New Concept Energy, Inc. (NYSE MKT: GBR), (the “Company” or

“NCE”) a Dallas-based oil and gas company, today reported net

income for the three months ended June 30, 2013 of $138,000 or

$0.07 per share, compared to a net loss of $169,000 or $(0.09) per

share for the three months ended June 30, 2012.

For the three months ended June 30, 2013, the Company recorded

oil and gas revenues, net of royalty expenses of $384,000 as

compared to $325,000 for the comparable period of 2012. The changes

in oil and gas revenue was due to new oil wells that were drilled

in late 2012.

The Company recorded revenues of $666,000 for the three months

ended June 30, 2013 from its retirement property compared to

$663,000 for the comparable period in 2012.

For the three months ended June 30, 2013, the Company recorded

oil and gas operating expenses of $493,000 as compared to $453,000

for the comparable period of 2012. The increase was partially due

to an increase in depletion expense of $20,000. The marked decrease

in the market price being paid for natural gas resulted in a

modification in the valuation the Company placed on its gas

reserves which impacted the anticipated production life of its

wells. This led to an acceleration of the depletion expense being

recorded. The balance of the increases in operating expenses were

due to an overall increase in non-payroll related expenses.

For the three months ended June 30, 2013, operating expenses at

the retirement property were $383,000 as compared to $353,000 for

the comparable period in 2012. The increases in operating expenses

were due to an overall increase in non-payroll related

expenses.

For the three months ended June 30, 2013, corporate general

& administrative expenses were $170,000 as compared to $134,000

for the comparable period in 2012. The increase is primarily due to

legal fees incurred by the company to defend itself against certain

lawsuits.

For the three months ended June 30, 2013, the Company recorded a

bad debt expense recovery of $394,000 with respect to a note

receivable that was fully reserved in 2011. During 2012 and the

first six months of 2013 the Company has received $2.8 million in

payments toward recovery of the note.

NEW CONCEPT ENERGY, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (unaudited) (amounts

in thousands)

June 30,2013

December 31,2012

Assets Current assets Cash and cash

equivalents $ 960 $ 398 Accounts receivable from oil and gas sales

236 210 Other current assets 6 2

Total current

assets 1,202 610

Oil and natural

gas properties (full cost accounting method) Proved developed

and undeveloped oil and gas properties, net of depletion 9,432

9,717

Property and equipment, net of depreciation

Land, buildings and equipment - oil and gas operations 1,461 1,410

Other 193 204

Total property and equipment

1,654 1,614

Other assets (including $119,625

and $161,300 due from related parties in 2013 and 2012

576 543

Total assets $ 12,864 $ 12,484

NEW CONCEPT ENERGY, INC. AND

SUBSIDIARIES CONSOLIDATED BALANCE SHEETS - CONTINUED

(unaudited) (amounts in thousands, except share

amounts)

June 30,2013

December 31,2012

Liabilities and stockholders' equity

Current liabilities Accounts payable - trade $ 137 $ 38

Accrued expenses 232 173 Current portion of long term debt

48 93

Total current liabilities 417 304

Long-term debt Notes payable less current portion

2,321 2,273 Asset retirement obligation 2,770 2,770 Other long-term

liabilities 541 491

Total

liabilities 6,049 5,838

Stockholders' equity

Preferred stock, Series B 1 1 Common stock, $.01 par value;

authorized, 100,000,000 shares; issued and outstanding, 1,946,935

shares at June 30, 2013 and December 31, 2012 20 20 Additional

paid-in capital 58,838 58,838 Accumulated deficit

(52,044 ) (52,213

) 6,815

6,646 Total liabilities &

equity $ 12,864 $ 12,484

NEW CONCEPT ENERGY, INC AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF OPERATIONS (unaudited)

(amounts in thousands, except per share data)

For the Three Monthsended June

30,

For the Six Monthsended June

30,

2013 2012 2013 2012 Revenue Oil

and gas operations, net of royalties $ 384 $ 325 $ 724 $ 615 Real

estate operations 666 663 1,346

1,337 1,050 988

2,070 1,952

Operating

expenses Oil and gas operations 493 453 949 924 Real estate

operations 383 353 769 719 Lease expense 236 231 472 462 Corporate

general and administrative 170 134 343 293 Accretion of asset

retirement obligation - 34 - 68 Impairment of natural gas and oil

properties - - -

912 1,282 1,205 2,533

3,378 Operating earnings (loss) (232 ) (217 )

(463 ) (1,426 )

Other income (expense)

Interest income 2 - 8 - Interest expense (24 ) (56 ) (73 ) (118 )

Recovery of bad debt expense 394 - 733 - Other income (expense),

net (2 ) 104 (36 ) 108

Other income (expense) 370 48

632 (10 )

Net income (loss) applicable to common

shares

$ 138 $ (169 ) $ 169 $ (1,436 )

Net income (loss) per common share-basic

and diluted

$ 0.07 $ (0.09 ) $ 0.09 $ (0.74 ) Weighted

average common and equivalent shares outstanding - basic 1,947

1,947 1,947 1,947

New Concept Energy Inc.Gene Bertcher,

972-407-8400info@newconceptenergy.comorInvestor Relations,

800-400-6407

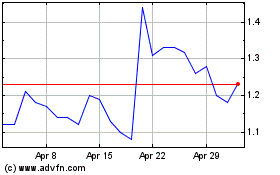

New Concept Energy (AMEX:GBR)

Historical Stock Chart

From May 2024 to Jun 2024

New Concept Energy (AMEX:GBR)

Historical Stock Chart

From Jun 2023 to Jun 2024