Bushveld Minerals Limited AfriTin Working Capital Support Financing - Update (3626J)

August 16 2019 - 7:30AM

UK Regulatory

TIDMBMN

RNS Number : 3626J

Bushveld Minerals Limited

16 August 2019

16 August 2019

Bushveld Minerals Limited

("Bushveld Minerals" or the "Company")

AfriTin Working Capital Support Financing - Update

Bushveld Minerals Limited (AIM: BMN), the AIM listed, integrated

primary vanadium producer, with ownership of high grade vanadium

assets in South Africa, notes that AfriTin Mining Limited

("AfriTin") has today agreed a NAD 35,000,000 (approximately US$2.3

million) working capital facility with Nedbank Namibia ("Nedbank").

Bushveld holds approximately 8% of the total issued share capital

in AfriTin.

On 22 May 2019, the Company announced that it had agreed to

provide a short-term standby working capital support facility to

AfriTin for the amount of ZAR 30,000,000 (approximately US$2.1

million on 22 May 2019). AfriTin has subsequently secured a working

capital facility for the amount of NAD 35,000,000 from Nedbank

Namibia (the "Nedbank Facility"), with the support of Bushveld

Minerals providing to stand surety for the Nedbank Facility to the

value of NAD 30,000,000 (approximately US$2.0 million).

In the unlikely event of default, Nedbank will first call on the

suretyship of the parent company of the AfriTin Group (i.e. AfriTin

Mining Limited). In the event that AfriTin Mining Limited cannot

meets its obligations under the facility, Nedbank will call upon

the Bushveld Minerals suretyship.

The above is less onerous on Bushveld Minerals as it is not a

cash collateralised guarantee. In addition,

the terms agreed for the Working Capital Facility announced on

the 22 May 2019 remain unchanged with respect to Bushveld Minerals.

The Company is comfortable with the progress that AfriTin has made

towards production at its Namibian flagship project and with the

security it retains from AfriTin for the suretyship in the form of

a notarial bond over the AfriTin processing plant.

Enquiries: info@bushveldminerals.com

Bushveld Minerals +27 (0) 11 268 6555

Fortune Mojapelo, Chief Executive

Officer

Chika Edeh, Head of Investor

Relations

SP Angel Corporate Finance

LLP Nominated Adviser & Broker +44 (0) 20 3470 0470

Ewan Leggat / Richard Morrison

Jonathan Williams / Richard

Parlons

Alternative Resource Capital Joint Broker

Rob Collins +44 (0) 207 186 9001

Alex Wood +44 (0) 207 186 9004

BMO Capital Markets Limited Joint Broker +44 (0) 20 7236 1010

Jeffrey Couch / Tom Rider

Michael Rechsteiner / Neil

Elliot

Tavistock Financial PR

Charles Vivian / Gareth Tredway +44 (0) 207 920 3150

Brunswick Financial PR (South Africa)

Miyelani Shikwambana +27 (0) 11 502 7300

ABOUT BUSHVELD MINERALS LIMITED

Bushveld Minerals is a low cost, integrated, primary vanadium

producer, with ownership of high grade vanadium assets.

The Company's flagship vanadium platform includes a 74 per cent

controlling interest in Bushveld Vametco Alloys (Pty) Ltd, a

primary vanadium mining and processing company; the Mokopane

Vanadium Project and the Brits Vanadium Project.

Bushveld's vision is to become a significant, low cost,

integrated primary vanadium producer through owning high grade

assets. This incorporates development and promotion of the role of

vanadium in the growing global energy storage market through

Bushveld Energy, the Company's energy storage solutions provider.

Whilst the demand for vanadium remains largely anchored in the

steel industry, Bushveld Minerals believes there is strong

potential for an imminent and significant global vanadium demand

surge from the fast-growing energy storage market, particularly

through the use and adoption of Vanadium Redox Flow Batteries.

While the Company's focus is on vanadium operations and the

development and promotion of VRFBs, it has additional investments

in coal, power and tin.

The Company's approach to project development recognises that,

whilst attractive project economics are imperative, they are

insufficient to secure capital to bring them to account. A clear

path to production within a visible timeframe, low capital

expenditure requirements and scalability are important factors in

ensuring a positive return on investment. This philosophy is core

to the Company's strategy in developing projects.

Detailed information on the Company and progress to date can be

accessed on the website www.bushveldminerals.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDPFMBTMBTBBBL

(END) Dow Jones Newswires

August 16, 2019 07:30 ET (11:30 GMT)

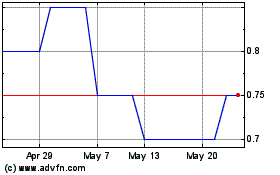

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

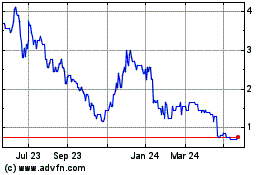

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024