XRP And Shiba Inu Rally Is Not Over According To This Indicator

November 03 2023 - 12:00PM

NEWSBTC

The crypto industry saw a spectacular run in October, as a few

cryptocurrencies like Bitcoin and Solana registered new yearly

highs. However, the entire market seems to be taking a breather

after this action-packed October that saw Bitcoin, XRP, and Shiba

Inu lead impressive rallies. On-chain data, particularly from

the crypto analytics platform Santiment, showed October ended on a

somehow bearish note. But history from this particular metric

suggests that the rally might not be over. XRP And Shiba Inu

Rally Not Over The first few days of November appear to be devoid

of significant crypto price movement, with the exception of

occasional whale transfers. At the time of writing, XRP and SHIB

are down by 1% and 2%, respectively, in a 24-hour timeframe.

Bitcoin and Ethereum are also down by 2.51% and 1.93% respectively.

Some crypto experts attribute this decline to traders taking

profit, while others think the crypto market has returned to its

normalcy of bearish sentiment. Related Reading: ProShares Goes

Short On Ethereum With New ETF Launch Popular crypto analytics

platform Santiment predicted this sentiment a few days ago.

According to Santiment, the Bullish Vs Bearish Sentiment Keyword

turned towards a bearish ratio at the end of October. The metric,

which tracks various keyword mentions like “buy,” “sell,” “buying,”

“selling,” “topped,” and “bottom” on social media, spent the bulk

of October on the bullish end of its range. The firm quickly

pointed out that previous instances of higher ratios of bearish

keywords had preceded gains in the market caps of popular

cryptocurrencies. Aside from Bitcoin, on-chain metrics and

fundamental analysis point to a continued rally for XRP and SHIB.

These two cryptocurrencies, in particular, have dominated social

mentions in the past few months, according to this indicator. 😒

After the trading crowd stayed pretty neutral over the weekend,

@santimentfeed data indicates that current sentiment has turned

#bearish once again. In the previous instances of higher ratios of

negative keywords, #Bitcoin & other market caps rose.

📈https://t.co/2p2uVitBkX pic.twitter.com/0vn3HGC7Gr — Santiment

(@santimentfeed) October 31, 2023 Altcoins Still Poised For Growth

On the fundamental side, XRP has done extremely well, especially as

trading resumed on various crypto exchanges. XRP is up by 32% since

the beginning of the year, and various analysts have pointed to

another price surge. A look into XRP’s price action shows a

series of higher low formations since October 30, indicating waning

pressure from the bears. XRP is now trading at $0.6036, and the

bulls could make another attempt to break over the latest higher

high of $0.62 if the price stays above $0.60. Related Reading:

Bitcoin Cash Rally Threatened As Exchange Drops BCH Following XRP

Listing Rumors SHIB has also had a similar path, with updates to

its ecosystem like Shibarium contributing to various price surges.

SHIB’s price momentum has slowed down at the time of writing, but

planned updates to the Shina Inu ecosystem could lead to another

price rally soon. At the same time, on-chain signals point to

more bullish than bearish. SHIB whales have resumed large transfers

to private wallets, as shown by data from Whale Alerts. SHIB is

trading at $0.000007788 at the time of writing. Despite the entire

market cap being down by 2.24% in the past day, data from

Coinmarketcap points to greed on the Fear & Greed Index. SHIB

holding steady above $0.000007 | Source: SHIBUSD on Tradingview.com

Featured image from Medium, chart from Tradingview.com

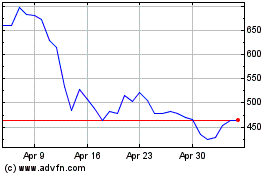

Bitcoin Cash (COIN:BCHUSD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Bitcoin Cash (COIN:BCHUSD)

Historical Stock Chart

From Jul 2023 to Jul 2024