New Concept Energy, Inc. (AMEX:GBR), (the “Company” or “NCE”) a

Dallas-based oil and gas company, today reported a net loss for the

twelve months ended December 31, 2011 of $11.8 million or $(6.06)

per share, compared to net loss of $11,000 or $(0.01) per share for

the twelve months ended December 31, 2010. Net loss for the three

months ended December 31, 2011 was $11.9 million as compared to a

net income of $125,000 for the three months ended December 31,

2010.

The most significant components of the loss recorded in 2011

were bad debt expense of $10 million and impairment expense of $1.4

million for the Company’s oil and gas properties.

Between 2006 and the early part of 2009 the Company loaned a

related real estate management company its surplus cash for

interest rates ranging from 2% over the prime rate to 8% interest.

At December 31, 2009 these loans totaled $11 million. Since 2009

the Company has been paid $857,000 in interest and a principal pay

down of $1 million; however, in the fourth quarter of 2011 the

Company determined that the financial condition of the obligator

had deteriorated and there could be no assurance that the amount

owed would or could be collected. The company has recorded a

reserve of $10 million and written the receivable to zero.

Due to the decline of the prices for natural gas during 2011 the

Company has taken a non-cash charge to operations of $1.4 million

as an impairment of the Company’s oil and gas reserves.

In December 2006, Carlton Energy Group, LLC (“Carlton”)

instituted litigation against an individual, Eurenergy Resources

Corporation (“Eurenergy”) and several other entities including New

Concept Energy, Inc., alleging tortuous conduct, breach of contract

and other matters and as to the Company that it was the “alter ego”

of Eurenergy. The Carlton claims were based upon an alleged

tortuous interference with a contract related to the right to

explore a coal bed methane concession in Bulgaria which had never

(and has not to this day) produced a drop of hydrocarbons. At no

time during the pendency of this project or since did the Company

or any of its officers or directors have any interest whatsoever in

the success or failure of the so-called “Bulgaria Project.”

However, in the litigation, Carlton alleged that the Company was

the “alter ego” of certain of the other Defendants including

Eurenergy. Following a jury trial in 2009, the Trial Court granted

a judgment for the Company that it was not the “alter ego” of any

of the other parties and thereby would not incur any damages.

Cross appeals were filed and on February 14, 2012 the Court of

Appeals issued an opinion which, among other things, reinstated the

jury award of damages jointly and severely against the defendants

including Eurenergy in the amount of $66.5 million and affirmed the

award of exemplary against Eurenergy of $8.5 million. The Court of

Appeals also overturned the Trial Court’s ruling favorable to the

Company rendering a judgment for that amount plus exemplary damages

against the Company as the “alter ego” of Eurenergy.

The Company plans to file a Petition for Review of the Court of

Appeals Decision with the Supreme Court of the State of Texas. The

Company vigorously denies that it is the “alter ego” of any other

entity. There are questions regarding the underlying liability of

Eurenergy and if Eurenergy is successful in its petition for review

or, even if unsuccessful if the Company is successful on its

positions described above, the Trial Court’s judgment could be

reinstated and the Company would have no liability on this

claim.

NEW CONCEPT ENERGY, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (amounts in thousands)

December 31,

2011 2010 Assets Current assets

Cash and cash equivalents $ 109 $ 59 Accounts receivable from oil

and gas sales 167 223 Other current assets 20 101

Total current assets 296 383

Note

and interest receivable – related party - 10,361

Oil

and natural gas properties (full cost accounting method) Proved

developed and undeveloped oil and gas properties, net of depletion

11,141 11,789

Property and equipment, net of

depreciation Land, buildings and equipment - oil and gas

operations

1,486

1,308 Other

150

156

Total property and equipment 1,636 1,464

Other assets 377 70

Total assets

$ 13,450 $ 24,067

NEW CONCEPT ENERGY, INC.

AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS - CONTINUED

(amounts in thousands, except share amounts)

December 31,

2011 2010 Liabilities and stockholders' equity

Current liabilities Accounts payable - trade $ 422 $

83

Accrued expenses

417 156

Total current

liabilities 839 239

Long-term debt Notes payable

2,249 1,308 Payable - related parties 691 953 Asset retirement

obligation 2,702 2,573 Other long-term liabilities 491

723

Total liabilities 6,972 5,796

Stockholders' equity Preferred stock, Series B 1 1

Common stock, $.01 par value; authorized, 100,000,000 shares;

issued and outstanding, 1,946,935 shares at December 31, 2010 and

2009 20 20 Additional paid-in capital 58,838 58,838 Accumulated

deficit (52,381 ) (40,588 ) 6,478

18,271

Total liabilities &

equity $ 13,450 $ 24,067

NEW CONCEPT ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATION (amounts in

thousands, except per share data) Year Ended December

31, 2011 2010 2009 Revenue Oil and

gas operations, net of royalties $ 1,020 $

1,288

$

1,246

Real estate operations 2,881

2,925

2,852

3,901 4,213 4,098

Operating expenses Oil and gas operations

1,430 1,292 1,498 Real estate operations 1,290 1,225 1,217 Lease

expense

866

886 958 Corporate general and administrative

619

731 1,342 Accretion of asset retirement obligation 129 123 117

Impairment of natural gas and oil

properties

1,428 - 1,695

5,762 4,257 6,827 Operating

earnings (loss) (1,861 ) (44 ) (2,729 )

Other income

(expense) Interest income 360 497 574 Interest expense (131 )

(124 ) (123 ) Bad debt expense - note receivable (10,006 ) - -

Other income (expense), net (155 ) (340 ) 68

(9,932 ) 33 519 Earnings from continuing operations

(11,793 ) (11 ) (2,210 ) Net income (loss) applicable to

common shares $ (11,793 ) $ (11 ) $ (2,210 ) Net income

(loss) per common share-basic and diluted $ (6.06 ) $ (0.01 ) $

(1.14 ) Weighted average common and equivalent shares

outstanding - basic 1,947 1,947 1,947

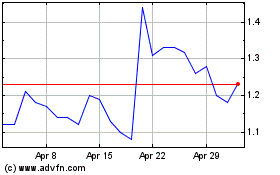

New Concept Energy (AMEX:GBR)

Historical Stock Chart

From May 2024 to Jun 2024

New Concept Energy (AMEX:GBR)

Historical Stock Chart

From Jun 2023 to Jun 2024