Amended Statement of Beneficial Ownership (sc 13d/a)

April 18 2022 - 4:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment (34)*

AVALON

HOLDINGS CORPORATION

(Name of Issuer)

Class A Common Stock, $0.01 par value

(Title of Class of Securities)

0534P109

(CUSIP Number)

Anil Choudary Nalluri

5500 Market Street, Suite 128

Youngstown, Ohio 44512

330-783-1147

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

April 11, 2022

(Date of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§240.13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

Persons who respond to the

collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

|

|

|

|

|

|

| 1. |

|

Names

of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only).

Anil Choudary Nalluri |

| 2. |

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a) ☐ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds (See

Instructions) PF |

| 5. |

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐ |

| 6. |

|

Citizenship or Place of

Organization United States |

| Number of

Shares

Beneficially

Owned by

Each Reporting

Person With

|

|

7. |

|

Sole Voting Power

829,069 |

| |

8. |

|

Shared Voting Power

0 |

| |

9. |

|

Sole Dispositive Power

829,069 |

| |

10. |

|

Shared Dispositive Power

0 |

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

829,063 |

| 12. |

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

|

Percent of Class Represented by

Amount in Row (11) |

| 14. |

|

Type of Reporting Person (See

Instructions) IN |

2

| Item 1. |

Security and Issuer |

This Statement on Schedule 13D (“Schedule 13D”) relates to the Class A Common Stock, $0.01 par value (the “Common

Stock”) of Avalon Holdings Corporation, an Ohio corporation (the “Issuer”), whose principal executive offices are located at One American Way, Warren, Ohio 44484.

| Item 2. |

Identity and Background |

This statement is filed by Anil Choudary Nalluri (“Mr. Nalluri” or the “Reporting Person”) on behalf of himself and

his wife, Parvati Nalluri and various accounts controlled by them. Mr Nalluri’s principal business address is 5500 Market Street, Suite 128, Youngstown, Ohio 44512. Mr. Nalluri’s principal occupation is practicing in the field of

psychiatry. During the past five years, Mr. Nalluri has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) and has not been a party to civil proceedings of a judical or administrative body of

competent jurisdiction, as a result of which Mr. Nalluri was or is subject to a judgment, decree, or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any

violation with respect to such laws. Mr. Nalluri is a United States citizen.

3

| Item 3. |

Source and Amount of Funds or Other Consideration |

Mr. Nalluri’s purchases of shares of Common Stock have all been made with his personal funds.

| Item 4. |

Purpose of Transaction |

The purpose of this filing is to state that Mr. Nalluri is the beneficial owner of greater than 20% of the Common Stock of the issuer.

Mr. Nalluri does not currently have any specific plans or proposals that relate to or would result in any of the actions or events

specified in clauses (a) through (j) of Item 4 of Schedule 13D. Mr. Nalluri reserves the right to change plans and take any and all actions that Mr. Nalluri may deem appropriate to maximize the value of his investments, including,

among other things, purchasing or otherwise acquiring additional securities of the Issuer, selling or otherwise disposing of any securities of the Issuer beneficially owned by him, in each case in the open market or in privately negotiated

transactions, or fomulating other plans or proposals regarding the Issuer or its securities to the extent deemed advisable by Mr. Nalluri is light of his general investment policies, market conditions, subsequent developments affecting the

Issuer and the general business and future prospects of the Issuer.

| Item 5. |

Interest in Securities of the Issuer |

(a) Mr. Nalluri beneficially owns 808,069 shares of Common Stock, which is equal to approximately 25.98% of the outstanding shares,

based on information from the Issuer that 3,191,100 Class A shares of Common Stock are outstanding as of March 3, 2018.

(b)

Mr. Nalluri has sole voting and dispositive power for all such shares of Common Stock held record by him.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

|

Not applicable

| Item 7. |

Material to be Filed as Exhibits |

Not applicable

| Item 8. |

Submission of Shareholders Proposals for 2019 Proxy Statement |

Not applicable

4

Date: April 11, 2022

|

|

|

| Signature |

|

/s/ Anil Choudary Nalluri |

| Name/Title: |

|

Anil Choudary Nalluri |

The original statement shall be signed by each person on whose behalf the statement is filed or his

authorized representative. If the statement is signed on behalf of a person by his authorized representative (other than an executive officer or general partner of the filing person), evidence of the representative’s authority to sign on behalf

of such person shall be filed with the statement: provided, however, that a power of attorney for this purpose which is already on file with the Commission may be incorporated by reference. The name and any title of each person who signs the

statement shall be typed or printed beneath his signature.

Attention: Intentional misstatements or omissions of fact constitute Federal

criminal violations (See 18 U.S.C. 1001)

5

PURCHASE OF AVALON HOLDINGS

|

|

|

|

|

|

|

|

|

| Date of Transaction |

|

Number of Shares |

|

|

Price Per Share |

|

| 12/31/2021 |

|

|

2,000 |

|

|

$ |

3.65 |

|

| 12/28/2021 |

|

|

1,000 |

|

|

$ |

3.52 |

|

| 12/28/2021 |

|

|

4,900 |

|

|

$ |

3.5848 |

|

| 12/28/2021 |

|

|

100 |

|

|

$ |

3.52 |

|

| 12/28/2021 |

|

|

100 |

|

|

$ |

3.508 |

|

| 12/28/2021 |

|

|

2,000 |

|

|

$ |

3.51 |

|

| 12/28/2021 |

|

|

600 |

|

|

$ |

3.5097 |

|

| 12/28/2021 |

|

|

1,690 |

|

|

$ |

3.475 |

|

| 12/28/2021 |

|

|

610 |

|

|

$ |

3.5 |

|

| 12/27/2021 |

|

|

4,000 |

|

|

$ |

3.47 |

|

| 12/27/2021 |

|

|

4,000 |

|

|

$ |

3.4595 |

|

6

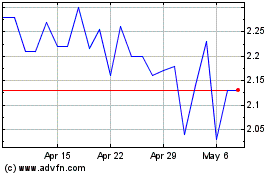

Avalon Holdngs (AMEX:AWX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avalon Holdngs (AMEX:AWX)

Historical Stock Chart

From Apr 2023 to Apr 2024