WidePoint Corporation (NYSE American: WYY), the

leading provider of Trusted Mobility Management (TM2) specializing

in Telecommunications Lifecycle Management, Identity Management and

Bill Presentment & Analytics solutions, today reported results

for the second quarter ended June 30, 2019.

Second Quarter 2019 and Recent Operational

Highlights:

- Awarded $5.3 million in federal government contract renewals

and modifications

- Soft-ex, a WidePoint subsidiary, awarded $6.0 million contract

renewal with a global communications service provider to deliver

both cloud and onsite telecom solutions to government and

multinational corporations

- Secured more than $1.3 million in Trusted Mobility Management

(TM2) contracts, the majority of which are high-margin, commercial

contracts

- Received Authority to Operate (ATO) from a major customer to

implement WidePoint’s Intelligent Telecommunications Management

System (ITMS™), which represents the second significant step toward

achieving a FedRAMP certification

Second Quarter 2019 Financial Highlights

(results compared to the same year-ago

period):

- Revenues increased 26% to $22.1 million

- Gross profit increased 14% to $4.1 million

- Net loss totaled $(308,000)

- Adjusted EBITDA, a non-GAAP financial measure, increased to

$0.6 million, marking the company’s eighth consecutive quarter of

positive adjusted EBITDA, and in line with forecast

Six Month 2019 Financial Highlights (results compared to

the same year-ago period):

- Revenues increased 17% to $44.0 million

- Gross profit increased 17% to $8.3 million

- Net income totaled $76,000

- Adjusted EBITDA totaled $1.6 million

Second Quarter 2019 Financial Summary

|

|

|

|

|

|

|

| (in

millions, except per share amounts) |

June 30, 2019 |

|

|

June 30, 2018 |

|

|

|

(Unaudited) |

|

|

Revenues |

$ |

22.1 |

|

|

$ |

17.5 |

|

|

Gross Profit |

$ |

4.1 |

|

|

$ |

3.5 |

|

|

Gross Profit Margin |

18 |

% |

|

20 |

% |

|

Operating Expenses |

$ |

4.2 |

|

|

$ |

4.0 |

|

|

Income (Loss) from Operations |

$ |

(0.2 |

) |

|

$ |

(0.4 |

) |

|

Net Income (Loss) |

$ |

(0.3 |

) |

|

$ |

(0.5 |

) |

|

Basic and Diluted Earnings per Share (EPS) |

$ |

0.00 |

|

|

$ |

(0.01 |

) |

|

Adjusted EBITDA |

$ |

0.6 |

|

|

$ |

0.1 |

|

Six Month 2019 Financial Summary

|

|

|

|

|

|

|

| (in

millions, except per share amounts) |

June 30, 2019 |

|

|

June 30, 2018 |

|

|

|

(Unaudited) |

|

|

Revenues |

$ |

44.0 |

|

|

$ |

37.6 |

|

|

Gross Profit |

$ |

8.3 |

|

|

$ |

7.1 |

|

|

Gross Profit Margin |

19 |

% |

|

19 |

% |

|

Operating Expenses |

$ |

8.0 |

|

|

$ |

8.0 |

|

|

Income (Loss) from Operations |

$ |

0.3 |

|

|

$ |

(0.9 |

) |

|

Net Income (Loss) |

$ |

0.1 |

|

|

$ |

(0.9 |

) |

|

Basic and Diluted Earnings per Share (EPS) |

$ |

0.00 |

|

|

$ |

(0.01 |

) |

|

Adjusted EBITDA |

$ |

1.6 |

|

|

$ |

0.2 |

|

The following statements are forward-looking, and actual results

could differ materially depending on market conditions and the

factors set forth under the “Safe Harbor Statement” below.

Financial OutlookFor the fiscal year ending

December 31, 2019, the company is reiterating its revenue guidance

of $90.0 million to $93.0 million, representing growth of 8% to

12%. The company is also reiterating its adjusted EBITDA guidance

of $2.75 million to $3.5 million, which represents an improvement

compared to fiscal 2018. The increase in adjusted EBITDA reflects

the company’s strategic investments in sales and marketing and

product development to accelerate growth, as well as a $400,000

increase due to new Financial Accounting Standards Board (FASB)

guidance regarding the treatment of capital lease. The company’s

financial outlook is based on current expectations.

Management Commentary“The second quarter was a

continuation of the strong performance we established at the start

of the year as we delivered another solid period of financial

results, expanded several contracts with current customers, and

continued to improve upon our already industry-leading

credentials,” said WidePoint’s CEO, Jin Kang. “From a financial

perspective, the quarter was highlighted by a 26% increase in

revenues, a 14% increase in gross profit, and our eighth

consecutive quarter of positive adjusted EBITDA.

“Operationally, we successfully re-secured and expanded several

contracts with current customers in both the government and

commercial sectors. These contract expansions and the positive

effects they have on our financial results show that our

cross-selling and upselling strategies continue to be an effective

means of increasing our topline as we simultaneously remain

conscientious of their effects on our bottom-line. Additionally, we

received an ATO from a major customer to implement ITMS™, which is

a major step toward ultimately receiving a FedRAMP

certification.

“Overall, we remain confident that we will be able to continue

to execute on our primary strategic initiatives throughout the

course of the year to accelerate growth, improve margins, and drive

higher profitability in the long-run.”

Conference CallWidePoint management will hold a

conference call today (August 14, 2019) at 4:30 p.m. Eastern time

(1:30 p.m. Pacific time) to discuss these results.

WidePoint President and CEO Jin Kang, Chief Sales and Marketing

Officer Jason Holloway, and President and CEO of Soft-ex

Communications and WidePoint Interim CFO Ian Sparling will host the

conference call, followed by a question and answer period.

U.S. dial-in number: 844-369-8770International number:

862-298-0840

Please call the conference telephone number 5-10 minutes prior

to the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact Gateway Investor Relations at

949-574-3860.

The conference call will be broadcast live and available for

replay here and via the investor relations section of the company’s

website.

A replay of the conference call will be available after 7:30

p.m. Eastern time on the same day through August 21, 2019.

Toll-free replay number: 877-481-4010International replay

number: 919-882-2331Replay ID: 51160

About WidePointWidePoint Corporation (NYSE

American: WYY) is a leading provider of trusted mobility management

(TM2) solutions, including telecom management, mobile management,

identity management, and bill presentment and analytics. For more

information, visit widepoint.com.

Non-GAAP Financial MeasuresWidePoint uses a

variety of operational and financial metrics, including non-GAAP

financial measures such as Adjusted EBITDA, to enable it to analyze

its performance and financial condition. The presentation of

non-GAAP financial information should not be considered in

isolation or as a substitute for, or superior to, the financial

information prepared and presented in accordance with GAAP. A

reconciliation of GAAP Net loss to Adjusted EBITDA is included on

the schedules attached hereto.

| |

|

|

|

THREE MONTHS ENDED |

|

|

SIX MONTHS ENDED |

|

| |

|

|

|

JUNE 30, |

|

|

JUNE 30, |

|

|

|

|

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

| NET (LOSS)

INCOME |

$ |

(307,800 |

) |

|

$ |

(472,200 |

) |

|

$ |

76,300 |

|

|

$ |

(934,400 |

) |

| Adjustments to

reconcile net (loss) income to EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

| |

Depreciation and

amortization |

477,100 |

|

|

368,600 |

|

|

949,800 |

|

|

762,000 |

|

| |

Amortization of

deferred financing costs |

1,200 |

|

|

7,000 |

|

|

2,500 |

|

|

14,800 |

|

| |

Income tax

provision (benefit) |

66,500 |

|

|

14,700 |

|

|

94,500 |

|

|

20,900 |

|

| |

Interest

income |

(200 |

) |

|

(2,100 |

) |

|

(4,700 |

) |

|

(5,400 |

) |

| |

Interest

expense |

74,200 |

|

|

23,900 |

|

|

152,900 |

|

|

49,900 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

$ |

311,000 |

|

|

$ |

(60,100 |

) |

|

$ |

1,271,300 |

|

|

$ |

(92,200 |

) |

| Other adjustments

to reconcile net (loss) income to Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

| |

Provision for

doubtful accounts |

3,600 |

|

|

- |

|

|

11,200 |

|

|

(5,800 |

) |

| |

Stock-based

compensation expense |

284,100 |

|

|

195,900 |

|

|

320,300 |

|

|

320,300 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA |

$ |

598,700 |

|

|

$ |

135,800 |

|

|

$ |

1,602,800 |

|

|

$ |

222,300 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Safe Harbor StatementThe information contained

in any materials that may be accessed above was, to the best of

WidePoint Corporations’ knowledge, timely and accurate as of the

date and/or dates indicated in such materials. However, the passage

of time can render information stale, and you should not rely on

the continued accuracy of any such materials. WidePoint Corporation

has no responsibility to update any information contained in any

such materials. In addition, you should refer to periodic reports

filed by WidePoint Corporation with the Securities and Exchange

Commission for information regarding the risks and uncertainties to

which forward-looking statements made in such materials are

subject. Such risks and uncertainties may cause WidePoint

Corporation’s actual results to differ materially from those

described in the forward-looking statements.

Investor Relations:Gateway Investor

RelationsMatt Glover or Charlie

Schumacher949-574-3860WYY@gatewayir.com

WIDEPOINT CORPORATION AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS

|

|

JUNE 30, |

|

|

DECEMBER 31, |

|

|

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

ASSETS |

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

5,422,065 |

|

|

$ |

2,431,892 |

|

|

Accounts receivable, net of allowance for doubtful

accounts |

|

|

|

|

|

|

of $117,120 and $106,733 in 2019 and 2018, respectively |

7,868,097 |

|

|

11,089,315 |

|

|

Unbilled accounts receivable |

11,259,905 |

|

|

9,566,170 |

|

|

Other current assets |

1,254,269 |

|

|

1,086,686 |

|

|

|

|

|

|

|

|

|

Total current assets |

25,804,336 |

|

|

24,174,063 |

|

|

|

|

|

|

|

|

|

NONCURRENT ASSETS |

|

|

|

|

|

|

Property and equipment, net |

658,074 |

|

|

1,012,684 |

|

|

Operating lease right of use asset, net |

5,827,822 |

|

|

- |

|

|

Intangibles, net |

2,826,141 |

|

|

3,103,753 |

|

|

Goodwill |

18,555,578 |

|

|

18,555,578 |

|

|

Other long-term assets |

142,952 |

|

|

209,099 |

|

|

|

|

|

|

|

|

|

Total assets |

$ |

53,814,903 |

|

|

$ |

47,055,177 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

Accounts payable |

$ |

6,575,453 |

|

|

$ |

7,363,621 |

|

|

Accrued expenses |

12,369,314 |

|

|

10,716,438 |

|

|

Deferred revenue |

2,065,446 |

|

|

2,072,344 |

|

|

Current portion of operating lease liabilities |

420,932 |

|

|

107,325 |

|

|

Current portion of other term obligations |

36,049 |

|

|

192,263 |

|

|

|

|

|

|

|

|

|

Total current liabilities |

21,467,194 |

|

|

20,451,991 |

|

|

|

|

|

|

|

|

| NONCURRENT LIABILITIES |

|

|

|

|

|

|

Operating lease liabilities, net of current portion |

5,534,028 |

|

|

122,040 |

|

|

Other term obligations, net of current portion |

- |

|

|

73,952 |

|

|

Deferred revenue |

381,261 |

|

|

466,714 |

|

|

Deferred tax liability |

1,581,020 |

|

|

1,523,510 |

|

|

|

|

|

|

|

|

|

Total liabilities |

28,963,503 |

|

|

22,638,207 |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares |

|

|

|

|

|

|

authorized; 2,045,714 shares issued and none outstanding |

- |

|

|

- |

|

|

Common stock, $0.001 par value; 110,000,000 shares |

|

|

|

|

|

|

authorized; 84,775,186 and 84,112,446 shares |

|

|

|

|

|

|

issued and outsanding, respectively |

84,776 |

|

|

84,113 |

|

|

Additional paid-in capital |

95,299,274 |

|

|

94,926,560 |

|

|

Accumulated other comprehensive loss |

(201,772 |

) |

|

(186,485 |

) |

|

Accumulated deficit |

(70,330,878 |

) |

|

(70,407,218 |

) |

|

|

|

|

|

|

|

|

Total stockholders’ equity |

24,851,400 |

|

|

24,416,970 |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

$ |

53,814,903 |

|

|

$ |

47,055,177 |

|

WIDEPOINT CORPORATION AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

| |

THREE MONTHS ENDED |

|

|

SIX MONTHS ENDED |

|

| |

JUNE 30, |

|

|

JUNE 30, |

|

| |

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

| |

(Unaudited) |

| REVENUES |

$ |

22,093,153 |

|

|

$ |

17,544,338 |

|

|

$ |

44,010,055 |

|

|

$ |

37,623,957 |

|

| COST OF REVENUES

(including amortization and depreciation of |

|

|

|

|

|

|

|

|

|

|

|

| |

$232,968,

$258,201, $465,159, and $554,165, respectively) |

18,036,409 |

|

|

13,997,185 |

|

|

35,699,468 |

|

|

30,524,797 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS PROFIT |

4,056,744 |

|

|

3,547,153 |

|

|

8,310,587 |

|

|

7,099,160 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

| |

Sales and marketing |

415,462 |

|

|

444,945 |

|

|

808,873 |

|

|

979,582 |

|

| |

General and administrative expenses (including share-based |

|

|

|

|

|

|

|

|

|

|

|

| |

|

compensation of

$284,111, $195,934, $373,377 and $320,338, respectively) |

3,563,405 |

|

|

3,427,301 |

|

|

6,698,114 |

|

|

6,780,642 |

|

| |

Depreciation and amortization |

244,064 |

|

|

110,463 |

|

|

484,612 |

|

|

207,849 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total operating expenses |

4,222,931 |

|

|

3,982,709 |

|

|

7,991,599 |

|

|

7,968,073 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (LOSS) INCOME FROM

OPERATIONS |

(166,187 |

) |

|

(435,556 |

) |

|

318,988 |

|

|

(868,913 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER (EXPENSE)

INCOME |

|

|

|

|

|

|

|

|

|

|

|

| |

Interest

income |

259 |

|

|

2,077 |

|

|

4,721 |

|

|

5,403 |

|

| |

Interest

expense |

(75,372 |

) |

|

(23,937 |

) |

|

(152,917 |

) |

|

(49,887 |

) |

| |

Other income |

(9 |

) |

|

3 |

|

|

- |

|

|

1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total other expense |

(75,122 |

) |

|

(21,857 |

) |

|

(148,196 |

) |

|

(44,483 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (LOSS) INCOME

BEFORE INCOME TAX PROVISION |

(241,309 |

) |

|

(457,413 |

) |

|

170,792 |

|

|

(913,396 |

) |

| INCOME TAX

PROVISION |

66,452 |

|

|

14,758 |

|

|

94,452 |

|

|

20,948 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET (LOSS)

INCOME |

$ |

(307,761 |

) |

|

$ |

(472,171 |

) |

|

$ |

76,340 |

|

|

$ |

(934,344 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BASIC EARNINGS

(LOSS) PER SHARE |

$ |

(0.00 |

) |

|

$ |

(0.01 |

) |

|

$ |

0.00 |

|

|

$ |

(0.01 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BASIC

WEIGHTED-AVERAGE SHARES OUTSTANDING |

83,990,722 |

|

|

83,081,597 |

|

|

83,902,077 |

|

|

83,061,707 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DILUTED EARNINGS

(LOSS) PER SHARE |

$ |

(0.00 |

) |

|

$ |

(0.01 |

) |

|

$ |

0.00 |

|

|

$ |

(0.01 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DILUTED

WEIGHTED-AVERAGE SHARES OUTSTANDING |

83,990,722 |

|

|

83,081,597 |

|

|

83,965,994 |

|

|

83,061,707 |

|

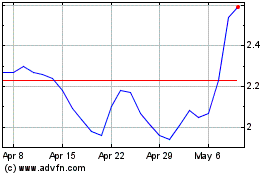

WidePoint (AMEX:WYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

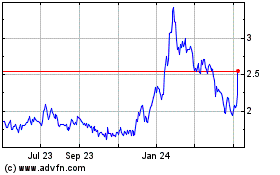

WidePoint (AMEX:WYY)

Historical Stock Chart

From Apr 2023 to Apr 2024