Intesa Sanpaolo Confirms It Is Assessing Potential Tie-Up With Assicurazioni Generali--Update

January 24 2017 - 4:13PM

Dow Jones News

By Giovanni Legorano

ROME -- Italian bank Intesa Sanpaolo SpA said Tuesday it

assessing a potential tie-up with Assicurazioni Generali SpA, as

part of its strategy of growth in the insurance, asset management

and private banking sector.

Intesa's statement follows two days of market speculation about

its interest in Europe's third largest insurer, after Italian daily

La Stampa first reported on Sunday it was considering an investment

in Generali, possibly in partnership with German insurer

Allianz.

Allianz couldn't immediately be reached for comment on Tuesday,

but had previously declined to comment on La Stampa's report.

Generali declined to comment.

Intesa said that in line with its strategy its management

normally assesses opportunities to strengthen its competitive

position and its financial performance.

"These opportunities, including possible industrial combinations

with Assicurazioni Generali, are currently being examined by the

bank's management," Intesa said in a statement.

A tie-up between the two companies would create Italy's largest

financial conglomerate and could potentially incur into antitrust

issues as Intesa already owns large insurance and asset management

businesses.

Many analysts showed skepticism about such a deal.

"A potential transaction...could be complex and raise antitrust

issues [given ISP activities in life insurance], and we deem it as

unlikely at current stage," Citi's analysts wrote in note earlier

Tuesday.

In a defensive move against a potential takeover bid by Intesa,

Generali said late Monday it bought voting rights worth 3.01% of

lender Intesa's share capital.

According to Italian regulations and under certain conditions, a

listed company can't hold more than 3% in another listed company's

voting rights if the latter already owns voting rights equal to

more than 3% of the former company's share capital.

This means that if Intesa bought a stake in Generali larger than

3%, the voting rights corresponding to the exceeding capital would

be frozen. In addition, Intesa would have to sell the exceeding

shares within 12 months.

Intesa could avoid these restrictions if it launched a takeover

bid for at least 60% of Generali's capital.

Shares in Generali soared on Tuesday, ending up 8.2%, while

those in Intesa dropped 4.4%.

William Wilkes contributed to this article.

Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

January 24, 2017 15:58 ET (20:58 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

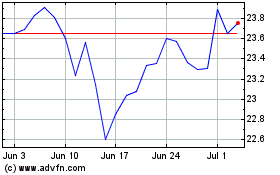

Generali (BIT:G)

Historical Stock Chart

From Jun 2024 to Jul 2024

Generali (BIT:G)

Historical Stock Chart

From Jul 2023 to Jul 2024