Uniswap (UNI) Likely To Reach $7 – If Token Overcomes This Resistance Level

October 15 2022 - 7:38AM

NEWSBTC

Uniswap is not looking good right now. UNI, the governance token of

the decentralized exchange platform bearing the same name, must be

able to muster enough energy to regain momentum and hit its

target. Uniswap’s key support levels are $5.7 and $5.2 UNI

price can go as high as $7, with a push for $8 also highly possible

An extended bearish run is still possible if breakdown below

support marker occurs According to tracking from Coingecko, at

press time, the cryptocurrency is trading at $6.20 and is currently

down on intraday, weekly and monthly periods. Over the last 24

hours, Uniswap went down by 2.8% while on a seven-day period the

asset is dealing with 8.2% price decline. Its year-to-date loss is

huge, being down by 76.4% and UNI already lost 86.2% of its

all-time high price of $44.92 attained last May 3, 2021. But

despite all of these negative price numbers, investors could be

looking at a bull run for the 17th largest cryptocurrency in terms

of market capitalization. Related Reading: Who Shines Brighter?

Solana Beats Altcoin King Ethereum In This Key Area How UNI Can Hit

The $7 Marker Analysis from its daily timeframe chart shows the

altcoin’s price has incorporated itself into an inverted head and

shoulder pattern, putting itself in a good position to start a

bullish rally. Chart: TradingView Investors need to keep their eyes

open for two crucial support levels for Uniswap, $5.7 and $5.2, as

they are significant points for buyers to initiate and sustain a

price recovery. With the nature of its current price pattern, UNI

could be in a position to make a 10.6% jump and finally hit the $7

level. There is an even better scenario for Uniswap, as success in

buyers’ attempt to sustain the $5.66 support level and push to the

$7 marker would mean accelerated surge for the digital asset all

the way to $8. Caution is still advised though, as breakdown below

the $5.2 support will wash away all hopes for the aforementioned

price rally and will mean extended bearish run for Uniswap. Uniswap

Labs Completes Successful Funding Round Perhaps one key driving

force for the forecasted bull rally for the cryptocurrency is the

recently completed funding round of Uniswap Labs. Motivated by its

goal of broadening its offerings, the parent company of the largest

decentralized exchange pulled all strings it could and raised $165

million in its Series B fund-raiser. The round, that pushed the

firm’s valuation to $1.6 billion, was led by Polychain Capital and

featured loyal supporters such as a16z crypto, SV Angel, Variant

and Paradigm. Uniswap Labs, in recent months, have been very vocal

about its plans to add several new offerings which include a wallet

system and enabling customers to trade non-fungible tokens (NFTs)

to Uniswap from different market places. The successful funding

round will certainly help the company in that department, not to

mention aid in pushing UNI price to higher levels before the year

ends. Related Reading: Dogecoin Can Regain Losses If DOGE

Extricates Itself From This Level UNI total market cap at $4.67

billion on the daily chart | Featured image from Inc Magazine,

Chart: TradingView.com Disclaimer: The analysis represents the

author's personal views and should not be construed as investment

advice.

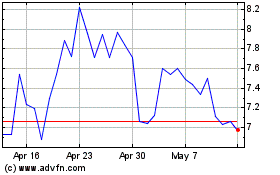

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024