New Concept Energy, Inc. (AMEX:GBR), ( the “Company” or “NCE”) a

Dallas-based oil and gas company, today reported a net loss for the

three months ended March 31, 2012 of $1.3 million or $(0.65) per

share, compared to net income of $97,000 or $0.05 per share for the

three months ended March 31, 2011.

During the past few years the exploration, development and

production of natural gas has resulted in an oversupply of natural

gas which has resulted in a substantial reduction in the market

price. Management of the Company believes that this oversupply will

last for some time and does not anticipate an increase in the price

we can receive in the market place. In April 2012 the Company

entered into an agreement to fix the price it receives for the sale

of its gas. For the five years ended April 2017, the Company will

receive $4.53 per MCF. While the lock-in price is approximately 40%

higher than the current price paid to the company when applying the

new price using the formula mandated by the accounting rules, which

includes a 10% present value factor, the result is a reduction of

$912,000 in the accounting value of the Company’s recorded

interests in its oil and gas properties. This accounting reduction

in value has been reflected in the financial statements of the

company as of March 31, 2012.

For the three months ended March 31, 2012, the Company recorded

oil and gas revenues of $290,000 as compared to $280,000 for the

comparable period of 2011. The changes in oil & gas revenue

were due to an increase of approximately $70,000 due to new oil

wells that were drilled in late 2011 and a decrease of

approximately $60,000 due to lower prices being received for the

sale of our natural gas.

The Company recorded revenues of $674,000 for the three months

ended March 31, 2012 from its retirement property compared to

$729,000 for the comparable period in 2011. The decrease was due

almost entirely to a reduction in the number of residents in the

facility.

For the three months ended March 31, 2012, the Company recorded

oil and gas operating expenses of $471,000 as compared to $335,000

for the comparable period of 2011. The increase was principally due

to an increase in depletion expense. The marked decrease in the

market price being paid for natural gas resulted in a modification

in the valuation the company placed on its gas reserves which

impacted the anticipated production life of its wells. This led to

an acceleration of the depletion expense being recorded.

For the three months ended March 31, 2012, operating expenses

and lease expense at the retirement property were $597,000 as

compared to $581,000 for the comparable period in 2011. The

increase was due to an increase in the lease payment being recorded

on the property of $40,000 offset by a general reduction in

operating costs.

For the three months ended March 31, 2012, corporate general

& administrative expenses were $159,000 as compared to $124,000

for the comparable period in 2011. The increase is primarily due to

legal fees incurred by the company to defend itself against certain

lawsuits.

For the three months ended March 31, 2012, interest income was

$0 as compared to $119,000 for the comparable period in 2011. In

December 2011 the Company became concerned about the collectability

of a certain note receivable and determined that the note and any

accrued interest be fully reserved. The company continues to accrue

interest but provides a full reserve should it be unable to

collect.

For the three months ended March 31, 2012, the Company recorded

interest expense of $62,000 as compared to $31,000 for the

comparable period in 2011. The increase is due to additional

interest due on financing obtained in late 2011. The proceeds were

used to drill wells.

NEW CONCEPT ENERGY, INC. AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATION

(unaudited) (amounts in thousands, except per share

data) For the Three Months Ended March 31,

2012 2011 Revenue Oil and gas operations, net

of royalties $ 290 $ 280 Real estate operations 674

729 964 1,009

Operating expenses Oil and gas operations 471 335

Real estate operations 366 390 Lease expense 231 191 Corporate

general and administrative 159 124 Accretion of asset retirement

obligation 34 32 Impairment of natural gas and oil properties

912 - 2,173 1,072

Operating earnings (loss) (1,209 ) (63 )

Other

income (expense) Interest income - 119 Interest expense (62 )

(31 ) Gain on sale of assets, net - - Other income (expense), net

4 72 Income/(Expense) (58 )

160 Net income (loss) applicable to

common shares $ (1,267 ) $ 97 Net income (loss) per

common share-basic and diluted $ (0.65 ) $ 0.05

Weighted average common and equivalent shares outstanding - basic

1,947 1,947

NEW CONCEPT ENERGY, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (unaudited) (amounts

in thousands) March 31, December 31,

2012 2011 Assets Current assets

Cash and cash equivalents

$

123 $ 109 Accounts receivable from oil and gas sales 167 167 Other

current assets 26 20

Total current assets

316 296

Oil and natural gas properties

(full cost accounting method) Proved developed and undeveloped

oil and gas properties, net of depletion 10,057 11,141

Property and equipment, net of depreciation Land, buildings and

equipment - oil and gas operations 1,467 1,486

Other

156 150 Total property and equipment 1,623 1,636

Other assets 423 377

Total

assets

$

12,419 $ 13,450

NEW CONCEPT ENERGY, INC.

AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS - CONTINUED

(unaudited) (amounts in thousands, except share

amounts) March 31, December 31,

2012 2011 Liabilities and stockholders'

equity Current liabilities Accounts payable -

trade $ 358 $ 422 Accrued expenses 421 417

Total current liabilities 779 839

Long-term

debt Notes payable 2,309 2,249 Payable - related parties 894

691 Asset retirement obligation 2,735 2,702 Other long-term

liabilities 491 491

Total

liabilities 7,208 6,972

Stockholders' equity

Preferred stock, Series B 1 1 Common stock, $.01 par value;

authorized, 100,000,000 shares; issued and outstanding, 1,946,935

shares at March 31, 2012 and December 31, 2011 20 20 Additional

paid-in capital 58,838 58,838 Accumulated deficit (53,648 )

(52,381 ) 5,211 6,478

Total liabilities & equity $ 12,419 $

13,450

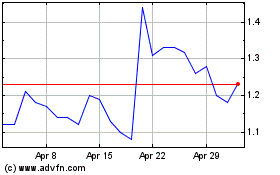

New Concept Energy (AMEX:GBR)

Historical Stock Chart

From May 2024 to Jun 2024

New Concept Energy (AMEX:GBR)

Historical Stock Chart

From Jun 2023 to Jun 2024