Evans Bancorp, Inc. (the “Company” or “Evans”) (NYSE American:

EVBN), a community financial services company serving Western New

York since 1920, today reported results of operations for the third

quarter ended September 30, 2021.

THIRD QUARTER 2021 HIGHLIGHTS (compared with prior-year

period unless otherwise noted)

- Net interest income increased 16% to $18.2 million reflecting

accelerated amortization of Paycheck Protection Program (“PPP”)

fees, higher commercial loan prepayment fees and lower interest

expense

- Results include $1.5 million release of allowance for loan

losses due to improved credit quality in the hotel portfolio and

lower specific reserves

- Total deposits of $1.88 billion, increased 5%

Net income increased 54% to a record $7.0 million, or $1.27 per

diluted share, in the third quarter of 2021, from $4.5 million, or

$0.84 per diluted share, in last year’s third quarter. The increase

included higher net interest income of $2.5 million and a $3.3

million decrease in provision for loan loss. Partially offsetting

these increases to net income was $1.9 million of higher salary

expenses primarily related to incentives and strategic hires.

The 11% increase in net income from the sequential second

quarter of $6.3 million, or $1.15 per diluted share, reflected a

$0.7 million decrease in provision for loan losses due to a

reduction in criticized assets and $0.7 million increase in

non-interest income primarily due to seasonally higher insurance

service and fee revenue. These increases were partially offset by a

$0.6 million increase in salary incentive expenses.

Return on average equity was 15.58% for the third quarter of

2021, compared with 14.72% in the second quarter of 2021 and 11.09%

in the third quarter of 2020.

“The Bank’s record results this quarter were supported by strong

loan production throughout the year, PPP fees and credit quality

improvements, reflecting underwriting strength and proactive

measures with our hotel portfolio resulting in upgrades to the

credit risk ratings of a number of relationships into normal

performing categories. While PPP forgiveness and higher than

typical payoffs in this historically low-rate environment continue

to provide headwinds to our overall loan growth, we are generating

strong loan production this year and are encouraged by the return

of more commercial and industrial loan opportunities,” said David

J. Nasca, President and CEO of Evans Bancorp, Inc.

“Our priority continues to be utilization of excess liquidity.

We are strategically adding talent to supplement our loan efforts

both within our legacy market and new market area in Rochester, as

well as bolstering our fee based businesses. We are in the process

of building out customer solutions in an effort to deliver an

enhanced experience that is centered on speed, flexibility and

efficiency. The actions we are taking are designed to continue to

enhance returns over the long-term.”

Net Interest Income

($ in thousands)

3Q 2021

2Q 2021

3Q 2020

Interest income

$

19,302

$

19,576

$

17,766

Interest expense

1,139

1,226

2,124

Net interest income

18,163

18,350

15,642

Provision (credit) for loan losses

(1,459)

(760)

1,881

Net interest income after provision

$

19,622

$

19,110

$

13,761

Net interest income decreased $0.2 million, or 1%, from the

sequential second quarter, but increased $2.5 million or 16% from

prior-year third quarter. The increase from the prior-year period

reflected higher PPP fees of $1.2 million, a $0.3 million increase

in commercial loan prepayment fees, and lower interest expense of

$1.0 million. The decrease in net interest income from the second

quarter of 2021 reflects lower fees earned in connection with PPP

and commercial prepayment fees. As PPP loans are forgiven, the

Company is accelerating the recognition of fees that were being

amortized over the original life of the loan. PPP fees recognized

in interest income were $2.1 million in the third quarter of 2021,

$2.5 million in the second quarter of 2021 and $0.9 million in the

third quarter of 2020.

Third quarter net interest margin of 3.48% decreased 14 basis

points from the second quarter of 2021, reflecting higher amounts

of low-yielding interest-bearing deposits at banks. Net interest

margin increased 29 basis points from the third quarter of 2020 due

to higher balances in interest-earning assets, PPP fee

amortization, commercial prepayment income and reduced interest

expense as the Company continued to align rates on deposits. The

yield on loans increased 4 basis points when compared with the

second quarter of 2021 and increased 35 basis points when compared

with the third quarter of 2020. The cost of interest-bearing

liabilities decreased to 0.31% compared with 0.34% in the second

quarter of 2021 and 0.59% in the third quarter of 2020.

The Company continues to evaluate its loan portfolio in response

to the economic impact of the COVID-19 pandemic on its clients.

During the third quarter of 2020, the Company identified a

well-defined weakness in the hotel industry and classified the

loans to clients within that industry as criticized. As of

September 30, 2021, the Company’s hotel loan portfolio totaled

approximately $80 million, of which the Company upgraded $20

million out of the criticized loan category and $2.2 million was

classified as nonaccrual during the recent third quarter.

The $1.5 million release of allowance for loan losses in the

current quarter included $0.7 million related to a decrease in

criticized hotel portfolio loans and a $0.5 million reduction in

specific reserves resulting from payments received from one

commercial customer relationship. Evans has deferred the adoption

of the Current Expected Credit Loss Impairment Model (CECL), as

permitted by its classification as a Smaller Reporting Company by

the Securities and Exchange Commission.

Asset Quality

($ in thousands)

3Q 2021

2Q 2021

3Q 2020

Total non-performing loans

$

25,463

$

24,317

$

21,466

Total net loan charge-offs

431

-

34

Non-performing loans / Total loans

1.58

%

1.43

%

1.26

%

Net loan charge-offs / Average loans

0.10

%

-

%

0.01

%

Allowance for loan losses / Total

loans

1.12

%

1.17

%

1.21

%

“Our hotel portfolio continues to show improvement as we moved

about a quarter of the total portfolio back to normal paying

status, and received all deferred interest. Only one hotel loan was

moved to nonaccrual status, which was reflected in the increase in

non-performing assets. We will continue to closely monitor the

portfolio and although the remaining hotel relationships have shown

improvement in their occupancy rates and have paid all amounts due,

the Bank is looking to establish sustained performance on these

credits before upgrading,” stated John Connerton, Chief Financial

Officer of Evans Bank.

Non-Interest Income

($ in thousands)

3Q 2021

2Q 2021

3Q 2020

Deposit service charges

$

664

$

607

$

598

Insurance service and fee revenue

3,191

2,657

3,217

Bank-owned life insurance

158

172

170

Gain on sale of securities

-

-

667

Other income

1,144

982

1,205

Total non-interest income

$

5,157

$

4,418

$

5,857

The increase in insurance service and fee revenue from the

sequential second quarter reflects seasonally higher commercial

lines insurance commissions and profit-sharing revenue.

During the third quarter of 2020, the Company recognized

approximately $0.7 million of gain on sale of investment

securities. There were no comparable gains during 2021.

The increase in other income from the sequential second quarter

was largely due to changes in the fair value of mortgage servicing

rights and other loan fee income.

Non-Interest Expense

($ in thousands)

3Q 2021

2Q 2021

3Q 2020

Salaries and employee benefits

$

9,930

$

9,365

$

8,101

Occupancy

1,126

1,177

1,204

Advertising and public relations

434

405

503

Professional services

840

989

865

Technology and communications

1,327

1,432

1,365

Amortization of intangibles

135

135

136

FDIC insurance

285

279

290

Merger-related expenses

-

-

524

Other expenses

1,316

1,394

1,480

Total non-interest expenses

$

15,393

$

15,176

$

14,468

Total non-interest expense increased $0.2 million, or 1%, from

the second quarter of 2021, and $0.9 million, or 6% from last

year’s third quarter.

Salaries and employee benefits increased $0.6 million, or 6%,

from the sequential second quarter and $1.8 million, or 23%, from

last year’s third quarter. The sequential change reflected a $0.6

million increase in incentive accruals, while the prior-year period

included a $0.7 million reduction of incentive accruals. The

year-over-year change also reflects the addition of strategic hires

to support the Company’s continued growth along with inflation in

the cost of labor.

Third quarter of 2020 merger-related expenses included costs

relating to the acquisition of Fairport Savings Bank. There were no

comparable expenses during the second or third quarters of

2021.

The Company’s GAAP efficiency ratio, or noninterest expenses

divided by the sum of net interest income and noninterest income,

was 66.0% in the third quarter of 2021, 66.7% in the second quarter

of 2021, and 67.3% in the third quarter of 2020. The Company’s

non-GAAP efficiency ratio, excluding amortization expense, gains

and losses from investment securities, and merger-related expenses,

was 65.4% compared with 66.1% in the second quarter of 2021 and

66.3% in last year’s third quarter.

Income tax expense was $2.4 million, or an effective tax rate of

25.6%, for the third quarter of 2021 compared with 24.4% in the

second quarter of 2021 and 11.8% in last year’s third quarter.

Excluding the impact of a 2020 historic tax credit transaction, the

effective tax rate was 25.6% in the third quarter of 2020.

Balance Sheet Highlights

Total assets were $2.15 billion as of September 30, 2021, a

decrease of less than 1% from $2.16 billion at June 30, 2021, but

up 5% from $2.06 billion at September 30, 2020. The increase from

the prior year was due to an increase in investment securities and

interest-bearing deposits at banks, partially offset by lower loan

balances. Since last year’s third quarter, residential mortgages

increased $38 million and commercial real estate loans were up $37

million. More than offsetting was a decrease in commercial and

industrial loans of $163 million, of which $127 million was a

result of the change in PPP loan balances. PPP loans totaled $76.3

million at September 30, 2021, compared with $145.7 million at June

30, 2021 and $203.1 million at September 30, 2020. The Company has

also experienced a significant increase in the level of commercial

payoffs, with a quarterly average of $43 million in 2021 compared

with a more normalized level around $21 million a quarter.

Investment securities were $258 million at September 30, 2021,

$24 million higher than the end of the second quarter of 2021, and

$97 million higher than at the end of last year’s third quarter.

The increases reflect the use of excess cash balances. The primary

objectives of the Company’s investment portfolio are to provide

liquidity, secure municipal deposits, and maximize income while

preserving the safety of principal.

Total deposits of $1.88 billion decreased $8 million, or less

than 1%, from June 30, 2021, but were up $95 million, or 5%, from

the end of last year’s third quarter. The increase from the prior

year reflects an accumulation of liquidity by commercial customers

in response to the pandemic, including deposits related to PPP

loans, and increases in consumer deposits from government stimulus

payments and lower consumer spending.

Capital Management

The Company has consistently maintained regulatory capital

ratios measurably above the Federal “well capitalized” standard,

including a Tier 1 leverage ratio of 8.34% at September 30, 2021

compared with 8.23% at June 30, 2021 and 7.82% at September 30,

2020. Book value per share was $32.73 at September 30, 2021

compared with $32.28 at June 30, 2021 and $30.29 at September 30,

2020. Tangible book value per share was $30.07 at September 30,

2021 compared with $29.58 at June 30, 2021 and $27.49 at September

30, 2020.

In October 2021, the Company paid a semi-annual cash dividend of

$0.60 per common share. Cash dividends totaled $1.20 per common

share during 2021, up 3% over 2020.

Webcast and Conference Call

The Company will host a conference call and webcast on Thursday,

October 28, 2021 at 4:45 p.m. ET. Management will review the

financial and operating results for the third quarter of 2021, as

well as the Company’s strategy and outlook. A question and answer

session will follow the formal presentation.

The conference call can be accessed by calling (201) 689-8471.

Alternatively, the webcast can be monitored at

www.evansbancorp.com.

A telephonic replay will be available from 7:45 p.m. ET on the

day of the teleconference until Thursday, November 4, 2021. To

listen to the archived call, dial (412) 317-6671 and enter

conference ID number 13723727, or access the webcast replay at

www.evansbancorp.com, where a transcript will be posted once

available.

About Evans Bancorp, Inc.

Evans Bancorp, Inc. is a financial holding company and the

parent company of Evans Bank, N.A., a commercial bank with $2.2

billion in assets and $1.9 billion in deposits at September 30,

2021. Evans is a full-service community bank with 21 financial

centers providing comprehensive financial services to consumer,

business and municipal customers throughout Western New York. Evans

Insurance Agency, a wholly owned subsidiary, provides life

insurance, employee benefits, and property and casualty insurance

through ten offices in the Western New York region. Evans

Investment Services provides non-deposit investment products, such

as annuities and mutual funds.

Evans Bancorp, Inc. and Evans Bank routinely post news and other

important information on their websites, at www.evansbancorp.com

and www.evansbank.com.

Safe Harbor Statement: This news release contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements include, but are not limited to, statements concerning

future business, revenue and earnings. These statements are not

historical facts or guarantees of future performance, events or

results. There are risks, uncertainties and other factors that

could cause the actual results of Evans Bancorp to differ

materially from the results expressed or implied by such

statements. Factors that may cause actual results to differ

materially from those contemplated by such forward-looking

statements include the impacts from COVID-19, competitive pressures

among financial services companies, interest rate trends, general

economic conditions, changes in legislation or regulatory

requirements, effectiveness at achieving stated goals and

strategies, and difficulties in achieving operating efficiencies.

These risks and uncertainties are more fully described in Evans

Bancorp’s Annual and Quarterly Reports filed with the Securities

and Exchange Commission. Forward-looking statements speak only as

of the date they are made. Evans Bancorp undertakes no obligation

to publicly update or revise forward-looking information, whether

as a result of new, updated information, future events or

otherwise.

EVANS BANCORP, INC. AND

SUBSIDIARIES

SELECTED FINANCIAL DATA

(UNAUDITED)

(in thousands, except shares and per

share data)

9/30/2021

6/30/2021

3/31/2021

12/31/2020

9/30/2020

ASSETS

Interest-bearing deposits at banks

$

179,231

$

126,810

$

105,658

$

83,902

$

88,249

Investment Securities

258,221

234,350

195,012

166,600

160,757

Loans

1,614,162

1,697,321

1,747,229

1,693,794

1,703,076

Allowance for loan losses

(18,051)

(19,942)

(20,701)

(20,415)

(20,601)

Goodwill and intangible assets

14,546

14,682

14,817

14,951

15,085

All other assets

103,949

106,982

102,250

105,283

110,427

Total assets

$

2,152,058

$

2,160,203

$

2,144,265

$

2,044,115

$

2,056,993

LIABILITIES AND STOCKHOLDERS'

EQUITY

Demand deposits

502,689

486,737

486,385

436,157

442,536

NOW deposits

253,124

261,173

238,769

230,751

215,492

Savings deposits

942,147

940,352

924,781

825,947

799,739

Time deposits

178,083

195,533

222,002

278,554

323,211

Total deposits

1,876,043

1,883,795

1,871,937

1,771,409

1,780,978

Borrowings

71,564

76,895

78,278

79,663

82,909

Other liabilities

25,617

23,824

27,076

24,138

30,218

Total stockholders' equity

178,834

175,689

166,974

168,905

162,888

SHARES AND CAPITAL RATIOS

Common shares outstanding

5,463,141

5,443,491

5,428,993

5,411,384

5,376,742

Book value per share

$

32.73

$

32.28

$

30.76

$

31.21

$

30.29

Tangible book value per share

$

30.07

$

29.58

$

28.03

$

28.45

$

27.49

Tier 1 leverage ratio

8.34

%

8.23

%

8.19

%

8.21

%

7.82

%

Tier 1 risk-based capital ratio

12.34

%

11.96

%

11.90

%

11.62

%

11.28

%

Total risk-based capital ratio

13.57

%

13.21

%

13.15

%

12.88

%

12.53

%

ASSET QUALITY DATA

Total non-performing loans

$

25,463

$

24,317

$

29,079

$

28,118

$

21,466

Total net loan charge-offs

431

-

27

60

34

Non-performing loans/Total loans

1.58

%

1.43

%

1.66

%

1.66

%

1.26

%

Net loan charge-offs /Average loans

0.10

%

-

%

0.01

%

0.01

%

0.01

%

Allowance for loans losses/Total loans

1.12

%

1.17

%

1.18

%

1.21

%

1.21

%

EVANS BANCORP, INC AND

SUBSIDIARIES

SELECTED OPERATIONS DATA

(UNAUDITED)

(in thousands, except share and per

share data)

2021

2021

2021

2020

2020

Third Quarter

Second Quarter

First Quarter

Fourth Quarter

Third Quarter

Interest income

$

19,302

$

19,576

$

17,970

$

18,175

$

17,766

Interest expense

1,139

1,226

1,373

1,744

2,124

Net interest income

18,163

18,350

16,597

16,431

15,642

Provision (credit) for loan losses

(1,459)

(760)

313

(126)

1,881

Net interest income after provision

(credit) for loan losses

19,622

19,110

16,284

16,557

13,761

Deposit service charges

664

607

572

619

598

Insurance service and fee revenue

3,191

2,657

2,502

2,301

3,217

Bank-owned life insurance

158

172

163

172

170

Gain on sale of securities

-

-

-

-

667

Other income

1,144

982

1,329

1,711

1,205

Total non-interest income

5,157

4,418

4,566

4,803

5,857

Salaries and employee benefits

9,930

9,365

9,044

9,087

8,101

Occupancy

1,126

1,177

1,187

1,169

1,204

Advertising and public relations

434

405

263

233

503

Professional services

840

989

959

893

865

Technology and communications

1,327

1,432

1,264

1,306

1,365

Amortization of intangibles

135

135

135

133

136

FDIC insurance

285

279

300

339

290

Merger-related expenses

-

-

-

-

524

Other expenses

1,316

1,394

1,213

1,350

1,480

Total non-interest expenses

15,393

15,176

14,365

14,510

14,468

Income before income taxes

9,386

8,352

6,485

6,850

5,150

Income tax provision

2,407

2,039

1,633

821

606

Net income

6,979

6,313

4,852

6,029

4,544

PER SHARE DATA

Net income per common share-diluted

$

1.27

$

1.15

$

0.89

$

1.11

$

0.84

Cash dividends per common share

$

0.60

$

-

$

0.60

$

-

$

0.58

Weighted average number of diluted

shares

5,516,781

5,489,420

5,463,674

5,416,198

5,395,806

PERFORMANCE RATIOS

Return on average total assets

1.28

%

1.17

%

0.93

%

1.18

%

0.88

%

Return on average stockholders' equity

15.58

%

14.72

%

11.48

%

14.51

%

11.09

%

Return on average tangible common

stockholders' equity*

16.96

%

16.11

%

12.59

%

15.96

%

12.23

%

Efficiency ratio

66.01

%

66.65

%

67.88

%

68.33

%

67.30

%

Efficiency ratio (Non-GAAP)**

65.43

%

66.06

%

67.24

%

67.71

%

66.28

%

* The calculation of the average tangible

common stockholders' equity ratio excludes goodwill and intangible

assets from average stockholders equity.

** The calculation of the non-GAAP

efficiency ratio excludes amortization of intangibles, gains and

losses from investment securities, merger-related expenses and the

impact of historic tax credit transactions.

EVANS BANCORP, INC AND

SUBSIDIARIES

SELECTED AVERAGE BALANCES AND

YIELDS/RATES (UNAUDITED)

(in thousands)

2021

2021

2021

2020

2020

Third Quarter

Second Quarter

First Quarter

Fourth Quarter

Third Quarter

AVERAGE BALANCES

Loans, net

$

1,647,395

$

1,718,507

$

1,706,325

$

1,677,502

$

1,671,338

Investment securities

248,690

216,134

180,473

162,941

172,712

Interest-bearing deposits at banks

174,296

97,168

76,651

92,974

106,154

Total interest-earning assets

2,070,381

2,031,809

1,963,449

1,933,417

1,950,204

Non interest-earning assets

109,601

119,392

115,200

117,458

117,244

Total Assets

$

2,179,982

$

2,151,201

$

2,078,649

$

2,050,875

$

2,067,448

NOW

262,105

246,565

230,627

218,587

221,343

Savings

949,956

928,375

866,991

818,878

799,082

Time deposits

186,126

210,287

246,120

300,605

337,967

Total interest-bearing deposits

1,398,187

1,385,227

1,343,738

1,338,070

1,358,392

Borrowings

74,326

77,050

78,284

80,814

84,926

Total interest-bearing liabilities

1,472,513

1,462,277

1,422,022

1,418,884

1,443,318

Demand deposits

503,006

493,734

464,579

439,953

430,658

Other non-interest bearing liabilities

25,250

23,682

23,031

25,882

29,644

Stockholders' equity

179,213

171,508

169,017

166,156

163,828

Total Liabilities and Equity

$

2,179,982

$

2,151,201

$

2,078,649

$

2,050,875

$

2,067,448

Average tangible common stockholders'

equity*

164,588

156,748

154,122

151,131

148,658

YIELD/RATE

Loans, net

4.36

%

4.32

%

4.06

%

4.09

%

4.01

%

Investment securities

1.82

%

1.94

%

2.00

%

2.18

%

2.06

%

Interest-bearing deposits at banks

0.14

%

0.08

%

0.08

%

0.10

%

0.10

%

Total interest-earning assets

3.70

%

3.86

%

3.71

%

3.74

%

3.62

%

NOW

0.10

%

0.11

%

0.13

%

0.15

%

0.19

%

Savings

0.15

%

0.17

%

0.20

%

0.24

%

0.33

%

Time deposits

0.49

%

0.52

%

0.64

%

0.90

%

1.04

%

Total interest-bearing deposits

0.18

%

0.21

%

0.27

%

0.37

%

0.48

%

Borrowings

2.62

%

2.55

%

2.52

%

2.43

%

2.26

%

Total interest-bearing liabilities

0.31

%

0.34

%

0.39

%

0.49

%

0.59

%

Interest rate spread

3.39

%

3.52

%

3.32

%

3.25

%

3.03

%

Contribution of interest-free funds

0.09

%

0.10

%

0.11

%

0.13

%

0.16

%

Net interest margin

3.48

%

3.62

%

3.43

%

3.38

%

3.19

%

* Average tangible common stockholders'

equity excludes goodwill and intangible assets from average

stockholders equity.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211028006118/en/

John B. Connerton Executive Vice President and Chief Financial

Officer (716) 926-2000 jconnerton@evansbank.com Media:

Kathleen Rizzo Young Public & Community Relations Manager

716-343-5562 krizzoyoung@evansbank.com -OR- Deborah K.

Pawlowski Kei Advisors LLC (716) 843-3908

dpawlowski@keiadvisors.com

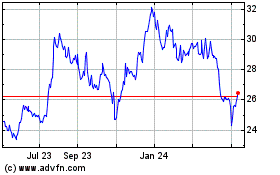

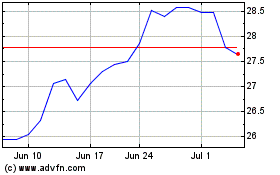

Evans Bancorp (AMEX:EVBN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Evans Bancorp (AMEX:EVBN)

Historical Stock Chart

From Apr 2023 to Apr 2024