albany Farm”) through a secured term loan of $4 million (the “Loan”). The Loan is evidenced by a Term Note (the “Note”).

Through July 31, 2025, the Loan bears interest at a rate equal to that for five-year U.S. Treasury Notes, plus 5%, on its outstanding principal balance; as of July 31, 2025, the interest rate shall be fixed for the remainder of the life of the Loan. Monthly payments of accrued interest on the outstanding principal amount of the Loan are payable prior to October 1, 2021; thereafter, the Loan is repaid through equal monthly payments of $56,831.95 through its maturity date of October 1, 2028, when all outstanding principal and interest under the Loan become due and payable. Provided that it is not then in default, ABFI may prepay amounts outstanding under the Loan, in whole or in part, provided that prepayments that in the aggregate exceed 10% of the outstanding principal balance on the most recent anniversary of the Closing Date are subject to a penalty equal to 5% of that excess; any prepayment would effect a permanent reduction in the amount of the applicable loan.

To guaranty ABFI’s obligations under the Credit Facility, the Parent has entered into an Unconditional and Continuing Guaranty Agreement (the “Parent Guaranty”) with First Farmers.

As the owner of the Albany Farm and certain personal property located thereon, the Registrant has entered into a Guarantor Security Agreement (the “Guarantor Security Agreement”), an Unconditional and Continuing Secured Guaranty Agreement (the “Secured Guaranty”), and a Collateral Access Agreement (the “Access Agreement”) with First Farmers; entered into an Environmental Indemnity Agreement (the “Environmental Indemnity”) with ABFI and First Farmers; and granted a Mortgage, Assignment of Rents and Leases, Security Agreement, Fixture Filing and Financing Statement (the “Mortgage”) in favor of First Farmers in regard to the Albany Farm to secure ABFI’s obligations under the Credit Facility.

The Loan Agreement grants a first security interest in all present and after-acquired property of ABFI, the Guarantor Security Agreement grants a first security interest in all present and after-acquired personal property of the Registrant located at or on the Albany Farm, and the Mortgage grants a first security interest in the buildings and land comprising the Albany Farm. In addition, the Registrant has entered into the Secured Guarantee to further secure ABFI’s obligations under the Credit Facility, and the Registrant’s obligations under the Secured Guarantee are secured by the collateral identified in the Guarantor Security Agreement.

The Loan Agreement contains customary representations, warranties, and affirmative and negative covenants, including, without limitation, certain covenants and limitations regarding incurring additional debt; encumbering property; making investments; making changes in the nature, structure, ownership, or management of the business; continuing the business; issuing dividends or making distributions; incurring lease payments that exceed $100,000 in the aggregate; maintaining properties; maintaining insurance; paying taxes; maintaining employee benefit plans; delivering monthly capital project updates, production records, and statements of profit and loss against projections; delivering interim reports from auditors and annual financial statements; complying with laws; maintaining a $500,000 deposit account with First Farmers; and notifying First Farmers of actions, suits, proceedings, and events of default.

The Loan Agreement contains customary events of default, including, without limitation, nonpayment of principal, interest, or other amounts under any loan from First Farmers; inaccuracy of representations and warranties; failure to perform or observe covenants within a specified period of time; bankruptcy or insolvency; inability to pay debts; assignment for the benefit of creditors; judgments of $250,000 or more against ABFI, the Parent, or the Registrant; change in control; impairment of collateral; failure to meet financial covenants; and material adverse financial change. Upon the occurrence and continuance of an event of default, First Farmers may declare the loans and all the other obligations under the Credit Facility immediately due and payable.

The foregoing summary of the Credit Facility does not purport to be complete and is qualified in its entirety by reference to the full text of the Loan Agreement, the Note, the Mortgage, the Guarantor Security Agreement, the Secured Guaranty, the Parent Guaranty, the Environmental Indemnity, and the Access Agreement, which the Registrant intends to file as exhibits to its Quarterly Report on Form 10-Q for the quarter ending June 30, 2020.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 above is hereby incorporated by reference in its entirety into this Item 2.03.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

AquaBounty Technologies, Inc.

|

|

|

|

(Registrant)

|

|

August 5, 2020

|

|

/s/ David A. Frank

|

|

|

|

David A. Frank

|

|

|

|

Chief Financial Officer

|

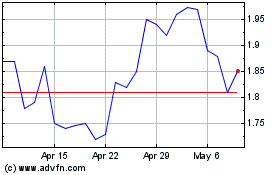

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Mar 2024 to Apr 2024

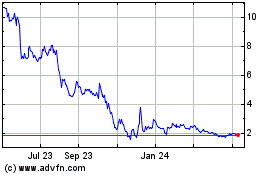

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Apr 2023 to Apr 2024