U.S. Dollar Notably Higher Against Majors

May 09 2023 - 3:32AM

RTTF2

The U.S. dollar was higher against its most major counterparts

in the European session on Tuesday, as the Federal Reserve's senior

loan officer opinion survey came in worse than expected in the

first quarter.

The survey showed that the credit conditions for U.S. business

and households continued tightening in the first months of the

year.

"Concerns about the economic outlook, credit quality, and

funding liquidity could lead banks and other financial institutions

to further contract the supply of credit to the economy," the Fed

said in its report.

A sharp contraction in the availability of credit would drive up

the cost of funding for businesses and households, potentially

resulting in a slowdown in economic activity, the report added.

U.S. President Joe Biden will meet with the top Republican and

Democratic leaders at the White House to resolve a standoff over

raising the country's debt limit before the impending deadline.

The greenback climbed to 4-day highs of 1.0972 against the euro,

0.8927 against the franc and 1.2596 against the pound, from its

early lows of 1.1004, 0.8886 and 1.2639, respectively. The

greenback is likely to find resistance around 1.08 against the

euro, 0.92 against the franc and 1.24 against the pound.

The greenback edged up to 0.6755 against the aussie and 0.6325

against the kiwi, off its early lows of 0.6786 and 0.6348,

respectively. Next near term resistance for the greenback is likely

seen around 0.64 against the aussie and 0.61 against the kiwi.

In contrast, the greenback eased to 1.3367 against the loonie

and 134.72 against the yen, from an early high of 1.3385 and a

6-day high of 135.32, respectively. The greenback is seen finding

support around 1.30 against the loonie and 130.00 against the

yen.

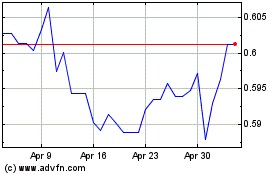

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

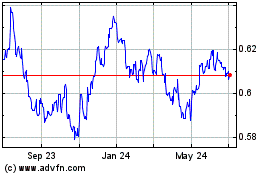

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024