Australian Dollar Drops On Hawkish Fed Remarks

January 09 2023 - 11:27PM

RTTF2

The Australian dollar fell against its major counterparts on

Tuesday, as comments from U.S. Fed officials indicated that the

central bank will have to keep raising rates to somewhere above 5

percent.

Two Fed officials suggested that the central bank should raise

rate to a 5% to 5.25% range to bring down inflation.

Federal Reserve Bank of San Francisco President Mary Daly and

her Atlanta equivalent, Raphael Bostic both remarked overnight that

the Fed funds target rate would rise above 5% by the middle of the

year.

Traders look ahead to US Fed Chair Jerome Powell's speech at a

central bank conference in Stockholm later in the day and the U.S.

December inflation report due on Thursday for additional clues on

interest the rate outlook.

Oil prices slipped after three consecutive sessions of

gains.

The aussie depreciated to 0.6885 against the greenback and 90.86

against the yen, down from its prior highs of 0.6928 and 91.30,

respectively. The aussie may locate support around 0.66 against the

greenback and 86.00 against the yen.

The aussie weakened to 4-day lows of 1.5577 against the euro and

1.0820 against the kiwi, off its early highs of 1.5500 and 1.0858,

respectively. The next immediate support for the aussie is seen

around 1.57 against the euro and 1.06 against the kiwi.

The aussie was down against the loonie, at a 4-day low of

0.9229. The aussie is poised to find support around the 0.90

level.

Looking ahead, at 9:00 am ET, Federal Reserve Chair Jerome

Powell will participate in a panel discussion titled "Central bank

independence and the mandate - evolving views" at the Riksbank's

International Symposium on Central Bank Independence, in

Stockholm.

U.S. wholesale inventories for November are scheduled for

release in the New York session.

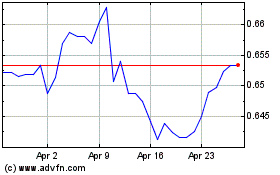

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024