HeartCore Enterprises, Inc. (Nasdaq: HTCR) (“HeartCore” or

“the Company”), a leading enterprise software and

consulting services company based in Tokyo, reported financial

results for the fourth quarter and full year ended December 31,

2023 and outlined its strategic priorities for a robust 2024.

Fourth Quarter 2023 and Recent Operational

Highlights

- Full year 2023 revenue of $21.8 million, up 148% compared to

full year 2022

- Strong growth from enterprise software business

- Formed Artificial Intelligence (AI) Software Development

Division

- Authorized a dividend payment

- Signed 13th Go IPO contract and signed 12th Go IPO

contract

- Announced the sale of Go IPO client warrant for $9 million

- Established HeartCore Luvina Vietnam Co., Ltd. as part of its

global sales expansion initiative

- Signed Toshiba Elevator and Building Systems Corporation to

implement its CMS platform

- Extended partnership with TOPPAN Inc. to jointly promote

Dashiwake platform

- Implemented new function to enhance its flagship HeartCore CMS

platform

- Announced its subsidiary Sigmaways signed binding MOU with

Actiquest

- Announced its subsidiary Sigmaways launched Psyche60s VR

experience

- Announced its subsidiary Sigmaways signed Heart-Tech Health and

Coherent Health

- Launched Dashiwake platform into the U.S. and Japanese

markets

- Awarded 8th consecutive top market share for its CMS

platform

Full Year 2023 Financial ResultsRevenues

increased 147.7% to $21.8 million compared to $8.8 million in the

same period last year. The increase was primarily due to an

increase in Go IPO consulting service revenues and received

warrants from customers, and an increase from customized software

development and services as a result of Sigmaways and its

subsidiaries.

Gross profit increased 140.7% to $8.1 million from $3.4 million

in the same period last year. The increase was primarily due to an

increase in Go IPO consulting service revenues and received

warrants from customers, and an increase from customized software

development and services as a result of Sigmaways and its

subsidiaries.

Operating expenses increased to $12.2 million from $10.0 million

in the same period last year. The increase was primarily due to

increases in general and administrative expenses and research and

development expenses, offset by a decrease in selling expenses.

Net loss was about $4.9 million or $(0.21) per diluted share

compared to a net loss of $6.7 million or $(0.37) per diluted

share, in the same period last year.

As of December 31, 2023, the Company had cash and cash

equivalents of $1.0 million compared to $7.2 million in December

31, 2022.

Management Commentary“Over the past year, our

operational footprint has extended beyond Japan into the dynamic

U.S. markets, marked by the strategic acquisition of Sigmaways and

the partnership with Sabatini Global’s sales and marketing team,”

said CEO Sumitaka Kanno Yamamoto. “These pivotal moves have

significantly bolstered and diversified our enterprise software

business’ revenue streams and reduced our reliance solely on sales

from Japan, a trend we have carried into 2024. Nonetheless, we have

sustained our dominance and have achieved top market share status

for the CMS platform segment in Japan for the 8th consecutive year.

Despite challenges such as the ongoing depreciation of the yen

against the dollar, we have consistently experienced year-over-year

top-line growth since becoming a publicly traded company.

“On the Go IPO front, we have signed and engaged with 10 new

clients, with additional companies in the pipeline, showcasing the

robust demand among Japanese companies seeking listings on major

U.S. exchanges. While macro-economic factors presented some

uncontrollable hurdles for our clients, which resulted in a limited

revenue influx for us this year, the recent sale of a $9 million

warrant underscores the revenue-generating potential of our

consulting business. As we navigate through these challenging

market conditions, we remain committed to supporting our valued

clients through the listing process with our white glove

approach.”

Full Year 2024 Strategic Priorities

- Maintain improved cost structure from synergies with the

recently established HeartCore Luvina Vietnam, a high-quality and

low-cost IT outsourcing provider

- Capitalize on strong organic growth opportunities within the

enterprise software business through newly established Artificial

Intelligence Software Division

- Expand upon the Go IPO business with the U.S. IPO markets

expected to improve in 2024

- Sustain market share as the number one CMS provider in Japan

while fueling global expansion

Full Year 2024 OutlookIn anticipation of a

robust 2024, HeartCore is poised to capitalize on its strong

momentum within the enterprise software sector. The recently

established HeartCore Luvina Vietnam joint venture and its

low-cost, high-quality IT outsourcing capabilities is primed to

contribute to the financial resiliency of the Company. With access

to 850 talented software engineers, this joint venture is expected

to significantly elevate the Company’s global sales expansion

efforts. Additionally, the AI software division is positioned to

unlock a fresh revenue stream within the U.S. and Japanese markets,

with opportunities to upsell other HeartCore software. As part of

its growth strategy, HeartCore remains vigilant for synergistic

M&A opportunities that seamlessly complement the expanding

software business.

Successful client listings through the Go IPO business have

proven to be a lucrative venture, with the first quarter of 2023

witnessing two successful listings yielding over $5 million in

revenue alone. More recently, the Company sold a Go IPO client

warrant totaling $9 million in revenue, scheduled to materialize in

the first quarter of 2024. Despite a sluggish IPO market in 2023,

market sentiment is now shifting toward a more favorable outlook

for 2024. With 10 companies currently in the Go IPO pipeline,

HeartCore continues to actively expand its reach in the Japanese

markets to bolster its pipeline. Though projections and timing of

listings remains uncertain due to lingering market uncertainties,

HeartCore remains optimistic about the continued financial

potential and benefits of its Go IPO business throughout 2024.

“We find ourselves amidst a transformative

phase,” added Yamamoto. “The outset of 2024 demonstrates

significant promise, bolstered by a resilient balance sheet derived

from our two-pronged business model and ongoing global expansion of

the HeartCore brand. Our adept cash management strategies have led

us to authorize our inaugural dividend payment, with plans for

additional quarterly payments, contingent upon macro-economic

factors and the financial standing of the Company. Building upon

the growth momentum seen this past year, we eagerly anticipate

sharing strong first-quarter results ahead.”

About HeartCore Enterprises, Inc.Headquartered

in Tokyo, Japan, HeartCore Enterprises is a leading enterprise

software and consulting services company. HeartCore offers Software

as a Service (SaaS) solutions to enterprise customers in Japan and

worldwide. The Company also provides data analytics services that

allow enterprise businesses to create tailored web experiences for

their clients through best-in-class design. HeartCore’s customer

experience management platform (CXM Platform) includes marketing,

sales, service and content management systems, as well as other

tools and integrations, which enable companies to enhance the

customer experience and drive engagement. HeartCore also operates a

digital transformation business that provides customers with

robotics process automation, process mining and task mining to

accelerate the digital transformation of enterprises. HeartCore’s

GO IPOSM consulting services helps Japanese-based companies go

public in the U.S. Additional information about the Company's

products and services is available at and

https://heartcore-enterprises.com/.

Forward-Looking StatementsThis press release

contains forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, Section 21E of the

Securities Exchange Act of 1934, as amended, or the Private

Securities Litigation Reform Act of 1995. All statements other than

statements of historical facts included in this press release are

forward-looking statements. In some cases, forward-looking

statements can be identified by words such as “believed,” “intend,”

“expect,” “anticipate,” “plan,” “potential,” “continue,” or similar

expressions. Such forward-looking statements include risks and

uncertainties, and there are important factors that could cause

actual results to differ materially from those expressed or implied

by such forward-looking statements. These factors, risks, and

uncertainties are discussed in HeartCore’s filings with the

Securities and Exchange Commission. Investors should not place any

undue reliance on forward-looking statements since they involve

known and unknown, uncertainties and other factors which are, in

some cases, beyond HeartCore’s control which could, and likely will

materially affect actual results, and levels of activity,

performance, or achievements. Any forward-looking statement

reflects HeartCore’s current views with respect to future events

and is subject to these and other risks, uncertainties, and

assumptions relating to operations, results of operations, growth

strategy, and liquidity. HeartCore assumes no obligation to

publicly update or revise these forward-looking statements for any

reason, or to update the reasons actual results could differ

materially from those anticipated in these forward-looking

statements, even if new information becomes available in the

future. The contents of any website referenced in this press

release are not incorporated by reference herein.

HeartCore Investor Relations Contact:Gateway

Group, Inc.Matt Glover and John YiHTCR@gateway-grp.com(949)

574-3860

| |

|

HEARTCORE ENTERPRISES, INC.CONSOLIDATED

BALANCE SHEETS |

| |

| |

|

December 31,2023 |

|

|

December 31,2022 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,012,479 |

|

|

$ |

7,177,326 |

|

|

Accounts receivable |

|

|

2,623,682 |

|

|

|

551,064 |

|

|

Investments in marketable securities |

|

|

642,348 |

|

|

|

- |

|

|

Investment in equity securities |

|

|

300,000 |

|

|

|

- |

|

|

Prepaid expenses |

|

|

536,865 |

|

|

|

538,230 |

|

|

Current portion of long-term note receivable |

|

|

100,000 |

|

|

|

- |

|

|

Due from related party |

|

|

44,758 |

|

|

|

48,447 |

|

|

Other current assets |

|

|

234,761 |

|

|

|

220,070 |

|

| Total current

assets |

|

|

5,494,893 |

|

|

|

8,535,137 |

|

| |

|

|

|

|

|

|

|

|

| Non-current

assets: |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

763,730 |

|

|

|

203,627 |

|

|

Operating lease right-of-use assets |

|

|

2,467,889 |

|

|

|

2,644,957 |

|

|

Intangible asset, net |

|

|

4,515,625 |

|

|

|

- |

|

|

Goodwill |

|

|

3,276,441 |

|

|

|

- |

|

|

Long-term investment in warrants |

|

|

2,004,308 |

|

|

|

- |

|

|

Long-term note receivable |

|

|

200,000 |

|

|

|

- |

|

|

Deferred tax assets |

|

|

369,436 |

|

|

|

263,339 |

|

|

Security deposits |

|

|

348,428 |

|

|

|

244,395 |

|

|

Long-term loan receivable from related party |

|

|

182,946 |

|

|

|

246,472 |

|

|

Other non-current assets |

|

|

71 |

|

|

|

661 |

|

| Total non-current

assets |

|

|

14,128,874 |

|

|

|

3,603,451 |

|

| |

|

|

|

|

|

|

|

|

| Total

assets |

|

$ |

19,623,767 |

|

|

$ |

12,138,588 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

1,757,038 |

|

|

$ |

497,742 |

|

|

Accrued payroll and other employee costs |

|

|

723,305 |

|

|

|

360,222 |

|

|

Due to related party |

|

|

1,476 |

|

|

|

402 |

|

|

Short-term debt |

|

|

135,937 |

|

|

|

- |

|

|

Current portion of long-term debts |

|

|

371,783 |

|

|

|

697,877 |

|

|

Factoring liability |

|

|

562,767 |

|

|

|

- |

|

|

Operating lease liabilities, current |

|

|

396,535 |

|

|

|

291,863 |

|

|

Finance lease liabilities, current |

|

|

17,445 |

|

|

|

19,294 |

|

|

Income tax payables |

|

|

162,689 |

|

|

|

2,747 |

|

|

Deferred revenue |

|

|

2,166,175 |

|

|

|

1,724,519 |

|

|

Other current liabilities |

|

|

216,405 |

|

|

|

53,027 |

|

| Total current

liabilities |

|

|

6,511,555 |

|

|

|

3,647,693 |

|

| |

|

|

|

|

|

|

|

|

| Non-current

liabilities: |

|

|

|

|

|

|

|

|

|

Long-term debts |

|

|

1,770,352 |

|

|

|

1,123,735 |

|

|

Operating lease liabilities, non-current |

|

|

2,135,160 |

|

|

|

2,421,054 |

|

|

Finance lease liabilities, non-current |

|

|

66,779 |

|

|

|

459 |

|

|

Deferred tax liabilities |

|

|

1,264,375 |

|

|

|

- |

|

|

Other non-current liabilities |

|

|

208,732 |

|

|

|

138,018 |

|

| Total non-current

liabilities |

|

|

5,445,398 |

|

|

|

3,683,266 |

|

| |

|

|

|

|

|

|

|

|

| Total

liabilities |

|

|

11,956,953 |

|

|

|

7,330,959 |

|

| |

|

|

|

|

|

|

|

|

| Shareholders’

equity: |

|

|

|

|

|

|

|

|

|

Preferred shares ($0.0001 par value, 20,000,000 shares authorized,

no shares issued and outstanding as of December 31, 2023 and 2022,

respectively) |

|

|

- |

|

|

|

- |

|

|

Common shares ($0.0001 par value, 200,000,000 shares authorized;

20,842,690 and 17,649,886 shares issued and outstanding as of

December 31, 2023 and 2022, respectively) |

|

|

2,083 |

|

|

|

1,764 |

|

|

Additional paid-in capital |

|

|

19,594,801 |

|

|

|

15,014,607 |

|

|

Accumulated deficit |

|

|

(14,763,469 |

) |

|

|

(10,573,579 |

) |

|

Accumulated other comprehensive income |

|

|

331,881 |

|

|

|

364,837 |

|

| Total HeartCore

Enterprises, Inc. shareholders’ equity |

|

|

5,165,296 |

|

|

|

4,807,629 |

|

|

Non-controlling interest |

|

|

2,501,518 |

|

|

|

- |

|

| Total shareholders’

equity |

|

|

7,666,814 |

|

|

|

4,807,629 |

|

| |

|

|

|

|

|

|

|

|

| Total liabilities and

shareholders’ equity |

|

$ |

19,623,767 |

|

|

$ |

12,138,588 |

|

| |

|

|

HEARTCORE ENTERPRISES, INC.CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS |

| |

|

| |

|

For the Years Ended December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

Revenues |

|

$ |

21,845,830 |

|

|

$ |

8,818,312 |

|

| |

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

13,778,416 |

|

|

|

5,467,017 |

|

| |

|

|

|

|

|

|

|

|

| Gross

profit |

|

|

8,067,414 |

|

|

|

3,351,295 |

|

| |

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Selling expenses |

|

|

1,516,247 |

|

|

|

2,826,615 |

|

| General and administrative

expenses |

|

|

9,651,381 |

|

|

|

6,579,734 |

|

| Research and development

expenses |

|

|

1,019,141 |

|

|

|

641,025 |

|

| |

|

|

|

|

|

|

|

|

| Total operating

expenses |

|

|

12,186,769 |

|

|

|

10,047,374 |

|

| |

|

|

|

|

|

|

|

|

| Loss from

operations |

|

|

(4,119,355 |

) |

|

|

(6,696,079 |

) |

| |

|

|

|

|

|

|

|

|

| Other income

(expenses): |

|

|

|

|

|

|

|

|

| Changes in fair value of

investments in marketable securities |

|

|

(615,520 |

) |

|

|

- |

|

| Changes in fair value of

investments in warrants |

|

|

(501,445 |

) |

|

|

- |

|

| Interest income |

|

|

70,624 |

|

|

|

66,963 |

|

| Interest expenses |

|

|

(162,968 |

) |

|

|

(41,800 |

) |

| Government grants |

|

|

76,612 |

|

|

|

- |

|

| Other income |

|

|

366,283 |

|

|

|

57,268 |

|

| Other expenses |

|

|

(124,595 |

) |

|

|

(69,736 |

) |

| Total other income

(expenses) |

|

|

(891,009 |

) |

|

|

12,695 |

|

| |

|

|

|

|

|

|

|

|

| Loss before income tax

provision |

|

|

(5,010,364 |

) |

|

|

(6,683,384 |

) |

| |

|

|

|

|

|

|

|

|

| Income tax benefit |

|

|

(133,664 |

) |

|

|

(5,918 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss |

|

|

(4,876,700 |

) |

|

|

(6,677,466 |

) |

| |

|

|

|

|

|

|

|

|

|

Less: net loss attributable to non-controlling interest |

|

|

(686,810 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Net loss attributable

to HeartCore Enterprises, Inc. |

|

$ |

(4,189,890 |

) |

|

$ |

(6,677,466 |

) |

| |

|

|

|

|

|

|

|

|

| Other comprehensive

income (loss): |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

(34,628 |

) |

|

|

380,009 |

|

| |

|

|

|

|

|

|

|

|

| Total comprehensive

loss |

|

|

(4,911,328 |

) |

|

|

(6,297,457 |

) |

|

Less: comprehensive loss attributable to non-controlling

interest |

|

|

(688,482 |

) |

|

|

- |

|

| Comprehensive loss

attributable to HeartCore Enterprises, Inc. |

|

$ |

(4,222,846 |

) |

|

$ |

(6,297,457 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss per common

share attributable to HeartCore Enterprises, Inc. |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.21 |

) |

|

$ |

(0.37 |

) |

|

Diluted |

|

$ |

(0.21 |

) |

|

$ |

(0.37 |

) |

| Weighted average

common shares outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

|

20,404,642 |

|

|

|

17,922,585 |

|

|

Diluted |

|

|

20,404,642 |

|

|

|

17,922,585 |

|

|

|

|

HEARTCORE ENTERPRISES, INC.CONSOLIDATED

STATEMENTS OF CASH FLOWS |

|

|

|

|

|

For the Years Ended December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(4,876,700 |

) |

|

$ |

(6,677,466 |

) |

|

Adjustments to reconcile net loss to net cash used in

operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization expenses |

|

|

683,019 |

|

|

|

83,333 |

|

|

Gain on disposal of property and equipment |

|

|

(4,514 |

) |

|

|

- |

|

|

Amortization of debt issuance costs |

|

|

3,733 |

|

|

|

4,546 |

|

|

Non-cash lease expense |

|

|

346,070 |

|

|

|

273,836 |

|

|

Loss on termination of lease |

|

|

76 |

|

|

|

- |

|

|

Deferred income taxes |

|

|

(291,596 |

) |

|

|

(1,610 |

) |

|

Stock-based compensation |

|

|

1,430,513 |

|

|

|

1,519,743 |

|

|

Warrants received as noncash consideration |

|

|

(3,763,621 |

) |

|

|

- |

|

|

Changes in fair value of investments in marketable securities |

|

|

615,520 |

|

|

|

- |

|

|

Changes in fair value of investments in warrants |

|

|

501,445 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(338,312 |

) |

|

|

296,835 |

|

|

Prepaid expenses |

|

|

359,310 |

|

|

|

62,195 |

|

|

Other assets |

|

|

(133,550 |

) |

|

|

(201,226 |

) |

|

Accounts payable and accrued expenses |

|

|

532,790 |

|

|

|

(70,525 |

) |

|

Accrued payroll and other employee costs |

|

|

152,101 |

|

|

|

149,617 |

|

|

Due to related party |

|

|

1,123 |

|

|

|

(575 |

) |

|

Operating lease liabilities |

|

|

(327,877 |

) |

|

|

(283,921 |

) |

|

Finance lease liabilities |

|

|

- |

|

|

|

(440 |

) |

|

Income tax payables |

|

|

162,045 |

|

|

|

(6,915 |

) |

|

Deferred revenue |

|

|

553,130 |

|

|

|

239,129 |

|

|

Other liabilities |

|

|

64,086 |

|

|

|

(195,103 |

) |

| |

|

|

|

|

|

|

|

|

| Net cash flows used in

operating activities |

|

|

(4,331,209 |

) |

|

|

(4,808,547 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(526,260 |

) |

|

|

(57,071 |

) |

|

Proceeds from disposal of property and equipment |

|

|

24,814 |

|

|

|

- |

|

|

Advances on notes receivable |

|

|

(600,000 |

) |

|

|

- |

|

|

Repayment of loan provided to related party |

|

|

45,404 |

|

|

|

44,871 |

|

|

Payment for acquisition of subsidiary, net of cash acquired |

|

|

(724,910 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Net cash flows used in

investing activities |

|

|

(1,780,952 |

) |

|

|

(12,200 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from initial public offering, net of issuance cost |

|

|

- |

|

|

|

13,602,554 |

|

|

Proceeds from issuance of common shares prior to initial public

offering |

|

|

- |

|

|

|

220,572 |

|

|

Repurchase of common shares |

|

|

- |

|

|

|

(3,500,000 |

) |

|

Payments for finance leases |

|

|

(22,422 |

) |

|

|

(34,465 |

) |

|

Proceeds from short-term and long-term debts |

|

|

710,107 |

|

|

|

258,087 |

|

|

Repayment of long-term debts |

|

|

(711,395 |

) |

|

|

(810,750 |

) |

|

Repayment of insurance premium financing |

|

|

(389,035 |

) |

|

|

(388,538 |

) |

|

Net proceeds from factoring arrangement |

|

|

562,767 |

|

|

|

- |

|

|

Payments for debt issuance costs |

|

|

(13,828 |

) |

|

|

(1,630 |

) |

|

Payment for mandatorily redeemable financial interest |

|

|

- |

|

|

|

(430,489 |

) |

| |

|

|

|

|

|

|

|

|

| Net cash flows

provided by financing activities |

|

|

136,194 |

|

|

|

8,915,341 |

|

| |

|

|

|

|

|

|

|

|

| Effect of exchange rate

changes |

|

|

(188,880 |

) |

|

|

(54,107 |

) |

| |

|

|

|

|

|

|

|

|

| Net change in cash and cash

equivalents |

|

|

(6,164,847 |

) |

|

|

4,040,487 |

|

| |

|

|

|

|

|

|

|

|

| Cash and cash equivalents -

beginning of the year |

|

|

7,177,326 |

|

|

|

3,136,839 |

|

| |

|

|

|

|

|

|

|

|

| Cash and cash

equivalents - end of the year |

|

$ |

1,012,479 |

|

|

$ |

7,177,326 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental cash flow

disclosure: |

|

|

|

|

|

|

|

|

|

Interest paid |

|

$ |

85,634 |

|

|

$ |

41,848 |

|

|

Income taxes paid |

|

$ |

91,707 |

|

|

$ |

3,013 |

|

| |

|

|

|

|

|

|

|

|

| Non-cash investing and

financing transactions: |

|

|

|

|

|

|

|

|

|

Payroll withheld as repayment of loan receivable from

employees |

|

$ |

- |

|

|

$ |

12,034 |

|

|

Share repurchase liability settled by issuance of common

shares |

|

$ |

- |

|

|

$ |

16 |

|

|

Deferred offering costs recognized against the proceeds from the

offering |

|

$ |

- |

|

|

$ |

178,847 |

|

|

Insurance premium financing |

|

$ |

389,035 |

|

|

$ |

388,538 |

|

|

Common shares issued for acquisition of subsidiary |

|

$ |

3,150,000 |

|

|

$ |

- |

|

|

Investments in warrants converted to marketable securities |

|

$ |

1,257,868 |

|

|

$ |

- |

|

|

Finance lease right-of-use asset obtained in exchange for finance

lease liability |

|

$ |

93,217 |

|

|

$ |

- |

|

|

Operating lease right-of-use asset obtained in exchange for

operating lease liability |

|

$ |

317,040 |

|

|

$ |

- |

|

|

Remeasurement of operating lease liability and right-of-use asset

due to lease modification |

|

$ |

30,186 |

|

|

$ |

- |

|

|

Note receivable converted to investment in equity securities |

|

$ |

300,000 |

|

|

$ |

- |

|

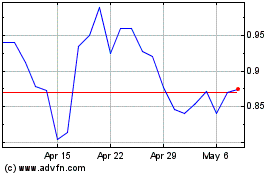

HeartCore Enterprises (NASDAQ:HTCR)

Historical Stock Chart

From Apr 2024 to May 2024

HeartCore Enterprises (NASDAQ:HTCR)

Historical Stock Chart

From May 2023 to May 2024