Finalisation of the sale of its property management business - EV

€440m

NEXITY REACHES A MAJOR MILESTONE IN ITS

TRANSFORMATION AND STEPS UP THE PACE OF ITS

DELEVERAGING, FINALISING THE SALE OF ITS PROPERTY MANAGEMENT FOR

INDIVIDUALS BUSINESS TO INVESTMENT FIRM BRIDGEPOINT BASED ON AN

ENTERPRISE VALUE OF €440M

Paris, 2 April 2024, 5:45 p.m.

Major step in Nexity’s strategy of

refocusing on urban regeneration and new developments for the Real

Estate Services to Individuals businesses acquired by world-leading

investment firm Bridgepoint

The finalisation of this sale with Bridgepoint

is a new step in Nexity’s transformation as the Group refocuses its

business model on serving regions across France as an urban

operator. The pivot towards urban regeneration accelerated in 2023,

with the launch of Nexity Héritage, our expert brand, and the

signing of a nationwide agreement with Carrefour.

Through this transaction, Bridgepoint aims to

give the newly formed entity – a major French operator in real

estate services to individuals – the means to consolidate its

growth, with solutions tailored to customers spanning the entire

real estate value chain.

Strategic and financial partnership to

amplify synergies between real estate services to individuals and

Nexity

After the conditions precedent1 were met, and

following consultation with employee representative bodies, who

issued a unanimously favourable opinion, the sale to investment

firm Bridgepoint was finalised today, under the conditions

announced on 21 December 2023. The transaction includes a strategic

partnership between Nexity and the new entity, for a period of six

years (which may be renewed for a further four years), aimed at

boosting existing synergies with the Group’s development businesses

and securing their long-term future.

This transaction will also be an opportunity for

this new company, which has 3,100 employees (condominium

management, rental management, sales and lettings of existing

properties, and insurance brokerage), to continue and ramp up its

growth.

Stepping the pace of the Group’s

deleveraging

Based on an enterprise value of

€440 million, the sale proceeds of €400 million for

Nexity, received today, will be used to significantly step up the

pace of the Group’s deleveraging process (net debt amounted to

€776 million at year-end 2023). The Group’s solid liquidity at

year-end 2023 (€882 million in cash and €630 million in

undrawn credit facilities) has been bolstered by this sale.

Facilitating transformation

The capital gains realised on this sale give

Nexity the means to immediately implement the in-depth

transformation announced on 28 February, including the decision to

launch within the next few days the process of informing and

consulting with employee representative bodies prior to the

implementation of a redundancy plan (PSE in French), in order to

become a more agile, regionally focused, multi-product organisation

that is better suited to new market conditions, paving the way for

a rebound in 2025.

“I am very proud to continue successfully

rolling out the refocusing roadmap announced last year. On Nexity’s

behalf, I’d like to thank all our staff in the Property Management

for Individuals business, and wish them all the best alongside

their new shareholder, Bridgepoint. The finalisation of this sale

and the implementation of this strategic partnership are a major

milestone in the transformation of the Group’s business model

towards that of an urban operator focused on urban regeneration and

managed real estate, while stepping up the pace of its

deleveraging. Thanks to a more agile, deleveraged, regionally

focused, multi-product organisation, Nexity will be in a position

to capitalise on all the opportunities offered by the impending new

real estate cycle.” Véronique Bédague – Chairwoman and

Chief Executive Officer of Nexity

“We are very pleased to have finalised this

transaction, which, thanks to the synergies built up with Nexity,

should enable the new company to emerge as a major player in the

French real estate sector. It will allow the newly formed entity to

focus on developing tailored solutions to satisfy its customers and

respond to new demand, particularly regarding the energy

transition.”Vincent-Gaël Baudet – Partner, Head of

Bridgepoint Europe in France

NEXITY – LIFE TOGETHER With

€4.3 billion in revenue in 2023, Nexity is France’s leading

comprehensive real estate operator, with a nationwide presence and

business operations in all areas of real estate development and

services. Our strategy as a comprehensive real estate operator is

designed to serve all our clients: individuals, companies,

institutional investors and local authorities. Our corporate

purpose, “Life together”, expresses our commitment to creating

sustainable spaces, neighbourhoods and cities that let our clients

connect and reconnect. Nexity has been ranked France’s number-one

low-carbon project owner by BBCA for the fifth year in a row, is a

member of the Bloomberg Gender-Equality Index (GEI), was included

in the Best Workplaces 2021 ranking and was awarded Great Place to

Work® certification in September 2022. Nexity is listed on the

SRD, Euronext’s Compartment A and the SBF 120.

CONTACTSGéraldine Bop – Head of

Financial Communications / +33 (0)6 23 15 40 56Anne-Sophie Lanaute

– Head of Investor Relations and Financial Communications / +33

(0)6 58 17 24 22investorrelations@nexity.frCyril Rizk – Media

Relations Manager / +33 (0)6 73 49 72 61 – presse@nexity.fr

About Bridgepoint

Bridgepoint is the reference middle-market

alternative asset manager in Europe, with c. €40 billion of assets

under management. With operations in France for over thirty years,

Bridgepoint is one of the principal international private equity

players locally. Bridgepoint’s investment team supports French SMEs

in the definition and execution of their strategy, in France and

abroad, thanks to its operations in Europe, the US and Asia.

Bridgepoint invests in high-quality businesses addressing resilient

and growing markets. Bridgepoint’s investments in France include

Balt, Groupe Bertrand / Burger King France, Empruntis, Kereis,

Primonial / La Financiere de l’Echiquier, and Vivacy. Bridgepoint

is listed on the London Stock Exchange.

(www.bridgepoint.eu)Contact: Rebecca David –

Image7 / rdavid@image7.fr / +33 (0)6 04 74 83 69

1 Approval obtained from the European Commission regarding

merger control procedures

- PR Nexity - Finalisation of the sale of its property management

business - EV €440m

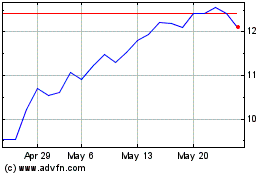

Nexity (EU:NXI)

Historical Stock Chart

From Oct 2024 to Nov 2024

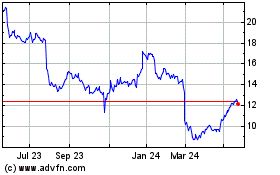

Nexity (EU:NXI)

Historical Stock Chart

From Nov 2023 to Nov 2024