Intermediate declaration by the Board of Directors

Regulatory News:

X-FAB (BOURSE:XFAB):

Highlights Q2 2024:

- Revenue was USD 205.1 million, within the guidance of USD

200-210 million, down 9% year-on-year (YoY) and down 4%

quarter-on-quarter (QoQ), mainly driven by weakness in industrial

and SiC

- Strong bookings at USD 248.4 million, up 12% YoY

- EBITDA at USD 47.9 million, down 23% YoY

- EBITDA margin of 23.3%; excluding IFRS 15 impact, EBITDA margin

was 22.7%, compared to the guidance of 20-23%

- EBIT was USD 22.8 million, down 44% YoY

Outlook:

- Q3 2024 revenue is expected to come in within a range of USD

205-215 million with an EBITDA margin in the range of 24-27%.

- The guidance is based on an average exchange rate of 1.07

USD/Euro and does not take the impact related to IFRS 15 into

account

- X-FAB adjusts the full-year revenue guidance from USD 900-970

million to USD 860-880 million, mainly reflecting the overall

delayed recovery of the SiC power device market; with a slightly

adjusted top end, the full-year EBITDA margin guidance range has

been narrowed to 25-28%.

Revenue breakdown per quarter:

in millions of USD

Q3 2022

Q4 2022

Q1 2023

Q2 2023

Q3 2023

Q4 2023

Q1 2024

Q2 2024

Q2 y-o-y growth

Automotive

96.9

104.4

120.9

131.1

135.3

151.8

135.6

142.4

9%

Industrial

46.7

42.3

46.9

51.3

53.7

54.3

52.6

34.4

-33%

Medical

13.5

14.6

17.6

16.2

17.0

16.4

14.5

13.2

-18%

Subtotal core business

157.0

161.3

185.4

198.7

206.1

222.5

202.6

190.1

-4%

83.4%

87.9%

89.1%

90.8%

92.2%

92.8%

92.6%

93.7%

CCC1

30.7

21.6

22.5

20.0

17.2

17.2

16.0

12.6

-37%

Others

0.6

0.7

0.2

0.2

0.2

0.1

0.1

0.1

Revenue*

188.3

183.6

208.1

218.9

223.5

239.8

218.7

202.8

-7%

Impact from revenue recognized over

time

0

0

0

8.3

10.4

-2.0

-2.6

2.3

Total revenue

188.3

183.6

208.1

227.1

233.8

237.7

216.2

205.1

-9%

1Consumer, Communications &

Computer

in millions of USD

Q3 2022

Q4 2022

Q1 2023

Q2 2023

Q3 2023

Q4 2023

Q1 2024

Q2 2024

Q2 y-o-y growth

CMOS

152.6

151.9

172.8

180.7

180.5

188.4

168.3

166.2

-8%

Microsystems

18.4

19.5

22.2

20.8

24.4

27.9

24.1

25.1

21%

Silicon carbide

17.4

12.2

13.2

17.3

18.6

23.5

26.3

11.6

-33%

Revenue*

188.3

183.6

208.1

218.9

223.5

239.8

218.7

202.8

-7%

Impact from revenue recognized over

time

0

0

0

8.3

10.4

-2.0

-2.6

2.3

Total revenue

188.3

183.6

208.1

227.1

233.8

237.7

216.2

205.1

-9%

Business development

In the second quarter of 2024, X-FAB recorded revenues of USD

205.1 million, down 9% year-on-year and 4% quarter-on-quarter.

Excluding the positive impact from revenue recognized over time of

USD 2.3 million, second quarter revenue totaled USD 202.8 million,

which is in line with the guidance of USD 200-210 million.

Revenues in X-FAB’s core markets – automotive, industrial, and

medical – amounted to USD 190.1 million*, down 4% year-on-year and

representing a record 94% share of total revenues*.

The second quarter was marked by a combination of developments.

Demand for X-FAB’s 200mm CMOS technologies remained on the high

side and the allocation of available capacities continued. In

particular, the continued ramp of X-FAB’s popular 180nm automotive

technology at X-FAB France contributed to automotive growth in the

second quarter with revenues amounting to USD 142.4 million, up 9%

year-on-year. X-FAB’s second quarter CMOS business totaled USD

166.2 million, down 8% compared to the same quarter last year. The

decline reflects the demand weakness for X-FAB’s 150mm CMOS

technologies following expected inventory corrections in the

industrial end-markets.

As anticipated, SiC revenue for the second quarter declined by

33% year-on-year to USD 11.6 million after low bookings in the

first quarter. The current weakness is projected to bottom out in

the third quarter. Based on customer feedback, a recovery is

anticipated to begin in the fourth quarter, with a return to robust

growth expected in 2025.

Both, the weakness in 150mm CMOS as well as silicon carbide had

an impact on X-FAB’s industrial business, which recorded second

quarter revenues of USD 34.4 million, down 33% year-on-year. Order

intake for X‑FAB’s 150mm CMOS technologies however started to

recover in the second quarter and will be contributing positively

to the revenue evolution in the fourth quarter.

X-FAB’s microsystems business recorded revenues of USD 25.1

million in the second quarter, with a strong growth of 21%

year-on-year. This was mainly driven by the ramp of a

next-generation automotive headlamp application.

Medical revenues came in at USD 13.2 million, down 18%

year-on-year. Apart from normal fluctuations, the decline is a

temporary effect related to the need to allocate capacity. Going

forward, medical revenue is expected to return to solid growth

based on new design wins, high-demand applications as well as

strong medical bookings in the second quarter.

Overall, X-FAB recorded strong quarterly bookings amounting to

USD 248.4 million, up 12% year-on-year. This reflects the robust

demand for X-FAB’s 200mm CMOS and microsystems technologies as well

as the uptick in 150mm CMOS order intake, the latter primarily

related to the industrial and medical end market. Backlog at the

end of the second quarter came in at USD 517.3 million, compared to

USD 520.9 million at the end of the previous quarter.

Quarterly prototyping revenues totaled USD 21.1 million*, down

24% year-on-year.

Prototyping and production revenue* per quarter and end

market:

in millions

of USD

Revenue

Q2 2023

Q3 2023

Q4 2023

Q1 2024

Q2 2024

Automotive

Prototyping

3.9

6.2

10.0

6.7

7.6

Production

127.2

129.1

141.8

128.9

134.8

Industrial

Prototyping

16.6

14.3

10.5

10.7

8.9

Production

34.8

39.4

43.8

41.9

25.5

Medical

Prototyping

2.5

3.3

3.3

2.7

2.0

Production

13.7

13.7

13.1

11.8

11.2

CCC

Prototyping

4.5

3.3

3.5

3.1

2.5

Production

15.4

13.9

13.7

12.9

10.2

The revision of the full year guidance mainly reflects the

delayed recovery of the silicon carbide business. Despite this

temporary effect, X-FAB remains confident in the long-term

prospects of its SiC business. With the projected increase in EV

unit sales, the greater adoption of SiC inverters in EV

powertrains, and the anticipated completion of customer destocking,

X-FAB expects a return to strong silicon carbide revenue growth in

2025.

Business fundamentals are intact and X-FAB remains well

positioned for long-term business success. X‑FAB's comprehensive

and highly specialized technology portfolio enables innovative

solutions to address the major megatrends of our time. The

electrification of everything is inevitable to move away from

fossil fuels and mitigate climate change, driving long-term growth

in X‑FAB's automotive and industrial businesses. Aging and growing

populations require technological innovation to make prevention,

diagnosis and treatment of disease more efficient, reliable and

accessible to an ever-growing number of people. X-FAB's

microsystems expertise with the combination of CMOS and MEMS

supports the development of world-leading medical applications and

fuels the long-term growth of X-FAB's medical business.

Operations update

Capacity utilization at X-FAB’s factories varied by technology.

The 200mm CMOS lines, especially those producing the high demand

180nm technologies, were running at full load while others recorded

lower utilization rates in line with the current demand.

In the second quarter, X-FAB continued its capacity expansion

program. Total capital expenditures for the second quarter amounted

to USD 121.9 million, up 17% sequentially.

The building construction at X-FAB Sarawak to create additional

cleanroom space is on track, as is the plan to start moving in

equipment in the fourth quarter. X-FAB France continued to expand

capacity with new equipment coming online. Both sites manufacture

X-FAB’s popular 200mm CMOS technologies and it is essential to

increase capacity to better meet customer demand.

The SiC capacity expansion at X-FAB Texas was slowed in the

second quarter in response to the current market demand, reflecting

X-FAB's approach of gradually increasing capacity in line with

identified demand and long-term customer commitments (long-term

agreements).

Financial update

Second quarter EBITDA was USD 47.9 million with an EBITDA margin

of 23.3%. Excluding the positive impact from revenues recognized

over time, the EBITDA margin of the second quarter would have been

22.7%, at the higher end of the guided 20-23%.

Profitability is not affected by exchange rate fluctuations as

X-FAB’s business is naturally hedged. At a constant USD/Euro

exchange rate of 1.09 as experienced in the previous year’s

quarter, the EBITDA margin would have been the same.

Cash and cash equivalents at the end of the second quarter

amounted to USD 290.1 million.

The financing of X-FAB’s capital expenditures for the ongoing

capacity expansion program through 2025 is secured by available

cash reserves in combination with credit facilities, prepayments

received from customers with long-term contracts and operating cash

flows, each of which accounting for approximately one-third of

total cash requirements.

For the additional capacity that X-FAB is building as part of

its expansion program, the corresponding business has been

identified, either as part of long-term agreements or as part of

customer forecasts for existing products in high demand.

Based on the amendments to IAS 1 (International Accounting

Standard) regarding the classification of liabilities as current or

non-current, X-FAB has changed the presentation of borrowings under

the Group's multicurrency revolving credit facility, which were

classified as current until December 31, 2023.

As of January 1, 2024, these obligations are classified as

non-current, also retrospectively. Accordingly, the balance sheets

as of June 30, 2023, and December 31, 2023, have been restated to

reflect this change, whereby the outstanding position of the

Group's multicurrency revolving credit facility, respectively

amounting to USD 180.9 million and USD 192.7 million, were

reclassified from current to non-current borrowings.

Management comments

Rudi De Winter, CEO of X-FAB Group, said: "X-FAB's second

quarter results, which were fully in line with expectations,

reflect the contrasting market dynamics we are currently

experiencing. We continue to see strong demand for our 200mm CMOS

technologies. They represent the largest part of our business, and

it is paramount that we continue to expand this capacity in line

with customer needs that have been identified and secured through

long-term contracts. I am pleased that we have initiated these

investments and continue to make good progress in executing our

expansion program. Another highlight for me is our microsystems

business, where demand is strong and the pipeline is full of

exciting applications. While our SiC business is experiencing a

period of customer destocking, I remain confident in the

structurally strong demand for silicon carbide applications driven

by the worldwide transition to green mobility and green energy. It

is rather a demand shift into next year, and I am convinced that

our SiC business will return to robust growth in 2025.”

Procedures of the independent auditor

The statutory auditor, KPMG Bedrijfsrevisoren – Réviseurs

d’Entreprises BV/SRL, represented by Herwig Carmans, has confirmed

that the review procedures, which have been substantially

completed, have not revealed any material misstatement in the

accounting information included in this press release as of and for

the six months ended June 30, 2024.

X-FAB Quarterly Conference Call

X-FAB’s second quarter results will be discussed in a live

conference call/webcast on Thursday, July 25, 2024, at 6.30 p.m.

CEST. The conference call will be in English.

Please register here for the webcast (listen only).

Please register here for the conference call (listen and ask

questions).

The third quarter 2024 results will be communicated on October

24, 2024.

About X-FAB

X-FAB is the leading analog/mixed-signal and MEMS foundry group

manufacturing silicon wafers for automotive, industrial, consumer,

medical and other applications. Its customers worldwide benefit

from the highest quality standards, manufacturing excellence and

innovative solutions by using X-FAB’s modular CMOS processes in

geometries ranging from 1.0 µm to 110 nm, and its special silicon

carbide and MEMS long-lifetime processes. X-FAB’s analog-digital

integrated circuits (mixed-signal ICs), sensors and

micro-electro-mechanical systems (MEMS) are manufactured at six

production facilities in Germany, France, Malaysia and the U.S.

X-FAB employs approx. 4,500 people worldwide. For more information,

please visit www.xfab.com.

Forward-looking information

This press release may include forward-looking statements.

Forward-looking statements are statements regarding or based upon

our management’s current intentions, beliefs or expectations

relating to, among other things, X-FAB’s future results of

operations, financial condition, liquidity, prospects, growth,

strategies or developments in the industry in which we operate. By

their nature, forward-looking statements are subject to risks,

uncertainties and assumptions that could cause actual results or

future events to differ materially from those expressed or implied

thereby. These risks, uncertainties and assumptions could adversely

affect the outcome and financial effects of the plans and events

described herein.

Forward-looking statements contained in this press release

regarding trends or current activities should not be taken as a

report that such trends or activities will continue in the future.

We undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, unless legally required. You should not place undue

reliance on any such forward-looking statements, which speak only

as of the date of this press release.

The information contained in this press release is subject to

change without notice. No re-report or warranty, express or

implied, is made as to the fairness, accuracy, reasonableness, or

completeness of the information contained herein and no reliance

should be placed on it.

*excluding impact from revenue recognized over time according to

IFRS 15

Condensed consolidated statement of profit and loss

in thousands of USD

Quarter

ended 30 Jun 2024

unaudited

Quarter

ended 30 Jun 2023

unaudited

Quarter

ended 31 Mar 2024

unaudited

Half-year

ended 30 Jun 2024

unaudited

Half-year

ended 30 Jun 2023

unaudited

Revenue*

202,847

218,870

218,712

421,559

426,979

Impact from revenue recognized over

time

2,255

8,261

-2,559

-305

8,261

Total revenue

205,102

227,131

216,152

421,254

435,240

Revenues in USD in %

58

56

62

60

56

Revenues in EUR in %

42

44

38

40

44

Cost of sales

-160,236

-159,492

-165,786

-326,022

-310,404

Gross profit

44,866

67,639

50,367

95,232

124,836

Gross profit margin in %

21.9

29.8

23.3

22.6

28.7

Research and development expenses

-11,387

-12,905

-11,106

-22,494

-23,828

Selling expenses

-2,142

-2,112

-2,537

-4,679

-4,308

General and administrative expenses

-11,660

-11,961

-12,811

-24,471

-22,462

Rental income and expenses from investment

properties

394

390

1,434

1,828

2,462

Other income and other expenses

2,755

-231

1,847

4,603

1,512

Operating profit

22,825

40,820

27,193

50,019

78,213

Finance income

6,775

6,658

5,778

12,552

15,196

Finance costs

-7,419

-8,229

-7,653

-15,072

-18,484

Net financial result

-644

-1,571

-1,875

-2,519

-3,288

Profit before tax

22,181

39,249

25,318

47,499

74,925

Income tax

-2,359

-548

-2,260

-4,619

6,494

Profit for the period

19,822

38,701

23,059

42,881

81,418

Operating profit (EBIT)

22,825

40,820

27,193

50,019

78,213

Depreciation

25,028

21,465

23,765

48,792

42,083

EBITDA

47,853

62,284

50,958

98,811

120,295

EBITDA margin in %

23.3

27.4

23.6

23.5

27.6

Earnings per share

0.15

0.30

0.18

0.33

0.62

Weighted average number of shares

130,631,921

130,631,921

130,631,921

130,631,921

130,631,921

EUR/USD average exchange rate

1.07667

1.08946

1.08605

1.08145

1.08060

Amounts in the financial tables provided in this press release

are rounded to the nearest thousand except when otherwise

indicated, rounding differences may occur.

*excluding impact from revenue recognized over time in

accordance with IFRS 15

Condensed consolidated statement of financial

position

in thousands of USD

Quarter ended

30 Jun 2024

unaudited

Quarter ended

30 Jun 2023

restated

unaudited

Year ended

31 Dec 2023

restated

audited

ASSETS

Non-current assets

Property, plant, and equipment

879,363

568,926

734,488

Investment properties

7,608

7,403

7,171

Intangible assets

5,986

5,989

5,627

Other non-current assets

50

68

58

Deferred tax assets

83,173

79,082

83,772

Total non-current assets

976,180

661,467

831,116

Current assets

Inventories

277,587

247,912

269,227

Contract assets

23,706

15,667

24,010

Trade and other receivables

108,980

115,217

123,101

Other assets

46,918

61,322

50,659

Cash and cash equivalents

290,054

441,786

405,701

Total current assets

747,245

881,905

872,698

TOTAL ASSETS

1,723,425

1,543,372

1,703,814

EQUITY AND LIABILITIES

Equity

Share capital

432,745

432,745

432,745

Share premium

348,709

348,709

348,709

Retained earnings

223,604

100,230

180,159

Cumulative translation adjustment

-636

-243

-301

Treasury shares

-770

-770

-770

Total equity

1,003,653

880,672

960,542

Non-current liabilities

Non-current loans and borrowings

244,604

236,833

235,318

Other non-current liabilities and

provisions

4,652

4,025

4,024

Total non-current liabilities

249,256

240,858

239,342

Current liabilities

Trade payables

55,103

67,764

90,681

Current loans and borrowings

26,272

24,067

25,659

Other current liabilities and

provisions

389,140

330,011

387,590

Total current liabilities

470,516

421,842

503,930

TOTAL EQUITY AND LIABILITIES

1,723,425

1,543,372

1,703,814

Condensed consolidated statement of cash flows

in thousands of USD

Quarter

ended 30 Jun 2024

unaudited

Quarter

ended 30 Jun 2023

unaudited

Quarter

ended 31 Mar 2024

unaudited

Half-year

ended 30 Jun 2024

unaudited

Half-year

ended 30 Jun 2023

unaudited

Income before taxes

22,181

39,249

25,318

47,499

74,925

Reconciliation of income before taxes

to cash flow arising from operating activities:

28,972

22,895

23,732

52,704

45,876

Depreciation and amortization, before

effect of grants and subsidies

25,028

21,465

23,765

48,792

42,083

Amortization of investment grants and

subsidies

-624

-751

-673

-1,296

-1,488

Interest income and expenses (net)

959

652

-306

653

2,097

Loss/(gain) on the sale of plant,

property, and equipment (net)

-2,020

-137

-1,751

-3,771

-1,620

Other non-cash transactions (net)

5,629

1,666

2,698

8,327

4,804

Changes in working capital:

7,487

141,779

-799

6,688

140,569

Decrease/(increase) of trade

receivables

10,211

-21,482

8,252

18,463

-42,483

Decrease/(increase) of other receivables

and other assets

12,244

-7,006

6,587

18,831

-3,933

Decrease/(increase) of inventories

-604

-12,303

-4,951

-5,554

-31,189

Decrease/(increase) of contract assets

-2,255

-15,667

2,559

305

-15,667

(Decrease)/increase of trade payables

-14,369

-8,175

-206

-14,575

19,065

(Decrease)/increase of other

liabilities

2,260

206,411

-13,040

-10,780

214,776

Income taxes (paid)/received

-1,227

-401

-1,441

-2,668

-509

Net cash from operating

activities

57,413

203,522

46,810

104,224

260,861

Cash flow from investing

activities:

Payments for property, plant, equipment

and intangible assets

-121,893

-104,498

-104,980

-226,873

-153,393

Acquisition of subsidiary, net of cash

acquired

-24,863

0

23,229

-1,634

0

Payments for loan investments to related

parties

0

-41

0

0

-176

Proceeds from loan investments related

parties

0

42

0

0

162

Proceeds from sale of property, plant, and

equipment

2,020

208

1,791

3,811

1,694

Interest received

2,984

2,557

3,433

6,417

3,571

Net cash used in investing

activities

-142,752

-101,732

-76,527

-218,279

-148,143

Condensed consolidated statement of cash flows –

con’t

in thousands of USD

Quarter

ended 30 Jun 2024

unaudited

Quarter

ended 30 Jun 2023

unaudited

Quarter

ended 31 Mar 2024

unaudited

Half-year

ended 30 Jun 2024

unaudited

Half-year

ended 30 Jun 2023

unaudited

Cash flow from (used in) financing

activities:

Proceeds from loans and borrowings

42,601

5,027

50,300

92,901

14,240

Repayment of loans and borrowings

-5,644

-13,870

-94,113

-99,757

-49,800

Receipts of sale and leaseback

arrangements

-5,147

0

31,616

26,469

0

Payments of lease installments

-3,061

-1,273

-1,169

-4,230

-2,785

Interest paid

-4,574

691

-4,058

-8,632

-2,568

Cash flow from (used in) financing

activities

24,175

-9,425

-17,423

6,751

-40,913

Effect of changes in foreign currency

exchange rates on cash balances

-1,250

-855

-7,093

-8,343

556

Increase/(decrease) of cash and cash

equivalents

-60,164

92,365

-47,140

-107,304

71,805

Cash and cash equivalents at the beginning

of the period

351,468

350,276

405,701

405,701

369,425

Cash and cash equivalents at the end

of the period

290,054

441,786

351,468

290,054

441,786

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725542174/en/

X-FAB Press Contact Uta Steinbrecher Investor Relations

X-FAB Silicon Foundries +49-361-427-6489

uta.steinbrecher@xfab.com

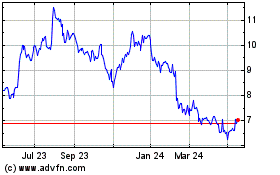

X-FAB Silicon Foundries (EU:XFAB)

Historical Stock Chart

From Oct 2024 to Nov 2024

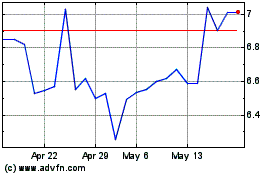

X-FAB Silicon Foundries (EU:XFAB)

Historical Stock Chart

From Nov 2023 to Nov 2024