Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

September 15 2022 - 4:16PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-262550

Prospectus Supplement

(To the Prospectus Dated February 10, 2022)

37,500,000 Shares of Common Stock

Under that certain prospectus, dated February 10, 2022 (the “Prospectus”), filed as part of our registration statement on Form S-1 (File No. 333-262550), NovaBay Pharmaceuticals, Inc. (the “Company”) registered for resale, from time to time, by the selling stockholders of up to 37,500,000 shares (the “Warrant Shares”) of the Company’s common stock, par value $0.01 per share (the “Common Stock”), underlying the warrants (the “Warrants”) issued by the Company pursuant to the Securities Purchase Agreement, dated October 29, 2021, that was entered into by the Company and each of the selling stockholders (the “Original Investors”).

This prospectus supplement (this “Supplement”) modifies, supersedes and supplements certain information contained or incorporated by reference in the Prospectus. This Supplement should be read in conjunction with the Prospectus, which is to be delivered with this Supplement. If there is any inconsistency between the information in the Prospectus and this Supplement, you should rely on the information in this Supplement. This Supplement is not complete without, and may only be delivered or utilized in connection with, the Prospectus, including any future amendments or supplements to it. You should read the entire Prospectus and any amendments or supplements carefully before you make an investment decision.

Our Common Stock is listed on the NYSE American under the symbol “NBY.” The last reported sale price of our Common Stock on September 13, 2022 was $0.18 per share.

Investing in our Common Stock involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks that we have described under the caption “Risk Factors” on page 8 of the Prospectus and in the documents incorporated by reference into the Prospectus and in any amendments or supplements to it.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this Supplement or the Prospectus. Any representation to the contrary is a criminal offense.

WARRANT REPRICE AND EXERCISE TRANSACTION

As disclosed in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on September 13, 2022 (the “Current Report”), the Company and all of the Original Investors (the “Participants”) entered into separate warrant repricing letter agreements with the Company, dated September 9, 2022 (the “Reprice Letter Agreements”). Pursuant to the Reprice Letter Agreements, the Company agreed with each Participant to amend their respective Warrants (the “Amended Warrants”) to (i) reduce the exercise price from $0.53 per Warrant Share to $0.18 per Warrant Share (the “Reduced Exercise Price”), (ii) extend the termination date until September 11, 2028 and (iii) provide for an exercise limitation after the Initial Exercise (as defined below) until the later of six months and the date on which the Company’s stockholders at a duly called meeting approve a reverse stock split of Common Stock that becomes effective and such other stockholder approvals as may be required to comply with the continued listing rules of the NYSE American Company Guide, and such approvals become effective, including under the laws of the State of Delaware as applicable. The Reprice Letter Agreements also provided for the Participants to make a cash exercise of their Amended Warrant for 25% of the shares of Common Stock underlying their Amended Warrants at the Reduced Exercise Price (the “Initial Exercise”) and to receive a new Common Stock purchase warrant to purchase a number of shares of Common Stock equal the shares of Common Stock received by such Participant in its Initial Exercise. As a result of the Initial Exercise by the Participants of an aggregate of 9,375,000 Warrant Shares, the Company received aggregate gross proceeds of approximately $1.7 million. The new warrants and the issuance of the underlying shares of Common Stock to Participants will be separately registered for resale in a registration statement to be filed by the Company pursuant to the Reprice Letter Agreement. This warrant reprice transaction is part of other financing transactions entered into by the Company at the same time, including another warrant reprice transaction and a private placement of Company securities, as more fully described in the Current Report.

This Supplement is being filed to update the information in the Prospectus with the information summarized above and contained in the Current Report.

The date of this prospectus supplement is September 15, 2022.

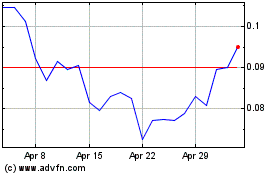

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Apr 2023 to Apr 2024