Current Report Filing (8-k)

April 12 2019 - 4:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 12,

2019

_________________

WIDEPOINT CORPORATION

(Exact

Name of Registrant as Specified in Charter)

|

Delaware

|

|

001-33035

|

|

52-2040275

|

|

(State or Other

Jurisdiction of Incorporation)

|

|

(Commission File

Number)

|

|

(I.R.S.

EmployerIdentification No.)

|

|

11250 Waples Mill Rd., South Tower, Suite 210, Fairfax,

Virginia

|

|

22030

|

|

(Address

of Principal Executive Office)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code:

(703) 349-2577

______________________________________________________________________________

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of

1934 (§240.12b-2 of this chapter). Emerging growth company

☐

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act.

☐

Item 5.02(b) and (c) Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

On

April 12, 2019, WidePoint Corporation (the “Company”)

accepted the resignation of Kito Mussa as the Company’s Chief

Financial Officer and Executive Vice President to pursue other

opportunities effective May 15, 2019. Mr. Mussa’s resignation

was not a result of any disagreement with the Company. The Company

intends to conduct a search for a new Chief Financial

Officer.

In the

interim, effective May 15, 2019, the Company appointed Ian

Sparling, age 53, to the position of interim Chief Financial

Officer. Mr. Sparling has served as the President and CEO of the

Company’s subsidiary, Soft-ex Communications Ltd

(“SCL”), since 2006. Prior to his role as CEO of SCL,

Mr. Sparling held the positions of Chief Commercial Officer and CFO

at SCL. He was also Group Financial Controller at a large public

quoted (LSE) European Industrial Holding Company and worked in

assurance for a number of years with PricewaterhouseCoopers. In

addition, Mr. Sparling has acted as a Board Advisor to a number of

internationally traded Irish companies. Mr. Sparling is a Fellow of

the Institute of Chartered Accountants, holds a Bachelor of

Commerce degree from University College Dublin and a post graduate

in Professional Finance from the Smurfit Business School. He also

holds a Diploma in International Selling from Dublin Institute of

Technology and is currently studying for a Diploma in Corporate

Governance with the Institute of Directors (UK).

The

Company is party to an employment agreement with Mr. Sparling to

serve as the Chief Executive Officer of SCL. The employment

agreement provides for an annual base salary of €200,000. In

addition, Mr. Sparling shall be eligible to receive bonus

compensation of up to 100% of his annual salary. Mr. Sparling will

also receive an annual automobile allowance in the amount

€16,500 and SCL will contribute up to €15,000 to

SCL’s pension scheme. The employment period will continue

unless terminated earlier by (i) Mr. Sparling upon not less than 3

months’ advance written notice or SCL upon not less than 9

months’ advance written notice, (ii) SCL or Mr. Sparling with

Good Reason (as defined therein), immediately, provided that the

remuneration to which Mr. Sparling is entitled under the Employment

Agreement shall continue for a period of 9 months following such

termination (which shall be increased to 12 months if within a

specified period of a change in control), or (iii) by SCL upon the

occurrence of certain events or actions by Mr. Sparling, including

Mr. Sparling being declared bankrupt or being found guilty of

fraud, serious misconduct or willful neglect to carry out his

duties under the employment agreement. A copy of the employment

agreement is filed herewith as Exhibit 10.1 and the foregoing

description is qualified by reference to the full text thereof.

There is no family relationship between Mr. Sparling and any

director, executive officer or person nominated or chosen by the

registrant to become a director or executive officer of the

registrant.

Item 9.01(d) Financial Statements and Exhibits

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the Registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

WIDEPOINT

CORPORATION

|

|

|

|

|

|

|

|

Date:

April 12,

2019

|

By:

|

/s/

Jin Kang

|

|

|

|

|

Jin

Kang

|

|

|

|

|

Chief

Executive Officer

|

|

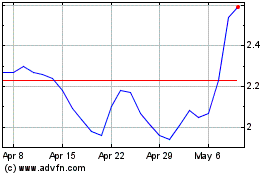

WidePoint (AMEX:WYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

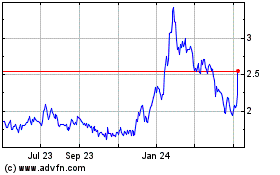

WidePoint (AMEX:WYY)

Historical Stock Chart

From Apr 2023 to Apr 2024