New Concept Energy, Inc. (NYSE MKT: GBR), (the “Company” or

“NCE”) a Dallas-based oil and gas company, today reported net

income for the three months ended June 30, 2015 of $110,000 or

$0.06 per share, compared to a net loss of $99,000 or $0.05 per

share for the three months ended June 30, 2014. Included in 2015

was income for a recovery of bad debt expense of $384,000.

For the six months ended June 30, 2015 the Company reported net

income of $424,000 or $0.22 per share as compared to a net loss of

$139,000 or $0.07 per share for the three months ended June 30,

2014.

Operating expenses included non-cash depletion, depreciation and

amortization of $333,000 and $338,000 in 2015 and 2014

respectively.

For the three months ended June 30, 2015, the Company recorded

oil and gas revenues, net of royalty expenses of $259,000 as

compared to $485,000 for the comparable period of 2014. The decline

in oil and gas revenue was principally due to the price the Company

was receiving for its oil sales in 2015 as compared to 2014

The Company recorded revenues of $744,000 for the three months

ended June 30, 2015 from its retirement property compared to

$728,000 for the comparable period in 2014. The increase was

primarily due to rate increases.

For the three months ended June 30, 2015, the Company recorded

oil and gas operating expenses of $440,000 as compared to $425,000

for the comparable period of 2014.

For the three months ended June 30, 2015, operating expenses at

the retirement property were $628,000 as compared to $619,000 for

the comparable period in 2014. The increases in operating expenses

were due to an overall increase in non-payroll related

expenses.

For the three months ended June 30, 2015, corporate general

& administrative expenses were $155,000 as compared to $205,000

for the comparable period in 2014. The decrease is primarily due to

a reduction in legal costs.

In 2011 the Company had a $10.3 million note receivable and

determined that the financial condition of the debtor had

deteriorated and there could be no assurance that the amount owed

would or could be collected. At that time the Company recorded a

loss and established a reserve of $10.3 million. In 2013 and

2012 the Company recorded a gain from the partial recovery of the

previously reserved note receivable of $1.6 million and $2.1

million respectively. For the first and second quarters ended June

30, 2015 the company recorded an additional recovery of $738,000

and $386,000 respectively.

NEW CONCEPT

ENERGY, INC AND SUBSIDIARIES CONSOLIDATED STATEMENT OF

OPERATIONS (unaudited) (amounts in thousands, except

per share data) For the Three Months For the

Six Months ended June 30, ended June 30,

2015 2014 2015 2014 Revenue Oil

and gas operations, net of royalties $ 259 $ 485 $ 431 $ 829 Real

estate operations 744 728 1,461

1,453 1,003 1,213

1,892 2,282

Operating

expenses Oil and gas operations 440 425 910 908 Real estate

operations 415 387 825 783 Real Estate - Lease Expense 245 241 490

481 Corporate general and administrative 155

205 309 397 1,255

1,258 2,534 2,569

Operating earnings (loss) (252 ) (45 ) (642 ) (287 )

Other income (expense) Interest income - 1 - 2 Interest

expense (16 ) (22 ) (42 ) (53 ) Recovery of bad debt expense 386 -

1,124 - Other income (expense) (8 ) (33 ) (16

) 199 362 (54 ) 1066

148 Net income (loss) applicable

to common shares $ 110 $ (99 ) $ 424 $ (139 )

Net income (loss) per common share-basic and diluted $ 0.06

$ (0.05 ) $ 0.22 $ (0.07 ) Weighted average

common and equivalent shares outstanding - basic 1,947 1,947 1,947

1,947

NEW CONCEPT ENERGY,

INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS

(unaudited) (amounts in thousands) June

30, December 31, 2015 2014

Assets Current assets Cash and cash

equivalents $ 437 $ 300 Accounts receivable from oil and gas sales

137 216 Other current assets 362 182

Total current

assets 936 698

Oil and natural

gas properties (full cost accounting method) Proved developed

and undeveloped oil and gas properties, net of depletion 8,776

8,809

Property and equipment, net of depreciation

Land, buildings and equipment - oil and gas operations 845 1,476

Other 152 162

Total property and equipment 997

1,638

Other assets (including $124 due from related

parties in 2014) 1,275 1,129

Total

assets $ 11,984 $ 12,274

NEW CONCEPT ENERGY, INC. AND SUBSIDIARIES CONSOLIDATED

BALANCE SHEETS - CONTINUED (unaudited) (amounts in

thousands, except share amounts)

June 30,2015

December 31,2014

Liabilities and stockholders' equity

Current liabilities Accounts payable (includes $494 due to

related parties in 2014) $ 165 $ 673 Accrued expenses 252 229

Current portion of long term debt 775 881

Total current liabilities 1,192 1,783

Long-term debt Notes payable less current portion 1,305

1,428 Asset retirement obligation 2,770 2,770

Total liabilities 5,267 5,981

Stockholders'

equity Preferred stock, Series B 1 1

Common stock, $.01 par value; authorized,

100,000,000 shares; issued and outstanding, 1,946,935 shares at

June 30, 2015 and December 31, 2014

20 20 Additional paid-in capital 58,838 58,838 Accumulated deficit

(52,142 )

(52,566 )

6,717 6,293

Total liabilities & equity $ 11,984 $ 12,274

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150812006341/en/

New Concept Energy Inc.Investor RelationsGene Bertcher,

800-400-6407info@newconceptenergy.com

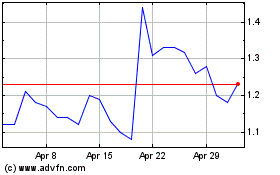

New Concept Energy (AMEX:GBR)

Historical Stock Chart

From May 2024 to Jun 2024

New Concept Energy (AMEX:GBR)

Historical Stock Chart

From Jun 2023 to Jun 2024