CORRECT: Adecco 3Q Net Beats Views As US, French Job Market Turns

November 05 2009 - 6:07AM

Dow Jones News

Adecco SA (ADEN.VX) Thursday reported a better-than-expected

third quarter net profit as the world's largest temporary

employment firm benefited from a pick-up in demand for blue-collar

workers in the U.S. and France.

The result raised hopes that global employment markets could

slowly recover after months of persistent weakness that has

catapulted jobless rates to record levels and has triggered

concerns that hiring will remain low even as the global economy

moves out of recession.

Although the Zurich-based firm's net profit fell 46% to EUR90

million from EUR168 million a year-earlier, the result easily beat

analyst calls for a bottom line result of EUR50 million as Adecco

was able to slash costs and slow the steep sales decline of the

past.

While sales still dropped 27% to EUR3.72 billion from EUR5.10

billion, the decline was less severe than in previous quarters when

revenues fell more than 30% amid sluggish job demand in the U.S.,

France and Germany.

"We are very pleased with the evolution of the market (in the

U.S. and France)...and our cost-cut efforts", said Chief Executive

Patrick de Maeseneire, adding that the improving market trend has

continued into October.

The company said demand has risen for the temporary placement of

industrial workers in the U.S. and France, Adecco's two key markets

that generate more than half of the company's annual revenue.

In the U.S., sectors such as car manufacturing, transport and

telecommunications increased hiring, Adecco said, noting that the

pick-up was marked in the South as well as in the Mid-West.

In France, the automotive, chemical and transport sectors saw

increased temporary hiring.

Analysts and investors welcomed the results as a first signal of

a potential job market turnaround but warned that the coming

quarters will remain challenging, as some market segments are still

weak.

"This is an important indicator for the staffing industry and

gives a first indication for a trend reversal," said Bank Vontobel

analyst Michael Foeth, who rates the stock at buy.

Shares of Adecco, which have risen 13.1% in the past year amid

hopes for a job market recovery, rose 2.6%, or CHF1.36, to CHF49.9

in early trade in Zurich.

Demand for permanent placements, meanwhile, remained slow as

well as the hiring of specialized workers such as lawyers,

financial advisors and medical staff. However, the company

suggested that these professional staffing segments could improve

at a later stage.

"Demand for professional staffing services as usual is expected

to pick up later in the cycle," said Chief Financial Officer

Dominik de Daniel. Adecco declined to make a specific forecast for

the turnaround of this market segment.

Many economist in the U.S. are concerned that the jobless rate

will remain close to 10% for the months to come even as the U.S.

economy is growing again because companies will continue to curb

costs and consumers will limit spending.

Similar fears exist in Europe, where jobless rates are expected

to rise through 2010 as many companies, which have introduced

short-time working hours, are expected to first introduce normal

working hours schemes before hiring new staff.

Zuercher Kantonalbank analyst Marco Strittmatter, who rates the

stock at market overweight, shared this view and said Adecco will

have to keep a close eye on costs as pricing pressure will remain

high. Adecco's closest competitors, such as world number two

Manpower Inc (MAN) and the third-largest staffing company by sales

Randstad Holding NV (RAND.AE), have already warned that margins

would stay depressed.

Adecco, which recently bought peer MPS Group Inc for $1.3

billion in an effort to broaden its foothold in the U.S., said it

would continue to reduce costs as pricing levels are expected to

remain under pressure as many companies are still avoiding to hire

staff, especially in Germany, which has introduced broad

short-working hour schemes, and the U.K., which is still mired in

recession.

Company Web Site: http://www.adecco.com

-By Goran Mijuk, Dow Jones Newswires, +41 43 443 80 47;

goran.mijuk@dowjones.com

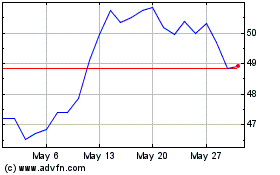

Randstad NV (EU:RAND)

Historical Stock Chart

From May 2024 to Jun 2024

Randstad NV (EU:RAND)

Historical Stock Chart

From Jun 2023 to Jun 2024