TIDMSEE

RNS Number : 9298R

Seeing Machines Limited

06 March 2023

Seeing Machines Limited ("Seeing Machines" or the "Company")

6 March 2023

Half year results and financial report

Record revenue with significant growth in high margin automotive

royalty revenue

Seeing Machines Limited (AIM: SEE, "Seeing Machines" or the

"Company"), the advanced computer vision technology company that

designs AI-powered operator monitoring systems to improve transport

safety, today published its unaudited results and financial report

for the six months to 31 December 2022 ("H1 2023").

As a result of the proportion of revenue and funding being

derived in US Dollars, the Company has changed its reporting

currency from Australian Dollars to US Dollars, in order to give a

clearer understanding of its financial performance. All figures

provided below, along with comparative information, are therefore

provided in US Dollars.

Financial Highlights:

- Total operational revenue of US$24.4m (H1 2022: US$15.8m)

reflecting comparative growth of 54% on the previous period

o OEM (Automotive and Aviation) revenue up by 268% year on year

to US$14.0m (H1 2022: US$3.8m)

-- Higher margin royalty revenue, derived from cars on road,

increased by 102% to US$3.1m (H1 2022: US$1.5m)

-- Revenue of US$5.4m from license fees earned from the

exclusive collaboration agreement with Magna (2021: nil)

o Annual Recurring Revenue(1) increased to US$11.9m (H1 2022:

US$10.2m)

o Aftermarket (Fleet and Off-Road) revenue was US$10.3m (H1

2022: US$12.0m)

- Gross profit of US$15.5m, up 109% year on year (H1 2022: US$7.4m)

- Net loss reduced by 47% to US$5.4m (H1 2022: US$10.1m)

- Strong balance sheet, with cash at 31 December 2022 of US$52.2m (30 June 2022: US$40.5m)

Operational Highlights:

- Entered into an exclusive collaboration with Magna

International, to pursue driver and occupant monitoring system

business targeting the vehicle's interior rear-view mirror

- Magna also provided additional investment in the Company

through a Convertible Note of up to US$47.5m, maturing in October

2026 with a conversion rate per ordinary share of 11 British pence.

To date, Seeing Machines has drawn down US$30m of the US$47.5m

- Seeing Machines continues to grow as an automotive technology

leader in driver and occupant monitoring system technology and was

appointed to an additional program with an existing large

European-based global automotive group (OEM) customer, carrying an

initial lifetime value of US$32m

- The Company has now won a total of 15 automotive programs

spanning 10 individual OEMs, covering more than 160 distinct

vehicle models, underpinned by over 11bn km of driving data and

delivered with proven global automotive Tier-1 customers and

partners

- Cumulative initial lifetime value of all awarded Automotive

OEM programs now stands at US$321m

- The Company reported a total of 701,049 cars on road as at 31

December 2022, representing an increase of 188% over the 12 months

period (H1 FY2022: 243,722) spanning six individual programs with

four global OEMs

- Guardian, Seeing Machines' Aftermarket driver distraction and

fatigue technology, is now installed into and monitoring 46,018

individual vehicles , compared to 36,933 in December 2021

representing a 25% increase over the 12-month period

- As at 31 December 2022, there were 6,085 Guardian units sold and yet to be connected

- Martin Ive, a highly experienced finance professional and

chartered accountant, was appointed to the position of CFO in

November 2022

- Seeing Machines' balance sheet was significantly strengthened

following the receipt of financing through a Convertible Note from

Magna International and the Company is now fully funded to deliver

on its current business plan for the foreseeable future

Outlook and current trading

- Seeing Machines' total addressable market is expanding,

underpinned by compelling structural drivers and regulatory

tailwinds which present an exciting opportunity to grow market

share and deliver long-term growth

- Company financial performance for FY2023 is expected to be in

line with consensus expectations(2)

Paul McGlone, CEO of Seeing Machines, said : "We are pleased

with the continued progress made during the first half of the year

and I'd like to thank all colleagues for their hard work. Transport

safety has moved meaningfully up the regulatory agenda around the

world and our market leadership, scalability and balance sheet

strength means we are ideally positioned to deliver on our business

objectives. Whether inside the car, cabin or cockpit, our

mission-critical technology is achieving strong take-up by a range

of customers. Whilst we have contended with some industry wide

supply chain challenges relating to automotive manufacturing, we

expect the impact of these to ease on our Aftermarket business in

the second half of the year, and are confident of meeting FY2023

expectations."

[1] The definition of Annual Recurring Revenue has been refined

to include only the annualised value of revenues recurring through

an ongoing service provision and excludes values related to

one-time purchases such as hardware royalties

(2) Consensus expectations for FY2023 are for revenue of

US$53.9m and EBITDA of US$(12.7m)

Earnings call

The Company will host a presentation via Investor Meet Company

platform on Tuesday 7 March 2023.

To register for the Investor Meet Company presentation, please

visit www.investormeetcompany.com .

Enquiries:

Seeing Machines Limited +61 2 6103 4700

Paul McGlone - CEO

Sophie Nicoll - Corporate Communications

Stifel Nicolaus Europe Limited (Nominated

Adviser and Broker) +44 20 7710 7600

Alex Price

Fred Walsh

Nick Adams

Ben Burnett

Dentons Global Advisors (Media Enquiries)

James Styles

Jonathon Brill

seeingmachines@dentonsglobaladvisors.com +44 20 7664 5095

About Seeing Machines (AIM: SEE), a global company founded in

2000 and headquartered in Australia, is an industry leader in

vision-based monitoring technology that enable machines to see,

understand and assist people. Seeing Machines is revolutionizing

global transport safety. Its technology portfolio of AI algorithms,

embedded processing and optics, power products that need to deliver

reliable real-time understanding of vehicle operators. The

technology spans the critical measurement of where a driver is

looking, through to classification of their cognitive state as it

applies to accident risk. Reliable "driver state" measurement is

the end-goal of Driver Monitoring Systems (DMS) technology. Seeing

Machines develops DMS technology to drive safety for Automotive,

Commercial Fleet, Off-road and Aviation. The company has offices in

Australia, USA, Europe and Asia, and supplies technology solutions

and services to industry leaders in each market vertical.

www.seeingmachines.com

Review of Operations

Overview

The Company achieved a record result for the six months to 31

December 2022 as well as securing significant additional investment

through a Convertible Note. Revenue increased by 54% and cash

balances increased to US$52.2m with a remaining US$17.5m of funding

available.

As a result of the increasing proportion of revenue and funding

being derived in US dollars, the Company has changed the functional

currency of the parent entity of the group, Seeing Machines

Limited, to US dollars.

Financial Results

The Company's total sales revenue for H1 FY2023 (excluding

foreign exchange gains and finance income) increased by 54% to

US$24.4m (H1 FY2022: US$15.8m).

Business unit 31 Dec 2022 31 Dec 2021 Variance

US$'000 US$'000 %

OEM 14,037 3,832 266%

Aftermarket 10,346 11,982 (14%)

Sales Revenue 24,383 15,814 54%

OEM revenue more than doubled compared to the previous

corresponding period in line with the early stage ramp up of

vehicle production for a number of Automotive OEM programs. Royalty

revenue, derived from installation of Seeing Machines' Driver

Monitoring System (DMS) technology, increased by 102% to US$3.1m

compared to the same period last year (H1 FY2022: US$1.5m). In

addition to production royalties, revenue of US$5.4m from license

fees was earned from the exclusive collaboration agreement with

Magna (2021: nil). The growth in royalty revenues in the OEM

business has resulted in the revenue mix moving to a greater

proportion of higher margin revenue streams, which is expected to

continue as Automotive programs become the dominant source of

revenue for this business unit.

Limited hardware supply in the half-year restricted potential

revenue growth in the Aftermarket business. Guardian hardware sales

generally constitute a majority of Aftermarket revenue, however,

they were limited to 1,536 units compared to 4,285 units for the

prior corresponding period resulting in an overall revenue decline

in the Aftermarket business for the half-year. Supply of the

reengineered Guardian 2 units commenced towards the end of the

period and will enable pent-up demand to be met for the remainder

of the financial year. Connected Guardian units increased to 46,018

units in December 2022 representing 15% growth from 39,892 in June

2022 and 25% annual growth from December 2021. As a result of this

growth monitoring services revenue increased by 7% to US$5.2m for

the half-year, compared to US$4.9m for the same period last year,

continuing the accumulation of recurring revenue from the Guardian

connections.

The Company continued to invest in its core technology

development to further strengthen its competitive moat, rapidly

expand features and leverage systems approach across global OEM and

Aftermarket industries. As a result, Seeing Machines incurred total

research and development expenses of US$17.2m during the six-months

ended 31 December 2022 (2021: US$13.2m), of which US$11.1m (2021:

US$8.6m) was capitalised.

Customer support and operations cost categories increased to

US$3.3m (2021: US$3.2m) and US$5.4m (2021: US$4.2m) respectively in

line with strengthening of business pursuit and emerging markets

activities to support increased pipeline and channel market

expansion.

On 4 October 2022, Seeing Machines received funding of US$47.5m

from Magna International in the form of a non-transferable 4-year

convertible note maturing in October 2026 (the "Convertible Note").

Details of the Convertible Note can be found in Note 12 to the

Financial Statements. The proceeds of the Convertible Note are

being used to meet technology demands, for general working capital

and corporate purposes, as well as to strengthen the Company's

balance sheet so that it is fully funded to deliver on its current

business plan.

Cash and cash equivalents as at 31 December 2022 totalled

US$52.2m (2022: US$40.4m) with an additional US$17.5m being

available as part of an undrawn Convertible Note facility.

We highlight this report is unaudited. There is no requirement

for the interim financial statements to be subject to review by the

external auditor.

Interim Consolidated Statement of Financial Position -

Unaudited

Consolidated

31 Dec 30 Jun 31 Dec

AS AT Notes 2022 2022 2021

Unaudited Audited Unaudited

US$000 US$000 US$000

(Restated) (Restated)

---------------------------------- -------------------- ----------- ------------ ------------

ASSETS

CURRENT ASSETS

Cash and cash equivalents 5 52,186 40,470 57,564

Other short-term deposits 321 325 343

Trade and other receivables 6 14,843 18,586 12,806

Inventories 7 5,742 933 5,112

Other current assets 8,756 5,676 3,883

----------- ------------ ------------

TOTAL CURRENT ASSETS 81,848 65,990 79,708

----------- ------------ ------------

NON-CURRENT ASSETS

Property, plant & equipment 8 3,152 3,033 2,431

Intangible assets 9 33,581 23,610 15,597

Right-of-use assets 2,114 2,376 2,794

----------- ------------ ------------

TOTAL NON-CURRENT ASSETS 38,847 29,019 20,822

----------- ------------ ------------

TOTAL ASSETS 120,695 95,009 100,530

----------- ------------ ------------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 1 0 7,692 11,290 6,697

Lease liabilities 1 1 686 653 725

Provisions 4,012 3,511 4,052

Contract liabilities 5,734 2,495 1,258

----------- ------------ ------------

TOTAL CURRENT LIABILITIES 18,124 17,949 12,732

----------- ------------ ------------

NON-CURRENT LIABILITIES

Provisions 212 245 189

Lease liabilities 1 1 2,620 3,000 3,465

Borrowings 1 2 22,955 - -

Financial liability at fair value

through profit or loss 1 3 7,389 - -

----------- ------------ ------------

TOTAL NON-CURRENT LIABILITIES 33,176 3,245 3,654

----------- ------------ ------------

TOTAL LIABILITIES 51,300 21,194 16,386

----------- ------------ ------------

NET ASSETS 69,395 73,815 84,144

=========== ============ ============

EQUITY

Contributed equity 1 6 240,948 240,948 240,805

Accumulated losses (175,396) (169,973) (161,533)

Other reserves 3,843 2,840 4,872

----------- ------------ ------------

Equity attributable to the owners

of the parent 69,395 73,815 84,144

----------- ------------ ------------

TOTAL EQUITY 69,395 73,815 84,144

=========== ============ ============

The above interim consolidated statement of financial position

should be read in conjunction with the accompanying notes.

Interim Consolidated Statement of Comprehensive Income -

Unaudited

Consolidated

2022 2021

FOR THE SIX-MONTH PERIODED 31 Notes Unaudited Unaudited

DECEMBER

US$000 US$000

(Restated)

---------------------------------------- ----------------- ----------- ----------------

Sale of goods 2,322 5,489

Services revenue 12,193 7,335

Royalty and license fees 9,868 2,990

----------- --------------

Revenue 3 24,383 15,814

----------- --------------

Cost of sales (8,901) (8,416)

----------- --------------

Gross profit 15,482 7,398

----------- --------------

Net gain in foreign exchange 1,942 95

Finance income 369 160

Net change in fair value of financial

liability (loss) (804) -

Other (expense) / income (81) (7)

Expenses

Research and development expenses 4 (6,090) (4,634)

Customer support and marketing expenses (3,325) (3,155)

Operations expenses (5,447) (4,230)

General and administration expenses (6,470) (5,498)

Finance costs (876) (175)

----------- --------------

Loss before tax (5,300) (10,046)

Income tax expense (123) (82)

----------- --------------

Loss after income tax (5,423) (10,128)

=========== ==============

Loss for the period attributable

to:

Equity holders of the parent (5,423) (10,128)

----------- --------------

Other comprehensive loss

Exchange differences on translation

of foreign operations (2) (1,447)

----------- --------------

Other comprehensive loss net of tax (2) (1,447)

----------- --------------

Total comprehensive loss (5,425) (11,575)

----------- --------------

Total comprehensive loss attributable

to:

Equity holders of the parent (5,425) (11,575)

=========== ==============

Total comprehensive loss for the

period (5,425) (11,575)

=========== ==============

Loss per share for loss attributable to the ordinary equity

holders of

the parent:

Basic loss per share 15 (0.001) (0.002)

Diluted loss per share 15 (0.001) (0.002)

The above interim consolidated statement of comprehensive income

should be read in conjunction with the accompanying notes.

Interim Consolidated Statement of Changes in Equity -

Unaudited

FOR THE Employee

SIX-MONTH Foreign Equity

PERIOD Currency BenefitsED 31 Contributed Accumulated Translation & Other

DECEMBER Equity Losses Reserve Reserve Total Equity

US$000 US$000 US$000 US$000 US$000

--------------- -------------------- -------------------- -------------------- -------------------- ------------------

As at 1 July

2021

(Restated) 200,558 (151,405) (8,457) 13,334 54,030

Loss for the

period

(Restated) - (10,128) - - (10,128)

Other

comprehensive

loss

(Restated) - - (1,447) - (1,447)

Total

comprehensive

loss

(Restated) - (10.128) (1,447) - (11,575)

Transactions

with owners

in their

capacity as

owners:

Issue of new

shares

(Restated) 41,275 - - - 41,275

Share issue

costs

(Restated) (1,028) - - - (1,028)

Share-based

payments

(Restated) - - - 1,442 1,442

At 31 December

2021 -

Unaudited

(Restated) 240,805 (161,533) (9,904) 14,776 84,144

As at 1 July

2022 240,948 (169,973) (14,128) 16,968 73,815

Loss for the

period - (5,423) - - (5,423)

Other

comprehensive

loss - - (2) - (2)

Total

comprehensive

loss - (5,423) (2) - (5,425)

Transactions

with owners

in their

capacity as

owners:

Issue of new - - - - -

shares

Capital - - - - -

raising costs

Share-based

payments - - - 1,005 1,005

At 31 December

2022 -

Unaudited 240,948 (175,396) (14,130) 17,973 69,395

The above consolidated statement of changes in equity should be

read in conjunction with the accompanying notes.

Interim Consolidated Statement of Cash Flows - Unaudited

FOR THE SIX-MONTH PERIODED 2022 2021

31 DECEMBER Notes Unaudited Unaudited

US$000 US$000

(Restated)

-------------------------------------------- ------- ----------- --------------

Operating activities

Receipts from customers 32,398 18,967

Payments to suppliers (39,476) (26,813)

Interest received 369 160

Interest paid - (175)

Income tax paid (123) (83)

----------- --------------

Net cash flows used in operating activities (6,832) (7,944)

----------- --------------

Investing activities

Proceeds from sale of property, plant 48 -

and equipment

Purchase of property, plant and equipment 8 (524) (222)

Payments for intangible assets (patents,

licences and trademarks) 9 (91) (132)

Payments for intangible assets (capitalised

development costs) 4, 9 (11,146) (8,623)

Net cash flows used in investing activities (11,712) (8,977)

----------- --------------

Financing activities

Proceeds from issue of new shares - 41,275

Cost of capital raising - (1,028)

Proceeds from issue of Convertible Note

(net of arrangement fee) 12 28,798

Principal repayment of lease liabilities (481) (308)

Net cash flows from financing activities 28,317 39,939

----------- --------------

Net increase in cash and cash equivalents 9,772 23,018

Net increase/(decrease) due to foreign

exchange difference 1,944 (995)

Cash and cash equivalents at 1 July 40,470 35,541

Cash and cash equivalents at 31 December 5 52,186 57,564

=========== ==============

The above interim consolidated statement of cash flows should be

read in conjunction with the accompanying notes.

Notes to the Interim Consolidated Financial Statements -

Unaudited

1 Corporate information

Seeing Machines Limited (the "Company" or the "Group") is a

limited liability company incorporated and domiciled in Australia

and listed on the AIM market of the London Stock Exchange. The

address of the Company's registered office is 80 Mildura Street,

Fyshwick, Australian Capital Territory, Australia.

Seeing Machines Limited and its subsidiaries (the "Group")

provide operator monitoring and intervention sensing technologies

and services for the automotive, mining, transport and aviation

industries.

The interim consolidated financial report of the Group (the

"interim financial report") for the six-month period ended 31

December 2022 was authorised for issue in accordance with a

resolution of the Directors on 3 March 2023.

2 Basis of preparation and changes to the Group's accounting policies

(a) Basis of preparation

The interim financial report for the six-month period ended 31

December 2022 has been prepared in accordance with AASB 134 Interim

Financial Reporting in order to fulfil the reporting requirements

of Rule 18 of the London Stock Exchange's AIM Rules for Companies

issued July 2016.

The interim financial report does not include all the

information and disclosures required in the annual financial report

and should be read in conjunction with the Group's annual

consolidated financial statements as at 30 June 2022. The interim

financial report has also been prepared on a historical cost basis,

except for derivative financial instruments which have been

measured at fair value.

There is no requirement for the interim financial report to be

subject to audit or review by the external auditor and accordingly

no audit or review has been conducted.

(b) Accounting policies

The accounting policies applied are consistent with those of the

consolidated financial statements for the year ended 30 June 2022,

except for the change in accounting policy in relating to change in

presentation currency from Australian Dollars ("AU$") to United

States Dollars ("US$"), as set out below:

Effective 1 July 2022, the Group's functional currency has

changed from AU$ to US$. This change in functional currency is

primarily indicated by the following factors:

(i) Sales and cash inflows: The currency that mainly influences

sales prices for goods and services. This will often be the

currency in which sales prices for goods and services are

denominated and settled. During the financial year ended 30 June

2022, approximately 65% of the Group's revenue were denominated in

US$. This proportion of revenue denominated in US$ is expected to

significantly increase for the financial year ending 30 June 2023

and thereafter. Therefore, change in functional currency for

periods commencing 1 July 2022 is considered appropriate.

(ii) Financing Activities: The Group's share capital is

denominated in Great Britain Pounds ("GBP") as the Company's shares

are listed on the AIM market of the London Stock Exchange. However,

a significant funding arrangement and a significant exclusive

collaboration arrangement, totalling to US$ 65 million with Magna

International were in the final stages of execution on 1 July 2022.

These arrangements were executed on 4 October 2022. Considering the

materiality of these arrangements to the Group's financial

position, together with the stage of execution on 1 July 2022,

change in functional currency to US$ for periods commencing 1 July

2022 is considered appropriate.

(iii) Expenses and cash outflows: The Group's expenses are

primarily comprised of salaries and wages for employees who are

mostly domiciled in Australia and these expenses are incurred and

settled in AU$. However, majority of other expenses for the Group

are incurred and settled in US$. During the financial year ended 30

June 2022, approximately 30% of the Group's expenses were

denominated in US$. This proportion of expenses denominated in US$

is expected to significantly increase for the financial year ending

30 June 2023 and thereafter. Further, all of the Group's

inventories are purchased and denominated in US$, with the Group

having significant commitments to make these purchases in US$.

Therefore, change in functional currency for periods commencing 1

July 2022 is considered appropriate.

The change in functional currency will significantly reduce the

volatility of the Group's earnings due to foreign exchange

movements, in particular due to translation of foreign currency

balances.

Notes to the Interim Consolidated Financial Statements -

Unaudited

2 Basis of preparation and changes to the Group's accounting policies (continued)

(b) Accounting policies (continued)

Applying the guidance provided in AASB 121: The Effects of

Changes in Foreign Exchange Rates ("AASB 121"), the change in

functional currency to US$ has been effected on 1 July 2022 using

the following procedures:

i) All items of assets and liabilities were translated from AU$

to US$ using the US$/ AU$ exchange rate prevailing on the date of

change, i.e. start of 1 July 2022. The exchange rate used was US$

0.68879/ AU$. As all assets and liabilities are translated using

the exchange rate at the date of change, the resulting translated

amounts for non-monetary items are treated as their historical

cost.

ii) Equity items were translated from AU$ to US$ using the

historical rate at the date of the transactions.

iii) Resulting differences in the historical rates and rate on

date of change is recognized in the Foreign Currency Translation

Reserve.

In line with the change in functional currency from AU$ to US$,

and to provide investors and other stakeholders a clearer

understanding of the Group's performance over time, the Directors

have elected to change the Group's presentation currency from AU$

to US$. The change in presentation currency is a voluntary change

which is accounted for retrospectively and comparatives in the

interim financial report have been restated accordingly. Applying

the guidance provided in AASB 121, the Group's interim financial

report has been restated to US$ using the procedures outlined

below:

i) Interim Consolidated Statement of Comprehensive Income and

Interim Consolidated Statement of Cash Flows have been translated

into US dollars using average foreign currency rates prevailing for

the relevant period.

ii) Assets and liabilities in the Interim Consolidated Statement

of Financial Position have been translated into US$ at the closing

foreign currency rates on the relevant balance sheet dates.

iii) The equity section of the Interim Consolidated Statement of

Financial Position, including foreign currency translation reserve,

retained earnings, share capital and the other reserves, have been

translated into US$ using historical rates.

iv) Earnings per share and dividend disclosures have also been

restated to US$ to reflect the change in presentation currency.

Certain new accounting standards, amendments to accounting

standards and interpretations have been published that are not

mandatory for 31 December 2022 reporting periods and have not been

early adopted by the Group. These standards, amendments or

interpretations are not expected to have a material impact on the

Group in the current or future reporting periods and on foreseeable

future transactions.

3 Segment information

a. Segment revenue based on operating segment

The following table presents revenue and net loss information

for the Group's operating segments for the six-month periods ended

31 December 2022 and 2021, respectively:

Segment Revenue Segment Loss

FOR THE SIX-MONTH PERIODED 2022 2021 2022 2021

31 DECEMBER US$000 US$000 US$000 US$000

Unaudited (Restated) (Restated)

--------------------------------------- ------------------ --------------- ------------------

OEM 14,037 3,832 (2,282) (6,805)

Aftermarket 10,346 11,982 (3,141) (3,323)

Total 24,383 15,814 (5,423) (10,128)

b.

Notes to the Interim Consolidated Financial Statements -

Unaudited

3 Segment information (continued)

b. Revenue from contracts with customers

In the following tables, revenue segments have been

disaggregated by type of goods or services which also reflects the

timing of revenue recognition.

FOR THE SIX-MONTH PERIODED OEM US$000 Aftermarket Total US$000

31 DECEMBER 2022 US$000

Unaudited

------------------------------- ------------------------- ------------------ ---------------------

Revenue Types

Sales at a point in time

Consulting - - -

Hardware and Installations 436 1,971 2,407

Royalties - 1,012 1,012

Sales over time

Driver Monitoring - 5,249 5,249

Non-recurring Engineering 4,745 2,114 6,859

Royalties 3,116 - 3,116

Licensing 5,740 - 5,740

Total revenue 14,037 10,346 24,383

FOR THE SIX-MONTH PERIODED OEM US$000 Aftermarket Total US$000

31 DECEMBER 2021 US$000

Unaudited (Restated) (Restated) (Restated)

-------------------------------- -------------------------- ------------------- ----------------------

Revenue Types

Sales at a point in time

Consulting - 613 613

Hardware and Installations 377 5,019 5,396

Royalties - 1,448 1,448

Sales over time

Driver Monitoring - 4,902 4,902

Non-recurring Engineering 1,913 - 1,912

Royalties 1,542 - 1,542

Total revenue 3,832 11,982 15,814

c. Geographic information

FOR THE SIX-MONTH PERIODED 2022 2021

31 DECEMBER US$000 US$000

Unaudited (Restated)

------------------------------------------------------------------- ------------------

Revenues from external customers

Australia 4,153 5,452

North America 15,117 7,253

Asia-Pacific (excluding Australia) 1,763 1,340

Europe 2,198 849

Other 1,152 920

Total revenue from external customers 24,383 15,814

The revenue information above is based on

the locations of the customers.

3

Notes to the Interim Consolidated Financial Statements -

Unaudited

4 Research and development expenses

Research and development expense relates to ongoing investment

in the Group's core technology.

The Group incurred total research and development expenses of

US$17,236,000 during the six-months ended 31 December 2022 (2021:

US$13,191,000 (Restated)), of which US$11,146,000 (2021:

US$8,623,000 (Restated)) were capitalised.

As part of the assessment of research and development expenses

at 30 June 2022, total costs of US$16,558,000 (Restated) were

capitalised for the year ended 30 June 2022, of which US$8,623,000

(Restated) pertained to the six-month period ended 31 December

2021.

5 Cash and cash equivalents

For the purpose of the interim consolidated statement of cash

flows, cash and cash equivalents are comprised of the

following:

31 Dec 30 June

2022 2022

Unaudited Audited

US$000 US$000

(Restated)

---------- ------------

Cash at bank 22,570 40,470

Term deposits maturing in less than 3 months 29,616 -

---------- ------------

Total cash and cash equivalents 52,186 40,470

========== ============

6 Trade and other receivables

Current 31 Dec 30 June

2022 2022

Unaudited Audited

US$000 US$000

(Restated)

--------------------------------------- -------------------- ---------------------

Trade receivables (net of provisions) 14,289 18,138

Deferred finance income (89) (105)

14,200 18,033

Other receivables 643 553

Total trade and other receivables

- current 14,843 18,586

7 Inventories

31 Dec 30 June

2022 2022

Unaudited Audited

US$000 US$000

(Restated)

---------- ------------

Finished goods (at lower of cost and net realisable

value) 5,758 949

Provision for obsolescence (15) (16)

---------- ------------

Total inventories at the lower of cost and

net realisable value 5,742 933

========== ============

7

Notes to the Interim Consolidated Financial Statements -

Unaudited

8 Property, plant and equipment

Acquisitions and disposals

During the six-month period ended 31 December 2022, the Group

acquired assets with a cost of US$524,000 (2021: US$222,000

(Restated)).

Assets costing US$17,000 (2021: nil) relating to plant and

equipment were disposed by the Group during the six-month period

ended 31 December 2022.

9 Intangible assets

During the six-month period ended 31 December 2022, the Group

incurred expenditure of US$11,237,000 (2021: US$8,755,000

(Restated)) related to intangibles. US$91,000 (2021: US$132,000

(Restated)) of this expenditure related to patent and trademark

applications and licenses. US$11,146,000 (2021: US$8,623,000

(Restated)) related to capitalised development costs.

No intangible assets were disposed by the Group during the

six-month period ended 31 December 2022 (2021: US$1,000).

10 Trade payables

At 31 December 2022, the balance of the trade payables was

US$7,692,000 (30 June 2022: US$11,290,000 (Restated)), of which an

amount of US$7,659,000 (30 June 2022: US$11,264,000 (Restated)) was

aged less than 60 days; and an amount of US$33,000 (30 June 2022:

US$26,000 (Restated)) was aged over 60 days.

11 Lease liabilities

31 Dec 30 June

2022 2022

Unaudited Audited

US$000 US$000

(Restated)

---------- ------------

Current

Lease liabilities 686 653

Non-current

Lease liabilities 2,620 3,000

---------- ------------

Total lease liabilities 3,306 3,653

========== ============

The table below summarises the maturity profile of the Group's

liabilities based on contractual undiscounted payments:

<=6 6-12 >1

AT 31 DEC 2022 months US$000 months year US$000 Total US$000 Carrying

US$000 Value US$000

------------------- ----------------------- ------------ ------------------ -------------------- --------------

Lease liabilities 447 456 3,002 3,905 3,306

======================= ============ ================== ==================== ==============

<=6 6-12 >1

AT 30 JUN 2022 months US$000 months year US$000 Total US$000 Carrying

(Restated) US$000 Value US$000

------------------- ----------------------- ------------ ------------------ -------------------- --------------

Lease liabilities 446 452 3,478 4,376 3,653

======================= ============ ================== ==================== ==============

Notes to the Interim Consolidated Financial Statements -

Unaudited

12 Borrowings - Non-Current

31 Dec 30 June

2022 2022

Unaudited Audited

US$000 US$000

(Restated)

---------- ------------

Convertible Note - Tranche 1 at amortised

cost 22,955 -

Total 22,955 -

========== ============

Movements during the period:

31 Dec 30 June

2022 2022

Unaudited Audited

US$000 US$000

(Restated)

---------- ------------

Opening balance - -

Drawdown during the period 30,000 -

Adjustment of arrangement fees to effective

interest rate (1,202) -

Reclassification to Financial liability at

fair value through profit or loss (6,585) -

Interest amortised during the period 742 -

Closing balance at amortised cost 22,955 -

========== ============

On 4 October 2022, Seeing Machines received funding of US$47.5m

from Magna International in the form of a non-transferable 4-year

convertible note maturing in October 2026 (the "Convertible Note").

The Convertible Note can be drawn down in two tranches across the

4-year term. The Convertible Note has an all-in yield of 8%,

inclusive of fees. The Convertible Note contains standard

covenants, and anti-dilution provisions. The interest due at the

end of the facility can be paid in cash or converted into equity at

Seeing Machines' election.

The first tranche ("Convertible Note - Tranche 1) of US$30m, was

drawn on 5 October 2022 and the remainder is available until

December 2024. The Convertible Note - Tranche 1 is valued at

amortised cost in accordance with AASB 9 Financial Instruments

("AASB 9") and has an effective interest rate as per AASB 9 of

14.4643% per annum inclusive of all fees.

Magna may elect to convert the principal and at Seeing Machines'

election, interest outstanding under the Convertible Note at any

time during its term, up to a maximum of 349,650,350 shares which,

when added to Magna's existing shareholding in the Company, will

represent approximately 9.9% of the fully diluted share capital of

the Company. The conversion will be at a price of 11 British pence

per share. The option provided to Magna is deemed to be an embedded

derivative and is accounted for as a financial liability at fair

value through profit or loss. Refer to Note 13 below.

13 Financial liability at fair value through profit or loss

31 Dec 30 June

2022 2022

Unaudited Audited

US$000 US$000

(Restated)

---------- ------------

Option component of Convertible Note - Tranche

1 7,389 -

Total 7,389 -

========== ============

Movements during the period:

31 Dec 30 June

2022 2022

Unaudited Audited

US$000 US$000

(Restated)

---------- ------------

Opening balance - -

Reclassification from Borrowings - Non-Current 6,585 -

Movement in fair value 804 -

Closing balance 7,389 -

========== ============

Notes to the Interim Consolidated Financial Statements -

Unaudited

14 Dividends paid

No interim dividends or distributions have been made to members

during the six-month period ended 31 December 2022 (2021: nil) and

no interim dividends or distributions have been recommended or

declared by the directors in respect of the six-month period ended

31 December 2022 (2021: nil).

15 Earnings per share

The following table reflects the income and share data used in

the basic and diluted earnings per share computations:

Earnings used in calculating earnings per share

Consolidated

2022 2021

US$000 US$000

FOR THE SIX-MONTH PERIODED 31 DECEMBER (Restated)

-------------------------------------------- ------------------ ------------------

For basic and diluted earnings per share:

Net loss (5,423) (10,128)

Net loss attributable to ordinary equity

holders of the Company (5,423) (10,128)

Weighted average number of shares

2022 2021

AT 31 DECEMBER Thousands Thousands

-------------------------------------------- ------------------ ------------------

Weighted average number of ordinary shares

for basic earnings per share 4,156,019 3,931,717

Weighted average number of ordinary shares

adjusted for the effect of

dilution 4,156,019 3,931,717

16 Share capital

Consolidated

31 Dec 30 June

2022 2022

Unaudited Audited

US$000 US$000

(Restated)

--------------------------------------------- ---- ------------------ ------------------

Ordinary shares 240,948 240,948

Total contributed equity 240,948 240,948

Number of ordinary shares

Consolidated

31 Dec 30 June

2022 2022

Unaudited Audited

Thousands Thousands

--------------------------------------------------- ------------------ ------------------

Issued and fully paid 4,156,019 4,156,019

Fully paid shares carry one vote per share

and carry the right to dividends.

The Company has no set authorised share capital

and shares have no par value.

14

Notes to the Interim Consolidated Financial Statements -

Unaudited

17 Share-based payments

LTI 2021 - Performance rights or share options offers -

Executive and key staff

From 1 July 2015, senior staff and other key staff are offered

long term incentive (LTI) performance rights or share options.

Under this structure, the staff are only able to exercise the

rights, and have new ordinary shares issued to them, if any

performance, market and vesting conditions are met. These

conditions typically include a performance condition requiring the

staff member to achieve a minimum "meets expectations" rating and

some rights have included a market condition in the form of a

minimum Target Share Price (TSP). The vesting period ranges from 9

months to 5 years from the end of the relevant financial year or

grant date. Performance rights or options are often offered as part

of the annual remuneration review and may be offered at other

times. Any offer of performance rights or options requires Board

approval and, when granted, is announced to the market.

In November 2021 the Company awarded a total of 64,996,414

performance rights in respect of ordinary shares to Executive and

key staff to be issued at nil cost.

14,845,702 of the performance rights under the LTI have been

awarded in recognition of the past achievement of the Company's

objectives in FY2021. The rights were valued at the spot rate of

the shares at grant date, and the value is amortised over the

vesting period. The rights vest annually over 3 years in equal

tranches with the first vesting date being 1 July 2022 and require

the employee to remain continuously employed by the Company until

each relevant vesting date. If an employee leaves before the rights

vest and the service condition is therefore not met, the rights

lapse.

In some cases, for 'good leavers', determined on a discretionary

basis by management, options are prorated for service in the

current period and that portion are vested on termination, and the

remaining rights are cancelled.

The remaining 50,150,712 performance rights have been granted

under Key Person Agreements in respect of a total of 27 nominated

key people. These people have been identified as having key roles

directly related to the Company's long-term success and the

allocation of accelerated performance rights has been implemented

by the Board to successfully retain these employees and affirm

successful delivery on a range of projects and customer

commitments. These awards have an accelerated grant with delayed

vesting taking place on 1 July 2024 and require the employee to

remain continuously employed by the Company until the vesting date.

If an employee leaves before the rights vest and the service

condition is therefore not met, the rights lapse.

In October 2022 the Company awarded a total of 11,151,003

performance rights in respect of ordinary shares to Executive and

key staff to be issued at no cost. These rights have been awarded

in recognition of the past achievement of the Company's objectives

in FY2022. The rights were valued at the spot rate of the shares at

grant date, and the value is amortised over the vesting period. The

rights vest annually over 3 years in equal tranches with the first

vesting date being 1 July 2023 and require the employee to remain

continuously employed by the Company until each relevant vesting

date. If an employee leaves before the rights vest and the service

condition is therefore not met, the rights lapse.

There is no cash settlement of the rights. The Group accounts

for the Executive Share Plan as an equity-settled plan.

18 Related party disclosures

The following table provides the total amount of transactions

that have been entered into with related parties during the

six-month period ended 31 December 2022 and 2021:

Balance Granted Acquired Balance

1-Jul as Remuneration or sold for 31-Dec

cash

Thousands Thousands Thousands Thousands

--------- --------------------- -------------- ----------

Director shares:

Directors' securities 2022 6,552 - - 6,552

Directors' securities 2021 5,714 - 238 5,952

19 Commitments

As at 31 December 2022, the group had commitments of

US$15,289,000 (31 December 2021: US$23,673,000 (Restated)) relating

to the manufacturing contract for the Group's Guardian 2.1 product

for the period January 2023 to June 2023.

Notes to the Interim Consolidated Financial Statements -

Unaudited

20 Events after the reporting period

There have been no matters that have occurred subsequent to the

reporting date, which have significantly affected, or may

significantly affect, the Group's operations, results or state of

affairs in future periods.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR MZGGFGVMGFZG

(END) Dow Jones Newswires

March 06, 2023 02:00 ET (07:00 GMT)

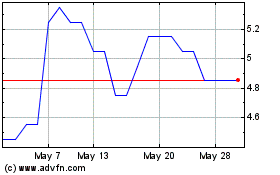

Seeing Machines (AQSE:SEE.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Seeing Machines (AQSE:SEE.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024